SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed by the

Registrant

☒

Filed by a Party other than the Registrant

☐

Check the appropriate box:

|

|

|

|

|

☐

|

|

Preliminary Proxy Statement

|

|

☐

|

|

Confidential, for Use of the Commission Only (as Permitted by Rule 14a-6(E)(2))

|

|

☒

|

|

Definitive Proxy Statement

|

|

☐

|

|

Definitive Additional Materials

|

|

☐

|

|

Soliciting Material Pursuant to Section 240.14a-11(c) or Section 240.14a-12

|

ASHLAND GLOBAL HOLDINGS INC.

(Name of Registrant as

Specified in Its Charter)

N/A

(Name of Person(s) Filing

Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies: N/A

|

|

|

(2)

|

Aggregate number of securities to which transaction applies: N/A

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the

amount on which the filing fee is calculated and state how it was determined): N/A

|

|

|

(4)

|

Proposed maximum aggregate value of transaction: N/A

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which

the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid: N/A

|

|

|

(2)

|

Form, Schedule or Registration Statement No.: N/A

|

Notes:

|

|

|

Ashland Global Holdings Inc.

|

|

50 E. RiverCenter Blvd.

Covington,

KY 41011

|

|

|

|

December 7, 2016

|

Dear Ashland Global Holdings Inc. Stockholder:

On behalf of your Board of Directors and management, I am pleased to invite you to the 2017 Annual Meeting of Stockholders of Ashland

Global Holdings Inc. The meeting will be held on Thursday, January 26, 2017, at 10:30 a.m. (EST), at the Metropolitan Club, 50 E. RiverCenter Boulevard, Covington, KY 41011.

The attached Notice of Annual Meeting and Proxy Statement describe the business to be conducted at the meeting. We have elected, where

possible, to provide access to our proxy materials over the Internet under the Securities and Exchange Commission’s “notice and access” rules. We believe that providing our proxy materials over the Internet reduces the environmental

impact of our Annual Meeting without limiting our stockholders’ access to important information about Ashland.

Whether or not

you plan to attend the meeting, we encourage you to vote promptly.

We appreciate your continued confidence in Ashland and look

forward to seeing you at the meeting.

|

|

|

Sincerely,

|

|

|

|

|

|

|

William A. Wulfsohn

Chairman and Chief Executive

Officer

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To our Stockholders:

Ashland Global Holdings Inc., a

Delaware corporation, will hold its Annual Meeting of Stockholders on Thursday, January 26, 2017, at 10:30 a.m. (EST) at the following location and for the purposes listed below:

|

|

|

|

|

|

|

|

Where:

|

|

Metropolitan Club, 50 E. RiverCenter Boulevard, Covington, KY 41011

|

|

|

|

|

Items of Business:

|

|

(1) To elect nine directors: Brendan M. Cummins,

William G. Dempsey, Jay V. Ihlenfeld, Barry W. Perry, Mark C. Rohr, George A. Schaefer, Jr., Janice J. Teal, Michael J. Ward and William A. Wulfsohn to the Board of Directors to serve for a one-year term and until their successors are duly

elected and qualified;

|

|

|

|

|

|

|

(2) To ratify the appointment of Ernst & Young

LLP as independent registered public accountants for fiscal 2017;

|

|

|

|

|

|

|

(3) To vote upon a non-binding advisory resolution

approving the compensation paid to Ashland’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion;

|

|

|

|

|

|

|

(4) To determine whether the stockholder vote to

approve the compensation of the named executive officers should occur every one, two or three years; and

|

|

|

|

|

|

|

(5) To consider any other business properly brought

before the Annual Meeting.

|

|

|

|

|

Who Can Vote:

|

|

Only stockholders of record at the close of business on December 5, 2016 are entitled to vote at the Annual Meeting or any

adjournment of that meeting.

|

|

|

|

|

|

|

|

You can vote in one of several ways:

|

|

|

|

|

|

Visit the website listed on your proxy card or Notice to vote

VIA THE INTERNET

|

|

|

Call the telephone number specified on your proxy card or the website listed on your Notice to vote

BY

TELEPHONE

|

|

|

If you received paper copies of your proxy materials in the mail, sign, date and return your proxy card in the enclosed envelope to

vote

BY MAIL

|

|

|

Attend the meeting to vote

IN PERSON

|

If you are a participant in the Ashland Employee Savings Plan (the “Employee Savings Plan”), the Leveraged

Employee Stock Ownership Plan (the “LESOP”), the Ashland Employee Union Savings Plan (the “Union Plan”) or the International Specialty Products Inc. 401(k) Plan (the “ISP Plan”), your vote will constitute voting

instructions to Fidelity Management Trust Company, who serves as trustee of all four of these plans (the “Trustee”), for the shares held in your account.

If you are a participant in the Employee Savings Plan, the LESOP, the Union Plan or the ISP Plan, then our proxy tabulator, Corporate Election Services or

its agent, must receive all voting instructions, whether given by telephone, over the Internet or by mail, before 6:00 a.m. (EST) on Tuesday, January 24, 2017.

|

|

|

By Order of the Board of Directors,

|

|

|

|

PETER J. GANZ

|

|

Senior Vice President, General Counsel and Secretary

|

Covington, Kentucky

December 7, 2016

TABLE OF CONTENTS

PROXY STATEMENT

ASHLAND GLOBAL HOLDINGS INC.

Annual Meeting

on January 26, 2017

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

|

Q:

|

What matters will be voted on at the Annual Meeting?

|

|

|

|

|

|

|

|

A:

|

|

(1)

|

|

Election of nine directors: Brendan M. Cummins, William G. Dempsey, Jay V. Ihlenfeld, Barry W. Perry, Mark C. Rohr, George A.

Schaefer, Jr., Janice J. Teal, Michael J. Ward and William A. Wulfsohn to the Board of Directors to serve for a one-year term and until their successors are duly elected and qualified;

|

|

|

|

|

|

|

|

(2)

|

|

Ratification of Ernst & Young LLP (“EY”) as Ashland’s independent registered public accountants for fiscal

2017;

|

|

|

|

|

|

|

|

(3)

|

|

A non-binding advisory resolution approving the compensation paid to Ashland’s named executive officers, as disclosed pursuant

to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion; and

|

|

|

|

|

|

|

|

(4)

|

|

A non-binding advisory proposal to approve the frequency of the stockholder vote on compensation of the named executive

officers.

|

|

Q:

|

Who may vote at the Annual Meeting?

|

|

A:

|

Stockholders of Ashland Global Holdings Inc. (“Ashland” or the “Company”) at the close of

business on December 5, 2016 (the “Record Date”) are entitled to vote at the Annual Meeting. As of the Record Date, there were 62,213,264 shares of Ashland Common Stock outstanding. Each share of Ashland Common Stock is entitled to

one vote.

|

|

Q:

|

Who can attend the Annual Meeting?

|

|

A:

|

All Ashland stockholders on the Record Date are invited to attend the Annual Meeting, although seating is limited.

