As filed with the Securities and Exchange Commission on December 2, 2016

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

EOG RESOURCES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware

|

|

47-0684736

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

1111 Bagby, Sky Lobby 2

Houston, Texas 77002

(713) 651-7000

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Michael P. Donaldson

Executive Vice President, General Counsel and Corporate Secretary

EOG Resources, Inc.

1111

Bagby, Sky Lobby 2

Houston, Texas 77002

Telephone: (713) 651-7000

Facsimile: (713) 651-6987

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

John Goodgame

Akin Gump

Strauss Hauer & Feld LLP

1111 Louisiana Street, 44th Floor

Houston, Texas 77002

(713)

220-5800

Approximate Date of Commencement of Proposed Sale to the Public:

From time to time after this registration statement becomes

effective, subject to market conditions and other factors.

If the only securities being registered on this Form are being offered pursuant

to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the

Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following

box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D.

filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☒

|

|

Accelerated filer

|

|

☐

|

|

Non-accelerated filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☐

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of Securities to be

Registered

|

|

Amount to be

Registered

|

|

Proposed Maximum

Offering Price

per Share

|

|

Proposed Maximum

Aggregate Offering

Price

|

|

Amount of

Registration Fee

|

|

Common Stock

|

|

25,203,773(1)

|

|

$91.69 (2)

|

|

$2,310,933,946.37 (2)

|

|

$267,837 (3)

|

|

|

|

|

|

(1)

|

Pursuant to Rule 416(a) under the Securities Act, the amount of common stock being registered on behalf of the selling stockholders shall be adjusted to include any additional common stock that may become issuable as a

result of any stock splits, stock dividends or similar transactions.

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) of the Securities Act on the basis of the average of the high and low sale prices of our common stock on November 29, 2016, as

reported on the New York Stock Exchange.

|

|

(3)

|

Pursuant to Rule 457(c) of the Securities Act.

|

PROSPECTUS

EOG Resources, Inc.

25,203,773 SHARES OF COMMON STOCK

This prospectus relates solely

to the resale of up to an aggregate of 25,203,773 shares of common stock of EOG Resources, Inc. by the selling stockholders named in this prospectus or in any supplement to this prospectus. We are registering the offer and sale of the shares on

behalf of the selling stockholders.

The selling stockholders may sell the shares of common stock offered by this prospectus from time to time as they may

determine through ordinary brokerage transactions, directly to market makers, in private sales, through dealers or agents or through any other means described in “Plan of Distribution.” The selling stockholders may sell the shares of

common stock at prevailing market prices or at prices negotiated with buyers. The selling stockholders will be responsible for any commissions due to brokers, dealers or agents and similar fees and fees of counsel incurred by such selling

stockholder. We will be responsible for all other offering expenses. We will not receive any of the proceeds from the sale by the selling stockholders of the shares of common stock offered by this prospectus.

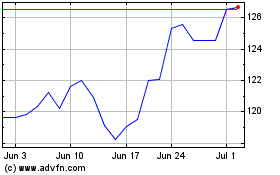

Our common stock is listed on the New York Stock Exchange under the symbol “EOG.” On November 30, 2016, the last reported sale price of our common

stock on the New York Stock Exchange was $102.52 per share.

You should read carefully the information included or incorporated by reference in this

prospectus and any applicable prospectus supplement, including any information we direct you to under the heading “Risk Factors,” for a discussion of factors you should consider before deciding to invest in any securities offered by this

prospectus. See “

Risk Factors

” on page 5.

Neither the Securities and Exchange Commission nor any state

securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is December 2, 2016.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement that we have filed with the United States Securities and Exchange Commission, referred to in this

prospectus as the “SEC” or the “Commission,” using a “shelf” registration process. Using this process, the selling stockholders named in this prospectus or any supplement to this prospectus may, from time to time, offer

to sell up to the number of shares of common stock set forth on the cover of this prospectus from time to time in one or more offerings in any manner described in “Plan of Distribution.” This prospectus generally describes EOG Resources,

Inc. and the common stock that the selling stockholders may offer. In some cases, a selling stockholder may also be required to provide a prospectus supplement containing specific information about the terms of a particular offering. The prospectus

supplement may also add, update or change the information contained in this prospectus. Please carefully read this prospectus and any applicable prospectus supplement, in addition to the information contained in the documents we refer you to under

the heading “Where You Can Find Additional Information” below. If there is any inconsistency between the information in this prospectus and any prospectus supplement, you should rely on the information in the applicable prospectus

supplement.

You should rely only on the information contained or incorporated by reference in this prospectus and any accompanying prospectus

supplement. Neither we, nor the selling stockholders, have authorized anyone to provide you with different information. This prospectus may only be used where it is legal to sell the offered securities. You should not assume that the information in

this prospectus or any prospectus supplement is accurate as of any date other than the respective date on the front cover of those documents. You should not assume that the information incorporated by reference in this prospectus is accurate as of

any date other than the date of the applicable document. Our business, financial condition, results of operations and prospects may have changed since those dates.

1

ABOUT EOG RESOURCES, INC.

EOG Resources, Inc., a Delaware corporation organized in 1985, together with its subsidiaries, explores for, develops, produces and markets crude oil and

natural gas primarily in major producing basins in the United States of America, The Republic of Trinidad and Tobago, the United Kingdom, The People’s Republic of China, Canada and, from time to time, select other international areas. At

December 31, 2015, our total estimated net proved reserves were 2,118 million barrels of oil equivalent (which we refer to in this prospectus as “MMBoe”), of which 1,098 million barrels (which we refer to in this prospectus as

“MMBbl”) were crude oil and condensate reserves, 383 MMBbl were natural gas liquids reserves and 3,825 billion cubic feet, or 637 MMBoe, were natural gas reserves. At such date, approximately 97% of our net proved reserves (on a crude oil

equivalent basis) were located in the United States and 3% in Trinidad. EOG employed approximately 2,760 persons, including foreign national employees, as of December 31, 2015.

Our principal executive offices are located at 1111 Bagby, Sky Lobby 2, Houston, Texas 77002. Our telephone number at that location is (713) 651-7000.

In this prospectus, references to “EOG,” “we,” “us,” “our” and “the Company” each refers to EOG

Resources, Inc. and, unless otherwise stated, our subsidiaries.

2

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We file annual, quarterly and other reports, proxy and information statements and other information with the SEC. You may read and copy any document we file

at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for information regarding the Public Reference Room and its copying charges. You can also find our filings on

the SEC’s website at http://www.sec.gov and on our website at http://www.eogresources.com. Information contained on our website, except for the SEC filings referred to below, is not a part of, and shall not be deemed to be incorporated by

reference into, this prospectus. In addition, our reports and other information concerning us can be inspected at the New York Stock Exchange, 11 Wall Street, New York, New York 10005.

