UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14f-1

Information Statement

Pursuant to Section 14(f) of the

Securities Exchange Act of 1934 and

Rule 14f-1 Promulgated Thereunder

ALLIED VENTURES HOLDINGS CORP.

(Exact name of registrant as specified in its

charter)

|

Nevada

|

0-11596

|

95-3506403

|

|

(State or other jurisdiction of incorporation)

|

(Commission

File Number)

|

(IRS Employer

Identification No.)

|

7702 E. Doubletree Ranch Road, Suite 300

Scottsdale, Arizona 85258

(Address of Principal Executive

Offices) (Zip Code)

(480) 607-4393

Registrant’s telephone number, including

area code

____________________________________________________________________________

NOTICE OF CHANGE IN

THE MAJORITY OF THE BOARD OF DIRECTORS

____________________________________________________________________________

ALLIED VENTURES HOLDINGS CORP.

_____________

INFORMATION STATEMENT

PURSUANT TO SECTION 14(f) OF THE

SECURITIES EXCHANGE ACT OF 1934

AND RULE 14f-1 PROMULGATED THEREUNDER

WE ARE NOT SOLICITING PROXIES IN CONNECTION

WITH THE MATTERS DESCRIBED IN THIS INFORMATION STATEMENT, AND NO VOTE OR OTHER ACTION BY OUR STOCKHOLDERS IS REQUIRED TO BE TAKEN

IN CONNECTION WITH THIS INFORMATION STATEMENT.

INTRODUCTION

This

Information Statement is being furnished to the holders of record as of November 29, 2016 (“Closing Date”), of the

outstanding shares of common stock, par value $0.0001 per share, of Allied Ventures Holdings Corp. Inc. (“Allied”),

pursuant to the requirements of Section 14(f) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

and Rule 14f-1 promulgated thereunder.

CHANGE IN CONTROL TRANSACTION

Effective

November 29, 2016 (Closing Date”), G. Reed Peterson sold 66,667 shares of common stock of the Company to Longwen Group Corp.,

a Grand Cayman company (“Longwen”). All of the shares held by Longwen are restricted securities. As a result of the

transactions, Mr. Petersen no longer owns any of the Company’s capital stock or securities.

On the

Closing Date, Mr. Petersen resigned in all officer capacities from the Company, and Mr. Xi Zhen Ye, President of Longwen, was appointed

a Director of the Company and President and Chief Executive Officer and Chief Financial Officer of the Company and Mr. Keith Wong

was appointed Chief Operating Officer of the Company.

Effective upon the 10th day after the Schedule 14f-1 has been mailed

to Company’s stockholders (the “Appointment Date”), Mr. Petersen automatically will resign as a director. On

that same date, Mr. Ye will be appointed as the Company’s Chairman of the Board at that time. A stockholder vote is not required

and will not be taken with respect to the appointment of Mr. Ye, the incoming director. You are not required to take any action

with respect to the appointment of Mr. Ye.

To the best of our

knowledge, except as set forth in this Information Statement, the incoming director is not currently a director of the Company,

does not hold any position with the Company nor have been involved in any transactions with the Company or any of our directors,

executive officers, affiliates or associates that are required to be disclosed pursuant to the rules and regulations of the SEC.

To the best of our knowledge, none of the officers or incoming or existing director of the Company has been the subject of any

bankruptcy petition filed by or against any business of which such person was a general partner or executive officer either at

the time of the bankruptcy or within two years prior to that time, been convicted in a criminal proceeding or been subject to a

pending criminal proceeding (excluding traffic violations and other minor offenses), been subject to any order, judgment or decree,

not subsequently reversed, suspended or vacated, of any court of competent jurisdiction, permanently or temporarily enjoining,

barring, suspending or otherwise limiting such person’s involvement in any type of business, securities or banking activities

or been found by a court of competent jurisdiction (in a civil action), the SEC or the Commodity Futures Trading Commission to

have violated a federal or state securities or commodities law, and the judgment has not been reversed, suspended or vacated.

