UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

INFORMATION

REQUIRED IN A PROXY STATEMENT

Proxy

Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed

by the Registrant [X]

Filed

by a Party other than the Registrant [ ]

Check

the appropriate box:

[ ]

Preliminary Proxy Statement

[ ]

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

[X] Definitive Proxy Statement

[ ] Definitive Additional Materials

[ ] Soliciting Material Pursuant to Rule 14a-11(c) or Rule 14a-12

REGI

U.S., INC.

(Name of Registrant as Specified in Its Charter)

Not

Applicable

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

[X]

No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1)

Title of each class of securities to which transaction applies: N/A

(2)

Aggregate number of securities to which transaction applies: N/A

(3)

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which

the filing fee is calculated and state how it was determined): N/A

(4)

Proposed maximum aggregate value of transaction: N/A

(5)

Total fee paid: N/A

[ ]

Fee paid previously with preliminary materials.

[ ]

Check box if any part of the fee if offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting

fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of

its filing.

(1)

Amount Previously Paid: N/A

(2)

Form, Schedule or Registration Statement No.: N/A

(3)

Filing Party: N/A

(4)

Date Filed: N/A

REGI

U.S., INC.

Suite 10 - 7520 N. Market St., Spokane , WA. 99217

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON JANUARY 6, 2017, at 10:00 AM (Pacific Daylight Time)

NOTICE

IS HEREBY GIVEN

that REGI U.S., Inc., a Oregon corporation, will hold a Special meeting of stockholders on January 6, 2017,

at 10:00 AM (PDT/local time) at our corporate office, Suite 10 - 7520 N. Market St. Spokane, WA, 99217 (the “

Meeting

").

The Meeting is being held for the following purposes:

|

1.

|

to

approve an amendment to our Articles of Incorporation to increase the authorized number of shares of our common stock from

100,000,000 shares of common stock, with no par value, to 150,000,000 shares of common stock, with no par value (the “

Amendment

”);

|

|

|

|

|

2.

|

to

elect Paul W. Chute, Paul Porter, Jina Liu, Shaojun Zhang, and Susanne Robertson as Directors to serve our company for the

ensuing year and until their successors are elected; and

|

|

|

|

|

3.

|

to

transact such other business as may properly come before the Meeting or any adjournment or postponement thereof.

|

Our

board of directors recommends that you vote “for” each of the nominees and vote “for” each proposal.

Our

board has fixed the close of business on November 4, 2016 as the record date for determining the stockholders entitled to notice

of, and to vote at, the Meeting or any adjournment or postponement of the Meeting. At the Meeting, each holder of record of shares

of common stock, with no par value, will be entitled to one vote per share of common stock held on each matter properly brought

before the Meeting.

THE

VOTE OF EACH STOCKHOLDER IS IMPORTANT. YOU CAN VOTE YOUR SHARES BY ATTENDING THE MEETING OR BY COMPLETING AND RETURNING THE PROXY

CARD SENT TO YOU. PLEASE SUBMIT A PROXY AS SOON AS POSSIBLE SO THAT YOUR SHARES CAN BE VOTED AT THE MEETING IN ACCORDANCE WITH

YOUR INSTRUCTIONS. FOR SPECIFIC INSTRUCTIONS ON VOTING, PLEASE REFER TO THE INSTRUCTIONS ON THE PROXY CARD OR THE INFORMATION

FORWARDED BY YOUR BROKER, BANK OR OTHER HOLDER OF RECORD. EVEN IF YOU HAVE VOTED YOUR PROXY, YOU MAY STILL VOTE IN PERSON IF YOU

ATTEND THE MEETING. PLEASE NOTE, HOWEVER, THAT IF YOUR SHARES ARE HELD OF RECORD BY A BROKER, BANK OR OTHER NOMINEE AND YOU WISH

TO VOTE IN PERSON AT THE MEETING, YOU MUST OBTAIN FROM SUCH BROKER, BANK OR OTHER NOMINEE, A PROXY ISSUED IN YOUR NAME.

Dated:

December 6, 2016

By

Order of the Board of Directors,

|

/s/

Paul W. Chute

|

|

|

Paul

W. Chute

|

|

|

President

and Director

|

|

IMPORTANT:

Please complete, date, sign and promptly return the enclosed proxy card in the prepaid envelope (if mailing within the United

States) to ensure that your shares will be represented. If you attend the meeting, you may choose to vote in person even if you

have previously sent in your proxy card.

Important

Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be held on January 6, 2017 the proxy statement

is available at pchute@radmaxtech.com.

REGI

U.S., INC.

Suite 10 - 7520 N. Market St. Spokane, WA, 99217

Proxy

Statement for the Special Meeting of Stockholders

The

enclosed proxy is solicited on behalf of our Board of Directors (the “

Board

”) for use at the Special Meeting

of Stockholders (the “

Meeting

”) to be held on January 6, 2017 at 10:00 AM (PDT/local time) at our corporate

office, 7520 N. Market St., Spokane, WA, 99217, or at any continuation, postponement or adjournment thereof, for the purposes

discussed in this proxy statement and in the accompanying Notice of Special Meeting and any business properly brought before the

Meeting. Proxies are solicited to give all stockholders of record an opportunity to vote on matters properly presented at the

Meeting. We intend to mail the proxy statement and accompanying proxy card on or about December 6, 2016 to all stockholders entitled

to vote at the Meeting who have not consented to electronic delivery of materials. Stockholders entitled to vote at the Meeting

who have consented to electronic delivery will instead receive materials electronically.

Unless

the context requires otherwise, references to “we”, “us” “our” and “our company”

refer to REGI U.S., Inc.

Who

Can Vote

You

are entitled to vote if you were a holder of record of shares of our common stock, with no par value per share (the “

Common

Stock

”) as of the close of business on November 4, 2016 (the “

Record Date

”). Your shares can be voted

at the Meeting only if you are present in person or represented by a valid proxy.

Shares

Outstanding and Quorum

Holders

of record of Common Stock at the close of business on the Record Date will be entitled to receive notice of and vote at the Meeting.

At the Meeting, each of the shares of Common Stock represented will be entitled to one (1) vote on each matter properly brought

before the Meeting. As of November 4, 2016, the record date, there were 32,779,298 shares of Common Stock issued and outstanding.

In

order to carry on the business of the Meeting, we must have a quorum. Under our bylaws, a quorum is a majority of issued and outstanding

entitled to vote, represented in person or by proxy.

Proxy

Card and Revocation of Proxy

In

voting, please specify your choices by marking the appropriate spaces on the enclosed proxy card, signing and dating the proxy

card and returning it in the accompanying envelope. If no directions are given and the signed proxy is returned, the proxy holders

will vote the shares in favor of Proposals 1 through 2 and, at their discretion, on any other matters that may properly come before

the Meeting. The Board knows of no other business that will be presented for consideration at the Meeting.

