SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Rule 14d-100)

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

(Amendment No. ____)

VAPOR CORP.

(Name of Subject Company (Issuer) and Name

of Filing Person (Issuer))

Series A Warrants

(Title of Class of Securities)

922099114

(CUSIP Number of Class of Securities)

Jeffrey Holman

Chief Executive Officer

Vapor Corp.

3800 North 28

th

Way

Hollywood, Florida 33020

(888) 766-5351

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications on Behalf of Filing Persons)

With a copy to:

Martin T. Schrier

Ellen Canan Grady

Cozen O’Connor

Southeast Financial Center

200 South Biscayne Blvd., Suite 4410

Miami, Florida 33131

(305) 704-5940

CALCULATION OF FILING FEE

|

Transaction Valuation*

|

|

Amount of Filing

Fee**

|

|

$7,097,673

|

|

$822.62

|

* Estimated solely for purposes of calculating the amount of

the filing fee, based on Vapor Corp. (the “

Company

”)’s purchase of up to 32,262,152 of the Company’s

outstanding Series A Warrants at the tender offer price of $0.22 in cash per Series A Warrant.

** The amount of the filing fee, calculated in accordance with

Rule 0-11 under the Exchange Act, equals $115.90 per $1,000,000 of the transaction value.

x

Check

the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee

was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its

filing.

Amount Previously Paid:

$11,151.84

Form of Registration No.:

333-208481

Filing Party:

Vapor Corp.

Date Filed:

December 11, 2015

|

|

¨

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

|

Check the appropriate boxes below to designate

any transactions to which the statement relates:

|

|

¨

|

third-party tender offer subject to Rule 14d-1.

|

|

|

x

|

issuer tender offer subject to Rule 13e-4.

|

|

|

¨

|

going-private transaction subject to Rule 13e-3.

|

|

|

¨

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final amendment reporting

the results of the tender offer:

¨

SCHEDULE TO

This Tender Offer Statement on Schedule

TO (this “

Schedule TO

”) is filed by Vapor Corp., a Delaware corporation (“

Vapor

”

or the “

Company

”). This Schedule TO relates to the offer by the Company to all holders of the Company’s

outstanding Series A Warrants (the “

Series A Warrants

”). The Company is offering to purchase up to 32,262,152

in the aggregate Series A Warrants for $0.22 in cash per Series A Warrant. Each Series A Warrant can be exercised for common stock

on a fixed price basis, or on a cashless basis for a variable number of shares, with the ratio depending in part on the market

value of our common stock. For each outstanding Series A Warrant properly tendered by the holder, we will pay a purchase price

of $0.22 per Series A Warrant net to the holder in cash, without interest less any applicable withholding tax. The offer is subject

to the terms and conditions set forth in the Offer to Purchase, dated December 7, 2016 (the “

Offer to Purchase

”),

a copy of which is filed herewith as Exhibit (a)(1)(A), and in the related Letter of Transmittal (the “

Letter of Transmittal

”),

a copy of which is filed herewith as Exhibit (a)(1)(B) (the Offer to Purchase and the Letter of Transmittal, together with any

amendments or supplements thereto, collectively constitute the “

Offer

”).

This Schedule TO is intended to satisfy

the reporting requirements of Rule 13e-4 under the Securities Exchange Act of 1934, as amended. The information in the Offer Letter

and the related Letter of Transmittal is incorporated by reference as set forth below. All references in this Schedule TO to the

number of Series A Warrants and number of shares of the Company’s common stock are on a pre-split basis without giving effect

to the 1:70 reverse stock split effected on March 8, 2016 and the 1:20,000 reverse stock split effected on June 1, 2016.

Item 1. Summary Term Sheet.

The information set forth in the section

of the Offer to Purchase titled “Summary Term Sheet” is incorporated herein by reference.

Item 2. Subject Company

Information.

(a) Name and Address

. The

name of the subject company, the issuer and the filing person is Vapor Corp., a Delaware corporation. The address of the Company’s

principal executive offices is 3800 North 28

th

Way, Hollywood, Florida 33020. The Company’s telephone number is

(888) 766-5351.

(b) Securities

. The subject

class of securities consists of Vapor’s outstanding Series A Warrants. As of December 5, 2016, the Company had 58,986,283

Series A Warrants outstanding. Each Series A Warrant can be exercised for one share of common stock on a fixed price basis, or

on a cashless basis for a variable number of shares, with the ratio depending in part on the market value of our common stock.

(c) Trading Market and Price

.

