Filed Pursuant to Rule 424(b)(5)

Registration No. 333-214890

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered

|

|

Amount

to be

Registered

(1)

|

|

Proposed

Maximum

Offering Price

per Share

(2)

|

|

Proposed

Maximum

Aggregate

Offering Price

(2)

|

|

Amount of

Registration Fee

|

|

Common Stock, $0.01 par value per share

|

|

3,000

|

|

$170.14

|

|

$510,420

|

|

$60

|

|

|

|

|

|

(1)

|

Pursuant to Rule 416 under the Act, this Registration Statement registers such indeterminate number of additional shares of Common Stock as may be issued in connection with stock splits, stock dividends or similar

transactions.

|

|

(2)

|

Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457(a) of the Securities Act of 1933, as amended (the “Act”). In accordance with Rule 457(c) of the Act, the

maximum offering price per share is the average of the high and low selling prices of the Common Stock on November 29, 2016 as reported on the New York Stock Exchange.

|

PROSPECTUS SUPPLEMENT

(to Prospectus Dated December 2, 2016)

Domino’s Pizza, Inc.

3,000 Shares

Piece of

the Pie Program

Domino’s Pizza, Inc. (the “Company”) is pleased to offer the opportunity for eligible customers to participate in the

Domino’s Pizza Piece of the Pie Program (the “Plan”) described in this prospectus supplement. We have established the Plan to provide our eligible customers with the opportunity to be entered into drawings under the Plan to receive

ten shares of our common stock, par value $0.01 per share (our “Common Stock”) as a thank you for being a loyal customer. An “eligible customer” means a U.S. resident age 18 or older who enrolls in the Plan, subject to certain

exceptions described in this prospectus supplement under “Description of the Plan—Eligibility.” Between December 5, 2016 and November 30, 2017 (the “Offer Period”), we will conduct 25 drawings per month. An eligible

customer who has enrolled in the Plan prior to a particular drawing date will be automatically entered into that drawing. Eligible customers will not be eligible to participate in drawings occurring prior to the date of enrollment in the Plan. An

eligible customer who is selected in a drawing to receive an award under the Plan will be presented with an offer (the “Offer”) to receive ten shares of our Common Stock (each a “Share” and collectively, the “Shares”)

under the Plan (each a “Piece of the Pie Award”). Redemptions of Piece of the Pie Awards will be fulfilled through Fidelity Brokerage Services LLC and Fidelity Capital Markets, a division of National Financial Services LLC

(collectively, “Fidelity”) and will require that, as a condition to redemption of a Piece of the Pie Award, the selected eligible customer open a brokerage account with Fidelity (the “Fidelity Account”) into which the Shares can

be deposited. Fidelity will obtain the Shares to be delivered upon redemption of Piece of the Pie Awards through open market purchases or, to the extent determined by the Company, delivery by the Company to Fidelity of newly-issued shares. A Piece

of the Pie Award must be redeemed within 30 days of receipt, after which time such Piece of the Pie Award will expire if not previously redeemed. Piece of the Pie Awards are limited to ten Shares per selected eligible customer and no eligible

customer may receive more than one Piece of the Pie Award. In order to enter for a chance to receive a Piece of the Pie Award, eligible customers must enroll in the Plan using their account on the Domino’s Pizza application (the

“Domino’s Pizza App”) or by registering on the www.dominos.com website. An eligible customer who enrolls in the Plan will only be eligible to participate in drawings occurring after the date of such enrollment.

We believe that the Plan presents an opportunity to thank our customers for their loyalty. As described in more detail in this prospectus

supplement, the following features are available to Plan participants (“participants,” “you,” or “your”) and Plan participants must agree to certain terms:

|

|

•

|

|

Simple Enrollment and Easy to Redeem Awards.

Eligible customers can enter for a chance to receive a Piece of the Pie Award by enrolling in the Plan using their account on the Domino’s Pizza App or by

registering on the www.dominos.com website. Eligible customers who are selected to receive a Piece of the Pie Award can redeem their Piece of the Pie Award by opening a brokerage account at Fidelity and otherwise complying with the terms of the Plan

as described in this prospectus supplement.

|

|

|

•

|

|

No Fees to Enroll and Redeem Piece of the Pie Awards.

A participant will be able to redeem a Piece of the Pie Award at no cost to the participant.

|

|

|

•

|

|

Fees to Sell Shares Issuable Upon Redemption of Piece of the Pie Awards.

A participant who redeems a Piece of the Pie Award will be entitled to make one purchase or sale transaction in his or her Fidelity Account

without paying a commission to Fidelity. This one transaction may, but need not, involve some or all of the Shares received upon redemption of a Piece of the Pie Award. All other transactions made in the eligible customer’s Fidelity Account

(including any such transactions involving Shares) will be subject to Fidelity’s fee schedule applicable to such Fidelity Account as specified by Fidelity from time to time. See “Cost to Participants” below. Participants may withdraw

proceeds from the sale of Shares by electronic transfer in accordance with the terms of their Fidelity Account.

|

|

|

•

|

|

Fully Electronic Stockholder Communications.

To participate in the Plan, participants must agree, subject to applicable law, to receive all stockholder communications from Domino’s Pizza electronically

through Fidelity.

|

|

|

•

|

|

Review Positions Online.

Participants can access positions and history and engage in Plan transactions through their Fidelity Account using the Fidelity technology platform.

|

|

|

•

|

|

No Control over Exact Timing of Redemption Transactions.

Plan participants will not have complete control over the exact timing of transactions or the price of Shares at the time of any redemption of a Piece of

the Pie Award, as Plan transaction orders may be executed on a batched basis.

|

|

|

•

|

|

Right to Suspend or Modify.

The Plan, and redemptions of Piece of the Pie Awards issued thereunder, may be suspended, modified, terminated or extended at any time. The terms and conditions of the Plan may be

changed, limited, modified or eliminated at any time.

|

Shares offered under the Plan are offered through Fidelity, a U.S.

registered broker-dealer. Fidelity will act as your broker and agent in all Plan transactions and you must open a Fidelity Account. You do not have to be a current stockholder of Domino’s Pizza to participate in the Plan.

As a condition to participation in the Plan, participants must consent to electronic delivery of this prospectus supplement, the accompanying

prospectus, all prospectus amendments and supplements, confirmations and other information relating to this offering. This consent may not be revoked. Upon enrollment, you must also consent to electronic delivery of annual reports, proxy statements,

communications and other materials provided generally to our stockholders from time to time.

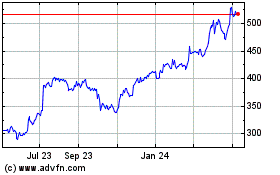

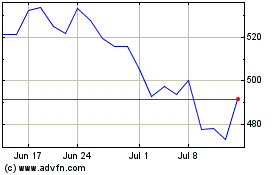

Our Common Stock is listed on the New York

Stock Exchange and trades under the ticker symbol “DPZ.” On December 1, 2016, the closing price of our Common Stock was $168.70 per Share. Please read this prospectus supplement carefully and keep it for future reference.