Any

stockholder giving a proxy has the power to revoke the proxy at any time before the proxy is voted. In addition to revocation

in any other manner permitted by law, a proxy may be revoked by an instrument in writing executed by the stockholder or by his

attorney authorized in writing, or, if the stockholder is a corporation, under its corporate seal or by an officer or attorney

thereof duly authorized, and deposited at the offices of our transfer agent, Nevada Agency and Transfer Company, 50 West Liberty

Street, Suite 880 Reno, Nevada, at any time up to and including the last business day preceding the day of the Meeting, or any

adjournment thereof, or with the chairman of the Meeting on the day of the Meeting. Attendance at the Meeting will not in and

of itself constitute revocation of a proxy.

Voting

of Shares

Stockholders

of record on November 4th, 2016 are entitled to one (1) vote for each share of Common Stock held on all matters to be voted upon

at the Meeting. You may vote in person or by completing and mailing the enclosed proxy card. All shares entitled to vote and represented

by properly executed proxies received before the polls are closed at the Meeting, and not revoked or superseded, will be voted

at the Meeting in accordance with the instructions indicated on those proxies.

ADVICE

TO BENEFICIAL HOLDERS OF SHARES OF COMMON STOCK

THE

INFORMATION SET FORTH IN THIS SECTION IS OF SIGNIFICANT IMPORTANCE TO MANY STOCKHOLDERS OF OUR COMPANY, AS A SUBSTANTIAL NUMBER

OF STOCKHOLDERS DO NOT HOLD SHARES IN THEIR OWN NAME.

Stockholders

who do not hold their shares in their own name (referred to in this Proxy Statement as “

beneficial stockholders

”)

should note that only proxies deposited by stockholders whose names appear on the records of our company as the registered holders

of shares of common stock can be recognized and acted upon at our special meeting. If shares of common stock are listed in an

account statement provided to a stockholder by a broker, then in almost all cases those shares of common stock will not be registered

in the stockholder’s name on the records of our company. Such shares of common stock will more likely be registered under

the names of the stockholder’s broker or an agent of that broker. In the United States, the vast majority of such shares

are registered under the name of Cede & Co. as nominee for The Depository Trust Company (which acts as depository for many

U.S. brokerage firms and custodian banks), and in Canada, under the name of CDS & Co. (the registration name for The Canadian

Depository for Securities Limited, which acts as nominee and custodian for many Canadian brokerage firms). Beneficial stockholders

should ensure that instructions respecting the voting of their shares of common stock are communicated to the appropriate person,

as without specific instructions, brokers/nominees are prohibited from voting shares for their clients.

Applicable

regulatory policy requires intermediaries/brokers to seek voting instructions from beneficial stockholders in advance of stockholders’

meetings, unless the beneficial stockholders have waived the right to receive meeting materials. Every intermediary/broker has

its own mailing procedures and provides its own return instructions to clients, which should be carefully followed by beneficial

stockholders in order to ensure that their shares of common stock are voted at our special meeting. The Form of Proxy supplied

to a beneficial stockholder by its broker (or the agent of the broker) is similar to the Form of Proxy provided to registered

stockholders by our company. However, its purpose is limited to instructing the registered stockholder (the broker or agent of

the broker) how to vote on behalf of the beneficial stockholder. The majority of brokers now delegate responsibility for obtaining

instructions from clients to Broadridge Financial Solutions, Inc. (“

Broadridge

”) (formerly, ADP Investor Communication

Services in the United States and Independent Investor Communications Company in Canada). Broadridge typically applies a special

sticker to proxy forms, mails those forms to the beneficial stockholders and the beneficial stockholders return the proxy forms

to Broadridge. Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting

the voting of shares to be represented at our special meeting.

A beneficial stockholder receiving a Broadridge proxy cannot

use that proxy to vote shares of common stock directly at our Special Meeting - the proxy must be returned to Broadridge well

in advance of our Special Meeting in order to have the shares of common stock voted

.

Although

a beneficial stockholder may not be recognized directly at our Special Meeting for the purposes of voting shares of common stock

registered in the name of his broker (or agent of the broker), a beneficial stockholder may attend at our Special Meeting as proxyholder

for the registered stockholder and vote the shares of common stock in that capacity. Beneficial stockholders who wish to attend

at our Special Meeting and indirectly vote their shares of common stock as proxyholder for the registered stockholder should enter

their own names in the blank space on the instrument of proxy provided to them and return the same to their broker (or the broker’s

agent) in accordance with the instructions provided by such broker (or agent), well in advance of our special meeting.

Alternatively,

a beneficial stockholder may request in writing that his or her broker send to the beneficial stockholder a legal proxy which

would enable the beneficial stockholder to attend at our Special Meeting and vote his or her shares of common stock.

There

are two kinds of beneficial owners – those who object to their name being made known to the issuers of securities which

they own (called OBOs for Objecting Beneficial Owners) and those who do not object to the issuers of the securities they own knowing

who they are (called NOBOs for Non-Objecting Beneficial Owners). Pursuant to National Instrument 54-101, issuers can obtain a

list of their NOBOs from intermediaries for distribution of proxy-related materials directly to NOBOs.

YOUR

VOTE IS IMPORTANT

Counting

of Votes

All

votes will be tabulated by the inspector of election appointed for the Meeting, who will separately tabulate affirmative and negative

votes and abstentions. Shares represented by proxies that reflect abstentions as to a particular proposal will be counted as present

and entitled to vote for purposes of determining a quorum. An abstention is counted as a vote against that proposal. Shares represented

by proxies that reflect a broker “non-vote” will be counted as present and entitled to vote for purposes of determining

a quorum. A broker “non-vote” will be treated as not-voted for purposes of determining approval of a proposal and

will not be counted as “for” or “against” that proposal. A broker “non-vote” occurs when a

nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary

authority or does not have instructions from the beneficial owner.

Solicitation

of Proxies

We

will bear the entire cost of solicitation of proxies, including preparation, assembly and mailing of this proxy statement, the

proxy and any additional information furnished to stockholders. Copies of solicitation materials will be furnished to banks, brokerage

houses, depositories, fiduciaries and custodians holding shares of Common Stock in their names that are beneficially owned by

others to forward to these beneficial owners. We may reimburse persons representing beneficial owners for their costs of forwarding

the solicitation material to the beneficial owners of the Common Stock. Original solicitation of proxies by mail may be supplemented

by telephone, facsimile, electronic mail or personal solicitation by our directors, officers or other regular employees. No additional

compensation will be paid to directors, officers or other regular employees for such services. To date, we have not incurred costs

in connection with the solicitation of proxies from our stockholders, however, our estimate for total costs is $8,000.