VOTING SECURITIES

The Company has 127,061

shares of common stock, par value $0.0001 per share (the “Common

Stock”)

and 50,000,000 shares of preferred stock, par value $0.0001 per share (the “Preferred Stock”) authorized

. As

of the date hereof, 127,061

shares of common stock are issued and outstanding,

and none of the Preferred Stock is issued and outstanding. Each share of common stock that is issued and outstanding is entitled

to one vote per share. The Preferred Stock may be issued with designations, rights and preferences determined from time to time

by our Board.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL

OWNERS AND MANAGEMENT

The following table

sets forth certain information as of November 29, 2016 and gives effect to the above described transaction, with respect to the

holdings of: (i) each of our current directors and named executive officers, (ii) each of the individuals who will be appointed

as directors of Company on the Appointment Date, and (iii) all directors and executive officers as a group, including the new directors.

Other than those individuals named below, no holder owns 5% or more of Company’s common stock. To the best of our knowledge,

each of the persons named in the table below as beneficially owning the shares set forth therein owns the shares directly and has

sole voting power and sole investment power with respect to such shares, unless otherwise indicated. Unless otherwise specified,

the address of each of the persons set forth below is the address of the Company. The information below is based on a total of

127,061 shares of Company’s common stock outstanding as of November 29, 2016.

|

Name and Address of Beneficial Owner

|

|

Amount and Nature of Beneficial Ownership

|

|

|

Percent of Shares Beneficially Owned

|

|

|

Longwen Group Corp. (1)(3)

|

|

|

66,667

|

|

|

|

52.4

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Officers and Directors

|

|

|

|

|

|

|

|

|

|

Xi Zhen Ye (1)

|

|

|

66,667

|

|

|

|

52.4

|

%

|

|

Keith Wong

(2)

|

|

|

66,667

|

|

|

|

52.4

|

%

|

|

G. Reed Petersen(3)

|

|

|

0

|

|

|

|

|

0

|

|

All directors and executive officers as a group (3 persons)

|

|

|

66,667

|

|

|

|

52.4

|

%

|

|

|

(1)

|

Mr. Xi Zhen Ye is the sole officer and beneficially owns 67.39%

of the capital stock of Longwen Group Corp., and is deemed the beneficial owner of such shares held by Longwen.

|

|

|

(2)

|

Mr. Keith Wong is the beneficial owner 32.61% of the capital stock

of Longwen Group Corp.

and is deemed the beneficial owner of such shares held by Longwen.

|

|

|

(3)

|

As of the date of this Information Statement, Mr. Petersen serves

as our director. Ten days after the filing and dissemination of the Schedule 14f -1 Information Statement, Mr. Petersen will resign

as a director. Mr. Petersen’s address is

3635 Cove Point Drive, Salt Lake City, Utah 84109.

|

CURRENT DIRECTORS AND EXECUTIVE

OFFICERS

The following table sets forth the names,

ages and positions of Company’s current executive officers and directors. Each director holds office until his successor

is elected and qualified or his earlier resignation or removal.

|

Name

|

|

Age

|

|

Position

|

|

Xi Zhen Ye

|

|

53

|

|

Chief Executive Officer, Chief Financial Officer and

|

|

|

|

|

|

Director

|

|

G. Reed Petersen

|

|

72

|

|

Director

|

|

|

|

|

|

|

|

|

|

|

|

|

Xi Zhen Ye has been the Company’s Chief Executive Officer

and Chief Financial Officer since November 4, 2016. Mr. Ye, a businessman in Hangzhou, China. He has operated and invested in several

local companies with notable success, including news distribution network, films, mining, energy and Chinese traditional medicine.

He has a BS degree in Journalism. Mr. Ye’s business background led to the decision to appoint him to the Company’s

Board of Directors.

Mr. Petersen was an officer of the Company since January 21, 2016

until November 29, 2016. Prior to his role with the Company, he was retired having spent the last four years prior to retirement

as the manager of a full service wood mill. He remains a Director of the Company until the 10

th

day following the mailing

of this Information Statement at which point Mr. Petersen automatically will resign as a Director.

CORPORATE GOVERNANCE

Family Relationships

There are no family relationships

among our directors or officers.

