Greif, Inc. (NYSE: GEF, GEF.B), a world leader in industrial

packaging products and services, announced fourth quarter and

fiscal 2016 results. Pete Watson, President and Chief Executive

Officer, stated “I am pleased with Greif’s solid fourth quarter

results, which conclude an improved fiscal 2016 for our company. We

increased Class A earnings before special items per share1 by 11.9

percent, more than doubled free cash flow2 to $200.9 million and

returned $98.7 million in dividends to our shareholders, despite

the effects of a tepid global industrial economy. Our performance

benefited from improved customer service, stronger operating

fundamentals and systematic fiscal discipline. Our plans for 2017

include furthering our commitment to customer service, continuing

to improve our underlying business and achieving our 2017 run rate

commitments. This will generate greater value for our customers and

shareholders."

Fourth Quarter Highlights include:

- Net income of $8.5 million or $0.14 per

diluted Class A share compared to net income of $12.4 million

or $0.21 per diluted Class A share for the fourth quarter of

2015. Net income, excluding the impact of special items, of $38.5

million or $0.65 per diluted Class A share compared to net

income, excluding the impact of special items, of $44.7 million or

$0.76 per diluted Class A share for the fourth quarter of

2015. The net income for the fourth quarter of 2016 was

significantly impacted by the changes in income tax expense as

described below.

- Net sales decreased $0.9 million to

$867.6 million compared to $868.5 million for the fourth quarter of

2015. Net sales, after adjusting for the effect of divestitures for

both quarters and currency translation for the fourth quarter of

20163, increased 5.3 percent compared to the fourth quarter

2015.

- Gross profit improved to $183.4 million

compared to $168.0 million for the fourth quarter of 2015. Gross

profit margin improved to 21.1 percent from 19.3 percent for the

fourth quarter of 2015.

- Operating profit improved $21.5 million

and operating profit before special items improved $15.0 million

from the fourth quarter of 2015. Operating profit margin before

special items improved to 10.0 percent compared to 8.3 percent for

the fourth quarter of 2015.

- Cash provided by operating activities

increased $10.1 million compared to the fourth quarter of 2015.

Free cash flow improved $9.0 million compared to the fourth quarter

of 2015.

- Income tax expense for the fourth

quarter of 2016 increased to $28.3 million, or 81.3 percent, from

$2.6 million, or 23.0 percent, for the fourth quarter 2015, due

primarily to the impact of discrete losses in jurisdictions for

which there is minimal tax benefit, adjustments to uncertain tax

position estimates, withholding tax expense on fourth quarter

transactions and corrections identified through enhanced control

procedures executed during the quarter. In addition, the fourth

quarter of 2015 tax expense was positively impacted by discrete

transactions which resulted in one-time tax benefits.

Fiscal Year Highlights Include:

- Net income of $74.9 million or $1.28

per diluted Class A share compared to net income of $71.9 million

or $1.23 per diluted Class A share for fiscal year 2015. Net

income, excluding the impact of special items, of $143.5 million or

$2.44 per diluted Class A share compared to net income,

excluding the impact of special items, of $127.7 million or $2.18

per diluted Class A share for fiscal year 2015.

- Net sales decreased $293.1 million to

$3,323.6 million compared to $3,616.7 million for fiscal year 2015.

Net sales, after adjusting for the effect of divestitures for both

years and currency translation for fiscal year 2016, were flat

compared to fiscal year 2015.

- Gross profit improved to $684.9 million

compared to $669.8 million for fiscal year 2015. Gross profit

margin improved to 20.6 percent compared to 18.5 percent for fiscal

year 2015.

- Operating profit improved $32.8 million

and operating profit before special items improved $42.1 million

from fiscal year 2015. Operating profit margin before special items

improved to 9.3 percent compared to 7.4 percent for fiscal year

2015.

- Cash provided by operating activities

increased $94.7 million compared to fiscal year 2015. Free cash

flow improved $130.4 million compared to fiscal year 2015.

Long-term debt has decreased $172.3 million since the previous

year-end.

- Income tax expense for the year was

$66.5 million or 47.1 percent. The increase in the tax rate from

the forecasted range of 35 - 38 percent was due primarily to the

same factors impacting the quarterly rate.

__________

1 A summary of all special items that are excluded from net

income before special items, earnings per diluted Class A share

before special items and from operating profit before special items

is set forth in the Selected Financial Highlights table following

the Dividend Summary in this release. 2 Free cash flow is defined

as net cash provided by operating activities less cash paid for

capital expenditures. 3 A summary of the adjustments for the impact

of divestitures and currency translation is set forth in the GAAP

to Non-GAAP Reconciliation Net Sales to Net Sales Excluding the

Impact of Divestitures and Currency Translation in the financial

schedules that are part of this release.

Note: A reconciliation of the differences between all non-GAAP

financial measures used in this release with the most directly

comparable GAAP financial measures is included in the financial

schedules that are a part of this release. These non-GAAP financial

measures are intended to supplement and should be read together

with our financial results. They should not be considered an

alternative or substitute for, and should not be considered

superior to, our reported financial results. Accordingly, users of

this financial information should not place undue reliance on these

non-GAAP financial measures.

Company Outlook

Our 2017 fiscal year guidance is set forth

below.

Class A Earnings Per Share before Special Items

$2.78 - $3.08

Note: 2017 GAAP Class A Earnings Per Share guidance is not

provided in this release due to the potential for one or more of

the following, the timing and magnitude of which we are unable to

reliably forecast: gains or losses on the disposal of businesses,

timberland or properties, plants and equipment, net, non-cash asset

impairment charges due to unanticipated changes in the business,

restructuring-related activities or acquisition costs, and the

income tax effects of these items and other income tax-related

events. No reconciliation of the fiscal year 2017 Class A

earnings per share guidance, a non-GAAP financial measure which

excludes gains and losses on the disposal of businesses, timberland

and property, plant and equipment, acquisition costs and

restructuring and impairment charges is included in this release

because, due to the high variability and difficulty in making

accurate forecasts and projections of some of the excluded

information, together with some of the excluded information not

being ascertainable or accessible, we are unable to quantify

certain amounts that would be required to be included in the most

directly comparable GAAP financial measure without unreasonable

efforts.

