Board of Directors Authorizes 14 Percent

Increase in Quarterly Cash Dividend from $0.07 to $0.08 Per

Share

Culp, Inc. (NYSE: CFI) today reported financial and operating

results for the second quarter and six months ended October

30, 2016.

Fiscal 2017 Second Quarter Highlights

- Net sales were $75.3 million, down 2.1

percent, with mattress fabric sales up 0.2 percent and upholstery

fabric sales down 5.4 percent, as compared with the same quarter

last year.

- Pre-tax income was $7.2 million, up

16.5 percent compared with $6.1 million in the second quarter of

fiscal 2016.

- Net income (GAAP) was $4.5 million, or

$0.36 per diluted share, compared with net income of $3.8 million,

or $0.30 per diluted share, in the prior year period.

- Adjusted net income (non-GAAP) was $5.9

million, or $0.47 per diluted share, for the current quarter,

compared with $5.2 million, or $0.41 per diluted share, for the

second quarter of fiscal 2016. (Adjusted net income is calculated

using estimated cash income tax expense. See the reconciliation to

net income on page 6).

- Cash and cash equivalents, short term

investments and long term investments held-to-maturity totaled

$47.4 million, up $5.3 million from last fiscal year end, with no

outstanding balance on the company’s line of credit as of October

30, 2016. The $47.4 million was achieved despite spending $10.6

million on capital expenditures and dividends during the first six

months of this fiscal year.

- The company announced a 14 percent

increase in its quarterly cash dividend from $0.07 to $0.08 per

share, or $0.32 per share on an annualized basis, commencing in the

third quarter of fiscal 2017.

Fiscal 2017 Year to Date Highlights

- Net sales were $156.0 million, down 0.7

percent, with mattress fabric sales up 3.0 percent and upholstery

fabric sales down 6.1 percent compared with the same period a year

ago.

- Pre-tax income was $15.7 million,

compared with $13.6 million for the same period last year,

representing a 15.9 percent increase.

- Net income (GAAP) was $9.8 million, or

$0.78 per diluted share, compared with net income of $8.5 million,

or $0.68 per diluted share, in the prior year period.

- Adjusted net income (non-GAAP) was

$12.9 million, or $1.03 per diluted share, compared with $11.4

million, or $0.92 per diluted share, for the prior year

period.

- Annualized consolidated return on

capital was 34 percent, compared with 32 percent for the same

period a year ago.

- Capital expenditures for the year to

date period totaled $6.3 million, almost all of which related to

the mattress fabrics segment, compared with $5.3 million a year

ago.

- During the first half of fiscal 2017,

the company paid $4.3 million in dividends, of which $2.5 million

was for a special dividend. Since June 2011, the company has

returned a total of $44.0 million to shareholders in the form of

regular quarterly and special dividends and share repurchases.

Financial Outlook

- The projection for third quarter fiscal

2017 is for overall sales to be flat to slightly lower than the

previous year’s third quarter. Pre-tax income for the third quarter

of fiscal 2017 is expected to be in the range of $6.7 million to

$7.3 million. Pre-tax income for the third quarter of fiscal 2016

was $7.2 million.

Overview

For the second quarter ended October 30, 2016, net sales were

$75.3 million, compared with $77.0 million a year ago. The

company reported net income of $4.5 million, or $0.36 per diluted

share, for the second quarter of fiscal 2017, compared with net

income of $3.8 million, or $0.30 per diluted share, for the second

quarter of fiscal 2016.

Given the volatility in the income tax area during fiscal 2016

and previous years, the company is reporting adjusted net income

(non-GAAP), which is calculated using estimated cash income tax

expense for its foreign subsidiaries. (A presentation of adjusted

net income and reconciliation to net income is set forth on page

6). The company currently does not incur cash income tax expense in

the U.S., nor does it expect to for two to three more years, due to

approximately $18.0 million in U.S. net operating loss

carryforwards as of the end of fiscal 2016. For the second quarter

of fiscal 2017, adjusted net income was $5.9 million, or $0.47 per

diluted share, compared with $5.2 million, or $0.41 per diluted

share, for the second quarter of fiscal 2016. On a pre-tax basis,

the company reported income of $7.2 million compared with

pre-tax income of $6.1 million for the second quarter

of fiscal 2016.

