CIBC's Profit Jumps 20%, and It Increases Dividend

December 01 2016 - 7:42AM

Dow Jones News

By Judy McKinnon

Canadian Imperial Bank of Commerce on Thursday raised its

dividend and posted a nearly 20% increase in fiscal-fourth quarter

earnings, besting analyst expectations on improved results across

its key operations.

Canada's fifth-largest lender by assets, which earlier this year

agreed to buy Chicago-based PrivateBancorp Inc . for about $3.8

billion in cash and stock, reported revenue and earnings

improvements in each of its retail and business banking,

wealth-management and capital-markets divisions in the quarter

ended Oct. 31.

Toronto-based CIBC said it earned 931 million Canadian dollars

($693 million), or C$2.32 a share in its latest quarter. That's

ahead of the C$778 million, or C$1.93 a share, it earned a year

earlier.

The bank said results in its latest quarter included items that

reduced earnings by 28 Canadian cents overall, the largest being a

25-Canadian-cent-a-share restructuring charge related to employee

severance.

Adjusted to exclude items, CIBC said it earned C$2.60 a share,

easily beating the C$2.48 a share analysts were expecting,

according to Thomson Reuters.

Revenue rose almost 6% to C$3.68 billion.

Loan-loss provisions, or the funds set aside to cover soured

loans, increased to C$222 million from C$198 million a year

earlier, but were down from C$243 million in the previous

quarter.

In the latest period, earnings from retail and business banking

rose 2%, while wealth management and capital markets earnings were

up 3% and 52%, respectively. The bank noted that loan-loss

provisions in its capital-markets division were nil in the quarter,

compared with C$22 million a year earlier, largely due to lower

losses in the oil and gas sector.

CIBC raised its quarterly payout by 3 Canadian cents a share, to

C$1.24 a share.

In June, CIBC agreed to buy Chicago-based PrivateBancorp Inc. in

what would be its biggest purchase to date. The bank has said it

expects to close the deal early next year.

Separately on Thursday, PrivateBancorp said two independent

proxy advisory firms are recommending shareholders vote in favor of

the CIBC offer. A special meeting of PrivateBancorp shareholders is

scheduled for Dec. 8, it noted.

Write to Judy McKinnon at judy.mckinnon@wsj.com

(END) Dow Jones Newswires

December 01, 2016 07:27 ET (12:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

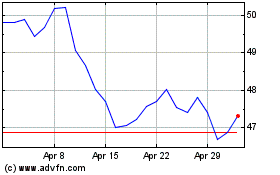

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Apr 2023 to Apr 2024