BHP Billiton, Cnooc, Total, Others Take Blocks in Mexico Offshore Auction--2nd Update

December 05 2016 - 4:44PM

Dow Jones News

By Robbie Whelan

MEXICO CITY -- Australia's BHP Billiton won the bidding to join

with Mexican state oil company Petróleos Mexicanos to explore a

oil-rich region of the Gulf of Mexico, in the first award of

several auctions of deep-water oil blocks on Monday.

Billiton outbid BP PLC to become Pemex's first private partner

in exploration and production in a deep-water block containing its

Trion oil field, located offshore just south of the U.S. Mexico

border, under Mexico's 2013 opening of the oil industry to foreign

investment.

China Offshore Oil Corp., or Cnooc, won two other blocks. One of

its bids offered an up to 17% additional royalty on oil production

to the government.

Other successful foreign bidders include a consortium of

France's Total SA and Exxon Mobil Corp., a group comprised of

Statoil ASA, BP PLC and Total, and another group including Murphy

Oil Corp., Ophir Energy and Malaysia's Petronas Carigali. Mexico

awarded eight of the 10 deep-water blocks up for bid, in addition

to the Trion joint-venture with Pemex.

Chevron Corp. also was awarded a deep water block in a joint bid

with Pemex.

For Trion, both Billiton and BP offered additional royalties of

4%, on top of the minimum royalty payment of 7.5%, while Billiton

offered an additional cash commitment of $624 million, higher than

the $606 million offered by BP.

Billiton will have 60% of the project and Pemex 40%, and as

winning bidder is obliged to make a minimum investment of $570

million.

Timothy Callahan, director general with BHP Billiton in Mexico,

said his company became more confident in its bid after Pemex in

early November changed certain terms in the Trion joint operating

agreement, including the voting procedures governing the

contract.

"We had to get comfortable with the JOA. It's not completely in

line with international standards...but we look forward to working

with Pemex, " he said.

BHP Billiton has collaborated with European exploration

companies on the production of two oil fields in U.S. waters in the

Gulf of Mexico. "We're a proven operator on the U.S. side of the

border," Mr. Callahan said. "We have proven that we can work in

deep waters and that we can work in the Gulf of Mexico, and we hope

to bring both skill sets to our collaboration with Pemex."

The auction is the fourth under the 2013 opening of the Mexican

oil industry, but the first for deep-water reserves and the first

to attract the interest of major oil companies.

The Trion field, part of a larger area of oil deposits known as

the Perdido trend, was discovered in 2012 and is thought to contain

about 485 million barrels of commercial reserves. It is expected to

cost about $11 billion to develop the field, with capital

expenditures of $7.5 billion, according to Mexico's oil regulator,

the National Hydrocarbons Commission.

"We see attractive potential in Trion and the Perdido trend, and

we are pleased to have the opportunity to further appraise and

potentially develop this prospective frontier area of the

deep-water Gulf of Mexico, " said Steve Pastor, president of BHP

Billiton petroleum operations.

Pemex's chief executive, José Antonio González Anaya, said the

state oil company hopes that by 2025, the Trion field will be

producing around 120,000 barrels a day.

BHP Billiton is the world's biggest mining company by market

value. Mr. González Anaya called Monday a "great day" for Mexico

and said he's confident it will bring significant advantages, such

as technology, to Pemex.

"I'm happy that the bids were so close, and that there wasn't a

'winner's curse.' When bids are far apart, sometimes winners may

think they offered too much."

Write to Robbie Whelan at robbie.whelan@wsj.com

(END) Dow Jones Newswires

December 05, 2016 16:29 ET (21:29 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

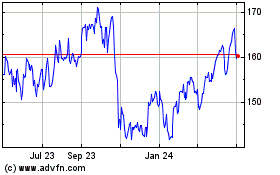

Chevron (NYSE:CVX)

Historical Stock Chart

From Mar 2024 to Apr 2024

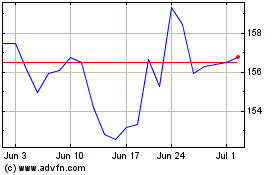

Chevron (NYSE:CVX)

Historical Stock Chart

From Apr 2023 to Apr 2024