The information set forth in the Offer to Purchase under Section 12 “Trading Market and Trading Information of Series A Warrants

and Our Common Stock” is incorporated herein by reference.

Item 3. Identity and Background

of Filing Person.

(a) Name and Address

. The

Company is the subject company and the filing person. The business address and telephone number of the Company are set forth under

Item 2(a) above.

The names of the executive officers and

directors of the Company who are persons specified in Instruction C to Schedule TO are set forth below. The business address for

each such person is c/o Vapor Corp., 3800 North 28

th

Way, Hollywood, Florida 33020 and the telephone number for each

such person is (888) 766-5351.

|

Name

|

|

Position

|

|

Jeffrey Holman

|

|

Chief Executive Officer and Chairman of the Board

|

|

Gina Hicks

|

|

Chief Financial Officer

|

|

Christopher Santi

|

|

President and Chief Operating Officer

|

|

Clifford J. Friedman

|

|

Director

|

|

Anthony Panierello, M.D.

|

|

Director

|

Item 4. Terms of the Transaction.

(a) Material Terms

. The information

set forth in Sections 1 through 17 of the Offer to Purchase is incorporated herein by reference. There will be no material differences

in the rights of security holders as a result of this transaction.

(b) Purchases

. None of our

officers or directors or their respective affiliates beneficially owns any of the Series A Warrants and, therefore, will not participate

in the Offer. The information set forth in Section 8 of the Offer to Purchase under “Interests of Certain Persons in the

Offer; Background of the Offer” is incorporated herein by reference.

Item 5. Past Contracts,

Transactions, Negotiations and Arrangements.

(e) Agreements Involving the Subject

Company’s Securities

. The information set forth in the Offer to Purchase under Section 15 “Transactions and

Arrangements Relating to the Company’s Securities” is incorporated herein by reference.

Item 6. Purposes of the

Transaction and Plans or Proposals.

(a) Purposes

. The information

set forth in the Offer to Purchase under Section 3 “Purpose of the Offer; Certain Effects of the Offer” is incorporated

herein by reference.

(b) Use of Securities Acquired

.

The securities will be canceled.

(c) Plans

. The Company does

not have any plans or proposal in connection with the Offer that relate to or would result in any of the conditions or transactions

described in Regulation M-A, Items 1006(c)(1)-(8) and (10). In the Offer, the Company is offering to purchase up to an aggregate

of 32,262,152 Series A Warrants. The information set forth in the Offer to Purchase under Section 3 “Purpose of the Offer;

Certain Effects of the Offer” is incorporated herein by reference.

Item 7. Source and Amount

of Funds or Other Consideration.

(a) Sources of Funds

. The

information set forth in the Offer to Purchase under Section 13 “Source and Amount of Funds” is incorporated herein

by reference.

(b) Conditions

. Not applicable.

(c) Borrowed funds

. Not applicable.

Item 8. Interest in Securities

of the Subject Company.

(a) Securities ownership

.

The information set forth in the Offer to Purchase under Section 8 “Interests of Certain Persons in the Offer; Background

of the Offer” is incorporated herein by reference.

(b) Securities transactions

.

The information set forth in the Offer to Purchase under Section 8 “Interests of Certain Persons in the Offer; Background

of the Offer” is incorporated herein by reference. To the Company’s knowledge after reasonable inquiry, none of its

officers or directors engaged in any transactions in the Series A Warrants required to be disclosed in this Item 8(b).

Item 9. Person/Assets, Retained,

Employed, Compensated or Used.

(a) Solicitations or Recommendations

.

The Company has retained Equity Stock Transfer, LLC (the “

Depositary

”) to act as the depositary and Okapi

Partners (the “

Information Agent

”) to act as the information agent for the Offer. The Company may contact

holders of Series A Warrants over the Internet, by mail, telephone, fax, email or other electronic means, and may request brokers,

dealers, commercial banks, trust companies and other nominee holders to forward materials relating to the Offer to beneficial owners.

Each of the Depositary and the Information Agent will receive reasonable and customary compensation for its services in connection

with the Offer, plus reimbursement for out-of-pocket expenses, and will be indemnified by the Company against certain liabilities

and expenses in connection therewith.

Item 10. Financial Statements.

Not applicable.

Item 11. Additional Information.

(a) Agreements, Regulatory Requirements

and Legal Proceedings

. To the Company’s knowledge after reasonable inquiry, there are no material agreements, arrangements,

understandings or relationships between the Company and any of its executive officers or directors. To the Company’s knowledge

after reasonable inquiry, there are no regulatory requirements that much be complied with or approvals which must be obtained in

connection with the Offer. To the Company’s knowledge after reasonable inquiry, there are no material pending legal proceedings

relating to the Offer.