INTEREST

OF CERTAIN PERSONS IN OR OPPOSITION TO MATTERS TO BE ACTED UPON

Except

as disclosed elsewhere in this Proxy Statement, since April 30, 2016, being the end of our last completed financial year, none

of the following persons has any substantial interest, direct or indirect, by security holdings or otherwise in any matter to

be acted upon:

|

|

1.

|

any

director or officer of our corporation;

|

|

|

|

|

|

|

2.

|

any

proposed nominee for election as a director of our corporation; and

|

|

|

|

|

|

|

3.

|

any

associate or affiliate of any of the foregoing persons.

|

The

shareholdings of our directors and officers are listed below in the section entitled “Principal Stockholders and Security

Ownership of Management”. To our knowledge, no director has advised that he intends to oppose the Amendments to our authorized

capital or to the proposed nominees for election as directors of our corporation, as more particularly described herein.

PRINCIPAL

STOCKHOLDERS AND SECURITY OWNERSHIP OF MANAGEMENT

As

of November 4, 2016, we had a total of 32,779,298 shares of common stock (no par value per share) issued and outstanding.

The

following table sets forth, as of the date of this report, certain information with respect to the beneficial ownership of our

common and preferred stock by each stockholder known by us to be the beneficial owner of more than 5% of our common and preferred

stock and by each of our current directors and executive officers. Each person has sole voting and investment power with respect

to the shares of common stock and preferred stock, except as otherwise indicated. Beneficial ownership consists of a direct interest

in the shares of common and preferred stock, except as otherwise indicated.

Name

and Address of

Beneficial Owner

|

|

Amount

and Nature of Beneficial Ownership

|

|

|

Percentage

of Class

(1)

|

|

|

|

|

|

|

|

|

|

|

John

G. Robertson

(2)(3)

|

|

|

4,093,849

|

|

|

|

12.5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Rand

Energy Group Inc.

(4)

|

|

|

588,567

|

|

|

|

1.8

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Reg

Technologies Inc.

|

|

|

2,744,700

|

|

|

|

8.4

|

%

|

|

|

(1)

|

Based

on 32,779,298 shares of common stock issued and outstanding as of November 4, 2016. Beneficial ownership is determined in

accordance with the rules of the SEC and generally includes voting and investment power with respect to securities. Except

as otherwise indicated, we believe that the beneficial owners of the common stock listed above, based on information furnished

by such owners, have sole investment and voting power with respect to such shares, subject to community property laws where

applicable.

|

|

|

|

|

|

|

(2)

|

This

individual may be deemed to be a “parent or founder” of REGI as that term is defined in the Rules and Regulations

promulgated under the Securities Act of 1933.

|

|

|

|

|

|

|

(3)

|

Includes

634,889 common shares owned by JGR Petroleum, Inc. of which Mr. Robertson was a sole director, 2,747,720 common shares owed

by Access Information Services, of which Mr. Robertson was a sole director, 86,160 common shares owned by SMR Investment Ltd,

of which Mr. Robertson is a sole director. John Robertson passed away on November 13, 2016

|

|

|

|

|

|

|

(4)

|

Rand

Energy Group Inc. is owned 51% by Reg Tech and 49% by Rand Cam-Engine Corp. Under Rule 13d-3 under the Securities Exchange

Act of 1934, both Reg Tech and Rand Cam-Engine Corp. could be considered the beneficial owner of the 588,567 shares registered

in the name of Rand Energy Group Inc.

|

PROPOSAL

NO. 1 - AMENDMENT TO OUR

CORPORATION’S ARTICLES – COMMON STOCK

Our

Articles of Incorporation (the “

Articles

”) currently authorize the issuance of 100,000,000 shares of common

stock, with no par value. On October 19, 2016, our board of directors approved, subject to receiving the approval of at least

two-thirds of voting stockholders of our common stock, an amendment to our Articles to increase our authorized shares of common

stock to 150,000,000 shares, with no par value per share:

Proposal

No. 1 is solely to approve the Amendment to our Articles of Incorporation to increase our authorized common stock to 150,000,000,

with no par value.

The

general purpose and effect of the amendment to our corporation’s Articles is to increase our authorized share capital, which

will enhance our company’s ability to finance the development and operation of our business.

Our

board of directors approved the amendment to our corporation’s Articles to increase our authorized share capital so that

such shares will be available for issuance for general corporate purposes, including financing activities, without the requirement

of further action by our stockholders. Potential uses of the additional authorized shares may include public or private offerings,

conversions of convertible securities, issuance of options pursuant to employee benefit plans, acquisition transactions and other

general corporate purposes. Increasing the authorized number of shares of our common stock will give us greater flexibility and

will allow us to issue such shares in most cases without the expense of delay of seeking stockholder approval. Our company is

at all times investigating additional sources of financing which our board of directors believes will be in our best interests

and in the best interests of our stockholders. Other than the asset purchase agreement dated September 16, 2016 with Reg Technologies

Inc, we do not currently have any agreements for any transaction that would require the issuance of additional shares of common

stock. Our common shares carry no pre-emptive rights to purchase additional shares. The adoption of the amendment to our Articles

of Incorporation will not of itself cause any changes in our capital accounts.

The

amendment to our corporation’s Articles to increase our authorized share capital will not have any immediate effect on the

rights of existing stockholders.

However, our board of directors will have the authority to issue authorized common stock

without requiring future stockholders approval of such issuances, except as may be required by applicable law or exchange regulations.

To the extent that additional authorized common shares are issued in the future, they will decrease the existing stockholders’

percentage equity ownership and, depending upon the price at which they are issued, could be dilutive to the existing stockholders.

The

increase in the authorized number of shares of our common stock and the subsequent issuance of such shares could have the effect

of delaying or preventing a change in control of our company without further action by the stockholders. Shares of authorized

and unissued common stock could be issued (within limits imposed by applicable law) in one or more transactions. Any such issuance

of additional stock could have the effect of diluting the earnings per share and book value per share of outstanding shares of

common stock, and such additional shares could be used to dilute the stock ownership or voting rights of a person seeking to obtain

control of our company.

We

do not have any provisions in our Articles, by laws, or employment or credit agreements to which we are party that have anti-takeover

consequences. We do not currently have any plans to adopt anti-takeover provisions or enter into any arrangements or understandings

that would have anti-takeover consequences. In certain circumstances, our management may issue additional shares to resist a third

party takeover transaction, even if done at an above market premium and favoured by a majority of independent stockholders.

Stockholders

should note that our company does not have any current plans, intentions, agreements or understandings to issue any of our common

stock that will result if Proposal No. 1 is approved.

