By Richard Rubin

WASHINGTON -- The U.S. Treasury Department spent nearly three

years reshaping international corporate transactions, reinforcing

the U.S. tax base and deterring inversions, the controversial

maneuvers that put companies' addresses in low-tax countries.

Now, all that work, capped with a crucial set of final rules in

October, could come undone.

The sudden fragility of the new regulations arises from the

election and the gridlock preceding it. Skeptical Republican

legislators and an incoming administration vowing to repeal

government rules could quickly tear down the regulatory framework

that helped kill large deals planned by Pfizer Inc. and AbbVie

Inc.

President-elect Donald Trump, who has said that he wants to stop

inversions, has suggested that a lower corporate tax rate would

sharply reduce companies' incentives to take a foreign address. Mr.

Trump and Steven Mnuchin, his pick to run the Treasury, have

proposed cutting the corporate tax rate to 15% from 35% as part of

a bigger revamp of the tax code.

As they wrote the rules, Treasury officials used generous

assessments of their own authority, with Congress deadlocked, to

make it much harder for companies to exploit gaps in the U.S. tax

system.

"We have a problem. We asked Congress to address it," said

Robert Stack, Treasury's top international tax official. "They

didn't do anything."

After an April draft prompted fierce lobbying by business groups

and corporations, Treasury's final rules in October pared back the

impact on U.S.-based companies, focusing the impact on

foreign-owned firms.

Those final rules, which could produce $600 million annually in

taxes, capped the Treasury's work. In all, the government erected

new barriers that made it harder for firms to escape the U.S. tax

net and ended some tax-avoidance techniques companies could use

once they had a foreign address.

Still, Republican complaints could prevail if Treasury officials

didn't erode businesses' objections far enough. Congress could

repeal the rules. The Treasury under Mr. Trump can withdraw

them.

"I'm hopeful that he stops those regulations cold," said Rep.

Kevin Brady (R., Texas), chairman of the House Ways and Means

Committee, after the election. "They built a regulation wall to

keep investment out of the United States."

The October regulations themselves drew cautious relief from

businesses. Treasury officials had listened to business feedback,

especially on this year's most expansive rules. Those limit a

tax-avoidance technique called earnings stripping, in which foreign

companies use internal loans to generate interest deductions

against the 35% U.S. tax rate and push income into lower-taxed

jurisdictions. Companies that invert often strip earnings to get

the full benefit of a foreign address.

Inversions had barely registered during President Barack Obama's

first term, but they started getting public attention in 2014 when

Pfizer announced it was considering an inversion, and when

Medtronic Inc. and Mylan Inc. announced their own deals.

Democrats, worried that more firms would flee, proposed targeted

legislation that would make it impossible for companies to invert

by buying a smaller foreign target. Republicans resisted, pushing

for a broader tax-code overhaul.

That left any action to Treasury, and as corporate departures

entered bankers' routine pitches to companies on how to lower tax

bills, the department began to explore its own powers, said Mark

Mazur, assistant secretary for tax policy, who oversaw the rule

making.

That happened in the background while Mr. Obama and Treasury

Secretary Jack Lew prodded Congress. Mr. Mazur, a 60-year-old

longtime government economist, described a bottom-up process,

driven more by Treasury staff.

"At first we thought that we didn't have authority to do much or

anything substantive," he said.

Publicly, that posture flipped quickly, and Mr. Obama urged them

along. Announcements followed in September 2014, November 2015 and

April 2016, produced by a core group of about 12, along with an

Internal Revenue Service team.

The Treasury's team worked outside public view to protect

market-moving information from leaking to investors before

releasing rules that curtailed benefits for foreign-owned

companies. During that whole rule-making period, Treasury's senior

tax officials, virtually unknown outside the tax world, operated

under unusual scrutiny from people invested in cross-border deals.

Mr. Stack recalled seeing the same investors or their

representatives over and over, conspicuous at tax conferences where

everyone knows everyone.

The investors sought mundane scraps of information such as

Treasury Department holiday schedules to unearth details of the

decade's most consequential tax rules. They peppered another

official with questions in a hotel elevator. "They're always

looking for some little hint," Mr. Mazur said.

Treasury's move in April was its most surprising, curbing what

the government called "serial inverters," or companies growing

through multiple inversions. That killed Pfizer's plan to buy

Allergan PLC and take an Irish address. Treasury officials were

aware of transactions but insist they weren't targeting particular

companies.

Simultaneously, Treasury proposed an earnings-stripping rule,

which alarmed U.S.-based companies because it relabeled some

internal debt as equity and imposed steep compliance costs.

Treasury officials met with roughly 50 companies and trade

groups this year. Some CEOs went straight to Mr. Lew, who directed

their tax and finance experts to Mr. Mazur. Eventually, Mr. Mazur's

team joked they would have covered the entire Fortune 100 with just

a few more meetings.

Treasury "proved to be much more flexible and much more

accommodating" than experts expected, said David Golden of Ernst

& Young LLP.

Inversions are "less attractive" now, but the rules still

discourage foreign investment, said Jason Bazar, a partner at Mayer

Brown LLP.

Write to Richard Rubin at richard.rubin@wsj.com

(END) Dow Jones Newswires

December 02, 2016 07:14 ET (12:14 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

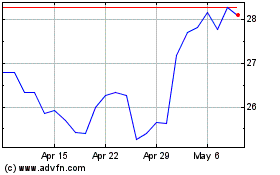

Pfizer (NYSE:PFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pfizer (NYSE:PFE)

Historical Stock Chart

From Apr 2023 to Apr 2024