Filed Pursuant to Rule 424(b)(2)

Registration No. 333-202916

Calculation of Registration Fee

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of

securities to be registered

|

|

Amount

to be

registered

(1)

|

|

Proposed

maximum

offering

price

per share (2)

|

|

Proposed

maximum

aggregate

offering price

|

|

Amount of

registration fee

(1)(2)(3)

|

|

Common Stock, no par value

|

|

9,240,000 shares

|

|

$11.80

|

|

$109,032,000

|

|

$12,637.00

|

|

|

|

|

|

(1)

|

Assumes exercise in full of the underwriter’s option to purchase up to an additional 840,000 shares of common stock.

|

|

(2)

|

Calculated in accordance with Rule 457(c) under the Securities Act of 1933, as amended. Based on the average high and low prices of the common stock reported on the New York Stock Exchange on December 7, 2016.

|

|

(3)

|

Calculated in accordance with Rules 457(r) under the Securities Act of 1933, as amended.

|

PROSPECTUS SUPPLEMENT

(To Prospectus dated March 20, 2015)

8,400,000 Shares

Common Stock

We are offering 8,400,000 shares of our common

stock, no par value per share, pursuant to this prospectus supplement and the accompanying prospectus.

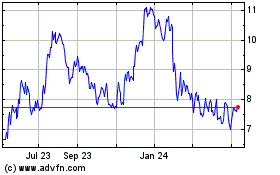

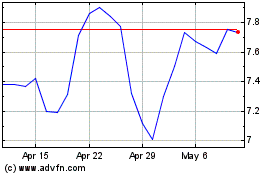

Our common stock is listed on the New York Stock

Exchange and trades under the symbol “VLY.” On December 7, 2016, the last reported sale price of our common stock as reported on the New York Stock Exchange (“NYSE”) was $11.88 per share.

Investing in our common stock involves risks. You should carefully consider the risks discussed in “

Risk Factors

”

beginning on page S-5, as well as in our Annual Report on Form 10-K for the year ended December 31, 2015, together with the information contained in this prospectus supplement and the information incorporated by reference in this prospectus

supplement before you make an investment in our common stock.

The underwriter has agreed to purchase the shares from us at a price of $11.55 per share, which will result in approximately $97,020,000 of proceeds, before

expenses, to us. The underwriter may offer the shares of common stock in transactions on the NYSE, in the over-the-counter market or through negotiated transactions at market prices or at negotiated prices. See “Underwriting.”

The underwriter may also purchase up to an additional 840,000 shares of common stock from us at a price of $11.55 per share within 30 days from the date of

this prospectus supplement. If this option is exercised in full, it would result in approximately $9,702,000 of additional proceeds, before expenses, to us.

Neither the Securities and Exchange

Commission nor any state securities commission has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal

offense.

These shares of common stock are not savings accounts, deposits or other obligations of any of our bank or non-bank subsidiaries and are not insured by the

Federal Deposit Insurance Corporation, the Board of Governors of the Federal Reserve System or any other government agency.

The underwriter expects to

deliver the shares of common stock to purchasers on or about December 13, 2016.

Sole Book-Running Manager

Keefe, Bruyette & Woods

A Stifel Company

Prospectus Supplement dated December 8, 2016.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

TABLE OF CONTENTS

PROSPECTUS

You should rely only on the information contained or incorporated by reference in this prospectus supplement or the accompanying

prospectus. We have not authorized anyone to provide you with different information. If you receive any other information, you should not rely on it.

We are not making an offer of shares of our common stock covered by this prospectus supplement in any jurisdiction where the offer is not

permitted.

You should not assume that the information contained in or incorporated by reference in this prospectus supplement or

the accompanying prospectus or any free writing prospectus prepared by us is accurate as of any date other than the respective dates thereof.

S-i

ABOUT THIS PROSPECTUS SUPPLEMENT

References in this prospectus supplement and the accompanying prospectus to “Valley,” “we,” “us” and

“our” are to Valley National Bancorp.

We have not authorized anyone to provide you with information different from that

contained or incorporated by reference in this prospectus supplement or the accompanying prospectus. The information contained in this prospectus supplement is accurate only as of the date of this prospectus supplement, regardless of the time of

delivery of this prospectus supplement or of any sale of the securities offered pursuant to this prospectus supplement.

This document

consists of two parts. The first part is this prospectus supplement, which describes the specific terms of this offering and certain other matters and also adds to and updates information contained in the accompanying prospectus and the documents

incorporated by reference into this prospectus supplement and the accompanying prospectus. The second part is the accompanying prospectus, which describes more general information about us, some of which may not apply to the offering. You should

read both this prospectus supplement and the accompanying prospectus, together with the additional information described below under the heading “Where You Can Find More Information”. Generally, when we refer to the prospectus, we are

referring to both parts of this document combined.

We are offering to sell, and seeking offers to buy, shares of our common stock only in

jurisdictions where offers and sales are permitted. The distribution of this prospectus and the offering of shares of our common stock in certain jurisdictions may be restricted by law. This prospectus does not constitute, and may not be used in

connection with, an offer to sell, or a solicitation of an offer to buy, any shares of our common stock offered by this prospectus by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

When acquiring any securities discussed in this prospectus, you should rely only on the information provided in this prospectus, including the

information incorporated by reference. Neither we nor any underwriter or agent have authorized anyone to provide you with different information. You should not assume that the information in this prospectus or any document incorporated by reference

is accurate or complete at any date other than the date mentioned on the cover page of these documents.

To the extent the information set

forth in this prospectus supplement differs from the information set forth in the accompanying prospectus or any document incorporated by reference filed prior to the date of this prospectus supplement, you should rely on the information in this

prospectus supplement.

Currency amounts in this prospectus supplement are stated in U.S. dollars.

S-ii

WHERE YOU CAN FIND MORE INFORMATION

We file reports, proxy statements and other information with the Securities and Exchange Commission, or the SEC. Our SEC filings are available

over the Internet at the SEC’s website at www.sec.gov and on our website at www.valleynationalbank.com. Except as specifically incorporated by reference in this prospectus supplement, information on those websites is not part of this prospectus

supplement. You may also read and copy any document we file by visiting the SEC’s public reference room in Washington, D.C. The SEC’s address in Washington, D.C. is 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at

1-800-SEC-0330 for further information about the public reference room. You may also inspect our SEC reports and other information at the New York Stock Exchange, Inc., 20 Broad Street, New York, New York 10005.

The SEC allows us to “incorporate by reference” the information we file with them, which means:

|

|

•

|

|

incorporated documents are considered part of this prospectus supplement;

|

|

|

•

|

|

we can disclose important information to you by referring you to those documents; and

|

|

|

•

|

|

information that we file with the SEC will automatically update and supersede this prospectus supplement and earlier information incorporated by reference.

|

In the case of a conflict or inconsistency between information contained in this prospectus supplement and information incorporated by

reference into this prospectus supplement, you should rely on the information contained in the document that was filed later.

