By Mark DeCambre and Victor Reklaitis, MarketWatch

The IBB is on track for its worst daily drop since the U.K.'s

vote to exit from the European Union

The Dow industrials and the S&P 500 on Wednesday hit

all-time highs in intraday trade ahead of key meetings of European

and U.S. central banks that have kept investors on a cautious

footing. A tumble in shares of health-care companies after comments

from the U.S. president-elect and back-to-back declines in

crude-oil prices also has kept the market 's advance in check.

But a modest climb higher has been sufficient to help the main

indexes to notch fresh records.

The Dow Jones Industrial Average set an all-time trading high of

19,276.25 and most recently was trading up 10 points, or less than

0.1%, at 19,264, on track for its third consecutive record close. A

1% rise in shares of Goldman Sachs Group(GS) helped to support the

blue-chip benchmark, while a slump in health-care shares of Johnson

& Johnson(JNJ)Pfizer Inc.(PFE), and Merck & Co. Inc.(MRK),

tumbled after President-elect Donald Trump threatened to cut drug

prices

(http://www.marketwatch.com/story/president-elect-trumps-promise-to-bring-down-drug-prices-sends-biotech-etfs-slumping-2016-12-07).

"I'm going to bring down drug prices," Trump told Time in his

"Person of the Year" cover story

(http://time.com/time-person-of-the-year-2016-donald-trump/). "I

don't like what has happened with drug prices."

The iShares Nasdaq Biotechnology ETF(IBB), the most widely used

way to place bets on the biotech space, sank 4.5%, and was on track

for its worst daily decline since after the U.K. vote to abandon

its membership with the European Union roiled markets in late June,

according to FactSet data.

The IBB's drop weighed on the Nasdaq Composite Index which was

the worst performer among the three main benchmarks, down 0.2% at

5,322.

Meanwhile, the S&P 500 index set an intraday trading high of

2,214.74, exceeding its intraday high set Nov. 30, and was most

recently up less than 0.1%, at 2,213, with all but one of the

S&P 500's 11 sector in positive territory. Health-care led the

way lower, with a 1.8%, decline.

On Tuesday, the S&P 500 finished 0.3% higher, the Dow gained

0.2% and finished at an all-time high for a second straight session

(http://www.marketwatch.com/story/dow-reaches-for-a-fresh-record-but-itll-be-a-struggle-2016-12-06),

and the Nasdaq Composite added 0.5%.

The stock market's postelection climb has been underpinned by

hopes that Trump will follow through with a slate of pro-business

policies, including boosting infrastructure spending and cutting

taxes for the wealthy. However, some strategists and traders are

concerned that a pullback

(http://www.marketwatch.com/story/gundlach-says-the-trump-trade-is-losing-steam-2016-12-02)

might be in the offing because the market has climbed too fast and

too furiously.

"It appears that nothing can stop the equity rally," said Naeem

Aslam, chief market analyst at ThinkMarkets UK, in a note.

"If you look at the volatility index, it has dropped near the 11

handle, which confirms that appetite for riskier assets is strong,"

he added, referring to the CBOE Volatility Index . "Buying

volatility at these levels may not be that much of a bad idea."

Other strategist say the market has traded in a relatively

narrow range since 2014 and make the case that for that reason the

recent monthlong Trump rally has a shot at moving higher into the

end of the year.

"It has only been about four weeks since the breakout for stocks

and a lot of people are looking at this to be quickly aborted, but

the market shouldn't be faulted for expecting more," said Bruce

Bittles, chief investment strategist at brokerage firm Robert W.

Baird & Co., a brokerage.

Another factor that may be supporting stock gains is traditional

selling patterns that occur at the end of the year aren't being

followed because investors are making bets on lower taxes under a

Trump administration. "Anyone who has gained [in December] are not

going to want to sell their stocks and pay taxes in April 2017,

when they can wait till 2018," he said. Of course taxes on profits

from the sale of assets could be higher then, but Bittles says Wall

Street traders are betting that it makes more sense to wait and

see, which is reducing traditional selling of stocks to take

year-end profits and encouraging buying.

Read:Why the rally by U.S. stocks is 'just getting started'--in

one chart

(http://www.marketwatch.com/story/why-the-rally-by-us-stocks-is-just-getting-started-in-one-chart-2016-11-28)

Other markets:European stocks

(http://www.marketwatch.com/story/credit-suisse-miners-push-stoxx-europe-600-toward-highest-close-since-september-2016-12-07)

gained, with banks and miners among the session's big winners, and

Asian markets closed broadly higher

(http://www.marketwatch.com/story/bank-stocks-surge-as-asian-markets-post-gains-2016-12-06).

Oil futures

(http://www.marketwatch.com/story/oil-prices-continue-to-backtrack-as-investors-question-opec-deal-2016-12-07)

retreated, while gold futures and a key dollar index

(http://www.marketwatch.com/story/dollar-flattens-out-as-investors-look-ahead-to-fed-ecb-meetings-2016-12-07)

were modestly higher.

Individual stocks: Ahead of the opening bell, Brown-Forman

Corp.(BFA) reported quarterly sales that topped estimates

(http://www.marketwatch.com/story/brown-forman-sales-top-estimates-sticks-with-full-year-view-2016-12-07),

as the maker of Jack Daniel's whiskey backed its full-year

forecast. The stock wasn't yet active in premarket trade.

Handbag seller Vera Bradley Inc.(VRA) cut its full-year outlook

(http://www.marketwatch.com/story/vera-bradley-shares-slump-as-company-cuts-outlook-2016-12-07)

after missing its own guidance range for the third quarter. Shares

were tumbling 7% in early trade.

Economic news: A report on consumer credit is due at 3 p.m.

Eastern.

The JOLTS report, or Job Openings and Labor Turnover Survey,

showed that job openings were unchanged at 5.5 million in October,

according to Labor Department.

Investors also are bracing for the European Central Bank's

policy-setting meeting

(http://www.marketwatch.com/story/how-italys-no-vote-might-be-the-ecbs-silver-lining-2016-12-05)

on Thursday. The Federal Reserve entered the so-called blackout

period Tuesday ahead of its meeting Dec. 13-14, so there are no Fed

speakers on the docket.

Check out:

(END) Dow Jones Newswires

December 07, 2016 11:33 ET (16:33 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

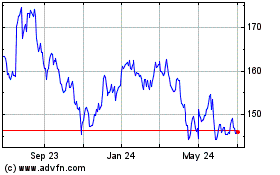

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

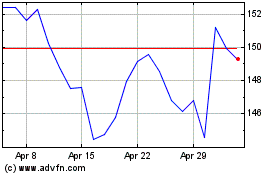

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024