The SEC allows us to “incorporate by reference” the information we have filed with the SEC, which means that we can disclose important information

to you by referring you to those documents without actually including the specific information in this prospectus. The information incorporated by reference is an important part of this prospectus, and information that we file later with the SEC

will automatically update and may replace this information and information previously filed with the SEC. We incorporate by reference into this prospectus the following documents:

|

|

•

|

|

our Annual Report on Form 10-K for the year ended December 31, 2015, filed with the SEC on February 25, 2016;

|

|

|

•

|

|

our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2016, June 30, 2016 and September 30, 2016, filed with the SEC on May 5, 2016, August 4, 2016 and November 3,

2016, respectively;

|

|

|

•

|

|

our Current Reports on Form 8-K filed with the SEC on January 14, 2016, January 15, 2016, April 29, 2016, September 9, 2016 and October 5, 2016; and

|

|

|

•

|

|

the description of our common stock, par value $0.01 per share, contained in our Registration Statement on Form 8-A filed with the SEC on August 29, 1989.

|

We also incorporate by reference into this prospectus any future filings we make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Securities

Exchange Act of 1934, as amended, referred to in this prospectus as the “Exchange Act,” until the selling stockholders sell all of the common stock offered by this prospectus, other than information furnished to the SEC under

Items 2.02 or 7.01, or the exhibits related thereto under Item 9.01, of Form 8-K, which information is not deemed filed under the Exchange Act and is not incorporated by reference into this prospectus.

You may request a copy of these filings at no cost by writing or telephoning our Corporate Secretary at our principal executive offices, which are located at

1111 Bagby, Sky Lobby 2, Houston, Texas 77002, telephone: (713) 651-7000.

3

OIL AND GAS TERMS

|

|

|

|

|

|

|

When describing commodities produced and sold:

|

|

oil

|

|

= crude oil and condensate

|

|

|

|

liquids

|

|

= crude oil, condensate, and natural gas liquids

|

|

|

|

gas

|

|

= natural gas

|

|

|

|

|

|

When describing liquids:

|

|

Bbl

|

|

= barrel

|

|

|

|

MBbl

|

|

= thousand barrels

|

|

|

|

MMBbl

|

|

= million barrels

|

|

|

|

Boe

|

|

= barrel of oil equivalent

|

|

|

|

MMBoe

|

|

= million barrels of oil equivalent

|

|

|

|

|

|

When describing natural gas:

|

|

Mcf

|

|

= thousand cubic feet

|

|

|

|

MMcf

|

|

= million cubic feet

|

|

|

|

Bcf

|

|

= billion cubic feet

|

|

|

|

MMBtu

|

|

= million British thermal units

|

Crude oil equivalent volumes are determined using a ratio of 1.0 Bbl of crude oil and condensate or natural gas liquids to 6.0

Mcf of natural gas.

4

RISK FACTORS

Investing in our common stock involves risks. Before deciding to purchase any of our common stock, you should carefully consider the following risk factors,

in addition to the discussion of risks and uncertainties under the headings “Risk Factors” and “Information Regarding Forward-Looking Statements” contained in our Annual Report on Form 10-K for the fiscal year ended

December 31, 2015, which is incorporated by reference in this prospectus, and under similar headings in our subsequently filed Quarterly Reports on Form 10-Q and Annual Reports on Form 10-K, as well as the other risks and

uncertainties described in any applicable prospectus supplement and in the other documents incorporated by reference in this prospectus. See the section entitled “Where You Can Find Additional Information” in this prospectus.

Realization of any of those risks or the following risks or adverse results from any matter listed under the heading “Information Regarding

Forward-Looking Statements” in this prospectus or in our reports filed with the SEC under Exchange Act could have a material adverse effect on our business, financial condition, cash flows and results of operations and could result in a decline

in the market price of our common stock. As a result, you could lose all or part of your investment in the shares of our common stock. The following risks and uncertainties and the risks and uncertainties we discuss in the documents incorporated by

reference in this prospectus are those we currently believe may materially affect our company.

Risks Related to Our Common Stock

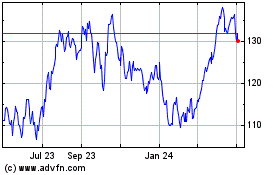

The market price of our common stock has historically experienced volatility.

The market price of our common stock has historically experienced fluctuations. For example, during 2016, the market price of our common stock has ranged from

$57.15 to $107.47 per share. The market price of our common stock is likely to continue to be volatile and subject to price and volume fluctuations in response to commodity price volatility and market and other factors, including the factors

discussed under “Information Regarding Forward-Looking Statements” in this prospectus, under Item 1A, “Risk Factors,” of our Annual Report on Form 10-K for the fiscal year ended December 31, 2015 and in the

documents incorporated by reference into this prospectus. Increased volatility could result in a decline in the market price of our common stock. Volatility or depressed market prices for our common stock could make it difficult for you to resell

your shares of our common stock when you want or at attractive prices.

We may reduce or cease to pay dividends on our common stock.

We can provide no assurance that we will continue to pay dividends on our common stock at the current rate or at all. The determination of the amount of future

cash dividends, if any, to be declared and paid on our common stock will depend upon, among other factors, our financial condition, cash flow, level of exploration and development expenditure opportunities and future business prospects.

There may be future dilution of our common stock, which may adversely affect the market price of our common stock.

We are not restricted from selling or issuing additional shares of our common stock or securities convertible into or exchangeable for our common stock. In

addition, holders of shares of our common stock are not entitled to any preemptive rights — that is, rights to purchase their pro rata share of any offering of shares of our common stock — and, therefore, any sales or issuances

by us of our common stock or securities convertible into or exchangeable for our common stock could result in increased dilution to our stockholders, and such dilution could be substantial. The market price of our common stock may be adversely

affected by sales or issuances of additional shares of our common stock or securities convertible into or exchangeable for our common stock, or by the perception that such a sale or issuance or other dilution may occur. Our Restated Certificate of

Incorporation, as amended, referred to in this prospectus as the “Restated Certificate of Incorporation,”

5

authorizes our board of directors to issue up to 640,000,000 shares of our common stock, $0.01 par value per share, and up to 10,000,000 shares of our preferred stock, $0.01 par value per share.

As of November 15, 2016, there were 576,456,353 shares of our common stock and no shares of our preferred stock outstanding.

We are able to issue

shares of preferred stock with greater rights than our common stock.

Our board of directors is authorized to issue one or more series of preferred

stock from time to time without any action on the part of our stockholders. Our board of directors also has the power, without stockholder approval, to set the terms of any such series of preferred stock that may be issued, including voting rights,

dividend rights, and preferences over our common stock with respect to dividends and other terms. If we issue preferred stock in the future that has a preference over our common stock with respect to the payment of dividends or other terms, or if we

issue preferred stock with voting rights that dilute the voting power of our common stock, the rights of holders of our common stock or the market price of our common stock could be adversely affected.

Provisions in our organizational documents and Delaware law could delay or prevent a change in control of us, which could adversely affect the market

price of our common stock.

