CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the information incorporated by reference herein contains certain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. Such statements are based on assumptions and expectations which may not be realized and are inherently subject to risks, uncertainties and other factors, many of which cannot be predicted with accuracy and some of which might not even be anticipated. Future events and actual results, performance, transactions or achievements, financial and otherwise, may differ materially from the results, performance, transactions or achievements expressed or implied by the forward-looking statements. Risks, uncertainties and other factors that might cause such differences, some of which could be material, include, but are not limited to:

|

|

·

|

|

Commodity price fluctuations;

|

|

|

·

|

|

Mine protests and work stoppages;

|

|

|

·

|

|

Rock formations, faults and fractures, water flow and possible CO2 gas exhalation or other unanticipated geological situations;

|

|

|

·

|

|

Decisions of foreign countries and banks within those countries;

|

|

|

·

|

|

Unexpected changes in business and economic conditions, including the rate of inflation;

|

|

|

·

|

|

Changes in interest rates and currency exchange rates;

|

|

|

·

|

|

Timing and amount of production;

|

|

|

·

|

|

Technological changes in the mining industry;

|

|

|

·

|

|

Changes in exploration and overhead costs;

|

|

|

·

|

|

Access and availability of materials, equipment, supplies, labor and supervision, power and water;

|

|

|

·

|

|

Results of current and future feasibility studies;

|

|

|

·

|

|

The level of demand for our products;

|

|

|

·

|

|

Changes in our business strategy, plans and goals;

|

|

|

·

|

|

Interpretation of drill hole results and the geology, grade and continuity of mineralization;

|

|

|

·

|

|

Acts of God such as floods, earthquakes and any other natural disasters;

|

|

|

·

|

|

The uncertainty of mineralized material estimates and timing of mine construction expenditures; and

|

|

|

·

|

|

Other risks identified in the section entitled “RISK FACTORS” in any post-effective amendment or prospectus supplement hereto, in our Annual Report on Form 10-K for the fiscal year ended December 31, 2015, and, from time to time, in other reports we file with the SEC or in other documents that we publicly disseminate.

|

This list, together with the factors identified under the section entitled “RISK FACTORS,” is not an exhaustive list of the factors that may affect any of our forward-looking statements. You should read this prospectus, any post-effective amendment, any prospectus supplement, and any documents incorporated by reference in any of those documents completely and with the understanding that our actual future results may be materially different from what we expect. These forward-looking statements represent our beliefs, expectations and opinions only as of the date of this prospectus, any post-effective amendment and any prospectus supplement.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. These forward-looking statements involve risks, uncertainties and other factors that may cause our actual results in future periods to differ materially from forecasted results. We do not undertake to publicly update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, other than to reflect a material change in the information previously disclosed, as required by applicable law. You should review our subsequent reports filed from time to time with the SEC on Forms 10-K, 10-Q and 8-K and any amendments thereto. We qualify all of our forward-looking statements by these cautionary statements.

Prospective investors are urged not to put undue reliance on forward-looking statements.

THE COMPANY

The following summary highlights information found in this prospectus and the documents incorporated by reference in this prospectus. It does not contain all of the information you should consider before investing in our common stock. You should read the entire prospectus carefully, including the sections entitled “RISK FACTORS”

and “INFORMATION INCORPORATED BY REFERENCE.”

As used in this prospectus, unless the context requires otherwise, the terms “Gold Resource Corporation,” the “Company,” “we,” “our,” and “us” refer to Gold Resource Corporation and, where the context requires, our subsidiaries.

Gold Resource Corporation was organized under the laws of the State of Colorado on August 24, 1998. We are a producer of metal concentrates that contain gold, silver, copper, lead and zinc, and doré containing gold and silver at the Aguila Project in the southern state of Oaxaca, Mexico (“Oaxaca”). The Aguila Project includes the Aguila open pit mine, which ceased operations in February 2011, and the Arista underground mine, which is currently in operation. We also perform exploration and evaluation work on our portfolio of precious and base metal exploration properties in Oaxaca and Nevada, United States of America (“Nevada”) and continue to evaluate other properties for possible acquisition.

We have two operational units in North America, the Oaxaca Mining Unit and the Nevada Mining Unit. The majority of our assets are located at our Oaxaca Mining Unit, located on our Aguila Project, including our Aguila milling facility and Arista underground mine. The Aguila milling facility produces metal concentrates and doré from ore mined from the Arista mine, which contains precious metal products of gold and silver, and by-products of copper, lead and zinc. The Aguila Project includes approximately 30,074 hectares of mining concessions, an access road from a major highway, haul roads, a mill facility and adjoining buildings, an assay lab, an open pit and underground mine, tailings pond and other infrastructure. We perform exploration, evaluation and development work on our properties within our Nevada Mining Unit.

Our operations in Oaxaca are conducted through our Mexican subsidiary, Don David Gold Mexico S.A. de C.V. (“DDGM”). Our Nevada exploration and development is done through our wholly-owned subsidiaries, GRC Nevada Inc. and Walker Lane Minerals Corp.

Our principal executive offices are located 2886 Carriage Manor Point, Colorado Springs, Colorado 80906, and our telephone number is (303) 320-7708. We maintain a website at

www.goldresourcecorp.com

and through a link on our website you can view the periodic filings that we make with the SEC, as well as certain of our corporate governance documents such as our code of ethics.

