Gencor Releases Fourth Quarter and Fiscal Year 2016 Results

December 02 2016 - 8:00AM

Gencor Industries, Inc., (NASDAQ:GENC) announced today net revenue

for the quarter ended September 30, 2016 increased 79.3% to $14.8

million compared to $8.2 million for the quarter ended September

30, 2015. Gross margin as a percentage of net revenue

increased 80.3% to 24.7% for the quarter ended September 30, 2016

from 13.7% for the quarter ended September 30, 2015. The

increase in gross margin was due to increased production resulting

in better overhead absorption.

Income from operations for the quarter ended

September 30, 2016 was $1.0 million compared to loss of $(1.0)

million for the quarter ended September 30, 2015. The Company had

non-operating income of $0.3 million for the quarter ended

September 30, 2016 compared to a non-operating loss of $(3.1)

million for the quarter ended September 30, 2015. The Company had a

tax benefit of ($0.4) million for the quarter ended September 30,

2016 compared to a tax benefit of $(1.9) million for the quarter

ended September 30, 2015. Net income for the quarter ended

September 30, 2016 was $1.7 million ($0.12 per basic and diluted

share) compared to a net loss of $(2.2) million ($(0.15) per basic

and diluted share) for the quarter ended September 30,

2015.

Net revenue for the year ended September 30,

2016 increased 78.4% to $70.0 million compared to $39.2 million for

the year ended September 30, 2015. Gross margin as a percentage of

net revenue increased to 25.0% for the year ended September 30,

2016 from 19.1% for the year ended September 30, 2015. The Company

had operating income for the year ended September 30, 2016 of $7.8

million compared to an operating loss of $(0.8) million for the

year ended September 30, 2015.

The Company had non-operating income of $1.6

million for the year ended September 30, 2016 compared to a

non-operating loss of $(2.8) million for the year ended September

30, 2015. The effective income tax rate for fiscal 2016 was 25.1%

versus a tax benefit of (48.7%) in fiscal 2015. The Company’s net

income was $7.0 million ($0.49 per basic share and $0.48 per

diluted share) for the year ended September 30, 2016, compared to a

net loss of $(1.8) million ($(0.13) per basic and diluted share)

for the year ended September 30, 2015.

At September 30, 2016 the Company had $104.1

million in cash and marketable securities, an increase of $8.6

million over the September 30, 2015 balance of $95.5 million. Net

working capital was $115.2 million at September 30, 2016. The

Company has no short or long term debt.

E.J. Elliott, Gencor’s Chairman, commented, “Our

industry has been rejuvenated and Gencor’s results are reflecting

it. Our fourth quarter 2016 revenues increased 79% which is

on top of a 68% increase in revenues in the fourth quarter

2015. What is typically our slowest quarter from a revenue

perspective, this year we experienced an improvement. Orders

came in throughout the summer and customers were requesting

deliveries into the fall and early winter months.

“Gencor managed the 78% growth in fiscal 2016

revenues with good cost discipline. This resulted in an

increase in both gross margins and operating margins for the

quarter and fiscal year. Operating margins of 11% in fiscal

2016 reflect a significant improvement over recent years. Net

profit margins of 10% in fiscal 2016 were also notable.

“Backlog going into fiscal year 2017 reflects an

improved order flow which we expect to continue as the FAST Act has

provided the secured funding that the industry needs. Our backlog

at September 30, 2016 of $43 million represents a 131% increase

from a year ago. Order inquiry for our equipment across all

regions of the country continues to be promising.

“Our efficient operations and cost discipline

should result in fiscal 2017 operating margins that continue to

reflect the margin improvements we realized in fiscal 2016.

“In fiscal 2016 Gencor increased manufacturing

headcount by 30% and continues to actively hire to meet production

demands at both our Iowa and Florida facilities.”

Gencor Industries is a diversified heavy

machinery manufacturer for the production of highway construction

materials, synthetic fuels and environmental control machinery and

equipment used in a variety of applications.

Caution Concerning Forward Looking Statements -

This press release and our other communications and statements may

contain “forward-looking statement,” including statement about our

beliefs, plans, objectives, goals, expectations, estimates,

projections and intentions. These statements are subject to

significant risks and uncertainties and are subject to change based

on various factors, many of which are beyond our control. The

words “may,” “could,” “should,” “would,” “believe,” “anticipate,”

“estimate,” “expect,” “intend,” “plan,” “target,” “goal,” and

similar expressions are intended to identify forward-looking

statements. All forward-looking statements, by their nature,

are subject to risks and uncertainties. Our actual future

results may differ materially from those set forth in our forward

looking statements. For information concerning these factors

and related matters, see our Annual Report on Form 10-K for the

year ended September 30, 2016: (a) “Risk Factors” in Part I, Item

1A and (b) “Management’s Discussion and Analysis of Financial

Position and Results of Operations” in Part II, Item 7.

However, other factors besides those referenced could adversely

affect our results, and you should not consider any such list of

factors to be a complete set of all potential risks or

uncertainties. Any forward-looking statements made by us

herein speak as of the date of the press release. We do not

undertake to update any forward-looking statement, except as

required by law.

Contact: Eric Mellen, Chief Financial Officer

407-290-6000

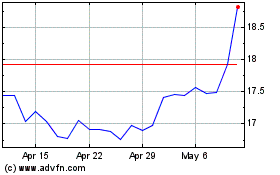

Gencor Industries (AMEX:GENC)

Historical Stock Chart

From Mar 2024 to Apr 2024

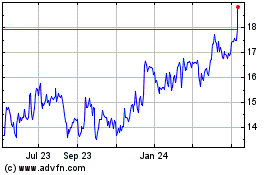

Gencor Industries (AMEX:GENC)

Historical Stock Chart

From Apr 2023 to Apr 2024