If your shares are held in the name of a broker, bank or other nominee, you will need to bring a proxy or letter from that nominee that confirms you are the beneficial owner of those shares.

|

|

Q:

|

Why did I receive the Notice of Internet Availability of Proxy Materials in the mail instead of a full set of proxy

materials?

|

|

A:

|

In accordance with rules adopted by the Securities and Exchange Commission (the “SEC”), we may furnish

proxy materials, including this Notice of Annual Meeting of Stockholders and Proxy Statement, together with our 2016 Annual Report, by providing access to such documents on the Internet instead of mailing printed copies. Most stockholders will not

receive printed copies of the proxy materials unless they have specifically requested them. Instead, a Notice of Internet Availability of Proxy Materials (“Notice”) will be mailed to stockholders starting on or around December 7,

2016.

|

|

Q:

|

How do I access the proxy materials?

|

|

A:

|

The Notice will provide you with instructions regarding how to view Ashland’s proxy materials for the Annual

Meeting and the 2016 Annual Report on the Internet. The Notice also instructs you on how you may submit your vote. If you would like to receive a paper or email copy of our proxy materials, you should follow the instructions for requesting such

materials in the Notice.

|

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

1

|

|

|

|

|

|

Q:

|

What shares are included on the proxy card?

|

|

A:

|

Your proxy card represents all shares of Ashland Common Stock that are registered in your name and any shares you

hold in the Employee Savings Plan, the LESOP, the Union Plan or the ISP Plan. Additionally, your proxy card includes shares you hold in the dividend reinvestment plan (the “DRP”) administered by Wells Fargo Bank, National Association

(“Wells Fargo”) for investors in Ashland Common Stock. If your shares are held through a broker, bank or other nominee, you will receive either a voting instruction form or a proxy card from the broker, bank or other nominee instructing

you on how to vote your shares.

|

|

Q:

|

How do I vote if I am a registered holder or I own shares through a broker, bank or other nominee?

|

|

A:

|

If you are a registered stockholder as of the Record Date, you can vote (i) by attending the Annual Meeting,

(ii) by following the instructions on the Notice or proxy card for voting by telephone or Internet or (iii) by signing, dating and mailing in your proxy card. If you hold shares through a broker, bank or other nominee, that institution

will instruct you as to how your shares may be voted by proxy, including whether telephone or Internet voting options are available. If you hold your shares through a broker, bank or other nominee and would like to vote in person at the meeting, you

must first obtain a proxy issued in your name from the institution that holds your shares.

|

All shares represented

by validly executed proxies will be voted at the Annual Meeting, and such shares will be voted in accordance with the instructions provided. If no voting specification is made on your returned proxy card, William A. Wulfsohn or Peter J. Ganz, as

individuals named on the proxy card, will vote (i) FOR the election of the nine director nominees, (ii) FOR the ratification of EY, (iii) FOR the non-binding advisory resolution approving the compensation paid to Ashland’s named

executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the Compensation Discussion and Analysis, compensation tables and narrative discussion and (iv) for holding a non-binding advisory vote on the compensation of

the named executive officers EVERY YEAR.

|

Q:

|

How do I vote my shares in the DRP?

|

|

A:

|

Shares of Ashland Common Stock credited to your account in the DRP will be voted by Wells Fargo, the plan sponsor

and administrator, in accordance with your voting instructions.

|

|

Q:

|

How will the Trustee of the Employee Savings Plan, the LESOP, the Union Plan and the ISP Plan vote?

|

|

A:

|

Each participant in the Employee Savings Plan, the LESOP, the Union Plan or the ISP Plan will instruct the Trustee

on how to vote the shares of Ashland Common Stock credited to the participant’s account in each plan. This instruction also applies to a proportionate number of those shares of Ashland Common Stock allocated to participants’ accounts for

which voting instructions are not timely received by the Trustee. These shares are collectively referred to as non-directed shares. Each participant who gives the Trustee such an instruction acts as a named fiduciary for the applicable plan under

the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). Your vote must be received by our proxy tabulator, Corporate Election Services (“CES”), before 6:00 a.m. (EST) on Tuesday, January 24, 2017.

|

|

Q:

|

Can a plan participant vote the non-directed shares differently from shares credited to his or her account?

|

|

A:

|

Yes, provided that you are a participant in the Employee Savings Plan or the LESOP. Any participant in the

Employee Savings Plan or the LESOP who wishes to vote the non-directed shares differently from the shares credited to his or her account or who wishes not

|

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

2

|

|

|

|

|

|

|

to vote the non-directed shares at all may do so by requesting a separate voting instruction card from CES at Corporate Election Services, P.O. Box 1150, Pittsburgh, PA 15230. Participants in the

Union Plan and the ISP Plan, however, cannot direct that the non-directed shares be voted differently from the shares in their accounts.

|

|

Q:

|

Can I change my vote once I vote by mail, by telephone or over the Internet?

|

|

A:

|

Yes. You have the right to change or revoke your proxy (1) at any time before the Annual Meeting by

(a) notifying Ashland’s Secretary in writing, (b) returning a later dated proxy card or (c) entering a later dated telephone or Internet vote; or (2) by voting in person at the Annual Meeting. However, any changes or

revocations of voting instructions to the Trustee of the Employee Savings Plan, the LESOP, the Union Plan or the ISP Plan must be received by our proxy tabulator, CES, before 6:00 a.m. (EST) on Tuesday, January 24, 2017.

|

|

Q:

|

Who will count the vote?

|

|

A:

|

Representatives of CES will tabulate the votes and will act as the inspector of election.

|

|

Q:

|

Is my vote confidential?

|

|

A:

|

Yes. Your vote is confidential.

|

|

Q:

|

What constitutes a quorum?

|

|

A:

|

As of the Record Date, 62,213,264 shares of Ashland Common Stock were outstanding and entitled to vote. A majority

of the shares issued and outstanding and entitled to be voted thereat must be present in person or by proxy to constitute a quorum to transact business at the Annual Meeting. If you vote in person, by telephone, over the Internet or by returning a

properly executed proxy card, you will be considered a part of that quorum. Abstentions and broker non-votes (i.e., when a broker does not have authority to vote on a specific issue) will be treated as present for the purpose of determining a

quorum but as unvoted shares for the purpose of determining the approval of any matter submitted to the stockholders for a vote.

|

|

Q:

|

What vote is required for approval of each matter to be considered at the Annual Meeting?

|

|

A:

|

(1)

|

Election of directors

—Under Article V of Ashland’s Amended and Restated Certificate of Incorporation (“Certificate”), the

affirmative vote of a majority of votes cast with respect to each director nominee is required for the nominee to be elected. A majority of votes cast means that the number of votes cast “for” a director nominee must exceed the number of

votes cast “against” that director nominee.

|

|

|

(2)

|

Ratification of independent registered public accountants

—The appointment of EY will be deemed ratified if

votes cast in its favor exceed votes cast against it.

|

|

|

(3)

|

Non-binding advisory resolution approving the compensation paid to Ashland’s named executive

officers

—The non-binding advisory resolution approving the compensation paid to Ashland’s named executive officers, as disclosed in this proxy statement pursuant to Item 402 of Regulation S-K, including the Compensation Discussion

and Analysis, compensation tables and narrative discussion, will be approved if the votes cast in its favor exceed the votes cast against it.

|

|

|

(4)

|

Frequency of the stockholder vote on executive compensation

—The non-binding advisory vote regarding the

frequency of the stockholder vote to approve the compensation of the named executive officers will be determined by a plurality of the votes cast.

|

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

3

|

|

|

|

|

|

Q:

|

How will broker non-votes and abstentions be treated?

|

|

A:

|

Ashland will treat broker non-votes as present to determine whether or not there is a quorum at the Annual

Meeting, but they will not be treated as entitled to vote on the matters, if any, for which the broker indicates it does not have discretionary authority. Abstentions will also be treated as present for the purpose of determining quorum but as

unvoted shares for the purpose of determining the approval of any matter submitted for a vote. This means that broker non-votes and abstentions will not have any effect on whether a matter proposed at the Annual Meeting passes.

|

|

Q:

|

Where can I find the voting results of the meeting?

|

|

A:

|

We intend to announce preliminary voting results at the Annual Meeting. We will report the final results on a

Current Report on Form 8-K filed with the SEC no later than February 1, 2017. You can obtain a copy of the Form 8-K from our website at

http://investor.ashland.com

, by calling the SEC at 1-800-SEC-0330 for the location of the nearest public

reference room or through the SEC’s EDGAR system at

http://www.sec.gov

.

|

|

|

|

Important Notice regarding the availability of Proxy Materials for the

Annual Meeting to be held on January 26, 2017.