Oaxaca Mining Unit

The Arista underground mine is our primary source of ore to feed the mill at present. The mining methods of long-hole stoping and cut-and-fill are utilized. During 2016, we have drifted toward the Switchback vein system, an area of mineralization approximately 500 meters northeast of the Arista vein system. Switchback drill results have intercepted at least seven veins with mineralized material identified along a strike length of nearly 450 meters and a vertical depth of more than 450 meters. We have reached the mineralized Switchback veins on level 24 of the decline ramp in the Arista mine at the end of the third quarter of 2016. We are preparing to extract mineralized material from Switchback during the fourth quarter 2016. Exploration from underground drill stations continue to test the extent of the Arista and Switchback vein systems mineralization while continuing to optimize the overall Arista mine plan.

We are also developing the Mirador mine at our Alta Gracia Project, having received our final permit to begin mining. We envision relatively small-scale mining initially at this site, improving on historic underground workings, and trucking approximately 100 to 200 tonnes per day to the Aguila mill for processing through the agitated leach circuit, which has heretofore remained dormant. We are targeting to process mill feed from Mirador in late 2016 or early 2017.

We also performed exploration at several of our other properties, including a surface drill program on portions of the Alta Gracia Project and Las Margaritas property that focused on previously identified drill targets and testing new targets.

Nevada Mining Unit

In 2015, we acquired a three-year option to purchase a property held by Silver Reserve Corporation, a wholly-owned subsidiary of Infrastructure Materials Corp. We refer to the property as Gold Mesa, a gold bearing property in south central Nevada’s Walker Lane Mineral Belt.

We also staked 140 additional unpatented claims surrounding the original Gold Mesa property covering an area of approximately 2,800 acres. We have completed two drill campaigns in 2016 and continue to develop additional drill targets. The results of our initial program were very encouraging, suggesting a future operation of high-grade, potential open pit or pits with standard heap leaching would be utilized for mineral extraction. The high-grade mineralization begins at and/or just below the surface.

In August 2016, we acquired an entity called Walker Lane Minerals Corp. from two Texas limited partnerships, which entity holds all of the assets related to the development project called Isabella-Pearl in Mineral County, Nevada. We acquired a total of 341 unpatented mining claims covering approximately 6,800 acres, which are subject to royalty interests up to 3% of net smelter returns. The project is in advanced-stage engineering and permitting. Initial activities at this property since our acquisition include drilling for reserve delineation and further metallurgical studies, in addition to completing preparations for permitting and drilling a water well. We expect to undertake further exploration activity, engineering and design work to determine a production decision in the near future.

In August 2016, we also acquired the Mina Gold property from Nevada Select Royalty, Inc., a wholly-owned subsidiary of Ely Gold & Minerals Inc., which property is located near Isabella-Pearl and Gold Mesa. Mina Gold is comprised of five patented and 43 unpatented mining claims covering approximately 825 acres, subject to royalty interests varying from 2% to 3% of net smelter returns. Mina Gold is an exploration-stage property. We continue to review historical mining data with an initial reverse circulation drill program planned for the fourth quarter of 2016.

During 2016, we released our option to purchase two Nevada exploration properties we referred to as Radar and Goose. The net effect of these additions and reductions in Nevada brings our total interest to approximately 12,000 acres in Mineral County, Nevada

over which we maintain a 100% interest.

Our goals for the remainder of 2016 are to replace and supplement the reserves we mined from the Oaxaca Mining Unit’s Arista underground mine, continue our focus on lowering our costs and diversifying our operations by further developing our Nevada Mining Unit and to determine whether to place the Isabella Pearl Project into production.

RISK FACTORS

An investment in our securities involves significant risks. Before you invest in any of our securities, you should carefully consider the information included and incorporated by reference in this prospectus and any applicable prospectus supplement, including the risk factors incorporated by reference from our Annual Report on Form 10-K for the year ended December 31, 2015, as updated by our quarterly reports on Form 10-Q and other filings we make with the SEC. Each of the risks described in these sections and documents could materially and adversely affect our business, financial condition, results of operations and prospects, and could result in a loss of your investment. Additional risks and uncertainties not known to us or that we deem immaterial may also impair our business, financial condition, results of operations and prospects.

RATIO OF EARNINGS TO FIXED CHARGES

The following table sets forth our consolidated ratio of earnings to fixed charges for the periods indicated. As we have no shares of preferred stock outstanding as of the date of this prospectus, no ratio of earnings to combined fixed charges and preferred stock dividends is presented. You should read this table in conjunction with the consolidated financial statements and notes incorporated by reference in this prospectus.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

|

|

Year Ended December 31,

|

|

|

|

September 30, 2016

|

|

2015

|

|

2014

|

|

2013

|

|

2012

|

|

2011

|

|

Ratio of earnings to fixed charges

(1)

|

|

144

|

|

41

|

|

81

|

|

20

|

|

352

|

|

63

|

_____________________

(1)

The ratio of earnings to fixed charges was computed by dividing earnings by fixed charges. Earnings consist of income from continuing operations before income taxes, fixed charges and amortization of capitalized interest, less capitalized interest. Fixed charges consist of capitalized interest and interest within rent expense.

USE OF PROCEEDS

Unless we specify otherwise in a prospectus supplement, we intend to use the net proceeds from sales of securities by us for general corporate purposes. If net proceeds from a specific offering will be used to repay indebtedness, the applicable prospectus supplement will describe the relevant terms of the debt to be repaid.

DESCRIPTION OF CAPITAL STOCK

Authorized Capital Stock

Our authorized capital stock consists of:

|

|

·

|

|

100,000,000 shares of common stock, par value $0.001 per share; and

|

|

|

·

|

|

5,000,000 shares of preferred stock, par value $0.001 per share.

|

As of December 6, 2016, we had 56,566,874 shares of common stock , and no shares of preferred stock, outstanding. Our common stock is listed on the NYSE MKT under the symbol “GORO.”

Common Stock

Holders of our common stock are each entitled to cast one vote for each share held of record on all matters presented to the shareholders. Cumulative voting is not allowed; hence, the holders of a majority of our outstanding common stock can elect all directors.

