- Net sales decreased 7% to $506.1

million.

- Diluted EPS was $0.15, including a

$0.04 net tax benefit.

- Total inventory was down

6%.

Express, Inc. (NYSE:EXPR), a specialty retail apparel company,

announced its financial results for the third quarter of 2016.

These results, which cover the thirteen and thirty-nine weeks ended

October 29, 2016, are compared to the thirteen and thirty-nine

weeks ended October 31, 2015.

David Kornberg, the Company’s president and chief executive

officer, stated: “Our third quarter performance was highlighted by

sales and earnings in line with our guidance and progress made

addressing the areas noted for improvement during our second

quarter call. This progress included refocusing our brand

projection and marketing to be more consistent with our core

demographic and additional steps taken to drive customer

acquisition and retention. Notably, while mall traffic challenges

continued to impact our store performance, we achieved a double

digit increase in e-commerce sales.”

Mr. Kornberg, continued: "We expect the holiday season to remain

challenging as mall traffic and a highly promotional retail

environment continue to be headwinds. That being said, we believe

our focus and execution against our key priorities, which include

driving improved profitability through a balanced approach to

growth, elevating our brand and customer experience, investing in

the growth and development of our associates and achieving the

benefits from our systems implementations, will position our

Company to create shareholder value over the long term.”

Third Quarter 2016 Operating Results:

- Net sales decreased 7% to $506.1

million from $546.6 million in the third quarter of 2015.

- Comparable sales (including e-commerce

sales) decreased 8%, compared to a 6% increase in the third quarter

of 2015.

- E-commerce sales increased 15% to $96.3

million.

- Merchandise margin declined by 340

basis points driven by increased promotional activity. Buying and

occupancy as a percentage of net sales rose by 160 basis points. In

combination, this resulted in a 500 basis point decline in gross

margin, representing 30.0% of net sales compared to 35.0% in last

year’s third quarter.

- Selling, general, and administrative

(SG&A) expenses were $136.6 million versus $146.6 million in

last year's third quarter. As a percentage of net sales, SG&A

expenses increased by 20 basis points to 27.0%.

- Operating income was $15.1 million, or

3.0% of net sales, compared to $44.5 million, or 8.1% of net sales

in the third quarter of 2015.

- Income tax expense was $2.8 million, at

an effective tax rate of 19.6%, compared to $16.9 million, at an

effective tax rate of 39.2% in last year's third quarter. The

effective tax rate for the thirteen weeks

ended October 29, 2016 includes a net tax benefit of

approximately $2.9 million attributable to certain discrete items

that occurred during the third quarter.

- Net income was $11.6 million, or $0.15

per diluted share and includes a net $0.04 per diluted share

benefit related to the aforementioned income tax items. This

compares to net income of $26.3 million, or $0.31 per diluted

share, in the third quarter of 2015.

- Real estate activity for the third

quarter of 2016 is presented in Schedule 5.

Third Quarter 2016 Balance Sheet Highlights:

- Cash and cash equivalents totaled

$101.9 million versus $91.2 million at the end of the third quarter

of 2015. During the thirty-nine weeks ended October 29, 2016,

approximately $51.5 million was used to repurchase approximately

3.2 million shares of the Company's outstanding common stock.

- Capital expenditures totaled $80.9

million for the thirty-nine weeks ended October 29, 2016 compared

to $85.0 million for the thirty-nine weeks ended October 31,

2015.

- Inventory was $341.9 million compared

to $364.7 million at the end of the prior year’s third quarter, a

6% decrease.

2016 Guidance:

The table below compares the Company's projected results for the

thirteen week period ended January 28, 2017 to the actual results

for the thirteen week period ended January 30, 2016.

Fourth Quarter 2016 Guidance

Fourth Quarter 2015

Actual Results

Comparable Sales Negative low double digits 4% Effective Tax Rate

Approximately 39% 38.5% Interest Expense, Net $0.7 million $1.1

million Net Income $20 to $23 million $56.1 million Diluted

Earnings Per Share (EPS) $0.26 to $0.30 $0.67 Weighted Average

Diluted Shares Outstanding 78.8 million 83.3 million

The table below compares the Company's projected results for the

52 week period ended January 28, 2017 to the actual results for the

52 week period ended January 30, 2016.

