- Third quarter revenue increased 4%

compared to the prior year period.

- Third quarter EPS on a GAAP basis was

$1.56 compared to guidance of $2.30 to $2.35. Results included a

$77 million noncash loss related to the deconsolidation of a

Mexican subsidiary, which was not previously included in guidance,

as regulatory approval was not received until the fourth

quarter.

- Third quarter EPS on a non-GAAP basis

was $2.60, which exceeded guidance of $2.35 to $2.40 and included a

$0.46 per share negative impact compared to the prior year period

related to foreign currency exchange rates.

- Full year 2016 EPS guidance on a GAAP

basis is projected to be in a range of $6.51 to $6.56, which

includes the $77 million noncash loss related to the

deconsolidation of a Mexican subsidiary. Previous guidance of $7.50

to $7.60 did not include such loss.

- Full year 2016 EPS guidance on a

non-GAAP basis was raised to a range of $6.70 to $6.75, which

includes a negative impact of approximately $1.65 per share related

to foreign currency exchange rates. Previous guidance was $6.55 to

$6.65, which included a $1.60 per share negative impact related to

foreign currency exchange rates.

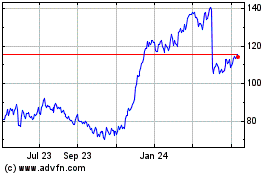

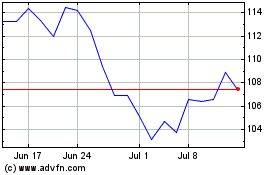

PVH Corp. (NYSE:PVH) reported 2016 third quarter results.

Non-GAAP Amounts:

Amounts stated to be on a non-GAAP basis exclude the items that

are described below under the heading “Non-GAAP Exclusions.”

Amounts stated on a constant currency basis are also deemed to be

on a non-GAAP basis. Reconciliations of amounts on a GAAP basis to

amounts on a non-GAAP basis are presented later in this release and

identify and quantify all excluded items.

CEO Comments:

Commenting on these results, Emanuel Chirico, Chairman and Chief

Executive Officer, noted, “We are very pleased with our strong

performance in the third quarter, which exceeded our guidance on a

non-GAAP basis despite the volatile macroeconomic environment. We

continue to over deliver against our 2016 plan, driven in large

part by strong momentum across our Calvin Klein and Tommy Hilfiger

International businesses. While our North America wholesale

businesses have performed well throughout the year, we have not

experienced any significant improvement in traffic and consumer

spending trends across our Tommy Hilfiger and Calvin Klein U.S.

outlet stores located in international tourist locations.”

Mr. Chirico continued, “Although we are increasing our non-GAAP

earnings guidance for the year, we continue to take a prudent

approach to planning the holiday season in light of the

macroeconomic and geopolitical volatility around the world, as well

as the strengthening dollar in the wake of the U.S. Presidential

election.”

Mr. Chirico concluded, “We believe that through the power of our

designer lifestyle brands, Calvin Klein and Tommy Hilfiger, we can

successfully navigate this uncertain environment. We expect our

proven business model and talented associates will continue to

drive the execution of our strategic initiatives in an

ever-changing environment while delivering stockholder value.”

Third Quarter Business Review:

Calvin Klein

Revenue in the Calvin Klein business for the quarter increased

9% to $891 million (increased 10% on a constant currency basis)

compared to the prior year period. Calvin Klein International

revenue increased 16% to $389 million (increased 17% on a constant

currency basis) compared to the prior year period, including a 7%

increase in comparable store sales. Europe and China continued to

demonstrate the strongest performance. Calvin Klein North America

revenue increased 5% to $502 million (increased 6% on a constant

currency basis) compared to the prior year period primarily driven

by continued healthy growth in the wholesale business. North

America retail revenue was flat compared to the prior year period,

as square footage expansion in Company-operated stores was offset

by a 5% comparable store sales decline driven by continued weakness

in traffic and consumer spending trends in Calvin Klein’s U.S.

stores located in international tourist locations.

Earnings before interest and taxes on a GAAP basis for the

quarter decreased to $69 million, compared to $142 million in the

prior year period. The decrease was principally due to the noncash

loss of $77 million recorded in the third quarter of 2016 in

anticipation of the deconsolidation of the Company’s subsidiary

that principally operated and managed its Calvin Klein business in

Mexico, which is expected to occur at 11:59 p.m. EST on November

30, 2016 in connection with the closing of the joint venture

transaction in Mexico (the “Mexico deconsolidation”). Partially

offsetting this decrease was the absence of $7 million of costs

incurred in the prior year period in connection with the Company’s

integration of Warnaco and the related restructuring. Earnings

before interest and taxes on a non-GAAP basis discussed below

excludes these amounts.

Earnings before interest and taxes on a non-GAAP basis for the

quarter decreased to $146 million, inclusive of a $16 million

negative impact due to foreign currency exchange rates, compared to

$148 million in the prior year period. Earnings on a non-GAAP basis

increased excluding the negative impact of foreign currency

exchange rates, despite a $10 million planned increase in expenses

related to marketing and investments associated with the recent

Calvin Klein creative team leadership change. The increase was

driven by the revenue increase noted above, as well as gross margin

improvement, particularly in Europe and in the North America

wholesale business.