Dissenters’

Rights of Appraisal

Under

Oregon law, our stockholders are not entitled to appraisal rights with respect to the Amendments and we will not independently

provide our stockholders with any such right.

Voting

Procedure

The

Amendments to our Articles will require the approval of stockholders holding at least a two-thirds majority of voting shares of

our common stock entitled to be voted at the Meeting.

If

Proposal No. 1 is accepted by the stockholders, the Articles of our company will be amended in substantially the same form as

attached Schedule “A”, with changes as may be required by the Oregon Secretary of State.

PROPOSAL

NO. 2 – ELECTION OF DIRECTORS

Our

Board of Directors has nominated the persons named below as candidates for Directors at the Meeting. Unless otherwise directed,

the proxy holders will vote the proxies received by them for the five nominees named below.

Each

Director who is elected will hold office until the next Meeting of Stockholders and until his or her successor is elected and

qualified. Any Director may resign his or her office at any time and may be removed at any time by the majority of vote of the

stockholders given at a special meeting of our stockholders called for that purpose.

Our

company’s management proposes to nominate the persons named in the table below for election by the stockholders as Directors

of the company. Information concerning such persons, as furnished by the individual nominees, is as follows:

Our

Board of Directors recommends that you vote FOR the nominees.

Nominees

Our

nominated Directors and executive officers, their age, positions held, and duration of term, are as follows:

|

Name

|

|

Position

Held with our Company

|

|

Age

|

|

|

Date

First Elected Or Appointed

|

|

Paul

W. Chute

|

|

Director,

President and CEO

|

|

|

67

|

|

|

July,

2016

|

|

Paul

Porter

|

|

Director,

Vice President and Chief Engineer

|

|

|

58

|

|

|

August,

2013

|

|

Jina

Liu

|

|

Director

|

|

|

52

|

|

|

Nominated

|

|

Shaojun

Zhang

|

|

Director

|

|

|

48

|

|

|

Nominated

|

|

Susanne

Robertson

|

|

Director

|

|

|

70

|

|

|

Nominated

|

Business

Experience

The

following is a brief account of the education and business experience of the nominees during at least the past five years, indicating

their principal occupation during the period, and the name and principal business of the organization by which they were employed.

Paul

W. Chute

Mr.

Chute has extensive experience in making development stage companies successful, serving as CFO, CEO and Director of both private

and public companies. Mr. Chute’s strong belief in the potential of the RadMax technology has led him to come out of recent

retirement to move REGI U.S., Inc. forward and focus on refining, testing and marketing the RadMax Technology. Mr. Chute was appointed

a director and the Chief Executive Officer of the company on July 17, 2016. Mr. Chute also serves as the President and CEO and

a director of Reg Technologies Inc. and Minewest Silver and Gold Inc., the president and CEO and the sole director of Rand Energy

Group, Inc. Mr. Chute has his Bachelor of Science degree in accounting and his MBA degree. Mr. Chute expects to devote 95% of

his time to the operations of REGI U.S., Inc. and Reg Technologies Inc.

Paul

Porter

Mr.

Porter was appointed a director in August, 2013. Mr. Porter had served as our Chief Engineer prior to his appointment. Mr. Porter

has extensive experience as an expert mechanical engineer in the manufacturing and designing of seals. Mr. Porter was the founder

and President of JetSeal, Inc., a manufacturing engineering tool and producing design firm. JetSeal, Inc. was sold to Heico Corp.

(HEI) an aerospace company in the late 1990’s when JetSeal, Inc. was under Mr. Porter’s ownership. Prior to this,

he was a manufacturing manager for Parker Seal Group, a Fortune 500 Company.

Jina

Liu

Ms.

Liu was appointed as a director of Reg Technologies, Inc. on March 27, 2014. She is currently the President of Canada-China Federation

of Entrepreneurs. Canada-China Federation of Entrepreneurs is mainly focused on building bridges for cooperation and communication

for both Chinese and Canadian entrepreneurs, contributing to the promotion of Canada-China economic cooperation and development.

Previously, Ms. Liu served as the Executive President of SinoCann Entrepreneurs Association, the Vice President of Canada China

Environmental Technology Development Association, and the Honorary President of Canada & China Association of Educators.

Shaojun

Zhang

Mr.

Zhang was appointed as a director of Reg Technologies on May 1, 2014. Mr. Zhang has been the Chairman of China Zhongling Hangke

New Energy Group Limited (“

Zhongling

”) since February 2012. Zhongling is an organization engaged in research

and development of new energy solutions. Prior thereto, Mr. Zhang was the CEO of the Natural Brand Strategy Network, based in

Beijing, China, from January 2007. From January 2003 to January 2007, Mr. Zhang was the President of Jun Xin Mining Group based

in Guangxi, China.

Susanne

Robertson

Mrs.

Robertson has been a director of Reg Technologies, Inc. since 1984, and has been an invaluable asset in facilitating the cooperation

between Reg Technologies Inc. and REGI U.S. Inc.

Executive

Officers

Our

executive officers are appointed by our Board of Directors and serve at the pleasure of our Board of Directors.

The

names of our executive officers, their ages, positions held, and durations of are as follows:

|

Name

|

|

Position

Held with our Company

|

|

Age

|

|

|

Date

First Elected Or Appointed

|

|

Paul

W. Chute

|

|

Director,

President and CEO

|

|

|

67

|

|

|

July,

2016

|

|

Victoria

Huang

|

|

Chief

Financial Officer

|

|

|

45

|

|

|

July,

2016

|

|

Paul

Porter

|

|

Director,

Vice President and Chief Engineer

|

|

|

58

|

|

|

August,

2013

|

|

Jim

Slinger

|

|

Vice

President of Investor Relations and Communications

|

|

|

72

|

|

|

July,

2016

|

Family

Relationships

There

are no family relationships between any director or executive officer.

Involvement

in Certain Legal Proceedings

We

know of no material proceedings in which any of our Directors, officers, affiliates or any stockholder of more than 5% of any

class of our voting securities, or any associate thereof is a party adverse to our company.