Full Year 2016 Guidance

Full Year 2015

Actual Results

Comparable Sales Negative high single digits 6% Effective Tax Rate

Approximately 37% 38.9% Interest Expense, Net $13.5 million(1)

$15.9 million(2) Net Income $55 to $58 million(1) $116.5 million(2)

Adjusted Net Income $62 to $65 million(3) $122.4 million(3) Diluted

EPS $0.70 to $0.74(1) $1.38(2) Adjusted Diluted EPS $0.78 to

$0.82(3) $1.45(3) Weighted Average Diluted Shares Outstanding 79.1

million 84.6 million Capital Expenditures $100 to $105 million

$115.3 million (1) Includes

approximately $11.4 million of non-core items related to an

amendment to the Times Square Flagship store lease that allows for

early termination at the landlord's option. (2) Includes

approximately $9.7 million of non-core items in connection with the

redemption of our Senior Notes. These items consist of the

redemption premium paid, the write-off of unamortized debt issuance

costs, and the write-off of the unamortized debt discount.

(3)

Adjusted Net Income and Adjusted Diluted

EPS are non-GAAP financial measures. Refer to Schedule 4 for a

reconciliation of GAAP to Non-GAAP financial measures.

This guidance does not take into account any additional non-core

items that may occur.

See Schedule 5 for a discussion of projected real estate

activity.

Conference Call Information:

A conference call to discuss third quarter 2016 results is

scheduled for Thursday, December 1, 2016 at 9:00 a.m. Eastern Time

(ET). Investors and analysts interested in participating in the

call are invited to dial (877) 705-6003 approximately ten minutes

prior to the start of the call. The conference call will also be

webcast live at: http://www.express.com/investor and remain

available for 90 days. A telephone replay of this call will be

available at 12:00 p.m. ET on December 1, 2016 until 11:59 p.m. ET

on December 8, 2016 and can be accessed by dialing (877) 870-5176

and entering replay pin number 13650225.

About Express, Inc.:

Express is a specialty apparel and accessories retailer of

women's and men's merchandise, targeting the 20 to 30- year-old

customer. Express has more than 35 years of experience offering a

distinct combination of fashion and quality for multiple lifestyle

occasions at an attractive value addressing fashion needs across

work, casual, jeanswear, and going-out occasions. The Company

currently operates more than 650 retail and factory outlet stores,

located primarily in high-traffic shopping malls, lifestyle

centers, and street locations across the United States, Canada, and

Puerto Rico. Express merchandise is also available at franchise

locations in Latin America and the Middle East. Express also

markets and sells its products through its e-commerce

website, www.express.com, as well

as on its mobile app.

Forward-Looking Statements:

Certain statements are “forward-looking statements” made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. Forward-looking statements include

any statement that does not directly relate to any historical or

current fact and include, but are not limited to, (1) guidance and

expectations for the fourth quarter and full year 2016, including

statements regarding expected comparable sales, effective tax

rates, interest expense, net income, adjusted net income, diluted

earnings per share, adjusted diluted earnings per share, and

capital expenditures, (2) statements regarding expected store

openings, store closures, and gross square footage, and (3)

statements regarding the Company's future plans and initiatives,

including, but not limited to, results expected from such

initiatives. Forward-looking statements are based on our current

expectations and assumptions, which may not prove to be accurate.

These statements are not guarantees and are subject to risks,

uncertainties, and changes in circumstances that are difficult to

predict, and significant contingencies, many of which are beyond

the Company's control. Many factors could cause actual results to

differ materially and adversely from these forward-looking

statements. Among these factors are (1) changes in consumer

spending and general economic conditions; (2) our ability to

identify and respond to new and changing fashion trends, customer

preferences, and other related factors; (3) fluctuations in our

sales, results of operations, and cash levels on a seasonal basis

and due to a variety of other factors, including, our product

offerings relative to customer demand, the mix of merchandise we

sell, promotions, and inventory levels; (4) competition from other

retailers; (5) customer traffic at malls, shopping centers, and at

our stores and online; (6) our dependence on a strong brand image;