Owning our Common Stock involves risks. See “

Risk Factors

” beginning on page S-4 of this

prospectus supplement. You should also consider the risk factors described in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus. You should review the disclosure under the heading “Certain

U.S. Federal Income Tax Considerations” and consult your tax advisor prior to redeeming any Piece of the Pie Award.

Neither the

Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is December 2, 2016.

Prospectus Supplement

We have not authorized any other person to provide you with information different from that contained in or

incorporated by reference into this prospectus supplement and the accompanying prospectus or in any free writing prospectus that we may provide to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other

information that others may give. The information contained in or incorporated by reference into this prospectus supplement and the accompanying prospectus is accurate only as of the date such information is presented regardless of the time of

delivery of this prospectus supplement and the accompanying prospectus or any award or redemption of Piece of the Pie Awards. Our business, financial condition, results of operations and prospects may have changed since such date. This document may

only be used where it is legal to sell these securities. We are not making an offer of these securities in any state where the offer is not permitted and are only making this offer available to eligible customers in the United States (excluding

Puerto Rico).

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus are part of a registration statement on Form S-3 under the Securities Act of

1933, as amended (the “Securities Act”), that we filed with the Securities and Exchange Commission (the “SEC”) using the “shelf” registration process. This document is in two parts. The first part is this prospectus

supplement, which describes the specific terms of this offering of the notes and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference in this prospectus supplement and the

accompanying prospectus. The second part is the accompanying prospectus, which gives more general information. Generally, when we refer to this prospectus, we are referring to both parts of this document combined. To the extent there is a conflict

between the information contained in the accompanying prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement; provided that if any statement in one of these documents is inconsistent with a

statement in another document having a later date—for example, a document incorporated by reference in the accompanying prospectus or this prospectus supplement—the statement in the document having the later date modifies or supersedes the

earlier statement.

As permitted by the rules and regulations of the Securities and Exchange Commission (the “SEC”), the

registration statement of which the accompanying prospectus forms a part includes additional information not contained in this prospectus supplement. You may read the registration statement and the other reports we file with the SEC at the

SEC’s website or at the SEC’s offices described below under the heading “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

You should read this prospectus supplement along with the accompanying prospectus and the documents incorporated by reference carefully before

you decide whether to participate in the Plan. These documents contain important information you should consider when making your investment decision. This prospectus supplement contains information about the securities offered in this offering and

may add, update or change information in the accompanying prospectus.

In this prospectus supplement, unless the context indicates

otherwise, references to “Domino’s,” “Domino’s Pizza,” the “Company,” “our Company,” “we,” “our,” “ours” and “us” refer to Domino’s Pizza, Inc.

Accordingly, unless otherwise noted, all of the financial information incorporated by reference in this prospectus supplement is presented on a consolidated basis of Domino’s Pizza.

Market data and other statistical information used in this prospectus supplement or the accompanying prospectus or incorporated by reference

into this prospectus supplement are based on independent industry publications, government publications, reports by market research firms and other published independent sources. Some data is also based on our good faith estimates, which we derive

from our review of internal surveys and independent sources. Although we believe these sources are reliable, we have not independently verified the information. We neither guarantee its accuracy nor undertake a duty to provide or update such data in

the future.

This prospectus supplement, the accompanying prospectus or the documents incorporated by reference into this prospectus

supplement or the accompanying prospectus may include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference in this prospectus supplement, the

accompanying prospectus or the documents incorporated by reference into this prospectus supplement or the accompanying prospectus are the property of their respective owners.

S-ii

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement and the documents incorporated by reference herein and therein include statements that express our opinions,

expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to be, “forward-looking statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (collectively, the “PSLRA”). These forward-looking statements are based on current management expectations that involve substantial risks and

uncertainties which could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements and such forward-looking statements are being made pursuant to the provisions of the PSLRA and with

the intention of obtaining the benefits of the “safe harbor” provisions of the PSLRA. These forward-looking statements generally can be identified by the use of words such as “anticipate,” “believe,” “could,”

“estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will,” “potential,” “outlook” and similar terms and phrases, including

references to assumptions, are forward-looking statements. These forward-looking statements address various matters including information concerning future results of operations and business strategy, and statements about our ability to complete our

“Pizza Theater” store redesign, the expected demand for future pizza delivery, our expectation that we will meet the terms of our agreement with our third-party supplier of pizza cheese, our belief that alternative third-party suppliers

are available for our key ingredients in the event we are required to replace any of our supply partners, our intention to continue to enhance and grow online ordering, digital marketing and technological capabilities, our expectation that there

will be no material capital expenditures for environmental control facilities, our plans to expand international operations in many of the markets where we currently operate and in selected new markets, our expectation that the contribution rate for

advertising fees payable to DNAF will remain in place for the foreseeable future and our expectation that we will use our unrestricted cash and cash equivalents, restricted cash amounts pledged as collateral for letters of credit, ongoing cash flows

from operations and available borrowings under the 2015 Variable Funding Notes to, among other things, fund working capital requirements, invest in our core business, pay dividends and repurchase our common stock.

Forward-looking statements relating to our anticipated profitability, the growth of our international business, ability to service our

indebtedness, our operating performance, trends in our business and other descriptions of future events reflect management’s expectations based upon currently available information and data. While we believe these expectations and projections

are based on reasonable assumptions, such forward-looking statements are inherently subject to risks, uncertainties and assumptions about us, including the risk associated with the risk factors referred to in the “Risk Factors” section of

this prospectus.

Actual results may differ materially from those in the forward looking statements as a result of various factors,

including but not limited to, the following:

|

|

•

|

|

our substantial increased indebtedness as a result of the 2012 recapitalization and the 2015 recapitalization and our ability to incur additional indebtedness or refinance that indebtedness in the

future;

|

|

|

•

|

|

our future financial performance;

|

|

|

•

|

|

the success of our marketing initiatives;

|

|

|

•

|

|

our ability to maintain good relationships with our franchisees;

|

|

|

•

|

|

our ability to successfully implement cost-saving strategies;

|

|

|

•

|

|

increases in our operating costs, including cheese, fuel and other commodity costs and the minimum wage;

|

|

|

•

|

|

our ability to compete domestically and internationally in our intensely competitive industry;

|

|

|

•

|

|

additional risk precipitated by international operations;

|

S-1

|

|

•

|

|

our ability to retain or replace our executive officers and other key members of management and our ability to adequately staff our stores and supply chain centers with qualified personnel;

|

|

|

•

|

|

our ability to pay principal and interest on our substantial debt;

|

|

|

•

|

|

our ability to find and/or retain suitable real estate for our stores and supply chain centers;

|

|

|

•

|

|

adverse legislation, regulation or publicity;

|

|

|

•

|

|

adverse legal judgments or settlements;

|

|

|

•

|

|

food-borne illness or contamination of products;

|

|

|

•

|

|

data breaches or other cyber risks;

|

|

|

•

|

|

the effect of war, terrorism or catastrophic events;

|

|

|

•

|

|

our ability to pay dividends;

|

|

|

•

|

|

changes in consumer taste, demographic trends and traffic patterns; and

|

|

|

•

|

|

adequacy of insurance coverage.

|

All forward-looking statements should be evaluated with the

understanding of their inherent uncertainty. We will not undertake and specifically decline any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of

these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus might not occur.