Provisions in our organizational documents and under Delaware law could delay or prevent a change in control of us,

which could adversely affect the market price of our common stock. The provisions in our Restated Certificate of Incorporation and bylaws that could delay or prevent an unsolicited change in control of us include the authority of our board of

directors to issue preferred stock discussed above and advance notice provisions for director nominations or business to be considered at a stockholders meeting. In addition, Delaware law imposes certain restrictions on mergers and other business

combinations between us and any holder of 15% or more of our outstanding common stock.

6

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference into this prospectus include forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, referred to in this prospectus as the “Securities Act,” and Section 21E of the Exchange Act. All statements, other than statements of historical facts, including, among others, statements and projections

regarding EOG’s future financial position, operations, performance, business strategy, returns, budgets, reserves, levels of production and costs, statements regarding future commodity prices and statements regarding the plans and objectives of

EOG’s management for future operations, are forward-looking statements. EOG typically uses words such as “expect,” “anticipate,” “estimate,” “project,” “strategy,” “intend,”

“plan,” “target,” “goal,” “may,” “will,” “should” and “believe” or the negative of those terms or other variations or comparable terminology to identify its forward-looking

statements. In particular, statements, express or implied, concerning EOG’s future operating results and returns or EOG’s ability to replace or increase reserves, increase production, reduce or otherwise control operating and capital

costs, generate income or cash flows or pay dividends are forward-looking statements. Forward-looking statements are not guarantees of performance. Although EOG believes the expectations reflected in its forward-looking statements are reasonable and

are based on reasonable assumptions, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all) or will prove to have been correct. Moreover, EOG’s forward-looking

statements may be affected by known, unknown or currently unforeseen risks, events or circumstances that may be outside EOG’s control. Important factors that could cause EOG’s actual results to differ materially from the expectations

reflected in EOG’s forward-looking statements include, among others:

|

|

•

|

|

the timing, extent and duration of changes in prices for, supplies of, and demand for, crude oil and condensate, natural gas liquids, natural gas and related commodities;

|

|

|

•

|

|

the extent to which EOG is successful in its efforts to acquire or discover additional reserves;

|

|

|

•

|

|

the extent to which EOG is successful in its efforts to economically develop its acreage in, produce reserves and achieve anticipated production levels from, and maximize reserve recovery from, its existing and future

crude oil and natural gas exploration and development projects;

|

|

|

•

|

|

the extent to which EOG is successful in its efforts to market its crude oil and condensate, natural gas liquids, natural gas and related commodity production;

|

|

|

•

|

|

the availability, proximity and capacity of, and costs associated with, appropriate gathering, processing, compression, transportation and refining facilities;

|

|

|

•

|

|

the availability, cost, terms and timing of issuance or execution of, and competition for, mineral licenses and leases and governmental and other permits and rights-of-way, and EOG’s ability to retain mineral

licenses and leases;

|

|

|

•

|

|

the impact of, and changes in, government policies, laws and regulations, including tax laws and regulations; environmental, health and safety laws and regulations relating to air emissions, disposal of produced water,

drilling fluids and other wastes, hydraulic fracturing and access to and use of water; laws and regulations imposing conditions or restrictions on drilling and completion operations and on the transportation of crude oil and natural gas; laws and

regulations with respect to derivatives and hedging activities; and laws and regulations with respect to the import and export of crude oil, natural gas and related commodities;

|

|

|

•

|

|

EOG’s ability to effectively integrate acquired crude oil and natural gas properties into its operations, fully identify existing and potential problems with respect to such properties and accurately estimate

reserves, production and costs with respect to such properties;

|

|

|

•

|

|

the extent to which EOG’s third-party-operated crude oil and natural gas properties are operated successfully and economically;

|

|

|

•

|

|

competition in the oil and gas exploration and production industry for the acquisition of licenses, leases and properties, employees and other personnel, facilities, equipment, materials and services;

|

7

|

|

•

|

|

the availability and cost of employees and other personnel, facilities, equipment, materials (such as water) and services;

|

|

|

•

|

|

the accuracy of reserve estimates, which by their nature involve the exercise of professional judgment and may therefore be imprecise;

|

|

|

•

|

|

weather, including its impact on crude oil and natural gas demand, and weather-related delays in drilling and in the installation and operation (by EOG or third parties) of production, gathering, processing, refining,

compression and transportation facilities;

|

|

|

•

|

|

the ability of EOG’s customers and other contractual counterparties to satisfy their obligations to EOG and, related thereto, to access the credit and capital markets to obtain financing needed to satisfy their

obligations to EOG;

|

|

|

•

|

|

EOG’s ability to access the commercial paper market and other credit and capital markets to obtain financing on terms it deems acceptable, if at all, and to otherwise satisfy its capital expenditure requirements;

|

|

|

•

|

|

the extent and effect of any hedging activities engaged in by EOG;

|

|

|

•

|

|

the timing and extent of changes in foreign currency exchange rates, interest rates, inflation rates, global and domestic financial market conditions and global and domestic general economic conditions;

|

|

|

•

|

|

political conditions and developments around the world (such as political instability and armed conflict), including in the areas in which EOG operates;

|

|

|

•

|

|

the use of competing energy sources and the development of alternative energy sources;

|

|

|

•

|

|

the extent to which EOG incurs uninsured losses and liabilities or losses and liabilities in excess of its insurance coverage;

|

|

|

•

|

|

acts of war and terrorism and responses to these acts;

|

|

|

•

|

|

physical, electronic and cyber security breaches; and

|

|

|

•

|

|

the other factors described under Item 1A, “Risk Factors,” on pages 13 through 21 of EOG’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015 and any updates to those factors set forth

in EOG’s subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K.

|

In light of these risks, uncertainties and

assumptions, the events anticipated by EOG’s forward-looking statements may not occur, and, if any of such events do, we may not have anticipated the timing of their occurrence or the duration and extent of their impact on our actual results.

Accordingly, you should not place any undue reliance on any of EOG’s forward-looking statements. EOG’s forward-looking statements speak only as of the date made, and EOG undertakes no obligation, other than as required by applicable law,

to update or revise its forward-looking statements, whether as a result of new information, subsequent events, anticipated or unanticipated circumstances or otherwise.

8

USE OF PROCEEDS

We will not receive any proceeds from the sale of the common stock offered under this prospectus. Any proceeds from the sale of common stock under this

prospectus will be received by the selling stockholders.

DESCRIPTION OF CAPITAL STOCK

Authorized and Outstanding Capital Stock

Our authorized

capital stock consists of:

|

|

•

|

|

640,000,000 shares of common stock, $0.01 par value per share, which we refer to in this prospectus as “common stock;” and

|

|

|

•

|

|

10,000,000 shares of preferred stock, $0.01 par value per share, which we refer to in this prospectus as “preferred stock,” 3,000,000 shares of which have been designated as “Series E Junior Participating

Preferred Stock” (which we refer to in this prospectus as the “Series E preferred stock”), with a liquidation preference of $1.00 per share or an amount equal to the payment made on one share of our common stock, whichever is greater.

|

As of November 15, 2016, there were 576,456,353 shares of our common stock and no shares of our preferred stock outstanding. The following

summary description of our common stock is qualified in its entirety by reference to our Restated Certificate of Incorporation, as amended. Copies of our Restated Certificate of Incorporation and the amendments thereto and our Bylaws are filed as

exhibits to the registration statement of which this prospectus is a part.