(7) our ability to develop and maintain a relevant and reliable

omni-channel experience for our customers; (8) the failure or

breach of information systems upon which we rely; (9) our ability

to protect customer data from fraud and theft; (10) our dependence

upon third parties to manufacture all of our merchandise; (11)

changes in the cost of raw materials, labor, and freight; (12)

supply chain disruption; (13) our dependence upon key executive

management; (14) our growth strategy, including our ability to

improve the productivity of our existing stores, open new stores,

and grow our e-commerce business; (15) our substantial lease

obligations; (16) our reliance on third parties to provide us with

certain key services for our business; (17) claims made against us

resulting in litigation or changes in laws and regulations

applicable to our business; (18) our inability to protect our

trademarks or other intellectual property rights which may preclude

the use of our trademarks or other intellectual property around the

world; (19) restrictions imposed on us under the terms of our

asset-based loan facility, including restrictions on our ability to

repurchase our common stock; (20) impairment charges on long-lived

assets; and (21) changes in tax requirements, results of tax

audits, and other factors that may cause fluctuations in our

effective tax rate. Additional information concerning these and

other factors can be found in Express, Inc.'s filings with the

Securities and Exchange Commission. We undertake no obligation to

publicly update or revise any forward-looking statement as a result

of new information, future events, or otherwise, except as

otherwise required by law.

Schedule 1

Express, Inc.

Consolidated Balance Sheets

(In thousands)

(Unaudited)

October 29, 2016

January 30, 2016 October 31, 2015 ASSETS

CURRENT ASSETS: Cash and cash equivalents $ 101,855 $ 186,903 $

91,215 Receivables, net 16,274 22,130 25,810 Inventories 341,936

255,350 364,662 Prepaid minimum rent 31,434 30,694 30,660 Other

21,786 18,342 28,788 Total current assets

513,285 513,419 541,135 PROPERTY AND EQUIPMENT 1,017,259

948,608 928,434 Less: accumulated depreciation (550,725 ) (504,211

) (484,929 ) Property and equipment, net 466,534 444,397 443,505

TRADENAME/DOMAIN NAMES/TRADEMARKS 197,618 197,597 197,597

DEFERRED TAX ASSETS 21,612 21,227 11,718 OTHER ASSETS 12,696

2,004 2,990 Total assets $ 1,211,745 $

1,178,644 $ 1,196,945

LIABILITIES AND

STOCKHOLDERS’ EQUITY CURRENT LIABILITIES: Accounts payable $

222,818 $ 149,884 $ 209,874 Deferred revenue 25,322 30,895 22,302

Accrued expenses 166,953 126,624 106,925 Total

current liabilities 415,093 307,403 339,101 DEFERRED LEASE

CREDITS 145,507 139,236 139,203 OTHER LONG-TERM LIABILITIES 40,451

114,052 112,518 Total liabilities 601,051

560,691 590,822 COMMITMENTS AND CONTINGENCIES Total

stockholders’ equity 610,694 617,953 606,123

Total liabilities and stockholders’ equity $ 1,211,745 $

1,178,644 $ 1,196,945

Schedule 2

Express, Inc.

Consolidated Statements of

Income

(In thousands, except per share

amounts)

(Unaudited)

Thirteen Weeks Ended

Thirty-Nine Weeks Ended

October 29, 2016

October 31, 2015

October 29, 2016

October 31, 2015

NET SALES $ 506,090 $ 546,616 $ 1,513,766 $ 1,584,576 COST OF GOODS

SOLD, BUYING AND OCCUPANCY COSTS 354,373 355,527

1,043,382 1,049,853 Gross profit 151,717 191,089 470,384

534,723 OPERATING EXPENSES: Selling, general, and administrative

expenses 136,633 146,585 405,547 420,334 Other operating (income)

expense, net (17 ) (29 ) 28 43 Total operating expenses

136,616 146,556 405,575 420,377 OPERATING INCOME 15,101

44,533 64,809 114,346 INTEREST EXPENSE, NET 567 1,207 12,845

14,751 OTHER EXPENSE (INCOME), NET 90 70 (404 ) 140

INCOME BEFORE INCOME TAXES 14,444 43,256 52,368 99,455 INCOME TAX

EXPENSE 2,827 16,949 17,725 39,058 NET INCOME

$ 11,617 $ 26,307 $ 34,643 $ 60,397 EARNINGS PER SHARE:

Basic $ 0.15 $ 0.31 $ 0.44 $ 0.72 Diluted $ 0.15 $ 0.31 $ 0.44 $

0.71 WEIGHTED AVERAGE SHARES OUTSTANDING: Basic 78,401

84,240 78,754 84,453 Diluted 78,595 84,849 79,151 85,009

Schedule 3

Express, Inc.