This Proxy Statement and Ashland’s 2016 Annual Report to Shareholders are available at

www.ashland.com/proxy.

|

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

4

|

|

|

|

|

ASHLAND COMMON STOCK OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS

The following table sets forth information with respect to each person known to Ashland to beneficially own more than 5% of the

outstanding shares of Ashland Common Stock as of September 30, 2016.

|

|

|

|

|

|

|

|

|

|

|

Name and Address of Beneficial Owner

|

|

Amount and

Nature of Common

Stock

Beneficial

Ownership

|

|

|

Percent of Class of

Common Stock*

|

|

|

T. Rowe Price Associates, Inc.

|

|

|

10,287,373

|

(1)

|

|

|

16.55

|

%

|

|

100 East Pratt Street

Baltimore, Maryland 21202

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BlackRock Inc.

|

|

|

4,936,319

|

(2)

|

|

|

7.94

|

%

|

|

55 East 52nd Street

New York, New York 10022

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Vanguard Group

|

|

|

4,765,246

|

(3)

|

|

|

7.67

|

%

|

|

100 Vanguard Blvd.

Malvern, Pennsylvania 19355

|

|

|

|

|

|

|

|

|

|

*

|

Based on 62,160,273 shares of Ashland Common Stock outstanding as of September 30, 2016.

|

|

(1)

|

Based upon information contained in the Schedule 13G filed by T. Rowe Price Associates, Inc. (“T. Rowe

Price”) with the SEC on October 11, 2016, T. Rowe Price beneficially owned 10,287,373 shares of Ashland Common Stock as of September 30, 2016, with sole voting power over 3,327,766 shares, shared voting power over no shares, sole

dispositive power over 10,287,373 shares and shared dispositive power over no shares.

|

|

(2)

|

Based upon information contained in the Schedule 13G/A filed by BlackRock, Inc. (“BlackRock”) with the SEC on

January 25, 2016, BlackRock beneficially owned 4,936,319 shares of Ashland Common Stock as of December 31, 2015, with sole voting power over 4,501,357 shares, shared voting power over no shares, sole dispositive power over 4,936,319 shares

and shared dispositive power over no shares. BlackRock reported its beneficial ownership on behalf of itself and the following direct and indirect subsidiaries and affiliates: BlackRock (Luxembourg) S.A., BlackRock (Netherlands) B.V., BlackRock

Advisors (UK) Limited; BlackRock Advisors, LLC; BlackRock Asset Management Canada Limited; BlackRock Asset Management Ireland Limited; BlackRock Asset Management North Asia Limited; BlackRock Asset Management Schweiz AG; BlackRock Capital

Management; BlackRock Financial Management, Inc.; BlackRock Fund Advisors; BlackRock Fund Managers Ltd; BlackRock Institutional Trust Company, N.A.; BlackRock International Limited; BlackRock Investment Management (Australia) Limited; BlackRock

Investment Management (UK) Ltd; BlackRock Investment Management, LLC; BlackRock Japan Co Ltd; and BlackRock Life Limited.

|

|

(3)

|

Based upon information contained in the Schedule 13G/A filed by The Vanguard Group (“Vanguard”) with the SEC on

February 10, 2016, Vanguard beneficially owned 4,765,246 shares of Ashland Common Stock as of December 31, 2015, with sole voting power over 58,719 shares, shared voting power over 6,200 shares, sole dispositive power over 4,696,827 shares

and shared dispositive power over 68,419 shares. Vanguard reported its beneficial ownership on behalf of itself and the following wholly owned subsidiaries: Vanguard Fiduciary Trust Company and Vanguard Investments Australia, LTD.

|

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

5

|

|

|

|

|

ASHLAND COMMON STOCK OWNERSHIP OF DIRECTORS AND EXECUTIVE

OFFICERS OF ASHLAND

The following table shows as of October 31, 2016, the beneficial ownership of Ashland Common

Stock and Valvoline Common Stock by each Ashland director and nominee and each Ashland executive officer named in the Summary Compensation Table on page 57 of this proxy statement and the beneficial ownership of Ashland Common Stock and Valvoline

Common Stock by the directors and executive officers of Ashland as a group.

Common Stock Ownership

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Beneficial Owner

|

|

Aggregate

Number of

Shares

of

Common

Stock

Beneficially

Owned

|

|

|

Percentage of

Common Stock

Beneficially

Owned

|

|

|

Aggregate

Number of

Shares

of

Valvoline

Common Stock

Beneficially

Owned

|

|

|

|

|

William A. Wulfsohn

|

|

|

149,263

|

|

|

|

*

|

|

|

|

45,500

|

|

|

(2)(4)

|

|

J. Kevin Willis

|

|

|

97,626

|

|

|

|

*

|

|

|

|

2,500

|

|

|

(1)(2)(3)(4)(6)

|

|

Peter J. Ganz

|

|

|

71,291

|

|

|

|

*

|

|

|

|

2,000

|

|

|

(2)(3)(4)(6)

|

|

Luis Fernandez-Moreno

|

|

|

90,196

|

|

|

|

*

|

|

|

|

5,000

|

|

|

(2)(3)(4)(6)

|

|

Anne T. Schumann

|

|

|

42,791

|

|

|

|

*

|

|

|

|

1,000

|

|

|

(1)(2)(3)(4)(6)

|

|

Samuel J. Mitchell, Jr.*

|

|

|

118,201

|

|

|

|

*

|

|

|

|

25,000

|

|

|

(1)(2)(3)(4)(6)

|

|

Brendan M. Cummins

|

|

|

6,802

|

|

|

|

*

|

|

|

|

-

|

|

|

(2)

|

|

William G. Dempsey

|

|

|

1,000

|

|

|

|

*

|

|

|

|

2,500

|

|

|

(5)

|

|

Jay V. Ihlenfeld**

|

|

|

-

|

|

|

|

*

|

|

|

|

-

|

|

|

|

|

Stephen F. Kirk***

|

|

|

3,527

|

|

|

|

*

|

|

|

|

4,937

|

|

|

(2)(5)(7)

|

|

Vada O. Manager***

|

|

|

27,045

|

|

|

|

*

|

|

|

|

4,937

|

|

|

(2)(5)(7)

|

|

Barry W. Perry

|

|

|

28,105

|

|

|

|

*

|

|

|

|

25,000

|

|

|

(2)(5)

|

|

Mark C. Rohr

|

|

|

30,917

|

|

|

|

*

|

|

|

|

20,000

|

|

|

(2)(5)

|

|

George A. Schaefer, Jr.