We

incorporate by reference the following documents that we have filed with the SEC:

|

|

•

|

|

Annual Report on Form 10-K (as amended on Form 10-K/A) for the year ended December 31, 2015 (including portions of our Proxy Statement for our 2016 Annual Meeting of Shareholders filed on March 18, 2016 with

the SEC to the extent specifically incorporated by reference in such Form 10-K);

|

|

|

•

|

|

Quarterly Reports on Form 10-Q for the quarters ended March 31, 2016, June 30, 2016 and September 30, 2016;

|

|

|

•

|

|

Current Reports on Form 8-K filed on the following dates: May 2, 2016, September 27, 2016, October 19, 2016, October 28, 2016 and December 7, 2016 (unless stated otherwise in the

applicable report, information furnished under Item 2.02 or 7.01 of our Current Reports on Form 8-K is not incorporated herein by reference);

|

|

|

•

|

|

The description of our common stock which is contained in our Registration Statement on Form 8-A including any amendment or report filed for the purpose of updating such description.

|

We also incorporate by reference each of the following documents that we will file with the SEC after the date of this prospectus supplement

(other than, in each case, documents or information deemed to have been furnished, and not filed in accordance with the SEC rules) until this offering is completed:

|

|

•

|

|

reports filed under Sections 13(a) and (c) of the Exchange Act;

|

|

|

•

|

|

any document filed under Section 14 of the Exchange Act; and

|

|

|

•

|

|

any reports filed under Section 15(d) of the Exchange Act.

|

You should rely only on

information contained or incorporated by reference in this prospectus supplement and accompanying prospectus. We have not authorized any other person to provide you with different information. If anyone provides you with different or

inconsistent information, you should not rely on it. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted.

You should assume that the information appearing in this prospectus supplement is accurate as of the date of this prospectus supplement only.

Our business, financial condition and results of operation may have changed since that date.

S-iii

To receive a free copy of any of the documents incorporated by reference in this prospectus

supplement (other than exhibits, unless they are specifically incorporated by reference in the documents), call or write our Shareholder Relations Department, as follows:

Valley National Bancorp

1455

Valley Road

Wayne, New Jersey 07470

Attention: Dianne M. Grenz

Telephone: (973) 305-8800

S-iv

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This document contains and incorporates by reference certain forward-looking statements regarding our financial condition, results of

operations and business. These statements are not historical facts and include expressions about management’s confidence and strategies and management’s expectations about new and existing programs and products, acquisitions,

relationships, opportunities, taxation, technology, market conditions and economic expectations.

You may identify these statements by

looking for:

|

|

•

|

|

forward-looking terminology, like “should,” “expect,” “believe,” “view,” “opportunity,” “allow,” “continues,” “reflects,”

“typically,” “usually,” or “anticipate;”

|

|

|

•

|

|

expressions of confidence like “strong” or “on-going;” or

|

|

|

•

|

|

similar statements or variations of those terms.

|

These forward-looking statements involve

certain risks and uncertainties. Actual results may differ materially from the results the forward-looking statements contemplate because of, among others, the following possibilities:

|

|

•

|

|

weakness or a decline in the U.S. economy, in particular in New Jersey, the New York Metropolitan area (including Long Island) and Florida;

|

|

|

•

|

|

unexpected changes in market interest rates for interest earning assets and/or interest bearing liabilities;

|

|

|

•

|

|

less than expected cost savings from the maturity, modification or prepayment of long-term borrowings that mature through 2022;

|

|

|

•

|

|

further prepayment penalties related to the early extinguishment of high cost borrowings;

|

|

|

•

|

|

less than expected cost savings in 2016 and 2017 from Valley’s branch efficiency and cost reduction plans;

|

|

|

•

|

|

lower than expected cash flows from purchased credit-impaired loans;

|

|

|

•

|

|

claims and litigation pertaining to fiduciary responsibility, contractual issues, environmental laws and other matters;

|

|

|

•

|

|

cyber attacks, computer viruses or other malware that may breach the security of our websites or other systems to obtain unauthorized access to confidential information, destroy data, disable or degrade service, or

sabotage our systems;

|

|

|

•

|

|

results of examinations by the OCC, the FRB, the CFPB and other regulatory authorities, including the possibility that any such regulatory authority may, among other things, require us to increase our allowance for

credit losses, write-down assets, require us to reimburse customers, change the way we do business, or limit or eliminate certain other banking activities;

|

|

|

•

|

|

government intervention in the U.S. financial system and the effects of and changes in trade and monetary and fiscal policies and laws, including the interest rate policies of the Federal Reserve;

|

|

|

•

|

|

our inability to pay dividends at current levels, or at all, because of inadequate future earnings, regulatory restrictions or limitations, and changes in the composition of qualifying regulatory capital and minimum

capital requirements (including those resulting from the U.S. implementation of Basel III requirements);

|

|

|

•

|

|

higher than expected loan losses within one or more segments of our loan portfolio;

|

|

|

•

|

|

unexpected significant declines in the loan portfolio due to the lack of economic expansion, increased competition, large prepayments, changes in regulatory lending guidance or other factors;

|

|

|

•

|

|

unanticipated credit deterioration in our loan portfolio;

|

S-v

|

|

•

|

|

unanticipated loan delinquencies, loss of collateral, decreased service revenues, and other potential negative effects on our business caused by severe weather or other external events;

|

|

|

•

|

|

an unexpected decline in real estate values within our market areas;

|

|

|

•

|

|

changes in accounting policies or accounting standards, including the new authoritative accounting guidance (known as the current expected credit loss (CECL) model) which may increase the required level of our allowance

for credit losses after adoption on January 1, 2020;

|

|

|

•

|

|

higher than expected income tax expense or tax rates, including increases resulting from changes in tax laws, regulations and case law;

|

|

|

•

|

|

higher than expected FDIC insurance assessments;

|

|

|

•

|

|

the failure of other financial institutions with whom we have trading, clearing, counterparty and other financial relationships;

|

|

|

•

|

|

lack of liquidity to fund our various cash obligations;

|

|

|

•

|

|

unanticipated reduction in our deposit base;

|

|

|

•

|

|

potential acquisitions that may disrupt our business;

|

|

|

•

|

|

declines in value in our investment portfolio, including additional other-than-temporary impairment charges on our investment securities;

|

|

|

•

|

|

future goodwill impairment due to changes in our business, changes in market conditions, or other factors;

|

|

|

•

|

|

legislative and regulatory actions (including the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act and related regulations) subject us to additional regulatory oversight which may result in higher

compliance costs and/or require us to change our business model;

|

|

|

•

|

|

our inability to promptly adapt to technological changes;

|

|

|

•

|

|

our internal controls and procedures may not be adequate to prevent losses;

|

|

|

•

|

|

the inability to realize expected revenue synergies from the merger with CNL Bancshares, Inc. (“CNL”) in the amounts or in the timeframe anticipated;

|

|

|

•

|

|

inability to retain customers and employees, including those of CNL; and

|

|

|

•

|

|

other unexpected material adverse changes in our operations or earnings.

|

We assume no

obligation for updating our forward-looking statements at any time. When considering these forward-looking statements, you should keep in mind these risks, uncertainties and other cautionary statements made in this prospectus and the prospectus

supplements. You should not place undue reliance on any forward-looking statement, which speaks only as of the date made. You should refer to our periodic and current reports filed with the SEC for specific risks that could cause actual results to

be significantly different from those expressed or implied by these forward-looking statements. See “Where You Can Find More Information” above and “Risk Factors” below.