Segment Results

Net sales are impacted primarily by the volume of primary

products sold, selling prices, product mix and the impact of

changes in foreign currencies against the U.S. Dollar. The table

below shows the percentage impact of each of these items on net

sales for our primary products for the fourth quarter of 2016 as

compared to the fourth quarter of 2015 for the business segments

with manufacturing operations:

Net Sales Impact

- Primary Products:

Rigid IndustrialPackaging

&Services *

Paper Packaging

&Services*

Flexible Products& Services

*

% % %

Currency Translation (1.9)% —%

(3.0)%

Volume (0.5)% 7.3% (1.5)%

Selling Prices

and Product Mix 10.2% (2.2)% 0.9%

Total Impact

of Primary Products 7.8% 5.1% (3.6)% * Primary

products are manufactured steel, plastic and fibre drums; IBCs;

linerboard, medium, corrugated sheets and corrugated containers;

and 1&2 loop and 4 loop FIBCs.

Rigid Industrial Packaging & Services

Net sales increased $1.8 million to $602.9 million for the

fourth quarter of 2016 compared to $601.1 million for the fourth

quarter of 2015. Net sales, after adjusting for the effect of

divestitures for both quarters and currency translation for the

fourth quarter of 2016 increased $42.0 million to $613.6 million

for the fourth quarter 2016 from $571.6 million for the fourth

quarter 2015 due primarily to the impact of strategic volume and

pricing decisions.

Gross profit increased to $130.9 million (21.7 percent) for the

fourth quarter of 2016 compared to $112.3 million (18.7 percent)

for the fourth quarter of 2015 due to the same factors impacting

net sales and the divestiture of select non-core and

underperforming assets.

Operating profit was $30.5 million for the fourth quarter of

2016 compared to operating profit of $10.9 million for the fourth

quarter of 2015. Operating profit before special items and

excluding the impact of divestitures increased to $60.3 million for

the fourth quarter of 2016 from $41.8 million for the fourth

quarter of 2015, due primarily to the same factors impacting gross

profit.

Paper Packaging & Services

Net sales increased $9.2 million to $189.0 million for the

fourth quarter of 2016 compared with $179.8 million for the fourth

quarter of 2015. The increase was primarily due to increases in

volumes offset by reductions in the published containerboard index

prices that occurred during 2016.

Gross profit was $39.0 million (20.6 percent) for the fourth

quarter of 2016 compared to $46.5 million (25.9 percent) for the

fourth quarter of 2015. The reduction in gross profit margin was

due primarily to increased input costs, primarily old corrugated

container costs, as well as reductions in published containerboard

index prices.

Operating profit was $24.7 million for the fourth quarter of

2016 compared with $32.6 million for the fourth quarter of 2015.

The reduction was due to the same factors impacting gross

profit.

Flexible Products & Services

Net sales decreased $4.2 million to $69.1 million for the fourth

quarter of 2016 compared with $73.3 million for the fourth quarter

of 2015. Excluding the impact of divestitures,4 sales decreased

$1.8 million to $69.1 million for the fourth quarter of 2016 from

$70.9 million for the fourth quarter of 2015, due primarily to the

negative impact of currency translation.

Gross profit was $11.7 million (16.9 percent) for the fourth

quarter 2016 compared to $6.9 million (9.4 percent) for the fourth

quarter 2015. The margin improvement was due primarily to reduced

fixed costs and the impact of strategic volume and pricing

decisions throughout 2016.

Operating loss was $3.6 million for the fourth quarter of 2016

compared to an operating loss of $12.8 million for the fourth

quarter of 2015. Operating profit before special items was $0.1

million for the fourth quarter of 2016 compared to an operating

loss of $5.3 million for the fourth quarter of 2015. The

improvement in the operating profit before special items was

primarily due to the same factors impacting gross profit.

Land Management

Net sales decreased $7.7 million to $6.6 million for the fourth

quarter of 2016 compared to $14.3 million for the fourth quarter of

2015. The decrease in net sales was due to the sale of 5,200 acres

of development properties in Canada during the fourth quarter of

2015.

Operating profit was $2.0 million for the fourth quarter of 2016

compared to $1.4 million for the fourth quarter of 2015.

__________

4 A summary of all adjustments by business segment related

to the impact of divestitures and special items that are excluded

from net sales, gross profit and operating profit is set forth in

the GAAP to Non-GAAP Reconciliation Selected Financial Information

Excluding the Impact of Divestitures in the financial schedules

that are part of this release.

Dividend Summary

On December 6, 2016, the Board of Directors

declared quarterly cash dividends of $0.42 per share of

Class A Common Stock and $0.62 per share of Class B Common

Stock. Dividends are payable on January 1, 2017, to stockholders of

record at the close of business on December 19, 2016.

GREIF, INC. AND SUBSIDIARY COMPANIES

SELECTED FINANCIAL HIGHLIGHTS

UNAUDITED

(Dollars in millions, except per share

amounts)

Three months ended October 31, Twelve months ended

October 31, 2016 2015 2016

2015

Selected Financial

Highlights

Net sales $ 867.6 $ 868.5 $ 3,323.6 $ 3,616.7 Gross profit 183.4

168.0 684.9 669.8 Gross profit margin 21.1 % 19.3 % 20.6 % 18.5 %

Operating profit 53.6 32.1 225.6 192.8 Operating profit before

special items 87.0 72.0 308.3 266.2 EBITDA 83.9 64.1 345.1 325.0

EBITDA before special items 117.3 104.0 427.8 393.5 Cash provided

by operating activities 143.0 132.9 301.0 206.3 Net income

attributable to Greif, Inc. 8.5 12.4 74.9 71.9 Diluted Class A

earnings per share attributable to Greif, Inc. $ 0.14 $ 0.21 $ 1.28

$ 1.23

Diluted Class A earnings per share

attributable to Greif, Inc. before special items

$

0.65

$

0.76

$

2.44

$

2.18

Special

items

Restructuring charges $ 9.0 $ 13.3 $ 26.9 $ 40.0

Acquisition-related costs 0.1 — 0.2 0.3 Timberland gains — — —

(24.3 ) Non-cash asset impairment charges 6.5 23.6 51.4 45.9 Loss

on disposal of properties, plants and equipment and businesses, net

17.8 3.0 4.2 2.2 Impact of Venezuela devaluation of inventory in

cost of products sold — — — 9.3 Impact of Venezuela devaluation on

other income — — — (4.9 ) Total special items

33.4 39.9 82.7 68.5 Total special

items, net of tax and noncontrolling interest 30.0 32.3

68.6 55.8 Impact of total special items, net

of tax, on diluted Class A earnings per share attributable to

Greif, Inc. $ 0.51 $ 0.55 $ 1.16 $ 0.95

October 31, 2016 October 31, 2015 Operating working

capital5 $ 304.6 $ 345.4

Note: Other income is not included in operating profit,

therefore, the impact of Venezuela devaluation on other income is

not applicable to operating profit before special items, but is

applicable to EBITDA before special items.