Commenting on the results, Frank Saxon, president and chief

executive officer of Culp, Inc., said, “Overall, our second quarter

sales were slightly lower than the same quarter of last year,

reflecting softness in the retail market for home furnishings.

However, in spite of lower sales, we are pleased with the strong

operating performance in both businesses, excellent free cash flow

and high returns on capital. We have continued to drive product

innovation and creativity and leverage the strength of our

efficient manufacturing platform with favorable results. We have

also realized the benefits of our recent capital improvement

projects in the mattress fabrics business. Importantly, we have the

financial strength to continue to make the strategic investments to

enhance our operations and support our growth objectives.

“We are also pleased that our financial performance and strong

balance sheet have enabled us to increase our quarterly cash

dividend by 14 percent from $0.07 to $0.08 per share, or $0.32 per

share on an annualized basis. Notably, we have consistently

increased our quarterly dividend every year since we reinstated the

dividend in June 2012 at an annualized rate of $0.12 per share.

This action is consistent with our capital allocation strategy and

confirms our commitment to generate value for our shareholders,”

added Saxon.

Mattress Fabric Segment

Mattress fabric sales for the second quarter were $45.5 million,

up slightly compared with $45.4 million for the second quarter

of fiscal 2016.

“We are pleased with our overall performance for the second

quarter, especially in light of challenging market conditions,”

said Iv Culp, president of Culp’s mattress fabrics division.

“We continued to execute our strategy in a difficult environment

and have outperformed current industry trends. Our strategic focus

on design creativity and innovation has been a key advantage in

meeting changing customer demand with a diverse product offering,

including mattress fabrics and covers, across all price points. Our

mirrored manufacturing platform, technical expertise and expanded

reactive capacity, support our strategy with outstanding customer

service and delivery performance.

“We have made excellent progress in our operating results

through the first half of fiscal 2017, demonstrating the strength

of our business model and consistent execution of our strategic

plan. These improved results reflect the benefits of our capital

investments over the past year including increased capacity via

newer, more efficient equipment, enhanced finishing capabilities

and better overall throughput. We also benefited from lower raw

material costs in the second quarter compared with a year ago. We

are near completion with the latest expansion projects in our North

Carolina facilities to enhance production capacity and

significantly improve our distribution capabilities. In addition,

we are planning further consolidation and equipment relocation to

streamline our production platform to more effectively support our

continuous improvement initiatives and long-term growth strategy.

We are also making progress with our Canadian expansion project,

including new equipment installations and enhanced finishing

capabilities. Importantly, our new Canadian distribution platform,

expected to commence operations in the fourth quarter of fiscal

2017, will allow us to ship directly to our customers in Canada.

Together, these major investments will significantly enhance our

ability to serve all of our customers and strengthen Culp’s

leadership position in North America.

“From product design to final delivery, we are executing our

diversification strategy to offer a full complement of fabrics and

sewn covers. CLASS, our mattress cover business, had a strong

performance in the second quarter, and we are excited about the

sales potential ahead to expand our business. We believe mattress

cover opportunities exist with our traditional customers, and we

are also reaching new markets, especially the fast growing Internet

bedding space.

“We are also in the final planning stages for expanding our

mattress cover capacity with another production facility in a

low-cost labor country. This new location, which is expected to

commence operations in the first half of next fiscal year, will

complement our existing production capabilities with a mirrored

platform and enhance our ability to meet customer demand while

remaining cost-competitive.

“Importantly, we believe Culp has a strong competitive position,

and we will be strategic in targeting customers who value our

innovation and compelling value proposition. We remain confident in

our ability to execute our strategy and drive our long-term

operating performance,” Culp concluded.

Upholstery Fabric Segment

Sales for this segment were $29.8 million for the second quarter

of fiscal 2017, down 5.4 percent compared with sales of

$31.5 million in the second quarter of fiscal 2016.