Tommy Hilfiger

Revenue in the Tommy Hilfiger business for the quarter increased

4% to $927 million (increased 6% on a constant currency basis)

compared to the prior year period. Tommy Hilfiger International

revenue increased 16% to $525 million (increased 18% on a constant

currency basis) compared to the prior year period. This increase

was driven by continued strong growth in Europe, including a 10%

increase in comparable store sales, and the Company’s April 2016

acquisition of the 55% interest in its joint venture for Tommy

Hilfiger in China (“TH China”) that it did not already own (the “TH

China acquisition”). Tommy Hilfiger North America revenue decreased

7% to $402 million (also decreased 7% on a constant currency basis)

compared to the prior year period. The North America revenue

decrease was principally due to an 11% comparable store sales

decline, driven by continued weakness in traffic and consumer

spending trends in Tommy Hilfiger’s U.S. stores located in

international tourist locations, and the winding down of the

Company’s directly operated womenswear wholesale business in the

U.S. and Canada in connection with licensing this business to G-III

Apparel Group, Ltd. (the “G-III license”).

Earnings before interest and taxes on a GAAP basis for the

quarter decreased to $116 million compared to $126 million in the

prior year period. Included in earnings for the current year period

were (i) costs of $19 million incurred in connection with the TH

China acquisition, primarily consisting of noncash amortization of

short-lived assets, and the G-III license and (ii) a gain of $18

million recorded in connection with a payment made to the Company

to exit a retail flagship store in Europe. Earnings before interest

and taxes on a non-GAAP basis discussed below excludes these

amounts.

Earnings before interest and taxes on a non-GAAP basis for the

quarter decreased to $117 million, inclusive of a $24 million

negative impact due to foreign currency exchange rates, compared to

$126 million on a GAAP basis in the prior year period (there were

no non-GAAP exclusions in the prior year period). Excluding the

negative impact of foreign currency exchange rates, earnings on a

non-GAAP basis increased due to the Tommy Hilfiger International

revenue increase noted above and gross margin improvement in

Europe, partially offset by the Tommy Hilfiger North America

revenue decline noted above.

Heritage Brands

Revenue in the Heritage Brands business for the quarter

decreased 8% to $426 million compared to the prior year period,

principally resulting from the rationalization initiatives

implemented in 2015 that continued to impact the business in 2016,

consisting of the exit from the Izod retail business and the

discontinuation of several licensed product lines in the dress

furnishings business. Partially offsetting these decreases was a 6%

increase in comparable store sales in the Van Heusen business.

Earnings before interest and taxes on a GAAP basis for the

quarter increased to $44 million compared to $26 million in the

prior year period principally due to the absence of $17 million of

costs incurred in the prior year period in connection with (i) the

Warnaco integration and restructuring, (ii) the operation of and

exit from the Izod retail business and (iii) the discontinuation of

several licensed product lines in the dress furnishings business.

These costs were excluded from earnings before interest and taxes

on a non-GAAP basis in the prior year period. Current quarter

earnings before interest and taxes on a GAAP basis of $44 million

(there were no non-GAAP exclusions in the current year period)

increased slightly compared to $43 million on a non-GAAP basis in

the prior year period, as gross margin improvement in the ongoing

businesses more than offset the overall revenue decline noted

above.

Third Quarter Consolidated Earnings:

Earnings before interest and taxes on a GAAP basis for the

quarter decreased to $198 million compared to the prior year period

of $254 million, principally driven by an increase of $43 million

of net costs, consisting of (i) the noncash loss recorded in

anticipation of the Mexico deconsolidation, (ii) the gain recorded

in connection with a payment made to the Company to exit a Tommy

Hilfiger retail flagship store in Europe, (iii) the costs incurred

in connection with the TH China acquisition, primarily consisting

of noncash amortization of short-lived assets, (iv) the costs

incurred in connection with the G-III license and (v) the reduction

in costs incurred in connection with the Warnaco integration and

restructuring and the Heritage Brands rationalization initiatives

compared to the prior year period. Earnings before interest and

taxes on a non-GAAP basis discussed below excludes the net cost

increase.

Earnings before interest and taxes on a non-GAAP basis for the

quarter was $276 million, inclusive of a $41 million negative

impact due to foreign currency exchange rates, compared to $288

million in the prior year period.

The effective tax rate on a GAAP basis for the quarter increased

to 25.3% compared to 1.9% in the prior year period. The increase

was principally attributable to a reduction in discrete tax

benefits recognized in the current year period as compared to the

prior year period, as well as an unfavorable impact in the current

year period due to the tax expense recorded on the assets held for

sale in anticipation of the Mexico deconsolidation. Excluding these

items, the effective tax rate on a non-GAAP basis for the quarter

decreased to 14.9% compared to 15.3% in the prior year period,

principally attributable to a favorable shift in the mix of

earnings between tax jurisdictions.

Net interest expense increased to $29 million from $27 million

in the prior year period primarily due to the negative impacts of

the interest rate swap that commenced in February 2016 to convert a

portion of the Company’s variable rate debt under its term loans to

fixed rate debt and the issuance of €350 million of senior notes in

June 2016, partially offset by the positive impacts from debt

repayments made during 2015 and 2016 and the amendment of the

Company’s credit facility in the second quarter of 2016.