__________

5 Operating working capital is defined as trade accounts

receivable plus inventories less accounts payable.

Conference Call

The Company will host a conference call to discuss the fourth

quarter of 2016 results on December 8, 2016, at 10:00 a.m.

Eastern Time (ET). To participate, domestic callers should call

877-201-0168. The Greif ID is 18972823. The number for

international callers is 1-647-788-4901. Phone lines will open at

9:30 a.m. ET. The conference call will also be available through a

live webcast, including slides, which can be accessed at

http://investor.greif.com by clicking on the Events and

Presentations tab and searching under the events calendar. A replay

of the conference call will be available on the Company’s website

approximately two hours following the call.

About Greif

Greif is a global leader in industrial packaging products and

services and is pursuing its vision to become the world’s best

performing customer service company in industrial packaging. The

company produces steel, plastic, fibre, flexible, corrugated, and

reconditioned containers, intermediate bulk containers,

containerboard and packaging accessories, and provides filling,

packaging and industrial packaging reconditioning services for a

wide range of industries. Greif also manages timber properties in

the southeastern United States. The company is strategically

positioned in over 45 countries to serve global as well as regional

customers. Additional information is on the company’s website at

www.greif.com.

Forward-Looking Statements

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

The words “may,” “will,” “expect,” “intend,” “estimate,”

“anticipate,” “aspiration,” “objective,” “project,” “believe,”

“continue,” “on track” or “target” or the negative thereof and

similar expressions, among others, identify forward-looking

statements. All forward-looking statements are based on

assumptions, expectations and other information currently available

to management. Such forward-looking statements are subject to

certain risks and uncertainties that could cause the company’s

actual results to differ materially from those forecasted,

projected or anticipated, whether expressed or implied. The

most significant of these risks and uncertainties are described in

Part I of the company’s Annual Report on Form 10-K for the fiscal

year ended October 31, 2016. The company undertakes no

obligation to update or revise any forward-looking statements.

Although the Company believes that the expectations reflected in

forward-looking statements have a reasonable basis, the company can

give no assurance that these expectations will prove to be correct.

Forward-looking statements are subject to risks and uncertainties

that could cause the company’s actual results to differ materially

from those forecasted, projected or anticipated, whether expressed

in or implied by the statements. Such risks and uncertainties that

might cause a difference include, but are not limited to, the

following: (i) historically, our business has been sensitive

to changes in general economic or business conditions,

(ii) our operations subject us to currency exchange and

political risks that could adversely affect our results of

operations, (iii) the current and future challenging global

economy and disruption and volatility of the financial and credit

markets may adversely affect our business, (iv) the continuing

consolidation of our customer base and suppliers may intensify

pricing pressure, (v) we operate in highly competitive

industries, (vi) our business is sensitive to changes in

industry demands, (vii) raw material and energy price

fluctuations and shortages may adversely impact our manufacturing

operations and costs, (viii) we may encounter difficulties

arising from acquisitions, (ix) we may incur additional

restructuring costs and there is no guarantee that our efforts to

reduce costs will be successful, (x) tax legislation

initiatives or challenges to our tax positions may adversely impact

our results or condition, (xi) full realization of our

deferred tax assets may be affected by a number of factors,

(xii) several operations are conducted by joint ventures that

we cannot operate solely for our benefit, (xiii) our ability

to attract, develop and retain talented and qualified employees,

managers and executives is critical to our success, (xiv) our

business may be adversely impacted by work stoppages and other

labor relations matters, (xv) our pension plans are

underfunded and will require future cash contributions, and our

required future cash contributions could be higher than we expect,

each of which could have a material adverse effect on our financial

condition and liquidity, (xvi) we may be subject to losses

that might not be covered in whole or in part by existing insurance

reserves or insurance coverage, (xvii) our business depends on

the uninterrupted operations of our facilities, systems and

business functions, including our information technology and other

business systems, (xviii) a security breach of customer,

employee, supplier or company information may have a material

adverse effect on our business, financial condition and results of

operations, (xix) legislation/regulation related to

environmental and health and safety matters and corporate social

responsibility could negatively impact our operations and financial

performance, (xx) product liability claims and other legal

proceedings could adversely affect our operations and financial

performance, (xxi) we may incur fines or penalties, damage to

our reputation or other adverse consequences if our employees,

agents or business partners violate, or are alleged to have

violated, anti-bribery, competition or other laws, (xxii) changing

climate, climate change regulations and greenhouse gas effects may

adversely affect our operations and financial performance,

(xxiii) the frequency and volume of our timber and timberland

sales will impact our financial performance, (xxiv) changes in

U.S. generally accepted accounting principles and SEC rules and

regulations could materially impact our reported results,

(xxv) if the company fails to maintain an effective system of

internal control, the company may not be able to accurately report

financial results or prevent fraud, and (xxvi) the company has

a significant amount of goodwill and long-lived assets which, if

impaired in the future, would adversely impact our results of

operations. Changes in business results may impact our book tax

rates. The risks described above are not all-inclusive, and given

these and other possible risks and uncertainties, investors should

not place undue reliance on forward-looking statements as a

prediction of actual results. For a detailed discussion of the most

significant risks and uncertainties that could cause our actual

results to differ materially from those forecasted, projected or

anticipated, see “Risk Factors” in Part I, Item 1A of our most

recently filed Form 10-K and our other filings with the Securities

and Exchange Commission. All forward-looking statements made in

this news release are expressly qualified in their entirety by

reference to such risk factors. Except to the limited extent

required by applicable law, we undertake no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise.