S-vi

PROSPECTUS SUPPLEMENT SUMMARY

The following summary is qualified in its entirety by the more detailed information included elsewhere or incorporated by reference into

this prospectus supplement or the accompanying prospectus. Because this is a summary, it may not contain all of the information that is important to you. You should read this entire prospectus supplement and the accompanying prospectus, including

the section entitled “Risk Factors” and the documents incorporated by reference herein, including our financial statements and the notes to those financial statements contained in such documents, before making an investment decision.

Valley National Bancorp

Valley

National Bancorp, headquartered in Wayne, New Jersey, is a New Jersey corporation organized in 1983 and is registered as a bank holding company with the Board of Governors of the Federal Reserve System under the Bank Holding Company Act of 1956, as

amended (the “Holding Company Act”). In addition to its principal subsidiary, Valley National Bank, Valley owns all of the voting and common shares of GCB Capital Trust III and State Bancorp Capital Trusts I and II through which trust

preferred securities were issued.

As of September 30, 2016, we had:

|

|

•

|

|

consolidated total assets of $22.4 billion;

|

|

|

•

|

|

total net loans of $16.5 billion;

|

|

|

•

|

|

total deposits of $17.0 billion; and

|

|

|

•

|

|

total shareholders’ equity of $2.3 billion.

|

Valley National Bank (referred to as the

“Bank”) is a national banking association chartered in 1927 under the laws of the United States. Currently, the Bank has 209 branches serving northern and central New Jersey, the New York City boroughs of Manhattan, Brooklyn, Queens and

Long Island, and southeast, southwest and central Florida. The Bank provides a full range of commercial, retail, insurance and wealth management financial services products. The Bank provides a variety of banking services including automated teller

machines, telephone, internet banking and mobile banking, remote deposit capture, overdraft facilities, drive-in and night deposit services, and safe deposit facilities. The Bank also provides certain international banking services to customers

including standby letters of credit, documentary letters of credit and related products, and certain ancillary services such as foreign exchange, documentary collections, foreign wire transfers and the maintenance of foreign bank accounts.

The Bank’s wholly-owned subsidiaries are all included in our consolidated financial statements. These subsidiaries include:

|

|

•

|

|

an all-line insurance agency offering property and casualty, life and health insurance;

|

|

|

•

|

|

asset management advisers which are Securities and Exchange Commission (“SEC”) registered investment advisers;

|

|

|

•

|

|

title insurance agencies in New Jersey, New York and Florida;

|

|

|

•

|

|

subsidiaries which hold, maintain and manage investment assets for the Bank;

|

|

|

•

|

|

a subsidiary which owns and services auto loans;

|

|

|

•

|

|

a subsidiary which specializes in health care equipment and other commercial equipment leases;

|

|

|

•

|

|

a subsidiary which owns and services existing general aviation aircraft loans and existing commercial equipment leases; and

|

|

|

•

|

|

a subsidiary which owns and services New York commercial loans and specializes in asset-based lending.

|

S-1

The Bank’s subsidiaries also include real estate investment trust subsidiaries (the

“REIT subsidiaries”) which own real estate related investments including some of the real estate utilized by the Bank and related real estate investments. Except for Valley’s REIT subsidiaries, all subsidiaries mentioned above are

directly or indirectly wholly owned by the Bank. Because each REIT must have 100 or more shareholders to qualify as a REIT, each REIT has issued less than 20% of its outstanding non-voting preferred stock to individuals, most of whom are current and

former (non-executive officer) Bank employees. The Bank owns the remaining preferred stock and all the common stock of the REITs.

Recent Acquisitions

We have grown significantly in the past five years primarily through bank acquisitions, including the recent transactions discussed

further below, as well as some modest de novo branch expansion mostly in targeted areas in Brooklyn and Queens, New York.

CNLBancshares, Inc.

On December 1, 2015, Valley acquired CNLBancshares, Inc. (“CNL”) and its wholly-owned

subsidiary, CNLBank, headquartered in Orlando, Florida, a commercial bank with approximately $1.6 billion in assets, $825 million in loans, $1.2 billion in deposits and 16 branch offices on the date of its acquisition by Valley. The common

shareholders of CNL received 0.705 of a share of Valley common stock for each CNL share they owned prior to the merger. The total consideration for the acquisition was approximately $230 million, consisting of 20.6 million shares of Valley

common stock. For further details, see Note 2 to the consolidated financial statements in our Annual Report on Form 10-K for the year ended December 31, 2015, which is incorporated by reference into this prospectus supplement.

1st United Bancorp, Inc.

On November 1, 2014, Valley acquired 1st United Bancorp, Inc. (“1st United”) and its

wholly-owned subsidiary, 1st United Bank, a commercial bank with approximately $1.7 billion in assets, $1.2 billion in loans, and $1.4 billion in deposits, after purchase accounting adjustments. The 1st United acquisition brought to Valley a 20

branch network covering some of the most attractive urban banking markets in Florida, including locations throughout southeast Florida, the Treasure Coast, central Florida and central Gulf Coast regions. The common shareholders of 1st United

received 0.89 of a share of Valley common stock for each 1st United share they owned prior to the merger. The total consideration for the acquisition was approximately $300 million, consisting of 30.7 million shares of Valley common stock and

$8.9 million of cash consideration paid to 1st United stock option holders. In conjunction with the merger, Valley shareholders approved an amendment of Valley’s certificate of incorporation to increase its authorized common shares by

100 million shares during the third quarter of 2014.

In connection with the 1st United acquisition, we acquired loans and other real

estate owned subject to FDIC loss-share agreements (referred to as “covered loans” and “covered OREO”, together “covered assets”). The FDIC loss-share agreements relate to three previous FDIC-assisted acquisitions

completed by 1st United from 2009 to 2011. The Bank will share losses on covered assets in accordance with provisions of each loss-share agreement. The commercial and single-family (residential) loan loss-sharing agreements with the FDIC expire

between December of 2015 and October of 2021.

State Bancorp, Inc.

On January 1, 2012, Valley acquired State Bancorp,

Inc. (State Bancorp), the holding company for State Bank of Long Island, a commercial bank with approximately $1.7 billion in assets, $1.1 billion in loans, and $1.4 billion in deposits and 16 branches in Nassau, Suffolk, Queens, and Manhattan at

December 31, 2011. Of the acquired branch offices, 14 remain within our 43 branch network in New York and are located in Long Island and Queens. The State Bancorp locations complement Valley’s other New York City locations, including five

branches in Queens, and provide a foundation for our efforts in these attractive markets. The common shareholders of State Bancorp received a fixed one-for-one exchange ratio of Valley National Bancorp common stock. The total consideration for the

all stock acquisition equaled $208 million.

