High-income households won't receive an "absolute tax cut" under

a Trump tax plan, the president-elect's new pick for Treasury

secretary said on Wednesday, a promise that is at odds with tax

proposals from Donald Trump and House Republicans.

Steven Mnuchin said that "Any reductions we have in upper-income

taxes will be offset by less deductions, so that there will be no

absolute tax cut for the upper class." The big tax cut, he told

CNBC, will go the middle class.

The comments echo occasional remarks from Mr. Trump, but not the

tax plan he campaigned on, and point to the political and

arithmetic challenges that lawmakers will face as they try to turn

those promises into legislation.

Aside from moving ahead on a large tax rewrite next year, Mr.

Mnuchin also said he would roll back parts of the landmark 2010

Dodd-Frank financial overhaul enacted by the Obama administration

and congressional Democrats in the wake of the financial crisis.

Mr. Mnuchin called that "the No. 1 one priority on the regulatory

side."

Mr. Trump's tax plan would lower top rates dramatically,

providing such large benefits to high-income households that

analysts say they can't be covered with limits on tax breaks, such

as the $100,000-a-person limit on itemized deductions already in

Mr. Trump's plan. The largest deductions typically are for mortgage

interest, state and local taxes and charitable contributions.

"I don't think there is a way to make it work with the current

marginal rates that they're working with," said Kyle Pomerleau,

director of federal projects at the conservative-leaning Tax

Foundation.

Under Mr. Trump's plan, the corporate tax rate would drop from

35% to 15%. The estate tax and alternative minimum tax would be

repealed. Capital-gains rates would drop. The top rate on business

income reported on individual tax returns would fall from 39.6% to

15%, and the top rate on ordinary income would fall from 39.6% to

33%.

The Tax Foundation says Mr. Trump's plan would boost after-tax

incomes for the top 1% of households by at least 10%, even before

accounting for any potential economic growth. The Tax Policy

Center, a think tank run by a former Clinton administration

official, estimates that the top 1% of households would pay an

average of $214,690 less in taxes in 2017 under Mr. Trump's plan

than they would otherwise.

Stephen Moore, who helped develop Mr. Trump's tax plan, said it

was designed so that the deduction cap offsets the revenue loss

from lowering the top tax rate on ordinary income from 39.6% to

33%. The cap wasn't written to offset the tax cuts on business

income, estates and capital gains, which independent analyses all

say flow disproportionately to top earners.

It wasn't immediately clear on Wednesday whether Mr. Trump and

his team were actually changing their tax plan. The transition team

didn't respond to a request for comment.

"Trump's plan was independently scored as giving more tax cuts

to the top 1% than the bottom 99% combined," said Gene Sperling, a

former economic-policy aide to President Barack Obama. "So, we'll

watch what they do."

In response to a question about studies showing Mr. Trump's plan

would raise taxes on millions of single parents, Mr. Mnuchin said

the plan would be "very clear" in ensuring a middle-class tax cut

when it emerges from Congress.

Mr. Mnuchin's comments on the distribution of the tax burden

also show a potential difference with Republicans in the House, who

are developing their own tax plan to lower rates and limit tax

breaks.

House Speaker Paul Ryan (R., Wis.) and Ways and Means Chairman

Kevin Brady (R., Texas) have brushed aside questions about a study

showing that their plan would deliver most of its benefits to the

top 1%. Instead, they say they are focusing on encouraging economic

growth.

That is a change from Republicans' positioning just a few years

ago. In 2012, presidential candidate Mitt Romney said he would make

sure taxes wouldn't go up for high-income households, though he had

trouble making the math work. In 2014, then-Rep. Dave Camp (R.,

Mich.) produced a plan that didn't change the distribution of the

tax burden.

A challenge for Republicans is navigating the tension between

economic theories that emphasize lower tax rates and the fact that

the income-tax burden is concentrated at the top of the income

distribution. Cutting marginal tax rates necessarily helps the top

1%, but Mr. Trump's campaign plan gives them a bigger share of the

tax cuts than their share of income or tax payments.

The top 1% of households receives 17.2% of all U.S. pretax

income and pays 28.7% of all federal taxes, according to Tax Policy

Center estimates for 2017. That group would be the beneficiary of

about half of Mr. Trump's tax cuts.

Mr. Mnuchin's comments on Dodd-Frank are consistent with those

made by Mr. Trump and other advisers. But they are significant

since Mr. Mnuchin himself has said little publicly about policy

matters, and his Wednesday remarks offer a fresh window into his

thinking and priorities.

Mr. Mnuchin, a former Goldman Sachs Group Inc. executive, said

the Volcker rule provision in Dodd-Frank—named after former Federal

Reserve Chairman Paul Volcker—is too complicated and signaled the

Trump administration may try to roll it back. The rule is aimed at

trying to stop banks from betting with deposit-insured funds.

Goldman and other Wall Street firms have complained that the rule

is too complex.

"The No. 1 problem with the Volcker rule is it's way too

complicated, and people don't know how to interpret it," Mr.

Mnuchin said. "So we're going to look at what do with it, as we are

with all of Dodd-Frank."

Write to Richard Rubin at richard.rubin@wsj.com

(END) Dow Jones Newswires

December 01, 2016 02:15 ET (07:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

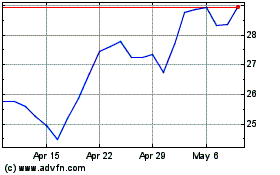

BankUnited (NYSE:BKU)

Historical Stock Chart

From Mar 2024 to Apr 2024

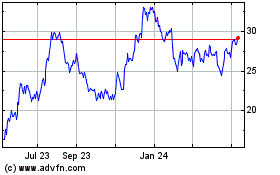

BankUnited (NYSE:BKU)

Historical Stock Chart

From Apr 2023 to Apr 2024