“Our upholstery fabric sales for the second quarter of fiscal

2017 reflected softer retail demand for residential furniture,”

noted Boyd Chumbley, president of Culp’s upholstery fabric

division. “However, in spite of the challenging sales environment,

we are pleased with our overall operating performance. We have

continued to drive innovation and creativity as we execute our

product-driven strategy. Our global platform supports this strategy

with the flexibility to meet changing customer demand trends and

provide exceptional quality and service. China produced fabrics

accounted for 93 percent of Culp’s upholstery fabric sales for the

second quarter.

“Our creative designs and innovative products continue to

distinguish the Culp brand in the marketplace. We had an excellent

showing at the recent October furniture market. We are especially

pleased with the favorable customer response to our latest

‘performance’ line of highly durable, stain-resistant fabrics. We

have recently launched a new marketing campaign to promote this

innovative product line, and we remain optimistic about the sales

opportunities for Culp,” added Chumbley.

Balance Sheet

“We have maintained a strong financial position through the

first half of fiscal 2017, even while investing $6.3 million of

capital expenditures mostly in our mattress fabrics business and

returning $4.3 million to shareholders in regular and special

dividends,” added Ken Bowling, senior vice president and chief

financial officer of Culp, Inc. “As of the end of the second

quarter, we reported $47.4 million in cash and cash equivalents,

short-term investments and long-term investments held-to-maturity,

up $5.3 million from $42.1 million at the end of last fiscal year.

We are also pleased that we paid off our outstanding line of credit

during the quarter.

“Free cash flow was $9.5 million for the first half of fiscal

2017, compared with $6.4 million for the same period in fiscal

2016. The year over year improvement in free cash flow was due

primarily to increased earnings and improved working capital

management, especially inventory management. We expect to have

another strong year of free cash flow in fiscal 2017, even with the

anticipated high level of capital expenditures and modest growth in

working capital,” added Bowling.

Dividends and Share Repurchases

The company also announced that the Board of Directors approved

a 14 percent increase in the company’s quarterly cash dividend from

$0.07 to $0.08 per share, or $0.32 per share on an annualized

basis. This payment will be made on January 17, 2017, to

shareholders of record as of January 3, 2017. Future dividend

payments are subject to Board approval and may be adjusted at the

Board’s discretion as business needs or market conditions

change.

The company did not repurchase any shares during the first half

of fiscal 2017, leaving $5.0 million available under the share

repurchase program approved by the Board in June 2016.

Since June 2011, the company has returned a total of $44.0

million to shareholders in the form of regular quarterly and

special dividends and share repurchases.

Outlook

Commenting on the outlook for the third quarter of fiscal 2017,

Saxon remarked, “We expect overall sales to be flat to slightly

lower as compared with the third quarter of last year, primarily

reflecting the timing of the Chinese New Year on our upholstery

fabrics business.

“Mattress fabrics sales are expected to be slightly higher than

the same period a year ago. Operating income and margins in this

segment are expected to be slightly higher compared to a year

ago.

“In our upholstery fabrics segment, we expect both sales and

operating income to be moderately lower than the same period a year

ago. The timing of the Chinese New Year holiday will have a greater

impact on our business in the third fiscal quarter as the holiday

occurs in January this coming year as opposed to February last

year.

“Considering these factors, the company expects to report

pre-tax income for the third fiscal quarter of 2017 in the range of

$6.7 million to $7.3 million. Pre-tax income for last year’s third

quarter was $7.2 million.

“Looking at the full year, capital expenditures for fiscal 2017

are projected to be approximately $12 million, mostly related to

expansion and efficiency improvement projects for mattress fabrics.

Additionally, the company expects another strong year of free cash

flow.”

In closing, Saxon remarked, “In spite of a more challenging

retail environment for home furnishings experienced during this

quarter, we are pleased with our results to date for fiscal 2017,

with a strong operating performance for both businesses. Our

creative designs and ability to consistently innovate have

distinguished our products in the marketplace, and we have done an

excellent job in meeting the changing demands of our customers. At

the same time, we continue to identify new market opportunities and

make strategic investments in our business to enhance our

competitive position. Importantly, we have the financial strength

to support our growth strategy and, at the same time, reward our

shareholders. Looking ahead, we are cautiously optimistic about the

potential for improved demand in the home furnishings industry

given the recent uptick in consumer confidence and the improvement

in other economic indicators.”

