Kinder Morgan Announces 2017 Financial Expectations

December 05 2016 - 4:05PM

Business Wire

Kinder Morgan, Inc. (NYSE: KMI) today announced its preliminary

2017 financial projections. “The fundamentals of our business

remain strong. We expect to generate $4.46 billion of distributable

cash flow for 2017 which continues to provide us great strength and

flexibility. We are also confident in our outlook for growth,

largely supported by our $13 billion backlog of energy

infrastructure expansion opportunities that have a high probability

of completion over the next few years,” said Steve Kean, president

and CEO. Below is a summary of KMI’s expectations for 2017:

- Continue to maximize shareholder value,

which includes maintaining a solid investment grade rating and

continuing to pursue attractive return projects and acquisitions.

As its backlog of projects continues to be placed in service, the

company expects to generate cash flow in excess of its investment

needs. KMI currently believes the best way to maximize shareholder

value will be to use a significant portion of that excess cash to

increase its dividend. KMI expects to declare dividends of $0.50

per share in 2017. KMI also expects to provide guidance on a

revised dividend policy in the latter part of 2017, with a view

toward delivering additional value to its shareholders in

2018.

- End 2017 with debt-to-Adjusted EBITDA

ratio of 5.4 times, with expected improvement based on additional

proceeds generated by joint ventures. The company is committed to

the continued strengthening of its investment grade balance sheet

and is pursuing select joint ventures to accelerate that process.

KMI’s 2017 budget assumes a joint venture partner on the company’s

TransMountain expansion project and contributions from that partner

to fund its share of expansion capital, but does not include any

potential proceeds in excess of the partner’s share of expansion

capital to recognize the value created in developing the project to

this stage. KMI expects to receive such proceeds, but did not

attempt to quantify them for budget purposes.

- Generate $1.99 per share of

distributable cash flow and $7.2 billion of Adjusted EBITDA,

essentially flat to 2016 with contributions from expansion projects

coming into service largely offsetting the full year effect of the

Sept. 1, 2016, sale of a 50 percent interest in SNG, the year over

year decline in realized oil prices in its CO2 segment, lower

contributions from certain gathering and processing assets, and the

impact from a rate case on CIG settled during 2016.

- Invest $3.2 billion on expansion

projects in 2017 and fund with excess, internally generated cash

flow, with no need to access equity markets during 2017.

- KMI does not provide budgeted net

income attributable to common stockholders (the GAAP financial

measure most directly comparable to the non-GAAP financial measures

distributable cash flow and Adjusted EBITDA) due to the inherent

difficulty and impracticality of quantifying certain amounts

required by GAAP such as ineffectiveness on commodity, interest

rate and foreign currency hedges, unrealized gains and losses on

derivatives marked to market, and potential changes in estimates

for certain contingent liabilities.

KMI’s expectations assume average annual prices for West Texas

Intermediate (WTI) crude oil and Henry Hub natural gas of $53 per

barrel and $3 per MMBtu, respectively, and which were consistent

with forward pricing during the budget process. The vast majority

of cash generated by KMI is fee-based and therefore is not directly

exposed to commodity prices. The primary area where KMI has

commodity price sensitivity is in its CO2 segment, where KMI hedges

the majority of its next 12 months of oil production to minimize

this sensitivity. For 2017, the company estimates that every $1 per

barrel change in the average WTI crude oil price impacts

distributable cash flow by approximately $6 million and each $0.10

per MMBtu change in the price of natural gas impacts distributable

cash flow by approximately $1 million.

The KMI board of directors will review the 2017 budget for

approval at the January board meeting and the budget will be

discussed in detail by management during the company’s annual

analyst meeting to be held on Jan. 25, 2017, in Houston, Texas.

Kinder Morgan remains committed to transparency and will continue

to publish its budget on the company’s website,

www.kindermorgan.com. The 2017 budget will be the standard by which

KMI measures its performance next year and will be a factor in

determining employee compensation.

Kinder Morgan, Inc. (NYSE: KMI) is the largest energy

infrastructure company in America. It owns an interest in or

operates approximately 84,000 miles of pipelines and approximately

180 terminals. KMI’s pipelines transport natural gas, gasoline,

crude oil, CO2 and other products, and its terminals store

petroleum products and chemicals, and handle bulk materials like

coal and petroleum coke. For more information please visit

www.kindermorgan.com.

