National Grid to Sell 61% of UK Gas Distribution Unit; Return GBP4 Billion to Holders

December 08 2016 - 3:03AM

Dow Jones News

By Ian Walker

LONDON--National Grid PLC (NGG) said Thursday it is selling 61%

of its interest in its U.K. gas distribution business to a

consortium of long-term infrastructure investors in a deal that

values the unit at about 13.8 billion pounds ($17.45 billion), and

will return GBP4 billion of the proceeds to shareholders.

The utility firm, which announced November last year that it was

selling the unit, will get GBP3.6 billion in cash from the

consortium on completion and will own a 39% minority equity

interest in a new holding company. In addition, it will get GBP1.8

billion from additional debt financing.

The consortium buying the business comprises Macquarie

Infrastructure and Real Assets, Allianz Capital Partners, Hermes

Investment Management, CIC Capital Corporation, Qatar Investment

Authority, Dalmore Capital and Amber Infrastructure

Ltd./International Public Partnerships Ltd. (INPP.LN).

National Grid said it expects that the deal to complete on or

before March 31, 2017.

Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

(END) Dow Jones Newswires

December 08, 2016 02:48 ET (07:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

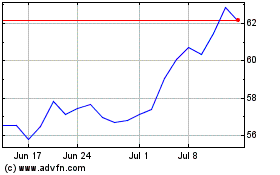

National Grid (NYSE:NGG)

Historical Stock Chart

From Mar 2024 to Apr 2024

National Grid (NYSE:NGG)

Historical Stock Chart

From Apr 2023 to Apr 2024