Common Stock

Our common stock possesses ordinary voting rights for the election of directors and in respect of other corporate matters, each share being entitled to one

vote. The common stock has no cumulative voting rights, meaning that the holders of a majority of the shares cast for the election of directors can elect all the directors if they choose to do so. The common stock carries no preemptive rights and is

not convertible, redeemable, assessable or entitled to the benefits of any sinking fund. The holders of common stock are entitled to dividends in such amounts and at such times as may be declared by our board of directors out of legally available

funds.

Upon our liquidation or dissolution, the holders of our common stock are entitled to share ratably in all net assets available for distribution to

stockholders after payment of any corporate debts and liquidation and any liquidation preference established for the preferred stock. All outstanding shares of common stock are, and upon issuance against full payment of the purchase price therefor,

shares of common stock offered hereby will be, duly authorized, validly issued, fully paid and non-assessable.

The transfer agent and registrar of the

common stock is Computershare Trust Company, N.A., College Station, Texas.

Preferred Stock

Under our Restated Certificate of Incorporation, as amended, our board of directors may provide for the issuance of up to 10,000,000 shares of preferred

stock in one or more series. We currently have one authorized series of preferred stock: the Series E preferred stock. In February 2000, our board of directors, in connection with a rights agreement, authorized 1,500,000 shares of the Series E

preferred stock, with a liquidation preference of $1.00 per share or an amount equal to the payment made on one share of our common stock, whichever is greater. In March 2005, our board of directors increased the authorized shares of the Series E

preferred stock to 3,000,000 in connection with the two-for-one stock split of the common stock effected in March 2005. The rights agreement and the related preferred share purchase rights expired on February 24, 2010. As of November 15, 2016, there

were no shares of the Series E preferred stock outstanding.

9

The rights, preferences, privileges and restrictions, including liquidation preferences, of the preferred stock

of each additional series will be fixed or designated by our board of directors pursuant to a certificate of designations without any further vote or action by our stockholders.

Limitation on Directors’ Liability

Delaware

corporation law authorizes corporations to limit or eliminate the personal liability of directors to corporations and their stockholders for monetary damages for breach of directors’ fiduciary duty of care. The duty of care requires that, when

acting on behalf of the corporation, directors must exercise an informed business judgment based on all material information reasonably available to them. Absent the limitations authorized by such laws, directors are accountable to corporations and

their stockholders for monetary damages for conduct constituting gross negligence in the exercise of their duty of care. Delaware law enables corporations to limit available relief to equitable remedies such as injunction or rescission. Our Restated

Certificate of Incorporation, as amended, limits the liabilities of our directors to us or our stockholders, in their capacity as directors but not in their capacity as officers, to the fullest extent permitted by Delaware law. Specifically, our

directors will not be personally liable for monetary damages for breach of a director’s fiduciary duty as a director, except for liability:

|

|

•

|

|

for any breach of the director’s duty of loyalty to us or to our stockholders;

|

|

|

•

|

|

for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law;

|

|

|

•

|

|

for unlawful payments of dividends or unlawful stock repurchases or redemptions as provided in Section 174 of the General Corporation Law of the State of Delaware; or

|

|

|

•

|

|

for any transaction from which the director derived an improper personal benefit.

|

This provision in our

Restated Certificate of Incorporation, as amended, may have the effect of reducing the likelihood of derivative litigation against directors, and may discourage or deter stockholders or management from bringing a lawsuit against directors for breach

of their duty of care, even though such an action, if successful, might otherwise have benefited us and our stockholders.

Anti-Takeover Provisions

Certain provisions in our organizational documents could delay or prevent an unsolicited change in control of us, including the authority of our board

of directors to issue preferred stock discussed above and advance notice provisions for director nominations or business to be considered at a stockholders meeting. In addition, Delaware law imposes certain restrictions on mergers and other business

combinations between us and any holder of 15% or more of our outstanding common stock.

10

SELLING STOCKHOLDERS

This prospectus covers the offering of up to 25,203,773 shares of our common stock by the selling stockholders identified below. The selling stockholders

listed below may from time to time offer and sell pursuant to this prospectus all 25,203,773 shares of our common stock. We are registering these 25,203,773 shares of our common stock for sale by the selling stockholders named below pursuant to (i)

a registration rights agreement, dated October 4, 2016, between us and certain of the selling stockholders which we entered into pursuant to an Agreement and Plan of Merger, dated as of September 2, 2016, by and among EOG, ERI Holdings I, Inc. and

Yates Petroleum Corporation; (ii) a registration rights agreement, dated October 4, 2016, between us and certain of the selling stockholders which we entered into pursuant to an Agreement and Plan of Merger, dated as of September 2, 2016, by and

among EOG, ERI Holdings II, Inc. and Abo Petroleum Corporation; (iii) a registration rights agreement, dated October 4, 2016, between us and certain of the selling stockholders which we entered into pursuant to an Agreement and Plan of Merger, dated

as of September 2, 2016, by and among EOG, ERI Holdings III, Inc. and MYCO Industries, Inc.; (iv) a registration rights agreement, dated November 18, 2016, by and between EOG and Trust Q u/w/o Peggy A. Yates (deceased) dated November 20, 1989; (v) a

registration rights agreement, dated November 18, 2016, by and between EOG and Los Chicos; and (vi) a registration rights agreement, dated November 16, 2016, by and between EOG and Yates Industries, LLC (the “

Registration Rights

Agreements

”). Pursuant to the Registration Rights Agreements, we will pay all expenses relating to the registration and offering of these shares, except that the selling stockholders will pay any commissions due to brokers, dealers or

agents and similar fees and fees of counsel incurred by such selling stockholder. However, we will not receive any of the proceeds from the sales of common stock by the selling stockholders. The term “selling stockholders” includes the

stockholders listed in the table below and their transferees, pledgees, donees, assignees or other successors.

Except as set forth in, or incorporated by

reference into, this prospectus or in any applicable prospectus supplement, none of the selling stockholders has held any position or office with, been employed by, or otherwise has had a material relationship with us or any of our affiliates during

the three years prior to the date of this prospectus.

No offer or sale under this prospectus may be made by a stockholder unless that holder is listed in

the table below, in a supplement to this prospectus or in an amendment to the related registration statement that has become effective. We may supplement or amend this prospectus to include additional selling stockholders.