Forward-looking

statements speak only as of the date of this prospectus. Except as required under federal securities laws and the rules and regulations of the Securities and Exchange Commission, we do not have any intention to update any forward-looking statements

to reflect events or circumstances arising after the date of this prospectus, whether as a result of new information, future events or otherwise. As a result of these risks and uncertainties, readers are cautioned not to place undue reliance on the

forward-looking statements included in this prospectus or that may be made elsewhere from time to time by, or on behalf of, us. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

Additional information concerning these and other risk factors is contained in the section titled “Risk Factors” in this prospectus

supplement.

S-2

OUR COMPANY

Domino’s is the second largest pizza restaurant chain in the world, with more than 12,500 locations in over 80 markets around the world.

Founded in 1960, our roots are in convenient pizza delivery, while a significant amount of our sales also come from carryout customers. Although we are a highly-recognized global brand, we focus on serving the local neighborhoods in which we live

and do business through our large network of franchise owners and Company-owned stores. On average, we sell more than 1.5 million pizzas each day throughout our global system.

Our business model is straightforward: we handcraft and serve quality food at a competitive price, with easy ordering access and efficient

service, enhanced by our technology innovations. Our dough is generally made fresh and distributed to stores around the world by us and our franchisees.

Domino’s generates revenues and earnings by charging royalties to its franchisees. Royalties are ongoing percent-of-sales fees for use of

the Domino’s brand marks. The Company also generates revenues and earnings by selling food, equipment and supplies to franchisees primarily in the U.S. and Canada, and by operating a number of our own stores. Franchisees profit by selling pizza

and other complementary items to their local customers. In our international markets, we generally grant geographical rights to the Domino’s Pizza

®

brand to master franchisees. These

master franchisees are charged with developing their geographical area, and they may profit by sub-franchising and selling ingredients and equipment to those sub-franchisees, as well as by running pizza stores. Everyone in the system can benefit,

including the end consumer, who can feed their family Domino’s menu items conveniently and economically.

Our corporate headquarters

and principal executive offices are located at 30 Frank Lloyd Wright Drive, Ann Arbor, Michigan 48105. Our telephone number is (734) 930-3030. We maintain a website at www.dominos.com where our Annual Reports on Form 10-K, Quarterly Reports on

Form 10-Q, Current Reports on Form 8-K and all amendments to those reports are available without charge, as soon as reasonably practicable following the time they are filed with or furnished to the SEC. The information on or accessible through our

website is not incorporated into or part of this prospectus supplement (except as set forth under “Incorporation of Certain Information by Reference”).

THE PIECE OF THE PIE PROGRAM

The Piece of the Pie Program is just one of the ways we are giving thanks to our customers. Through the Plan, we are offering our eligible

customers the opportunity to be entered into drawings for a chance to be selected to receive ten Shares.

S-3

RISK FACTORS

An investment in our securities involves a high degree of risk. Prior to making a decision about participating in the Plan, you should

carefully consider the following risks and uncertainties, as well as those discussed under the caption “Item 1A—Risk Factors” in our Annual Report on Form 10-K for the year ended January 3, 2016, and subsequent reports we file on

Forms 10-Q and 8-K, which are incorporated by reference into this prospectus supplement or the accompanying prospectus. If any of the risks described in this prospectus supplement or the accompanying prospectus, or the risks described in any

documents incorporated by reference in this prospectus supplement or the accompanying prospectus, actually occur, our business, prospects, financial condition or operating results could be harmed. In such case, the trading price of our Common Stock

could decline, and you may lose all or part of your investment.

Additional Risks Relating to Participation in the Plan

You will not have control over the exact timing of transactions and you will not know the price of the Shares you are obtaining upon redemption of a

Piece of the Pie Award under the Plan at the time you authorize the transaction.

You will not have complete control over the

exact timing of transactions or the price of Shares at the time you redeem a Piece of the Pie Award, as Plan transaction orders may be executed on a batched basis—meaning that your order will be batched or combined with orders from other

participants redeeming Piece of the Pie Awards. Unlike a market order placed in an ordinary brokerage account, there may be a substantial delay between the time you enter your redemption order and the time it is executed. The time between the

placement of a redemption order and the execution of that order could be four or more business days or possibly longer. Order processing may be further delayed by market events such as trading halts, whether due to external causes, such as exchange

halts (which would apply to all securities transactions) or suspension of Plan trading activity initiated by Fidelity or by the Company (at Fidelity’s or the Company’s sole discretion). In the event of a trading halt or Plan activity

suspension, redemption orders will be executed according to Fidelity’s batch trading policies on the first available day after the trading halt or Plan activity suspension is lifted.

As a result of the batch method of transactions, the price of Shares of our Common Stock may fluctuate, perhaps significantly, between the

time you decide to redeem a Piece of the Pie Award under the Plan and the time of actual execution of such transaction, potentially causing you to realize less in respect of your investment. During this time period, you may become aware of

additional information that might affect your investment decision, but you will not be able to change or cancel your transaction.

We may limit, add

to, suspend, modify, terminate or extend the Plan, or redemptions of Piece of the Pie Awards, at any time.

At any time and in our

sole discretion, we may limit, add to, suspend, modify terminate or extend the Plan, or redemptions of Piece of the Pie Awards under the Plan, or any of its terms and conditions, which could result in the realization of substantially fewer benefits

to participants than what you may expect. We have no prior experience with the implementation of a program such as the Plan. We may find that it is substantially more expensive to implement and maintain than what we currently expect, or it may

result in substantially fewer benefits than what we anticipate. We have reserved the right to change the terms and conditions of the Plan or Piece of the Pie Awards or to modify, suspend, or cancel the Plan in its entirety or to modify, suspend or

cancel any Piece of the Pie Awards at any time. Any of these actions could keep you from realizing any meaningful benefit from the Plan or any Piece of the Pie Award, and you could realize substantially fewer benefits of participation than what you

may expect.

S-4

All communications with Plan participants and all voting with respect to Shares held through the Plan will

be electronic, meaning that you will not be provided with paper communications and must rely on having access to the Internet.

Subject to applicable laws and rules, all stockholder communications will be made electronically, either via email, email notification to

access online information, or as otherwise contemplated herein. As a result, you should not expect to receive stockholder communications through the mail. Electronic communications will include, among others, confirmations of transactions, account

statements, annual reports, proxy materials and stockholder communications, notices of modifications of Fidelity’s privacy policies as well as other basic communications, including information about your Fidelity Account. Generally, the only

way to get paper copies of these communications is to print them from a computer. Regular and continuous Internet access is required to access all communications relating to your Shares in the Plan and your Fidelity Account. You should not hold

Shares through the Plan if you do not have regular and continuous Internet access.

When you redeem your Piece of the Pie Award, you

become a Domino’s Pizza stockholder. As a stockholder, you gain all the voting rights and privileges associated with ownership of Shares. You will have the right to vote your Shares, but all voting will be done through Fidelity through

electronic communication. When you communicate to Fidelity how you would like to vote your Shares, Fidelity will collect that information, aggregate it with all other voting instructions submitted with respect to Shares held through the Plan and

communicate those instructions on an aggregated basis to Domino’s Pizza. Except as otherwise permitted by applicable law or stock exchange rule, none of your Shares will be voted in any way unless authorized by you.