S-2

Our principal executive offices and telephone number are:

Valley National Bancorp

1455

Valley Road

Wayne, New Jersey 07470

(973) 305-8800

S-3

THE OFFERING

The following summary of this offering contains basic information about this offering and the terms of our shares

of common stock and is not intended to be complete. It does not contain all the information that is important to you. For a more complete understanding of our common stock, please refer to the section of this prospectus supplement entitled

“Description of Common Stock.”

|

|

|

|

|

Issuer:

|

|

Valley National Bancorp, a New Jersey corporation.

|

|

|

|

|

Common Stock Offered:

|

|

8,400,000 shares of common stock, no par value (9,240,000 shares if the underwriter exercises its option to purchase additional shares in full).

|

|

|

|

|

Common Stock to be Outstanding after the Offering

|

|

262,904,465 shares (263,744,465 shares if the underwriter exercises its option to purchase additional shares in full), based on shares outstanding as of December 7, 2016, which excludes 813,740 shares subject to

outstanding options having a weighted average exercise price of $14.52 per share, 3,280,974 shares issuable upon the exercise of warrants having a weighted exercise price of $15.40 per share and 744,281 shares of restricted stock units subject to

certain market and performance conditions.

|

|

|

|

|

Use of Proceeds

|

|

We intend to use the net proceeds of this offering to pay related fees and expenses and for general corporate purposes. See “Use of Proceeds.”

|

|

|

|

|

Dividends

|

|

We currently pay a cash dividend of $0.11 per share. Any future determination to pay dividends on our common stock will be made by our board of directors and will depend upon certain factors that our board of directors deems

relevant. For additional information, see “Description of Common Stock—Dividend Rights” in this prospectus supplement.

|

|

|

|

|

Risk Factors:

|

|

See “Risk Factors” and other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of factors you should consider carefully before deciding to

invest in our common stock.

|

|

|

|

|

Market and Trading Symbol for the Common Stock

|

|

Our common stock is traded on the New York Stock Exchange under the symbol “VLY.”

|

|

|

|

|

Transfer Agent and Registrar

|

|

American Stock Transfer & Trust Company, LLC

|

Unless otherwise stated, the shares presented in this prospectus assume no exercise of the underwriter’s

option to purchase additional shares.

S-4

RISK FACTORS

An investment in our common stock is subject to certain risks and uncertainties. Before you decide to invest in our common stock, you should

consider the risk factors described below, as well as in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 as may be amended or supplemented by other documents incorporated by reference into this prospectus

supplement or the accompanying prospectus. Please refer to “Where You Can Find More Information” in this prospectus supplement and in the accompanying prospectus for discussions of these other filings. If any of the risks or uncertainties

actually occurs, our business, financial condition, and results of operations could be materially adversely affected. If this were to happen, the trading price of our common stock could decline due to any of these risks, and you may lose all or part

of your investment. The prospectus is qualified in its entirety by those risk factors.

Shares of our common stock are equity interests and therefore

subordinate to our existing and future indebtedness and preferred stock we may issue in the future.

Shares of our common stock are

equity interests in us and do not constitute indebtedness. As such, shares of our common stock rank junior to all indebtedness and other non-equity claims on us with respect to assets available to satisfy claims, including in our liquidation.

Holders of our common stock are also subject to the prior dividend and liquidation rights of any holders of our preferred stock that we may issue in the future.

In addition, our right to participate in any distribution of assets of any of our subsidiaries, including Valley National Bank, upon the

subsidiary’s liquidation or otherwise, and thus your ability as a holder of our common stock to benefit indirectly from such distribution, will be subject to the prior claims of creditors of that subsidiary, except to the extent that any of our

claims as a creditor of such subsidiary may be recognized. As a result, shares of our common stock are effectively subordinated to all existing and future liabilities and obligations of our subsidiaries.

We have broad discretion to use the proceeds from this offering.

We expect to use the net proceeds from this offering for general corporate purposes, which may include working capital, funding potential

acquisitions and other strategic business opportunities. We will have broad discretion as to the application of such net proceeds. You will not have the opportunity to evaluate the economic, financial or other information on which we base our

decisions on how to use these net proceeds. Our failure to use these funds effectively could have a negative impact on our financial condition and results of operations.

S-5

USE OF PROCEEDS

We estimate that the net cash proceeds to us from the sale of our common stock will be approximately $96.7 million (approximately $106.4

million if the underwriter exercises its option to purchase additional shares in full), after deducting estimated underwriting discounts and commissions and estimated offering expenses. We intend to use the net proceeds from this offering to pay

related fees and expenses and for general corporate purposes.

Our management will have broad discretion in the application of the net

proceeds from this offering, and investors will be relying on the judgment of our management with regard to the use of these net proceeds. Pending the use of the net proceeds from this offering as described above, we may invest the net proceeds in

short-term, investment-grade, interest-bearing instruments.

S-6

CAPITALIZATION

The following table sets forth, on a consolidated basis, our capitalization as of September 30, 2016 on (i) an actual basis and

(ii) as adjusted to give effect to this offering (assuming the underwriter’s option to purchase additional shares of common stock is not exercised). You should read the following table together with our consolidated financial statements

and notes thereto incorporated by reference into this prospectus supplement and the accompanying prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

As of September 30, 2016

|

|

|

|

|

Actual

|

|

|

As Adjusted for

Common

Stock Issuance

|

|

|

($ in thousands)

|

|

(Unaudited)

|

|

|

Shareholders’ Equity

|

|

|

|

|

|

|

|

|

|

Preferred stock (no par value, authorized 30,000,000 shares; issued 4,600,000 shares)

|

|

$

|

111,590

|

|

|

$

|

111,590

|

|

|

Common stock (no par value, authorized 332,023,233 shares; issued 254,492,480 shares, actual;

262,892,480 as adjusted) and surplus(1)

|

|

|

2,026,579

|

|

|

|

2,123,271

|

|

|

Retained earnings

|

|

|

153,531

|

|

|

|

153,531

|

|

|

Accumulated other comprehensive loss

|

|

|

(34,343

|

)

|

|

|

(34,343

|

)

|

|

Treasury stock, at cost (30,574 common shares at September 30, 2016)

|

|

|

(284

|

)

|

|

|

(284

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Total Shareholders’ Equity

|

|

$

|

2,257,073

|

|

|

$

|

2,353,765

|

|

|

|

|

|

|

|

|

|

|

|

|

Capital Adequacy

|

|

|

|

|

|

|

|

|

|

Tangible common equity to total tangible assets(2)

|

|

|

6.53

|

%

|

|

|

6.94

|

%

|

|

Tier 1 leverage ratio

|

|

|

7.35

|

|

|

|

7.76

|

|

|

Tier 1 common capital ratio

|

|

|

8.73

|

|

|

|

9.30

|

|

|

Tier 1 risk-based capital

|

|

|

9.36

|

|

|

|

9.94

|

|

|

Total risk-based capital

|

|

|

11.64

|

|

|

|

12.22

|

|

|

(1)

|

Does not reflect outstanding options to purchase 813,740 shares, 3,280,974 shares issuable upon the exercise of outstanding warrants and 744,281 share of restricted stock units subject to certain market and performance

conditions.