|

|

|

30,841

|

|

|

|

*

|

|

|

|

-

|

|

|

(2)(5)

|

|

Janice J. Teal

|

|

|

7,855

|

|

|

|

*

|

|

|

|

5,000

|

|

|

(2)(5)

|

|

Michael J. Ward

|

|

|

66,093

|

|

|

|

*

|

|

|

|

-

|

|

|

(2)(5)

|

|

All directors and executive officers as a group (18 people)

|

|

|

791,290

|

|

|

|

1.27

|

%

|

|

|

143,374

|

|

|

(1)(2)(3)(4)(5)(6)

|

|

*

|

In connection with the initial public offering of Valvoline Inc., Mr. Mitchell ceased to be an executive officer of

Ashland in September 2016.

|

|

**

|

Mr. Ihlenfeld is a director nominee and does not beneficially own any shares of Ashland Common Stock.

|

|

***

|

Messrs. Kirk and Manager are not seeking re-election and will end their service on Ashland’s Board in January.

|

As of October 31, 2016, there were 62,174,301 shares of Ashland Common Stock outstanding and

204,529,622 shares of Valvoline Common Stock outstanding. None of the listed individuals owned more than 1% of Ashland’s or Valvoline’s Common Stock outstanding as of October 31, 2016. All directors and executive officers as a

group owned 791,290 shares of Ashland Common Stock, which equaled 1.27% of the Ashland Common Stock outstanding as of October 31, 2016 and 143,374 shares of Valvoline Common Stock, which equaled .07% of Valvoline Common Stock outstanding as of

October 31, 2016. Shares deemed to be beneficially owned are included in the number of shares of common stock outstanding on October 31, 2016, for computing the percentage ownership of the applicable person and the group, but shares are not

deemed to be outstanding for computing the percentage ownership of any other person.

|

|

(1)

|

Includes shares of Ashland Common Stock held under the Employee Savings Plan and/or the LESOP by executive officers: as

to Mr. Willis, 16,533 shares; as to Ms. Schumann, 1,301 shares; as to Mr. Mitchell, 1,913 shares; and as to all executive officers as a group, 20,667 shares. Participants can vote the Employee Savings Plan and the LESOP shares.

|

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

6

|

|

|

|

|

|

|

(2)

|

Includes grants of restricted stock units to executive officers that vest within 60 days of October 31, 2016, and

common stock units and/or restricted stock units (share equivalents) held by executive officers in the Ashland Common Stock Fund under Ashland’s non-qualified deferred compensation plans for employees (the “Employees’ Deferral

Plan”) or by directors under the non-qualified deferred compensation plans for non-employee directors (the “Directors’ Deferral Plan”): as to Mr. Wulfsohn, 3,649 units; as to Mr. Willis, 16,004 units; as to Mr. Ganz,

622 units; as to Mr. Fernandez-Moreno, 639 units; as to Ms. Schumann, 283 units; as to Mr. Mitchell, 35,023 units; as to Mr. Kirk 2,069 units; as to Mr. Manager, 24,593 units; as to Mr. Perry, 27,105 units; as to Mr. Rohr,

24,917 units; as to Mr. Schaefer, 27,105 units; as to Dr. Teal, 6,855 units; as to Mr. Ward, 65,093 units; and as to all directors and executive officers as a group, 234,726 units. Mr. Cummins, as a non-U.S. resident, is not

eligible to defer

U.S.-based

compensation and therefore holds 6,802 restricted stock units directly and not through the Directors’ Deferral Plan.

|

|

|

(3)

|

Includes shares of Ashland Common Stock with respect to which the executive officers have the right to acquire beneficial

ownership within 60 calendar days after October 31, 2016, through the exercise of stock appreciation rights (“SARs”): as to Mr. Willis, 4,913 shares; as to Mr. Ganz, 8,857 shares; as to Mr. Fernandez-Moreno, 2,378

shares; as to Ms. Schumann, 3,003 shares; as to Mr. Mitchell, 20,398 shares; and as to all directors and executive officers as a group, 42,702 shares through SARs. All SARs included in this table are reported on a net basis based on the

closing price for Ashland Common Stock as reported on the New York Stock Exchange (“NYSE”) Composite Tape on October 31, 2016. All SARs are stock settled and are not issued in tandem with an option.

|

|

|

(4)

|

Includes restricted shares of Ashland Common Stock: as to Mr. Wulfsohn, 32,837 shares and 95,963 performance based

restricted shares; as to Mr. Willis, 11,076 shares and 40,337 performance based restricted shares; as to Mr. Ganz, 9,565 shares and 34,547 performance based restricted shares; as to Mr. Fernandez-Moreno, 40,686 shares and

35,465 performance based restricted shares; as to Ms. Schumann 5,991 shares and 25,250 performance based restricted shares; as to Mr. Mitchell, 9,689 shares and 31,947 performance based restricted shares; and as to all

executive officers as a group, 110,974 shares and 263,509 performance based restricted shares.

|

|

|

(5)

|

Includes 1,000 restricted shares of Ashland Common Stock for each of the non-employee directors, except for

Mr. Cummins who received 1,000 restricted stock units in lieu of 1,000 restricted shares (discussed in footnote 2 above).

|

|

|

(6)

|

Includes shares of Ashland Common Stock with respect to which the executive officers have the right to acquire beneficial

ownership within 60 calendar days after October 31, 2016, from the vesting of the 2014-2016 Long Term Incentive Performance Plan shares: as to Mr. Willis, 8,532 shares; as to Mr. Ganz, 4,740 shares; as to Mr. Fernandez-Moreno, 4,029

shares; as to Ms. Schumann, 2,133 shares; as to Mr. Mitchell, 3,911 shares; and as to all executive officers as a group, 26,071 shares.

|

|

|

(7)

|

Includes 4,937 restricted shares of Valvoline Common Stock.

|

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

7

|

|

|

|

|

PROPOSAL ONE – ELECTION OF DIRECTORS

FOR A ONE-YEAR TERM

BOARD OF DIRECTORS

The nine individuals nominated for election as directors at the 2017 Annual Meeting are Brendan M.

Cummins, William G. Dempsey, Jay V. Ihlenfeld, Barry W. Perry, Mark C. Rohr, George A. Schaefer, Jr., Janice J. Teal, Michael J. Ward and William A. Wulfsohn. All nominees are incumbent directors, other than Mr. Ihlenfeld who is being nominated

as a Director and would join the Board in January if approved. The nominees will be elected to serve a one-year term until the 2018 Annual Meeting and will hold office until their successors are elected and qualified. The Governance and

Nominating Committee (“G&N Committee”) has confirmed that all nine nominees will be available to serve as directors upon election and recommends that stockholders vote for them at the Annual Meeting. During fiscal 2016, the

G&N Committee engaged Russell Reynolds Associates, an independent executive and director search firm, to assist it in identifying and recruiting suitable director candidates. As a result of that engagement, Messrs. Dempsey and Ihlenfeld were

suggested to the G&N Committee by Russell Reynolds Associates.

Stephen F. Kirk and Vada O. Manager, whose terms as directors

expire in 2017, are not seeking re-election and will retire from Ashland’s Board at the 2017 Annual Meeting in January. Messrs. Kirk and Manager joined the Board of Valvoline Inc., Ashland’s majority-owned subsidiary, in connection

with its initial public offering in September 2016. In connection with the 2017 Annual Meeting, the Board expects to reduce the number of total directorships to nine.

