UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of December 2016

Commission File Number 001-34837

MAKEMYTRIP

LIMITED

(Exact name of registrant as specified in its charter)

Not Applicable

(Translation of registrant’s name into English)

Mauritius

(Jurisdiction

of incorporation or organization of registrant)

Tower A, SP

Infocity, 243,

Udyog Vihar, Phase 1

Gurgaon, Haryana 122016, India

(Address of principal executive office)

Indicate by check mark whether

the registrant files or will file annual reports under cover

Form 20-F

or

Form 40-F.

Form

20-F

☒

Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

MakeMyTrip Limited (“MakeMyTrip”) is incorporating by reference the information set forth in this Form

6-K into its notice of special meeting of shareholders and proxy statement (the “Proxy Statement”), each dated November 22, 2016, and submitted on Form 6-K to the SEC on such date.

Other Information

Audited Historical Carve-out

Combined Financial Statements of ibibo Group

Pursuant to the terms of the Transaction Agreement (the “Transaction

Agreement”), dated October 18, 2016, between MakeMyTrip, MIH Internet SEA Private Limited and MIH B2C Holdings B.V., prior to the consummation of the transactions contemplated thereunder (collectively, the “Transaction”), ibibo Group

will carve out its ownership stakes in PayU Global B.V. (“PayU”) and Tek Travels Private Limited (“TBO”), such that upon the closing of the Transaction, MakeMyTrip will acquire Ibibo Group Holdings (Singapore) Private Limited

(“ibibo Group”) without its ownership in PayU and TBO.

In order to provide shareholders with additional information regarding

ibibo Group, the carve-out combined financial statements of ibibo Group (the “ibibo Financial Statements”), which comprise the carve-out combined balance sheets as of March 31, 2016, March 31, 2015 and April 1, 2014, and the related

carve-out combined statement of profit and loss and other comprehensive income (loss), combined statement of changes in invested capital and combined statement of cash flows for the years ended March 31, 2016 and March 31, 2015 are attached hereto

as Exhibit 99.1. The ibibo Financial Statements have been prepared on a “carve out” basis to reflect the financial information of ibibo Group without its ownership stake in PayU and TBO for the periods indicated.

Key Performance Indicators

As described

more fully in the section of the Proxy Statement titled “Recommendation of the Board of Directors and Reasons for the Transaction – Reasons for the Transaction”, MakeMyTrip’s discussions with Parent and its affiliates regarding

the acquisition of ibibo Group were not based on price, but were instead based on the relative valuations of ibibo Group and MakeMyTrip, utilizing certain key performance indicators important to both companies’ businesses (such as the

“Number of Transactions” serviced by various business segments of each of MakeMyTrip and ibibo Group, the ability to scale the bus ticketing business and a pro rata cash infusion from Parent).

In addition to the information regarding key performance indicators as set out in the Proxy

Statement, additional information regarding the ibibo Group (being the ibibo Financial Statements) is being provided to shareholders of MakeMyTrip. Revenues of ibibo Group are calculated net of discounts and rebates (unless such discounts are higher

than the commission income, in which case net discounts are accounted for as advertising and sales promotion expenses). The Revenue before adjustment for discounts and rebates for ibibo Group for the year ended March 31, 2016 amounted to USD

103.6 million and after adjustment for discounts and rebates amounted to USD 60.5 million. Likewise, the Revenues less Service Costs before adjustment for discounts and rebates amounted to USD 82.1 million and after adjustments for discounts and

rebates amounted to USD 38.9 million.

Djubo Right of First Refusal

As described more fully in the section of the Proxy Statement titled “Transaction Agreements – Additional Terms – The

Transaction Agreement,” ibibo Group currently owns a 31.7% stake in Saaranya Hospitality Technologies Private Limited, India (“Djubo”). Pursuant to the articles of association of Djubo, the other shareholders of Djubo have rights of

first refusal to purchase ibibo Group’s equity in Djubo that are triggered by the Transaction. On November 23, 2016, the other shareholders of Djubo waived such rights of first refusal. The ibibo Group’s interest in Djubo will be included

within the scope of the Transaction at Closing (without amending any other terms of the Transaction, including the consideration being paid therefor).

Where to Find Additional Information

MakeMyTrip is a foreign private issuer. As such, MakeMyTrip’s Proxy Statement and other proxy materials with respect to the Transaction,

including this Form 6-K, will not be subject to preliminary review and comment by the SEC. Accordingly, MakeMyTrip’s proxy materials have not been reviewed by the SEC and may not have all of the disclosures required to be included under the

SEC’s rules that apply to U.S. domestic issuers. The Proxy Statement contains risk factor disclosure alerting its shareholders of the foregoing.

Shareholders are urged to carefully read the Proxy Statement, any information and documents incorporated by reference therein and any other

relevant documents submitted or filed with the SEC, including this Form 6-K, when they become available, because they contain important information about MakeMyTrip and the Transaction. Copies of the Proxy Statement, any information and documents

incorporated by reference therein and other documents submitted or filed by MakeMyTrip with the SEC, including this Form 6-K, are available at the website maintained by the SEC at

www.sec.gov

. Copies of such filings also can be obtained,

without charge, by directing a request to Jonathan Huang, Vice President – Investor Relations at

Jonathan.Huang@makemytrip.com

or +1 (917) 769-2027.

Participants in the Solicitation

MakeMyTrip and its directors and executive officers may be deemed to be participants in the solicitation of proxies in favor of the Transaction

from the shareholders of MakeMyTrip. Information about the directors and executive officers of MakeMyTrip is set forth in MakeMyTrip’s annual report on Form 20-F, which was filed with the SEC on June 14, 2016. Shareholders may obtain additional

information regarding the interests of MakeMyTrip and its directors and executive officers in the Transaction, which may be different than those of MakeMyTrip’s shareholders generally, by reading the Proxy Statement (including all information

and documents incorporated by reference therein, including this Form 6-K).

Exhibits

|

|

|

|

|

99.1

|

|

Carve-out combined financial statements of Ibibo Group Holdings (Singapore) Private Limited, which comprise the carve-out combined balance sheets as of March 31, 2016, March 31, 2015 and April 1, 2014, and the related carve-out

combined statement of profit and loss and other comprehensive income (loss), combined statement of changes in invested capital and combined statement of cash flows for the years ended March 31, 2016 and March 31, 2015.

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date: December 2, 2016

|

|

|

|

|

MAKEMYTRIP LIMITED

|

|

|

|

|

By:

|

|

/s/ Deep Kalra

|

|

Name:

|

|

Deep Kalra

|

|

Title:

|

|

Group Chairman and

Group Chief Executive

Officer

|

EXHIBIT INDEX

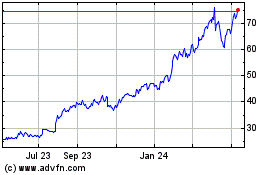

MakeMyTrip (NASDAQ:MMYT)

Historical Stock Chart

From Mar 2024 to Apr 2024

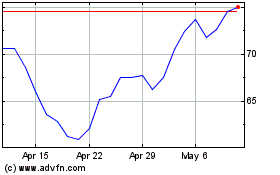

MakeMyTrip (NASDAQ:MMYT)

Historical Stock Chart

From Apr 2023 to Apr 2024