UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10/A

(Amendment No. 1)

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the

Securities Exchange Act of 1934

TGI

Solar Power Group Inc.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

20-2976749

|

|

(State or other jurisdiction of incorporation)

|

I.R.S. Employer Identification Number

|

1011 Whitehead Road Ext, Suite 101, Ewing,

NJ 08638

(Address of principal executive offices)

(609) 201-2099

(Registrant’s telephone number, including

area code)

Securities to be registered under Section

12(g) of the Act:

Common stock, par value $0.001 per share

(Title of class)

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of

“large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2

of the Exchange Act.

|

Large accelerated filer

¨

|

Accelerated filer

¨

|

|

|

|

|

Non-accelerated filer

¨

|

Smaller reporting company

x

|

|

(Do not check if a smaller reporting company)

|

|

TABLE OF CONTENTS

References to "we," "us,"

"our", "our company" and "the Company" in this Form 10 refer to TGI Solar Power Group, Inc. ("TGI"

or the "Company") and, unless the context indicates otherwise, includes TGI's wholly-owned subsidiaries.

Item 1. Business.

Background

TGI Solar Power Group, Inc. (“TGI”

or the “Company”) is a publicly held corporation formed under the laws of the State of Delaware as Liberty Leasing

Co. Inc. in 1967. The Company changed its name to LIBCO Corporation on June 29, 1973, RDIS Corporation on January 11, 1993 and

TenthGate International, Inc. on February 20, 2007, before adopting its current name in June 2008. Tenth Gate International, Inc.

acquired TenthGate Incorporated, a Delaware corporation, by merger of TGI’s subsidiary, TenthGate Merger Sub, Inc., a Utah

corporation, with and into TenthGate Incorporated in April 2007. Thereafter, TenthGate International, Inc. became a development

stage company which owned various subsidiaries with licenses and patents held by those subsidiaries. On July 25, 2008, Tenth Gate

International, Inc., acquired, as a result of a merger with Solar 18 Corporation, a Florida corporation, (“Solar 18”),

Solar 18’s license to manufacture, sell, market and distribute Solar 18’s patented thin-film solar panel technology

which the Company believed to be viable in commercial and residential applications, especially in the field of green energy. Thereafter,

the Company changed its name to TGI Solar Power Group, Inc. TGI Solar Power Group, Inc. discontinued operations of its other subsidiaries

(of the former TenthGate International, Inc.) to pursue the energy technology products and services the Company licensed from Solar

18. However, due to the severe reduction in price of solar panels after the acquisition, the Company was unable to effectively

pursue manufacturing solar panels at a competitive price.

TGI Solar Power Group, Inc. is primarily

engaged in the business of providing potential alternative energy solutions to residential and business customers. The Company

markets alternative energy solutions on its website and directly to potential customers and attempts to create a Present Value

solution that details price, tax benefits or cost support and the potential energy savings that might be realized from customers

installing an alternative energy solution to support their energy needs.

On June 26, 2016, the Company sold 137,500

shares of its Series C Convertible Preferred Stock (the “Series C Stock”) each to Ensure HR, LLC, a New Jersey limited

liability company (“Ensure”) and Meros HR, LLC, a New Jersey limited liability company (“Meros”). The Series

C Stock is convertible into a number of shares of the Company’s common stock, par value $0.001 per share (the “Common

Stock”) at the conversion price of $0.0000161240 per share and votes on an as converted basis, multiplied by 1.9. As a result,

the sale of the Series C Stock resulted in a change of control of the Company.

Accordingly, TGI intends to launch new

business initiatives intended to provide clients with management, tools and resources to deliver interactive, real-time, on demand

staffing for full time and project based personnel. The Company is exploring the possibility of entering into a business

to provide staffing for contract projects in solar or alternative energy, as well as potentially in other businesses. The Company

intends these business initiatives will result in infrastructure which supports qualifying, investigating and on-boarding of viable

project management candidates. This process includes automated reporting of hours, benefits and insurance and obtaining insurance

and building expertise that may drive continued support of this model. The model may include three offerings to companies: permanent,

temporary and contract-based staffing in five established vertical markets: information technology, engineering, light industrial,

financial services and medical.

The Company is also exploring launching

a job board technology, smart phone application and a broker network. With this technology, the Company hopes it can leverage its

historical connections and management’s potential customer base. The staffing and support industry for sourced labor and

human capital and resource management is over $400 billion dollars worldwide according to the Staffing Industry Analysts, a leading

trade association.

TGI Solar has been involved in planning

and gathering resources for solar and alternative energy projects over the past eight years. TGI Solar has had discussion with

a number of third parties to provide consulting and staffing services within the period of this report, however, these discussions

did not lead to revenues for the Company. In various projects examined over the past years in the solar and alternative energy

industry, governmental legislation, reporting, benefit and compliance hurdles have become burdensome fixed costs for many growing

mid-size to larger companies, and the Company believes that it may be able to successfully launch a business initiative in this

arena.

While the Company has not generated revenues from its business

activities for the periods reported in this Annual Report, it has since been retained to provide strategic consulting services.

Market Overview

Alternative Energy

Solar energy is a growing form of renewable

energy with numerous economic and tax incentives, as well as environmental benefits that make it an attractive complement to, and/or

substitute for, traditional forms of electricity generation. In recent years, the price of Photo Voltaic (“PV”) systems,

and accordingly the cost of producing electricity from PV solar, has dropped to levels that are in some markets and applications

close to (or even below) the retail price of electricity. Solar markets worldwide continue to develop, both at the module and system

level, which make solar power more affordable to new markets.

TGI Solar Power Group Inc. has attempted

to build a business in solar and alternative energy in the United States that focuses on residential and small commercial installations

to reduce power costs, take advantage of tax incentives and to reduce electrical bills by moving power from the usage location

back onto the active electric grid (“back metering”). Large corporate, financial and governmental agencies provide

opportunities to capture management and oversight over larger scale PV projects and agents in the United States and in the Middle

East that will introduce the Company to mid to large scale projects with a design on providing end to end, or part of, overall

project installations in the regions where we have access to staff and support personnel to build a viable business model in solar

PV installation, support and service. Based upon the business opportunities in project management and the technology and expertise

that the Company has developed for solar projects and installation, we have made plans to establish consulting and personnel service

business units.

Staffing

US staffing industry revenue rose by 7%

in 2015 and is anticipated to rise by approximately 6% in 2016 to bring total US revenue in the industry to a record $142.4 billion,

according to the new industry forecast by Staffing Industry Analysts. Revenue considered for the report includes commercial and

professional temporary staffing, direct hire, retained search, and temp to hire.

Higher bill rates because of the Affordable

Care Act are helping drive this increase along with rising pay rates for some high demand occupations, primarily in the professional

skill segments. Overall, U.S. businesses are expected to add about 7.2 million jobs through 2021 – a 4.6 percent increase.

Growth Strategy

Our growth strategy is to expand our consulting

service offerings, which may require investments in new hires, acquisitions of complementary businesses, possible expansion into

other geographic areas, and related capital expenditures.

