Private-equity giant Blackstone Group LP is about to open up its

massive bet on single-family housing to outside investors.

Invitation Homes LP, which manages the largest pool of rental

homes in the U.S., has filed confidentially for an initial public

offering that could come as soon as January, according to people

familiar with the matter.

The Dallas-based company plans to sell about $1.5 billion worth

of stock and use the proceeds to pay down debt, one of the people

said. Based upon the portion of a company that is typically sold in

an IPO, Invitation Homes could be worth around $7.5 billion.

Deutsche Bank AG and J.P. Morgan Chase & Co. are among the

banks Invitation Homes tapped to lead the IPO, said people familiar

with the deal.

A public listing would set the stage for Blackstone to start

exiting the business, one of the biggest bets the firm has ever

made. As of last fall, the firm had spent roughly $10 billion to

acquire and fix up about 50,000 foreclosed homes, taking advantage

of bargain prices in the aftermath of the housing crash.

The deal's outcome also could cement the legacy of Jonathan

Gray, who runs the firm's $102 billion real-estate business and is

in line to eventually succeed co-founder Stephen Schwarzman as

chief executive. Mr. Gray recently was in the running to serve as

Treasury secretary under President-elect Donald Trump but said he

still had "much work to do at Blackstone."

An Invitation Homes IPO would come at a time when U.S. home

prices have reached all-time highs and homeownership rates are at

their lowest level in at least 50 years, suggesting that

rental-housing demand will remain robust.

Starting with a $100,000 home in Phoenix in 2012, Blackstone

went on a multiyear homebuying binge in 14 metropolitan areas. At

its peak, the firm was spending about $150 million a week on

foreclosed homes, often sight unseen. Invitation Homes now manages

about 50,000 homes.

In an interview last year, Mr. Schwarzman said the firm's

housing bet began after the foreclosure crisis when banks were

loaded with repossessed homes and under pressure from regulators to

tighten lending standards.

"We said, 'Oh my goodness, this could be huge. Nobody is going

to be able to borrow, they're going to need housing,'" Mr.

Schwarzman told The Wall Street Journal. "So we went out and

started to buy houses to rent to people."

The wager spawned follow-on investments at the firm. When

Blackstone found itself unable to secure financing for its

purchases, it decided to launch a company, B2R Finance LP, that

lends specifically to landlords. To recoup some of the cash it

spent on homes, Blackstone and its bankers created a new type of

bond backed by rental income from batches of homes.

Though Blackstone assembled the largest pool of homes, it isn't

the only Wall Street firm that scooped up big swaths of Main

Street.

With cash from Alaska's state oil fund, self-storage magnate B.

Wayne Hughes launched American Homes 4 Rent, which owns about

48,000 homes in 22 states.

Real estate moguls Barry Sternlicht and Thomas J. Barrack Jr.

merged their rental-home portfolios earlier this year to make the

country's third largest landlord, Colony Starwood Homes, which said

it owned 30,407 houses as of Sept. 30.

Donald Mullen Jr., a former Goldman Sachs Group LP executive who

a decade ago helped oversee the firm's lucrative bet against the

housing market, has been soliciting investors for $1 billion to buy

homes to add to the 16,500 houses his Progress Residential has

already bought.

The stock market reception for American Homes 4 Rent and Colony

Starwood was tepid at first, as investors questioned their ability

to efficiently maintain houses spread across the country and

wondered whether they would abandon on the rental business and sell

the homes when prices rebounded.

But their stocks have risen this year to move closer to the

value of their properties. Colony Starwood shares are up 34.9%,

giving the company a market value of about $3.1 billion. American

Homes 4 Rent shares are up 26.5%, and the company has a market

value of nearly $5 billion. The companies are structured as

real-estate investment trusts, which manage properties, collect

rent and pass profits onto shareholders.

On a conference call with analysts in July, Blackstone President

Hamilton "Tony" James said Invitation Homes was still buying homes,

though in lower volumes, despite rising prices. He said the company

had become a "more mature investment in terms of rate of growth"

for Blackstone.

Blackstone has indicated plans to take Invitation Homes public

by early next year, without being more specific.

Write to Matt Jarzemsky at matthew.jarzemsky@wsj.com, Dana

Mattioli at dana.mattioli@wsj.com and Ryan Dezember at

ryan.dezember@wsj.com

(END) Dow Jones Newswires

November 30, 2016 19:05 ET (00:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

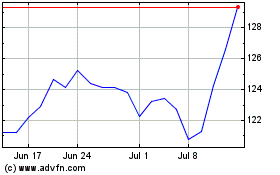

Blackstone (NYSE:BX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Blackstone (NYSE:BX)

Historical Stock Chart

From Apr 2023 to Apr 2024