Should you revoke your consent to electronic delivery to receive paper copies of these communications, your revocation will constitute a

request to liquidate your Shares held in your Fidelity Account on your behalf, unless you provide instructions for a transfer of your Shares from Fidelity to another U.S. financial institution that makes those communications available through

non-electronic means. Any such revocation will be deemed effective as of the date of the liquidation or transfer and will not affect any such communications previously delivered by Fidelity, or pertaining to transactions or matters occurring prior

to the transfer. There can be no assurance that you will be able to effect the transfer requested and communication in paper form in a timely manner.

Any Piece of the Pie Awards you receive as a result of the Plan could have adverse tax consequences to you.

You will be subject to U.S. federal income tax on the value of your Piece of the Pie Award. Your participation in the Plan may also increase

the complexity of your tax filings and may cause you to be ineligible to file Internal Revenue Service (“IRS”) Form 1040-EZ, if you would otherwise be eligible to file such form. See “Certain U.S. Federal Income Tax

Considerations,” below for more information on the U.S. federal income tax consequences of participation in the Plan.

The administration and

operation of the Plan is significantly dependent on information technology.

The Plan utilizes a technology platform, posing

increased operational risk associated with the use of newer technologies. Because all redemptions under the Plan will be placed through e-commerce Web sites, participants must rely on us and Fidelity to securely collect, transmit, and store

electronic information in connection with its administration of the Plan. Despite any security measures that we or Fidelity may put in place, we and its (and our and its service providers’) information technology systems may be susceptible to

damage, disruptions, or shutdowns due to hardware failures, computer viruses, hacker attacks, telecommunication failures, user errors, catastrophic events, or other factors. Any damage or disruption to, or shutdown suffered by, information

technology systems used in connection with the Plan could interrupt Plan administration and expose participants (current and past) to the risk that others may obtain unauthorized access to their confidential information, including personal

information and credit card and other financial data.

S-5

DESCRIPTION OF THE PLAN

Summary

We have served up the Piece of

the Pie Program to thank our customers for their loyalty and to enable selected eligible customers to participate in the ownership of our Company.

Shares for the Plan will be purchased in the open market by Fidelity or, at our election, provided by us to Fidelity out of our authorized but

unissued shares and will be initially deposited in a custody account in the name of the Company (“Custody Account”). Open market purchases will be effected by Fidelity, with all Shares to be credited to the applicable participant’s

Fidelity Account. Fidelity has full discretion as to all matters relating to open market purchases, subject to the terms of our agreement with them, including the number of Shares, if any, to be purchased on any day or at any time of day, the price

paid for such Shares, the markets on which Shares are purchased (including on any securities exchange, in the over-the-counter market or in negotiated transactions) and the persons (including brokers and dealers) from or through whom such purchases

are made.

The Plan is not designed for short-term investors, as participants will not have complete control over the exact timing of

redemption transactions or the market value of our Common Stock redeemed pursuant to a Piece of the Pie Award under the Plan. See “—Timing of Purchases.” The Plan is designed primarily for customers who have a long-term

perspective and affinity for the Company and its values.

|

|

•

|

|

Simple Enrollment and Easy to Redeem Awards.

Eligible customers can enter for a chance to receive a Piece of the Pie Award by enrolling in the Plan using their account on the Domino’s Pizza App or by

registering on the www.dominos.com website. Eligible customers who are selected to receive a Piece of the Pie Award can redeem their Piece of the Pie Award by opening a brokerage account at Fidelity and otherwise complying with the terms of the Plan

as described in this prospectus supplement.

|

|

|

•

|

|

No Fees to Enroll and Redeem Piece of the Pie Awards.

A participant will be able to redeem a Piece of the Pie Award offer at no cost to the participant.

|

|

|

•

|

|

Fees to Sell Shares Issuable Upon Redemption of Piece of the Pie Awards.

A participant who redeems a Piece of the Pie Award will be entitled to make one purchase or sale transaction in his or her Fidelity Account

without paying a commission to Fidelity. This one transaction may, but need not, involve some or all of the Shares received upon redemption of a Piece of the Pie Award. All other transactions made in the eligible customer’s Fidelity Account

(including any such transactions involving Shares) will be subject to Fidelity’s fee schedule applicable to such Fidelity Account as specified by Fidelity from time to time. See “Cost to Participants” below. Participants may withdraw

proceeds from the sale of Shares by electronic transfer in accordance with the terms of their Fidelity Account.

|

|

|

•

|

|

Fully Electronic Stockholder Communications.

To participate in the Plan, participants must agree, subject to applicable law, to receive all stockholder communications from Domino’s Pizza electronically

through Fidelity.

|

|

|

•

|

|

Review Positions Online.

Participants can access positions and history and engage in Plan transactions through their Fidelity Account using the Fidelity technology platform.

|

|

|

•

|

|

No Control over Exact Timing of Transactions.

Plan participants will not have complete control over the exact timing of transactions or the price of Shares at the time of any redemption of a Piece of the Pie

Award, as Plan transaction orders may be executed on a batched basis.

|

|

|

•

|

|

Right to Suspend or Modify.

The Plan, and redemptions of Piece of the Pie Awards issued thereunder, may be suspended, modified, terminated or extended at any time. The terms and conditions of the Plan may be

changed, limited, modified or eliminated at any time.

|

S-6

The Offer

We are pleased to offer the opportunity for eligible customers to participate in the Plan described in this prospectus supplement. We have

established the Plan to provide our eligible customers with the opportunity to be entered into drawings under the Plan to receive ten shares of our Common Stock as a thank you for being a loyal customer. Between December 5, 2016 and November 30,

2017 (the “Offer Period”), we will conduct 25 drawings per month. An eligible customer who has enrolled in the Plan prior to a particular drawing date will be automatically entered into that drawing. Eligible customers will not be eligible

to participate in drawings occurring prior to the date of enrollment in the Plan. An eligible customer who is selected in a drawing to receive an award under the Plan will be presented with an offer (the “Offer”) to receive ten shares of

our Common Stock (each a “Share” and collectively, the “Shares”) under the Plan (each a “Piece of the Pie Award”).

Redemptions of Piece of the Pie Awards will be fulfilled through Fidelity and will require that, as a condition to redemption of a Piece of

the Pie Award, the selected eligible customer open a brokerage account with Fidelity into which the Shares can be deposited. Fidelity will obtain the Shares to be delivered upon redemption of Piece of the Pie Awards through open market purchases or,

to the extent determined by the Company, delivery by the Company to Fidelity of newly-issued shares. A Piece of the Pie Award must be redeemed within 30 days of receipt, after which time such Piece of the Pie Award will expire if not previously

redeemed. Piece of the Pie Awards are limited to ten Shares per selected eligible customer and no eligible customer may receive more than one Piece of the Pie Award. In order to enter for a chance to receive a Piece of the Pie Award, eligible

customers must enroll in the Plan using their account on the Domino’s Pizza App or by registering on the www.dominos.com website. An eligible customer who enrolls in the Plan will only be eligible to participate in drawings occurring after the

date of such enrollment.

