PrivateBancorp Postpones Shareholder Vote on CIBC Offer

December 07 2016 - 9:52AM

Dow Jones News

By Judy McKinnon

PrivateBancorp Inc. said Wednesday it had postponed a

shareholder vote on the proposed $3.8 billion cash-and-stock

takeover offer from Canadian Imperial Bank of Commerce due to

market conditions that have pushed the Chicago-based lender's

shares higher over the past few weeks.

The special meeting of PrivateBancorp shareholders, originally

planned for Thursday, is now expected to be held early in the first

quarter of next year, the U.S. lender said.

"In view of the significant changes to trading market conditions

over the past few weeks, we believe it is in the best interests of

all of PrivateBancorp's stockholders to have additional time to

consider the value and long-term strategic benefits of this

transaction," PrivateBancorp Chairman James Guyette said in a

release. He said the bank remains committed to the takeover.

CIBC, Canada's fifth-largest lender by assets, agreed in June to

buy PrivateBancorp in a bid to expand in the U.S. to help fuel

growth. Its cash-and-stock offer at the time had valued the deal at

$47 a share, or a 31% premium over PrivateBancorp's closing price

of $35.93 on June 28, the day before the offer was announced.

Shares of PrivateBancorp closed at $52.14 in its most recent

trading session, up about 45% since CIBC first announced its offer

of $18.80 in cash plus 0.3657 of a CIBC share for each

PrivateBancorp share. Shares of U.S. banks have surged since the

U.S. election on hopes that President-elect Donald Trump will ease

some of their regulatory burdens.

CIBC, which last week raised its dividend and posted

better-than-expected fiscal fourth-quarter earnings, closed Tuesday

at $82.42 in New York, up nearly 7% from when the offer was

announced. Based on its latest closing price, CIBC's cash-and-stock

offer values PrivateBancorp shares at nearly $49 each.

CIBC said it believes its offer provides "significant immediate

and long-term value" to the shareholders of PrivateBancorp.

"We remain committed to this transaction on the agreed terms,

which were established by both companies based on our analysis of

the fundamental, long-term merits of the combination," CIBC Chief

Executive Victor Dodig said in a release.

CIBC said both it and PrivateBancorp are continuing to work on

obtaining regulatory approvals and developing integration plans for

their operations.

Write to Judy McKinnon at judy.mckinnon@wsj.com

(END) Dow Jones Newswires

December 07, 2016 09:37 ET (14:37 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

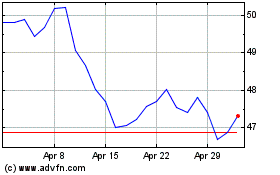

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Apr 2023 to Apr 2024