Mexico Awards Oil Rights -- WSJ

December 06 2016 - 3:02AM

Dow Jones News

BHP Billiton, Chevron, CNOOC grab offshore blocks in nation's

first test of foreign interest

By Robbie Whelan and Anthony Harrup

MEXICO CITY -- The world's largest oil companies won rights to

develop Mexico's offshore oil deposits in an auction that led to

twice as many awards as officials expected and could generate $40

billion in investment.

Eight of the 10 exploration blocks available were snatched up in

competitive bidding by firms including Exxon Mobil Corp., Chevron

Corp., and China's state-run China National Offshore Oil Corp.

Australia's BHP Billiton also made history by becoming the first

foreign company to join state oil firm Petróleos Mexicanos in

developing the already discovered Trion oil field in the Gulf of

Mexico.

The Trion partnership and the deep-water auctions were the

centerpiece of President Enrique Peña Nieto's 2013 energy reform

laws, which opened Mexico's energy industry to foreign investment

for the first time since nationalization in 1938.

"We've very happy that this investment will come to Mexico,"

said Juan Carlos Zepeda, head of the country's energy regulator,

the National Hydrocarbons Commission. "The energy reform initiated

by President Pena is a success."

Mexican energy officials said the eight blocks plus Trion

eventually should lead to production of 900,000 barrels a day of

oil equivalent.

BHP Billiton outbid BP PLC for a 60% stake in the Trion field,

believed to contain 485 million barrels of crude oil, by offering a

bonus payment $624 million, just $18 million more than its British

rival.

Among the biggest winners was China's Cnooc, which won rights to

explore and develop two blocks in the oil-rich central portion of

the Gulf of Mexico. Cnooc offered some of the highest royalty

payments, committing to pay 15.01% of its gross income on one block

and 17.01% on another.

"We salute that the Chinese business has come to compete in

Mexico and to win," said Pedro Joaquín Coldwell, Mexico's Secretary

of Energy. "When we talk about diversification, we don't only refer

to the scale of the companies...we also refer to

nationalities."

"The way the Chinese are approaching Mexico's energy industry is

very similar to the way they approached Brazil," said R. Evan Ellis

a Latin American studies professor at the U.S. Army War College,

referring to the policy of investing in small companies and setting

up investment funds first, then taking exploratory steps to develop

caches of resources.

Cnooc couldn't be reached for comment.

Other successful foreign bidders include a consortium included

France's Total SA alongside Statoil ASA and BP, and another group

including Murphy Oil Corp., Ophir Energy and Malaysia's Petronas

Carigali.

Aside from securing a partner for Trion, Pemex won one block in

a consortium with Chevron and Japan's Inpex Corp., and lost in

another in which it bid alone.

They were the first competitive bids for Pemex, which had a

monopoly on oil exploration and production in Mexico since

1938.

"Pemex is realizing the need to change and adjusting to the new

reality, " said Pablo Medina, a Latin America upstream analyst at

energy research firm Wood Mackenzie.

For Trion, both Billiton and BP offered additional royalties of

4%, on top of the minimum royalty payment of 7.5%, while Billiton

offered an additional cash commitment of $624 million, higher than

the $606 million offered by BP.

Billiton will have 60% of the project and Pemex 40%, and as

winning bidder is obliged to make a minimum investment of $570

million.

Timothy Callahan, a director general with BHP Billiton, said his

company became more confident in its bid after Pemex in early

November changed certain terms in the Trion joint operating

agreement, including voting procedures governing the contract.

The auction is the fourth under the 2013 opening of the Mexican

oil industry, but the first for deep-water reserves and the first

to attract the interest of major oil companies.

The Trion field was discovered in 2012 and is thought to contain

about 485 million barrels of commercial reserves. It is expected to

cost about $11 billion to develop the field, with capital

expenditures of $7.5 billion, according to Mexican oil regulator

National Hydrocarbons Commission.

Write to Robbie Whelan at robbie.whelan@wsj.com and Anthony

Harrup at anthony.harrup@wsj.com

(END) Dow Jones Newswires

December 06, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

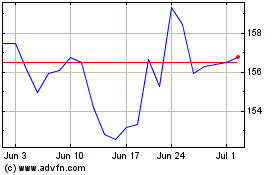

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

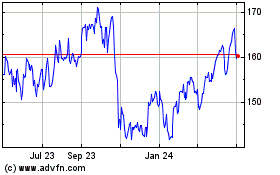

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024