Fidelity

Fidelity Brokerage Services LLC and Fidelity Capital Markets, a division of National Financial Services LLC (collectively,

“Fidelity”), a U.S. registered broker-dealer, will act as your broker and agent in all Plan transactions and you must open a brokerage account (“Fidelity Account”) with Fidelity. We will be paying Fidelity for brokerage,

technology, and other services. All brokerage services will be provided by Fidelity. We expect to pay Fidelity a customary fee per redemption of Piece of the Pie Awards.

Any questions regarding a participant’s Fidelity Account or transactions in such account, including any transactions involving Shares,

should be directed to Fidelity in the manner specified by Fidelity in the information provided in connection with opening the Fidelity Account. Any other questions regarding the Plan may be directed to us at Domino’s Pizza, Inc., 30 Frank Lloyd

Wright Drive, Ann Arbor, MI 48106, Attention: Legal Department or by calling us at (734) 930-3030.

Eligibility

Except as described in the next sentence, you are eligible to participate in the Plan if you are a U.S. resident age 18 or older who enrolls in

the Plan. Employees of Domino’s Pizza, Fidelity, HelloWorld, Inc., and their respective parent, subsidiary and affiliate companies and advertising and promotion agencies as well as the immediate family members (spouse, parents, siblings and

children and their respective spouses, regardless of where they reside) and household members of each such employee, whether or not related, are not eligible to participate in the Plan. In addition, participation in the Plan is not permitted where

prohibited by applicable law. An eligible customer who has enrolled in the Plan prior to a particular drawing date will be automatically entered into that drawing. Eligible customers will not be eligible to participate in drawings occurring prior to

the date of enrollment in the Plan. No person may receive or redeem more than one Piece of the Pie Award under the Offer.

If you are

selected by us in a drawing to receive a Piece of the Pie Award, you will be required to open a brokerage account with Fidelity in order to redeem a Piece of the Pie Award under the Plan. Such participants must pass Fidelity’s eligibility

criteria, including verification of your identity, minimum age and U.S. residence. Participants who fail to meet such criteria will not be eligible to redeem any Piece of the Pie Award.

S-7

Domino’s Pizza reserves the right to make all determinations regarding eligibility to

participate in the Plan or to receive or redeem a Piece of the Pie Award.

Piece of the Pie Awards are not transferable. Shares acquired

upon redemption of a Piece of the Pie Award are freely transferable by the holder thereof.

Source of the Shares

Shares of our Common Stock needed to meet Plan requirements will be purchased in the open market or, to the extent determined by the Company,

delivery by the Company to Fidelity of newly-issued shares, and will be held through the Custody Account. Open market purchases will be effected by Fidelity, with all Shares to be credited to the applicable participants’ accounts.

Timing of Receipt of Shares upon Redemption of Piece of the Pie Awards

Once an eligible customer that has received a Piece of the Pie Award has opened a Fidelity Account and redeemed a Piece of the Pie Award,

Fidelity will generally deposit the Shares in such participant’s account within 10 trading days, provided that no suspension of activity or trading halt has occurred, as described below.

Timing of Purchases

Open Market.

Share purchases in the open market to satisfy the redemption of a Piece of the Pie Award will generally occur on a daily basis on the first regular trading day following approval and opening of the Fidelity Account (or on the next trading day if

the market is not open), which normally takes four or more business days after your redemption order is entered, but may be longer. You will receive an electronic redemption confirmation upon deposit of the Shares into your Fidelity Account.

Trade Halts and Black-Out Periods.

Please note that the timing of any redemptions may be affected by market events such as trading

halts, whether due to external causes, such as exchange halts (which would apply to all securities transactions) or suspension of Plan trading activity initiated by Fidelity or by the Company (at Fidelity’s or the Company’s sole

discretion). In the event of a trading halt or Plan activity suspension, redemptions may be executed according to Fidelity’s batch trading policies on the first available day after the trading halt or Plan activity suspension is lifted.

Sale of Shares

You may sell all of your

Shares held received under the Plan at any time after you have received a confirmation that the Shares acquired upon redemption of your Piece of the Pie Award are in your account. You may do so by entering sale instructions online through your

Fidelity Account. Sale orders will typically be executed the same trading day by Fidelity depending on the type of order placed by the customer. All executions at Fidelity are done on a real time basis. The timing of any sale order processing may be

affected by market events such as trade halts initiated by Fidelity or otherwise.

A participant who redeems a Piece of the Pie Award will

be entitled to make one purchase or sale transaction in his or her Fidelity Account without paying a commission to Fidelity. This one transaction may, but need not, involve some or all of the Shares received upon redemption of a Piece of the Pie

Award. All other transactions made in the eligible customer’s Fidelity Account (including any such transactions involving Shares) will be subject to Fidelity’s fee schedule applicable to such Fidelity Account as specified by Fidelity from

time to time. See “Cost to Participants” below.

In order to transfer proceeds from the sale of Shares held in your Fidelity

Account out of your Fidelity Account, you must follow the procedures established by Fidelity and applicable to your Fidelity Account.

S-8

Subject to certain restrictions, if you would like to transfer some or all of the Shares held in

your Fidelity Account to a different brokerage account, you may do so by instructing your new broker to initiate the transfer.

Electronic Book-Entry

of Shares

Shares issued pursuant to the Plan and held in your Fidelity Account will be maintained in your name in book-entry form.

Physical certificates are not available.

Communications and Reports to Participants

By becoming a participant in the Plan, you agree, for so long as you continue as a participant or hold Shares through the Plan or remain a

customer of Fidelity, to receive all communications from the Company and Fidelity electronically either via email or email notification to access online information (except when the Company or Fidelity is required to provide the option for

non-electronic communication or documentation by law or regulation upon your request). Electronic communication will include, but will not be limited to, confirmations of transactions, account statements, proxy materials and stockholder

communications, notices of modifications of the privacy policies of Fidelity as well as other basic communications, including information from Fidelity. Any communications electronically delivered by Fidelity to your password-protected area of the

Plan participant site will be deemed to have been received by you at the time notice by email is sent to your email address, and any communications delivered by email when sent to your email address. You agree to advise Fidelity promptly of any

change of your email and/or residential address. You also agree to notify Fidelity promptly of any errors or omissions in any transaction or in the handling of your Plan participation.

You will also consent to electronically receive U.S. tax reporting documents (such as an IRS Form 1099-B reflecting proceeds in the case of a

sale of Shares held in the Plan) unless you affirmatively opt to receive them in paper form in connection with the opening of your Fidelity Account.

Termination of Plan Participation

You

may discontinue participation in the Plan at any time by selling all of your Shares received pursuant to the Plan.

