Current Report Filing (8-k)

December 02 2016 - 4:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

November 30, 2016

BIOSCRIP, INC.

(Exact name of Registrant as specified in

its charter)

|

Delaware

|

|

001-11993

|

|

05-0489664

|

|

(State of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

1600 Broadway, Suite 950, Denver, Colorado

|

80202

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including

area code: (720) 697-5200

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 5.02. Departure of Directors or

Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On November 30, 2016, the stockholders

of BioScrip, Inc. (the “Company”) approved two amendments to the Company’s Amended and Restated 2008 Equity

Incentive Plan (the “2008 Plan”). The first amendment increases the number of shares of

common

stock of the Company (“Common Stock”) in the aggregate that may be subject to awards by 5,250,000 shares, from 9,355,000

to 14,605,000. The second amendment increases the annual grant caps under the 2008 Plan from 500,000 Options, 500,000 Stock Appreciation

Rights, and 350,000 Stock Grants and Restricted Stock Units that are intended to comply with the requirements of Section 162(m)

of the Code to a cap of no more than a total of 3,000,000 Options, Stock Appreciation Rights, Stock Grants and Restricted Stock

Units combined. The Board of Directors of the Company had previously approved these amendments to the 2008 Plan, subject to stockholder

approval. The foregoing summary of the amendments to the 2008 Plan is qualified in its entirety by reference to the text of the

Second Amendment to the 2008 Plan, which is filed as Exhibit 10.1 to this filing and is incorporated in this Item 5.02 by reference.

Item 5.07. Submission of Matters to

a Vote of Security Holders.

On November 30, 2016, the Company held

a special meeting of stockholders (the “Stockholders’ Meeting”) to vote on the following proposals:

|

|

·

|

An amendment to the Company’s Second Amended and Restated Certificate of Incorporation to increase the number of shares

of Common Stock that the Company is authorized to issue from 125 million shares to 250 million shares (the “Charter Amendment”);

|

|

|

·

|

An amendment to the 2008 Plan to (i) increase the number of shares of Common Stock in the aggregate that may be subject to

awards by 5,250,000 shares, from 9,355,000 to 14,605,000 shares and (ii) increase the annual grant caps under the Company’s

2008 Plan from 500,000 Options, 500,000 Stock Appreciation Rights and 350,000 Stock Grants and Restricted Stock Units that are

intended to comply with the requirements of Section 162(m) of the Code to a cap of no more than a total of 3,000,000 Options, Stock

Appreciation Rights, Stock Grants and Restricted Stock Units that are intended to comply with the requirements of Section 162(m)

of the Code combined (the “2008 Plan Amendment ”); and

|

|

|

·

|

If necessary, an adjournment of the Stockholders’ Meeting if there were insufficient votes in favor of the Charter Amendment

(the “Adjournment Proposal”).

|

According to the final report of the inspector

of elections, each of the Charter Amendment, the 2008 Plan Amendment and the Adjournment Proposal was approved by the Company’s

stockholders.

Approval of the Charter Amendment required

the affirmative vote of (i) the majority of the votes entitled to be cast by the holders of the outstanding shares of Common Stock,

Series A Preferred Stock and Series C Preferred Stock represented in person or by proxy at the Stockholders’ Meeting, voting

together as a single class (with the holders of Common Stock entitled to one vote per share and the holders of Series A and Series

C Preferred Stock voting on an as-converted into Common Stock basis) and (ii) the holders of a majority of the Common Stock outstanding

and entitled to vote on the matter, voting as a separate class.

The final results of the vote on the Charter Amendment (inclusive

of the Series A and Series C Preferred Stock on an as-converted into Common Stock basis) are as follows:

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

BROKER NON-VOTES

|

|

115,079,428

|

|

5,207,882

|

|

220,882

|

|

0

|

The final results of the vote on the Charter

Amendment (exclusive of the Series A and Series C Preferred Stock on an as-converted into Common Stock basis) are as follows:

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

BROKER NON-VOTES

|

|

100,358,477

|

|

5,191,219

|

|

220,681

|

|

0

|

Approval of the 2008 Plan Amendment required

the affirmative vote of the holders of a majority of the aggregate shares of Common Stock (inclusive of the Series A and Series

C Preferred Stock on an as-converted into Common Stock basis) that have voting power represented in person or by proxy and entitled

to vote on the matter at the Stockholders’ Meeting. The final results of the vote on the 2008 Plan Amendment are as follows:

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

BROKER NON-VOTES

|

|

77,480,583

|

|

20,478,786

|

|

53,895

|

|

22,494,928

|

Approval of the Adjournment Proposal required

the affirmative vote of holders of a majority of the votes cast on the Adjournment Proposal at the Stockholders’ Meeting.

The final results of the vote on the Adjournment Proposal are as follows:

|

FOR

|

|

AGAINST

|

|

ABSTAIN

|

|

BROKER NON-VOTES

|

|

112,230,841

|

|

8,025,281

|

|

252,070

|

|

0

|

The Certificate of Amendment, which effected

the Charter Amendment, is filed as Exhibit 3.1 to this filing.

Item 9.01. Financial Statements and

Exhibits

|

Exhibit No.

|

|

Description

|

|

3.1

|

|

Certificate of Amendment of the Second Amended and Restated Certificate of Incorporation of BioScrip, Inc.

|

|

|

|

|

|

10.1

|

|

Second Amendment to BioScrip, Inc. 2008 Equity Incentive Plan (as amended on June 1, 2016).

|

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

BIOSCRIP, INC.

|

|

|

|

|

|

Date: December 2, 2016

|

|

|

|

/s/ Kathryn Stalmack

|

|

|

|

By:

|

|

Kathryn Stalmack

|

|

|

|

|

|

Senior Vice President, General Counsel and Secretary

|

Exhibit

Index

|

Exhibit No.

|

|

Description

|

|

3.1

|

|

Certificate of Amendment of the Second Amended and Restated Certificate of Incorporation of BioScrip, Inc.

|

|

|

|

|

|

10.1

|

|

Second Amendment to BioScrip, Inc. 2008 Equity Incentive Plan (as amended on June 1, 2016).

|

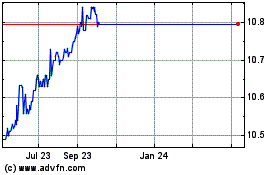

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

BioPlus Acquisition (NASDAQ:BIOS)

Historical Stock Chart

From Apr 2023 to Apr 2024