Our business development and marketing

activities are aimed at cultivating relationships, driving demand for our consulting services, generating leads and attempting

to increase penetration and visibility with alternative energy providers. Currently, we have one existing client and we anticipate

that any new engagements would be generated through relationships with existing providers from our contacts in the industry. We

actively seek to identify new business opportunities. We hope to retain dedicated business development professionals who are focused

exclusively on developing client relationships and generating new business.

Competition

Consulting:

The consulting services

industry is extremely competitive, highly fragmented, and subject to rapid change. The industry includes a large number of participants

with a variety of skills and industry expertise, including other consulting firms, the consulting practices of major accounting

firms, technical and economic advisory firms, regional and specialty consulting firms, and the internal professional resources

of organizations. We compete with a large number of service and technology providers in all of our segments. Our competitors often

vary, depending on the particular practice area. We expect to continue to face competition from new entrants.

We believe the principal competitive factors

in our market include recognition, reputation, the ability to attract and retain top talent, and the capacity to manage engagements

effectively to drive high value to clients. There is also competition on price. Our competitors have a greater geographic footprint,

a broader international presence, and more resources than we do.

Solar:

The solar power industry

is highly competitive. Many competitors are well established with substantial expertise and have much greater assets and greater

financial, marketing, personnel, and other resources than we do. There can be no assurance that we will be able to compete effectively

with existing or potential competitors. Other factors that will affect our success in these markets include our continued ability

to attract additional experienced marketing, sales and management talent, and our ability to expand our support, training and field

service capabilities.

Customers

We intend to offer market available solar-based

products and services to distributors and original equipment manufacturers (OEMs) in various diverse industries as a reseller.

We will request our distributors to provide point of sales reporting, which enables us to gain knowledge of the breakdown of industries

into which any third party manufactured products we might resell are sold.

Government Regulation

We are not currently a “regulated

utility” in the United States under applicable national, state or other local regulatory regimes. In the United States, we

would be required to obtain federal and state regulatory exemptions by establishing “Qualifying Facility” status with

the Federal Energy Regulatory Commission for all of our qualifying solar energy projects. Also, we would likely be required to

obtain interconnection agreements from the applicable local primary electricity utility. Depending on the size of the solar energy

system and local law requirements, interconnection agreements are between the local utility and either us or our customer. In most

cases, interconnection agreements are standard form agreements that have been pre-approved by the local public utility commission

or other regulatory body with jurisdiction over interconnection agreements. As such, we believe no additional regulatory approvals

would be required once interconnection agreements were signed. We may be required to maintain a utility administration function,

with primary responsibility for engaging with utilities and ensuring our compliance with interconnection rules.

Solar power companies are subject to stringent

and complex federal, state and local laws and regulations governing the occupational health and safety of our employees, wage regulations

and environmental regulations. For example, solar power companies are subject to the requirements of the federal Occupational Safety

and Health Act, as amended, or OSHA, and comparable state laws that protect and regulate employee health and safety.

Federal and/or state prevailing wage requirements,

which generally apply to any “public works” construction project that receives public funds, may apply if potential

installations of our solar energy systems were on government facilities. The prevailing wage is the basic hourly rate paid on public

works projects to a majority of workers engaged in a particular craft, classification or type of work within a particular area.

Prevailing wage requirements are established and enforced by regulatory agencies.

Employees

As of December 2, 2016, the Company

had one employee, its Chief Executive Officer

,

Henry Val. Mr. Val does not have an employment agreement and is not

covered by a collective bargaining agreement.

Item 1A. Risk Factors

Risks Related to our Business

An investment in our stock involves

a high degree of risk. You should carefully consider the following information, together with the other information in this Form

10, before buying shares of our stock. If any of the following risks or uncertainties occur, our business, financial condition,

and results of operations could be materially and adversely affected and the trading price of our stock could decline.

We are at a very early operational

stage and our success is subject to the substantial risks inherent in the establishment of a new business venture.

The implementation of our business strategy

is still in development. Our business and operations should be considered to be in a very early stage. Accordingly, the intended

business and operations may not prove to be successful in the near future, if at all. Any future success that we might enjoy will

depend upon many factors, several of which may be beyond our control, or which cannot be predicted at this time, and which could

have a material adverse effect upon our financial condition, business prospects and operations and the value of an investment in

the Company.

We have suffered operating losses

since inception and we may not be able to achieve profitability.

We had an accumulated consolidated deficit

of $14,550,323 as of July 31, 2016 and we expect to continue to incur significant set up expenses in the foreseeable future. As

a result, we are sustaining substantial operating and net losses, and it is possible that we will never be able to sustain or develop

the revenue levels necessary to attain profitability.

Our independent registered public

accounting firm’s report contains an explanatory paragraph that expresses substantial doubt about our ability to continue

as a “going concern.”

As of July 31, 2016, we had $129,568in

cash and working capital of $132,308. Further, we have incurred and expect to continue to incur significant costs in pursuit of

our plans. Any plans to raise capital and to consummate our business operations may not be successful. These factors, among others,

raise substantial doubt about our ability to continue as a going concern. The financial statements contained elsewhere in this

prospectus do not include any adjustments that might result from our inability to consummate this offering or our inability to

continue as a going concern.

Competition at the systems level

can be intense, thereby potentially exerting downward pressure on systems level profit margins industry-wide, which could make

our efforts to establish customers and project management opportunities impossible and adversely affect our results of operations.

While we believe our plans, offerings and

experience are positively different in many cases from that of our competitors, we may fail to correctly identify our competitive

position, we may be unable to develop or maintain a sufficient magnitude of new systems projects worldwide at economically attractive

rates of return, and we may not otherwise be able to achieve meaningful profitability.

Depending on the market opportunity, we

may be at a disadvantage compared to potential competitors. For example, certain of our competitors may have a stronger and/or

more established localized business presence in a particular geographic region. Certain of our competitors may be larger entities

that have greater financial resources and greater overall brand name recognition than we do and, as a result, may be better positioned

to impact customer behavior or adapt to changes in the industry or the economy as a whole. Certain competitors may also have direct

or indirect access to sovereign capital and/or other incentives, which could enable such competitors to operate at minimal or negative

operating margins for sustained periods of time.

Our future success depends on our

ability to retain our key associates and to successfully integrate them into our management team.

We are dependent on the services of our

Chief Executive Officer. The loss of our Chief Executive Officer could have a material adverse effect on us. We may not be able

to retain or replace our Chief Executive Officer, and we may not have adequate succession plans in place.

If we are unable to attract, train,

and retain key personnel, our business may be materially and adversely affected.

Our future success depends, to a significant

extent, on our ability to attract, train, and retain management, operations, sales, training and technical personnel, including

in foreign jurisdictions as we continue to execute on our long term strategic plan. Recruiting and retaining capable personnel,

particularly those with expertise in the PV industry across a variety of technologies, are vital to our success. There is substantial

competition for qualified technical personnel and there can be no assurances that we will be able to attract and retain our technical

personnel. If we are unable to attract and retain qualified associates, or otherwise experience unexpected labor disruptions within

our business, we may be materially and adversely affected.