Cost to Participants

Applicable fees are as follows:

|

|

|

|

|

Plan Enrollment:

|

|

No charge

|

|

Redemption of Piece of the Pie Award:

|

|

No charge

|

|

Sale of Shares:

|

|

No commission charge for one online purchase or sale transaction effected in the Fidelity Account through Fidelity.com. Thereafter, all transactions subject to Fidelity’s fee schedule applicable to the Fidelity Account as

specified by Fidelity from time to time (generally Fidelity charges a $7.95 brokerage commission in connection with online purchase or sale transactions)

|

|

Transfer of Shares to another brokerage account:

|

|

No charge

|

The fees specified above may be changed by Fidelity from time to time in accordance with the terms of the

Fidelity Account. Fidelity will provide you with advance notice of the imposition of any sales charge and of any changes to the fees charged by Fidelity with respect to your Fidelity Account.

S-9

Additional Information about the Plan

Voting

.

You will be entitled to all of the voting rights and privileges associated with ownership of your Shares. You will

receive all stockholder communications electronically, including proxy materials and annual reports. You will have the right to vote your Shares, but all voting will be done through Fidelity through electronic communication. When you communicate to

Fidelity how you would like to vote your Shares, Fidelity will collect that information, aggregate it with all other voting instructions submitted with respect to shares of our Common Stock and communicate those instructions on an aggregated basis

to Domino’s Pizza. Your voting instructions will be obtained through an electronic voting instruction form distributed to you through the Fidelity platform. None of your Shares will be voted in any way unless authorized by you.

Responsibilities

.

Neither the Company nor Fidelity can assure you a minimum guaranteed sales price on the Shares that you

acquire under the Plan. Neither the Company nor Fidelity nor any of their affiliates will be liable for any act done in good faith, or as required by applicable law, or for any good faith omission to act. This includes, without limitation, any

claims for liability relating to the prices at which Shares of our Common Stock are acquired or sold for you, the dates of redemption or sales, or any change in the value of the Shares.

Your Plan participation represents an investment in our Common Stock, which may increase or decrease in value. You are responsible for the

investment decisions regarding your Plan investments. Neither we nor Fidelity will provide any investment advice.

You must make independent investment decisions on the redemption of Piece of the Pie Awards and sale of Shares received pursuant to

the Plan based upon your own judgment and research.

You are responsible for all costs that you separately incur in connection with

Plan participation, such as the cost of your Internet service provider or any fees that your bank may charge you for electronic funds transfer and delivery. You are responsible for providing notice of any change in your email address, or other

personal or payment information on the Fidelity platform.

Plan Changes or Interpretations.

This prospectus supplement

(including any supplements or revisions that may be distributed in the future) sets forth the terms of the Plan. We reserve the right to add to, suspend, modify, or terminate the Plan or any Piece of the Pie Award at any time. You will receive

notice of any significant addition, suspension, modification, or termination. The Company and Fidelity also reserve the right to change any administrative procedures of the Plan without notice.

We or Fidelity will determine any question of interpretation arising under the Plan, and any such determination will be final. Any action

taken by us or Fidelity to effectuate the Plan in the good faith exercise of our or its respective judgment will be binding on all parties.

Handling of Stock Splits and Stock Dividends

.

The number of Shares of our Common Stock registered under the Registration

Statement for the Plan (of which this prospectus supplement and the accompanying prospectus forms a part) as well as any calculation of Shares to be issued pursuant to any Piece of the Pie Award and any other per share calculations based on Shares

will be subject to equitable adjustment to reflect any increase or decrease in the number of issued shares of Common Stock resulting from any stock split, stock dividend or similar transaction.

S-10

USE OF PROCEEDS

The Company will not receive any proceeds from the issuance or redemption of Piece of the Pie Awards or from the sale of any Shares issued

under the Plan in respect of Piece of the Pie Awards.

S-11

CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS

The following is a general summary of certain U.S. federal income tax considerations that may be relevant to the Plan. This discussion is

based upon the Internal Revenue Code of 1986, as amended, (the “Code”), the U.S. Treasury regulations promulgated thereunder, administrative pronouncements and judicial decisions, all as of the date hereof and all of which are subject to

change, possibly with retroactive effect. The following discussion is for general purposes only, is limited to U.S. federal income tax consequences, and is addressed only to individuals who are “U.S. persons” within the meaning of the Code

(very generally, U.S. citizens and residents) and who hold their Shares as “capital assets” within the meaning of the Code. You are urged to consult your own tax advisor with respect to any other tax consequences of the Plan, including the

tax consequences, if any, under state, local, foreign, estate, and other tax laws.

We intend to treat your receipt of Shares under the

Plan in connection with your redemption of your Piece of the Pie Award as a taxable prize or award for U.S. federal income tax purposes, resulting in taxable ordinary income to you upon redemption equal to the fair market value of the Shares on the

date you redeem such award.

Upon a taxable sale or other taxable disposition of any Shares you receive pursuant to the Plan, you will

realize, in general, a capital gain or loss equal to the difference between the amount you receive on such disposition and your adjusted tax basis in such Shares. In general, any gain or loss recognized upon a disposition of Shares will be long-term

capital gain or loss if you have held the Shares for more than 12 months at the time of disposition. Otherwise, any gain or loss recognized on a disposition of Shares will be treated as short-term capital gain or loss. Under the Code as currently in

effect, long-term capital gains of individuals are taxed at lower rates than ordinary income and short-term capital gains are taxable at ordinary income rates. Your ability to deduct capital losses could be limited. Your adjusted tax basis in your

Shares should equal the taxable income that you recognize upon redemption of your Piece of the Pie Award, which will generally equal the fair market value of the Shares on the date of redemption of your award.

If you receive Shares pursuant to a redemption of a Piece of the Pie Award, you will be issued an IRS Form 1099-MISC, and a copy of such Form

will be provided to the IRS. You will also be required to furnish your taxpayer identification number and to certify that you are not subject to backup withholding on an IRS

Form W-9.

If you fail to

furnish properly a correct taxpayer identification number, or to certify that you are not subject to backup withholding, or if you have under-reported dividend or interest income, you may be subject to backup withholding at a rate of 28%. Your

participation in the Plan may also be subject to other information reporting and tax withholding requirements.

Your participation in

the Plan may increase the complexity of your tax filings and may cause you to be ineligible to file Internal Revenue Service Form 1040-EZ, if you would otherwise be eligible to file such form.

The U.S. federal income tax discussion set forth above is included for general information only. You are urged to consult your own tax

advisor with respect to the tax consequences of your participation in the Plan, including the tax consequences under state, local, foreign, estate, and other tax laws and tax treaties, and the possible effects of changes in U.S. or other tax laws.

S-12

PLAN OF DISTRIBUTION

The Shares offered pursuant to the Plan are offered directly to Plan participants. There are no expenses charged to participants in connection

with the issuance of Shares upon redemption of Piece of the Pie Awards under the Plan. All costs of administering the Plan will be paid by us. Costs associated with the sale or other disposition of Shares acquired under Plan will be borne by the

recipient of such Shares. We are not making an offer to sell our Common Stock in any jurisdiction where the offer or sale is not permitted.

S-13

LEGAL MATTERS

Certain legal matters with respect to the validity of the Shares offered hereby will be passed upon for us by Ropes & Gray LLP, Boston,

Massachusetts.

