Home Builder Hovnanian Posts Disappointing Results

December 08 2016 - 11:20AM

Dow Jones News

Home builder Hovnanian Enterprises Inc., which has struggled

under a massive debt load, said earnings declined in the latest

period even though revenue rose, hurt by climbing expenses.

The results missed Wall Street expectations, and shares fell

2.9% to $2.38 in morning trading in New York.

Hovnanian has faced maturing public debt from land purchases and

acquisitions during the boom years. The company increased its use

of land bank financing and joint ventures and exited four

underperforming markets in 2016, which Chief Executive Ara

Hovnanian said was a "challenging year" for the company.

But the company said it would start to actively seek out land

investment opportunities, which should lead to higher levels of

profitability in the future, Mr. Hovnanian said.

Over all, net income was $22.3 million, or 14 cents a share,

compared with $25.5 million, or 17 cents a share, in the prior-year

period. Analysts polled by Thomson Reuters expected 13 cents a

share.

Revenue rose 16% to $805.1 million, as analysts expected $802.3

million.

Total home-building expenses rose to $719.9 million from $612.9

million in the prior-year period. U.S. home builders have faced

growing concerns over rising land and labor costs and an tepid

housing recovery.

Luxury home builder Toll Brothers Inc. earlier this week

reported double-digit revenue growth in its fourth-quarter results

and projected a strong performance going into 2017 despite

softening in some markets.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

December 08, 2016 11:05 ET (16:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

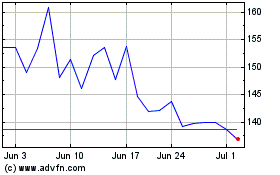

Hovnanian Enterprises (NYSE:HOV)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hovnanian Enterprises (NYSE:HOV)

Historical Stock Chart

From Apr 2023 to Apr 2024