Current Report Filing (8-k)

December 06 2016 - 4:33PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): December 1, 2016

MagnaChip Semiconductor Corporation

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-34791

|

|

83-0406195

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

c/o MagnaChip Semiconductor S.A.

1, Allée Scheffer, L-2520

Luxembourg, Grand Duchy of Luxembourg

|

|

Not Applicable

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (352) 45-62-62

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

On December 1, 2016, following a hearing on November 21, 2016 and an order dated November

21, 2016, the United States District Court for the Northern District of California (the “Court”) entered a supplemental order and final judgment (the “Judgment”) granting final approval of the Stipulation and Agreement of

Settlement, dated February 5, 2016, providing for the settlement of the consolidated securities class action lawsuit,

Thomas, et al. v. MagnaChip Semiconductor Corp. et al.

, Civil Action No. 3:14-CV-01160-JST (the “Class Action

Litigation”). The settlement releases all claims asserted against all defendants in the Class Action Litigation except for Avenue Capital Management II, L.P. and is more fully described in the Company’s Current Report on Form 8-K

filed with the Securities and Exchange Commission on December 11, 2015.

The Judgment is subject to appeal. In the event that no appeal is filed, the

settlement will become effective at the expiration of the appeal period, which is 30 days from December 1, 2016, the date the Judgment was entered by the Court.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

MAGNACHIP SEMICONDUCTOR CORPORATION

|

|

|

|

|

|

|

Dated: December 6, 2016

|

|

|

|

By:

|

|

/s/ Theodore Kim

|

|

|

|

|

|

|

|

Theodore Kim

|

|

|

|

|

|

|

|

Chief Compliance Officer, Executive Vice President, General Counsel and Secretary

|

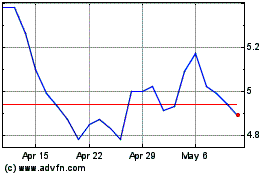

Magnachip Semiconductor (NYSE:MX)

Historical Stock Chart

From Mar 2024 to Apr 2024

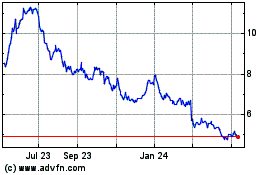

Magnachip Semiconductor (NYSE:MX)

Historical Stock Chart

From Apr 2023 to Apr 2024