EXPERTS

The consolidated financial statements and management’s assessment of the effectiveness of internal control over financial reporting

(which is included in Management’s Report on Internal Control over Financial Reporting) incorporated in this prospectus supplement by reference to the Annual Report on Form 10-K for the year ended January 3, 2016, have been so incorporated in

reliance of the report of PricewaterhouseCoopers LLP, an independent registered public accounting firm, given on the authority of said firm as experts in auditing and accounting.

S-14

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the shares of our common stock being

offered by this prospectus supplement. This prospectus, which forms a part of the registration statement, does not contain all of the information set forth in the registration statement. For further information with respect to us and the shares of

our common stock, reference is made to the registration statement and its exhibits. Statements contained in this prospectus supplement as to the contents of any contract or other document are not necessarily complete. We are required to file annual

and quarterly reports, special reports, proxy statements, and other information with the SEC. The registration statement, such reports and other information can be inspected and copied at the Public Reference Room of the SEC located at 100 F Street,

N.E., Washington, D.C. 20549. Copies of such materials, including copies of all or any portion of the registration statement, can be obtained from the Public Reference Room of the SEC at prescribed rates. You can call the SEC at 1-800-SEC-0330 to

obtain information on the operation of the Public Reference Room. Such materials may also be accessed electronically by means of the SEC’s website at www.sec.gov.

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate by reference” into this prospectus supplement information we file with it, which means that we can

disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus supplement, and information in documents that we file later with the SEC will

automatically update and supersede information in this prospectus supplement. We incorporate by reference into this prospectus supplement the documents listed below and any future filings made by us with the SEC under Section 13(a), 13(c), 14 or

15(d) of the Exchange Act, except for information “furnished” under Items 2.02, 7.01 or 9.01 on Form 8-K or other information “furnished” to the SEC which is not deemed filed and not incorporated in this prospectus supplement,

until the termination of the offering of securities described herein. We hereby incorporate by reference the following documents:

|

|

•

|

|

Our Annual Report on Form 10-K for the fiscal year ended January 3, 2016, filed with the SEC on February 25, 2016 (File No. 001-32242);

|

|

|

•

|

|

Our Quarterly Reports on Form 10-Q for the quarters ended March 27, 2016, June 19, 2016 and September 11, 2016, filed with the SEC on April 28, 2016, July 21, 2016 and October 18, 2016, respectively (File No.

001-32242);

|

|

|

•

|

|

Our Current Reports on Form 8-K, filed with the SEC on April 28, 2016 and May 25, 2016 (File No. 001-32242);

|

|

|

•

|

|

The description of capital stock contained in the Registration Statement on Form 8-A, as filed with the SEC on July 13, 2004 (File No. 001-32242), as supplemented by the “Description of Capital Stock, Certificate

of Incorporation and By-Laws” included in the attached prospectus and including any amendments or reports filed for the purpose of updating such description.

|

You may request a copy of these filings, at no cost, by writing or telephoning us at the following address:

Secretary

Domino’s Pizza,

Inc.

30 Frank Lloyd Wright Drive

Ann Arbor, Michigan 48105

(734)

930-3030

Copies of these filings are also available, without charge, on the SEC’s website at www.sec.gov and on our website at

www.biz.dominos.com as soon as reasonably practicable after they are filed electronically with the SEC. The information contained on our website is not a part of this prospectus supplement.

S-15

Domino’s Pizza, Inc.

Common stock

We may offer

and sell from shares of our common stock from time to time in amounts, at prices and on terms that will be determined at the time of the offering.

This prospectus describes the general manner in which we may sell shares of our common stock. The specific manner in which shares of common

stock may be offered and sold will be described in a supplement to this prospectus.

You should carefully read this prospectus and any

accompanying prospectus supplement, together with the documents we incorporate by reference, before you invest in our common stock.

Our

common stock is listed on the New York Stock Exchange under the symbol “DPZ.” On December 1, 2016, the last sale price of our common stock as reported on the New York Stock Exchange was $168.70 per share.

Investing in our common stock involves substantial risk. Please read “

Risk factors

” beginning on page

1 of this prospectus and any risk factors described in any applicable prospectus supplement and in the documents we incorporate by reference.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon

the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Prospectus dated

December 2, 2016

TABLE OF CONTENTS

We have not authorized anyone to provide any information or to make any representations other than those contained in or incorporated by

reference into this prospectus, any accompanying prospectus supplement or in any free writing prospectuses we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may

give you. This prospectus and any accompanying prospectus supplement are an offer to sell only the shares offered hereby, but only under circumstances and in jurisdictions where it is lawful to do so. The information contained in this prospectus and

any accompanying prospectus supplement is current only as of the date of the applicable document.

i

ABOUT THIS PROSPECTUS

Unless otherwise indicated or the context otherwise requires, references in this prospectus to the “Company,”

“Domino’s,” “Domino’s Pizza,” “we,” “us” and “our” refer to Domino’s Pizza Inc. and its consolidated subsidiaries.

This prospectus supplement and the prospectus is a part of a registration statement that we filed with the Securities and Exchange Commission

(“SEC”), as a “well-known seasoned issuer” as defined under Rule 405 under the Securities Act of 1933, as amended (the “Securities Act”), using a “shelf” registration process. Under this shelf registration

process, we may from time to time sell common stock in one or more offerings. This prospectus provides you with a general description of our common stock. Each time we sell securities under this shelf registration, we will provide a prospectus

supplement that will contain specific information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. Any statement that we make in this prospectus will be modified or

superseded by any inconsistent statement made by us in a prospectus supplement. You should read both this prospectus and any prospectus supplement, including all documents incorporated herein or therein by reference, together with additional

information described under “Where you can find more information.”

ii

RISK FACTORS

Investing in our common stock involves a high degree of risk. See “Item 1A — Risk Factors” in our most recent Annual Report

on Form 10-K and in subsequent Quarterly Reports on Form 10-Q, each of which are incorporated by reference in this prospectus and the “Risk Factors” section in the applicable prospectus supplement for a discussion of the factors you should

carefully consider before deciding to purchase our common stock.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

This prospectus, any prospectus supplement and the documents incorporated by reference herein and therein

include statements that express our opinions, expectations, beliefs, plans, objectives, assumptions or projections regarding future events or future results and therefore are, or may be deemed to be, “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (collectively, the “PSLRA”). These forward-looking statements are based on current management

expectations that involve substantial risks and uncertainties which could cause actual results to differ materially from the results expressed in, or implied by, these forward-looking statements and such forward-looking statements are being made

pursuant to the provisions of the PSLRA and with the intention of obtaining the benefits of the “safe harbor” provisions of the PSLRA. These forward-looking statements generally can be identified by the use of words such as

“anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “predict,” “project,” “will,” “potential,”

“outlook” and similar terms and phrases, including references to assumptions, are forward-looking statements. These forward-looking statements address various matters including information concerning future results of operations and

business strategy, and statements about our ability to complete our “Pizza Theater” store redesign, the expected demand for future pizza delivery, our expectation that we will meet the terms of our agreement with our third-party supplier

of pizza cheese, our belief that alternative third-party suppliers are available for our key ingredients in the event we are required to replace any of our supply partners, our intention to continue to enhance and grow online ordering, digital

marketing and technological capabilities, our expectation that there will be no material capital expenditures for environmental control facilities, our plans to expand international operations in many of the markets where we currently operate and in

selected new markets, our expectation that the contribution rate for advertising fees payable to DNAF will remain in place for the foreseeable future and our expectation that we will use our unrestricted cash and cash equivalents, restricted cash

amounts pledged as collateral for letters of credit, ongoing cash flows from operations and available borrowings under the 2015 Variable Funding Notes to, among other things, fund working capital requirements, invest in our core business, pay

dividends and repurchase our common stock.