Under Article V of Ashland’s Certificate, in an uncontested election, the affirmative vote of a majority of votes cast with respect

to a director nominee is required for the nominee to be elected. Therefore, the number of votes cast “for” a nominee must exceed those cast “against” a nominee for the nominee to be elected to the Board of Directors. Abstentions

will not be counted as votes cast either for or against the nominees.

Pursuant to the Board of Directors’ resignation policy in

Ashland’s Corporate Governance Guidelines (published on Ashland’s website (

http://investor.ashland.com

)), any nominee who is serving as a director at the time of an uncontested election who fails to receive a greater number of votes

“for” his or her election than votes “against” his or her election will tender his or her resignation for consideration by Ashland’s Board within ten days following the certification of the stockholder vote. The Board will

decide, through a process managed by the G&N Committee, whether to accept the resignation within 90 days following the date of the stockholder meeting. The Company will then promptly disclose the Board’s decision and reasons therefor. As a

condition to his or her nomination, each person nominated by the G&N Committee must agree in advance to abide by the policy. All nine director nominees have each agreed to abide by the policy.

If no voting specification is made on a properly returned or voted proxy card, William A. Wulfsohn or Peter J. Ganz (proxies

named on the proxy card) will vote FOR the nine nominees named in this proxy statement. Should any of the nominees be unable or unwilling to stand for election at the time of the Annual Meeting, the proxies may vote for a replacement nominee

recommended by the Board of Directors, or the Board may reduce the number of directors to be elected at the Annual Meeting. At this time, the Board knows of no reason why any of the nominees would not be able to serve as a director if elected.

|

|

|

The Board of Directors recommends a vote FOR the following directors

at the 2017 Annual Meeting: Brendan M. Cummins, William G.

Dempsey,

Jay V. Ihlenfeld, Barry W. Perry, Mark C. Rohr, George A. Schaefer, Jr., Janice J. Teal,

Michael J. Ward and William A. Wulfsohn

|

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

8

|

|

|

|

|

DIRECTOR NOMINEES

|

|

|

|

|

BRENDAN M. CUMMINS

|

|

Principal Occupation:

Former Consultant to

The Valence Group; Former

Chief Executive Officer of

Ciba Specialty Chemicals

Director Since:

2012

Age:

65

|

|

Professional Experience:

Mr. Cummins

served as a global strategic advisor to, and on the senior executive panel of, The Valence Group, a specialist mergers and acquisitions firm, from 2010 until May 2012. Prior to that position, Mr. Cummins served with Ciba Specialty Chemicals as

Chief Executive Officer from 2007 to 2008 and as Chief Operating Officer from 2005 to 2007. From 1974 to 2005, Mr. Cummins held a variety of international and senior management positions with Ciba.

Education:

Mr. Cummins is an Associate and Fellow of the Institute of Company Accountants, is a Fellow of the Association of International Accountants and

received a Diploma in Company Direction from the Institute of Directors in 2010. He also completed a management development program at Harvard in 1989.

Other Company Boards:

Mr. Cummins serves as a board member

of Perstorp Group of Sweden and is a member of the Remuneration Committee, and serves on the boards of Tom Murphy Car Sales Ltd in Ireland and Nanoco Ltd based in Manchester UK. He served until February 2014 as a board member of SolarPrint

Ltd.

Non-Profit Boards:

Mr. Cummins served as Chairman of The Viking Trust Ltd in Waterford City, Ireland from 2012 until July 2016, and as Chair of the Audit Committee and

member of the Planning Committee of Waterford City and County Council until the first quarter of 2016.

Director Qualifications:

As the former Chief Executive Officer

of a major chemical company and chemical industry consultant, Mr. Cummins brings significant management and chemical industry experience and knowledge to the Board in the areas of international business operations, accounting and finance, risk

oversight, environmental compliance and corporate governance.

Board

Committees:

* Audit

* Environmental, Health, Safety and Quality

|

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

9

|

|

|

|

|

|

|

|

|

|

WILLIAM G. DEMPSEY

|

|

Principal Occupation:

Former Executive Vice

President of Global

Pharmaceuticals at Abbott Laboratories

Director Since:

2016

Age:

65

|

|

Professional Experience:

Mr. Dempsey

held various executive positions with Abbott Laboratories from 1982 until 2007, including, Executive Vice President of Global Pharmaceuticals from 2006, Senior Vice President of Pharmaceutical Operations from 2003 and Senior Vice President of

International Operations from 1999. He has previously served as Chairman of the International Section of the Pharmaceutical Research and Manufacturers of America (PhRMA) and as Chairman of the Accelerating Access Initiative, a cooperative

public-private partnership of UNAIDS, the World Bank, and six research-based pharmaceutical companies.

Education:

Mr. Dempsey holds a Bachelor of Science degree

in Accounting from DePaul University.

Public Company Boards:

Mr. Dempsey currently serves as a Director of Hill-Rom since 2014, where he is a member of the Compensation and Management Development Committee, and

as Director of Landauer, Inc. since 2008 where he serves on the Governance and Nominating Committee, chairs the Compensation Committee and is the lead independent director. In the past five years, Mr. Dempsey has served on the board of

directors of Hospira, Inc.

Non-Profit Boards:

Mr. Dempsey is a member of the Board of Trustees for the Guadalupe Center in Immokalee Florida.

Director Qualifications:

As former Executive Vice President of Global Pharmaceuticals at a public company, Mr. Dempsey brings significant experience within the pharmaceutical

industry, as well as knowledge in the areas of finance, accounting, international operations and corporate governance. He also brings significant experience gained from service on the boards of other public companies.

Board Committees:

* Audit

* Environmental, Health, Safety and Quality

|

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

10

|

|

|

|

|

|

|

|

|

|

JAY V. IHLENFELD

|

|

|

|

Principal Occupation:

Former Senior Vice President

of 3M Company

Director Since:

N/A

Age:

65

|

|

Professional Experience:

Dr. Ihlenfeld

served as the Senior Vice President, Asia Pacific, for 3M Company, a leader in technology and innovation from 2006 until his retirement in 2010. Dr. Ihlenfeld has held various leadership positions during his 33-year career at 3M Company,

including Senior Vice President, Research and Development from 2002 to 2006, Vice President of its Performance Materials business and Executive Vice President of its Sumitomo/3M business in Japan.

Education:

Dr. Ihlenfeld holds a Bachelor of Science degree in chemical engineering from Purdue University and a Ph.D. in chemical engineering from the University of

Wisconsin.

Public Company Boards:

Dr. Ihlenfeld is a director of Celanese Corporation, where he serves on the Compensation and Management Development Committee and the Environmental,

Health, Safety and Public Policy Committee.

Non-Profit Boards:

Dr. Ihlenfeld is a director of the Minnesota Orchestra and serves as a trustee for the Phi Delta Theta Foundation.

Director Qualifications:

As a former Senior Vice President of a global science company, Dr. Ihlenfeld brings significant management and chemical industry experience to the Board,

as well as knowledge in the areas of international operations, leadership development and succession, environmental compliance and safety, risk oversight and M&A evaluation. He also brings significant experience gained from service on the

board of directors of another public company.

|

|

|

|

|

|

BARRY W. PERRY

|

|

|

|

Principal Occupation:

Former Chairman and Chief

Executive Officer of

Engelhard Corporation

Director Since:

2007

Age:

70

Lead Independent Director

|

|

Professional Experience:

Mr. Perry

served as Chairman and Chief Executive Officer of Engelhard Corporation from January 2001 to June 2006. Prior to that position, he held various management positions with Engelhard Corporation beginning in 1993. From 1991 to 1993, Mr. Perry was

a Group Vice President of Rhone-Poulenc. Prior to joining Rhone-Poulenc, he held a number of executive positions with General Electric Company.

