Current Report Filing (8-k)

December 06 2016 - 5:13PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 6, 2016

CRAWFORD & COMPANY

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Georgia

|

|

1-10356

|

|

58-0506554

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

1001 Summit Blvd.,

ATLANTA, GEORGIA 30319

(Address of principal executive office) (zip code)

Registrant’s telephone number, including area code: (404) 300-1000

N/A

(Former name or

former address, if changed since last report)

Check the

appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On December 6, 2016 (the

“

Effective Date

”), Crawford Innovative Ventures, LLC, (the “

Purchaser

”), a wholly-owned subsidiary of Crawford & Company (the “

Company

”), entered into a Membership Interest Purchase

Agreement (the “

Purchase Agreement

”) to acquire 85% of the outstanding membership interests of WeGoLook, LLC, an Oklahoma limited liability company (the “

Target

”), for an aggregate purchase price (the

“

Purchase Price

”) of $36,125,000 (the “

Transaction

”). The Target provides a variety of on-demand inspection, verification and other field services for businesses and consumers through a mobile platform of

independent contractors. Subject to certain conditions, the Transaction is expected to close in early January 2017 (the “

Closing Date

”).

The Purchase Price is subject to a potential post-closing adjustment (the “

Purchase Price Adjustment

”) based on the value of

the Target’s net working capital on the Closing Date and less any debt on the Closing Date.

The Purchase Agreement contains

representations, warranties, covenants and indemnification provisions customary for transactions of this nature.

The Purchase Agreement

also provides that: (a) $250,000 of the Purchase Price will be held in escrow to secure the Purchase Price Adjustment; (b) $800,000 of the Purchase Price will be held in escrow for a period of fifteen months after the Closing Date to

secure any valid indemnification claims that the Purchaser may assert for specified breaches of representations, warranties or covenants under the Purchase Agreement; and (c) $1,000,000 of the Purchase Price will be held in escrow for a period

of twenty four months after the Closing Date to secure any valid indemnification claims that the Purchaser may assert for specified breaches of representations, warranties or covenants under the Purchase Agreement. The Purchaser will obtain a

representation and warranty insurance policy at closing, which will provide coverage for certain breaches of the representations and warranties contained in the Purchase Agreement.

Target’s founder and current Chief Executive Officer Robin Smith and current Chief Operating Officer Kenneth Knoll (the

“

Principals

”) will continue in their roles and will remain as owners of the Target, holding an aggregate of 15% of the membership interests in Target (the “

Principals’ Interest

”). In connection with the

Transaction, the Target’s operating agreement will be amended and restated, in part to give the Purchaser the option, beginning on January 1, 2022 and expiring on December 31, 2023, to acquire the Principals’ Interest (the

“

Option

”). In the event the Purchaser does not exercise the Option, beginning on January 1, 2024, the Principals shall have the right to require the Purchaser to acquire the Principals’ Interest on or before

December 31, 2024 (the “

Put

”). In addition, at the time of the exercise of the Option or the Put, the Principals may be entitled to additional consideration depending on whether certain annual revenue and EBITDA targets are

achieved between closing and December 31, 2021.

The press release issued by the Company on December 6, 2016 announcing the

Transaction is attached as Exhibit 99.1 hereto and is incorporated herein by reference.

|

Item 7.01

|

Regulation FD Disclosure.

|

Crawford expects to present information about the Transaction

to certain investors, potential investors, and other interested parties. Attached as Exhibit 99.2 is a copy of the Investor Update that will be discussed during such presentations. These materials may also be used by the Company at one or more

subsequent conferences with investors, potential investors or other interested parties after the date hereof.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

|

|

|

|

Exhibit

Number

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release dated December 6, 2016, titled “Crawford & Company Acquires Majority Interest in WeGoLook, LLC”.

|

|

|

|

|

99.2

|

|

Investor Update regarding Acquisition of WeGoLook, LLC.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Crawford & Company has duly caused this report to be signed on

its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Crawford & Company

|

|

|

|

|

|

Date: December 6, 2016

|

|

By:

|

|

/s/ R. Eric Powers, III

|

|

|

|

|

|

R. Eric Powers, III

|

|

|

|

|

|

Corporate Secretary

|

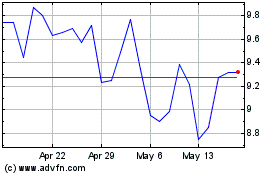

Crawford (NYSE:CRD.B)

Historical Stock Chart

From Mar 2024 to Apr 2024

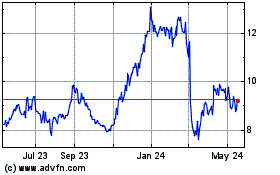

Crawford (NYSE:CRD.B)

Historical Stock Chart

From Apr 2023 to Apr 2024