11

The following table sets forth information relating to the selling stockholders as of November 18, 2016, based on

information supplied to us by the selling stockholders on or prior to that date. We have not sought to verify such information. The selling stockholders may hold or acquire at any time shares of our common stock in addition to the shares offered by

this prospectus and may have acquired additional shares of our common stock since the date on which the information reflected herein was provided to us. Additionally, the selling stockholders may have sold or transferred some or all of their shares

of our common stock in transactions exempt from the registration requirements of the Securities Act since such date. Other information about the selling stockholders may also change over time. The following table sets forth the maximum number of

shares of our common stock that may be sold by the selling stockholders identified below. Because the selling stockholders may offer all or some of their shares of our common stock from time to time, we cannot estimate the number of shares of our

common stock that will be held by the selling stockholders upon the termination of any particular offering by such selling stockholders. The selling stockholders are not obligated to sell any of the shares of common stock offered by this prospectus.

The selling stockholders reserve the right to accept or reject, in whole or in part, any proposed sale of shares. The selling stockholders may also offer and sell less than the number of shares of common stock indicated. The selling stockholders are

not making any representation that any shares of common stock covered by this prospectus will or will not be offered for sale.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of Common Stock

Beneficially Owned

Prior to the Offering

|

|

|

Shares of

Common

Stock That

May Be

Offered

|

|

|

Shares of Common Stock

Beneficially Owned

After the Offering(2)

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

|

Percentage(1)

|

|

|

|

Number

|

|

|

Percentage(1)

|

|

|

Andrew P. Yates 2012 Irrevocable Trust(3)

|

|

|

26,703

|

|

|

|

0.00

|

%

|

|

|

26,703

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Bobby and Shari Smith 2012 Delaware Trust(4)

|

|

|

165,972

|

|

|

|

0.02

|

%

|

|

|

165,972

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Bow Brook LLLP (5)

|

|

|

1,437,187

|

|

|

|

0.25

|

%

|

|

|

1,437,187

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Brenda Yates

|

|

|

154,844

|

|

|

|

0.03

|

%

|

|

|

154,844

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Courtney S. Yates 2012 Irrevocable Trust(6)

|

|

|

26,703

|

|

|

|

0.00

|

%

|

|

|

26,703

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Cynthia Ann Yates Price

|

|

|

2,700,139

|

(7)

|

|

|

0.47

|

%

|

|

|

1,337,781

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Dads Lifework LP(8)

|

|

|

556,330

|

|

|

|

0.10

|

%

|

|

|

556,330

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Dan Lewis, Trustee of the Irrevocable Trey Yates Trust UTA dated December 4, 2012(9)

|

|

|

525,473

|

|

|

|

0.09

|

%

|

|

|

525,473

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Darin Eugene Yates

|

|

|

2,645,419

|

(10)

|

|

|

0.46

|

%

|

|

|

1,718,201

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Douglas E. Brooks

|

|

|

199,166

|

|

|

|

0.03

|

%

|

|

|

199,166

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Foghorn II Trust(11)

|

|

|

162,403

|

|

|

|

0.03

|

%

|

|

|

162,403

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Foghorn’s Baby EHY for Andrew Porter Yates(12)

|

|

|

185,443

|

|

|

|

0.03

|

%

|

|

|

185,443

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Foghorn’s Baby EHY for Courtney St. Clair Yates(13)

|

|

|

185,443

|

|

|

|

0.03

|

%

|

|

|

185,443

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Foghorn’s Baby EHY for Kelsy Megan Yates(14)

|

|

|

185,443

|

|

|

|

0.03

|

%

|

|

|

185,443

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Frank Yates, Jr.

|

|

|

1,969,682.948

|

(15)

|

|

|

0.34

|

%

|

|

|

1,718,201

|

|

|

|

539.948

|

|

|

|

0.00

|

%

|

|

Jeffrey Martin Price

|

|

|

152,230

|

|

|

|

0.03

|

%

|

|

|

152,230

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Jo Ann Yates

|

|

|

2,735,179

|

(16)

|

|

|

0.47

|

%

|

|

|

1,807,961

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Jo Ann Yates 2012 Delaware Trust(17)

|

|

|

463,609

|

|

|

|

0.08

|

%

|

|

|

463,609

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Jo Ann Yates 2013 Delaware Trust(18)

|

|

|

463,609

|

|

|

|

0.08

|

%

|

|

|

463,609

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

John A. Yates, III

|

|

|

1,298

|

|

|

|

0.00

|

%

|

|

|

1,298

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

John A. Yates, Sr. Trust Established Under the John A. Yates, Sr. and Charlotte G. Yates Revocable

Trust(19)

|

|

|

1,917,125

|

|

|

|

0.33

|

%

|

|

|

1,871,125

|

|

|

|

46,000

|

|

|

|

0.01

|

%

|

|

John A. Yates, Sr., Trustee of Trust Q u/w/o Peggy A. Yates (deceased) dated November 20,

1989(20)

|

|

|

3,926,179

|

|

|

|

0.68

|

%

|

|

|

3,923,179

|

|

|

|

3,000

|

|

|

|

0.00

|

%

|

12

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares of Common Stock

Beneficially Owned

Prior to the Offering

|

|

|

Shares of

Common

Stock That

May Be

Offered

|

|

|

Shares of Common Stock

Beneficially Owned

After the Offering(2)

|

|

|

Name of Selling Stockholder

|

|

Number

|

|

|

Percentage(1)

|

|

|

|

Number

|

|

|

Percentage(1)

|

|

|

John A. Yates, Jr. and Cynthia Yates Price, Trustee of the John A. Yates, Sr. Trust UTA dated

December 13, 2010(21)

|

|

|

611,893

|

|

|

|

0.11

|

%

|

|

|

611,893

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

John A. Yates, Jr., and Cynthia Yates Price, Trustee of the John A. Yates, Sr.,

Grandchildren’s Trust UTA dated December 27, 2010(22)

|

|

|

479,363

|

|

|

|

0.08

|

%

|

|

|

479,363

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

John A. Yates, Jr. and Cynthia Yates Price, Trustee of the John A. Yates, Sr., Exempt Trust UTA

dated January 3, 2011(23)

|

|

|

253,780

|

|

|

|

0.04

|

%

|

|

|

253,780

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

John A Yates, Jr., and Nancy E. Yates, Trustee of the John Yates, Jr. and Nancy Yates Revocable