Holders of our common stock are entitled to receive such dividends as may be declared by our Board of Directors out of funds legally available and, in the event of liquidation, to share pro rata in any distribution of our assets after payment of liabilities. Our Board of Directors is not obligated to declare a dividend.

Holders of our common stock do not have preemptive rights to subscribe to additional shares if issued. There are no conversion, redemption, sinking fund or similar provisions regarding the common stock. All outstanding shares of common stock are fully paid and nonassessable.

The transfer agent for our common stock is Computershare Investor Services, Inc., and can be contacted at 8742 Lucent Blvd. Suite 300, Highlands Ranch, Colorado 80129 or by telephone at (303) 262-0600.

Preferred Stock

Shares of preferred stock may be issued from time to time in one or more series as may be determined by our Board of Directors. The voting powers and preferences, the relative rights of each such series (including any right to convert the preferred stock into common stock, rights, or warrants) and the qualifications, limitations and restrictions of each series will be

established by the Board of Directors. Our directors may issue preferred stock with multiple votes per share and dividend rights which would have priority over any dividends paid with respect to the holders of our common stock. The issuance of preferred stock with these rights may make the removal of management difficult even if the removal would be considered beneficial to shareholders generally, and will have the effect of limiting shareholder participation in transactions such as mergers or tender offers if these transactions are not favored by our management. As of the date of this prospectus, no shares of preferred stock are outstanding.

The terms and conditions, if any, upon which any series of preferred stock is convertible into common stock or other securities will be set forth in the prospectus supplement relating to the offering of those shares of preferred stock. These terms typically will include

|

|

·

|

|

the number of shares of common stock or other securities into which the preferred stock is convertible;

|

|

|

·

|

|

the conversion price (or manner of calculation);

|

|

|

·

|

|

provisions as to whether conversion will be at the option of the holders of the preferred stock or at our option;

|

|

|

·

|

|

the events, if any, requiring an adjustment of the conversion price; and

|

|

|

·

|

|

provisions affecting conversion in the event of the redemption of that series of preferred stock.

|

We will identify the transfer agent and registrar for any series of preferred stock offered by this prospectus in a prospectus supplement.

Anti-Takeover Provisions

Provisions of Colorado law, our Articles of Incorporation and Bylaws could make it more difficult to acquire us by means of a tender offer, a proxy contest or otherwise, or to remove incumbent officers and directors. These provisions are expected to discourage certain types of coercive takeover practices and takeover bids that our Board of Directors may consider inadequate and to encourage persons seeking to acquire control of us to first negotiate with our Board of Directors. We believe that the benefits of increased protection of our ability to negotiate with the proponent of an unfriendly or unsolicited proposal to acquire or restructure us outweigh the disadvantages of discouraging takeover or acquisition proposals because, among other things, negotiation of these proposals could result in an improvement of their terms. These

provisions

could adversely affect the price of our common stock. Among other things, our Articles of Incorporation and Bylaws:

|

|

·

|

|

permit

our Board of Directors to issue up to 5,000,000 shares of preferred stock, with any rights, preferences and privileges as they may designate (including the right to approve an acquisition or other change in our control);

|

|

|

·

|

|

provide that the authorized number of directors may be fixed only by our Board of Directors from time to time;

|

|

|

·

|

|

do not provide for cumulative voting rights (therefore allowing the holders of a majority of the shares of common stock entitled to vote in any election of directors to elect all of the directors standing for election, if they should so choose); and

|

|

|

·

|

|

provide that special meetings of our shareholders may be called only by our President, Board of Directors, or by the holders of at least 10% of the stock entitled to vote at such meeting.

|

In addition, as a matter of Colorado law, certain significant transactions would require the affirmative vote of a majority of the shares eligible to vote at a meeting of shareholders which requirement could result in delays to, or greater cost associated with, a change in control of our company.

DESCRIPTION OF DEBT SECURITIES

We may issue debt securities from time to time under this prospectus. We will issue any such debt securities under one or more separate indentures that we will enter into with a trustee to be named in the indenture and specified in the applicable prospectus supplement. The specific terms of debt securities being offered will be described in the applicable prospectus supplement, which, along with other offering material relating to such offering, will describe the specific terms relating to the series of debt securities being offered, including a description of the material terms of the indenture (and any supplemental indentures) governing such series. These terms may include the following:

|

|

·

|

|

the title of the series of the offered debt securities;

|

|

|

·

|

|

the price or prices at which the offered debt securities will be issued;

|

|

|

·

|

|

any limit on the aggregate principal amount of the offered debt securities;

|

|

|

·

|

|

the date or dates on which the principal of the offered debt securities will be payable;

|

|

|

·

|

|

the rate or rates (which may be fixed or variable) per year at which the offered debt securities will bear interest, if any, or the method of determining the rate or rates and the date or dates from which interest, if any, will accrue;

|

|

|

·

|

|

if the amount of principal, premium or interest with respect to the offered debt securities of the series may be determined with reference to an index or pursuant to a formula, the manner in which these amounts will be determined;

|

|

|

·

|

|

the date or dates on which interest, if any, on the offered debt securities will be payable and the regular record dates for the payment thereof;

|

|

|

·

|

|

the place or places, if any, in addition to or instead of the corporate trust office of the trustee, where the principal, premium and interest with respect to the offered debt securities will be payable;

|

|

|

·

|

|

the period or periods, if any, within which, the price or prices of which, and the terms and conditions upon which the offered debt securities may be redeemed, in whole or in part, pursuant to optional redemption provisions;

