Current Report Filing (8-k)

December 02 2016 - 9:06AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of

the Securities Exchange Act of 1934

December 2, 2016

Date of report (Date of earliest event reported)

TARGA

RESOURCES CORP.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-34991

|

|

20-3701075

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification Number)

|

1000 Louisiana Street, Suite 4300

Houston, TX 77002

(Address of prinicipal executive offices)

(713) 584-1000

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

On December 2, 2016, Targa Resources

Corp. (the “

Company

”) entered into an Equity Distribution Agreement (the “

Agreement

”) with Deutsche Bank Securities Inc., Barclays Capital Inc., Capital One Securities Inc., Citigroup Global Markets Inc., Goldman,

Sachs & Co., Jefferies LLC, J.P. Morgan Securities LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated, Morgan Stanley & Co. LLC, RBC Capital Markets, LLC, SunTrust Robinson Humphrey, Inc., and Wells Fargo Securities,

LLC (each, a “

Manager

” and collectively, the “

Managers

”). Pursuant to the terms of the Agreement, the Company may sell from time to time through the Managers, as the Company’s sales agents, shares of the

Company’s common stock, par value $0.001, having an aggregate gross sales price to the public of up to $750,000,000 (the “

Shares

”). Sales of the Shares, if any, will be made by means of ordinary brokers’ transactions on

the New York Stock Exchange, any other national securities exchange or facility thereof, a trading facility of a national securities association or an alternate trading system, to or through a market maker or directly on or through an electronic

communication network or any similar market venue, at market prices, in block transactions or as otherwise agreed by the Company and one or more of the Managers.

Under the terms of the Agreement, the Company may also sell Shares from time to time to any Manager as principal for its own account at a

price to be agreed upon at the time of sale. Any sale of Shares to any Manager as principal would be pursuant to the terms of a separate terms agreement between the Company and such Manager.

The Shares will be issued pursuant to the Company’s shelf registration statement on Form S-3 (Registration No. 333-211522), filed on

May 23, 2016.

The summary of the Agreement in this report does not purport to be complete and is qualified by reference to such

agreement, which is filed as Exhibit 1.1 hereto. Legal opinions relating to the Shares are included as Exhibit 5.1 hereto.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

Exhibit

Number

|

|

Description of the Exhibits

|

|

|

|

|

1.1

|

|

Equity Distribution Agreement, dated December 2, 2016, by and between the Company and Deutsche Bank Securities Inc., Barclays Capital Inc., Capital One Securities Inc., Citigroup Global Markets Inc., Goldman, Sachs & Co.,

Jefferies LLC, J.P. Morgan Securities LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated, Morgan Stanley & Co. LLC, RBC Capital Markets, LLC, SunTrust Robinson Humphrey, Inc., and Wells Fargo Securities, LLC.

|

|

|

|

|

5.1

|

|

Opinion of Vinson & Elkins L.L.P. regarding legality of the Shares.

|

|

|

|

|

23.1

|

|

Consent of Vinson & Elkins L.L.P. (included in Exhibit 5.1).

|

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

Targa Resources Corp.

|

|

|

|

|

By:

|

|

/s/ Matthew J. Meloy

|

|

Name:

|

|

Matthew J. Meloy

|

|

Title:

|

|

Executive Vice President and Chief Financial Officer

|

Date: December 2, 2016

3

EXHIBIT INDEX

|

|

|

|

|

Exhibit

Number

|

|

Description of the Exhibits

|

|

|

|

|

1.1

|

|

Equity Distribution Agreement, dated December 2, 2016, by and between the Company and Deutsche Bank Securities Inc., Barclays Capital Inc., Capital One Securities Inc., Citigroup Global Markets Inc., Goldman, Sachs & Co.,

Jefferies LLC, J.P. Morgan Securities LLC, Merrill Lynch, Pierce, Fenner & Smith Incorporated, Morgan Stanley & Co. LLC, RBC Capital Markets, LLC, SunTrust Robinson Humphrey, Inc., and Wells Fargo Securities, LLC.

|

|

|

|

|

5.1

|

|

Opinion of Vinson & Elkins L.L.P. regarding legality of the Shares.

|

|

|

|

|

23.1

|

|

Consent of Vinson & Elkins L.L.P. (included in Exhibit 5.1).

|

4

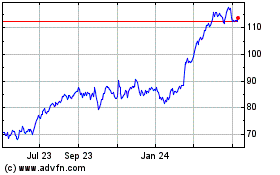

Targa Resources (NYSE:TRGP)

Historical Stock Chart

From Mar 2024 to Apr 2024

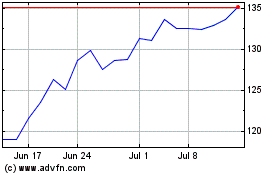

Targa Resources (NYSE:TRGP)

Historical Stock Chart

From Apr 2023 to Apr 2024