|

|

(2)

|

Tangible common equity to tangible assets ratio is a non-GAAP financial measure. Management believes this non-GAAP financial measure provides information useful to investors in understanding Valley’s financial

results. Specifically, Valley provides the measure based on what it believes are its operating earnings on a consistent basis and excludes material non-core operating items which affect the GAAP reporting of results of operations. Management

utilizes this measure for internal planning and forecasting purposes. Management believes that Valley’s presentation and discussion, together with the accompanying reconciliation, provides a complete understanding of factors and trends

affecting Valley’s business and allows investors to view performance in a manner similar to management. Non-GAAP measures should not be considered a substitute for a GAAP basis measures and results and Valley strongly encourages investors to

review its consolidated financial statements in their entirety and not to rely on any single financial measure. Because non-GAAP financial measures are not standardized, it may not be possible to compare these financial measures with other

companies’ non-GAAP financial measures having the same or similar name.

|

S-7

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2016

|

|

|

|

|

Actual

|

|

|

As Adjusted for

Common

Stock Issuance

|

|

|

($ in thousands)

|

|

(Unaudited)

|

|

|

Tangible common equity to tangible assets:

|

|

|

|

|

|

|

|

|

|

Total equity

|

|

$

|

2,257,073

|

|

|

$

|

2,353,765

|

|

|

Less: Goodwill and other intangible assets

|

|

|

733,627

|

|

|

|

733,627

|

|

|

Less: Series A Preferred Stock

|

|

|

111,590

|

|

|

|

111,590

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible shareholders’ equity

|

|

$

|

1,411,856

|

|

|

$

|

1,508,548

|

|

|

Total assets

|

|

|

22,368,453

|

|

|

|

22,465,145

|

|

|

Less: Goodwill and other intangible assets

|

|

|

733,627

|

|

|

|

733,627

|

|

|

|

|

|

|

|

|

|

|

|

|

Tangible assets

|

|

$

|

21,634,826

|

|

|

$

|

21,731,518

|

|

|

Tangible common equity to tangible assets

|

|

|

6.53

|

%

|

|

|

6.94

|

%

|

S-8

DESCRIPTION OF CAPITAL STOCK

The following is a summary of the material terms and provisions of our capital stock. This summary does not purport to be complete and is

qualified in its entirety by reference to the pertinent sections of our Restated Certificate of Incorporation, our By-laws and the applicable provisions of the New Jersey Business Corporation Act and federal law governing bank holding companies.

General

Under our Restated

Certificate of Incorporation we have authority to issue up to 332,023,233 shares of common stock and 30,000,000 shares of preferred stock, 4,600,000 of which have been designated Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock,

Series A (the “Series A Preferred Shares”). As of September 30, 2016, 254,492,480 shares of Valley common stock and 4,600,000 shares of Series A Preferred Shares had been issued, along with 4,838,995 shares of common stock issuable

upon the exercise of outstanding warrants and an additional number of shares of common stock issuable pursuant to officer or employee stock options and restricted stock units. The remaining 25,400,000 shares of preferred stock remain unissued blank

check preferred stock (the “Blank Check Preferred Stock”).

Valley is a New Jersey general business corporation governed by the

New Jersey Business Corporation Act and a registered bank holding company under the Holding Company Act.

Common Stock

The following description of Valley common stock describes certain general terms of Valley common stock.

Dividend Rights

Holders

of Valley common stock are entitled to dividends when, as and if declared by the board of directors of Valley out of funds legally available for the payment of dividends. The only statutory limitation is that such dividends may not be paid when

Valley is insolvent. Funds for the payment of dividends by Valley must come primarily from the earnings of Valley’s bank subsidiary. Thus, as a practical matter, any restrictions on the ability of Valley National Bank to pay dividends will act

as restrictions on the amount of funds available for payment of dividends by Valley.

As a national banking association, Valley National

Bank is subject to limitations on the amount of dividends it may pay to Valley, Valley National Bank’s only shareholder. Prior approval by the Office of the Comptroller of the Currency (“OCC”) is required to the extent the total

dividends to be declared by Valley National Bank in any calendar year exceeds net profits for that year combined with the bank’s retained net profits from the preceding two calendar years, less any transfers to capital surplus.

Valley is also subject to certain Federal Reserve Board policies that may, in certain circumstances, limit its ability to pay dividends. These

policies require, among other things, that a bank holding company maintain a minimum capital base. The Federal Reserve Board may prohibit any dividend payment that would reduce a holding company’s capital below these minimum amounts.

The dividend rights of holders of Valley common stock are qualified and subject to the dividend rights of holders of Valley preferred stock

described below.

Voting Rights

At meetings of shareholders, holders of Valley common stock are entitled to one vote per share. The quorum for shareholders’ meetings is

a majority of the outstanding shares. Generally, actions and authorizations to be taken or given by shareholders require the approval of a majority of the votes cast by holders of Valley common stock at a meeting at which a quorum is present.

S-9

Liquidation Rights

In the event of liquidation, dissolution or winding up of Valley, holders of Valley common stock are entitled to share equally and ratably in

assets available for distribution after payment of debts and liabilities, subject to the rights of the holders of Valley preferred stock described below.

Assessment and Redemption

All outstanding shares of Valley common stock are fully paid and non-assessable. Valley common stock is not redeemable at the option of the

issuer or the holders thereof.

Other Matters

American Stock Transfer & Trust Company, LLC is presently both the transfer agent and the registrar for Valley common stock. Valley

common stock is traded on the New York Stock Exchange under the symbol “VLY”, and is registered with the SEC under Section 12(b) of the Exchange Act.

Series A Preferred Shares

The following

description of Valley preferred stock describes certain general terms of Valley’s Series A Preferred Shares.

Dividend &

Repurchase Rights

The Series A Preferred Shares are senior to our common stock and pay dividends at a rate of 6.25% per annum

from the original issue date to, but excluding, June 30, 2025. Thereafter the Series A Preferred Shares will pay dividends at a floating rate per annum equal to three-month LIBOR plus a spread of 3.85%. Dividends on the Series A Preferred

Shares are not cumulative and are not mandatory.

Liquidation Rights

The Series A Preferred Shares have a liquidation preference of $25 per share. In the event of liquidation, dissolution or winding up of

Valley, holders of the Valley preferred stock are entitled to receive full payment of the liquidation amount per share and the amount of any accrued and unpaid dividends, before any distribution of assets or proceeds is made to the holders of Valley

common stock.

Ranking

The Series A Preferred Shares will rank, with respect to the payment of dividends and distributions upon our liquidation, dissolution or

winding-up, respectively:

|

|

•

|

|

senior to our common stock and to each other class or series of our capital stock issued in the future, unless the terms of that capital stock expressly provide that it ranks at least on parity with the Series A

Preferred Shares with respect to such dividends and distributions;

|

|

|

•

|

|

on parity with any class or series of our capital stock issued in the future the terms of which expressly provide that it ranks on parity with our Series A Preferred Shares with respect to such dividends and

distributions; and

|

|

|

•

|

|

junior to any class or series of our capital stock issued in the future, the terms of which expressly provide that it ranks senior to the Series A Preferred Shares with respect to such dividends and distributions, if it

is approved by the holders of at least 66 2/3% of the outstanding Series A Preferred Shares.

|

S-10

Blank Check Preferred Stock

The remaining 25,400,000 unissued shares of preferred stock are typically referred to as “blank check” preferred stock. This term

refers to stock for which the rights and restrictions are determined by the board of directors of a corporation. Except in limited circumstances, Valley’s certificate of incorporation authorizes the Valley board of directors to issue new shares

of Valley common stock or preferred stock without further shareholder action.