About the Company

Culp, Inc. is one of the world's largest marketers of mattress

fabrics for bedding and upholstery fabrics for residential and

commercial furniture. The company markets a variety of fabrics to

its global customer base of leading bedding and furniture

companies, including fabrics produced at Culp’s manufacturing

facilities and fabrics sourced through other suppliers. Culp has

operations located in the United States, Canada and China.

This release contains contain “forward-looking statements”

within the meaning of the federal securities laws, including the

Private Securities Litigation Reform Act of 1995 (Section 27A of

the Securities Act of 1933 and Section 27A of the Securities and

Exchange Act of 1934). Such statements are inherently subject to

risks and uncertainties. Further, forward looking statements are

intended to speak only as of the date on which they are made, and

we disclaim any duty to update such statements. Forward-looking

statements are statements that include projections, expectations or

beliefs about future events or results or otherwise are not

statements of historical fact. Such statements are often but not

always characterized by qualifying words such as “expect,”

“believe,” “estimate,” “plan” and “project” and their derivatives,

and include but are not limited to statements about expectations

for our future operations, production levels, sales, profit

margins, profitability, operating income, capital expenditures,

income taxes, SG&A or other expenses, pre-tax income, earnings,

cash flow, and other performance measures, as well as any

statements regarding future economic or industry trends or future

developments. Factors that could influence the matters discussed in

such statements include the level of housing starts and sales of

existing homes, consumer confidence, trends in disposable income,

and general economic conditions. Decreases in these economic

indicators could have a negative effect on our business and

prospects. Likewise, increases in interest rates, particularly home

mortgage rates, and increases in consumer debt or the general rate

of inflation, could affect us adversely. Changes in consumer

tastes or preferences toward products not produced by us could

erode demand for our products. Changes in the value of the U.S.

dollar versus other currencies could affect our financial results

because a significant portion of our operations are located outside

the United States. Strengthening of the U.S. dollar against other

currencies could make our products less competitive on the basis of

price in markets outside the United States, and strengthening of

currencies in Canada and China can have a negative impact on our

sales of products produced in those places. Also, economic and

political instability in international areas could affect our

operations or sources of goods in those areas, as well as demand

for our products in international markets. Further information

about these factors, as well as other factors that could affect our

future operations or financial results and the matters discussed in

forward-looking statements, is included in Item 1A “Risk Factors”

in our Form 10-K filed with the Securities and Exchange Commission

on July 15, 2016, for the fiscal year ended May 1, 2016. In

addition, please note that the company is not responsible for

changes made to this release by wire services, internet services,

or other media.

CULP, INC.

Condensed Financial Highlights

(Unaudited)

Three Months Ended

Six Months Ended

October 30,

November 1,

October 30,

November 1,

2016

2015

2016

2015

Net sales $ 75,343,000 $ 76,956,000 $ 156,026,000 $

157,141,000 Income before income taxes $ 7,159,000 $ 6,144,000 $

15,706,000 $ 13,552,000 Net income $ 4,475,000 $ 3,771,000 $

9,789,000 $ 8,471,000 Net income per share: Basic $ 0.36 $ 0.31 $

0.80 $ 0.69 Diluted $ 0.36 $ 0.30 $ 0.78 $ 0.68 Adjusted net

income $ 5,885,000 $ 5,179,000 $ 12,910,000 $ 11,424,000 Adjusted

net income per share Basic $ 0.48 $ 0.42 $ 1.05 $ 0.93 Diluted $

0.47 $ 0.41 $ 1.03 $ 0.92 Average shares outstanding: Basic

12,308,000 12,343,000 12,297,000 12,310,000 Diluted 12,507,000

12,484,000 12,495,000 12,481,000

Presentation of Adjusted Net Income and

Adjusted Income Taxes (1)

Three Months Ended

Six Months Ended

October 30,

November 1,

October 30,

November 1,

2016

2015

2016

2015

Income before income taxes $ 7,159,000 $ 6,144,000 $

15,706,000 $ 13,552,000 Adjusted income taxes (2) $ 1,274,000 $

965,000 $ 2,796,000 $ 2,128,000 Adjusted net income $ 5,885,000 $

5,179,000 $ 12,910,000 $ 11,424,000

(1)

Culp, Inc. currently does not incur cash

income tax expense in the U.S. due to its $18 million in net

operating loss carryforwards as of May 1, 2016. Therefore, adjusted

net income is calculated using only income tax expense for the

company’s subsidiaries in Canada and China.