Inventory levels decreased 6% compared to the prior year’s third

quarter. Included in inventory was an increase related to the TH

China acquisition, which was offset by a decrease resulting from

the reclassification of the Company’s Mexico subsidiary’s assets as

held for sale in anticipation of the Mexico deconsolidation.

Nine Months Consolidated Results:

Earnings per share was $5.52 on a GAAP basis for the first nine

months of 2016 compared to $5.26 in the prior year period. Earnings

per share was $5.57 on a non-GAAP basis for the first nine months

of 2016 compared to $5.53 in the prior year period. Earnings per

share on both a GAAP and non-GAAP basis for the first nine months

of 2016 included a $1.42 negative impact related to foreign

currency exchange rates.

Revenue for the first nine months of 2016 increased 3% to $6.10

billion (increased 4% on a constant currency basis) compared to the

prior year period.

The revenue change was due to:

- An 11% increase (13% increase on a

constant currency basis) in the Calvin Klein business compared to

the prior year period, driven by significant growth in Europe,

China and the North America wholesale business. International

retail comparable store sales increased 7%. North America retail

comparable store sales decreased 4%, driven by the continued

weakness in traffic and consumer spending trends in Calvin Klein’s

U.S. stores located in international tourist locations.

- A 5% increase (6% increase on a

constant currency basis) in the Tommy Hilfiger business compared to

the prior year period, driven principally by strong growth across

Europe, including a 9% increase in comparable store sales, and the

TH China acquisition, which was completed in April 2016. In the

Tommy Hilfiger North America business, wholesale growth was more

than offset by a 9% decline in comparable store sales compared to

the prior year period, driven by continued weakness in traffic and

consumer spending trends in Tommy Hilfiger’s U.S. stores located in

international tourist locations.

- An 11% decrease in the Heritage Brands

business compared to the prior year period, driven principally by

the rationalization initiatives in the business, partially offset

by a 9% increase in comparable store sales in the Van Heusen

business.

Earnings before interest and taxes on a GAAP basis for the first

nine months of 2016 increased to $635 million compared to the prior

year period of $585 million due in large part to a net gain of $64

million, consisting of (i) the noncash gain of $153 million

recorded in 2016 to write-up the Company’s equity investment in TH

China to fair value in connection with the TH China acquisition,

(ii) the gain of $18 million recorded in 2016 in connection with a

payment made to the Company to exit a Tommy Hilfiger retail

flagship store in Europe, (iii) a $64 million reduction in costs

incurred in connection with the Warnaco integration and

restructuring and the Heritage Brands rationalization initiatives

compared to the prior year period, (iv) the noncash loss of $77

million recorded in the third quarter of 2016 in anticipation of

the Mexico deconsolidation, (v) $68 million of costs incurred in

2016 in connection with the TH China acquisition, primarily

consisting of noncash valuation adjustments and amortization of

short-lived assets, (vi) $16 million of costs incurred in

connection with the amendment of the Company’s credit facility and

(vii) $10 million of costs incurred in connection with the G-III

license and the restructuring associated with the new global

creative strategy for Calvin Klein. Earnings before interest and

taxes on a non-GAAP basis discussed below excludes these

amounts.

Earnings before interest and taxes on a non-GAAP basis for the

first nine months of 2016 was $647 million, inclusive of a $124

million negative impact due to foreign currency exchange rates,

compared to $659 million in the prior year period. Excluding the

negative impact of foreign currency exchange rates, the strong

growth on a non-GAAP basis was primarily driven by earnings

increases in the Calvin Klein business and in the Tommy Hilfiger

International business. Partially offsetting these increases were

earnings declines in Tommy Hilfiger North America, principally due

to continued weak performance in Tommy Hilfiger’s U.S. stores

located in international tourist locations, and in the Heritage

Brands business due to the overall revenue decline and a

deleveraging of expenses resulting from the rationalization

initiatives in the business.

Stock Repurchase Program:

During the first nine months of 2016, the Company repurchased

approximately 2.3 million shares of its common stock for $226

million (approximately 3.6 million shares for $352 million since

inception) under the $500 million three-year stock repurchase

program authorized by the Board of Directors in June 2015. Stock

repurchases under this program may be made from time to time over

the period through open market purchases, accelerated share

repurchase programs, privately negotiated transactions or other

methods, as the Company deems appropriate. Purchases are made based

on a variety of factors, such as price, corporate requirements and

overall market conditions, applicable legal requirements and

limitations, restrictions under the Company’s debt arrangements,

trading restrictions under the Company’s insider trading policy and

other relevant factors. The stock repurchase program may be

modified, including to increase or decrease the repurchase

limitation or extend, suspend, or terminate the program, at any

time, without prior notice.