Our largest stockholders have significant

influence over us and their interests may conflict with or differ from interests of other stockholders.

Our largest stockholders, consisting collectively

of Henry Val and his wholly-owned corporation Netter Capital, Inc., Meros HR, LLC and Ensure HR, LLC (collectively, the “Significant

Stockholders”), owned approximately 93% of our outstanding voting, capital stock at September 2016, on an as-converted basis.

As a result, the Significant Stockholders have substantial influence over all matters requiring stockholder approval, including

the election of our directors and the approval of significant corporate transactions such as mergers, tender offers, and the sale

of all or substantially all of our assets. The interests of the Significant Stockholders could conflict with or differ from interests

of other stockholders. For example, the concentration of ownership held by the Significant Stockholders could delay, defer or prevent

a change of control of our Company or impede a merger, takeover, or other business combination that a majority of stockholders

may view favorably.

Unanticipated changes in our tax

provisions, the adoption of a new U.S. tax legislation, or exposure to additional income tax liabilities could affect our profitability.

We are subject to income taxes in the United

States and the foreign jurisdictions in which we may someday operate. Our tax liabilities are affected by the amounts we charge

for inventory, services, licenses, funding, and other items in inter-company transactions that may occur in the future. We are

subject to potential tax examinations in these various jurisdictions. Tax authorities may disagree with our inter-company charges

if we had any or other tax positions and assess additional taxes. We regularly assess the likely outcomes of these examinations

in order to determine the appropriateness of our tax provision. However, there can be no assurance that we will accurately predict

the outcomes of these potential examinations, and the amounts ultimately paid upon resolution of examinations could be materially

different from the amounts previously included in our income tax expense and therefore, could have a material impact on our tax

provision, net income, and cash flows. In addition, our future effective tax rate could be adversely affected by changes to our

operating structure, changes in the mix of earnings in jurisdictions with differing statutory tax rates, changes in the valuation

of deferred tax assets and liabilities, changes in tax laws, and the discovery of new information in the course of our tax return

preparation process. A number of proposals for broad reform of the corporate tax system in the U.S. are under evaluation by various

legislative and administrative bodies, but it is not possible to determine accurately the overall impact of such proposals on our

effective tax rate at this time.

Risk Related to Our Securities

Risks Related to Our Securities

There is a substantial lack of liquidity

of our common stock and volatility risks.

Our common stock is quoted under the symbol

“TSPG” On the OTC Pink Sheets. The liquidity of our common stock may be very limited and affected by our limited trading

market. The OTC Pink Sheets quotation platform is an inter-dealer market much less regulated than the major exchanges, and is subject

to abuses, volatilities and shorting. There is currently no broadly followed and established trading market for our common stock.

An established trading market may never develop or be maintained. Active trading markets generally result in lower price volatility

and more efficient execution of buy and sell orders. Absence of an active trading market reduces the liquidity of the shares traded.

The trading volume of our common stock

may be limited and sporadic. This situation is attributable to a number of factors, including the fact that we are a small company

which is relatively unknown to stock analysts, stock brokers, institutional investors and others in the investment community that

generate or influence sales volume, and that even if we came to the attention of such persons, they tend to be risk-averse and

would be reluctant to follow an unproven company such as ours or purchase or recommend the purchase of our shares until such time

as we became more seasoned and viable. As a consequence, there may be periods of several days or more when trading activity in

our shares is minimal or non-existent, as compared to a seasoned issuer which has a large and steady volume of trading activity

that will generally support continuous sales without an adverse effect on share price. We cannot give you any assurance that a

broader or more active public trading market for our common stock will develop or be sustained, or that current trading levels

will be sustained. As a result of such trading activity, the quoted price for our common stock on the OTC Pink Sheets may not necessarily

be a reliable indicator of our fair market value. In addition, if our shares of common stock cease to be quoted, holders would

find it more difficult to dispose of, or to obtain accurate quotation as to the market value of, our common stock and as a result,

the market value of our common stock likely would decline.

The market price for our stock may be volatile

and subject to fluctuations in response to factors, including the following:

|

|

·

|

the increased concentration of the ownership of our shares by a limited number of affiliated stockholders following the sale of our Series C Preferred Shares may limit interest in our securities;

|

|

|

|

|

|

|

·

|

variations in quarterly operating results from the expectations of securities analysts or investors;

|

|

|

|

|

|

|

·

|

revisions in securities analysts’ estimates or reductions in security analysts’ coverage;

|

|

|

|

|

|

|

·

|

announcements of new products or services by us or our competitors;

|

|

|

|

|

|

|

·

|

reductions in the market share of our products;

|

|

|

|

|

|

|

·

|

announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures or capital commitments;

|

|

|

|

|

|

|

·

|

general technological, market or economic trends;

|

|

|

|

|

|

|

·

|

investor perception of our industry or prospects;

|

|

|

|

|

|

|

·

|

insider selling or buying;

|

|

|

·

|

investors entering into short sale contracts;

|

|

|

|

|

|

|

·

|

regulatory developments affecting our industry; and

|

|

|

|

|

|

|

·

|

additions or departures of key personnel.

|

Many of these factors are beyond our control

and may decrease the market price of our common stock, regardless of our operating performance. We cannot make any predictions

or projections as to what the prevailing market price for our common stock will be at any time, including as to whether our common

stock will sustain current market prices, or as to what effect that the sale of shares or the availability of common stock for

sale at any time will have on the prevailing market price.

If we fail to prepare and timely

file our periodic reports with the SEC, our access to the public markets to raise capital and could have other negative consequences.

If we fail to file our periodic reports

within the timeframe required by the SEC, we may be limited in our ability to access the public markets to raise capital, which

could prevent us from pursuing transactions or implementing business strategies that we believe would be beneficial to our business.

Also, we would be ineligible to use shorter and less costly filings, such as Form S-3, to register our securities for sale for

a period of 12 months following the month in which we regain compliance with our SEC reporting obligations.

Additionally, current SEC reporting is

an obligation to be quoted on the other tiers of the OTC Markets which we believe is more beneficial to the Company and its investors.

We are currently quoted on the OTC Pink Sheets. To be quoted on the other tiers of the OTC Markets, or a national securities

exchange, we would be required to be current in our reporting obligations. If we fail to timely file our reports we may only be

able to be traded on the OTC Pink Sheets. The OTC Pink Sheets is the bottom tier of the OTC market – a speculative trading

marketplace that helps broker-dealers get the best prices for investors. Accordingly, our securities may become worthless and we

may be forced to curtail or abandon our business plan.

Further,

under Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”) (“Rule 144”), if we

fail to file our reports with the SEC, it will be more difficult for investors to satisfy the requirements of Rule 144 and it may

be more difficult for investors to sell their shares of our Common Stock, if at all

.