GREIF, INC. AND SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

UNAUDITED

(Dollars and shares in millions, except

per share amounts)

Three months ended October 31, Twelve months ended

October 31, 2016 2015 2016

2015 Net sales $ 867.6 $ 868.5 $ 3,323.6 $ 3,616.7 Cost of

products sold 684.2 700.5 2,638.7 2,946.9

Gross profit 183.4 168.0 684.9 669.8 Selling, general and

administrative expenses 96.5 96.0 376.8 413.2 Restructuring charges

9.0 13.3 26.9 40.0 Timberland gains — — — (24.3 ) Non-cash asset

impairment charges 6.5 23.6 51.4 45.9 (Gain) loss on disposal of

properties, plants and equipment, net (0.8 ) 2.3 (10.3 ) (7.0 )

Loss on disposal of businesses 18.6 0.7 14.5

9.2 Operating profit 53.6 32.1 225.6 192.8 Interest expense,

net 17.2 18.6 75.4 74.8 Other expense, net 1.6 2.2

9.0 3.2 Income before income tax expense and equity

earnings of unconsolidated affiliates, net 34.8 11.3 141.2 114.8

Income tax expense 28.3 2.6 66.5 48.4 Equity earnings of

unconsolidated affiliates, net of tax — (0.5 ) (0.8 ) (0.8 )

Net income 6.5 9.2 75.5 67.2 Net (income) loss attributable to

noncontrolling interests 2.0 3.2 (0.6 ) 4.7

Net income attributable to Greif, Inc. $ 8.5 $ 12.4 $

74.9 $ 71.9

Basic earnings per share attributable

to Greif, Inc. common shareholders: Class A Common Stock $ 0.14

$ 0.21 $ 1.28 $ 1.23 Class B Common Stock $ 0.22 $ 0.32 $ 1.90 $

1.83

Diluted earnings per share attributable to Greif, Inc.

common shareholders: Class A Common Stock $ 0.14 $ 0.21 $ 1.28

$ 1.23 Class B Common Stock $ 0.22 $ 0.32 $ 1.90 $ 1.83

Shares

used to calculate basic earnings per share attributable to Greif,

Inc. common shareholders: Class A Common Stock 25.8 25.7 25.8

25.7 Class B Common Stock 22.0 22.1 22.1 22.1

Shares used to

calculate diluted earnings per share attributable to Greif, Inc.

common shareholders: Class A Common Stock 25.8 25.7 25.8 25.7

Class B Common Stock 22.0 22.1 22.1 22.1

GREIF, INC. AND SUBSIDIARY COMPANIES CONDENSED

CONSOLIDATED BALANCE SHEETS

UNAUDITED

(Dollars in millions)

October 31, 2016 October 31, 2015

ASSETS CURRENT ASSETS Cash and cash equivalents $ 103.7 $

106.2 Trade accounts receivable 399.2 403.7 Inventories 277.4 297.0

Other current assets 140.0 201.6 920.3 1,008.5

LONG-TERM ASSETS Goodwill 786.4 807.1 Intangible assets 110.6 132.7

Assets held by special purpose entities 50.9 50.9 Other long-term

assets 141.3 98.8 1,089.2 1,089.5 PROPERTIES, PLANTS

AND EQUIPMENT 1,163.9 1,217.7 $ 3,173.4 $ 3,315.7

LIABILITIES AND EQUITY CURRENT LIABILITIES Accounts payable

$ 372.0 $ 355.3 Short-term borrowings 51.6 40.7 Current portion of

long-term debt — 30.7 Other current liabilities 235.6 220.3

659.2 647.0 LONG-TERM LIABILITIES Long-term debt 974.6

1,116.2 Liabilities held by special purpose entities 43.3 43.3

Other long-term liabilities 506.6 449.3 1,524.5

1,608.8 REDEEMABLE NONCONTROLLING INTEREST 31.8 — EQUITY

Total Greif, Inc. equity 947.4 1,015.6 Noncontrolling interests

10.5 44.3 957.9 1,059.9 $ 3,173.4 $ 3,315.7

GREIF, INC. AND SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(UNAUDITED)

(Dollars in millions)

Three months ended October 31, Twelve months ended

October 31, 2016 2015 2016

2015 CASH FLOWS FROM OPERATING ACTIVITIES: Net income $ 6.5

$ 9.2 $ 75.5 $ 67.2 Depreciation, depletion and amortization 31.9

33.7 127.7 134.6 Asset impairments 6.5 23.6 51.4 45.9 Other

non-cash adjustments to net income 30.7 2.4 18.4 (25.8 ) Operating

working capital changes 50.0 81.6 24.2 21.8 Deferred purchase price

on sold receivables 25.4 5.1 5.2 (5.7 ) Increase (decrease) in cash

from changes in other assets and liabilities (8.0 ) (22.7 ) (1.4 )

(31.7 ) Net cash provided by operating activities 143.0

132.9 301.0 206.3 CASH FLOWS FROM INVESTING

ACTIVITIES: Acquisitions of businesses, net of cash acquired — (0.1

) (0.4 ) (1.6 ) Collection (issuance) of subordinated note

receivable — (44.2 ) 44.2 (44.2 ) Purchases of properties, plants

and equipment (28.7 ) (27.6 ) (100.1 ) (135.8 ) Purchases of and

investments in timber properties (2.4 ) (0.2 ) (7.1 ) (38.4 )

Purchases of properties, plants and equipment with insurance

proceeds — — (4.4 ) — Proceeds from the sale of properties, plants

and equipment, businesses, timberland and other assets 1.4 3.2 36.1

68.9 Proceeds on insurance recoveries — 1.2 6.6

4.6 Net cash used in investing activities (29.7 )

(67.7 ) (25.1 ) (146.5 ) CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from (payments on) debt, net (77.8 ) (38.8 ) (159.8 ) 82.4

Dividends paid to Greif, Inc. shareholders (24.7 ) (24.7 ) (98.7 )

(98.7 ) Other 0.9 — (14.3 ) (3.8 ) Net cash used in

financing activities (101.6 ) (63.5 ) (272.8 ) (20.1 ) Effects of

exchange rates on cash (2.3 ) 2.8 (5.6 ) (18.6 ) Net increase

(decrease) in cash and cash equivalents 9.4 4.5 (2.5 ) 21.1 Cash

and cash equivalents, beginning of period 94.3 101.7

106.2 85.1 Cash and cash equivalents, end of period $

103.7 $ 106.2 $ 103.7 $ 106.2

GREIF, INC. AND SUBSIDIARY COMPANIES

FINANCIAL HIGHLIGHTS BY SEGMENT

UNAUDITED

(Dollars in millions)

Three months ended October 31, Twelve months ended

October 31, 2016 2015 2016

2015 Net sales: Rigid Industrial Packaging &

Services $ 602.9 $ 601.1 $ 2,324.2 $ 2,586.4 Paper Packaging &

Services 189.0 179.8 687.1 676.1 Flexible Products & Services

69.1 73.3 288.1 322.6 Land Management 6.6 14.3 24.2

31.6 Total net sales $ 867.6 $ 868.5 $

3,323.6 $ 3,616.7

Operating profit (loss):