2016 Guidance:

The Company currently expects its full year 2016 earnings per

share results will be negatively impacted compared to 2015 by

approximately $1.65 per share attributable to foreign currency

exchange rates due to the stronger U.S. dollar against other

currencies in which the Company transacts significant levels of

business. Approximately 80% of the negative impact is expected to

be on a transactional basis and approximately 20% is expected to be

due to currency translation. The negative impact on a transactional

basis is primarily due to our international businesses purchasing

inventory in U.S. dollars, as the increased local currency value of

inventory results in higher cost of goods in local currency when

the goods are sold. The negative translation impact is related to

the earnings generated in foreign markets, which will translate

into fewer U.S. dollars.

Please see the section entitled “Full Year and Quarterly

Reconciliations of GAAP to Non-GAAP Amounts” at the end of this

release for further detail and reconciliations of GAAP to non-GAAP

amounts discussed in this section.

Full Year Guidance

The Company currently projects that 2016 earnings per share on a

GAAP basis will be in a range of $6.51 to $6.56 compared to $6.89

in the prior year. The Company currently projects that 2016

earnings per share on a non-GAAP basis will be in a range of $6.70

to $6.75 compared to $7.05 in the prior year. Both projections

include approximately $1.65 per share negative impact related to

foreign currency exchange rates, as described above.

Revenue in 2016 is currently projected to increase approximately

2% (increase approximately 3% on a constant currency basis) as

compared to 2015. It is currently projected that revenue for the

Calvin Klein business will increase approximately 6% (increase

approximately 8% on a constant currency basis). Revenue for the

Tommy Hilfiger business is currently projected to increase

approximately 4% (increase approximately 5% on a constant currency

basis). Revenue for the Heritage Brands business is currently

projected to decrease approximately 9% principally due to the

rationalization initiatives implemented in 2015 that continued to

impact the business in 2016, consisting of the exit from the Izod

retail business and the discontinuation of several licensed product

lines in the dress furnishings business.

Net interest expense in 2016 is expected to be approximately

$117 million compared to $113 million in 2015 primarily due to the

negative impacts of the interest rate swap that commenced in

February 2016 to convert a portion of the Company’s variable rate

debt under its term loans to fixed rate debt and the issuance of

€350 million of senior notes in June 2016, partially offset by the

positive impacts from debt repayments made during 2015 and expected

to be made in 2016 and the amendment of the Company’s credit

facility in the second quarter of 2016. The Company currently

estimates that the 2016 effective tax rate will be in a range of

18% to 18.5% on a GAAP basis and 19% to 19.5% on a non-GAAP

basis.

The Company’s 2016 earnings per share estimate on a non-GAAP

basis excludes $27 million of expected pre-tax net costs,

consisting of (i) the $77 million noncash loss recorded in the

third quarter of 2016 in anticipation of the Mexico

deconsolidation, (ii) $22 million of costs incurred in connection

with the Warnaco integration and restructuring, the discontinuation

of several licensed product lines in the Heritage Brands dress

furnishings business, the G-III license and the restructuring

associated with the new global creative strategy for Calvin Klein,

(iii) $16 million of costs incurred in connection with the

amendment of the Company’s credit facility in the second quarter of

2016, (iv) the $70 million net gain related to TH China, including

the noncash gain recorded to write-up the Company’s equity

investment in TH China to fair value, partially offset by

acquisition costs expected to be incurred, and (v) the $18 million

gain recorded in connection with a payment made to the Company

during the third quarter of 2016 to exit a Tommy Hilfiger retail

flagship store in Europe. Also excluded from the Company’s estimate

of 2016 earnings per share on a non-GAAP basis are discrete tax

benefits of $14 million recorded related to the resolution of

uncertain tax positions, tax expense of $16 million recorded in the

third quarter of 2016 on the assets held for sale in anticipation

of the Mexico deconsolidation and the estimated tax effects of the

above pre-tax items.

Fourth Quarter Guidance

The Company currently expects its fourth quarter 2016 earnings

per share results will be negatively impacted compared to the

fourth quarter of 2015 by $0.23 per share related to foreign

currency exchange rates due to the stronger U.S. dollar against

other currencies in which the Company transacts significant levels

of business.

The Company currently expects that the fourth quarter of 2016

will include an expense increase of $25 million over the prior year

period related to marketing and investments associated with the

recent Calvin Klein creative team leadership change, including a

shift of $5 million of expenses into the fourth quarter that were

previously planned in the third quarter. Previous guidance included

a $20 million planned increase in the fourth quarter over the prior

year period.

Fourth quarter 2016 earnings per share on a GAAP basis is

currently projected to be in a range of $0.99 to $1.04 compared to

$1.63 in the prior year period. The Company currently projects that

fourth quarter 2016 earnings per share on a non-GAAP basis will be

in a range of $1.13 to $1.18 compared to $1.52 in the prior year

period. Both projections include a $0.23 per share negative impact

related to foreign currency exchange rates, as described above.

Revenue in the fourth quarter of 2016 is currently projected to

decrease approximately 1% (increase approximately 1% on a constant

currency basis) compared to the prior year period. Negatively

impacting revenue in the current year’s fourth quarter as compared

to the prior year period is a 2% revenue reduction resulting from

the Mexico deconsolidation and the G-III license. Revenue for the

Calvin Klein business in the fourth quarter is currently projected

to decrease approximately 5% (decrease approximately 3% on a

constant currency basis), which includes a revenue reduction

resulting from the Mexico deconsolidation. Revenue for the Tommy

Hilfiger business in the fourth quarter is currently projected to

increase approximately 3% (increase approximately 5% on a constant

currency basis), which includes a revenue reduction resulting from

the G-III license. Revenue for the Heritage Brands business in the

fourth quarter is currently projected to decrease approximately

3%.