Director Independence

We do not have any independent directors

and our Board is in the process of searching for suitable candidates.

Committees of the Board of

Directors

Our Board does not

have any committees, as companies whose securities are not traded on a national exchange are not required to have Board committees.

However, at such time in the future that we appoint independent directors on our Board, we expect to form the appropriate Board

committees and identity an audit committee financial expert. All functions of an audit committee, nominating committee and compensation

committee are and have been performed by our Board.

Director Nominations

Our Board believes

that, considering our size, decisions relating to director nominations can be made on a case-by-case basis by all members of the

Board without the formality of a nominating committee or a nominating committee charter. To date, we have not engaged third parties

to identify or evaluate or assist in identifying potential nominees, although we reserve the right to do so in the future.

The Board does not

have an express policy with regard to the consideration of any director candidates recommended by shareholders since the Board

believes that it can adequately evaluate any such nominees on a case-by-case basis; however, the Board will evaluate shareholder-recommended

candidates under the same criteria as internally generated candidates. Although the Board does not currently have any formal minimum

criteria for nominees, substantial relevant business and industry experience would generally be considered important, as would

the ability to attend and prepare for Board,

committee and shareholder meetings. Any candidate must state in advance his or her willingness and interest in serving on the Board.

Board Oversight

The leadership structure

of our Board is such that, after the Appointment Date, we will have the same individual serving as Chairman and as President. Our

management is responsible for managing risk and bringing the most material risks facing the Company to the Board’s attention.

Because we do not yet have separately designated committees, the entire Board has oversight responsibility for the processes established

to report and monitor material risks applicable to the Company relating to (1) the integrity of the Company’s financial statements

and review and approve the performance of the Company’s internal audit function and independent accountants, (2) succession

planning and risk related to the attraction and retention of talent and to the design of compensation programs and arrangements,

and (3) monitoring the design and administration of the Company’s compensation programs to ensure that they incentivize strong

individual and group performance and include appropriate safeguards to avoid unintended or excessive risk taking by Company employees.

Board Diversity

While we do not have

a formal policy on diversity, our Board considers diversity to include the skill set, background, reputation, type and length of

business experience of our Board members, as well as a particular nominee’s contributions to that mix. Although there are

many other factors, the Board seeks individuals with industry knowledge and experience, senior executive business experience, and

legal and accounting skills.

NEW DIRECTORS AND EXECUTIVE OFFICERS

Our new management team and their backgrounds

are as follows:

|

Name

|

|

Age

|

|

Position

|

|

Xi Zhen Ye

|

|

53

|

|

Chief Executive Officer and Chief Financial Officer

|

|

Keith Wong

|

|

62

|

|

Chief Operating Officer

|

|

|

(1)

|

Effective upon the 10

th

day after this Schedule 14f-1

has been mailed to Company’s stockholders, Mr. Ye will be appointed as Chairman of the Board of Company.

|

Mr. Ye’s biography

appears above, under the heading, “Current Directors and Executive Officers.”

Mr. Wong brings 27

years of experience in sales, business management, finance, manufacturing, Asian suppliers and Asian business networks. For over

twelve years, Mr. Wong was the President and CEO of ATC Technology Group, which later became EastBridge Investment Group Corporation.

Mr. Wong holds a Bachelors and Masters degree in electrical engineering from Rutgers University and Northeastern University, respectively

and Advanced Management Program from Harvard University’s Business School. Mr. Wong also holds two U.S. utility patents and

one U.S. design patent.

CERTAIN RELATIONSHIPS AND RELATED

TRANSACTIONS

Except

as described above, there have been no material transactions, series of similar transactions, currently proposed transactions,

or series of similar transactions, to which the Company is to be a party, in which any promoter or founder, or any member of the

immediate family of any of the foregoing persons, had a material interest.