Ranking

Unless otherwise specified in the applicable prospectus supplement, the preferred stock will, with respect to distribution rights and rights

upon liquidation, dissolution or winding up of Valley, rank:

|

|

•

|

|

senior to all classes or series of our common stock and to all equity securities the terms of which specifically provide that the equity securities rank junior to the preferred stock being offered;

|

|

|

•

|

|

equally with our Series A Fixed Rate Cumulative Perpetual Preferred Stock and all equity securities issued by us other than our common stock and preferred stock and other equity securities which by their terms rank

junior to or senior to the preferred stock being offered; and

|

|

|

•

|

|

junior to all equity securities issued by us the terms of which specifically provide that the equity securities rank senior to the preferred stock being offered.

|

For purposes of this subheading, the term “equity securities” does not include convertible debt securities.

Distributions

Holders

of the preferred stock of each series will be entitled to receive, when, as and if declared by our board of directors, out of our assets legally available for payment to stockholders, cash distributions, or distributions in kind or in other property

if expressly permitted and described in the applicable prospectus supplement, at the rates and on the dates as we will set forth in the applicable prospectus supplement.

Liquidation Preference

Upon any voluntary or involuntary liquidation, dissolution or winding up of the affairs of Valley, then, before any distribution or payment

will be made to the holders of any common stock or any other class or series of shares of our capital stock ranking junior to the preferred stock in the distribution of assets upon any liquidation, dissolution or winding up of Valley, the holders of

each series or class of preferred stock will be entitled to receive out of our assets legally available for distribution to stockholders liquidating distributions in the amount of the liquidation preference set forth in the applicable prospectus

supplement, plus an amount equal to all accumulated and unpaid distributions.

S-11

PRICE RANGE OF OUR COMMON STOCK AND DIVIDENDS DECLARED

Our common stock trades publicly on the New York Stock Exchange under the symbol “VLY.” The following table sets forth, for the

periods indicated, the quarterly high and low sales prices of our common stock as reported by the New York Stock Exchange. Also set forth below are dividends declared per share in each of these periods.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

High

|

|

|

Low

|

|

|

Dividend

Declared

|

|

|

Year Ended December 31, 2016

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter ended December 31, 2016 (through December 7, 2016)

|

|

$

|

11.91

|

|

|

$

|

9.36

|

|

|

|

TBD

|

|

|

Quarter ended September 30, 2016

|

|

$

|

9.86

|

|

|

$

|

8.73

|

|

|

$

|

0.11

|

|

|

Quarter ended June 30, 2016

|

|

$

|

10.20

|

|

|

$

|

8.49

|

|

|

$

|

0.11

|

|

|

Quarter ended March 31, 2016

|

|

$

|

9.76

|

|

|

$

|

8.31

|

|

|

$

|

0.11

|

|

|

Year Ended December 31, 2015

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter ended December 31, 2015

|

|

$

|

11.24

|

|

|

$

|

9.50

|

|

|

$

|

0.11

|

|

|

Quarter ended September 30, 2015

|

|

$

|

10.50

|

|

|

$

|

9.04

|

|

|

$

|

0.11

|

|

|

Quarter ended June 30, 2015

|

|

$

|

10.48

|

|

|

$

|

9.26

|

|

|

$

|

0.11

|

|

|

Quarter ended March 31, 2015

|

|

$

|

9.80

|

|

|

$

|

8.80

|

|

|

$

|

0.11

|

|

|

Year Ended December 31, 2014

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Quarter ended December 31, 2014

|

|

$

|

10.09

|

|

|

$

|

9.05

|

|

|

$

|

0.11

|

|

|

Quarter ended September 30, 2014

|

|

$

|

10.18

|

|

|

$

|

9.38

|

|

|

$

|

0.11

|

|

|

Quarter ended June 30, 2014

|

|

$

|

10.81

|

|

|

$

|

9.42

|

|

|

$

|

0.11

|

|

|

Quarter ended March 31, 2014

|

|

$

|

10.50

|

|

|

$

|

9.28

|

|

|

$

|

0.11

|

|

S-12

CERTAIN U.S. FEDERAL INCOME TAX CONSEQUENCES TO

NON-U.S. HOLDERS OF COMMON STOCK

The following is a summary of the material U.S. federal income tax consequences of the purchase, ownership, and disposition of common stock by

a non-U.S. holder (as defined below) that holds the common stock as a capital asset. This discussion is based upon the Internal Revenue Code of 1986, as amended, or the Code, effective U.S. Treasury regulations, and judicial decisions and

administrative interpretations thereof, all as of the date hereof and all of which are subject to change, possibly with retroactive effect. The foregoing are subject to differing interpretations which could affect the tax consequences described

herein. We have not sought any ruling from the Internal Revenue Service with respect to the statements made and the conclusions reached in this summary, and there can be no assurance that the Internal Revenue Service will agree with such statements

and conclusions. This discussion does not address all aspects of U.S. federal income taxation that may be applicable to investors in light of their particular circumstances, or to investors subject to special treatment under U.S. federal income tax

laws, such as financial institutions, insurance companies, tax-exempt organizations, entities that are treated as partnerships for U.S. federal income tax purposes, dealers in securities or currencies, expatriates, persons deemed to sell common

stock under the constructive sale provisions of the Code, persons that hold common stock as part of a straddle, hedge, conversion transaction, or other integrated investment, controlled foreign corporations, and passive foreign investment companies.

Furthermore, this discussion does not address any U.S. federal estate or gift tax laws or any state, local, or foreign tax laws.

You are urged to

consult your tax advisors regarding the U.S. federal, state, local, and foreign income and other tax consequences of the purchase, ownership, and disposition of common stock.

For purposes of this summary, you are a “non-U.S. holder” if you are a beneficial owner of common stock that, for U.S. federal

income tax purposes, is not:

|

|

•

|

|

an individual who is a citizen of the United States;

|

|

|

•

|

|

an individual who is a resident of the United States, which refers generally to an individual who is not a citizen of the U.S. (a “non-U.S. individual”) who (1) is a lawful permanent resident of the

United States, (2) is present in the United States for or in excess of certain periods of time, or (3) makes a valid election to be treated as a U.S. person;

|

|

|

•

|

|

a corporation, or any other entity treated as a corporation for U.S. federal income tax purposes, that is created or organized under the laws of the United States, any state thereof, or the District of Columbia;

|

|

|

•

|

|

an estate, the income of which is subject to U.S. federal income taxation regardless of its source; or

|

|

|

•

|

|

a trust, provided that, (1) a court within the United States is able to exercise primary supervision over its administration and one or more United States persons (as defined in the Code) have the authority to

control all substantial decisions of that trust, or (2) the trust has made an election under the applicable Treasury regulations to be treated as a United States person.

|

If a partnership (including any entity or arrangement treated as a partnership for U.S. federal income tax purposes) owns common stock, the

U.S. federal income tax treatment of a partner in the partnership generally will depend upon the status of the partner and the activities of the partnership. Partners in a partnership that own common stock should consult their tax advisors as to the

particular U.S. federal income tax consequences applicable to them.