The Company currently projects that fourth quarter 2016 net

interest expense will be $31 million compared to $28 million in the

prior year period, primarily due to the negative impacts of the

interest rate swap noted above and the issuance of €350 million of

senior notes in June 2016, partially offset by the positive impacts

of debt repayments made during 2015 and expected to be made in 2016

and the amendment of the Company’s credit facility in the second

quarter of 2016. The Company currently estimates that the fourth

quarter effective tax rate will be in a range of 14% to 17% on a

GAAP basis and 17% to 20% on a non-GAAP basis.

The Company’s fourth quarter earnings per share estimate on a

non-GAAP basis excludes $16 million of pre-tax costs expected to be

incurred in connection with the TH China acquisition, primarily

consisting of noncash amortization of short-lived assets, and the

estimated tax effects of these pre-tax costs.

Non-GAAP Exclusions:

The discussions in this release that refer to non-GAAP amounts

exclude the following:

- Pre-tax costs of approximately $10

million incurred in 2016 in connection with the integration of

Warnaco and the related restructuring, of which $7 million was

incurred in the first quarter and $2 million was incurred in the

second quarter.

- Pre-tax costs of $3 million incurred in

the first quarter of 2016 related to the discontinuation of several

licensed product lines in the Heritage Brands dress furnishings

business.

- Pre-tax costs of $4 million incurred in

2016 in connection with the G-III license, of which $1 million was

incurred in each of the first and second quarters and $2 million

was incurred in the third quarter.

- Pre-tax costs of $6 million incurred in

the first quarter of 2016 in connection with the restructuring

associated with the new global creative strategy for Calvin

Klein.

- Pre-tax noncash gain of $153 million

recorded in the first quarter of 2016 to write-up the Company’s

equity investment in TH China to fair value in connection with the

TH China acquisition, which was completed in the first quarter of

2016. Partially offsetting the pre-tax gain are transaction-related

pre-tax costs of $83 million expected to be incurred in 2016,

primarily consisting of noncash charges related to valuation

adjustments and amortization of short-lived assets. Of these

pre-tax costs, $30 million was incurred in the first quarter, $20

million was incurred in the second quarter, $17 million was

incurred in the third quarter and $16 million is expected to be

incurred in the fourth quarter.

- Pre-tax noncash loss of $77 million

recorded in the third quarter of 2016 in anticipation of the Mexico

deconsolidation. The loss will be remeasured in connection with the

closing of the transaction in the fourth quarter and will be

impacted by many factors subsequent to October 30, 2016, such as,

but not limited to, fluctuations in the Mexican peso exchange rate

and changes to the Mexico subsidiary’s balance sheet, revenues and

income.

- Pre-tax costs of $16 million incurred

in the second quarter of 2016 in connection with the amendment of

the Company’s credit facility.

- Pre-tax gain of $18 million recorded in

the third quarter of 2016 in connection with a payment made to the

Company to exit a Tommy Hilfiger retail flagship store in

Europe.

- Discrete tax benefits of $14 million

recorded in 2016 related to the resolution of uncertain tax

positions, of which $6 million was recorded in the first quarter

and $8 million was recorded in the third quarter.

- A tax expense of $16 million recorded

in the third quarter of 2016 on the assets held for sale in

anticipation of the Mexico deconsolidation.

- Pre-tax costs of $73 million incurred

in 2015 in connection with the integration of Warnaco and the

related restructuring, of which $19 million was incurred in the

first quarter, $13 million was incurred in the second quarter, $19

million was incurred in the third quarter and $23 million was

incurred in the fourth quarter.

- Pre-tax costs of $17 million incurred

in 2015 principally related to the discontinuation of several

licensed product lines in the Heritage Brands dress furnishings

business, of which $3 million was incurred in the second quarter,

$13 million was incurred in the third quarter and less than $1

million was incurred in the fourth quarter.

- Pre-tax costs of $10 million incurred

in 2015 related to the operation of and exit from the Izod retail

business, of which $1 million was incurred in the first quarter, $6

million was incurred in the second quarter, $3 million was incurred

in the third quarter and $1 million was incurred in the fourth

quarter.

- Pre-tax costs of $3 million incurred in

the fourth quarter of 2015 in connection with the G-III

license.

- A pre-tax gain of $2 million recorded

in the second quarter of 2015 on the Company’s equity investment in

the parent company of the Karl Lagerfeld brand.

- A pre-tax gain of $20 million recorded

in the fourth quarter of 2015 related to recognized actuarial gains

on retirement plans.

- Discrete tax benefits of $35 million

recorded in 2015 primarily related to the resolution of uncertain

tax positions and the impact of tax law and tax rate changes on

deferred taxes, of which $2 million was recorded in the first

quarter, $1 million was recorded in the second quarter, $19 million

was recorded in the third quarter and $13 million was recorded in

the fourth quarter.