Trust UTA Dated September 21, 2012(24)

|

|

|

879,651

|

|

|

|

0.15

|

%

|

|

|

879,651

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Kelsy M. Yates 2012 Irrevocable Trust(25)

|

|

|

26,703

|

|

|

|

0.00

|

%

|

|

|

26,703

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Los Chicos (26)

|

|

|

17,140

|

|

|

|

0.00

|

%

|

|

|

17,140

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Nicole S. Price Wesselmann

|

|

|

152,370

|

|

|

|

0.03

|

%

|

|

|

152,230

|

|

|

|

140

|

|

|

|

0.00

|

%

|

|

PY Foundation

|

|

|

556,330

|

|

|

|

0.10

|

%

|

|

|

556,330

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

PY 2012 Trust(27)

|

|

|

162,403

|

|

|

|

0.03

|

%

|

|

|

162,403

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Richard M. Yates

|

|

|

1,202,228

|

(28)

|

|

|

0.21

|

%

|

|

|

483,496

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Ryan Ashby Price

|

|

|

152,230

|

|

|

|

0.03

|

%

|

|

|

152,230

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Scott and Jill Yates 2012 Delaware Trust(29)

|

|

|

927,218

|

|

|

|

0.16

|

%

|

|

|

927,218

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Scott Martin Yates

|

|

|

2,645,419

|

(30)

|

|

|

0.46

|

%

|

|

|

790,983

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Sean Joseph Price

|

|

|

154,756

|

|

|

|

0.03

|

%

|

|

|

152,230

|

|

|

|

2,526

|

|

|

|

0.00

|

%

|

|

Shari Ann Yates

|

|

|

1,718,200

|

(31)

|

|

|

0.30

|

%

|

|

|

1,552,228

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

St. Clair Peyton Yates, Jr.

|

|

|

1,205,382

|

(32)

|

|

|

0.21

|

%

|

|

|

486,649

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

Yates Industries, LLC(33)

|

|

|

250,942

|

|

|

|

0.04

|

%

|

|

|

250,942

|

|

|

|

0

|

|

|

|

0.00

|

%

|

|

(1)

|

Based upon an aggregate of 576,456,353 shares outstanding as of November 15, 2016.

|

|

(2)

|

Assumes that the selling stockholders dispose of all the shares of common stock covered by this prospectus and do not acquire beneficial ownership of any additional shares. The registration of these shares does not

necessarily mean that the selling stockholders will sell all or any portion of the shares covered by this prospectus.

|

|

(3)

|

Century Trust and Asset Management, a division of Century Bank is the trustee of the Andrew P. Yates 2012 Irrevocable Trust.

|

|

(4)

|

J.P. Morgan Trust Company of Delaware is the trustee of the Bobby and Shari Smith 2012 Delaware Trust. Each of Bobby J. Smith, Shari A. Yates, Ryan Brewer and Rustin Brewer share voting and investment power over the

shares of common stock held by the Bobby and Shari Smith 2012 Delaware Trust and may be deemed to own beneficially shares of common stock held by the Bobby and Shari Smith 2012 Delaware Trust.

|

|

(5)

|

Under the Agreement of Bow Brook LLLP, the voting and disposition of the shares of common stock held by Bow Brook LLLP are controlled by its sole general partner. Peyton Davis is the sole general partner of Bow Brook

LLLP.

|

|

(6)

|

Century Trust and Asset Management, a division of Century Bank is the trustee of the Courtney S. Yates 2012 Irrevocable Trust.

|

|

(7)

|

The John A. Yates, Sr., Grandchildren’s Trust UTA dated December 27, 2010 is the beneficial owner of 479,363

shares of common stock it holds directly. John A. Yates, Jr. and Cynthia Yates Price are the co-trustees of the John A. Yates, Sr., Grandchildren’s Trust UTA dated December 27, 2010. Accordingly, Cynthia Ann Yates Price may be deemed to be the

beneficial owner of 479,363 shares of common stock. The John A. Yates, Sr., Exempt Trust UTA dated January 3, 2011 is the beneficial owner of 253,780 shares of common stock it holds directly. John A. Yates, Jr. and Cynthia Yates Price are the

co-trustees of the John A. Yates, Sr., Exempt Trust UTA dated January 3, 2011. Accordingly, Cynthia Ann Yates Price may be deemed to be the beneficial owner of 253,780 shares of common stock. The John A. Yates, Sr. Trust UTA dated December 13, 2010

is the beneficial owner of 611,893 shares of common stock it holds directly. John A. Yates, Jr. and Cynthia Yates Price are the co-trustees of the John A. Yates, Sr. Trust UTA dated December 13, 2010. Accordingly, Cynthia Ann Yates Price may be

deemed to be the beneficial owner of

|

13

|

|

611,893 shares of common stock. Los Chicos is the beneficial owner of 17,140 shares of common stock it holds directly. John A. Yates, Jr. and Cynthia Yates Price are the general partners of Los

Chicos. Accordingly, Cynthia Ann Yates Price may be deemed to be the beneficial owner of 17,140 shares of common stock.

|

|

(8)

|

PY Cabin, LLC is the sole managing partner of Dads Lifework LP. St. Clair Peyton Yates, Jr. is the sole managing member of PY Cabin, LLC and may be deemed to be the beneficial owner of 556,330 shares of common stock

held by Dads Lifework LP.

|

|

(9)

|

Dan Lewis is the trustee of the Irrevocable Trey Yates Trust.

|

|

(10)

|

The Jo Ann Yates 2012 Delaware Trust is the beneficial owner of 463,609 shares of common stock it holds directly. J.P. Morgan Trust Company of Delaware is the trustee of the Jo Ann Yates 2012 Delaware Trust. Each of Jo

Ann Yates, Scott M. Yates and Darin E. Yates share voting and investment power over the shares of common stock held by the Jo Ann Yates 2012 Delaware Trust. Accordingly, Darin E. Yates may be deemed to be the beneficial owner 463,609 shares of

common stock. The Jo Ann Yates 2013 Delaware Trust is the beneficial owner of 463,609 shares of common stock it holds directly. J.P. Morgan Trust Company of Delaware is the trustee of the Jo Ann Yates 2013 Delaware Trust. Each of Jo Ann Yates, Scott

M. Yates and Darin E. Yates share voting and investment power over the shares of common stock held by the Jo Ann Yates 2013 Delaware Trust. Accordingly, Darin E. Yates may be deemed to be the beneficial owner 463,609 shares of common stock.

|

|

(11)

|

Richard Martin Yates is the trustee of the Foghorn II Trust.

|

|

(12)

|

Richard Martin Yates is the trustee of the Foghorn’s Baby EHY For Andrew Porter Yates.

|

|

(13)

|

Richard Martin Yates is the trustee of the Foghorn’s Baby EHY For Courtney St. Clair Yates.

|

|

(14)

|

Richard Martin Yates is the trustee of the Foghorn’s Baby EHY For Kelsy Megan Yates.

|

|

(15)

|

Yates Industries, LLC is the beneficial owner of 250,942 shares of common stock it holds directly. Yates Industries, LLC is a single member limited liability company wholly owned by Frank Yates, Jr. Accordingly, Frank

Yates, Jr. may be deemed to be the beneficial owner of 250,942 shares of common stock.

|

|

(16)

|

The Jo Ann Yates 2012 Delaware Trust is the beneficial owner of 463,609 shares of common stock it holds directly. J.P. Morgan Trust Company of Delaware is the trustee of the Jo Ann Yates 2012 Delaware Trust. Each of Jo

Ann Yates, Scott M. Yates and Darin E. Yates share voting and investment power over the shares of common stock held by the Jo Ann Yates 2012 Delaware Trust. Accordingly, Jo Ann Yates may be deemed to be the beneficial owner 463,609 shares of common

stock. The Jo Ann Yates 2013 Delaware Trust is the beneficial owner of 463,609 shares of common stock it holds directly. J.P. Morgan Trust Company of Delaware is the trustee of the Jo Ann Yates 2013 Delaware Trust. Each of Jo Ann Yates, Scott M.

