Filing by Certain Investment Companies of Rule 482 Advertising in Accordance With Rule 497 and the Note to Rule 482(e) (497ad)

December 12 2016 - 9:16AM

Edgar (US Regulatory)

Filed Pursuant to 497(a)

File Nos. 333-214182

Rule 482ad

Saratoga Investment Corp. Announces Offering of Notes

NEW YORK, NY (December 12, 2016) – Saratoga Investment Corp. (the “Company”) (NYSE: SAR) announced the commencement of a

registered public offering of Notes (the “Notes”).

The Notes are expected to be listed on the New York Stock Exchange and to

trade thereon within 30 days of the original issue date.

Ladenburg Thalmann & Co. Inc., a subsidiary of Ladenburg Thalmann Financial

Services Inc. (NYSE MKT: LTS), BB&T Capital Markets, Compass Point and William Blair are acting as joint book-running managers. Investors are advised to consider carefully the investment objective, risks and charges and expenses of the Company

before investing.

A registration statement, including a prospectus, which is preliminary and subject to completion, relating to the Notes

has been filed with the U.S. Securities and Exchange Commission, but has not yet become effective. The Notes may not be sold, nor may offers to buy be accepted, prior to the time the registration statement becomes effective. This press release does

not constitute an offer to sell or the solicitation of an offer to buy, nor will there be any sale of, the Notes referred to in this press release in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of such state or jurisdiction.

The offering will be made only by means of a

prospectus. Copies of the preliminary prospectus relating to the offering may be obtained for free by visiting the Securities and Exchange Commission’s website at www.sec.gov or may be obtained from of any of the following investment banks:

Ladenburg Thalmann, Attn: Syndicate Department, 570 Lexington Avenue, 11th Floor New York, NY 10022, or by emailing

prospectus@ladenburg.com

(telephone number 1-800-573-2541); BB&T Capital Markets at 901 East Byrd Street, 3

rd

Floor, Richmond, VA 23219 Attn: Syndicate Dept. or via email request:

prospectusrequests@bbandtcm.com

; Compass Point Research & Trading, LLC 1055 Thomas Jefferson Street NW, Suite 303

Washington, D.C. 20007, or email at

syndicate@compasspointllc.com

; or William Blair & Company, L.L.C., Attention: Prospectus Department, 222 West Adams Street, Chicago, IL 60606, or by telephone at 1-800-621-0687 or email at

prospectus@williamblair.com

.

The preliminary prospectus contains a description of these matters and other important information about the Company and should be read carefully before investing.

About Saratoga Investment Corp.

Saratoga

Investment Corp. is a specialty finance company that invests primarily in leveraged loans and mezzanine debt issued by privately owned U.S. middle-market businesses, which the Company defines as companies having annual EBITDA (earnings before

interest, taxes, depreciation and amortization) of between $5 million and $50 million, both through direct lending and through participation in loan syndicates. Saratoga Investment Corp.’s objective is to generate current income and, to a

lesser extent, capital appreciation from our investments. Saratoga Investment Corp. has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940 and is externally-managed by Saratoga

Investment Advisors, LLC, a New York-based investment firm affiliated with Saratoga Partners, a middle market private equity investment firm. Within the BDC, Saratoga Investment Corporation manages both an SBIC-licensed subsidiary and a

Collateralized Loan Obligation (CLO) fund. The Company believes these diverse funding sources, combined with a permanent capital base, enable Saratoga Investment Corp. to offer a broad range of financing solutions.

Forward Looking Statements

Statements included herein may contain “forward-looking statements”. Statements other than statements of historical facts included in

this press release may constitute forward-looking statements and are not guarantees of future performance or results and involve a number of assumptions, risks and uncertainties, which change over time. Actual results may differ materially from

those anticipated in any forward-looking statements as a result of a number of factors, including those described from time to time in filings by the Company with the Securities and Exchange Commission. Except as required by law, the Company

undertakes no duty to update any forward-looking statement made herein. All forward-looking statements speak only as of the date of this press release.

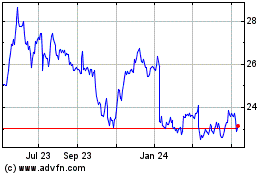

Saratoga Investment (NYSE:SAR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Saratoga Investment (NYSE:SAR)

Historical Stock Chart

From Apr 2023 to Apr 2024