Review, Approval and Ratification

of Related Party Transactions

We have not adopted

formal policies and procedures for the review, approval or ratification of related party transactions with our executive officers,

directors and principal stockholders

Stockholder Communications with

Directors

Stockholders who want to communicate

with our Board or any individual director can write to:

7702 E. Doubletree Ranch Road, Suite 300

Scottsdale, Arizona 85258

Your letter should indicate that you are a stockholder

of our company. Depending on the subject matter, management will:

|

|

·

|

Forward the communication to the director or directors to whom it is addressed;

|

|

|

·

|

Attempt to handle the inquiry directly; or

|

|

|

·

|

Not forward the communication if it is primarily commercial in nature or if it relates to an

improper or irrelevant topic.

|

At each Board meeting,

a member of management presents a summary of all communications received since the last meeting that were not forwarded and makes

those communications available to the directors upon request.

COMPENSATION OF DIRECTORS AND EXECUTIVE

OFFICERS

Officer and Director Compensation

The

following summary compensation table sets forth all compensation awarded to, earned by, or paid to our officers and directors by

the Company during the years ended December 30, 2015 and 2014 in all capacities:

|

Name and Position

|

|

Year

|

|

Salary

|

|

Bonus

|

|

Stock

Award(s)

|

|

Option|

Awards

|

|

All Other

Compensation

|

|

Total

|

|

G. Reed Petersen/Harold Minsky

President, CEO and Director

|

|

2015

2014

|

|

None

None

|

|

None

None

|

|

None

None

|

|

None

None

|

|

None

None

|

|

None

None

|

The

Company's officers and directors have not received any cash or other remuneration since they was appointed to serve in

such capacities. No remuneration of any nature has been paid for on account of services rendered by a director in such capacity.

Our sole officer and director intends to devote very limited time to our affairs.

We

have formulated no plans as to the amounts of future cash compensation. It is possible that, after the Company successfully

consummates a business combination with an unaffiliated entity, that entity may desire to employ or retain members of our management

for the purposes of providing services to the surviving entity. No retirement, pension, profit sharing, stock option or insurance

programs or other similar programs have been adopted by the Company for the benefit of its employees. There are no understandings

or agreements regarding compensation our management will receive after a business combination that is required to be disclosed.

The Company does not have a standing compensation committee or a committee performing similar functions.

Employment Agreements

We have not entered

into employment agreements with any of our officers, directors or employees.

Director Compensation

Our

directors are reimbursed for expenses incurred by them in connection with attending Board meetings, but they do not receive any

other compensation for serving on the Board.

SECTION 16(a) BENEFICIAL OWNERSHIP

REPORTING COMPLIANCE

Section 16(a) of the

Securities Exchange Act of 1934, as amended, requires the Company’s directors and executive officers, and persons who beneficially

own more than 10% of a registered class of the Company’s equity securities (the “Reporting Persons”), to file

reports of beneficial ownership and changes in beneficial ownership of the Company’s securities with the SEC on Forms 3 (Initial

Statement of Beneficial Ownership), 4 (Statement of Changes of Beneficial Ownership of Securities) and 5 (Annual Statement of Beneficial

Ownership of Securities). The Reporting Persons are required by SEC regulations to furnish the Company with copies of all Section

16(a) forms that they file. To the best of our knowledge, during the fiscal year ended December 31, 2016, the Reporting Persons

were not in compliance with all applicable Section 16(a) reporting requirements.

WHERE YOU CAN FIND MORE INFORMATION

We file reports with

the SEC. These reports, including annual reports, quarterly reports as well as other information we are required to file pursuant

to securities laws. You may read and copy materials we file with the SEC at the SEC’s Public Reference Room at 100 F. Street,

N.E., Washington, D.C. 20549. You may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330.

The SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers

that file electronically with the SEC at http://www.sec.gov.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this information statement to be signed on

its behalf by the undersigned hereunto duly authorized.

Allied Ventures Holdings Corp.

By:

/s/ Xi Zhen Ye

Name: Xi Zhen Ye

Title: Chief Executive

Officer

Dated: November

30, 2015

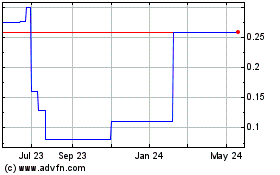

Longwen (QB) (USOTC:LWLW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Longwen (QB) (USOTC:LWLW)

Historical Stock Chart

From Apr 2023 to Apr 2024