(2)

Represents estimated cash income tax

expense for the company’s subsidiaries in Canada and China,

calculated with a consolidated adjusted effective income tax rate

of 17.8% for fiscal 2017 and 15.7% for fiscal 2016.

Consolidated Adjusted Effective Income Tax Rate,

Net Income and Earnings Per Share For the Six Months Ended

October 30, 2016, and November 1, 2015 (Unaudited)

(Amounts in Thousands)

SIX MONTHS

ENDED

Amounts

October 30, November 1,

2016 2015

Consolidated Effective GAAP Income Tax Rate (1)

37.7

% 37.5 % Non-Cash U.S. Income Tax Expense

(19.6 )% (21.5 )% Non-Cash Foreign Income Tax

Expense

(0.3 )% (0.3 )%

Consolidated Adjusted Effective Income Tax Rate (2)

17.8 % 15.7 %

THREE MONTHS ENDED As reported October 30,

2016 As reported November 1, 2015 October

30, Proforma Net November 1, Proforma Net

2016 Adjustments

of Adjustments 2015

Adjustments

of Adjustments Income before income taxes

$ 7,159 $ -

$ 7,159 $

6,144 $ 6,144 Income taxes (3)

2,684 $ (1,410 )

1,274

2,373 $ (1,408 )

965 Net income

$

4,475 $ 1,410

$ 5,885 $ 3,771 $

1,408

$ 5,179 Net income per share-basic

$ 0.36 $ 0.11

$ 0.48 $

0.31 $ 0.11

$ 0.42 Net income per

share-diluted

$ 0.36 $ 0.11

$ 0.47

$ 0.30 $ 0.11

$ 0.41 Average shares

outstanding-basic

12,308 12,308 12,308

12,343 12,343 12,343 Average shares

outstanding-diluted

12,507 12,507 12,507

12,484 12,484 12,484 SIX

MONTHS ENDED As reported October 30, 2016 As

reported November 1, 2015 October 30, Proforma

Net November 1, Proforma Net 2016

Adjustments

of Adjustments 2015 Adjustments

of

Adjustments Income before income taxes

$

15,706 $ -

$ 15,706 $ 13,552 $ -

$ 13,552 Income taxes (3)

5,917

$ (3,121 )

2,796 5,081 $ (2,953

)

2,128 Net income

$ 9,789 $ 3,121

$ 12,910 $ 8,471 $ 2,953

$

11,424 Net income per share-basic

$

0.80 $ 0.25

$ 1.05 $ 0.69 $ 0.24

$ 0.93 Net income per share-diluted

$

0.78 $ 0.25

$ 1.03 $ 0.68 $ 0.24

$ 0.92 Average shares outstanding-basic

12,297

12,297 12,297 12,310 12,310

12,310 Average shares outstanding-diluted

12,495

12,495 12,495 12,481 12,481

12,481

(1)

Calculated by dividing consolidated income

tax expense by consolidated income before income taxes.

(2)

Represents estimated cash income tax

expense for our subsidiaries located in Canada and China divided by

consolidated income before income taxes.

(3)

Proforma income taxes calculated using the

Consolidated Adjusted Effective Income Tax Rate as reflected

above.