- Estimated tax effects associated with

the above pre-tax items, which are based on the Company’s

assessment of deductibility. In making this assessment, the Company

evaluated each item that it had identified above as a non-GAAP

exclusion to determine if such item is taxable or tax deductible,

and if so, in what jurisdiction the tax expense or tax deduction

would occur. All items above were identified as either primarily

taxable or tax deductible, with the tax effect taken at the

statutory income tax rate of the local jurisdiction, or as

non-taxable or non-deductible, in which case the Company assumed no

tax effect.

As a supplement to the Company’s reported operating results, the

Company presents constant currency financial information, which is

a non-GAAP financial measure. The Company presents results in this

manner because it is a global company that reports financial

information in U.S. dollars in accordance with GAAP. Foreign

currency exchange rate fluctuations affect the amounts reported by

the Company in U.S. dollars with respect to its foreign revenues

and profit. Additionally, the Company’s international businesses

often purchase inventory in U.S. dollars and, as the U.S. dollar

strengthens, the increased local currency value of inventory

results in higher cost of goods in local currency when the goods

are sold. Exchange rate fluctuations can have a significant effect

on reported operating results. The Company believes presenting

constant currency information provides useful information to

investors, as it provides information to assess how its businesses

performed excluding the effects of changes in foreign currency

exchange rates and assists investors in evaluating the

effectiveness of the Company’s operations and underlying business

trends in a manner that is consistent with management’s evaluation

of business performance.

The Company calculates constant currency financial information

by translating its foreign revenues and profit for the current year

period into U.S. dollars at the average exchange rates in effect

during the comparable prior year period (rather than at the actual

exchange rates in effect during the current year period).

Additionally, for international businesses that purchase inventory

in U.S. dollars, the Company calculates cost of goods sold for the

current period on a constant currency basis assuming such inventory

was purchased at the average exchange rates in effect during the

comparable prior year period.

Constant currency performance should be viewed in addition to,

and not in lieu of or as superior to, the Company’s operating

performance calculated in accordance with GAAP. The constant

currency information presented may not be comparable to similarly

described measures reported by other companies.

Please see Tables 1 through 9 and the sections entitled

“Reconciliations of 2016 Constant Currency Amounts” and “Full Year

and Quarterly Reconciliations of GAAP to Non-GAAP Amounts” later in

this release for reconciliations of GAAP to non-GAAP amounts.

The Company webcasts its conference calls to review its earnings

releases. The Company’s conference call to review its third

quarter earnings release is scheduled for Thursday, December 1,

2016 at 9:00 a.m. EST. Please log on to the Company’s web site

at www.pvh.com and go to the Events page included in the

Investors section to listen to the live webcast of the conference

call. The webcast will be available for replay for one year after

it is held, commencing approximately two hours after the live

broadcast ends. Please log on to www.pvh.com as described above to

listen to the replay. In addition, an audio replay of the

conference call is available for 48 hours starting approximately

two hours after it is held. The replay of the conference call can

be accessed by calling (domestic) 888-203-1112 and (international)

719-457-0820 and using passcode 8980277. The conference call and

webcast consist of copyrighted material. They may not be

re-recorded, reproduced, re-transmitted, rebroadcast or otherwise

used without the Company’s express written permission. Your

participation represents your consent to these terms and

conditions, which are governed by New York law.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995: Forward-looking statements in this press

release and made during the conference call/webcast, including,

without limitation, statements relating to the Company’s future

revenue and earnings, plans, strategies, objectives, expectations

and intentions are made pursuant to the safe harbor provisions of

the Private Securities Litigation Reform Act of 1995. Investors are

cautioned that such forward-looking statements are inherently

subject to risks and uncertainties, many of which cannot be

predicted with accuracy, and some of which might not be

anticipated, including, without limitation, (i) the Company’s

plans, strategies, objectives, expectations and intentions are

subject to change at any time at the discretion of the Company;