Dividends

Any distributions of cash or property with respect to our common stock generally will constitute dividends for U.S. federal income tax

purposes to the extent of our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. If a distribution exceeds our current and accumulated earnings and

S-13

profits, the excess will be treated as a tax-free return of a non-U.S. holder’s investment, up to such non-U.S. holder’s tax basis in our common stock. Any remaining excess will be

treated as capital gain subject to the tax treatment in “—Disposition of Common Stock.”

Except as described below, if you

are a non-U.S. holder of common stock, dividends paid to you are subject to withholding of U.S. federal income tax at a 30% rate or at a lower rate if you are eligible for the benefits of an income tax treaty that provides for a lower rate. Even if

you are eligible for a lower treaty rate, we and other payors will generally be required to withhold at a 30% rate (rather than the lower treaty rate) on dividend payments to you, unless you have furnished to us or another payor:

|

|

•

|

|

a valid Internal Revenue Service Form W-8BEN or Form W-8BEN-E or an acceptable substitute form upon which you certify, under penalties of perjury, your status as (or, in the case of a non-U.S. holder that is an estate

or trust, such forms certifying the status of each beneficiary of the estate or trust as) a non-United States person and your entitlement to the lower treaty rate with respect to such payments; or

|

|

|

•

|

|

in the case of actual or constructive dividends, if required by the Foreign Account Tax Compliance Act (“FATCA”) or any intergovernmental agreement enacted pursuant to that law, such non-U.S. holder or any

entity through which it receives such dividends has provided the withholding agent with certain information with respect to its or the entity’s direct and indirect U.S. owners, and if such non-U.S. holder holds our common stock through a

foreign financial institution, such institution has entered into an agreement with the U.S. government to collect and provide to the U.S. tax authorities information about its accountholders (including certain investors in such institution or

entity) and such non-U.S. holder has provided any required information to such institution.

|

If you are eligible for a

reduced rate of United States withholding tax under a tax treaty, you may obtain a refund of any amounts withheld in excess of that rate by filing a refund claim with the United States Internal Revenue Service.

If dividends paid to you are “effectively connected” with your conduct of a trade or business within the United States, and you have

not claimed the dividends are eligible for any treaty benefits as income that is not attributable to a permanent establishment that you maintain in the United States, we and other payors generally are not required to withhold tax from the dividends,

provided that you have furnished to us or another payor a valid Internal Revenue Service Form W-8ECI or an acceptable substitute form upon which you certify, under penalties of perjury, that you are a non-United States person, and the dividends are

effectively connected with your conduct of a trade or business within the United States and are includible in your gross income. “Effectively connected” dividends are taxed at rates applicable to United States citizens, resident aliens,

and domestic United States corporations on a net income basis. If you are a corporate non-U.S. holder, “effectively connected” dividends that you receive may, under certain circumstances, be subject to an additional “branch profits

tax” at a 30% rate or at a lower rate if you are eligible for the benefits of an income tax treaty that provides for a lower rate.

Disposition of

Common Stock

If you are a non-U.S. holder, you generally will not be subject to U.S. federal income tax on gain that you recognize on

a disposition of our common stock unless:

|

|

•

|

|

the gain is “effectively connected” with your conduct of a trade or business in the United States, and the gain is attributable to a permanent establishment that you maintain in the United States, if that is

required by an applicable income tax treaty as a condition for subjecting you to United States taxation on a net income basis;

|

|

|

•

|

|

you are an individual, you hold the common stock as a capital asset, and you are present in the United States for 183 or more days in the taxable year of the disposition; or

|

S-14

|

|

•

|

|

we are or have been a “United States real property holding corporation” for U.S. federal income tax purposes.

|

“Effectively connected” gains are taxed at rates applicable to United States citizens, resident aliens, and domestic United States

corporations on a net income tax basis. If you are a corporate non-U.S. holder, “effectively connected” gains that you recognize may also, under certain circumstances, be subject to an additional “branch profits tax” at a 30%

rate or at a lower rate if you are eligible for the benefits of an income tax treaty that provides for a lower rate.

An individual

non-U.S. holder described in the second bullet point above will only be subject to U.S. federal income tax on the gain from the sale of common stock to the extent such gain is deemed to be from U.S. sources, which will generally only be the case

where (i) the individual’s tax home is in the United States or (ii) the individual maintains an office or other fixed place of business in the United States and the sale is attributable to such office or other fixed place of business.

An individual’s tax home is generally considered to be located at the individual’s regular or principal (if more than one regular) place of business. If the individual has no regular or principal place of business because of the nature of

the business, or because the individual is not engaged in carrying on any trade or business, then the individual’s tax home is his regular place of abode. If an individual is a non-U.S. holder as described in the second bullet point above, and

the gain derived from the sale of common stock is deemed to be from U.S. sources (as discussed above), then the non-U.S. holder may be subject to a flat 30% tax on such gain, which gain may be offset by U.S.-source capital losses.

In the case of the sale or disposition of our common stock on or after January 1, 2019, a non-U.S. holder may be subject to a 30%

withholding tax on the gross proceeds of the sale or disposition unless the requirements of FATCA described in the last bullet point under “—Dividends” above are satisfied.

We believe we are not, and we do not anticipate becoming, a “United States real property holding corporation” for U.S. federal

income tax purposes.

Information Reporting and Backup Withholding

Except as described below, a non-U.S. holder generally will be exempt from backup withholding and information reporting requirements with

respect to dividend payments and the payment of the proceeds from the sale of common stock effected at a United States office of a broker, as long as the payor or broker does not have actual knowledge or reason to know that you are a United States

person and you have furnished to the payor or broker:

|

|

•

|

|

a valid Internal Revenue Service Form W-8BEN or Form W-8BEN-E upon which you certify, under penalties of perjury, that you are (or, in the case of a non-U.S. holder that is an estate or a trust, Form W-8IMY (if

applicable), together with any other relevant documents, certifying that the non-U.S. holder and each beneficiary of the estate or trust is) a non-United States person; or

|

|

|

•

|

|

other documentation upon which it may rely to treat the payments as made to a non-United States person in accordance with U.S. Treasury regulations.

|

However, we must report annually to the Internal Revenue Service and to each non-U.S. holder the amount of dividends paid to such holder and

the tax withheld with respect to such dividends, regardless of whether withholding was required. Copies of the information returns reporting such dividends and withholding may also be made available to the tax authorities in the country in which the

non-U.S. holder resides under the provisions of an applicable income tax treaty.