Forward-looking statements relating to our anticipated profitability, the growth of our

international business, ability to service our indebtedness, our operating performance, trends in our business and other descriptions of future events reflect management’s expectations based upon currently available information and data. While

we believe these expectations and projections are based on reasonable assumptions, such forward-looking statements are inherently subject to risks, uncertainties and assumptions about us, including the risk associated with the risk factors referred

to in the “Risk Factors” section of this prospectus.

Actual results may differ materially from those in the forward looking

statements as a result of various factors, including but not limited to, the following:

|

|

•

|

|

our substantial increased indebtedness as a result of the 2012 recapitalization and the 2015 recapitalization and our ability to incur additional indebtedness or refinance that indebtedness in the future;

|

|

|

•

|

|

our future financial performance;

|

|

|

•

|

|

the success of our marketing initiatives;

|

1

|

|

•

|

|

our ability to maintain good relationships with our franchisees;

|

|

|

•

|

|

our ability to successfully implement cost-saving strategies;

|

|

|

•

|

|

increases in our operating costs, including cheese, fuel and other commodity costs and the minimum wage;

|

|

|

•

|

|

our ability to compete domestically and internationally in our intensely competitive industry;

|

|

|

•

|

|

additional risk precipitated by international operations;

|

|

|

•

|

|

our ability to retain or replace our executive officers and other key members of management and our ability to adequately staff our stores and supply chain centers with qualified personnel;

|

|

|

•

|

|

our ability to pay principal and interest on our substantial debt;

|

|

|

•

|

|

our ability to find and/or retain suitable real estate for our stores and supply chain centers;

|

|

|

•

|

|

adverse legislation, regulation or publicity;

|

|

|

•

|

|

adverse legal judgments or settlements;

|

|

|

•

|

|

food-borne illness or contamination of products;

|

|

|

•

|

|

data breaches or other cyber risks;

|

|

|

•

|

|

the effect of war, terrorism or catastrophic events;

|

|

|

•

|

|

our ability to pay dividends;

|

|

|

•

|

|

changes in consumer taste, demographic trends and traffic patterns; and

|

|

|

•

|

|

adequacy of insurance coverage.

|

All forward-looking statements should be evaluated with the

understanding of their inherent uncertainty. We will not undertake and specifically decline any obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of

these risks, uncertainties and assumptions, the forward-looking events discussed in this prospectus might not occur.

Forward-looking

statements speak only as of the date of this prospectus. Except as required under federal securities laws and the rules and regulations of the Securities and Exchange Commission, we do not have any intention to update any forward-looking statements

to reflect events or circumstances arising after the date of this prospectus, whether as a result of new information, future events or otherwise. As a result of these risks and uncertainties, readers are cautioned not to place undue reliance on the

forward-looking statements included in this prospectus or that may be made elsewhere from time to time by, or on behalf of, us. All forward-looking statements attributable to us are expressly qualified by these cautionary statements.

2

USE OF PROCEEDS

Except as otherwise set forth in a prospectus supplement, we intend to use the net proceeds from any sale of our common stock by this

prospectus for general corporate purposes. The net proceeds may be invested temporarily in short-term marketable securities or applied to repay short-term debt until they are used for their stated purpose.

DESCRIPTION OF CAPITAL STOCK, CERTIFICATE OF INCORPORATION AND BY-LAWS

General

The total amount

of our authorized capital stock consists of 160,000,000 shares of common stock, 10,000,000 shares of non-voting common stock, and 5,000,000 shares of undesignated preferred stock. As of November 6, 2016, we had outstanding

48,193,386 shares of common stock held by 1,214 stockholders of record and 17,754 shares of non-voting common stock held by 5 stockholders of record and we had outstanding options to purchase 2,483,149 shares of common stock

at a weighted average exercise price of $42.50 per share. We had no shares of preferred stock outstanding. Our non-voting common stock was issued to certain securityholders who acquired these shares, or options exercisable for such shares,

prior to our initial public offering and we do not expect to issue any additional shares of our non-voting common stock.

The following

summary describes the material provisions of our capital stock. We urge you to read our certificate of incorporation and our by-laws, which are included as exhibits to the registration statement of which this prospectus forms a part, together with

the applicable provisions of the Delaware General Corporation Law, as amended.

Our certificate of incorporation and by-laws contain

provisions that are intended to enhance the likelihood of continuity and stability in the composition of the board of directors and which may have the effect of delaying, deferring or preventing a future takeover or change in control of our company

unless such takeover or change in control is approved by our board of directors. These provisions include elimination of stockholder action by written consents, elimination of the ability of stockholders to call special meetings, advance notice

procedures for stockholder proposals and supermajority vote requirements for amendments to our certificate of incorporation and by-laws.

Common Stock

Shares of

our common stock have the following rights, preferences and privileges:

Voting Rights.

Each outstanding share of common stock

(other than shares of non-voting common stock held by certain securityholders that acquired these shares, or options exercisable for such shares, prior to our initial public offering) entitles its holder to one vote on all matters submitted to a

vote of our stockholders, including the election of directors. There are no cumulative voting rights. Our voting common stock votes together as one class on all matters.

Conversion Rights of Non-Voting Common Stock.

All shares of non-voting common stock are convertible into shares of our common stock

upon transfer to a non-affiliate of the holder or otherwise in a brokerage transaction. We do not expect to issue any additional shares of our non-voting common stock.

Dividends.

Subject to the rights of the holders of any preferred stock which may be outstanding from time to time, the holders of

common stock are entitled to receive dividends as, when and if dividends are declared by our board of directors out of assets legally available for the payment of dividends.

3

Liquidation.

In the event of a liquidation, dissolution or winding up of our affairs,

whether voluntary or involuntary, after payment of our liabilities and obligations to creditors and any holders of preferred stock, our remaining assets will be distributed ratably among the holders of shares of common stock on a per share basis.

Rights and Preferences.

Our common stock has no preemptive, redemption, conversion or subscription rights. The rights, powers,

preferences and privileges of holders of our common stock are subject to, and may be adversely affected by, the rights of the holders of shares of any series of preferred stock that we may designate and issue in the future.

Merger.

In the event of a merger or consolidation of us with or into another entity, holders of each share of common stock will be

entitled to receive the same per share consideration.

Listing.

Our common stock is listed on the New York Stock Exchange under the

trading symbol “DPZ.”

Preferred Stock

Our board of directors may, without further action by our stockholders, from time to time, direct the issuance of shares of preferred stock in

series and may, at the time of issuance, determine the designations, powers, preferences, privileges, and relative participating, optional or special rights as well as the qualifications, limitations or restrictions thereof, including dividend