Current Report Filing (8-k)

December 07 2016 - 4:07PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 1, 2016

SecureWorks Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-37748

|

|

56-2015395

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

One Concourse Parkway NE Suite 500

Atlanta, Georgia

|

|

30328

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

(404) 327-6339

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of

the registrant under any of the following provisions:

|

☐

|

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

(b) and (e)

Amendment and Restatement of Form of

Confidentiality,

Non-Solicitation

and

Non-Competition

Agreement

As

previously reported by SecureWorks Corp. (the “Company”) in a Current Report on Form

8-K

filed with the Securities and Exchange Commission on September 6, 2016, the Compensation Committee (the

“Compensation Committee”) of the Company’s Board of Directors approved, on September 1, 2016, an amendment and restatement (the “Amended and Restated Severance Plan”) of the Company’s Severance Pay Plan for

Executive Employees to provide that, among other matters, participants in the Amended and Restated Severance Plan will receive severance pay equal to 12 months of base salary in connection with a qualifying termination (as defined in the plan). On

December 1, 2016, the Compensation Committee approved a similar amendment and restatement of the Company’s Form of Confidentiality,

Non-Solicitation

and

Non-Competition

Agreement, entitled the Form of Protection of Sensitive Information, Noncompetition and Nonsolicitation Agreement

(the “Amended and Restated Form of Agreement”). Pursuant to

the amendment and restatement, if an executive’s employment is terminated by the Company without Cause (as defined in the agreement), the Company is required under the Amended and Restated Form of Agreement to pay the executive an amount equal

to 12 months of base salary (rather than six months of base salary, as provided in the prior form of agreement), as severance, subject to specified conditions. No other changes were made to the prior form of agreement. The Amended and Restated Form

of Agreement, among other matters, obligates each executive that is a party to the agreement to comply with specified

non-competition

and

non-solicitation

obligations

for a period of 12 months following the termination of his or her employment.

As of December 1, 2016, each of the Company’s current named

executive officers has entered, or plans to enter, into a restrictive covenant agreement in the form of the Amended and Restated Form of Agreement in replacement of the restrictive covenant agreement with the Company to which such officer was

previously a party.

The foregoing description of the Amended and Restated Form of Agreement is qualified in its entirety by reference to the full text of

the Amended and Restated Form of Agreement, which is filed as Exhibit 10.1 to this Current Report on Form

8-K

and incorporated herein by reference.

Departure of Named Executive Officer

On

December 1, 2016, Tyler Winkler, the Company’s Vice President, Global Sales & Marketing, informed the Company that he will retire effective on February 3, 2017. Mr. Winkler will receive severance pay and benefits

equivalent to those that would be payable under the Amended and Restated Severance Plan in the event of a qualifying termination and with the shares of restricted stock of the Company held by Mr. Winkler to be treated as if such shares were

restricted stock units under the Amended and Restated Severance Plan.

|

Item 9.01

|

Financial Statements and Exhibits.

|

|

(d)

|

Exhibits

. The following document is herewith filed as an exhibit to this report:

|

|

|

|

|

|

Exhibit No.

|

|

Exhibit Description

|

|

|

|

|

10.1

|

|

SecureWorks Corp. Form of Protection of Sensitive Information, Noncompetition and Nonsolicitation Agreement

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: December 7, 2016

|

|

|

|

SecureWorks Corp.

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ R. Wayne Jackson

|

|

|

|

|

|

|

|

R. Wayne Jackson

|

|

|

|

|

|

|

|

Chief Financial Officer

|

|

|

|

|

|

|

|

(Duly Authorized Officer)

|

EXHIBIT INDEX

|

|

|

|

|

Exhibit No.

|

|

Exhibit Description

|

|

|

|

|

10.1

|

|

SecureWorks Corp. Form of Protection of Sensitive Information, Noncompetition and Nonsolicitation Agreement

|

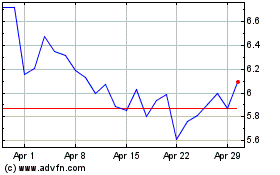

SecureWorks (NASDAQ:SCWX)

Historical Stock Chart

From Mar 2024 to Apr 2024

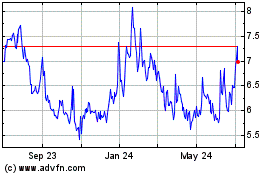

SecureWorks (NASDAQ:SCWX)

Historical Stock Chart

From Apr 2023 to Apr 2024