Yates and Darin E. Yates share voting and investment power over the shares of common stock held by the Jo Ann Yates 2013 Delaware Trust. Accordingly, Jo Ann Yates may be deemed to be the beneficial owner 463,609 shares of common stock.

|

|

(17)

|

J.P. Morgan Trust Company of Delaware is the trustee of the Jo Ann Yates 2012 Delaware Trust. Each of Jo Ann Yates, Scott M. Yates and Darin E. Yates share voting and investment power over the shares of common stock

held by the Jo Ann Yates 2012 Delaware Trust.

|

|

(18)

|

J.P. Morgan Trust Company of Delaware is the trustee of the Jo Ann Yates 2013 Delaware Trust. Each of Jo Ann Yates, Scott M. Yates and Darin E. Yates share voting and investment power over the shares of common stock

held by the Jo Ann Yates 2013 Delaware Trust.

|

|

(19)

|

John A. Yates, Sr. is the trustee of the John A. Yates, Sr. Trust Established Under the John A. Yates, Sr. and Charlotte G. Yates Revocable Trust.

|

|

(20)

|

John A. Yates, Sr. is the trustee of Trust Q, u/w/o Peggy A. Yates (deceased) dated November 20, 1989.

|

|

(21)

|

John A. Yates, Jr. and Cynthia Yates Price are the co-trustees of the John A. Yates, Sr., Trust UTA dated December 13, 2010.

|

|

(22)

|

John A. Yates, Jr. and Cynthia Yates Price are the co-trustees of the John A. Yates, Sr., Grandchildren’s Trust UTA dated December 27, 2010.

|

|

(23)

|

John A. Yates, Jr. and Cynthia Yates Price are the co-trustees of the John A. Yates, Sr., Exempt Trust UTA dated January 3, 2011.

|

|

(24)

|

John A. Yates, Jr. and Nancy E. Yates are the co-trustees of the John Yates, Jr. and Nancy Yates Revocable Trust.

|

|

(25)

|

Century Trust and Asset Management, a division of Century Bank is the trustee of the Kelsy M. Yates 2012 Irrevocable Trust.

|

|

(26)

|

John A. Yates, Jr. and Cynthia Yates Price are the general partners of Los Chicos.

|

|

(27)

|

St. Clair Peyton Yates, Jr. is the trustee of the PY 2012 Trust.

|

14

|

(28)

|

The Foghorn II Trust is the beneficial owner of 162,403 shares of common stock it holds directly. Richard Martin Yates is the trustee of the Foghorn II Trust. Accordingly, Richard Martin Yates may be deemed to be the

beneficial owner of 162,403 shares of common stock. The Foghorn’s Baby EHY For Andrew Porter Yates is the beneficial owner of 185,443 shares of common stock it holds directly. Richard Martin Yates is the trustee of the Foghorn’s Baby EHY

For Andrew Porter Yates. Accordingly, Richard Martin Yates may be deemed to be the beneficial owner of 185,443 shares of common stock. The Foghorn’s Baby EHY For Courtney St. Clair Yates is the beneficial owner of 185,443 shares of common stock

it holds directly. Richard Martin Yates is the trustee of the Foghorn’s Baby EHY For Courtney St. Clair Yates. Accordingly, Richard Martin Yates may be deemed to be the beneficial owner of 185,443 shares of common stock. The Foghorn’s Baby

EHY For Kelsy Megan Yates is the beneficial owner of 185,443 shares of common stock it holds directly. Richard Martin Yates is the trustee of the Foghorn’s Baby EHY For Kelsy Megan Yates. Accordingly, Richard Martin Yates may be deemed to be

the beneficial owner 185,443 shares of common stock.

|

|

(29)

|

J.P. Morgan Trust Company of Delaware is the trustee of the Scott and Jill Yates 2012 Delaware Trust. Each of Scott M. Yates, Marilyn Jill Yates, Amber R. Yates, Jakob S. Yates, Chambrie E. Yates and Glenn R. McColpin

share voting and investment power over the shares of common stock held by the Scott and Jill Yates 2012 Delaware Trust. J.P.

|

|

(30)

|

The Jo Ann Yates 2012 Delaware Trust is the beneficial owner of 463,609 shares of common stock it holds directly. J.P. Morgan Trust Company of Delaware is the trustee of the Jo Ann Yates 2012 Delaware Trust. Each of Jo

Ann Yates, Scott M. Yates and Darin E. Yates share voting and investment power over the shares of common stock held by the Jo Ann Yates 2012 Delaware Trust. Accordingly, Scott Martin Yates may be deemed to be the beneficial owner 463,609 shares of

common stock. The Jo Ann Yates 2013 Delaware Trust is the beneficial owner of 463,609 shares of common stock it holds directly. J.P. Morgan Trust Company of Delaware is the trustee of the Jo Ann Yates 2013 Delaware Trust. Each of Jo Ann Yates, Scott

M. Yates and Darin E. Yates share voting and investment power over the shares of common stock held by the Jo Ann Yates 2013 Delaware Trust. Accordingly, Scott Martin Yates may be deemed to be the beneficial owner 463,609 shares of common stock. The

Scott and Jill Yates 2012 Delaware Trust is the beneficial owner of 927,218 shares of common stock it holds directly. J.P. Morgan Trust Company of Delaware is the trustee of the Scott and Jill Yates 2012 Delaware Trust. Each of Scott M. Yates,

Marilyn Jill Yates, Amber R. Yates, Jakob S. Yates, Chambrie E. Yates and Glenn R. McColpin share voting and investment power over the shares of common stock held by the Scott and Jill Yates 2012 Delaware Trust. J.P. Accordingly, Scott Martin Yates

may be deemed to be the beneficial owner 927,218 shares of common stock.

|

|

(31)

|

The Bobby and Shari Smith 2012 Delaware Trust is the beneficial owner of 165,972 shares of common stock it holds directly. J.P. Morgan Trust Company of Delaware is the trustee of the Bobby and Shari Smith 2012 Delaware

Trust. Each of Bobby J. Smith, Shari A. Yates, Ryan Brewer and Rustin Brewer share voting and investment power over the shares of common stock held by the Bobby and Shari Smith 2012 Delaware Trust. Accordingly, Shari Ann Yates may be deemed to be

the beneficial owner 165,972 shares of common stock.

