Current Report Filing (8-k)

December 06 2016 - 5:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

December 1, 2016

(Date of earliest event report)

WEYERHAEUSER COMPANY

(Exact name of registrant as specified in charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Washington

|

|

1-4825

|

|

91-0470860

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

220 Occidental Avenue South

Seattle, Washington 98104-7800

(Address of principal executive offices)

(zip code)

Registrant’s telephone number, including area code:

(206) 539-3000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

o

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

o

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

o

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

o

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Exhibit 99.1

|

|

|

Exhibit 99.2

|

Section 2 - Financial Information

Item 2.01. Completion of Acquisition or Disposition of Assets.

On December 1, 2016, Weyerhaeuser Company (“Weyerhaeuser” or the “Company”) completed a previously announced sale of its cellulose fibers pulp business (“Pulp Business”) to International Paper Company for $2.2 billion in cash consideration, subject to certain post-closing adjustments including (1) for changes in the working capital of the Pulp Business from a targeted amount, (2) for certain third-party indebtedness of the Pulp Business and (3) for certain specified capital expenditures undertaken prior to closing of the transaction with respect to the Pulp Business. The Pulp Business consists of five pulp mills located in Columbus, Mississippi; Flint River, Georgia; New Bern, North Carolina; Port Wentworth, Georgia; and Grande Prairie, Alberta, and two modified fiber mills located in Columbus, Mississippi and Gdansk, Poland. The sale of the Pulp Business is the third of three dispositions resulting from the Company’s strategic review of its cellulose fibers business segment. Weyerhaeuser completed the sale of its newsprint and printing papers business to One Rock Capital Partners, LLC on November 1, 2016, and it completed the sale of its liquid packaging board business to Nippon Paper Industries Co., Ltd. on August 31, 2016. The press release announcing the sale of the Pulp Business is attached as Exhibit 99.1 to this Current Report on Form 8-K.

These descriptions of the sale do not purport to be complete and are qualified in their entirety by reference to the Purchase Agreement between Weyerhaeuser NR Company, a wholly owned subsidiary of the Company, and International Paper Company dated as of May 1, 2016 (as amended on August 12, 2016, the “Purchase Agreement”). The Purchase Agreement was filed as Exhibit 2.2 to the Company's Form 10-Q filed on August 5, 2016, the contents of which are incorporated herein by reference.

Forward Looking Statements

Statements in this current report on Form 8-K and in any exhibits furnished or filed herewith, other than historical facts, constitute forward-looking statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. All forward-looking statements speak only as of the date hereof, are based on current expectations and involve a number of assumptions, risks and uncertainties that could cause the actual results to differ materially from such forward-looking statements. Weyerhaeuser will not update these forward-looking statements after the date of this communication.

Section 9 - Financial Statements and Exhibits

Item 9.01. Financial Statements and Exhibits

(b) Pro Forma Financial Information

The following unaudited pro forma condensed consolidated financial information of Weyerhaeuser Company prepared in accordance with Article 11 of Regulation S-X is filed as Exhibit 99.2 hereto and is incorporated herein by reference:

|

|

|

|

•

|

The unaudited pro forma condensed consolidated statements of income of Weyerhaeuser Company for the nine months ended September 30, 2016, the year ended December 31, 2015, the year ended December 31, 2014, and the year ended December 31, 2013;

|

|

|

|

|

•

|

The unaudited pro forma condensed consolidated balance sheet of Weyerhaeuser Company as of September 30, 2016; and

|

|

|

|

|

•

|

Notes to the unaudited pro forma condensed consolidated financial information.

|

(d) Exhibits

|

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press release of Weyerhaeuser Company dated December 1, 2016.

|

|

|

|

|

99.2

|

|

Unaudited pro forma condensed consolidated financial information of Weyerhaeuser Company (Incorporated by reference to Exhibit 99.2 to the Current Report on Form 8-K, File No. 1-4825, filed on November 7, 2016).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

WEYERHAEUSER COMPANY

|

|

|

|

|

|

|

By

|

|

/s/ Jeanne M. Hillman

|

|

|

Its:

|

|

Vice President and Chief Accounting Officer

|

Date: December 6, 2016

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press release of Weyerhaeuser Company dated December 1, 2016.

|

|

|

|

|

99.2

|

|

Unaudited pro forma condensed consolidated financial information of Weyerhaeuser Company (Incorporated by reference to Exhibit 99.2 to the Current Report on Form 8-K, File No. 1-4825, filed on November 7, 2016).

|

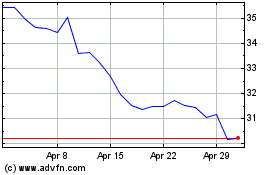

Weyerhaeuser (NYSE:WY)

Historical Stock Chart

From Mar 2024 to Apr 2024

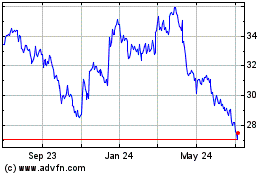

Weyerhaeuser (NYSE:WY)

Historical Stock Chart

From Apr 2023 to Apr 2024