Education:

Mr. Perry holds a Bachelor of Science degree in

plastics engineering from the University of Massachusetts.

Public Company

Boards:

Mr. Perry is the Lead Director of Arrow Electronics, Inc., where he serves on the Compensation Committee, and a director of Albemarle

Corporation, where he serves on the Executive Compensation Committee and chairs the Health, Safety and Environment Committee. Mr. Perry previously served on the Board of Directors of Cookson Group PLC.

Director Qualifications:

As the former Chairman of the Board and Chief Executive Officer of a leading chemical company, Mr. Perry brings significant management and chemical

industry experience and knowledge to the Board in the areas of finance, accounting, international business operations, safety, environmental compliance, risk oversight and corporate governance. He also brings significant experience gained from

service on the board of directors of other public companies.

Board

Committees:

* Personnel and Compensation (Chair)

* Governance and Nominating

|

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

11

|

|

|

|

|

|

|

|

|

|

MARK C. ROHR

|

|

|

|

Principal Occupation:

Chairman and Chief

Executive Officer of

Celanese Corporation

Director Since:

2008

Age:

65

|

|

Professional Experience:

Mr. Rohr is

Chairman and Chief Executive Officer of Celanese Corporation, a technology and specialty materials company. He has served in these roles since April 2012. Prior to that position, he held several executive positions with Albemarle Corporation, a

specialty chemical company, including Executive Chairman of the Board (2011-2012), Chairman of the Board (2008-2011), Chief Executive Officer (2002-2011) and President (2000-2010). Before joining Albemarle, he served with Occidental Chemical

Corporation as Senior Vice President, Specialty Chemicals.

Education:

Mr. Rohr holds Bachelor of Science degrees in chemistry and chemical engineering from Mississippi State University.

Public Company Boards:

Within the past five years, Mr. Rohr has served as the Executive Chairman and Chairman of the Board of Albemarle Corporation.

Non-Profit Boards:

Mr. Rohr serves on the Executive Committee of the American Chemistry Council and the Advisory Board of Mississippi State University College of Arts

and Sciences. He is the Chair of City Year Dallas, on the board of Commit! and is the campaign chair of United Way Metropolitan Dallas.

Director Qualifications:

As a current Chairman and Chief

Executive Officer of a leading technology and specialty materials company and former Chairman of the Board and Chief Executive Officer of a leading chemical company, Mr. Rohr brings significant management and chemical industry experience and

knowledge to the Board in the areas of finance, accounting, international business operations, safety, environmental compliance, risk oversight and corporate governance. He also brings significant experience gained from service on the board of

directors of other public companies.

Board Committees:

* Audit

* Environmental, Health, Safety and Quality

|

|

|

|

|

|

GEORGE A. SCHAEFER, JR.

|

|

Principal Occupation:

Former Chairman and

Chief Executive

Officer of Fifth Third

Bancorp

Director Since:

2003

Age:

71

|

|

Professional Experience:

Mr. Schaefer

served as Chairman of the Board of Directors and Chief Executive Officer of Fifth Third Bancorp and Fifth Third Bank headquartered in Cincinnati, Ohio, until June 2008. Prior to that position, he held several executive positions with Fifth Third

Bancorp and Fifth Third Bank, including Chief Executive Officer, President and Chief Operating Officer.

Education:

Mr. Schaefer holds a Bachelor of Science degree

from the U.S. Military Academy at West Point and a Masters in Business Administration from Xavier University.

Public Company Boards:

Mr. Schaefer is Lead Director of the

Board of Directors of Anthem Inc., where he chairs the Executive Committee and is a member of the Compensation, Governance and Audit committees.

Non-Profit Boards:

Mr. Schaefer is a member of the Board of

Trustees of the University of Cincinnati Healthcare System. Mr. Schaefer is also a board member of the UC Healthcare Foundation, the William S. Rowe Foundation and the Charles P. Taft Foundation.

Director Qualifications:

Mr. Schaefer brings significant experience and knowledge to the Board in the areas of finance, accounting, business operations, risk oversight and

corporate governance. He also brings significant experience gained from service on the board of directors of other public companies.

Board Committees:

* Audit (Chair)

* Personnel and Compensation

|

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

12

|

|

|

|

|

|

|

|

|

|

JANICE J. TEAL

|

|

|

|

Principal Occupation:

Former Group Vice

President and Chief

Scientific Officer for

Avon Products Inc.

Director Since:

2012

Age:

64

|

|

Professional Experience:

Dr. Teal

served as the Group Vice President and Chief Scientific Officer for Avon Products Inc., a direct seller of beauty and related products, from January 1999 to May 2010. Prior to that position, Dr. Teal served as Vice President of the Avon Skin

Care Laboratories, where she led the bioscience research and skin care teams.

Education:

Dr. Teal holds a doctorate degree and a Master

of Science degree in Pharmacology from Emory University Medical School, a Pharmacy Degree from Mercer University and was a Post-Doctoral Fellow at the New York University Medical Center Institute of Environmental Medicine.

Public Company Boards:

From 2003 until 2011, Dr. Teal served on the Board of Directors of Arch Chemicals, Inc., where she served on the Audit Committee and the Corporate

Governance Committee.

Director Qualifications:

As former Group Vice President and Chief Scientific Officer of a leading personal care company, Dr. Teal brings significant scientific and personal

care industry experience and knowledge to the Board in the areas of research and development, marketing, safety and risk oversight. She also brings significant experience gained from service on the board of directors of another public chemical

company.

Board Committees:

* Environmental, Health, Safety and Quality (Chair)

* Personnel and Compensation

|

|

MICHAEL J. WARD

|

|

Principal Occupation:

Chairman of the Board

and Chief Executive

Officer of CSX

Corporation

Director Since:

2001

Age:

66

|

|

Professional Experience:

Mr. Ward is

Chairman of the Board and Chief Executive Officer of CSX Corporation, a transportation supplier. Prior to that position, he was President of CSX Transportation, the corporation’s rail unit.

Education:

Mr. Ward holds a Bachelor of Science degree from the University of Maryland and a Masters in Business Administration from the Harvard Business

School.

Non-Profit Boards:

Mr. Ward is a Director of the American Coalition for Clean Coal Electricity, City Year and Take Stock in Children. His other affiliations include The

Florida Council of 100, The Business Roundtable, the Hubbard House Foundation, Edward Waters College Foundation and Michael Ward and Jennifer Glock Foundation.

Director Qualifications:

As a current Chairman of the Board and

Chief Executive Officer of a major transportation company, Mr. Ward brings significant experience and knowledge to the Board in the areas of finance, accounting, business operations, safety, environmental compliance, risk oversight and

corporate governance. He also brings significant experience gained from service on the board of directors of another public company.

Board Committees:

* Governance and Nominating

* Personnel and Compensation

|

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

13

|

|

|

|

|

|

|

|

|

|

WILLIAM A. WULFSOHN

|

|

Principal Occupation:

Chairman of the Board and

Chief Executive Officer of

Ashland Global Holdings Inc.