Payment of the proceeds from the sale of common stock

effected at a foreign office of a broker generally will not be subject to information reporting or backup withholding. However, a sale of common stock that is effected at a foreign office of a broker will be subject to information reporting and

backup withholding if:

|

|

•

|

|

the proceeds are transferred to an account maintained by you in the United States;

|

|

|

•

|

|

the payment of proceeds or the confirmation of the sale is mailed to you at a United States address; or

|

S-15

|

|

•

|

|

the sale has some other specified connection with the United States as provided in U.S. Treasury regulations,

|

unless the broker does not have actual knowledge or reason to know that you are a United States person and the documentation requirements described above are

met or you otherwise establish an exemption.

In addition, a sale of common stock will be subject to information reporting if it is

effected at a foreign office of a broker that is:

|

|

•

|

|

a United States person;

|

|

|

•

|

|

a “controlled foreign corporation” for U.S. federal income tax purposes;

|

|

|

•

|

|

a foreign person 50% or more of whose gross income is effectively connected with the conduct of a United States trade or business for a specified three-year period; or

|

|

|

•

|

|

a foreign partnership, if at any time during its tax year (a) one or more of its partners are “U.S. persons”, as defined in U.S. Treasury regulations, who in the aggregate hold more than 50% of the income

or capital interest in the partnership, or (b) such foreign partnership is engaged in the conduct of a United States trade or business,

|

unless the broker does not have actual knowledge or reason to know that you are a United States person and the documentation requirements described above are

met or you otherwise establish an exemption. Backup withholding will apply if the sale is subject to information reporting and the broker has actual knowledge that you are a United States person.

You generally may obtain a refund of any amounts withheld under the backup withholding rules that exceed your income tax liability by filing a

refund claim with the Internal Revenue Service.

S-16

UNDERWRITING

Subject to the terms and conditions contained in an underwriting agreement between us and Keefe, Bruyette & Woods, Inc., as

underwriter, we have agreed to sell to the underwriter, and the underwriter has agreed to purchase from us, 8,400,000 shares of common stock at a price of $11.55 per share.

Subject to the terms and conditions set forth in the underwriting agreement, the underwriter has agreed to purchase all of the shares sold

under the underwriting agreement (other than those covered by the option to purchase additional shares described below) if any of these shares are purchased.

We have agreed to indemnify the underwriter against specified liabilities, including liabilities under the Securities Act, or to contribute to

payments the underwriter may be required to make in respect of those liabilities.

The underwriter is offering the shares, subject to

prior sale, when, as and if issued to and accepted by it, subject to approval of legal matters by counsel and other conditions. The underwriter reserves the right to withdraw, cancel or modify this offer and to reject orders in whole or in part.

Commissions and Discounts

The

underwriter may receive from purchasers of the shares normal brokerage commissions in amounts agreed with such purchasers.

The

underwriter proposes to offer the shares of common stock offered hereby from time to time for sale in one or more transactions on the NYSE, in the over-the-counter market, through negotiated transactions or otherwise at market prices prevailing at

the time of sale, at prices related to prevailing market prices or at negotiated prices, subject to receipt and acceptance by the underwriter and subject to the underwriter’s right to reject any order in whole or in part. The underwriter may

effect such transactions by selling the shares of common stock to or through dealers and such dealers may receive compensation in the form of discounts, concessions or commissions from the underwriter and/or purchasers of shares of common stock for

whom they may act as agents or to whom they may sell as principal. The difference between the price at which the underwriter purchases shares and the price at which the underwriter resells such shares may be deemed underwriting compensation.

The expenses of the offering are estimated at approximately $328 thousand and are payable by us.

Option to Purchase Additional Shares

We

have granted an option to the underwriter to purchase up to 840,000 additional shares at a price of $11.55 per share. The underwriter may exercise this option for 30 days from the date of this prospectus supplement.

No Sales of Similar Securities

We and

each of our executive officers, severally and not jointly, have agreed, with limited exceptions, not to sell or transfer any shares of Valley common stock for 60 days after the date of this prospectus supplement without first obtaining the

written consent of Keefe, Bruyette & Woods, Inc. We will be permitted to issue shares to sellers in connection with acquisitions or business combinations, and to file with the SEC registration statements under the Securities Act relating to

such acquisitions or business combinations.

Specifically, we and each of our executive officers have agreed, subject to certain

exceptions, not to, directly or indirectly:

|

|

•

|

|

offer, pledge, sell or contract to sell any common stock;

|

S-17

|

|

•

|

|

sell any option or contract to purchase any common stock;

|

|

|

•

|

|

purchase any option or contract to sell any common stock;

|

|

|

•

|

|

grant any option, right or warrant for the sale of any common stock;

|

|

|

•

|

|

lend or otherwise dispose of or transfer any common stock;

|

|

|

•

|

|

enter into any swap or other agreement or any transaction that transfers, in whole or in part, directly or indirectly, the economic consequence of ownership of any common stock, whether any such swap or transaction is

to be settled by delivery of common stock or other securities, in cash or otherwise;

|

|

|

•

|

|

file with the SEC a registration statement under the Securities Act relating to any additional shares of common stock; or

|

|

|

•

|

|

publicly disclose the intention to effect any transaction described in the above bullet points.

|

This lockup provision applies to Valley common stock and to securities convertible into or exchangeable or exercisable for Valley common stock

and, with respect to executive officers, whether now owned or hereafter acquired or for which the power of disposition is later acquired.

In the event that we notify the underwriter in writing that we do not intend to proceed with this offering, if the underwriting agreement does

not become effective, or if the underwriting agreement is terminated prior to payment for and delivery of our common stock, the lockup provisions will be released.

NYSE Listing

Our common stock is listed

on the NYSE under the symbol “VLY.”

Electronic Offer, Sale and Distribution of Securities

In connection with the offering, the underwriter or securities dealers may distribute this prospectus supplement and the accompanying

prospectus by electronic means, such as e-mail.

Conflicts of Interest

The underwriter and its affiliates are full-service financial institutions engaged in various activities, which may include securities

trading, commercial and investment banking, financial advisory, investment management, investment research, principal investment, hedging, financing and brokerage activities. The underwriter and its affiliates have engaged in, and may in the future

engage in, investment banking, commercial banking and other commercial dealings in the ordinary course of business with us and our affiliates, for which they have received and may continue to receive customary fees and commissions.

In addition, in the ordinary course of their business activities, the underwriter and its affiliates may make or hold a broad array of

investments and actively trade debt and equity securities (or related derivative securities) and financial instruments (including bank loans) for their own account and for the accounts of their customers. Such investments and securities activities

may involve securities and/or instruments of ours or our affiliates. If the underwriter or its affiliates have a lending relationship with us, the underwriter or its affiliates may hedge their credit exposure to us consistent with their customary

risk management policies. Typically, the underwriter and its affiliates would hedge such exposure by entering into transactions which consist of either the purchase of credit default swaps or the creation of short positions in our securities. The

underwriter and its affiliates may also make investment recommendations and/or publish or express independent research views in respect of such securities or financial instruments and may hold, or recommend to clients that they acquire, long and/or

short positions in such securities and instruments.

S-18

LEGAL MATTERS

The validity of the common stock offered hereby will be passed upon for us by Day Pitney LLP, New York, New York. Certain legal matters will

be passed upon for the underwriter by Hogan Lovells US LLP, Washington, D.C.

EXPERTS