|

|

|

·

|

|

the terms on which we would be required to redeem or purchase the offered debt securities pursuant to any sinking fund or similar provision, and the period or periods within which, the price or prices at which and the terms and conditions on which the offered debt securities will be so redeemed and purchased in whole or in part;

|

|

|

·

|

|

the denominations in which the offered debt securities will be issued;

|

|

|

·

|

|

the form of the offered debt securities and whether the offered debt securities are to be issued in whole or in part in the form of one or more global securities and, if so, the identity of the depositary for the global security or securities;

|

|

|

·

|

|

the portion of the principal amount of the offered debt securities that is payable on the declaration of acceleration of the maturity, if other than their principal amount;

|

|

|

·

|

|

if other than U.S. dollars, the currency or currencies in which the offered debt securities will be denominated and payable, and the holders’ rights, if any, to elect payment in a foreign currency or a foreign currency unit other than that in which the offered debt securities are otherwise payable;

|

|

|

·

|

|

any addition to, or modification or deletion of, any event of default or any covenant specified in the indenture;

|

|

|

·

|

|

whether the offered debt securities will be convertible or exchangeable into other securities, and if so, the terms and conditions upon which the offered debt securities will be convertible or exchangeable;

|

|

|

·

|

|

whether the offered debt securities will be senior or subordinated debt securities;

|

|

|

·

|

|

any trustees, authenticating or paying agents, transfer agents or registrars or other agents with respect to the offered debt securities; and

|

|

|

·

|

|

any other specific terms of the offered debt securities.

|

The indenture and debt securities will be governed by and construed in accordance with the laws of the State of New York. We intend to disclose the relevant restrictive covenants for any issuance or series of debt securities in the applicable prospectus supplement. Unless otherwise indicated in the applicable prospectus supplement, the debt securities will not be listed on any securities exchange.

As of the date of this prospectus, we have no outstanding registered debt securities.

DESCRIPTION OF WARRANTS

We may offer warrants for the purchase of our debt securities, common stock, preferred stock, or other securities. We may issue warrants separately or together with any other securities offered by means of this prospectus, and the warrants may be attached to or separate from such securities. Each series of warrants may be issued under a separate warrant agreement to be entered into between us and a warrant agent specified therein. The warrant agent will act solely as our agent in connection with the warrants of such series and will not assume any obligation or relationship of agency or trust for or with any holders or beneficial owners of warrants.

The applicable prospectus supplement will describe the following terms, where applicable, of the warrants in respect of which this prospectus is being delivered:

|

|

·

|

|

the title of such warrants;

|

|

|

·

|

|

the aggregate number of such warrants;

|

|

|

·

|

|

the price or prices at which such warrants will be issued;

|

|

|

·

|

|

the currencies in which the price or prices of such warrants may be payable;

|

|

|

·

|

|

the designation, amount and terms of the securities purchasable upon exercise of such warrants;

|

|

|

·

|

|

the designation and terms of the other securities with which such warrants are issued and the number of such warrants issued with each such security;

|

|

|

·

|

|

if applicable, the date on and after which such warrants and the securities purchasable upon exercise of such warrants will be separately transferable;

|

|

|

·

|

|

the price or prices at which and currency or currencies in which the securities purchasable upon exercise of such warrants may be purchased;

|

|

|

·

|

|

the date on which the right to exercise such warrants shall commence and the date on which such right shall expire;

|

|

|

·

|

|

the minimum or maximum amount of such warrants which may be exercised at any one time;

|

|

|

·

|

|

whether the warrants represented by the warrant certificates will be issued in registered or bearer form and, if registered, where they may be transferred and registered;

|

|

|

·

|

|

call provisions, if any, of the warrants;

|

|

|

·

|

|

anti-dilution provisions, if any, of the warrants;

|

|

|

·

|

|

if applicable, a discussion of the material United States federal income tax considerations; and

|

|

|

·

|

|

any other material terms of such warrants, including terms, procedures and limitations relating to the exchange and exercise of such warrants.

|

The description in the prospectus supplement will not necessarily be complete and will be qualified in its entirety by reference to the warrant agreement and warrant certificate relating to the warrants being offered.

Each warrant will entitle the holder to purchase for cash that principal amount of, or number of, securities, as the case may be, at the exercise price set forth in, or to be determined as set forth in, the applicable prospectus supplement relating to the warrants. Unless otherwise specified in the applicable prospectus supplement, warrants may be exercised at the corporate trust office of the warrant agent or any other office indicated in the applicable prospectus supplement at any time up to 5:00 p.m., New York City time, on the expiration date set forth in the applicable prospectus supplement. After 5:00 p.m., New York City time, on the expiration date, unexercised warrants will become void. Upon receipt of payment and the warrant certificate properly completed and duly executed, we will, as soon as practicable, issue the securities purchasable upon exercise of the warrant. If less than all of the warrants represented by the warrant certificate are exercised, a new warrant certificate will be issued for the remaining amount of warrants.

Before the exercise of their warrants, holders of warrants will not have any of the rights of holders of the securities purchasable upon the exercise of the warrants, and will not be entitled to:

|

|

·

|

|

in the case of warrants to purchase debt securities, payments of principal of, or any premium or interest on, the debt securities purchasable upon exercise; or

|

|

|

·

|

|

in the case of warrants to purchase equity securities, the right to vote or to receive dividend payments or similar distributions on the securities purchasable upon exercise.

|

Warrant certificates will be exchangeable for new warrant certificates of different denominations at the corporate trust office of the warrant agent or any other office indicated in the applicable prospectus supplement.

DESCRIPTION OF UNITS

We may, from time to time, issue units consisting of any combination of the other types of securities offered under this prospectus in one or more series. We may evidence each series of units by unit certificates that it will issue under a separate agreement. We may enter into unit agreements with a unit agent. Each unit agent will be a bank or trust company that we select. We will indicate the name and address of the unit agent in the applicable prospectus supplement relating to a particular series of units.

