Current Report Filing (8-k)

December 06 2016 - 6:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 5, 2016 (December 2, 2016)

Trinity Place Holdings Inc.

(Exact name of registrant as specified in

its charter)

Delaware

(State or other jurisdiction of incorporation)

|

001-8546

|

|

22-2465228

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

717 Fifth Avenue

New York, New York 10022

(Address of principal executive offices and zip code)

(212) 235-2190

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

|

|

|

Item 1.01

|

Entry into a Material Definitive Agreement

|

On December 2, 2016, Trinity Place Holdings Inc. (the “Company”)

entered into an At the Market Offering Agreement (the “Agreement”) with Craig-Hallum Capital Group LLC, as sales agent

(“Craig-Hallum”), pursuant to which the Company may offer and sell, from time to time through Craig-Hallum, shares

of its common stock (the “Shares”), having an aggregate offering price of up to $12,000,000. Any Shares offered and

sold in the offering will be issued pursuant to the Company’s effective shelf registration statement on Form S-3 (File No.

333-214482) and the related prospectus previously declared effective by the Securities and Exchange Commission (the “SEC”)

on December 1, 2016, as supplemented by a prospectus supplement, dated December 2, 2016, which the Company filed with the SEC pursuant

to Rule 424(b)(5) under the Securities Act of 1933, as amended (the “Securities Act”).

Under the Agreement, Craig-Hallum may sell Shares by any method

permitted by law and deemed to be an “at-the-market” offering as defined in Rule 415 promulgated under the Securities

Act, including sales made directly on the NYSE MKT or on any other existing trading market for the Shares, sales to or through

a market maker. Craig-Hallum may also sell Shares in privately negotiated transactions with the Company’s prior written approval.

The offering of Shares pursuant to the Agreement will terminate

upon the earlier of (a) the sale of all of the Shares subject to the Agreement or (b) the termination of the Agreement by Craig-Hallum

or the Company, as permitted therein.

The Company will pay Craig-Hallum a commission rate of 2.5%

of the aggregate gross sales prices of the Shares unless Craig-Hallum acts as principal, and has agreed to provide Craig-Hallum

with customary indemnification and contribution rights. The Company will also reimburse Craig-Hallum for certain specified expenses

in connection with entering into the Agreement.

The Company intends to use the net proceeds raised through any

“at-the-market” sales primarily for new investment opportunities, working capital and general corporate purposes.

The foregoing description of the Agreement is not complete and

is qualified in its entirety by reference to the full text of the Agreement, a copy of which is filed herewith as Exhibit 10.1

to this Current Report on Form 8-K and is incorporated herein by reference. The opinion of the Company’s counsel regarding

the validity of the Shares that will be issued pursuant to the Agreement is also filed herewith as Exhibit 5.1.

This Current Report on Form 8-K shall not constitute an offer

to sell or the solicitation of an offer to buy the Shares, nor shall there be any offer, solicitation, or sale of the Shares in

any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such state.

The information included in Item 2.01 of this Current Report

on Form 8-K is incorporated by reference into this Item 1.01.

|

|

Item 2.01

|

Completion of Acquisition or Disposition of Assets

|

As previously reported in its Current Report on Form 8-K filed

on October 14, 2016, the Company indirectly owns a 50% interest in a joint venture formed to acquire and operate 223 North 8

th

Street, Brooklyn, a newly constructed luxury multi-family property with 95 units encompassing approximately 65,000 rentable

square feet (“The Berkley”). On December 5, 2016, the joint venture closed on the acquisition of The Berkley

through a wholly-owned special purpose entity (the “Property Owner”) for a purchase price of $68,875,000, subject

to closing prorations and expenses, of which $42,500,000 was borrowed by the joint venture through the Property Owner pursuant

to a 10-year loan (the “Loan”) and the balance was paid in the form of an equity investment (half of which was funded

indirectly by the Company)

.

The Loan bears interest at a rate of 1 month LIBOR + 2.16%

,

is interest only for five years

,

is prepayable after two years with a 1% prepayment

premium and has covenants and defaults customary for a Freddie Mac financing. Each of the Company and Pacolet are joint

and several recourse carve-out guarantors under the Loan pursuant to Freddie Mac’s standard form of guaranty.

On December 5, 2016, the Company issued a press release announcing

the closing of the acquisition of The Berkley. A copy of the press release is attached hereto as Exhibit 99.1.

|

|

Item 2.03

|

Creation of a Direct Financial Obligation or an

Obligation under an Off-Balance Sheet Arrangement of a Registrant

|

The information included in Item 2.01 of this Current Report

on Form 8-K is incorporated by reference into this Item 2.03.

|

|

Item 9.01.

|

Financial Statements and Exhibits

|

Because The Berkley is newly constructed and commenced operations

in July 2016 and has a rental history as of the end of the Company’s most recently completed quarter of less than three

months, no financial information for The Berkley is required to be filed under Item 3-14 of Regulation S-X.

(d) Exhibits

|

Exhibit No.

|

Exhibit Description

|

|

|

|

|

5.1

|

Opinion of Kramer Levin Naftalis & Frankel LLP

|

|

|

|

|

10.1

|

At the Market Offering Agreement by and among Trinity Place Holdings Inc. and Craig-Hallum Capital Group LLC dated December 2, 2016

|

|

|

|

|

23.1

|

Consent of Kramer Levin Naftalis & Frankel LLP (included in Opinion of Kramer Levin Naftalis & Frankel LLP filed as Exhibit 5.1)

|

|

|

|

|

99.1

|

Press release, dated December 5, 2016

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

Trinity Place Holdings Inc.

|

|

|

|

|

|

|

|

Date: December 5, 2016

|

/s/ Steven Kahn

|

|

|

Steven Kahn

|

|

|

Chief Financial Officer

|

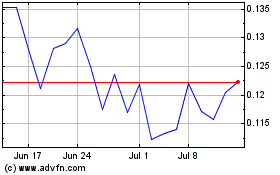

Trinity Place (AMEX:TPHS)

Historical Stock Chart

From Mar 2024 to Apr 2024

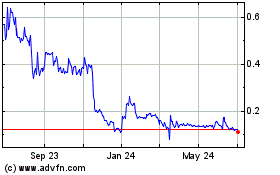

Trinity Place (AMEX:TPHS)

Historical Stock Chart

From Apr 2023 to Apr 2024