Our common stock may never be listed

on a major stock exchange.

We currently do not satisfy the initial

listing standards and cannot ensure that we will be able to satisfy such listing standards or that our common stock will be accepted

for listing on any such major stock exchange. Should we fail to satisfy the initial listing standards of such exchanges, or our

common stock is otherwise rejected for listing, the trading price of our common stock could suffer, the trading market for our

common stock may be less liquid, and our common stock price may be subject to increased volatility.

A decline in the price of our common

stock could affect our ability to raise working capital and adversely impact our ability to continue operations.

A prolonged decline in the price of our

common stock could result in a reduction in the liquidity of our common stock and a reduction in our ability to raise capital.

A decline in the price of our common stock could be especially detrimental to our liquidity and our operations. Such reductions

may force us to reallocate funds from other planned uses and may have a significant negative effect on our business plan and operations,

including our ability to develop new services and continue our current operations. If our common stock price declines, we can offer

no assurance that we will be able to raise additional capital or generate funds from operations sufficient to meet our obligations.

If we are unable to raise sufficient capital in the future, we may not be able to have the resources to continue our normal operations.

Concentrated ownership of our common

stock creates a risk of sudden changes in our common stock price.

The sale by any shareholder of a significant

portion of their holdings could have a material adverse effect on the market price of our common stock.

Sales of our currently issued and

outstanding stock may become freely tradable pursuant to Rule 144 and may dilute the market for your shares and have a depressive

effect on the price of the shares of our common stock.

A number of the outstanding shares of common

stock are “restricted securities” within the meaning of Rule 144 under the Securities Act of 1933, as amended (the

“Securities Act”) (“Rule 144”). As restricted shares, these shares may be resold only pursuant to an effective

registration statement or under the requirements of Rule 144 or other applicable exemptions from registration under the Securities

Act and as required under applicable state securities laws. Rule 144 provides in essence that a non-affiliate who has held restricted

securities for a period of at least six months may sell their shares of common stock. Under Rule 144, affiliates who have held

restricted securities for a period of at least six months may, under certain conditions, sell every three months, in brokerage

transactions, a number of shares that does not exceed the greater of 1% of a company’s outstanding shares of common stock

or the average weekly trading volume during the four calendar weeks prior to the sale (the four calendar week rule does not apply

to companies quoted on the OTC Pink Platform). A sale under Rule 144 or under any other exemption from the Securities Act, if available,

or pursuant to subsequent registrations of our shares of common stock, may have a depressive effect upon the price of our shares

of common stock in any active market that may develop.

If we issue additional shares or

derivative securities in the future, it will result in the dilution of our existing stockholders

.

Our Articles of Incorporation authorizes

the issuance of up to 2,400,000,000 shares of common stock, $0.001 par value per share, and 100,000,000 shares are designated as

“blank check” preferred stock, par value $0.001 per share (the “Preferred Stock”). Our board of directors

may choose to issue some or all of such shares, or derivative securities to purchase some or all of such shares, to provide additional

financing in the future.

We do not plan to declare or pay

any dividends to our stockholders in the near future.

We have not declared any dividends in the

past, and we do not intend to distribute dividends in the near future. The declaration, payment and amount of any future dividends

will be made at the discretion of the board of directors and will depend upon, among other things, the results of operations, cash

flows and financial condition, operating and capital requirements, and other factors as the board of directors considers relevant.

There is no assurance that future dividends will be paid, and if dividends are paid, there is no assurance with respect to the

amount of any such dividend.

The requirements of being a public

company may strain our resources and distract management.

As a result of filing this registration

statement, we are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), and the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”). These requirements are extensive. The Exchange

Act requires that we file annual, quarterly and current reports with respect to our business and financial condition. The Sarbanes-Oxley

Act requires that we maintain effective disclosure controls and procedures and internal controls over financial reporting.

We may incur significant costs associated

with our public company reporting requirements and costs associated with applicable corporate governance requirements. We expect

all of these applicable rules and regulations to significantly increase our legal and financial compliance costs and to make some

activities more time consuming and costly. This may divert management’s attention from other business concerns, which could

have a material adverse effect on our business, financial condition and results of operations. We also expect that these applicable

rules and regulations may make it more difficult and more expensive for us to obtain director and officer liability insurance and

we may be required to accept reduced policy limits and coverage or incur substantially higher costs to obtain the same or similar

coverage. As a result, it may be more difficult for us to attract and retain qualified individuals to serve on our board of directors

or as executive officers. We are currently evaluating and monitoring developments with respect to these rules, and we cannot predict

or estimate the amount of additional costs we may incur or the timing of such costs.

Persons associated with securities offerings, including

consultants, may be deemed to be broker dealers.

In the event that any of our securities

are offered without engaging a registered broker-dealer, we may face claims for rescission and other remedies. If any claims or

actions were to be brought against us relating to our lack of compliance with the broker-dealer requirements, we could be subject

to penalties, required to pay fines, make damages payments or settlement payments, or repurchase such securities. In addition,

any claims or actions could force us to expend significant financial resources to defend our company, could divert the attention

of our management from our core business and could harm our reputation.

Future changes in financial accounting

standards or practices may cause adverse unexpected financial reporting fluctuations and affect reported results of operations.

A change in accounting standards or practices

can have a significant effect on our reported results and may even affect our reporting of transactions completed before the change

is effective. New accounting pronouncements and varying interpretations of accounting pronouncements have occurred and may occur

in the future. Changes to existing rules or the questioning of current practices may adversely affect our reported financial results

or the way we conduct business.

“Penny Stock” rules may

make buying or selling our common stock difficult.

Trading in our common stock is subject

to the “penny stock” rules. The SEC has adopted regulations that generally define a penny stock to be any equity security

that has a market price of less than $5.00 per share, subject to certain exceptions. These rules require that any broker-dealer

that recommends our common stock to persons other than prior customers and accredited investors, must, prior to the sale, make

a special written suitability determination for the purchaser and receive the purchaser’s written agreement to execute the

transaction. Unless an exception is available, the regulations require the delivery, prior to any transaction involving a penny

stock, of a disclosure schedule explaining the penny stock market and the risks associated with trading in the penny stock market.

In addition, broker-dealers must disclose commissions payable to both the broker-dealer and the registered representative and current

quotations for the securities they offer. The additional burdens imposed upon broker-dealers by such requirements may discourage

broker-dealers from effecting transactions in our common stock, which could severely limit the market price and liquidity of our

common stock.

Item 2. Financial Information

Selected Financial Data

The Company is a smaller reporting company

as defined by 17 C.F.R.229(10)(f)(i) and is not required to provide this information.

Management’s Discussion and Analysis of Financial Condition

and Results of Operations.

This Statement contains forward-looking

statements. All statements other than statements of historical facts contained in this Form 10, including statements regarding

our future results of operations and financial position, business strategy and plans and objectives of management for future operations,

are forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause

our actual results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by the forward-looking statements.