If we offer any units, certain terms of that series of units will be described in the applicable prospectus supplement, including, without limitation, the following, as applicable:

|

|

·

|

|

the material terms of the units and of the securities comprising the units, including whether and under what circumstances those securities may be held or transferred separately;

|

|

|

·

|

|

any material provisions relating to the issuance, payment, settlement, transfer, or exchange of the units or of the securities comprising the units;

|

|

|

·

|

|

the price or prices at which the units will be issued;

|

|

|

·

|

|

the date, if any, on and after which the constituent securities comprising the units will be separately transferable;

|

|

|

·

|

|

a discussion of certain United States federal income tax considerations applicable to the units; and

|

|

|

·

|

|

any other terms of the units and their constituent securities.

|

DESCRIPTION OF RIGHTS

As specified in the applicable prospectus supplement, we may issue rights to purchase the securities offered in this prospectus to our existing stockholders, and such rights may or may not be issued for consideration. The applicable prospectus supplement will describe the terms of any such rights. The description in the prospectus supplement will not purport to be complete and will be qualified in its entirety by reference to the documents pursuant to which such rights will be issued.

PLAN OF DISTRIBUTION

We may sell the securities being offered hereby from time to time in one or more of the following ways:

|

|

·

|

|

to or through underwriters or dealers;

|

|

|

·

|

|

directly to purchasers, including through negotiated sales or a specific bidding, auction or other process;

|

|

|

·

|

|

in “at the market offerings,” within the meaning of Rule 415(a)(4) under the Securities Act, to or through a market maker or into an existing trading market, on an exchange or otherwise;

|

|

|

·

|

|

as a dividend or distribution to our existing shareholders or other security holders;

|

|

|

·

|

|

through a combination of any of these method; or

|

|

|

·

|

|

through any other method permitted by applicable law and described in a prospectus supplement.

|

The prospectus supplement relating to the offered securities will set forth the terms of the offering, including:

|

|

·

|

|

the name or names of any underwriters, dealers or agents;

|

|

|

·

|

|

the purchase price of the offered securities;

|

|

|

·

|

|

any over-allotment options under which underwriters may purchase additional securities from us;

|

|

|

·

|

|

the public offering price;

|

|

|

·

|

|

the net proceeds to us;

|

|

|

·

|

|

any delayed delivery arrangements;

|

|

|

·

|

|

any underwriting discounts, commissions and other items constituting underwriters’ compensation;

|

|

|

·

|

|

any discounts, concessions or other items allowed or reallowed or paid to dealers or agents;

|

|

|

·

|

|

any commissions paid to agents; and

|

|

|

·

|

|

any securities exchanges on which the offered securities may be listed.

|

Underwriters, Agents, and Dealers

We may use one or more underwriters in the sale of the offered securities, in which case the offered securities will be acquired by the underwriter or underwriters for their own account and may be resold from time to time in one or more transactions either:

|

|

·

|

|

at a fixed price or prices, which may be changed;

|

|

|

·

|

|

at market prices prevailing at the time of sale;

|

|

|

·

|

|

at prices related to such prevailing market prices; or

|

Agents designated by us may solicit offers to purchase the securities from time to time. The prospectus supplement will name any such agent involved in the offer or sale of the securities and will set forth any commissions payable by us to such agent. Unless otherwise indicated in such prospectus supplement, any such agent will be acting on a reasonable best efforts basis for the period of its appointment. Any such agent may be deemed to be an underwriter of the securities so offered and sold.

If we utilize an underwriter in the sale of the securities offered by this prospectus, we will execute an underwriting agreement with the underwriter or underwriters at the time of sale. We will provide the name of any underwriter in the prospectus supplement that the underwriter will use to make resales of the securities to the public. In connection with a sale of securities offered by means of this prospectus, underwriters may be deemed to have received compensation from us in the form of underwriting discounts or commissions and may also receive commissions from purchasers of securities for whom they may act as agent. Underwriters may sell securities offered by means of this prospectus to or through dealers, and such dealers may receive compensation in the form of discounts, concessions or commissions from the underwriters and/or commissions from the purchasers for whom they may act as agent. Any underwriting compensation paid by us to underwriters or agents in connection with the offering of securities offered by means of this prospectus, and any discounts, concessions or commissions allowed by underwriters to participating dealers, will be set forth in the applicable prospectus supplement. Underwriters, dealers and agents participating in the distribution of the offered securities may be deemed to be underwriters, and any discounts or commissions received by them and any profit realized by them upon the resale of the offered securities may be deemed to be underwriting discounts and commissions, under the Securities Act.

Underwriters, dealers and agents may be entitled, under agreements that may be entered into with us, to indemnification against certain civil liabilities, including liabilities under the Securities Act, or to any contribution with respect to payments which they may be required to make in respect thereof and may engage in transactions with, or perform services for, us in the ordinary course of business.

If we use delayed delivery contracts, we will, directly or through agents, underwriters or dealers, disclose that we are using them in the prospectus supplement and state when it will demand payment and delivery of the securities under the delayed delivery contracts. We may further agree to adjustments before a public offering to the underwriters’ purchase price for the securities based on changes in the market value of the securities. The prospectus supplement relating to any such public offering will contain information on the number of securities to be sold, the manner of sale or other distribution, and other material facts relating to the public offering. These delayed delivery contracts will be subject only to the conditions that we set forth in the prospectus supplement.