(ii) the Company may be considered to be highly leveraged and uses

a significant portion of its cash flows to service its

indebtedness, as a result of which the Company might not have

sufficient funds to operate its businesses in the manner it intends

or has operated in the past; (iii) the levels of sales of the

Company’s apparel, footwear and related products, both to its

wholesale customers and in its retail stores, the levels of sales

of the Company’s licensees at wholesale and retail, and the extent

of discounts and promotional pricing in which the Company and its

licensees and other business partners are required to engage, all

of which can be affected by weather conditions, changes in the

economy, fuel prices, reductions in travel, fashion trends,

consolidations, repositionings and bankruptcies in the retail

industries, repositionings of brands by the Company’s licensors and

other factors; (iv) the Company’s plans and results of

operations will be affected by the Company’s ability to manage its

growth and inventory, including the Company’s ability to realize

benefits from acquisitions; (v) the Company’s operations and

results could be affected by quota restrictions and the imposition

of safeguard controls (which, among other things, could limit the

Company’s ability to produce products in cost-effective countries

that have the labor and technical expertise needed), the

availability and cost of raw materials, the Company’s ability to

adjust timely to changes in trade regulations and the migration and

development of manufacturers (which can affect where the Company’s

products can best be produced), changes in available factory and

shipping capacity, wage and shipping cost escalation, civil

conflict, war or terrorist acts, the threat of any of the

foregoing, or political and labor instability in any of the

countries where the Company’s or its licensees’ or other business

partners’ products are sold, produced or are planned to be sold or

produced; (vi) disease epidemics and health related concerns,

which could result in closed factories, reduced workforces,

scarcity of raw materials and scrutiny or embargoing of goods

produced in infected areas, as well as reduced consumer traffic and

purchasing, as consumers become ill or limit or cease shopping in

order to avoid exposure; (vii) acquisitions and divestitures

and issues arising with acquisitions, divestitures and proposed

transactions, including, without limitation, the ability to

integrate an acquired entity or business into the Company with no

substantial adverse effect on the acquired entity’s, the acquired

business’s or the Company’s existing operations, employee

relationships, vendor relationships, customer relationships or

financial performance, and the disposal of the net assets of a

divested entity; (viii) the failure of the Company’s licensees

to market successfully licensed products or to preserve the value

of the Company’s brands, or their misuse of the Company’s brands;

(ix) the Company’s results could be adversely affected by the

strengthening of the U.S. dollar against foreign currencies in

which we transact significant levels of business; (x) the Company’s

retirement plan expenses recorded throughout the year are

calculated using actuarial valuations that incorporate assumptions

and estimates about financial market, economic and demographic

conditions, and differences between estimated and actual results

give rise to gains and losses that are recorded immediately in

earnings, generally in the fourth quarter of the year; and

(xi) other risks and uncertainties indicated from time to time

in the Company’s filings with the Securities and Exchange

Commission (“SEC”).

This press release includes, and the conference call/webcast

will include, certain non-GAAP financial measures, as defined under

SEC rules. Reconciliations of these measures are included in the

financial information later in this release, as well as in the

Company’s Current Report on Form 8-K furnished to the SEC in

connection with this earnings release, which is available on the

Company’s website at www.pvh.com and on the SEC’s website at

www.sec.gov.

The Company does not undertake any obligation to update publicly

any forward-looking statement, including, without limitation, any

estimate regarding revenue or earnings, whether as a result of the

receipt of new information, future events or otherwise.

PVH

CORP. Consolidated GAAP Income Statements (In

millions, except per share data)

Quarter Ended Nine Months Ended

10/30/16

11/1/15

10/30/16

11/1/15

Net sales $ 2,123.4 $ 2,040.9 $ 5,786.5 $ 5,591.9 Royalty

revenue 93.9 97.4 240.9 247.0 Advertising and other revenue 27.0

26.2 68.0 68.9 Total revenue $ 2,244.3

$ 2,164.5 $ 6,095.4 $ 5,907.8 Gross profit on

net sales $ 1,070.7 $ 977.4 $ 2,923.4 $ 2,772.8 Gross profit on

royalty, advertising and other revenue 120.9 123.6

308.9 315.9 Total gross profit 1,191.6 1,101.0 3,232.3

3,088.7 Selling, general and administrative expenses 918.0

853.8 2,657.9 2,519.2 Debt modification and extinguishment

costs 15.8 Other noncash (loss) gain, net (76.9 ) 76.2

Equity in net income of unconsolidated affiliates 1.2

6.4 0.7 15.0 Earnings before interest and

taxes 197.9 253.6 635.5 584.5 Interest expense, net 29.2

27.4 86.3 85.2 Pre-tax income 168.7

226.2 549.2 499.3 Income tax expense 42.6 4.3

101.0 61.1 Net income 126.1 221.9 448.2 438.2

Less: Net loss attributable to redeemable non-controlling interest

(1) (0.1 ) (0.1 ) Net income attributable to

PVH Corp. $ 126.2 $ 221.9 $ 448.3 $ 438.2

Diluted net income

per common share attributable to PVH Corp. (2) $ 1.56

$ 2.67 $ 5.52 $ 5.26

Quarter

Ended Nine Months Ended

10/30/16

11/1/15

10/30/16

11/1/15

Depreciation and amortization expense $ 84.4 $ 63.0 $ 237.6

$ 187.0

Please see following pages for information related to non-GAAP

measures discussed in this release.

(1) On June 29, 2016, the Company and Arvind Limited formed

a joint venture in Ethiopia, PVH Arvind Manufacturing Private

Limited Company, in which the Company owns a 75% interest.

(2) Please see Note A in the Notes to Consolidated GAAP Income

Statements for reconciliations of GAAP diluted net income per

common share to diluted net income per common share on a non-GAAP

basis.