In some cases, forward-looking statements

can be identified by terms such as "may," "will," "should," "expects," "plans,"

"anticipates," "could," "intends," "target," "projects," "contemplates,"

"believes," "estimates," "predicts," "potential" or "continue" or the negative

of these terms or other similar words. These statements are only predictions. We have based these forward-looking statements largely

on our current expectations and projections about future events and financial trends that we believe may affect our business, financial

condition and results of operations. We discuss many of the risks in greater detail under the heading "Risk Factors."

Also, these forward-looking statements represent our estimates and assumptions only as of the date of the filing of this Form 10.

Except as required by law, we assume no obligation to update any forward-looking statements after the date of the filing of this

Form 10.

This Form 10 also contains estimates and

other statistical data made by independent parties and by us relating to market size and growth and other industry data. This data

involves a number of assumptions and limitations, and investors are cautioned not to give undue weight to such estimates. We have

not independently verified the statistical and other industry data generated by independent parties and contained in this Form

10 and, accordingly, we cannot guarantee their accuracy or completeness. In addition, projections, assumptions and estimates of

our future performance and the future performance of the industries in which we operate are necessarily subject to a high degree

of uncertainty and risk due to a variety of factors, including those described in “Risk Factors” and elsewhere in this

Form 10. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent

parties and by us.

Overview

TGI Solar Power Group, Inc. (“TGI”

or the “Company”) is a publicly held corporation formed in 1967 in the State of Delaware originally under the name

Liberty Leasing Co., Inc. The Company changed its name to LIBCO Corporation on June 29, 1973, RDIS Corporation on January 11, 1993

and TenthGate International, Inc. on February 20, 2007, before adopting its current name in June 2008. Tenth Gate International,

Inc. acquired TenthGate Incorporated, a Delaware corporation, by merger of TGI’s subsidiary, TenthGate Merger Sub, Inc.,

a Utah corporation, with and into TenthGate Incorporated in April 2007. Thereafter, TenthGate International, Inc. became a development

stage company which owned various subsidiaries with licenses and patents held by those subsidiaries. On July 25, 2008, Tenth Gate

International, Inc., acquired, as a result of a merger with Solar 18 Corporation, a Florida corporation, (“Solar 18”),

Solar 18’s license to manufacture, sell, market and distribute Solar 18’s patented, thin-film solar panel Technology

which the Company believed to be viable in commercial and residential applications, especially in the field of green energy. Thereafter,

the Company changed its name to TGI Solar Power Group, Inc. TGI Solar Power Group, Inc. discontinued operations of its other subsidiaries

(of the former TenthGate International, Inc.) to pursue energy technology products and services the Company licensed from Solar

18. However, due to the severe reduction in price of solar panels after the acquisition, the Company was unable to effectively

pursue manufacturing solar panels at a competitive price.

Historically, TGI Solar Power Group, Inc.

pursued the acquisition, development, staffing and distribution of next generation green energy products and service solutions.

The company provided enhanced, cost effective energy generation products and services while protecting the environment. The company

was pursuing acquiring proprietary technology, collaborating with leading international scientists and research institutions and

developing strategic alliances in its effort to provide world class, state of the art alternative energy worldwide.

On June 26, 2016, the Company sold 137,500

shares of its Series C Convertible Preferred Stock (the “Series C Stock”) each to Ensure HR, LLC, a New Jersey limited

liability company (“Ensure”) and Meros HR, LLC, a New Jersey limited liability company (“Meros”). Upon

consummation of the sale of the Shares, the Series C Stock was convertible into a number of shares of the Company’s common

stock, par value $0.001 per share (the “Common Stock”) at the conversion price of $0.0000161240 per share and votes

on an as converted basis multiplied by 1.9. As a result, the sale of the Series C Stock resulted in a change of control of the

Company.

The solar installation business has had

an especially challenging time in recent years due to the saturation of low-priced competitive alternatives. As a result, the Company

has focused its efforts on consulting services focused toward alternative energy providers.

As of July 31, 2016, we had $129,568 in

cash and no accounts receivable. In order to fulfill our plans as a consultant and advisor of alternative energy companies we will

be required to actively market this portion of the Company’s business and employ sales affiliates to obtain clients on the

Company’s behalf.

The successful outcome of future activities

cannot be determined at this time and there is no assurance that, if achieved, we will have sufficient funds to execute our intended

business plan or generate positive operating results.

Growth Strategy

Our growth strategy is to expand our consulting

service offerings, which may require investments in new hires, acquisitions of complementary businesses, possible expansion into

other geographic areas, and related capital expenditures.

Our business development and marketing

activities are aimed at cultivating relationships, driving demand for our consulting services, generating leads and attempting

to increase penetration and visibility with alternative energy providers. Currently, we have one existing client and we anticipate

that any new engagements would be generated through relationships with existing providers from our contacts in the industry. We

actively seek to identify new business opportunities. We hope to retain dedicated business development professionals who are focused

exclusively on developing client relationships and generating new business.

Critical Accounting Policies

(1)

Use of Estimates:

The preparation of financial statements

in conformity with accounting principles generally accepted in the United States of America requires management to make estimates

and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities

at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. Actual results

could differ from those estimates.

(2)

Earnings Per Share:

Basic earnings per share includes no dilution

and is computed by dividing net income available to common stockholders by the weighted average number of common shares outstanding

for the period. The difference between reported basic and diluted weighted-average common shares results from the assumption that

all dilutive stock options and convertible preferred stock exercised into common stock. Total potentially dilutive shares excluded

from diluted weighted shares outstanding at July 31, 2016 and 2015 totaled 230,000,000 and 230,000,000, respectively

Results of Operations

The following discussion of our financial

condition and results of operations should be read in conjunction with our financial statements and the related notes, and other

financial information included in this Form 10.

Our Management’s Discussion and Analysis

contains not only statements that are historical facts, but also statements that are forward-looking. Forward-looking statements

are, by their very nature, uncertain and risky. These risks and uncertainties include international, national, and local general

economic and market conditions; our ability to sustain, manage, or forecast growth; our ability to successfully make and integrate

acquisitions; new product development and introduction; existing government regulations and changes in, or the failure to comply

with, government regulations; adverse publicity; competition; the loss of significant customers or suppliers; fluctuations and

difficulty in forecasting operating results; change in business strategy or development plans; business disruptions; the ability

to attract and retain qualified personnel; the ability to protect technology; the risk of foreign currency exchange rate; and other

risks that might be detailed from time to time in our filing with the Securities and Exchange Commission.

Currently, the Company has no operations

that provide cash flow, however a new business plan was developed and TGI intends to enter into business to provide clients with

services that include: business development, project management, management consulting, staffing as well as to develop application

to manage timing and logistics for employers.

We did not have any sales for the years

ended July 31, 2016 and July 31, 2015. During the year ended July 31, 2016 and 2015, the entity incurred $131,679 and $66,635,

respectively, in operating expenses. The increase in fiscal year 2016 pertains to an increase in consulting expenses paid to the

Company’s CEO. In addition to consulting fees, operating expenses are primarily comprised of accounting, legal, and OTC fees.