Other than the common stock, all securities offered by this prospectus will be a new issue of securities with no established trading market. Any underwriter to whom securities are sold by us for public offering and sale may make a market in such securities, but such underwriters may not be obligated to do so and may discontinue any market making at any time without notice. The securities may or may not be listed on a national securities exchange or a foreign securities exchange, except for the common stock which is currently listed and traded on the NYSE MKT. Any common stock sold by this prospectus will be listed for trading on the NYSE MKT subject to official notice of issuance. We cannot give you any assurance as to the liquidity of the trading markets for any securities.

Agents, underwriters and dealers may be customers of, engage in transactions with, or perform services for, us and our subsidiaries in the ordinary course of business.

At The Market Offerings and Derivative Transactions

We may engage in at the market offerings into an existing trading market in accordance with Rule 415(a)(4) under the Securities Act. In addition, we may enter into derivative transactions with third parties, or sell securities not covered by this

prospectus to third parties in privately negotiated transactions. If the applicable prospectus supplement so indicates, in connection with those derivatives, the third parties may sell securities covered by this prospectus and the applicable prospectus supplement, including in short sale transactions. If so, the third party may use securities pledged by us or borrowed from us or others to settle those sales or to close out any related open borrowings of stock, and may use securities received from us in settlement of those derivatives to close out any related open borrowings of stock. The third party in such sale transactions will be an underwriter and will be identified in the applicable prospectus supplement. In addition, we may otherwise loan or pledge securities to a financial institution or other third party that in turn may sell the securities short using this prospectus and an applicable prospectus supplement. Such financial institution or other third party may transfer its economic short position to investors in our securities or in connection with a concurrent offering of other securities.

Direct Sales

We may directly solicit offers to purchase our securities and may sell such securities directly to institutional investors or others, who may be deemed to be underwriters within the meaning of the Securities Act with respect to any resale thereof. We will describe the terms of direct sales in the prospectus supplement.

Stabilization Activities

To facilitate the offering of securities, certain persons participating in the offering may engage in transactions that stabilize, maintain or otherwise affect the price of the securities. This may include over-allotments or short sales of the securities, which involve the sale by persons participating in the offering of more securities than we sold to them. In these circumstances, these persons would cover such over-allotments or short positions by exercising their over-allotment option, if any, or making purchases in the open market. In addition, these persons may stabilize or maintain the price of the securities by bidding for or purchasing securities in the open market or by imposing penalty bids, whereby selling concessions allowed to dealers participating in the offering may be reclaimed if securities sold by them are repurchased in connection with stabilization transactions. The effect of these transactions may be to stabilize or maintain the market price of the securities at a level above that which might otherwise prevail in the open market. These transactions may be discontinued at any time.

WHERE YOU CAN FIND MORE INFORMATION

The registration statement (including post-effective amendments) that contains this prospectus, including the exhibits to the registration statement, contains additional information about us and the securities we may offer under this prospectus.

We file annual, quarterly and current reports, proxy statements and other information with the SEC. You may read and copy materials we have filed with the SEC at the SEC’s Public Reference Room at 100 F Street N.E., Washington, DC 20549. The public may obtain more information on the operation of the Public Reference Room by calling 1-800-SEC-0330. The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC at

www.sec.gov

. You may review and copy any of the reports or proxy statements that we file with the SEC at that site.

This prospectus contains summaries of provisions contained in some of the documents discussed in this prospectus, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to in this prospectus have been filed or will be filed or incorporated by reference as exhibits to the registration statement of which this prospectus forms a part. If any contract, agreement or other document is filed or incorporated by reference as an exhibit to the registration statement, you should read the exhibit for a more complete understanding of the document or matter involved. Do not rely on or assume the accuracy of any representation or warranty in any agreement that we have filed or incorporated by reference as an exhibit to the registration statement because such representation or warranty may be subject to exceptions and qualifications contained in separate disclosure schedules, may have been included in such agreement for the purpose of allocating risk between the parties to the particular transaction, and may no longer continue to be true as of any given date.

Our filings with the SEC, as well as additional information about us, are also available to the public through our website at

www.goldresourcecorp.com

and are made as soon as reasonably practicable after such material is filed with or furnished to the SEC. Information contained on, or that can be accessed through, our website is not incorporated into this prospectus or our other securities filings and does not form a part of this prospectus.

INFORMATION INCORPORATED BY REFERENCE

The SEC allows us to incorporate by reference information into this prospectus. This means we can disclose information to you by referring you to another document we filed with the SEC. We will make those documents available to you without charge upon your oral or written request. Requests for those documents should be directed to Gold Resource Corporation, 2886 Carriage Manor Point, Colorado Springs, Colorado 80906, Attention: Secretary, telephone: (303) 320-7708. This prospectus incorporates by reference the following documents (other than any portion of the respective filings furnished, rather than filed, under the applicable SEC rules) that we have filed with the SEC (File No. 001-34857) but have not included or delivered with this prospectus:

(a)

Our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 and our Quarterly Reports on Form 10-Q for the quarter ended March 31, 2016, June 30, 2016 and September 30, 2016;

(b)

Our Current Reports on Form 8-K filed on March 22, 2016, March 24, 2016, June 15, 2016, and August 18, 2016 (except, with respect to each of the foregoing, for portions of such reports which were deemed to be furnished and not filed);

(c)

Our Definitive Proxy Statement on Schedule 14A filed April 29, 2016 (solely those portions that were incorporated by reference into Part III of our Annual Report on Form 10-K for the year ended December 31, 2015); and

(d)

The description of our capital stock contained in the registration statement on Form 8-A filed with the SEC on August 25, 2010.

All documents filed by us with the SEC pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Securities Exchange Act of 1934, as amended (“Exchange Act”) subsequent to the date of this prospectus and prior to the termination of the offering registered hereby shall be deemed to be incorporated by reference into the registration statement and to be a part hereof from the date of the filing of such documents. In addition, all documents we may file pursuant to Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act after the date of the registration statement of which this prospectus forms a part, and prior to effectiveness of such registration statement, shall be deemed to be incorporated by referenced into this prospectus. This additional information is a part of this prospectus from the date of filing those documents.