Reconciliation of Free Cash

Flow For the Six Months Ended October 30, 2016, and November

1, 2015

(Unaudited)

(Amounts in thousands)

Six Months Ended Six Months Ended October

30, 2016 November 1, 2015 Net cash provided by

operating activities $ 16,602 $ 11,204 Minus: Capital expenditures

(6,308 ) (5,255 ) Add: Proceeds from the sale of equipment - 225

Minus: Purchase of long-term investments (Rabbi Trust) (929 ) (864

) Add: Excess tax benefits related to stock-based compensation 167

838 Effect of exchange rate changes on cash and cash equivalents

(38 ) 271 Free Cash Flow $ 9,494

$ 6,419

Reconciliation of Return on Capital For the Six Months

Ended October 30, 2016, and November 1, 2015

(Unaudited)

(Amounts in thousands)

Six Months Ended Six Months Ended October

30, 2016 November 1, 2015 Consolidated Income

from Operations $ 15,973 $ 13,760 Average Capital Employed (2)

93,019 87,372 Return on Average

Capital Employed (1) 34.3 % 31.5 % Average

Capital Employed

October 30, 2016 July 31,

2016 May 1, 2016 Total assets $ 179,127 $ 183,360

$ 175,142 Total liabilities (43,178 ) (51,925 )

(46,330 ) Subtotal $ 135,949 $ 131,435 $ 128,812

Less: Cash and cash equivalents (13,910 ) (45,549 ) (37,787 )

Short-term investments (2,430 ) (2,434 ) (4,359 ) Long-term

investments- Held-To-Maturity (31,050 ) - - Long-term investments -

Rabbi Trust (4,994 ) (4,611 ) (4,025 ) Income taxes receivable - -

(155 ) Deferred income taxes - non-current (581 ) (1,942 ) (2,319 )

Income taxes payable - current 513 358 180 Income taxes payable -

long-term 3,734 3,779 3,841 Deferred income taxes - non-current

1,699 1,532 1,483 Line of credit - 7,000 - Deferred compensation

5,171 5,031 4,686 Total

Capital Employed $ 94,101 $ 94,599 $ 90,357

Average Capital Employed (2) $ 93,019

November 1, 2015 August 2, 2015 May 3,

2015 Total assets $ 168,947 $ 166,880 $ 171,300 Total

liabilities (45,972 ) (48,155 ) (51,873 )

Subtotal $ 122,975 $ 118,725 $ 119,427 Less: Cash and cash

equivalents (31,176 ) (25,933 ) (29,725 ) Short-term investments

(6,320 ) (6,336 ) (10,004 ) Long-term investments - Rabbi Trust

(3,279 ) (2,893 ) (2,415 ) Income taxes receivable (75 ) (142 )

(229 ) Deferred income taxes - non-current (3,415 ) (4,406 ) (5,169

) Current maturities of long-term debt - 2,200 2,200 Income taxes

payable - current 305 392 325 Income taxes payable - long-term

3,655 3,634 3,792 Deferred income taxes - non-current 1,206 1,072

982 Deferred compensation 4,421 4,280

4,041 Total Capital Employed $ 88,297 $ 90,593

$ 83,225 Average Capital Employed (2) $

87,372

Notes:

(1)

Return on average capital employed

represents operating income for the six month period ending October

30, 2016, or November 1, 2015, times two quarters to arrive at an

annualized value then divided by average capital employed. Average

capital employed does not include cash and cash equivalents,

short-term investments, long-term investments - Held-To-Maturity,

long-term investments - Rabbi Trust, current maturities of

long-term debt, line of credit, noncurrent deferred income tax

assets and liabilities, income taxes receivable and payable, and

deferred compensation.

(2)

Average capital employed used for the

six months ending October 30, 2016, was computed using the three

quarterly periods ending October 30, 2016, July 31, 2016, and May

1, 2016.

Average capital employed used for the

six months ending November 1, 2015 was computed using the three

quarterly periods ending November 1, 2015, August 2, 2015, and May

3, 2015.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161201006352/en/

Culp, Inc.Investor Contact:Kenneth R. Bowling, 336-881-5630Chief

Financial OfficerorMedia Contact:Teresa A. Huffman,

336-889-5161Vice President, Human Resources

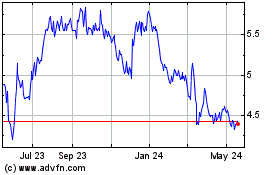

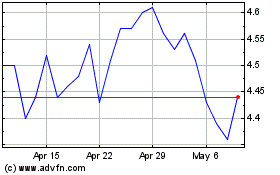

Culp (NYSE:CULP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Culp (NYSE:CULP)

Historical Stock Chart

From Apr 2023 to Apr 2024