Net loss from continuing operations for

the years ended July 31, 2015 and 2014 was $139,534 and $73,809 respectively.

Comparison of the fiscal years ended

July 31, 2016 and July 31, 2015

We did not have any sales for the years

ended July 31, 2016 and July 31, 2015. During the year ended July 31, 2016 and 2015, the entity incurred $121,679 and $66,635,

respectively, in operating expenses. The increase in fiscal year 2016 pertains to an increase in consulting expenses as the Company

hired a CEO. In addition to consulting fees, operating expenses are primarily comprised of accounting, legal, and OTC fees.

Net loss from continuing operations for

the years ended July 31, 2016 and 2015 was $129,534 and $73,809 respectively.

Liquidity and Capital Resources

At July 31, 2016 we had

approximately $130,000 in cash. As of December 2, 2016, we had approximately $60,000 in cash. In June 2016, the Company

received net proceeds of $255,540 in conjunction with the sale of it's Preferred Series C Stock. We did not have any

cash flows from investing activities for the fiscal year end 2015. We received an advance from a third party of $65,000 in

fiscal 2015.

Our ability to continue as a going concern

is dependent upon our ability to generate future profitable operations and/or to obtain the necessary financing to meet our obligations

and repay our liabilities arising from normal business operations when they come due. Management’s plan includes obtaining

additional funds by equity financing and/or related party advances, however there is no assurance of additional funding being available.

The uncertainty surrounding the Company’s ability to consummate such transactions raise substantial doubt regarding the Company’s

ability to continue as a going concern. These financial statements have been prepared with the assumption that the Company will

continue as a going concern and will be able to realize its assets and discharge its liabilities in the normal course of business

and do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or

the amounts and classification of liabilities that may result from the inability of the Company to continue as a going concern.

Subsequent Event

In August 2016, the Company entered into

an Advising Agreement with an unrelated third party for strategic planning and business consulting services. The Company received

300,000 shares of the client’s common stock for such services in October of 2016.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements

that have or are reasonably likely to have a current or future effect on our financial condition or results of operations.

Quantitative and Qualitative Disclosures

about Market Risk

We are a smaller reporting company as defined

by 17 C.F.R. 229(10)(f)(i) and are not required to provide information under this item.

Item 3. Properties.

Our executive offices is located at 1011

Whitehead Road Ext, Suite 101 Ewing, NJ 08638.

Item 4. Security Ownership of Certain Beneficial Owners and

Management.

The following table sets forth as of December 2, 2016, the number of shares of Common Stock held of record or beneficially (i) by each person who held of record, or was known

by the Company to own beneficially, more than five percent of the outstanding shares of Common Stock, (ii) by each director and

(iii) by all officers and directors as a group:

Name and address of Beneficial

Owner

|

|

Amount and

Nature

of Common

Stock

Beneficially

Owned

|

|

|

Amount and

Percentage

of Voting

Stock

Beneficially

Owned (1)

|

|

|

Percent

of Common

Stock

Beneficially

Owned (2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Henry Val (3)

|

|

|

327,000,000

|

|

|

|

2,377,000,000

|

|

|

|

63.3

|

%

|

|

|

19.2

|

%

|

|

All directors and executive officers as a group

|

|

|

327,000,000

|

|

|

|

2,377,000,000

|

|

|

|

63.3

|

%

|

|

|

19.2

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other 5% Shareholders

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ensure HR, LLC (4)

|

|

|

8,527,660,650

|

|

|

|

8,527,660,650

|

|

|

|

83

|

%

|

|

|

83

|

%

|

|

Meros HR, LLC (5)

|

|

|

8,527,660,650

|

|

|

|

8,527,660,650

|

|

|

|

83

|

%

|

|

|

83

|

%

|

|

|

(1)

|

For each shareholder, the percentage of voting stock beneficially owned is based upon 1,705,036,105 shares of Common Stock outstanding as of December 2, 2016. The percentage of voting capital stock of each shareholder which is entitled to vote on the same basis as the Company’s Common Stock.

|

|

|

|

|

|

|

(2)

|

For each shareholder, the calculation of percentage of beneficial ownership is based upon 1,705,036,105 shares of Common Stock outstanding as of December 2, 2016, and shares of Common Stock subject to options, warrants and/or conversion rights held by the shareholder that are currently exercisable or exercisable within 60 days, which are deemed to be outstanding and to be beneficially owned by the shareholder holding such options, warrants, or conversion rights. The percentage ownership of any shareholder is determined by assuming that the shareholder has exercised all options, warrants and conversion rights to obtain additional securities and that no other shareholder has exercised such rights.

|

|

|

(3)

|

Includes 310,000,000 shares held by Netter Capital,

Inc. of whom Mr. Val holds voting and dispositive power. For the purpose of determining the number of shares of Common Stock

beneficially owned by Mr. Val, does not include 5,000,000 shares of Series A Preferred Stock, which votes at the rate of 10

votes per share, or 2,000,000 shares of Series B Preferred Stock, which votes at the rate of 1,000 votes per share, held by

Netter Capital, Inc. which are not readily convertible. The shares of Series A Preferred Stock and Series B Preferred Stock

are included for purposes of determining the percentage of voting stock beneficially owned by Mr. Val.

|

|

|

(4)

|

Includes 137,500 shares of Series C Convertible Preferred Stock which are convertible into approximately 8,527,660,650 shares of common stock and vote on an as-converted basis multiplied by 1.9. James Radvany holds voting and dispositive control of the Shares held by Ensure HR, LLC. The address for Ensure is 1011 Whitehead Road Ext, Suite 101 Ewing, NJ 08638.

|

|

|

(5)

|

Includes 137,500 shares of Series C Convertible Preferred Stock which are convertible into approximately 8,527,660,650 shares of common stock and vote on an as-converted basis multiplied by 1.9. Todd McNulty holds voting and dispositive control of the Shares held by Meros HR, LLC. The address for Meros is 1011 Whitehead Road Ext, Suite 101 Ewing, NJ 08638.

|

Item 5. Directors and Executive Officers.

Our executive officers and directors, and

their ages, positions and offices with us are as follows:

|

Name

|

|

Age

|

|

Position with the Company

|

|

|

|

|

|

|

|

Henry Val

|

|

56

|

|

Chief Executive Officer, Chief Financial Officer, President and Chairman

|

Henry Val, Chief Executive Officer, Chief Financial Officer,

President and Chairman.

Henry Val has served as the Chief Executive

Officer of the Company since 2007. Henry has over twenty-five years of experience in the financial markets ranging from trading

global futures and equity markets, senior secured debt, convertible securities, private investments in public equities (PIPEs)

and investing.

Prior to forming Netter

Capital, Inc., Henry was a Partner with Delta Capital LLC, a boutique advisory firm, specializing in M&A, management consulting,

turnaround situations and other advisory services. He was involved in originating, structuring, negotiating and closing financing

transactions providing growth capital, acquisition financing, recapitalization, restructuring and general working capital to late-stage

venture, distressed and middle market companies across all industries and sectors.