To

the best of our knowledge, none of our directors or executive officers has, during the past ten years:

|

1.

|

been

convicted in a criminal proceeding or been subject to a pending criminal proceeding (excluding traffic violations and other

minor offences);

|

|

|

|

|

2.

|

had

any bankruptcy petition filed by or against the business or property of the person, or of any partnership, corporation or

business association of which he was a general partner or executive officer, either at the time of the bankruptcy filing or

within two years prior to that time;

|

|

|

|

|

3.

|

been

subject to any order, judgment, or decree, not subsequently reversed, suspended or vacated, of any court of competent jurisdiction

or federal or state authority, permanently or temporarily enjoining, barring, suspending or otherwise limiting, his involvement

in any type of business, securities, futures, commodities, investment, banking, savings and loan, or insurance activities,

or to be associated with persons engaged in any such activity;

|

|

|

|

|

4.

|

been

found by a court of competent jurisdiction in a civil action or by the SEC or the Commodity Futures Trading Commission to

have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended, or vacated;

|

|

|

|

|

5.

|

been

the subject of, or a party to, any federal or state judicial or administrative order, judgment, decree, or finding, not subsequently

reversed, suspended or vacated (not including any settlement of a civil proceeding among private litigants), relating to an

alleged violation of any federal or state securities or commodities law or regulation, any law or regulation respecting financial

institutions or insurance companies including, but not limited to, a temporary or permanent injunction, order of disgorgement

or restitution, civil money penalty or temporary or permanent cease-and-desist order, or removal or prohibition order, or

any law or regulation prohibiting mail or wire fraud or fraud in connection with any business entity; or

|

|

|

|

|

6.

|

been

the subject of, or a party to, any sanction or order, not subsequently reversed, suspended or vacated, of any self-regulatory

organization (as defined in Section 3(a)(26) of the Exchange Act (15 U.S.C. 78c(a)(26))), any registered entity (as defined

in Section 1(a)(29) of the Commodity Exchange Act (7 U.S.C. 1(a)(29))), or any equivalent exchange, association, entity or

organization that has disciplinary authority over its members or persons associated with a member.

|

Corporate Governance

Public Availability of Corporate Governance

Documents

Our key corporate governance document is our

Code of Ethics which is:

|

●

|

available in print to any stockholder who requests it from our President; and

|

|

|

|

|

●

|

filed on EDGAR as an exhibit to our Annual Report on Form 10-K filed on August 15, 2011.

|

Code of Ethics

We adopted a Code of Ethics applicable to our

senior financial officers and certain other finance executives, which is a “code of ethics” as defined by applicable

rules of the SEC. Our Code of Ethics is attached as an exhibit to our Annual Report on Form 10-K filed on August 15, 2011. If we

make any amendments to our Code of Ethics other than technical, administrative, or other non-substantive amendments, or grant any

waivers, including implicit waivers, from a provision of our Code of Ethics to our Chief Executive Officer, chief financial officer,

or certain other finance executives, we will disclose the nature of the amendment or waiver, its effective date and to whom it

applies in a Current Report on Form 8-K filed with the SEC.

Meetings

Our Board of Directors held no formal meetings

during the year ended April 30, 2016, 2015, 2014, 2013, 2012, 2011, or 2010. All proceedings of the Board of Directors were conducted

by resolutions consented to in writing by all the Directors and filed with the minutes of the proceedings of the Directors. Such

resolutions consented to in writing by the Directors entitled to vote on that resolution at a meeting of the Directors are, according

to the Nevada Revised Statutes and our Bylaws, as valid and effective as if they had been passed at a meeting of the Directors

duly called and held.

It is our policy to invite Directors to attend

the Meeting of stockholders. Four Directors are expected to attend the Meeting.

Committees of the Board of Directors

We currently do not have a nominating or compensation

committee or committees performing similar functions. There has not been any defined policy or procedure requirements for stockholders

to submit recommendations or nomination for Directors.

Audit Committee and Audit Committee Financial

Expert

The Company currently does not have an audit

committee.

The Company does not have nominating, compensation

committees or committees performing similar functions, nor does our Company have a written nominating, compensation or audit committee

charter. Our Board of Directors believes that due to our small size it is not necessary to have such committees as the functions

of such committees are performed by the Board of Directors.

Director Independence

We currently act with three Directors, consisting

of Paul W. Chute, Paul Porter and Thomas Robertson. John G. Robertson served as a Director until his death on November 13, 2016.

Mr. Robertson’s vacancy has not been filled.

We have determined that Paul Porter is an “independent

director” as defined in Rule 5605(a) of the Nasdaq Listing Rules and that Jina Liu, Shaojun Zhang and Susanne Robertson will

be each an “independent director” as defined in Rule 5605(a) of the Nasdaq Listing Rules if elected as Directors to

our company.

Stockholder Communications with Our Board

of Directors

Because of our company’s small size,

we do not have a formal procedure for stockholder communication with our Board of Directors. In general, members of our Board of

Directors and executive officers are accessible by telephone or mail. Any matter intended for our Board of Directors, or for any

individual member or members of our Board of Directors, should be directed to our President with a request to forward the communication

to the intended recipient.

Section 16(a) Beneficial Ownership Reporting

Compliance

Section 16(a) of the Securities Exchange Act

of 1934 requires our executive officers and Directors, and persons who own more than 10% of our common stock, to file reports regarding

ownership of, and transactions in, our securities with the Securities and Exchange Commission and to provide us with copies of

those filings. Based solely on our review of the copies of such forms received by us, or written representations from certain reporting

persons, we believe that during fiscal year ended April 30, 2016, all filing requirements applicable to our executive officers,

Directors and persons who own more than 10% of our common stock were complied with.

Executive Compensation

Compensation Discussion and Analysis

The company’s executive officers make

recommendations to the board of directors regarding compensation policies and the compensation of senior officers. The company

does not have a Compensation Committee. The compensation of the senior executives comprises two components; namely, a base salary

or consulting fees and the grant of stock options pursuant to the company’s stock option plan which is more particularly

outlined below under the

Option-based Awards

section. These forms of compensation are chosen to attract, retain and motivate

the performance of selected directors, officers, employees or consultants of the company of high caliber and potential. Each senior

executive is employed for his or her skills to perform specific tasks and the base salary and number of options is fixed accordingly.

Summary Compensation Table

Named Executive Officer mean the Chief Executive

Officer (“CEO”), the Chief Financial Officer (“CFO”) or any individual acting in a similar capacity or

function, regardless of the amount of compensation of that individual and each of the company’s two most highly compensated

executive officers, other than the CEO and CFO, or three two highly compensated individuals acting in similar capacities, who were

serving as executive officers, or in a similar capacity, at the end of the most recent financial year and whose compensation exceeds

$100,000, and such individuals who would be an NEO but for the fact that they were not serving as an executive officer or in a

similar capacity at the end of that financial year.

During our company’s last completed financial year ended April

30, 2016, our company had two Named Executive Officers: Mr. John Robertson, President and CEO and Ms. Susanne Robertson, CFO.