Rigid Industrial Packaging & Services $ 30.5 $ 10.9 $ 143.9 $

86.4 Paper Packaging & Services 24.7 32.6 89.1 109.3 Flexible

Products & Services (3.6 ) (12.8 ) (15.5 ) (36.6 ) Land

Management 2.0 1.4 8.1 33.7 Total

operating profit $ 53.6 $ 32.1 $ 225.6 $ 192.8

EBITDA6: Rigid Industrial Packaging

& Services $ 50.3 $ 34.3 $ 223.8 $ 179.5 Paper Packaging &

Services 32.7 39.8 120.7 138.4 Flexible Products & Services

(2.3 ) (12.1 ) (11.3 ) (29.9 ) Land Management 3.2 2.1

11.9 37.0 Total EBITDA $ 83.9 $ 64.1

$ 345.1 $ 325.0

EBITDA before special

items: Rigid Industrial Packaging & Services $ 80.2 $ 65.9

$ 293.6 $ 259.9 Paper Packaging & Services 33.1 40.5 123.3

140.9 Flexible Products & Services 1.4 (4.6 ) 0.6 (17.4 ) Land

Management 2.6 2.2 10.3 10.1 Total

EBITDA before special items $ 117.3 $ 104.0 $ 427.8

$ 393.5

__________

6 EBITDA is defined as net income, plus interest expense,

net, plus income tax expense, plus depreciation, depletion and

amortization. However, because the company does not calculate net

income by segment, this table calculates EBITDA by segment with

reference to operating profit (loss) by segment, which, as

demonstrated in the table of Consolidated EBITDA, is another method

to achieve the same result. See the reconciliations in the table of

Segment EBITDA.

GREIF, INC. AND SUBSIDIARY

COMPANIES FINANCIAL HIGHLIGHTS BY GEOGRAPHIC REGION

UNAUDITED

(Dollars in millions)

Three months ended October 31, Twelve months ended

October 31, 2016 2015 2016

2015 Net sales: United States $ 431.8 $ 418.6 $

1,610.8 $ 1,688.3

Europe, Middle East and Africa

302.5

307.7

1,208.4

1,287.2

Asia Pacific and other Americas

133.3

142.2

504.4

641.2

Total net sales

$

867.6

$

868.5

$

3,323.6

$

3,616.7

Gross profit: United States $ 100.0 $ 95.3 $ 360.1 $ 349.2

Europe, Middle East and Africa 57.9 50.9 227.3 226.7 Asia Pacific

and other Americas 25.5 21.8 97.5 93.9 Total

gross profit $ 183.4 $ 168.0 $ 684.9 $ 669.8

Operating profit (loss): United States $ 56.4 $ 40.7 $ 176.6

$ 155.2 Europe, Middle East and Africa (12.8 ) (11.5 ) 26.1 20.7

Asia Pacific and other Americas 10.0 2.9 22.9

16.9 Total operating profit $ 53.6 $ 32.1 $ 225.6

$ 192.8

GREIF,

INC. AND SUBSIDIARY COMPANIES GAAP TO NON-GAAP

RECONCILIATION OPERATING WORKING CAPITAL

UNAUDITED

(Dollars in millions)

October 31, 2016 October 31, 2015 Trade

accounts receivable $ 399.2 $ 403.7 Plus: inventories 277.4 297.0

Less: accounts payable 372.0 355.3 Operating working capital

$ 304.6 $ 345.4

GREIF, INC. AND

SUBSIDIARY COMPANIES GAAP TO NON-GAAP RECONCILIATION

CONSOLIDATED EBITDA7

UNAUDITED

(Dollars in millions)

Three months ended October 31, Twelve months ended

October 31, 2016 2015 2016

2015 Net income $ 6.5 $ 9.2 $ 75.5 $ 67.2 Plus: interest

expense, net 17.2 18.6 75.4 74.8 Plus: income tax expense 28.3 2.6

66.5 48.4 Plus: depreciation, depletion and amortization expense

31.9 33.7 127.7

134.6 EBITDA $ 83.9 $ 64.1 $ 345.1 $

325.0 Net income $ 6.5 $ 9.2 $ 75.5 $ 67.2 Plus: interest

expense, net 17.2 18.6 75.4 74.8 Plus: income tax expense 28.3 2.6

66.5 48.4 Plus: other expense, net 1.6 2.2 9.0 3.2 Less: equity

earnings of unconsolidated affiliates, net of tax —

(0.5 ) (0.8 ) (0.8 ) Operating profit

$

53.6

$

32.1

$

225.6

$

192.8

Less: other expense, net 1.6 2.2 9.0 3.2 Less: equity earnings of

unconsolidated affiliates, net of tax — (0.5 ) (0.8 ) (0.8 ) Plus:

depreciation, depletion and amortization expense 31.9

33.7 127.7 134.6 EBITDA $

83.9 $ 64.1 $ 345.1 $ 325.0

__________

7 EBITDA is defined as net income, plus interest expense,

net, plus income tax expense, plus depreciation, depletion and

amortization. As demonstrated in this table, EBITDA can also be

calculated with reference to operating profit.

GREIF, INC. AND SUBSIDIARY COMPANIES GAAP TO NON-GAAP

RECONCILIATION

SEGMENT EBITDA8

UNAUDITED

(Dollars in millions)

Three months ended October 31, Twelve months ended

October 31, 2016 2015 2016

2015 Rigid Industrial Packaging & Services

Operating profit $ 30.5 $ 10.9 $ 143.9 $ 86.4 Less: other expense,

net 1.1 0.8 5.5 1.3 Less: equity earnings of unconsolidated

affiliates, net of tax — (0.4 ) (0.8 ) (0.4 ) Plus: depreciation

and amortization expense 20.9 23.8 84.6 94.0

EBITDA $ 50.3 $ 34.3 $ 223.8 $ 179.5 Restructuring charges

7.8 9.2 19.0 29.6 Acquisition-related costs 0.1 — 0.2 0.3 Non-cash

asset impairment charges 3.5 22.1 43.3 43.4 Loss on disposal of

properties, plants, equipment and businesses, net 18.5 0.3 7.3 2.7

Impact of Venezuela devaluation of inventory on cost of products

sold — — — 9.3 Impact of Venezuela devaluation on other (income)

expense — — — (4.9 ) EBITDA before special

items $ 80.2 $ 65.9 $ 293.6 $ 259.9

Paper Packaging & Services Operating profit $ 24.7 $

32.6 $ 89.1 $ 109.3 Less: other income, net — — — (0.4 ) Plus:

depreciation and amortization expense 8.0 7.2 31.6

28.7 EBITDA $ 32.7 $ 39.8 $ 120.7 $ 138.4

Restructuring charges 0.4 1.2 1.5 2.2 Non-cash asset impairment

charges — — 1.5 0.8 Gain on disposal of properties, plants,

equipment and businesses, net — (0.5 ) (0.4 ) (0.5 ) EBITDA

before special items $ 33.1 $ 40.5 $ 123.3 $

140.9

Flexible Products & Services Operating loss

$ (3.6 ) $ (12.8 ) $ (15.5 ) $ (36.6 ) Less: other expense, net 0.5

1.4 3.5 2.3 Less: equity earnings of unconsolidated affiliates, net

of tax — (0.1 ) — (0.4 ) Plus: depreciation and amortization

expense 1.8 2.0 7.7 8.6 EBITDA $ (2.3 )

$ (12.1 ) $ (11.3 ) $ (29.9 ) Restructuring charges 0.7 2.8 6.3 8.1

Non-cash asset impairment charges 3.0 1.5 6.6 1.7 (Gain) loss on

disposal of properties, plants, equipment and businesses, net —

3.2 (1.0 ) 2.7 EBITDA before special items $

1.4 $ (4.6 ) $ 0.6 $ (17.4 )

Land Management

Operating profit $ 2.0 $ 1.4 $ 8.1 $ 33.7 Plus: depreciation,

depletion and amortization expense 1.2 0.7 3.8

3.3 EBITDA $ 3.2 $ 2.1 $ 11.9 $ 37.0 Restructuring charges

0.1 0.1 0.1 0.1 Timberland gains — — — (24.3 ) Gain on disposal of

properties, plants, equipment and businesses, net (0.7 )

— (1.7 )

(2.7 ) EBITDA before special items $ 2.6 $ 2.2 $ 10.3

$ 10.1 Consolidated EBITDA $ 83.9 $ 64.1

$ 345.1 $ 325.0 Consolidated EBITDA before

special items $ 117.3 $ 104.0 $ 427.8 $ 393.5

__________

8 EBITDA is defined as net income, plus interest expense,

net, plus income tax expense, plus depreciation, depletion and

amortization. However, because the company does not calculate net

income by segment, this table calculates EBITDA by segment with

reference to operating profit (loss) by segment, which, as

demonstrated in the table of Consolidated EBITDA, is another method

to achieve the same result.

GREIF, INC. AND

SUBSIDIARY COMPANIES GAAP TO NON-GAAP RECONCILIATION

FREE CASH FLOW9

UNAUDITED

(Dollars in millions)

Three months ended October 31, Twelve months ended

October 31, 2016 2015 2016

2015 Net cash provided by operating activities $

143.0 $ 132.9 $ 301.0 $ 206.3 Less: Cash paid for capital

expenditures (28.7 ) (27.6 ) (100.1 ) (135.8 )

Free Cash

Flow $ 114.3 $ 105.3 $ 200.9 $ 70.5

FREE CASH FLOW FROM VENEZUELA

OPERATIONS10

Three months ended October 31, Twelve months ended

October 31, 2016 2015 2016 2015

Net cash provided by (used in) operating activities for

Venezuela $ — $ (0.2 ) $ — $ 4.1 Less: Cash paid for capital

expenditures for Venezuela — — — (14.0 )

Free Cash Flow from Venezuela

Operations

$ — $ (0.2 ) $ — $ (9.9 )

FREE CASH FLOW

EXCLUDING THE IMPACT OF VENEZUELA OPERATIONS11 Three

months ended October 31, Twelve months ended October 31,

2016 2015 2016 2015 Net cash

provided by operating activities excluding the impact of Venezuela

operations $ 143.0 $ 133.1 $ 301.0 $ 202.2 Less: Cash paid for

capital expenditures excluding the impact of Venezuela operations

(28.7 ) (27.6 ) (100.1 ) (121.8 )

Free Cash Flow Excluding the

Impact of Venezuela Operations $ 114.3 $ 105.5 $

200.9 $ 80.4

__________

9 Free cash flow is defined as net cash provided by

operating activities less cash paid for capital expenditures. 10

Free cash flow from Venezuela operations

is defined as net cash provided by (used in) Venezuela operating

activities less cash paid for Venezuela capital expenditures.

11 Free cash flow excluding the impact of Venezuela operations is

defined as net cash provided by operating activities, excluding

Venezuela’s net cash provided by operating activities, less capital

expenditures, excluding Venezuela’s capital expenditures. The

information is relevant and presented due to the impact of the

devaluation of the Venezuelan currency at the end of the third

quarter 2015 from 6.3 bolivars per USD to 199.4 bolivars per USD.

GREIF, INC. AND SUBSIDIARY COMPANIES

GAAP TO NON-GAAP RECONCILIATION

SEGMENT OPERATING PROFIT (LOSS) BEFORE

SPECIAL ITEMS12

UNAUDITED

(Dollars in millions)

Three months ended October 31, Twelve months ended

October 31, 2016 2015 2016

2015 Operating profit (loss): Rigid Industrial

Packaging & Services $ 30.5 $ 10.9 $ 143.9 $ 86.4 Paper

Packaging & Services 24.7 32.6 89.1 109.3 Flexible Products

& Services (3.6 ) (12.8 ) (15.5 ) (36.6 ) Land Management 2.0

1.4 8.1 33.7 Total operating profit

53.6 32.1 225.6 192.8

Restructuring

charges: Rigid Industrial Packaging & Services 7.8 9.2 19.0

29.6 Paper Packaging & Services 0.4 1.2 1.5 2.2 Flexible

Products & Services 0.7 2.8 6.3 8.1 Land Management 0.1

0.1 0.1 0.1 Total restructuring charges 9.0

13.3 26.9 40.0

Acquisition-related

costs: Rigid Industrial Packaging & Services 0.1 —

0.2 0.3 Total acquisition-related costs 0.1

— 0.2 0.3

Timberland gains: Land

Management — — — (24.3 ) Total timberland

gains — — — (24.3 )