Consolidated Statements of Cash

Flows

(In thousands)

(Unaudited)

Thirty-Nine Weeks Ended October 29,

2016 October 31, 2015 CASH FLOWS FROM

OPERATING ACTIVITIES: Net income $ 34,643 $ 60,397 Adjustments to

reconcile net income to net cash provided by operating activities:

Depreciation and amortization 58,960 56,103 Loss on disposal of

property and equipment 907 1,313 Impairment charge 829 —

Amortization of lease financing obligation discount 11,354 — Excess

tax benefit from share-based compensation — (334 ) Share-based

compensation 10,783 15,114 Non-cash loss on extinguishment of debt

— 5,314 Deferred taxes (385 ) (6,805 ) Landlord allowance

amortization (8,345 ) (9,208 ) Payment of original issue discount —

(2,812 ) Changes in operating assets and liabilities: Receivables,

net 5,883 (2,546 ) Inventories (86,468 ) (123,806 ) Accounts

payable, deferred revenue, and accrued expenses 28,749 42,514 Other

assets and liabilities 2,954 20,389 Net cash provided

by operating activities 59,864 55,633 CASH FLOWS FROM

INVESTING ACTIVITIES: Capital expenditures (80,900 ) (85,013 )

Purchase of intangible assets (21 ) (35 ) Investment in equity

interests (10,133 ) — Net cash used in investing activities

(91,054 ) (85,048 ) CASH FLOWS FROM FINANCING ACTIVITIES:

Repayment of long-term debt — (198,038 ) Costs incurred in

connection with debt arrangements — (1,006 ) Payments on lease

financing obligations (1,186 ) (1,168 ) Excess tax benefit from

share-based compensation — 334 Proceeds from exercise of stock

options 2,735 1,265 Repurchase of common stock under share

repurchase program (51,538 ) (22,020 ) Repurchase of shares for tax

withholding obligations (4,498 ) (4,400 ) Net cash used in

financing activities (54,487 ) (225,033 ) EFFECT OF EXCHANGE

RATE ON CASH 629 (496 ) NET DECREASE IN CASH AND CASH

EQUIVALENTS (85,048 ) (254,944 ) CASH AND CASH EQUIVALENTS,

Beginning of period 186,903 346,159 CASH AND CASH

EQUIVALENTS, End of period $ 101,855 $ 91,215

Schedule 4

Supplemental Information - Consolidated

Statements of Income

Reconciliation of GAAP to Non-GAAP

Financial Measures

(Unaudited)

The Company supplements the reporting of its financial

information determined under United States generally accepted

accounting principles (GAAP) with certain non-GAAP financial

measures: adjusted net income and adjusted diluted earnings per

share. The Company believes that these non-GAAP measures provide

additional useful information to assist stockholders in

understanding its financial results and assessing its prospects for

future performance. Management believes adjusted net income and

adjusted diluted earnings per share are important indicators of the

Company's business performance because they exclude items that may

not be indicative of, or are unrelated to, the Company's underlying

operating results, and provide a better baseline for analyzing

trends in the business. In addition, adjusted diluted earnings per

share is used as a performance measure in the Company's executive

compensation program for purposes of determining the number of

equity awards that are ultimately earned. Because non-GAAP

financial measures are not standardized, it may not be possible to

compare these financial measures with other companies' non-GAAP

financial measures having the same or similar names. These adjusted

financial measures should not be considered in isolation or as a

substitute for reported net income and reported diluted earnings

per share. These non-GAAP financial measures reflect an additional

way of viewing the Company's operations that, when viewed with the

GAAP results and the below reconciliations to the corresponding

GAAP financial measures, provide a more complete understanding of

the Company's business. Management strongly encourages investors

and stockholders to review the Company's financial statements and

publicly-filed reports in their entirety and not to rely on any

single financial measure.