|

|

(32)

|

PY 2012 Trust is the beneficial owner of 162,403 shares of common stock it holds directly. St. Clair Peyton Yates, Jr. is the trustee of the PY 2012 Trust. Accordingly, St. Clair Peyton Yates, Jr. may be deemed to be

the beneficial owner of 162,403 shares of common stock. Dads Lifework L.P. is the beneficial owner of 556,330 shares of common stock it holds directly. PY Cabin, LLC is the sole managing partner of Dads Lifework LP. St. Clair Peyton Yates, Jr. is

the sole managing member of PY Cabin, LLC. Accordingly, St. Clair Peyton Yates, Jr. may be deemed to be the beneficial owner of 556,330 shares of common stock.

|

|

(33)

|

Yates Industries, LLC is a single member limited liability company wholly owned by Frank Yates, Jr. Accordingly, Frank Yates, Jr. may be deemed to be the beneficial owner of 250,942 shares of common stock.

|

15

PLAN OF DISTRIBUTION

The selling stockholders may, from time to time, sell any or all of their shares of common stock offered by this prospectus on any stock exchange, market or

trading facility on which the shares are traded or in private transactions. Subject to the limitations set forth in the Registration Rights Agreements, the selling stockholders may use any one or more of the following methods when selling the shares

of common stock offered by this prospectus:

|

|

•

|

|

through brokers, dealers or agents;

|

|

|

•

|

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

•

|

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

•

|

|

privately negotiated transactions;

|

|

|

•

|

|

settlement of short sales entered into after the effective date of the registration statement of which this prospectus is a part;

|

|

|

•

|

|

broker-dealers may agree with the selling stockholders to sell a specified number of such shares at a stipulated price per share;

|

|

|

•

|

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

•

|

|

a combination of any such methods of sale; and

|

|

|

•

|

|

any other method permitted pursuant to applicable law.

|

In addition, the selling stockholders may from time to

time sell common stock in compliance with Rule 144 under the Securities Act, if available, or pursuant to other available exemptions from the registration requirements under the Securities Act, rather than pursuant to this prospectus. In such event,

the selling stockholders may be required by the securities laws of certain states to offer and sell the shares of common stock only through registered or licensed brokers or dealers.

The selling stockholders may set the price or prices of their shares of common stock at:

|

|

•

|

|

varying prices determined at the time of sale;

|

|

|

•

|

|

market prices prevailing at the time of any sale under this registration statement;

|

|

|

•

|

|

prices related to market prices; or

|

From time to time, the selling stockholders may pledge or grant a security interest in

some or all of the common stock owned by them. If a selling stockholder defaults in performance of its secured obligations, the pledged or secured parties may offer and sell the common stock from time to time by this prospectus after we have filed a

prospectus supplement amending the list of selling stockholders to include the pledgee, transferee, or other successor-in-interest as a selling stockholder under this prospectus.

The selling stockholders also may transfer the common stock in other circumstances. The amount of common stock beneficially owned by a selling stockholder

will decrease as and when it transfers its common stock or defaults in performing obligations secured by the common stock. The plan of distribution for the common stock offered and sold under this prospectus will otherwise remain unchanged, except

that the transferees, distributees, pledgees, affiliates, other secured parties or other successors in interest will be selling stockholders for purposes of this prospectus.

16

Broker-dealers or other persons may receive commissions from the selling stockholders, or they may receive

commissions from purchasers of the shares of common stock for whom they acted as agents, or both. Any of such commissions might be in excess of those customary in the types of transactions involved. Broker-dealers or other persons engaged by the

selling stockholders may allow other broker-dealers or other persons to participate in resales. The selling stockholders may agree to indemnify any broker-dealer or agent against certain liabilities related to the selling of the common stock,

including liabilities arising under the Securities Act. If a broker-dealer purchases common stock as a principal, it may resell the common stock for its own account under this prospectus. A distribution of the common stock by the selling

stockholders may also be effected through the issuance by the selling stockholder or others of derivative securities, including warrants, exchangeable securities, forward delivery contracts and the writing of options.

The aggregate proceeds to the selling stockholders from the sale of the common stock will be the purchase price of the common stock less the aggregate

agents’ commissions, if any, and other expenses of the distribution not borne by us. The selling stockholders and any agent, broker or dealer that participates in sales of common stock offered by this prospectus may be deemed

“underwriters” under the Securities Act and any profits, commissions or other consideration received by any agent, broker or dealer may be considered underwriting discounts or commissions under the Securities Act.

Any of the selling stockholders’ agents or any of either of their affiliates may be customers of, engage in transactions with and perform services for

us, and/or the selling stockholders or their affiliates in the ordinary course of business.

To our knowledge, there are currently no plans, arrangements

or understandings between either of the selling stockholders and any broker, dealer or agent regarding the sale of the common stock by the selling stockholders.

The selling stockholders and any other person participating in the sale of the common stock will be subject to the Exchange Act. The Exchange Act rules

include, without limitation, Regulation M, which may limit the timing of purchases and sales of any of the common stock by the selling stockholders and any other such person. In addition, Regulation M may restrict the ability of any person engaged

in the distribution of the common stock to engage in market-making activities with respect to the particular common stock being distributed. This may affect the marketability of the common stock and the ability of any person or entity to engage in

market-making activities with respect to the common stock.

To the extent required, this prospectus may be amended or supplemented from time to time to

describe a specific plan of distribution.

17

LEGAL MATTERS

Certain legal matters in connection with the offering of the common stock will be passed upon for us by Akin Gump Strauss Hauer & Feld LLP, Houston,

Texas.

EXPERTS

The consolidated financial statements incorporated in this Prospectus by reference from the Company’s Annual Report on Form 10-K for the year ended

December 31, 2015, and the effectiveness of the Company’s internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their report, which is

incorporated herein by reference. Such consolidated financial statements have been so incorporated in reliance upon the report of such firm given upon their authority as experts in accounting and auditing.

The letter report of DeGolyer and MacNaughton, independent petroleum consultants, included as an exhibit to our Annual Report on Form 10-K for the year

ended December 31, 2015 and the estimates from the reports of that firm appearing in such Annual Report, are incorporated herein by reference on the authority of said firm as experts in petroleum engineering.

18

Part II

INFORMATION NOT REQUIRED IN PROSPECTUS

|

ITEM 14.

|

Other expenses of issuance and distribution

|

The following table sets forth the expenses

to be incurred by EOG Resources, Inc., referred to herein as the “Registrant,” in connection with the issuance and distribution of the securities being registered.

|

|

|

|

|

|

|

Securities and Exchange Commission Registration Fee

|

|

$

|

267,837

|

|

|

Legal Fees and Expenses

|

|

$

|

75,000

|

|

|

Accounting Fees and Expenses

|

|

$

|

25,000

|

|

|

Printing and Engraving Expenses

|

|

$

|

15,000

|

|

|

Miscellaneous

|

|

$

|

2,500

|

|

|

Total

|

|

$

|

385,337

|

|

|

|

|

|

|

|

|

ITEM 15.

|

Indemnification of directors and officers

|

Section 145 of the General

Corporation Law of the State of Delaware permits a corporation to include in its charter documents and in agreements between the corporation and its directors and officers provisions as to the scope of indemnification.