Mr. Val co-developed the internal deal

flow process from origination to closing for internal investment bankers and business development officers. Additionally, he worked

with internal and third-party marketers in presenting to institutional investors, family offices and funds to raise capital for

the fund.

Audit Committee

Our board of directors has not established

a separate audit committee within the meaning of Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”). Instead the Company’s Chairman acts as the audit committee within the meaning of Section 3(a)(58)(B) of the

Exchange Act. Given the small size of the Company and its board, plus the Company’s limited resources, locating, obtaining

and retaining additional independent directors is extremely difficult. The Company intends on establishing an Audit Committee composed

of independent directors of the Company. The Audit Committee’s duties would be to recommend to the Company’s board

of directors the engagement of independent auditors to audit the Company’s financial statements and to review its accounting

and auditing principles. The Audit Committee would review the scope, timing and fees for the annual audit and the results of audit

examinations performed by the internal auditors and independent public accountants, including their recommendations to improve

the system of accounting and internal controls. The Audit Committee would at all times be composed exclusively of directors who

are, in the opinion of the Company’s board of directors, free from any relationship which would interfere with the exercise

of independent judgment as a committee member and who possess an understanding of financial statements and generally accepted accounting

principles.

Compensation Committee

Our board of directors does not have a

separate compensation committee responsible for determining executive and director compensation. Instead, the Company’s Chairman

fulfills this function. Given the small size of the Company and its board, plus the Company’s limited resources, locating,

obtaining and retaining additional independent directors is extremely difficult. In the absence of independent directors, the board

does not believe that creating a separate compensation committee would result in any improvement in the compensation determination

process. Accordingly, the board of directors has concluded that the Company and its stockholders would be best served at this time

by having the entire board of director’s act in place of a compensation committee. When acting in this capacity, the board

does not have a charter.

Code of Ethics

We have adopted a code of ethics meeting

the requirements of Section 406 of the Sarbanes-Oxley Act of 2002. We believe our code of ethics is reasonably designed to deter

wrongdoing and promote honest and ethical conduct; provide full, fair, accurate, timely and understandable disclosure in public

reports; comply with applicable laws; ensure prompt internal reporting of violations; and provide accountability for adherence

to the provisions of the code of ethic. Our code of ethics is filed as an exhibit to this Form 10.

Item 6. Executive Compensation.

Name and

Principal

Position

|

|

Year

|

|

|

Salary

|

|

|

Bonus

|

|

|

Equity

Awards

|

|

|

Option

Awards

|

|

|

All

Other

Compensation

|

|

Total

|

|

|

Henry Val,

|

|

|

2016

|

|

|

$

|

70,066

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

-

|

|

$

|

70,066

|

|

|

Chairman, Chief Executive Officer, Chief Financial Officer and President

|

|

|

2015

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

-

|

|

|

-

|

|

Employment Agreements

The Company has no employment agreements

with any of its employees, executive officers, or consultants.

Outstanding Equity Awards at July 31,

2016.

None of our executive officers have outstanding

equity awards as of July 31, 2016.

Item 7. Certain Relationships and Related Transactions, and

Director Independence.

Certain Relationships and Related Transactions

In June 2016, in conjunction with the Preferred Series C sale,

the president received $60,000 as payment in full for consulting expense. As of July 31, 2016, the Company prepaid consulting fees

to the president relating to fiscal year 2017 in the amount of $15,000.

Director Independence

We currently use NASDAQ’s general

definition for determining director independence, which states that “independent director” means a person other than

an officer or employee of the company or its subsidiaries or any other individual having a relationship, that, in the opinion of

the company’s board of directors, would interfere with the exercise of independent judgment in carrying out the responsibilities

of the director. According to this definition, Henry Val, our sole officer and director, would not meet the definition as an independent

director.

Item 8. Legal Proceedings.

We are not currently subject to any material

legal proceedings, nor, to our knowledge, is any material legal proceeding threatened against us. From time to time, we may be

a party to certain legal proceedings in the ordinary course of business.

Item 9. Market Price of and Dividends

on the Registrant’s Common Equity and Related Stockholder Matters.

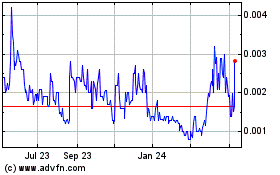

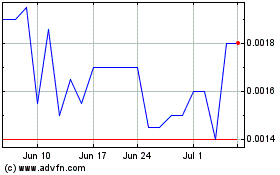

The shares of our common stock are quoted

on the Over-the-Counter “Pink Sheets” maintained by OTCMarkets.com under the symbol “TSPG.”. Trading in

our common stock is limited.

For the periods indicated, the following

table sets forth the high and low bid prices per share of our common stock. These prices represent inter-dealer quotations without

retail markup, markdown, or commission and may not necessarily represent actual transactions.

|

Fiscal Quarter

|

|

High Bid

|

|

|

Low Bid

|

|

|

2015 First Quarter

|

|

$

|

0.0006

|

|

|

$

|

0.0001

|

|

|

2015 Second Quarter

|

|

$

|

0.0004

|

|

|

$

|

0.0002

|

|

|

2015 Third Quarter

|

|

$

|

0.0004

|

|

|

$

|

0.0001

|

|

|

2015 Fourth Quarter

|

|

$

|

0.0011

|

|

|

$

|

0.0002

|

|

|

2016 First Quarter

|

|

$

|

0.0008

|

|

|

$

|

0.0002

|

|

|

2016 Second Quarter

|

|

$

|

0.0028

|

|

|

$

|

0.0006

|

|

|

2016 Third Quarter

|

|

$

|

0.0016

|

|

|

$

|

0.0003

|

|

|

2016 Fourth Quarter

|

|

$

|

0.0028

|

|

|

|

0.001

|

|

As of the date of the filing of this Form

10, there are issued and outstanding 1,705,036,105 shares of Common Stock.

As of the date of the filing of this Form

10, there are 93 holders of record of our Common Stock.

We have not declared any cash dividends

on our Common Stock since inception and do not anticipate paying such dividends in the foreseeable future. We plan to retain any

future earnings for use in our business operations. Any decisions as to future payment of cash dividends will depend on our earnings

and financial position and such other factors as the Board of Directors deems relevant.

Equity Compensation Plan Information

The Company does not have any compensation plans under which

under which equity securities of can be issued.

Item 10. Recent Sales of Unregistered Securities.

On June 26, 2016, the Company sold 275,000

shares of its Series C Convertible Preferred Stock, par value $0.001 per share, to two previously-unrelated parties for a purchase

price of $275,000.

The securities set forth above were issued

by the Company pursuant to Section 4(2) of the Securities Act of 1933, as amended, or the provisions of Rule 504 of Regulation

D promulgated under the Securities Act. All such shares issued contained a restrictive legend and the Holders confirmed that they

were acquiring the shares for investment and without intent to distribute the shares. All of the purchasers were experienced in

making speculative investments, understood the risks associated with investments, and could afford a loss of the entire investment.

