Current Report Filing (8-k)

December 05 2016 - 7:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT

REPORT Pursuant

to

Section 13 or 15(

d

) of the

Securities

Exchange Act of 1934

|

Date of report (Date of earliest event reported)

|

December 5, 2016

|

|

|

|

Hudson

Technologies, Inc.

|

|

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

New York

|

|

(State or Other Jurisdiction of Incorporation)

|

|

|

|

1-13412

|

13-3641539

|

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

|

|

PO Box

1541, 1 Blue Hill Plaza, Pearl River, New York

|

10965

|

|

(Address of Principal Executive Offices)

|

(Zip Code)

|

|

|

|

(845)

735-6000

|

|

(Registrant's Telephone Number, Including Area Code)

|

|

|

|

Not Applicable

|

|

(Former Name or Former Address, if Changed Since Last Report)

|

|

|

|

|

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (

see

General Instruction A.2. below):

o

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

o

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 7.01. Regulation FD Disclosure

On December 5, 2016, Hudson Technologies,

Inc. (the “Company”) issued a press release announcing a proposed underwritten public offering of its common stock

(the “Offering”). A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is

incorporated herein by reference.

In connection with the Offering, the Company

filed a preliminary prospectus supplement on December 5, 2016 (the “Prospectus Supplement”). The Prospectus Supplement

sets forth the following disclosure under the heading “Prospectus Supplement Summary - Recent Developments”:

In conjunction with this offering,

and given the proximity to the close of the fourth quarter of 2016, we have chosen to provide a range of estimated losses per share

and revenues for the three months ending December 31, 2016, as well as additional refrigerant pricing trend information.

While we do not provide quarterly guidance, with respect to the fourth quarter of 2016, we estimate that the total loss per share,

excluding the impact of this offering, will be between ($0.04) and ($0.05) and our revenues for the three months ending December

31, 2016, will be between $6.8 million and $7.5 million, which revenues are comparable to the prior year period. In addition,

we reiterate our expectation that the full-year 2017 will continue the trend of revenue growth and higher than average historical

gross margins. Moreover, during the fourth quarter of 2016, we are continuing to see further price increases for R-22 refrigerant.

No assurances can be given, however, that the results for the fourth quarter of 2016 will not differ from these estimated amounts.

These estimated amounts and related trend information are forward-looking statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These estimated amounts and trends may or may not be realized, and they may be based upon judgments

or assumptions that prove incorrect. Our results for this quarter or any future period may vary significantly from these amounts

based on other unexpected issues in our business and operations.

The Company is furnishing the information

in this Current Report on Form 8-K. Such information, including Exhibit 99.1, shall not be deemed “filed” for any purpose,

including for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or

otherwise subject to the liabilities of that Section. The information in this Current Report on Form 8-K, including Exhibit 99.1,

shall not be deemed incorporated by reference into any filing under the Securities Act or the Exchange Act, regardless of any general

incorporation language in such filings.

Item 9.01. Financial Statements and

Exhibits

(d)

Exhibits

99.1 Press

Release dated December 5, 2016

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: December 5, 2016

|

|

HUDSON TECHNOLOGIES, INC.

|

|

|

|

|

|

|

By:

|

/s/ Stephen P. Mandracchia

|

|

|

Name:

|

Stephen P. Mandracchia

|

|

|

Title:

|

Vice President Legal & Regulatory

|

|

|

|

Secretary

|

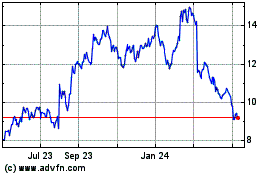

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hudson Technologies (NASDAQ:HDSN)

Historical Stock Chart

From Apr 2023 to Apr 2024