The following table (presented in accordance

with Item 402 of Regulation S-K – Executive Compensation) sets forth all annual, long term and other compensation for services

in all capacities to our company and its subsidiaries payable to the NEOs for the three financial years ended April 30, 2016, 2015

and 2014 (to the extent required by the Regulations) in respect of the Named Executive Officers:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-equity incentive plan compensation

|

|

|

|

|

|

|

|

Name and Principal Position

|

|

|

Year Ended

April 30

|

|

|

Salary

($)

|

|

Bonus

($)

|

|

Share-based Awards

($)

|

|

Option- Based Awards

($)(7)

|

|

Annual incentive plans

($)

|

|

Long-term incentive plans

($)

|

|

Pension value

($)

|

|

All other

Compensation

($)(2)

|

|

Total

compensation

($)

|

John G.

Robertson,

CEO(1)(2)(3)

|

|

|

2016

2015

2014

|

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

22,500

30,000

30,000

|

|

22,500

30,000

30,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

James

Vandeberg,

CFO(4)(5)

|

|

|

2016

2015

2014

|

|

|

NA

Nil

Nil

|

|

NA

Nil

Nil

|

|

NA

Nil

Nil

|

|

NA

Nil

Nil

|

|

NA

Nil

Nil

|

|

NA

Nil

Nil

|

|

NA

Nil

Nil

|

|

NA

Nil

Nil

|

|

NA

Nil

Nil

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Susanne

Robertson,

CFO(6)

|

|

|

2016

2015

2014

|

|

|

Nil

NA

NA

|

|

Nil

NA

NA

|

|

Nil

NA

NA

|

|

Nil

NA

NA

|

|

Nil

NA

NA

|

|

Nil

NA

NA

|

|

Nil

NA

NA

|

|

Nil

NA

NA

|

|

Nil

NA

NA

|

|

|

(1)

|

Mr. Robertson was also a director and did not receive compensation in that capacity. See “Director Compensation – Narrative Discussion”. Mr. Robertson resigned as the CEO on July 17, 2016.

|

|

|

|

|

|

|

(2)

|

Access Information Services, Inc., a Washington corporation which is owned and controlled by the Robertson Family Trust, accrued $2,500 per month for management services until January 31, 2016. Mr. Robertson was a trustee of the Robertson Family Trus

t.

The amounts for fiscals 2014, 2015 and 2016 were accrued but not paid.

|

|

|

|

|

|

|

(3)

|

Mr. Robertson’s option-based awards granted during 2013 consisted of 500,000 stock options granted on May 15, 2013 at an exercise price of $0.10 with the vested options fair valued at $0.04 per option, and 500,000 stock options granted on April 11, 2013 at an exercise price of $0.20 and vested options fair valued at $0.05 per option.

|

|

|

|

|

|

|

(4)

|

Mr. Vandeberg resigned as the CFO of the company on November 11, 2014. He was also a director until August 2, 2016 and did not receive compensation in that capacity. See “Director Compensation – Narrative Discussion”.

|

|

|

|

|

|

|

(5)

|

Mr. Vandeberg’s option-based awards granted during 2013 consisted of 200,000 stock options granted on May 15, 2013 at an exercise price of $0.10 with the vested options fair valued at $0.04 per option, and 200,000 stock options granted on April 11, 2013 at an exercise price of $0.20 with the vested options fair valued at $0.05 per option.

|

|

|

|

|

|

|

(6)

|

Mrs. Robertson was appointed as the CFO of the company on November 11, 2014 and resigned on July 17, 2016.

|

|

|

|

|

|

|

(7)

|

The valuation of the fair value of the options at the time of the grant is based on the Black Scholes model and includes the following assumptions; weighted average risk free rate, weighted average expected life, expected volatility and dividend yield.

|

Narrative Discussion

Our company does not have a share-based award

plan other than the stock option plan referred to above. The company also does not have a pension plan or a long term incentive

plan. Other than John Robertson, as described below in the

Narrative Description – Directors

reported in the

Directors’

Compensation

table below, no directors, who were not NEO’s of the company were compensated during the financial year

ended April 30, 2016 for services in their capacity as directors.

A management fee was payable, but accrued to

Access Information Inc., a company controlled by Mr. Robertson. Other than as herein set forth, the company did not pay any compensation

to its directors or Named Executive Officers.

Employment Contracts and Termination

of Employment

For the fiscal year ended April 30, 2016, there

were no employment agreements or other compensating plans or arrangements with regard to any of the Named Executive Officers which

provide for specific compensation in the event of resignation, retirement, other termination of employment or from a change of

control of the Issuer or from a change in a Named Executive Officer’s responsibilities following a change in control.

Pursuant to the company’s stock option

plan, in the event the optionee’s employment by or engagement with (as a director or otherwise) the company is

terminated

by the company

for any reason other than death before exercise of the options granted hereunder, the stock option granted to

the Participant shall expire three months after the optionees’ departure and all rights to purchase shares thereunder shall

cease and expire three months after the optionees’ departure and be of no further force or effect.

In the event the Participant resigns as an

employee, officer or director, the stock option granted to the Participant shall expire three months after the optionees’

departure and all rights to purchase shares thereunder shall cease and expire three months after the optionees’ departure

and be of no further force or effect.

Refer also to the

Compensation Discussion

and Analysis

section above.

Incentive Plan Awards

Narrative Discussion

As reported above under the

Summary Compensation

Table,

the company does not have a share-based award plan or a long term incentive plan. Information with respect to the grant

of stock options is more particularly described above in the

Option-based Awards

and

Compensation Discussion and Analysis

sections.

Outstanding Option-Based Awards and Share-Based

Awards

The grant of option-based awards to the senior

executives is determined by the recommendation of executive officers to the board of directors pursuant to the terms of the stock

option plan referred to below. Previous grants of option-based awards are taken into account when considering new grants.

The options are always granted at or above

market price. The valuation of the fair value of the options at the time of the grant is based on the Black Scholes model and includes

the following assumptions: weighted average risk free rate, weighted average expected life, expected volatility and dividend yield.

The following table sets out the option-based

awards that were outstanding as at April 30, 2016:

|

|

|

|

Option-based Awards

|

|

|

|

Stock-based Awards

|

|

Name

|

|

|

Number of

securities underlying unexercised options

(#)

|

|

|

|

Option exercise price

($)

|

|

|

Option expiration date

|

|

|

Value of unexercised

in-the-money options

($)

|

|

|

|

Number of shares or units of shares that

have not vested

(#)

|

|

|

Market or payout value of share-based awards

that have not vested

($)

|

|

John Robertson

|

|

|

500,000

|

|

|

|

0.10

|

|

|

May 15, 2017

|

|

|

Nil

|

|

|

|

375,000

|

|

|

Nil

|

|

|

|

|

500,000

|

|

|

|

0.20

|

|

|

April 11, 2018

|

|

|

Nil

|

|

|

|

375,000

|

|

|

Nil

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

James Vandeberg

|

|

|

200,000

|

|

|

|

0.10

|

|

|

May 15, 2017

|

|

|

Nil

|

|

|

|

150,000

|

|

|

Nil

|

|

|

|

|

200,000

|

|

|

|

0.20

|

|

|

April 11, 2018

|

|

|

Nil

|

|

|

|

150,000

|

|

|

Nil

|

Incentive Plan Awards – value vested or earned during

the year

Pension Plan Benefits

As reported under the

Summary Compensation

Table

, the company does not maintain a Pension Plan for its employees and therefore no benefits were received.