The Company did not utilize an underwriter or a placement agent for any of these offerings of its securities.

Item 11. Description of Registrant’s Securities to

be Registered.

Common Stock

At December 2, 2016, the Company had 2,400,000,000

shares authorized and 1,705,036,105 shares of common stock, par value $0.001 per share (the “Common Stock”) issued

and outstanding.

Voting Rights.

Holders of our

Common Stock are entitled to one vote for each share held on all matters submitted to a vote of stockholders and do not have cumulative

voting rights.

Dividends

. Holders of Common Stock

are entitled to receive proportionately any dividends as may be declared by our board of directors, subject to any preferential

dividend rights of any series of preferred stock that we may designate and issue in the future.

Liquidation and Dissolution.

In

the event of our liquidation or dissolution, the holders of Common Stock are entitled to receive proportionately our net assets

available for distribution to stockholders after the payment of all debts and other liabilities and subject to the prior rights

of any outstanding preferred stock.

Other Rights

. Holders of Common

Stock have no preemptive, subscription, redemption or conversion rights. The rights, preferences and privileges of holders of Common

Stock are subject to and may be adversely affected by the rights of the holders of shares of any series of preferred stock that

we may designate and issue in the future.

Transfer Agent and Registrar

. Direct

Transfer, LLC. is transfer agent and registrar for the Common Stock.

Preferred Stock

At December 2, 2016, the Company had 100,000,000

preferred shares authorized and 12,275,000 shares of $0.001 par value preferred stock issued and outstanding.

Series A Preferred Stock

There are currently 10,000,000 shares of

Series A Preferred Stock authorized, of which all 10,000,000 shares are currently issued and outstanding. The Series A Preferred

Stock has a liquidation preference over the Common Stock and any other class or series of capital stock whose terms expressly provide

that the holders of the Preferred Stock should receive preferential payment. Holders of the Series A Preferred Stock are entitled

to vote on all matters submitted to shareholders of the Company and are entitled to vote at the rate of ten (10) votes for each

share of the Series A Preferred Stock owned. In addition, the consent of not less than a majority of the outstanding Series A Preferred

Stock is necessary to sell or pledge all or substantially all of the Company’s assets or effect a transaction resulting in

the acquisition of a majority of the Company’s voting capital stock. Each share of Series A Preferred Stock is convertible

into three shares of Common Stock if: the shares of Series A Preferred Stock have been held for more than twenty-four (24) months;

the Common Stock is trading at a bid price of at least $0.50 per share; the Company has a positive net worth; and the Company’s

common stock is traded on the Pink Sheets, or a higher exchange.

Series B Preferred Stock

There are currently 2,000,000 shares of

Series B Preferred Stock authorized, of which all 2,000,000 shares are currently issued and outstanding. The Series B Preferred

Stock has a liquidation preference over the Common Stock and any other class or series of capital stock whose terms expressly provide

that the holders of the Preferred Stock should receive preferential payment. Holders of the Series B Preferred Stock are entitled

to vote on all matters submitted to shareholders of the Company and are entitled to 1,000 votes for each share of Series B Preferred

Stock owned. In addition, the consent of not less than a majority of the outstanding Series B Preferred Stock is necessary to sell

or pledge all or substantially all of the Company’s assets or effect a transaction resulting in the acquisition of a majority

of the Company’s voting capital stock. Each share of Series B Preferred Stock is convertible into one hundred (100) shares

of Common Stock if: the shares of Series B Preferred Stock have been held for more than twelve (12) months; the Common Stock is

trading at a bid price of at least $0.01 per share; and the Company’s Common Stock is traded on the Pink Sheets, or a higher

exchange.

Series C Preferred Stock

As of December 2, 2016, there were 275,000

shares of Series C Convertible Preferred Stock (the “Series C Preferred Stock”) authorized, of which all 275,000 shares

are currently issued and outstanding. In the event of a liquidation or dissolution, the Series C Preferred Stock ranks prior to

the Company’s Common Stock, Series A Preferred Stock and the Series B Preferred Stock but junior to all newly-created securities

of the Company so designated. The stated value of the Series C Preferred Stock is $1.00 per share. The Series C Preferred Stock

has a liquidation of twice its stated value, converts into shares of Common Stock at the initial conversion price of $0.000016124

per share, subject to anti-dilution provisions and adjustment for stock splits, reclassifications and distributions. The Series

C Preferred Stock votes on an as-converted basis multiplied by 1.9 and, so long as any shares of Series C Preferred Stock are outstanding,

the Holders of the Series C Preferred Stock shall vote as a single class and shall be entitled to elect two directors to the Company’s

board of such number as shall constitute a majority of the board. Holders of the Series C Preferred Stock are entitled to receive

dividends with the holders of Common Stock or other junior securities of the Company.

Anti-Takeover Effects of Delaware Law;

Our Amended and Restated Certificate of Incorporation and Amended Bylaws.

Certain provisions of Delaware law, our

Amended and Restated Certificate of Incorporation and our Amended Bylaws that will be effective following the separation could

make an acquisition of the Company more difficult. These provisions could prohibit or delay mergers or other takeover or change

of control attempts and, accordingly, may discourage attempts to acquire us. These provisions, summarized below, are expected to

discourage certain types of coercive takeover practices and inadequate takeover bids, and are designed to encourage persons seeking

to acquire control of us to negotiate with our board of directors.

Delaware Anti-takeover Law.

We

are subject to Section 203 of the Delaware General Corporation Law, an anti-takeover law. In general, Section 203 prohibits

a publicly held Delaware corporation from engaging in a “business combination” with an “interested stockholder”

for a period of three years following the date the person became an interested stockholder, unless:

|

|

•

|

|

prior to such date, the board of directors approved either the “business combination” or the transaction which resulted in the stockholder becoming an “interested stockholder”;

|

|

|

•

|

|

upon consummation of the transaction that resulted in the stockholder becoming an “interested stockholder,” the “interested stockholder” owned at least 85 percent of the voting stock outstanding at the time the transaction commenced, excluding for purposes of determining the number of shares outstanding those shares owned by (i) officers who are also directors and (ii) certain other stockholders; or

|

|

|

•

|

|

on or subsequent to such date, the “business combination” is approved by the board of directors and authorized at an annual or special meeting of stockholders by the affirmative vote of at least 66

2

/3 percent of the outstanding voting stock that is not owned by the “interested stockholder.”

|

Generally, a “business combination”

includes a merger, asset or stock sale, or other transaction resulting in a financial benefit to the interested stockholder. Generally,

an “interested stockholder” is a person who, together with affiliates and associates, owns or, within three years prior

to the determination of interested stockholder status, did own, 15 percent or more of a corporation’s voting stock. This

provision may have an anti-takeover effect with respect to transactions not approved in advance by the board of directors, including

discouraging attempts that might result in a premium over the market price for the shares of common stock held by stockholders.