Sotherly Hotels Inc. Announces Board Authorization of Stock Repurchase Program

December 02 2016 - 12:08PM

Sotherly Hotels Inc. (NASDAQ:SOHO) (the “Company”) today announced

that its Board of Directors authorized a stock repurchase program

under which the Company may acquire up to $10 million of its

outstanding common stock, at the discretion of management.

The Company expects to complete the repurchase program prior to

December 31, 2017, unless extended by the Board of Directors.

The shares will be purchased pursuant to the

program from time to time at prevailing market prices, through open

market or privately negotiated transactions, depending upon market

conditions and may be made pursuant to one or more plans

established pursuant to Rule 10b5-1 under the Securities Exchange

Act, as amended. Under the program, the purchases will be funded

from available working capital. There is no guarantee as to the

exact number of shares that will be repurchased by the Company and

the Company may discontinue purchases at any time that management

determines additional purchases are not warranted. As of November

8, 2016, the Company had approximately 14.9 million shares

outstanding.

Drew Sims, CEO and Chairman of the Company,

remarked, “The Board’s approval of this program reflects our

confidence in the Company’s future. Repurchasing stock is one means

of underscoring our commitment to enhancing stockholder value.”

Forward Looking Statements

This news release includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933 and Section 21E of the Securities Exchange Act of 1934.

Although the Company believes that the expectations and assumptions

reflected in the forward-looking statements are reasonable, these

statements are not guarantees of future performance and involve

certain risks, uncertainties and assumptions which are difficult to

predict and many of which are beyond the Company’s control.

Therefore, actual outcomes and results may differ materially from

what is expressed, forecasted or implied in such forward-looking

statements. Factors which could have a material adverse effect on

the Company’s future results, performance and achievements,

include, but are not limited to: national and local economic and

business conditions that affect occupancy rates and revenues at the

Company’s hotels and the demand for hotel products and services;

risks associated with the hotel industry, including competition,

increases in wages, energy costs and other operating costs; the

magnitude and sustainability of the economic recovery in the

hospitality industry and in the markets in which the Company

operates; the availability and terms of financing and capital and

the general volatility of the securities markets; risks associated

with the level of the Company’s indebtedness and its ability to

meet covenants in its debt agreements and, if necessary, to

refinance or seek an extension of the maturity of such indebtedness

or modify such debt agreements; management and performance of the

Company’s hotels; risks associated with maintaining our system of

internal controls; risks associated with the conflicts of interest

of the Company’s officers and directors; risks associated with

redevelopment and repositioning projects, including delays and cost

overruns; supply and demand for hotel rooms in the Company’s

current and proposed market areas; risks associated with our

ability to maintain our franchise agreements with our third party

franchisors; the Company’s ability to acquire additional properties

and the risk that potential acquisitions may not perform in

accordance with expectations; the Company’s ability to successfully

expand into new markets; legislative/regulatory changes, including

changes to laws governing taxation of REITs; the Company’s ability

to maintain its qualification as a REIT; and the Company’s ability

to maintain adequate insurance coverage. These risks and

uncertainties are described in greater detail under “Risk Factors”

in the Company’s Annual Report on Form 10-K and subsequent reports

filed with the Securities and Exchange Commission. The Company

undertakes no obligation to and does not intend to publicly update

or revise any forward-looking statement, whether as a result of new

information, future events or otherwise. Although the Company

believes its current expectations to be based upon reasonable

assumptions, it can give no assurance that its expectations will be

attained or that actual results will not differ materially.

About Sotherly

Hotels Inc. Sotherly Hotels Inc. is a self-managed

and self-administered lodging REIT focused on the acquisition,

renovation, upbranding and repositioning of upscale and

upper-upscale full-service hotels in the Southern United

States. Currently, the Company’s portfolio consists of

investments in twelve hotel properties, comprising 3,011 rooms.

Most of the Company’s properties operate under the Hilton

Worldwide, InterContinental Hotels Group and Marriott

International, Inc. brands. Sotherly Hotels Inc. was organized in

2004 and is headquartered in Williamsburg, Virginia. For more

information, please visit www.sotherlyhotels.com

Contact at the Company:

Scott Kucinski

Sotherly Hotels Inc.

410 West Francis Street

Williamsburg, Virginia 23185

(757) 229-5648

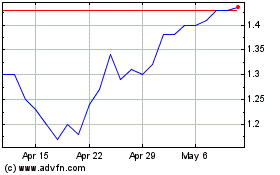

Sotherly Hotels (NASDAQ:SOHO)

Historical Stock Chart

From Mar 2024 to Apr 2024

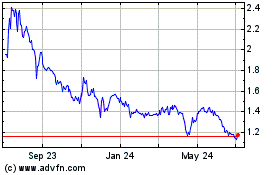

Sotherly Hotels (NASDAQ:SOHO)

Historical Stock Chart

From Apr 2023 to Apr 2024