Termination of Employment or Change of

Control

Other than as described in the

Narrative

Discussion

section under the

Summary Compensation Table

, the company has no plans or arrangements with respect to remuneration

received or that may be received by the Named Executive Officers during the company’s most recently completed financial year

or current financial year in view of compensating such officers in the event of termination of employment (as a result of resignation,

retirement, change of control, etc.) or a change in responsibilities following a change of control, where the value of such compensation

exceeds $100,000 per executive officer.

DIRECTOR COMPENSATION

Director Compensation Table

The following table sets forth all compensation

provided to the directors for the year ended April 30, 2016.

The company does not have a share-based award

plan for the directors other than the stock option plan, details of which are provided below under

Outstanding Option-Based

Awards, Share- Based Awards and Non-equity Incentive Plan Compensation.

The company also does not have a pension plan or a

non-equity incentive plan for its directors.

No directors, who were not NEO’s of the

Company, were compensated during the financial year ended April 30, 2016 for services in their capacity as directors.

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-equity incentive plan compensation ($)

|

|

|

|

|

|

|

|

Name and Principal Position

|

|

|

Year Ended April 30

|

|

|

Salary

($)

|

|

Share- based Awards

($)

|

|

Option- Based Awards

($) (6)

|

|

Annual incentive plans

($)

|

|

Long-term incentive plans

|

|

Pension value

($)

|

|

All other Compensation

($)

|

|

Total compensation

($)

|

John G.

Robertson,

CEO(1)(2)

|

|

|

2016

2015

2014

|

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

James

Vandeberg,

CFO(3)

|

|

|

2016

2015

2014

|

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Paul Porter (4) (5)

|

|

|

2016

2015

2014

|

|

|

Nil

NA

NA

|

|

Nil

NA

NA

|

|

Nil

NA

NA

|

|

Nil

NA

NA

|

|

Nil

NA

NA

|

|

Nil

NA

NA

|

|

Nil

NA

NA

|

|

Nil

NA

NA

|

|

Thomas Robertson

|

|

|

2016

2015

2014

|

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

Nil

Nil

Nil

|

|

|

(1)

|

Mr. Robertson was also an NEO and indirectly received or accrued compensation in that capacity. See “Executive Compensation – Narrative Discussion”.

|

|

|

|

|

|

|

(2)

|

Mr. Robertson did not receive option-based awards in his capacity as a director. John Robertson passed away on November 13, 2016

|

|

|

|

|

|

|

(3)

|

Mr. Vandeberg does not receive any compensation in his capacity as a director, nor any option-based awards in his capacity as a director.

|

|

|

|

|

|

|

(4)

|

Mr. Porter was appointed to the Board of Directors in August, 2013.

|

|

|

|

|

|

|

(5)

|

Mr. Porter provides research and development services for the company and receives consulting fees in that capacity. See related party transactions below.

|

|

|

|

|

|

|

(6)

|

The valuation of the fair value of the options at the time of the grant is based on the Black Scholes model and includes the following assumptions; weighted average risk free rate, weighted average expected life, expected volatility and dividend yield.

|

Narrative Description

Directors of the company who are also NEOs

are not compensated for their services in their capacity as directors, although directors of the company are reimbursed for their

expenses incurred in connection with their services as directors.

Information with respect to grants of options

to the directors is reported below under the

Narrative Description

in the section below entitled

Outstanding Option-Based

Awards, Share-Based Awards and Non-equity Incentive Plan Compensation.

Other than as described above, no directors

of the company were compensated by the company during the financial year ended April 30, 2016 for services as consultants or experts.

Option-Based Awards, Share-Based Awards

and Non-equity Incentive Plan Compensation for Directors

As disclosed under the

Director Compensation

Table,

the company does not have a share-based award plan, a pension plan or a non-equity incentive plan for its directors.

Option-based awards to the directors are granted

pursuant to the terms of the company’s stock option plan. The options are always granted at market price. The valuation of

the fair value of the options at the time of the grant is based on the Black Scholes model and includes the following assumptions;

weighted average risk free rate, weighted average expected life, expected volatility and dividend yield.

Directors generally receive a grant of stock

options upon their appointment.

The following table shows at April 30, 2016

the options held by the directors and former directors who served during the year ended April 30, 2016:

|

|

|

Option-based Awards

|

|

Stock-based Awards

|

|

Name

|

|

Number of securities underlying unexercised

options

(#)

|

|

|

Option exercise price

($)

|

|

|

Option expiration date

|

|

Value of unexercised in-the-money options

($)

|

|

Number of shares or units of shares that

have not vested

(#)

|

|

|

Market or payout value of share-based awards

that have not vested**

($)

|

|

John G. Robertson

|

|

|

500,000

500,000

|

|

|

|

0.10

0.20

|

|

|

May 15, 2017

April 11, 2018

|

|

Nil

Nil

|

|

|

375,000

375,000

|

|

|

Nil

Nil

|

|

James Vandeberg

|

|

|

200,000

200,000

|

|

|

|

0.10

0.20

|

|

|

May 15, 2017

April 11, 2018

|

|

Nil

Nil

|

|

|

150,000

150,000

|

|

|

Nil

Nil

|

|

Paul Porter

|

|

|

55,000

55,000

|

|

|

|

0.10

0.10

|

|

|

May 15, 2017

April 11, 2018

|

|

Nil

Nil

|

|

|

41,250

41,250

|

|

|

Nil

Nil

|

|

Thomas Robertson

|

|

|

50,000

|

|

|

|

0.20

|

|

|

April 11, 2018

|

|

Nil

|

|

|

37,500

|

|

|

Nil

|

“HOUSEHOLDING” OF PROXY MATERIAL

The Securities and Exchange Commission permits

companies and intermediaries (e.g. brokers) to satisfy the delivery requirements for proxy statements with respect to two or more

stockholders sharing the same address by delivering a single proxy statement addressed to those stockholders. This process, commonly

referred to as “householding”, potentially means extra conveniences for stockholders and cost savings for companies.

A number of brokers with accountholders who

are stockholders of our Company will be “householding” our proxy materials. As indicated in the notice previously provided

by these brokers to stockholders, a single proxy statement will be delivered to multiple stockholders sharing an address unless

contrary instructions have been received from an affected stockholder. Once you have received notice from your broker that they

will be “householding” communications to your address, “householding” will continue until you are notified

otherwise or until you revoke your consent. If at any time, you no longer wish to participate in “householding” and

would prefer to receive a separate proxy statement, please notify your broker.