Any statement contained in a document incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained herein or in any subsequently filed document which also is or is deemed to be incorporated by reference herein modifies or supersedes such statement. Such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this prospectus.

LEGAL MATTERS

Certain legal matters relating to the issuance and sale of the securities offered hereby will be passed upon for us by Polsinelli PC, Denver, Colorado. Additional legal matters may be passed upon for us or any underwriters, dealers or agents, by counsel that we will name in the applicable prospectus supplement.

EXPERTS

Our financial statements as of December 31, 2015 and 2014, and for each of the three years in the three-year period ended December 31, 2015, and management’s assessment of the effectiveness of internal control over financial reporting as of December 31, 2015 included in our Annual Report on Form 10-K for the year ended December 31, 2015, have been incorporated by reference in this prospectus in reliance upon the reports of KPMG LLP, Denver, Colorado, our independent registered public accounting firm for those years. These financial statements have been incorporated herein by reference upon the authority of said firm as an expert in accounting and auditing.

GOLD RESOURCE CORPORATION

Common Stock

Preferred Stock

Debt Securities

Warrants

Units

Rights

Prospectus

, 20__

Part II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following table sets forth the costs and expenses, other than underwriting discounts and commissions, payable by us in connection with the sale and distribution of the securities being registered. All amounts except the SEC registration fee are estimated.

|

|

|

|

|

|

SEC Registration Fee

|

|

$

|

23,180

|

|

Listing Fees

|

|

|

**

|

|

Accounting Fees and Expenses

|

|

|

**

|

|

Legal Fees and Expenses

|

|

|

**

|

|

Printing and Mailing Expenses

|

|

|

**

|

|

Miscellaneous Fees and Expenses

|

|

|

**

|

|

Total

|

|

|

**

|

** These fees will be dependent on the type of securities and number of offerings and, therefore, cannot be estimated at this time. The applicable prospectus supplement or one or more Current Reports on Form 8-K, which will be incorporated by reference, will set forth the estimated amount of such expenses payable in respect of any offering of securities.

Item 15. Indemnification of Directors and Officers

We have entered into indemnification agreements with each of our executive officers and directors which provide that we must indemnify, to the fullest extent permitted by the laws of the State of Colorado, but subject to certain exceptions, any of our directors or officers who are made or threatened to be made a party to a proceeding, by reason of the person serving or having served in their capacity as an executive officer or director with us. We may also be required to advance expenses of defending any proceeding brought against them while serving in such capacity.

Our Articles of Incorporation and Bylaws provide that we must indemnify, to the fullest extent permitted by the laws of the State of Colorado, any of our directors, officers, employees or agents made or threatened to be made a party to a proceeding, by reason of the person serving or having served in a capacity as such, against judgments, penalties, fines, settlements and reasonable expenses incurred by the person in connection with the proceeding if certain standards are met.

The Colorado Business Corporation Act (“CBCA”) allows indemnification of directors, officers, employees and agents of a company against liabilities incurred in any proceeding in which an individual is made a party because he or she was a director, officer, employee or agent of the company if such person conducted himself in good faith and reasonably believed his actions were in, or not opposed to, the best interests of the company, and with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. A person must be found to be entitled to indemnification under this statutory standard by procedures designed to assure that disinterested members of the board of directors have approved indemnification or that, absent the ability to obtain sufficient numbers of disinterested directors, independent counsel or shareholders have approved the indemnification based on a finding that the person has met the standard. Indemnification is limited to reasonable expenses.

Our Articles of Incorporation limit the liability of our directors to the fullest extent permitted by the CBCA. Specifically, our directors will not be personally liable for monetary damages for breach of fiduciary duty as directors, except for:

|

|

·

|

|

any breach of the duty of loyalty to us or our stockholders;

|

|

|

·

|

|

acts or omissions not in good faith or that involved intentional misconduct or a knowing violation of law;

|

|

|

·

|

|

dividends or other distributions of corporate assets that are in contravention of certain statutory or contractual restrictions;

|

|

|

·

|

|

violations of certain laws; or

|

|

|

·

|

|

any transaction from which the director derives an improper personal benefit.

|

Liability under federal securities law is not limited by our Articles of Incorporation.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, or otherwise, the Registrant has been advised that in the opinion of the SEC such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question, whether such indemnification by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

Item 16. Exhibits

The exhibits to this registration statement are listed in the exhibit index that immediately precedes such exhibits and is incorporated herein by reference.

Item 17. Undertakings

|

|

(a)

|

|

The undersigned registrant hereby undertakes:

|

|

|

(1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

|

|

|

(i)

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

|

|

|

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

|

|

|

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

|

Provided, however, that paragraphs(a)(1)(i), (a)(1)(ii) and (a)(1)(iii)do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

|

|

(2)

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered

|

|

therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

|

|

|

(4)

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

|

|

|

(i)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

|

|

|

(ii)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which the prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

|

|

|

(5)

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

|

|

|

(i)

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

|

|

|

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

|

|

|

(iii)

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or their securities provided by or on behalf of the undersigned registrant; and

|

|

|

(iv)

