NOTICE TO MERRILL LYNCH CUSTOMERS – Klayman & Tokses, P.A. Announces Investigation into Merrill Lynch Loan Management Accou...

December 01 2016 - 2:43PM

Business Wire

The Securities Arbitration Law Firm

of Klayman & Toskes, P.A.

(“K&T”), www.nasd-law.com, announces an investigation into

Merrill Lynch, a wholly owned brokerage firm of Bank of America

(NYSE:BAC), for Financial Industry Regulatory Authority

(FINRA) sales practice violations from its Loan Management

Accounts (LMAs) following FINRA regulatory fines. Yesterday, FINRA

accepted from Merrill Lynch an Acceptance Waiver and Consent for

$6.25 million in fines and approximately $780,000 in restitution to

Puerto Rico customers, for inadequately supervising the use of

Merrill Lynch loans for customer accounts. According to FINRA,

Merrill Lynch brokerage accounts received proceeds transferred from

LMAs and purchased millions of dollars in securities, the majority

being purchased on margin, within 14 days of the transfer. FINRA

concluded that these supervisory failures occurred from January

2010 to November 2014.

According to K&T founder, Lawrence L. Klayman,

Esq., “The use of brokerage account assets as collateral for these

loans greatly increased the risks assumed by Merrill Lynch

customers.” Mr. Klayman explains, “Our firm is

investigating sales practice violations by Merrill Lynch for

failure to supervise its financial advisors’ recommendations to

customers concerning the use of LMA proceeds to purchase stock on

margin. Merrill Lynch’s advice to use margin loans signals a

potential conflict of interest, which

increased commissions for their financial advisors at the expense

of customers who did not fully understand the risks associated with

these loans.”

The sole purpose of this release is in furtherance of our

investigation into Merrill Lynch’s sales practices related

to Loan Management Accounts (LMAs) which may include

violations for unsuitable recommendations, margin abuse,

breach of fiduciary duty, misrepresentations and omissions of

material facts and a failure to supervise. Current

and former Merrill Lynch customers who have information about

the sales practices of Bank of America and its brokerage firm,

Merrill Lynch are encouraged to contact Lawrence

L. Klayman, Esq. or Raymond Gentile, Esq.

of Klayman & Toskes, P.A. at (888)

997-9956, or visit our website at www.nasd-law.com.

About Klayman & Toskes, P.A.

K&T is a leading national securities law firm which

practices exclusively in the field of securities arbitration and

litigation, on behalf of retail and institutional investors

throughout the world in large and complex securities matters. The

firm represents high net-worth, ultra-high-net-worth, and

institutional investors, such as non-profit organizations, unions,

public and multi-employer pension funds. K&T has office

locations in California, Florida, New York and Puerto Rico.

Destination: http://nasd-law.com/notice-to-merrill-lynch-customers-klayman-tokses-p-a-announces-investigation-into-merrill-lynch-loan-management-accounts-in-light-of-finra-sanctions-for-7-million-in-fines-and-restitut/

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161201006292/en/

Klayman & Toskes, P.A.Lawrence L. Klayman,

Esq. or Raymond Gentile, Esq., 888-997-9956info@nasd-law.com

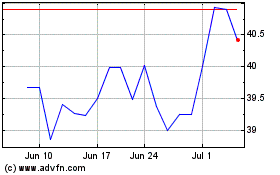

Bank of America (NYSE:BAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

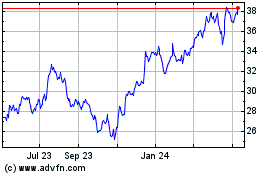

Bank of America (NYSE:BAC)

Historical Stock Chart

From Apr 2023 to Apr 2024