Director Since:

2015

Age:

54

|

|

Professional Experience:

Mr. Wulfsohn is

Ashland’s Chairman of the Board and Chief Executive Officer. Prior to this position, Mr. Wulfsohn served as President and Chief Executive Officer of Carpenter Technology Corporation from July 2010 to December 2014. Mr. Wulfsohn

also served as a Director for Carpenter Technology Corporation beginning in April 2009. Prior to joining Carpenter Technology Corporation, Mr. Wulfsohn served as Senior Vice President, Industrial Coatings at PPG Industries. Before

joining PPG Industries, Mr. Wulfsohn served as Vice President and General Manager for Honeywell International. Previously, Mr. Wulfsohn worked for Morton International/Rohm & Haas, beginning as a director of marketing and

subsequently as Vice President and Business Director. Mr. Wulfsohn began his professional career with McKinsey & Company.

Education:

Mr. Wulfsohn holds a chemical engineering degree from

the University of Michigan and a Masters of Business Administration degree from Harvard University.

Public Company Boards:

Mr. Wulfsohn is a director of

PolyOne Corporation, where he serves on the Audit and Compensation committees and is the non-executive chairman of Valvoline Inc. Within the past five years, Mr. Wulfsohn also served on the Board of Directors of Carpenter Technology

Corporation.

Director Qualifications:

As the Chairman and Chief Executive Officer of Ashland and as the former President and Chief Executive Officer of Carpenter Technology Corporation, a

leading specialty materials company, Mr. Wulfsohn brings significant experience and knowledge to the Board in the areas of finance, accounting, business operations, management, manufacturing, safety, environmental compliance, risk oversight and

corporate governance. Also, as former Senior Vice President of Industrial Coatings at PPG Industries and an executive at other chemical companies, Mr. Wulfsohn brings considerable specialty chemicals management and manufacturing experience to

the Board. He also brings significant experience gained from service on the board of directors of other public companies.

|

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

14

|

|

|

|

|

COMPENSATION OF DIRECTORS

Director Compensation Table

The following table is a summary of compensation information for the fiscal year ended September 30, 2016, for Ashland’s

non-employee directors. Mr. Wulfsohn, Chairman of the Board and Chief Executive Officer, receives no compensation as a director of Ashland. Mr. Ihlenfeld is a director nominee and has not received any compensation from Ashland.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Fees Earned or

Paid in Cash (1)

($)

|

|

|

Stock

Awards (2)

($)

|

|

|

Total

($)

|

|

|

(a)

|

|

(b)

|

|

|

(c)

|

|

|

(d)

|

|

|

Brendan M. Cummins

|

|

|

100,000

|

|

|

|

110,000

|

|

|

|

210,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

William G. Dempsey*

|

|

|

19,565

|

|

|

|

177,437

|

|

|

|

197,002

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Roger W. Hale(3)**

|

|

|

85,450

|

|

|

|

176,510

|

|

|

|

261,960

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen F. Kirk***

|

|

|

100,000

|

|

|

|

110,000

|

|

|

|

210,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vada O. Manager***

|

|

|

115,000

|

|

|

|

110,000

|

|

|

|

225,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Barry W. Perry

|

|

|

140,000

|

|

|

|

110,000

|

|

|

|

250,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark C. Rohr

|

|

|

100,000

|

|

|

|

110,000

|

|

|

|

210,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

George A. Schaefer, Jr.

|

|

|

120,000

|

|

|

|

110,000

|

|

|

|

230,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Janice J. Teal

|

|

|

115,000

|

|

|

|

110,000

|

|

|

|

225,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael J. Ward

|

|

|

100,000

|

|

|

|

110,000

|

|

|

|

210,000

|

|

|

*

|

Mr. Dempsey joined Ashland’s Board on July 20, 2016.

|

|

**

|

Mr. Hale retired from Ashland’s Board on July 22, 2016.

|

|

***

|

Messrs. Kirk and Manager are not seeking re-election to Ashland’s Board and will end their service in January 2017.

|

|

(1)

|

For fiscal 2016, Messrs. Manager, Perry and Ward and Dr. Teal deferred all or a portion of their fees into the

Directors’ Deferral Plan. Mr. Manager deferred $11,500, Mr. Perry deferred $140,000, Dr. Teal deferred $115,000, and Mr. Ward deferred $100,000 in each case, into the Directors’ Deferral Plan.

|

|

(2)

|

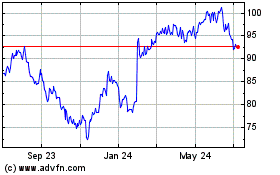

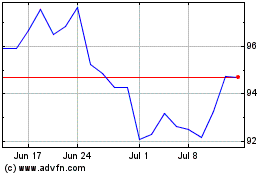

The values in column (c) represent the aggregate grant date fair value of restricted stock unit awards granted in

fiscal 2016 computed in accordance with FASB ASC Topic 718. These restricted stock unit awards do not require assumptions in computing their grant date fair value under generally accepted accounting principles. The number of restricted stock unit

awards received is rounded to the nearest whole share. Other than Mr. Cummins and Mr. Dempsey, each non-employee director received a grant of 1,166 restricted stock units of Ashland Common Stock in the Directors’ Deferral Plan on

January 27, 2016. Mr. Cummins received a grant of 1,166 restricted stock units directly on January 27, 2016. The grant date fair value per share of each restricted stock unit was the same as the closing price of

$94.32 per share of Ashland Common Stock on the NYSE on January 27, 2016. Mr. Dempsey joined the Board in July and received a pro-rated grant of 450 restricted stock units, with a grant date fair value of $122.37 per share, the closing

price of Ashland Common Stock on the NYSE on July 20, 2016, the date of the grant. Upon joining the Board, Mr. Dempsey received 1,000 restricted shares of Ashland Common Stock with a grant date fair value of $122,370, which was based on the closing

price of Ashland Common Stock on the date of grant of $122.37.

|

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

15

|

|

|

|

|

|

(3)

|

Mr. Hale retired from Ashland’s Board on July 22, 2016. Due to his continued service past the age of retirement

in order to assist in the separation of the Valvoline business from Ashland’s specialty chemicals businesses, the Board decided to accelerate a pro-rated portion of his fiscal 2016 restricted stock unit grant in lieu of Mr. Hale forfeiting the

entire grant. As such, Mr. Hale received 568 Ashland common stock units in the Directors’ Deferral Plan after the acceleration with an additional incremental fair value of $66,510 using the payment stock price of $117.08 on August 31, 2016

and forfeited the remaining 606 restricted stock units.

|

The following table identifies the aggregate number of

stock awards for each non-employee director outstanding as of September 30, 2016.

