Current Report Filing (8-k)

December 09 2016 - 5:29PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported):

December 7, 2016

Northwest Biotherapeutics, Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

0-35737

|

94-3306718

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation or organization)

|

File Number)

|

Identification No.)

|

4800 Montgomery Lane, Suite 800

Bethesda, Maryland 20814

(Address of Principal Executive Offices)

(240) 497-9024

(Registrant’s telephone number, including

area code)

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions

A.2 below):

|

|

☐

|

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

Item 2.04.

|

Triggering Events That Accelerate or Increase a Direct

Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

|

As discussed in Item

3.01 herein, on December 7, 2016, Northwest Biotherapeutics, Inc. (the “Company”) notified the Nasdaq Stock Market

(“Nasdaq”) of its intention to voluntarily withdraw the Company’s common stock from listing on the Nasdaq Capital

Market.

Ceasing to be listed

or quoted on Nasdaq will constitute a “Fundamental Change” pursuant to the indenture (“Indenture”) relating

to the Company’s Convertible Senior Notes (the “Notes”) that were issued in August, 2014 and are otherwise due

in August, 2017. In accordance with the terms of the Indenture, the Company will be obligated to make an offer to repurchase the

Notes for cash in accordance with the terms of the Indenture within a period of 20 business days following this change. The aggregate

principal amount of the Notes outstanding is $11.0 million. The Company has begun to evaluate its options to finance the repurchase

of the Notes, although there can be no assurance that such options will be available or will be on acceptable terms. If the Company

fails to satisfy its obligations, such failure would result in an event of default under the Notes.

The voluntary withdrawal

of the Company’s common stock from listing on Nasdaq also will constitute a “Make-Whole Fundamental Change” under

the Indenture. As a result, beginning on December 12, 2016, holders of the Notes will have the right to convert their Notes in

accordance with the terms of the Indenture. This conversion right will continue until the later of: (i) 5:00 p.m., New York City

time, on the business day that is on the 30th scheduled trading day immediately following the actual effective date of the delisting

and (ii) 5:00 p.m., New York City time, on the business day immediately preceding the fundamental change repurchase date relating

to the delisting.

Because the current

trading price of the Company’s common stock is below $6.004 per share, the Company does not presently anticipate that any

“Make-Whole Conversion Rate Adjustment” (as defined in the Indenture) will be required in connection with the Make-Whole

Fundamental Change. Pursuant the Indenture, the Company has the right to settle any conversions, at its election, in cash, shares

of common stock, or a combination thereof. To the extent any Notes are converted in connection with the Make-Whole Fundamental

Change, the Company intends to settle any such conversions solely in shares of common stock (plus cash in lieu of fractional shares).

The closing price of the Company’s common stock on December 8, 2016 was $0.58 per share. The conversion price in respect

of the Notes is $6.60 per share.

|

|

Item 3.01.

|

Notice of Delisting or Failure to Satisfy a Continued

Listing Rule or Standard; Transfer of Listing.

|

On December 7, 2016,

the Company notified the Nasdaq of its intention to voluntarily withdraw the Company’s common stock from listing on the Nasdaq

Capital Market. The Company intends to file Form 25, Notification of Removal from Listing and/or Registration under Section 12(b)

of the Exchange Act, with the Securities and Exchange Commission (the “SEC”) on December 19, 2016, and expects trading

in its common stock on Nasdaq to be suspended at that time. The Company further expects that the delisting will become effective

ten days from the filing of the Form 25 with the SEC, or on or about December 29, 2016. The Company is also voluntarily withdrawing

from listing on Nasdaq its series of warrants to purchase common stock that are traded on Nasdaq. The Company anticipates that

its common stock will be quoted on the OTC market at the time trading in its common stock on Nasdaq is suspended.

A copy of the press

release, dated December 7, 2016, announcing the Company’s intention to voluntarily withdraw the Company's common stock from

listing on Nasdaq is included as Exhibit 99.1 and is incorporated herein by reference.

|

|

Item 9.01.

|

Financial Statements and Exhibits

|

Exhibit

No.

|

|

Description

|

|

99.1

|

|

Press release, dated December 7, 2016

|

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

NORTHWEST BIOTHERAPEUTICS, INC.

|

|

|

|

|

|

|

|

|

|

|

|

Date: December 9, 2016

|

By:

|

/s/ Linda

Powers

|

|

|

|

Name:

|

Linda Powers

|

|

|

|

Title:

|

Chief Executive

Officer and Chairman

|

|

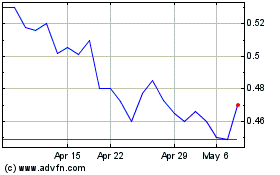

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Northwest Biotherapeutics (QB) (USOTC:NWBO)

Historical Stock Chart

From Apr 2023 to Apr 2024