Non-cash asset

impairment charges: Rigid Industrial Packaging & Services

3.5 22.1 43.3 43.4 Paper Packaging & Services — — 1.5 0.8

Flexible Products & Services 3.0 1.5 6.6

1.7 Total non-cash asset impairment charges 6.5 23.6

51.4 45.9

(Gain) loss on disposal of

properties, plants, equipment and businesses, net: Rigid

Industrial Packaging & Services 18.5 0.3 7.3 2.7

Paper Packaging & Services

— (0.5 ) (0.4 ) (0.5 ) Flexible Products & Services — 3.2 (1.0

) 2.7 Land Management (0.7 ) — (1.7 ) (2.7 ) Total loss on

disposal of properties, plants, equipment and businesses, net 17.8

3.0 4.2 2.2

Impact of Venezuela

devaluation of inventory on cost of products sold Rigid

Industrial Packaging & Services — — — 9.3

Total Impact of Venezuela devaluation of inventory on cost

of products sold — — — 9.3

Operating

profit (loss) before special items: Rigid Industrial Packaging

& Services 60.4 42.5 213.7 171.7 Paper Packaging & Services

25.1 33.3 91.7 111.8 Flexible Products & Services 0.1 (5.3 )

(3.6 ) (24.1 ) Land Management 1.4 1.5 6.5 6.8

Total operating profit before special items $ 87.0 $

72.0 $ 308.3 $ 266.2

__________

12

Operating profit (loss) before special

items is defined as operating profit (loss), plus restructuring

charges plus acquisition-related costs, plus non-cash impairment

charges, less timberland gains, less (gain) loss on disposal of

properties, plants, equipment and businesses, net, plus the impact

of Venezuela devaluation of inventory on cost of products sold.

GREIF, INC. AND SUBSIDIARY COMPANIES

GAAP TO NON-GAAP RECONCILIATION NET INCOME AND CLASS A

EARNINGS PER SHARE BEFORE SPECIAL ITEMS

UNAUDITED

(Dollars in millions, except for per share

amounts)

Three months ended October 31, 2016 Class A

Net Income Attributable to Greif, Inc. $ 8.5 $ 0.14 Plus: Loss on

disposal of properties, plants, equipment and businesses, net 17.3

0.29 Plus: Restructuring charges 7.4 0.13 Plus: Non-cash asset

impairment charges 5.3 0.09 Plus: Acquisition related costs —

— Net Income Attributable to Greif, Inc. Excluding

Special Items $ 38.5 $ 0.65

Three months

ended October 31, 2015 Class A Net Income Attributable

to Greif, Inc. $ 12.4 $ 0.21 Plus: Loss on disposal of properties,

plants, equipment and businesses, net 1.7 0.03 Plus: Restructuring

charges 9.5 0.16 Plus: Non-cash asset impairment charges 21.1

0.36 Net Income Attributable to Greif, Inc. Excluding

Special Items $ 44.7 $ 0.76

Twelve months

ended October 31, 2016 Class A Net Income Attributable

to Greif, Inc. $ 74.9 $ 1.28 Plus: Loss on disposal of properties,

plants, equipment and businesses, net 7.0 0.12 Plus: Restructuring

charges 19.1 0.33 Plus: Non-cash asset impairment charges 42.4 0.71

Plus: Acquisition related costs 0.1 — Net Income

Attributable to Greif, Inc. Excluding Special Items $ 143.5

$ 2.44

Twelve months ended October 31, 2015

Class A Net Income Attributable to Greif, Inc. $ 71.9 $ 1.23

Less: Gain on disposal of properties, plants, equipment and

businesses, net (2.8 ) (0.05 ) Less: Timberland Gains (14.9 ) (0.25

) Less: Venezuela devaluation on other income/expense (4.9 ) (0.08

) Plus: Restructuring charges 28.2 0.48 Plus: Non-cash asset

impairment charges 40.7 0.69 Plus: Acquisition related costs 0.2 —

Plus: Venezuela devaluation of inventory on cost of products sold

9.3 0.16 Net Income Attributable to Greif,

Inc. Excluding Special Items $ 127.7 $ 2.18

All special items are net of tax and noncontrolling

interests

GREIF, INC. AND SUBSIDIARY COMPANIES GAAP

TO NON-GAAP RECONCILIATION SELECTED FINANCIAL INFORMATION

EXCLUDING THE IMPACT OF DIVESTITURES

UNAUDITED

(Dollars in millions)

Three months ended October 31, Twelve months ended

October 31, 2016

Impact ofDivestitures

Excluding theImpact

ofDivestitures

2016

Impact ofDivestitures

Excluding theImpact of

Divestitures

Net Sales: Rigid Industrial Packaging & Services $ 602.9

$ 1.6 $ 601.3 $ 2,324.2 $ 59.6 $ 2,264.6 Paper Packaging &

Services 189.0 — 189.0 687.1 — 687.1

Flexible Products & Services

69.1 — 69.1 288.1 6.5 281.6 Land Management 6.6 — 6.6

24.2 — 24.2 Consolidated $ 867.6

$ 1.6 $ 866.0 $ 3,323.6 $ 66.1 $

3,257.5

Gross Profit: Rigid Industrial

Packaging & Services $ 130.9 $ 0.3 $ 130.6 $ 489.4 $ 5.7 $

483.7 Paper Packaging & Services 39.0 — 39.0 144.5 — 144.5

Flexible Products & Services

11.7 — 11.7 42.0 1.1 40.9 Land Management 1.8 — 1.8

9.0 — 9.0 Consolidated $ 183.4 $

0.3 $ 183.1 $ 684.9 $ 6.8 $ 678.1

Operating Profit (Loss): Rigid Industrial

Packaging & Services $ 30.5 $ (0.4 ) $ 30.9 $ 143.9 $ (24.6 ) $

168.5 Paper Packaging & Services 24.7 — 24.7 89.1 — 89.1

Flexible Products & Services

(3.6 ) — (3.6 ) (15.5 ) 0.3 (15.8 ) Land Management 2.0 —

2.0 8.1 — 8.1 Consolidated $

53.6 $ (0.4 ) $ 54.0 $ 225.6 $ (24.3 ) $ 249.9

Operating profit (loss) before special

items13: Rigid Industrial Packaging &

Services $ 60.4 $ 0.1 $ 60.3 $ 213.7 $ (0.3 ) $ 214.0 Paper

Packaging & Services 25.1 — 25.1 91.7 — 91.7

Flexible Products & Services

0.1 — 0.1 (3.6 ) 0.3 (3.9 ) Land Management 1.4 — 1.4

6.5 — 6.5 Consolidated $ 87.0 $

0.1 $ 86.9 $ 308.3 $ — $ 308.3

__________

13 See table contained herein entitled GAAP to Non-GAAP

Reconciliation Segment Operating Profit (Loss) Before Special Items

for a reconciliation of each segment’s operating profit (loss)

before special items.