Thirty-Nine Weeks Ended October 29, 2016 (in thousands,

except per share amounts) Net Income

Diluted Earnings per

Share

Weighted Average

Diluted Shares

Outstanding

Reported GAAP Measure $ 34,643 $ 0.44 79,151 Interest Expense (a)

11,354 0.14 Income Tax Benefit (b) (4,428 ) (0.06 ) Adjusted

Non-GAAP Measure $ 41,569 $ 0.53

(a) Represents non-core items related to the amendment of

the Times Square Flagship store lease. (b) Represents the

tax impact of the interest expense adjustment at our statutory rate

of approximately 39% for the thirty-nine weeks ended October 29,

2016.

Thirty-Nine Weeks Ended

October 31, 2015 (in thousands, except per share

amounts) Net Income

Diluted Earnings per

Share

Weighted Average

Diluted Shares

Outstanding

Reported GAAP Measure $ 60,397 $ 0.71 85,009 Interest Expense (a)

9,657 0.11 Income Tax Benefit (b) (3,741 ) (0.04 ) Adjusted

Non-GAAP Measure $ 66,313 $ 0.78

(a) Includes the redemption premium paid, the write-off of

unamortized debt issuance costs, and the write-off of the

unamortized debt discount related to the redemption of all $200.9

million of our Senior Notes. (b) Represents the tax impact

of the interest expense adjustment at our statutory rate of

approximately 39% for the thirty-nine weeks ended October 31, 2015.

Schedule 4 (Continued)

Supplemental Information - Consolidated

Statements of Income

Reconciliation of GAAP to Non-GAAP

Financial Measures

(Unaudited)

Fifty-Two Weeks Ended January 28, 2017 (in

thousands, except per share amounts)

Projected Net

Income

Projected Diluted

Earnings per Share

Projected Weighted

Average Diluted

Shares Outstanding

Projected GAAP Measure * $ 56,500 $ 0.71 79,068 Interest Expense

(a) 11,354 0.14 Income Tax Benefit (b) (4,428 ) (0.06 ) Projected

Adjusted Non-GAAP Measure * $ 63,426 $ 0.80

(a) Represents non-core items related to the

amendment of the Times Square Flagship store lease. (b)

Represents the tax impact of the interest expense adjustment at our

statutory rate of approximately 39% for the fifty-two weeks ended

January 28, 2017.

* Represents mid-point of guidance

range.

Fifty-Two Weeks Ended January 30,

2016 (in thousands, except per share amounts) Net

Income

Diluted Earnings per

Share

Weighted Average

Diluted Shares

Outstanding

Reported GAAP Measure $ 116,513 $ 1.38 84,591 Interest Expense (a)

9,657 0.11 Income Tax Benefit (b) (3,741 ) (0.04 ) Adjusted

Non-GAAP Measure $ 122,429 $ 1.45

(a) Includes the redemption premium paid, the

write-off of unamortized debt issuance costs, and the write-off of

the unamortized debt discount related to the redemption of all

$200.9 million of our Senior Notes. (b) Represents the tax

impact of the interest expense adjustment at our statutory rate of

approximately 39% for the fifty-two weeks ended January 30, 2016.

Schedule 5

Express, Inc.

Real Estate Activity

(Unaudited)

Third Quarter 2016 - Actual

October 29, 2016 - Actual Company-Operated Stores

Opened Closed Conversion

Store Count

Gross Square

Footage

United States - Retail Stores — — — 537 United States

- Outlet Stores 5 — — 99 Canada — — — 17 Total 5 — —

653 5.6 million

Fourth Quarter 2016 - Projected

January 28, 2017 - Projected Company-Operated Stores

Opened Closed Conversion

Store Count

Gross Square

Footage

United States - Retail Stores — (1) (1) 535 United States - Outlet

Stores 4 — 1 104 Canada — — — 17 Total 4 (1) — 656

5.7 million

Full Year 2016 - Projected

Company-Operated Stores Opened

Closed Conversion United States - Retail

Stores — (16) (4) United States - Outlet Stores 19 — 4 Canada —

— — Total 19 (16) —

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161201005457/en/

Investors:ICR, Inc.Allison Malkin,

203-682-8225orMedia:Express, Inc.Robin

Hoffman, 614-474-4834Director, Communications

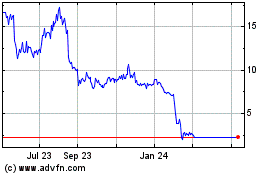

Express (NYSE:EXPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

Express (NYSE:EXPR)

Historical Stock Chart

From Apr 2023 to Apr 2024