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

|

|

|

(b)

|

|

The undersigned registrant hereby undertake that, for purposes of determining any liability under the Securities Act of 1933, each filing of Gold Resource Corporation’s annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

|

|

|

(c)

|

|

That, if the undersigned registrant use this registration statement to offer securities to their existing security holders upon the exercise of warrants or subscription rights and any securities not taken by security holders are to be reoffered to the public, then the undersigned registrant will supplement the applicable prospectus supplement, after the expiration of the subscription period, to set forth the results of the subscription offer, the transactions by the underwriters during the subscription period, the amount of unsubscribed securities to be purchased by the underwriters, and the terms of any subsequent reoffering thereof. If any public offering by the underwriters is to be made on terms differing from those set forth on the cover page of the applicable prospectus supplement, a post-effective amendment will be filed to set forth the terms of such offering.

|

|

|

(d)

|

|

The undersigned registrant hereby undertakes (1) to use its best efforts to distribute prior to the opening of bids, to prospective bidders, underwriters, and dealers, a reasonable number of copies of a prospectus which at that time meets the requirements of section 10(a) of the Act, and relating to the securities offered at competitive bidding, as contained in the registration statement, together with any supplements thereto, and (2) to file an amendment to the registration statement reflecting the results of bidding, the terms of the reoffering and related matters to the extent required by the applicable form, not later than the first use, authorized by the issuer after the opening of bids, of a prospectus relating to the securities offered at competitive bidding, unless no further public offering of such securities by the issuer and no reoffering of such securities by the purchasers is proposed to be made.

|

|

|

(e)

|

|

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant have been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

|

|

|

(f)

|

|

The undersigned registrant hereby further undertake to file an application for the purpose of determining the eligibility of the trustee to act under subsection (a) of Section 310 of the Trust Indenture Act in accordance with the rules and regulations prescribed by the SEC under Section 305(b)(2) of the Trust Indenture Act.

|

Signatures

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Colorado Springs, State of Colorado, on December 7, 2016.

|

|

|

|

|

|

GOLD RESOURCE CORPORATION

|

|

|

|

|

|

|

|

By:

|

/s/ Jason D. Reid

|

|

|

|

|

Jason D. Reid,

|

|

|

|

Chief Executive Officer, President, and Director

|

Power of ATTORNEY

Each of the undersigned whose signature appears below hereby constitutes and appoints Jason D. Reid the individual’s true and lawful attorney-in-fact and agent, with full power of substitution and re-substitution, for the person and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement, and any registration statement relating to the offering covered by this registration statement and filed pursuant to Rule 462(b) under the Securities Act of 1933, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities Exchange Commission, under the Securities Act of 1933, granting unto said attorney-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that each of said attorney-in-fact and agents or their substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration statement was signed by the following persons in the capacities and on the dates stated:

|

|

|

|

|

/s/ Jason D. Reid

Jason D. Reid

|

Chief Executive Officer, President and Director

(Principal Executive Officer)

|

December 7, 2016

|

|

|

|

|

|

/s/ John A. Labate

John A. Labate

|

Chief Financial Officer

(Principal Financial and Accounting Officer)

|

December 7, 2016

|

|

|

|

|

|

/s/ Bill M. Conrad

Bill M. Conrad

|

Director

|

December 7, 2016

|

|

|

|

|

|

/s/ Gary C. Huber

Gary C. Huber

|

Director

|

December 7, 2016

|

|

|

|

|

|

/s/ Alex G. Morrison

Alex G. Morrison

|

Director

|

December 7, 2016

|

Index to Exhibits

The following exhibits are filed with this registration statement:

|

Exhibit

|

|

|

|

Number

|

|

Description

|

|

|

|

|

|

1.1

|

|

Form of underwriting agreement (for equity securities)*

|

|

1.2

|

|

Form of underwriting agreement (for debt securities)*

|

|

4.1

|

|

Specimen stock certificate (incorporated by reference from our amended registration statement on Form SB-2/A filed on March 27, 2006, Exhibit 4, File No. 333-129321)

|

|

4.2

|

|

Specimen Preferred Stock Certificate*

|

|

4.3

|

|

Form of Indenture relating to Debt Securities (filed herewith)

|

|

4.5

|

|

Form of Debt Securities*

|

|

4.6

|

|

Specimen Warrant Certificate*

|

|

4.7

|

|

Form of Warrant Agreement*

|

|

4.8

|

|

Specimen Unit Certificate*

|

|

4.9

|

|

Form of Unit Agreement*

|

|

4.10

|

|

Form of Subscription Rights Certificate*

|

|

5.1

|

|

Opinion of Polsinelli PC (filed herewith)

|

|

12.1

|

|

Calculation of Ratio of Earnings to Fixed Charges (filed herewith)

|

|

23.1

|

|

Consent of Polsinelli PC (contained in Exhibit 5.1)

|

|

23.2

|

|

Consent of KPMG LLP, Denver, Colorado (filed herewith)

|

|

24.1

|

|

Power of Attorney (included on signature page of the Registration Statement)

|

|

25.1

|

|

Statement of Eligibility on Form T-1 under the Trust Indenture Act of 1939, as amended, of the trustee with respect to the Debt Securities**

|

_________________________________

* To be filed, if necessary, either by amendment to the Registration Statement or as an exhibit to a Current Report on Form 8-K and incorporated herein by reference.

** To be filed, if necessary, in accordance with the requirements of Section 305(b)(2) of the Trust Indenture Act of 1939, as amended.

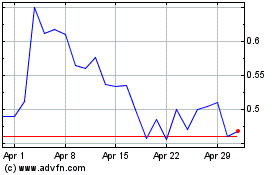

Gold Resource (AMEX:GORO)

Historical Stock Chart

From Mar 2024 to Apr 2024

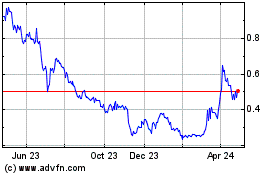

Gold Resource (AMEX:GORO)

Historical Stock Chart

From Apr 2023 to Apr 2024