(b) Other Material Information

.

The information set forth in the Offer to Purchase and the related Letter of Transmittal, copies of which are filed as Exhibits

(a)(l)(A) and (a)(l)(B) hereto, respectively, is incorporated herein by reference.

Item 12. Exhibits.

Exhibit

Number

|

|

Description

|

|

(a)(1)(A)

|

|

Offer to Purchase dated December 7, 2016.

|

|

(a)(1)(B)

|

|

Letter of Transmittal.

|

|

(a)(1)(C)

|

|

Form of letter to brokers, dealers, commercial banks, trust companies and other nominees to their clients.

|

|

(a)(1)(D)

|

|

Form of letter to be used by brokers, dealers, commercial banks, trust companies and other nominees for their clients.

|

|

(a)(5)(A)

|

|

Press Release dated December 6, 2016 filed on December 6, 2016 as Exhibit 99.1 to our Current Report on Form 8-K and incorporated herein by reference.

|

|

(a)(5)(B)

|

|

Press Release dated December 7, 2016 filed on December 7, 2016 as Exhibit 99.1 to our Current Report on Form 8-K and incorporated herein by reference.

|

|

(b)

|

|

Not applicable.

|

|

(d)(1)

|

|

Form of Series A Warrant filed on July 10, 2015 as an exhibit to our Registration Statement on Form S-1/A (File No. 333- 204599) and incorporated herein by reference.

|

|

(d)(2)

|

|

Specimen certificate evidencing shares of Common Stock filed on December 31, 2013 as an exhibit to our Current Report on Form 8-K dated December 31, 2013 and incorporated herein by reference.

|

|

(d)(3)

|

|

Depositary Agreement by and between Vapor Corp. and Equity Stock Transfer, LLC

|

|

(g)

|

|

Not applicable.

|

|

(h)

|

|

Not applicable.

|

Item 13. Information Required

by Schedule 13e-3.

Not applicable.

SIGNATURE

After due inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

VAPOR CORP.

|

|

|

|

|

|

|

By:

|

/s/ Jeffrey E. Holman

|

|

|

|

Jeffrey E. Holman

|

|

|

|

Chief Executive Officer

|

|

|

|

|

|

Date: December 7, 2016

|

INDEX TO EXHIBITS

Exhibit

Number

|

|

Description

|

|

(a)(1)(A)

|

|

Offer to Purchase dated December 7, 2016.

|

|

(a)(1)(B)

|

|

Letter of Transmittal.

|

|

(a)(1)(C)

|

|

Form of letter to brokers, dealers, commercial banks, trust companies and other nominees to their clients.

|

|

(a)(1)(D)

|

|

Form of letter to be used by brokers, dealers, commercial banks, trust companies and other nominees for their clients.

|

|

(a)(5)(A)

|

|

Press Release dated December 6, 2016 filed on December 6, 2016 as Exhibit 99.1 to our Current Report on Form 8-K and incorporated herein by reference.

|

|

(a)(5)(B)

|

|

Press Release dated December 7, 2016 filed on December 7, 2016 as Exhibit 99.1 to our Current Report on Form 8-K and incorporated herein by reference.

|

|

(b)

|

|

Not applicable.

|

|

(d)(1)

|

|

Form of Series A Warrant filed on July 10, 2015 as an exhibit to our Registration Statement on Form S-1/A (File No. 333- 204599) and incorporated herein by reference.

|

|

(d)(2)

|

|

Specimen certificate evidencing shares of Common Stock filed on December 31, 2013 as an exhibit to our Current Report on Form 8-K dated December 31, 2013 and incorporated herein by reference.

|

|

(d)(3)

|

|

Depositary Agreement by and between Vapor Corp. and Equity Stock Transfer, LLC

|

|

(g)

|

|

Not applicable

|

|

(h)

|

|

Not applicable.

|

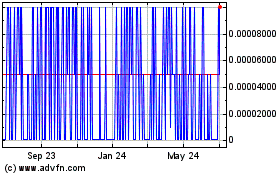

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Mar 2024 to Apr 2024

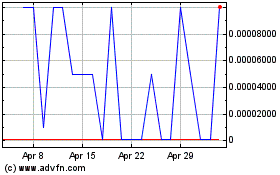

Healthier Choices Manage... (PK) (USOTC:HCMC)

Historical Stock Chart

From Apr 2023 to Apr 2024