Non-GAAP Financial

Measures

The non-generally accepted accounting principles (non-GAAP)

financial measures of distributable cash flow (DCF), both in the

aggregate and per share and net income before interest expense,

taxes, depreciation, depletion, amortization and amortization of

cost of equity investments and certain items (Adjusted EBITDA) are

presented herein.

Certain items are items that are

required by GAAP to be reflected in net income, but typically

either (1) do not have a cash impact (for example, asset

impairments), or (2) by their nature are separately identifiable

from our normal business operations and in our view are likely to

occur only sporadically (for example certain legal settlements,

hurricane impacts and casualty losses).

DCF is a significant performance

measure used by us and by external users of our financial

statements to evaluate our performance and to measure and estimate

the ability of our assets to generate cash earnings after servicing

our debt and preferred stock dividends, paying cash taxes and

expending sustaining capital, that could be used for discretionary

purposes such as common stock dividends, stock repurchases,

retirement of debt, or expansion capital expenditures. Management

uses this measure and believes it provides users of our financial

statements a useful measure reflective of our business’s ability to

generate cash earnings to supplement the comparable GAAP measure.

We believe the GAAP measure most directly comparable to DCF is net

income available to common stockholders. DCF per share is DCF

divided by average outstanding shares, including restricted stock

awards that participate in dividends.

Adjusted EBITDA is used by

management and external users, in conjunction with our net debt, to

evaluate certain leverage metrics. Therefore, we believe Adjusted

EBITDA is useful to investors. We believe the GAAP measure most

directly comparable to Adjusted EBITDA is net income available to

common stockholders. Adjusted EBITDA is calculated by adjusting net

income before interest expense, taxes, and DD&A (EBITDA) for

certain items, noncontrolling interests before certain items, and

KMI’s share of certain equity investees’ DD&A and book

taxes.

Our non-GAAP measures described above should not be considered

alternatives to GAAP net income or other GAAP measures and have

important limitations as analytical tools. Our computations of DCF

and Adjusted EBITDA may differ from similarly titled measures used

by others. You should not consider these non-GAAP measures in

isolation or as substitutes for an analysis of our results as

reported under GAAP. DCF should not be used as an alternative to

net cash provided by operating activities computed under GAAP.

Management compensates for the limitations of these non-GAAP

measures by reviewing our comparable GAAP measures, understanding

the differences between the measures and taking this information

into account in its analysis and its decision making processes.

Important Information Relating to

Forward-Looking Statements

This news release includes forward-looking statements within the

meaning of the U.S. Private Securities Litigation Reform Act of

1995 and Section 21E of the Securities and Exchange Act of 1934.

Generally the words “expects,” “believes,” anticipates,” “plans,”

“will,” “shall,” “estimates,” and similar expressions identify

forward-looking statements, which are generally not historical in

nature. Forward-looking statements are subject to risks and

uncertainties and are based on the beliefs and assumptions of

management, based on information currently available to them.

Although Kinder Morgan believes that these forward-looking

statements are based on reasonable assumptions, it can give no

assurance that any such forward-looking statements will

materialize. Important factors that could cause actual results to

differ materially from those expressed in or implied from these

forward-looking statements include the risks and uncertainties

described in Kinder Morgan’s reports filed with the Securities and

Exchange Commission (SEC), including its Annual Report on Form 10-K

for the year-ended December 31, 2015 (under the headings “Risk

Factors” and “Information Regarding Forward-Looking Statements” and

elsewhere) and its subsequent reports, which are available through

the SEC’s EDGAR system at www.sec.gov and on our website at

ir.kindermorgan.com. Forward-looking statements speak only as of

the date they were made, and except to the extent required by law,

Kinder Morgan undertakes no obligation to update any

forward-looking statement because of new information, future events

or other factors. Because of these risks and uncertainties, readers

should not place undue reliance on these forward-looking

statements.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161205006197/en/

Kinder Morgan, Inc.Dave Conover, (713) 369-9407Media

Relationsdave_conover@kindermorgan.comorInvestor Relations(713)

369-9490km_ir@kindermorgan.comwww.kindermorgan.com

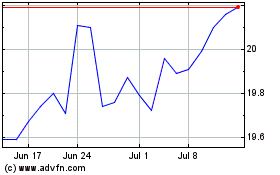

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

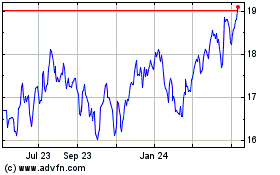

Kinder Morgan (NYSE:KMI)

Historical Stock Chart

From Apr 2023 to Apr 2024