Asia Currencies Hit by ECB Easing, but Stocks Mostly Gain

December 08 2016 - 11:30PM

Dow Jones News

Asian currencies were hit Friday by a perceived policy easing by

the European Central Bank, even as stock-market reaction was mostly

positive.

Japan's Nikkei was up 1.1%, Australia's S&P/ASX 200 gained

0.3% and Taiwan's Taiex was up 0.1%.

The ECB said Thursday it would extend its bond-purchase program

by nine months to the end of 2017, but cut its monthly purchases to

€60 billion ($64 billion) from €80 billion, as of April.

The ECB action combined tightening and loosening measures, but

markets chose to focus on the extension of the asset-purchase

program, known as quantitative easing, or QE.

"More QE removes concerns," said Alex Furber, a sales trader at

CMC Markets. "It gives investors confidence."

The ECB decision triggered a sharp drop in the euro in late New

York trading, bolstering the U.S. dollar broadly. That spilled over

into Asian trading Friday, sparking losses in Asian currencies

against the dollar, said Khoon Goh, head of Asia research at ANZ.

"The broad dollar move is still a very important factor in driving

Asian currencies," he added.

China set the yuan 0.35% weaker against the U.S. dollar Friday,

fixing the daily dollar-yuan midpoint at 6.8972, compared with

6.8731 on Thursday. Depreciation pressure for the yuan has picked

up in recent days, with the dollar-yuan rate in the offshore market

rising above 6.91.

The Korean won was down 0.5% against the dollar, partly due to

the volatile political situation there: South Korean President Park

Geun-hye is widely expected to be impeached by lawmakers today. The

Korea Kospi was also down 0.4%.

In Japan, the yen was off 0.4% against the dollar. The yen's

weakening helped Japan's export-oriented stock, as a devalued yen

makes their goods cheaper in dollars. Sony gained 3.1% and Honda

Motor was up 0.7%.

The Shanghai Composite was up 0.2% after solid economic data was

released Friday.

China's producer price index rose 3.3% in November from a year

earlier, flagging improved demand and pricing power for China's

industries. The reading from the National Bureau of Statistics for

factory-gate prices came in much stronger than economists' median

forecast of a 2.4% increase.

China's consumer price index increased 2.3% in November from a

year earlier, beating the median forecast for a 2.2% gain from a

survey of economists by The Wall Street Journal.

However, that did not help the Hang Seng Index, which was

trading down 0.6%, partly due to a sharp selloff in casino

stocks.

The South China Morning Post reported that the daily ATM

withdrawal limit in Macau for China UnionPay bank card holders will

be cut by half to 5,000 patacas (US$626). The capital outflow

measure cuts the sums that the Chinese can gamble in the special

administrative region.

Galaxy Entertainment tumbled 8.5%, Sands China dropped 8.6% and

MGM China fell 7.4% in early trade Friday.

The China market is still largely being weighed down with

capital outflow and the yuan depreciation, said Andrew Sullivan,

managing director of sales trading at Haitong International

Securities.

Saumya Vaishampayan, Liyan Qi, Saumya Vaishampayan and Kenan

Machado contributed to this article.

Write to Willa Plank at willa.plank@wsj.com

(END) Dow Jones Newswires

December 08, 2016 23:15 ET (04:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

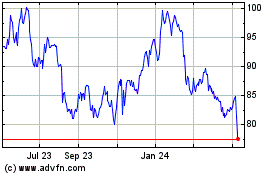

Sony (NYSE:SONY)

Historical Stock Chart

From Mar 2024 to Apr 2024

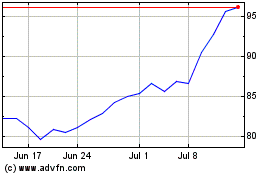

Sony (NYSE:SONY)

Historical Stock Chart

From Apr 2023 to Apr 2024