Stockholders who currently receive multiple

copies of the proxy statement at their address and would like to request “householding” of their communications should

contact their broker.

STOCKHOLDER PROPOSALS

Pursuant to Rule 14a-8 under the Exchange Act,

stockholders may present proper proposals for inclusion in our proxy statement and for consideration at our next meeting of stockholders.

To be eligible for inclusion in our 2017 proxy statement, your proposal must be received by us no later than 120 days before March

23, 2017 and must otherwise comply with Rule 14a-8 under the Exchange Act. Further, if you would like to nominate a Director or

bring any other business before the stockholders at the 2017 Meeting, you must comply with the procedures contained in the bylaws

and you must notify us in writing and such notice must be delivered to or received by the Secretary no later than 120 days before

March 23, 2017. While the Board will consider stockholder proposals, we reserve the right to omit from our proxy statement relating

to our 2017 meeting stockholder proposals that it is not required to include under the Exchange Act, including Rule 14a-8 of the

Exchange Act.

All stockholder proposals, notices and requests

should be made in writing and sent via registered, certified or express mail, to our company, at the address on the first page

of this Proxy Statement to the attention of the President.

With respect to business to be brought before

the Meeting, we have received no notices from our stockholders that we were required to include in this proxy statement.

OTHER BUSINESS

The Board knows of no other business that will

be presented for consideration at the Meeting. If other matters are properly brought before the Meeting; however, it is the intention

of the persons named in the accompanying proxy to vote the shares represented thereby on such matters in accordance with their

best judgment.

If there are insufficient votes to approve

any of the proposals contained herein, the Board may adjourn the Meeting to a later date and solicit additional proxies. If a vote

is required to approve such adjournment, the proxies will be voted in favor of such adjournment.

NOTICE REGARDING ANNUAL MEETINGS OF THE SHAREHOLDERS

Our company has not historically held an annual

meeting of the shareholders for the purpose of electing the Board of Directors or other business. We have not convened an annual

meeting of the shareholders because, in the opinion of our management, we have not had adequate resources or administrative support

during our development stage to host a comprehensive meeting. In our decision not to convene an annual meeting we have relied on

the relevant provisions of our constating documents and of Oregon corporate law, which are summarized as follows:

Section 60.201 of Chapter 60 – Private

Corporations:

|

|

(1)

|

Except as provided in subsection (4) of this section, a corporation shall hold an annual meeting of the shareholders at a time stated in or fixed in accordance with the bylaws.

|

|

|

|

|

|

|

(3)

|

A failure to hold an annual meeting at the time stated in or fixed in accordance with a corporations bylaws does not affect the validity of any corporate action.

|

In light of the applicable provisions of our

Company’s bylaws and of Section 60.201 of Chapter 60 – Private Corporations, and absent an order by the Oregon district

court obtained pursuant to Section 60.207 of Section 60.201 of Chapter 60 – Private Corporations, our management believes

that there is no material adverse consequence resulting from our Company’s failure to hold an annual meeting. We do, however,

intend to hold an annual meeting in the future when adequate resources are available to us. The capital alterations proposed to

the shareholders at the forthcoming Meeting are in part intended to lay the groundwork for additional financing and the engagement

of additional independent directors to be confirmed at an annual meeting of the shareholders.

By Order of the Board of Directors,

|

/s/ Paul W. Chute

|

|

|

Paul W. Chute

|

|

|

Director

|

|

Schedule A

REGISTRY NUMBER:

307187-87

|

In accordance with Oregon Revised Statute 192.410-192.490, the information on this application is public record.

|

|

|

We must release this information to all parties upon request and it will be posted on our website.

|

For office use only

|

Please Type or Print Legibly in

Black

Ink. Attach Additional

Sheet if Necessary.

|

1.

|

ENTITY NAME:

|

REGI U.S., INC.

|

|

2.

|

THE FOLLOWING AMENDMENT(S) TO THE ARTICLES OF INCORPORATION IS MADE HEREBY:

State the article number(s) and set forth the article(s) as it is amended to read. (Attach a separate sheet if necessary.)

|

The Capital Stock shall consist of 150,000,000 shares of common

stock, with no par value,

all of which stock shall be entitled to voting power.

|

3.

|

THE AMENDMENT WAS ADOPTED ON:

|

|

|

|

(If more than one amendment was adopted, identify the date of adoption of each amendment.

|

|

4.

|

PLEASE CHECK THE APPROPRIATE STATEMENT:

|

|

|

[X]

|

Shareholder action was required to adopt the amendment(s).

|

The vote was as follows:

|

Class or series of shares

|

|

|

Number of shares outstanding

|

|

|

Number of votes entitled to be cast

|

|

|

Number of votes cast FOR

|

|

|

Number of votes cast AGAINST

|

|

|

Common

|

|

|

|

32,779,298

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[ ]

|

Shareholder action was not required to adopt the amendment(s). The amendment(s) was adopted by the board of directors without shareholder action.

|

|

|

|

|

|

|

[ ]

|

The corporation has not issued any shares of stock. Shareholder action was not required to adopt the amendment(s). The amendment(s) was adopted by the Incorporators or by the board of directors.

|

|

5.

|

EXECUTION

: By my signature, I declare as an authorized signer, that this filing has been examined by me and is, to the best of my knowledge and belief, true, correct, and complete. Making false statements in this document is against the law and may be penalized by fines, imprisonment or both.

|

|

Signature:

|

|

Printed Name:

|

|

Title:

|

|

|

|

|

|

|

|

CONTACT

NAME

: (To resolve questions with this filing)

|

|

FEES

|

|

|

|

Required Processing Fee $100

|

|

PHONE NUMBER

: (Include area code)

|

|

processing Fees are nonrefundable. Please make check payable to “Corporation Division”.

|

|

|

|

Free copies are available at FilingInOregon.com using the Business Name Search program.

|

|

Articles of Amendment - Business/Professional Corporation (05/14)

|

|

|

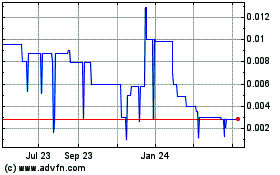

REGI US (PK) (USOTC:RGUS)

Historical Stock Chart

From Mar 2024 to Apr 2024

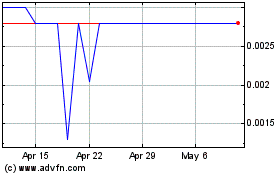

REGI US (PK) (USOTC:RGUS)

Historical Stock Chart

From Apr 2023 to Apr 2024