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Shares of

Restricted Ashland

Common Stock

(#)

|

|

|

Unvested

Restricted Stock

Units of Ashland

Common Stock

(1)

(#)

|

|

|

Brendan M. Cummins

|

|

|

0

|

|

|

|

6,802

|

|

|

|

|

|

|

|

|

|

|

|

|

William G. Dempsey

|

|

|

1,000

|

|

|

|

451

|

|

|

|

|

|

|

|

|

|

|

|

|

Roger W. Hale*

|

|

|

0

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

Stephen F. Kirk

|

|

|

1,000

|

|

|

|

1,178

|

|

|

|

|

|

|

|

|

|

|

|

|

Vada O. Manager

|

|

|

1,000

|

|

|

|

1,178

|

|

|

|

|

|

|

|

|

|

|

|

|

Barry W. Perry

|

|

|

1,000

|

|

|

|

1,178

|

|

|

|

|

|

|

|

|

|

|

|

|

Mark C. Rohr

|

|

|

1,000

|

|

|

|

1,178

|

|

|

|

|

|

|

|

|

|

|

|

|

George A. Schaefer, Jr.

|

|

|

1,000

|

|

|

|

1,178

|

|

|

|

|

|

|

|

|

|

|

|

|

Janice J. Teal

|

|

|

1,000

|

|

|

|

1,178

|

|

|

|

|

|

|

|

|

|

|

|

|

Michael J. Ward

|

|

|

1,000

|

|

|

|

1,178

|

|

|

*

|

Mr. Hale retired from Ashland’s Board on July 22, 2016 and his 1,000 restricted shares of Ashland Common

Stock vested upon his retirement. His restricted stock units were pro-rated and accelerated, as discussed in footnote 3 to the Director Compensation Table.

|

|

(1)

|

Includes credit for reinvested dividends allocated since the grant date for all directors. For all directors other than

Mr. Cummins, the restricted stock units vest one year after date of grant or upon the date of the next annual stockholder meeting, if earlier. Mr. Cummins’s restricted stock units vest as described below under “Restricted

Shares/Units” of this proxy statement.

|

Annual Retainer

Ashland’s non-employee director compensation program provides: (a) an annual retainer of $100,000 for each director; (b) an

additional annual retainer of $25,000 for the Lead Independent Director; (c) an additional annual retainer of $20,000 for the Chair of the Audit Committee; and (d) an additional annual retainer of $15,000 for other committee chairs.

Non-employee directors may elect to receive part or all of each annual retainer in cash or in shares of Ashland Common Stock. They may

also elect to have a part or all of each annual retainer deferred and paid through the Directors’ Deferral Plan. The directors who make an election to defer part or all of any annual retainer may have the deferred amounts held as

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

16

|

|

|

|

|

common stock units (share equivalents) in the hypothetical Ashland Common Stock fund or invested under the other available investment options under the plan. The payout of the amounts deferred

occurs upon termination of service by a director. Directors may elect to have the payout in a single lump sum or in installments not to exceed 15 years. For amounts deferred before January 1, 2005, upon a “change in control” of

Ashland (as defined in the Directors’ Deferral Plan), deferred amounts in the directors’ deferral accounts will be automatically distributed as a lump sum in cash to the director. For amounts deferred on and after January 1, 2005,

such amounts will be distributed pursuant to each director’s election and valued at the time of the distribution.

Restricted

Shares/Units

Upon election to Ashland’s Board, each new non-employee director (other than Mr. Cummins, who is a

non-U.S. resident) received 1,000 restricted shares of Ashland Common Stock. In lieu of 1,000 restricted shares of Ashland Common Stock, Mr. Cummins received 1,000 restricted stock units. The restricted shares and Mr. Cummins’s

restricted stock units may not be sold, assigned, transferred or otherwise encumbered until the earliest to occur of: (i) retirement from the Board of Directors; (ii) death or disability of the director; (iii) a 50% change in the

beneficial ownership of Ashland; or (iv) voluntary early retirement to enter governmental service. The G&N Committee has discretion to limit a director’s forfeiture of these shares or restricted stock units if the non-employee director

leaves Ashland’s Board for reasons other than those listed above.

Each non-employee director (other than Mr. Cummins) also

receives an annual award of deferred restricted stock units in the Directors’ Deferral Plan with a grant date value of $110,000 (pro-rated as applicable for less than a full-year of service). The restricted stock units vest one year after date

of grant or upon the date of the next annual stockholder meeting, if earlier, and are settled in accordance with each such director’s deferral election. Dividends on restricted stock units are reinvested in additional restricted stock units.

Upon a “change in control” of Ashland, the restricted stock units immediately vest. Prior to being awarded restricted stock units, directors can elect to have his or her vested units paid in shares of Ashland Common Stock or in cash after

the director terminates from service. In November 2016, Ashland amended its Directors’ Deferral Plan to provide that the annual grant of restricted stock units will vest one year after the date of grant, regardless of an earlier occurring

annual stockholder meeting.

Mr. Cummins, as a non-U.S. resident, is not eligible to participate in the Directors’ Deferral

Plan. Therefore, he received an annual award of restricted stock units directly, which will vest on the same basis as his restricted stock units described above. His annual award will continue to be granted directly (and not through deferral).

Stock Ownership Guidelines for Directors

The Board of Directors considers Ashland Common Stock ownership by directors to be of utmost importance. The Board believes that such

ownership enhances the commitment of directors to Ashland’s future and aligns their interests with those of Ashland’s other stockholders. The Board has therefore established minimum stock ownership guidelines for non-employee directors

which require each director to own the lesser of (i) 12,500 shares or units of Ashland Common Stock or (ii) Ashland Common Stock having a value of at least five times his or her base annual cash retainer of $100,000. Each newly elected

director has five years from the year elected to reach this ownership level. As of October 31, 2016, all of Ashland’s current non-employee directors had attained the minimum stock ownership levels based on holdings, except for

(a) Mr. Kirk, who joined the Board in 2013 and would not have been required to meet the minimum stock ownership guidelines until 2018 and (b) Mr. Dempsey, who joined the Board in 2016 and will not be required to meet the minimum stock

ownership guidelines until 2021.

Other Compensation

Messrs. Kirk and Manager joined the Board of Directors of Valvoline Inc., Ashland’s majority-owned subsidiary, in connection with its

initial public offering in September 2016. As members of

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

17

|

|

|

|

|

the Valvoline Board of Directors, on October 1, 2016, Messrs. Kirk and Manager each received an initial grant of 4,937 restricted shares of Valvoline common stock, which will vest upon the

earliest of (i) retirement from the Valvoline Board of Directors; (ii) death or disability of the director; (iii) any removal or involuntary separation of the director from the Valvoline Board following a change in control; or

(iv) voluntary early retirement to enter governmental service. Additionally, they each received a pro-rated portion of their annual Valvoline restricted stock unit grant equal to 1,561 Valvoline restricted stock units, which will vest

one year after the date of grant and will be settled in accordance with each such director’s deferral election.

|

|

|

|

|

|

|

|

|

|

|

|

/ efficacy usability allure integrity profitability

™

|

|

18

|

|

|

|

|

CORPORATE GOVERNANCE

Governance Principles

Ashland is committed to adhering to sound corporate governance practices. The documents described below are published on Ashland’s

website (

http://investor.ashland.com

). These documents are also available in print at no cost to any stockholder who requests them. Among the corporate governance practices followed by Ashland are the following:

|

|

•

|

|

Ashland has adopted Corporate Governance Guidelines. These guidelines provide the framework for the Board of

Directors’ governance of Ashland and include a general description of the Board’s purpose, director qualification standards, retirement and resignation policies and other responsibilities. The Corporate Governance Guidelines require that

at least two-thirds of Ashland’s directors be independent, as defined by Ashland’s Director Independence Standards (the “Standards”), which incorporate the independence requirements of the SEC rules and the listing standards of

the NYSE.

|

|

|

•

|

|

Ashland also requires compliance with its global code of conduct which applies to all of Ashland’s directors and