GREIF, INC. AND

SUBSIDIARY COMPANIES GAAP TO NON-GAAP RECONCILIATION

SELECTED FINANCIAL INFORMATION EXCLUDING THE IMPACT OF

DIVESTITURES (CONTINUED)

UNAUDITED

(Dollars in millions)

Three months ended October 31, Twelve months ended

October 31, 2015

Impact ofDivestitures

Excluding theImpact of

Divestitures

2015

Impact ofDivestitures

Excluding theImpact of

Divestitures

Net Sales: Rigid Industrial Packaging & Services $ 601.1

$ 29.5 $ 571.6 $ 2,586.4 $ 154.5 $ 2,431.9 Paper Packaging &

Services 179.8 — 179.8 676.1 — 676.1

Flexible Products & Services

73.3 2.4 70.9 322.6 13.6 309.0 Land Management 14.3 —

14.3 31.6 — 31.6 Consolidated $ 868.5

$ 31.9 $ 836.6 $ 3,616.7 $ 168.1

$ 3,448.6

Gross Profit: Rigid Industrial

Packaging & Services $ 112.3 $ 2.8 $ 109.5 $ 463.4 $ 9.7 $

453.7 Paper Packaging & Services 46.5 — 46.5 163.5 — 163.5

Flexible Products & Services

6.9 0.4 6.5 33.8 2.2 31.6 Land Management 2.3 — 2.3

9.1 — 9.1 Consolidated $ 168.0 $

3.2 $ 164.8 $ 669.8 $ 11.9 $ 657.9

Operating Profit (Loss): Rigid Industrial

Packaging & Services $ 10.9 $ (12.5 ) $ 23.4 $ 86.4 $ (36.4 ) $

122.8 Paper Packaging & Services 32.6 — 32.6 109.3 — 109.3

Flexible Products & Services

(12.8 ) — (12.8 ) (36.6 ) 0.4 (37.0 ) Land Management 1.4 —

1.4 33.7 — 33.7 Consolidated $

32.1 $ (12.5 ) $ 44.6 $ 192.8 $ (36.0 ) $

228.8

Operating profit (loss) before special

items14: Rigid Industrial Packaging &

Services $ 42.5 $ 0.7 $ 41.8 $ 171.7 $ (3.7 ) $ 175.4 Paper

Packaging & Services 33.3 — 33.3 111.8 — 111.8

Flexible Products & Services

(5.3 ) — (5.3 ) (24.1 ) 0.4 (24.5 ) Land Management 1.5 —

1.5 6.8 — 6.8 Consolidated $

72.0 $ 0.7 $ 71.3 $ 266.2 $ (3.3 ) $

269.5

Note: The 2015 Acquisitions were completed at the beginning of

the fiscal year and are not adjusted because they are fully

reflected in both periods.

__________

14 See table contained herein entitled GAAP to Non-GAAP

Reconciliation Segment Operating Profit (Loss) Before Special Items

for a reconciliation of each segment’s operating profit (loss)

before special items.

GREIF, INC.

AND SUBSIDIARY COMPANIES GAAP TO NON-GAAP RECONCILIATION

NET SALES TO NET SALES EXCLUDING THE IMPACT OF

DIVESTITURES AND CURRENCY TRANSLATION

UNAUDITED

(Dollars in millions)

Three months ended October 31, 2016

2015

Increase(Decrease) inNet

Sales ($)

Increase(Decrease) inNet

Sales (%)

Net Sales $ 867.6 $ 868.5 $ (0.9 ) (0.1 )% Impact of

Divestitures 1.6 31.9

Net Sales excluding the

impact of divestitures $ 866.0 $ 836.6 Currency Translation

(14.7 ) N/A

Net Sales excluding the impact of

divestitures and currency translation $ 880.7 $ 836.6

$ 44.1 5.3 %

Twelve months ended October 31,

2016 2015

Increase(Decrease) inNet

Sales ($)

Increase(Decrease) inNet

Sales (%)

Net Sales $ 3,323.6 $ 3,616.7 $ (293.1 ) (8.1 )% Impact of

Divestitures 66.1 168.1

Net Sales excluding the

impact of divestitures $ 3,257.5 $ 3,448.6 Currency Translation

(208.5 ) N/A

Net Sales excluding the impact of

divestitures and currency translation $ 3,466.0 $

3,448.6 $ 17.4 0.5 %

GREIF,

INC. AND SUBSIDIARY COMPANIES GAAP TO NON-GAAP

RECONCILIATION RIGID INDUSTRIAL PACKAGING & SERVICES

NET SALES TO NET SALES EXCLUDING THE IMPACT OF

DIVESTITURES AND CURRENCY TRANSLATION

UNAUDITED

(Dollars in millions)

Three months ended October 31, 2016

2015

Increase inNet Sales ($)

Increase inNet Sales (%) Net Sales $ 602.9 $

601.1 $ 1.8 0.3 % Impact of Divestitures 1.6 29.5

Net Sales excluding the impact of divestitures $ 601.3 $

571.6 Currency Translation (12.3 ) N/A

Net Sales

excluding the impact of divestitures and currency translation $

613.6 $ 571.6 $ 42.0 7.3 %

Twelve months

ended October 31, 2016 2015

Increase(Decrease) inNet

Sales ($)

Increase(Decrease) inNet

Sales (%)

Net Sales $ 2,324.2 $ 2,586.4 $ (262.2 ) (10.1 )% Impact of

Divestitures 59.6 154.5

Net Sales excluding the

impact of divestitures $ 2,264.6 $ 2,431.9 Currency Translation

(195.5 ) N/A

Net Sales excluding the impact of

divestitures and currency translation $ 2,460.1 $

2,431.9 $ 28.2 1.2 %

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161207006198/en/

Greif, Inc.Matt Eichmann,

740-549-6067matt.eichmann@greif.com

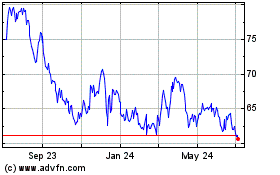

Greif (NYSE:GEF.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

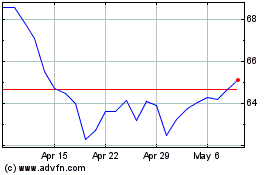

Greif (NYSE:GEF.B)

Historical Stock Chart

From Apr 2023 to Apr 2024