PVH CORP. Non-GAAP Measures (In millions,

except per share data)

The Company believes presenting its results for the periods

ended October 30, 2016 and November 1, 2015 excluding (i) the costs

incurred in the first and second quarters of 2016 and the first,

second and third quarters of 2015 in connection with its

integration of The Warnaco Group, Inc. (“Warnaco”) and the related

restructuring; (ii) the costs incurred in the first quarter of 2016

and the second and third quarters of 2015 in connection with the

discontinuation of several licensed product lines in its Heritage

Brands dress furnishings business; (iii) the costs incurred in the

first, second and third quarters of 2016 in connection with the

licensing to G-III Apparel Group, Ltd. (“G-III”) of the Tommy

Hilfiger womenswear wholesale business in the U.S. and Canada (the

“G-III license”), which will result in the discontinuation of the

Company’s directly operated Tommy Hilfiger North America womenswear

wholesale business in the fourth quarter of 2016; (iv) the costs

incurred in the first quarter of 2016 in connection with the

restructuring associated with the new global creative strategy for

Calvin Klein; (v) the noncash gain recorded in the first quarter of

2016 to write-up its equity investment in TH Asia, Ltd. (“TH

China”), its joint venture for Tommy Hilfiger in China, to fair

value in connection with the acquisition of the 55% interest that

it did not already own (the “TH China acquisition”); (vi) the

one-time costs recorded in the first quarter of 2016 on its equity

investment in TH China prior to the TH China acquisition closing;

(vii) the costs incurred in the first, second and third quarters of

2016 in connection with the TH China acquisition, primarily

consisting of noncash charges related to valuation adjustments and

amortization of short-lived assets; (viii) the costs incurred in

the second quarter of 2016 related to the amendment of its credit

facility; (ix) the noncash loss recorded in the third quarter of

2016 in anticipation of the deconsolidation of the Company’s

subsidiary that principally operated and managed its Calvin Klein

business in Mexico, which is expected to occur at 11:59 p.m. EST on

November 30, 2016 in connection with the closing of the joint

venture transaction in Mexico (the “Mexico deconsolidation”); (x)

the gain recorded in the third quarter of 2016 in connection with a

payment made to the Company to exit a Tommy Hilfiger retail

flagship store in Europe; (xi) the costs incurred in the first,

second and third quarters of 2015 in connection with the operation

of and exit from its Izod retail business; (xii) the gain recorded

in the second quarter of 2015 on its equity investment in the

parent company of the Karl Lagerfeld brand (“Karl Lagerfeld”);

(xiii) the tax effects associated with the foregoing pre-tax items;

(xiv) the tax benefits recorded in the first and third quarters of

2016 and the first, second and third quarters of 2015 associated

with discrete items related to the resolution of uncertain tax

positions; and (xv) the tax expense recorded in the third quarter

of 2016 on the assets held for sale in anticipation of the Mexico

deconsolidation, which are on a non-GAAP basis, provides useful

information to investors. The Company excludes such amounts that it

deems non-recurring or non-operational and believes that this (i)

facilitates comparing current results against past and future

results by eliminating amounts that it believes are not comparable

between periods, thereby permitting management to evaluate

performance and investors to make decisions based on the ongoing

operations of the Company and (ii) assists investors in evaluating

the effectiveness of the Company’s operations and underlying

business trends in a manner that is consistent with management’s

evaluation of business performance. The Company believes that

investors often look at ongoing operations of an enterprise as a

measure of assessing performance. The Company uses its results

excluding these amounts to evaluate its operating performance and

to discuss its business with investment institutions, the Company’s

Board of Directors and others. The Company’s results excluding

certain of the items described above are also the basis for certain

incentive compensation calculations. The non-GAAP measures should

be viewed in addition to, and not in lieu of or superior to, the

Company’s operating performance measures calculated in accordance

with GAAP. The non-GAAP information presented may not be comparable

to similarly titled measures reported by other companies.

The following table presents the non-GAAP measures that are

discussed in this release. Please see Tables 1 through 9 for

reconciliations of the GAAP amounts to amounts on a non-GAAP

basis.

Quarter

Ended Nine Months Ended

10/30/16

11/1/15

10/30/16

11/1/15

Non-GAAP Measures Total gross profit(1) $ 1,193.4 $

1,106.8 $ 3,239.6 $ 3,069.2 Selling, general and administrative

expenses(2) 919.0 824.8 2,599.4 2,423.4 Debt modification and

extinguishment costs (3) — Other noncash (loss) gain, net (4) — —

Equity in net income of unconsolidated affiliates(5) 6.6 12.8

Earnings before interest and taxes(6) 275.6 288.4 646.8 658.6

Income tax expense(7) 36.7 39.9 108.2 112.9 Net income attributable

to PVH Corp.(8) 209.8 221.1 452.4 460.5 Diluted net income per

common share attributable to PVH Corp.(9) $ 2.60 $ 2.66 $ 5.57 $

5.53 Depreciation and amortization expense(10) $ 68.9

$ 61.4 $ 201.2 $ 182.2

PVH CORP. Non-GAAP Measures (continued) (In

millions, except per share data)

(1)

Please see Table 3 for reconciliations of

GAAP gross profit to gross profit on a non-GAAP basis.

(2)

Please see Table 4 for reconciliations of

GAAP selling, general and administrative expenses (“SG&A”) to

SG&A on a non-GAAP basis.

(3)

Please see Table 5 for reconciliation of

GAAP debt modification and extinguishment costs to debt

modification and extinguishment costs on a non-GAAP basis.

(4)

Please see Table 6 for reconciliations of

GAAP other noncash (loss) gain, net to other noncash (loss) gain,

net on a non-GAAP basis.

(5)

Please see Table 7 for reconciliations of

GAAP equity in net income of unconsolidated affiliates to equity in

net income of unconsolidated affiliates on a non-GAAP basis.

(6)

Please see Table 2 for reconciliations of

GAAP earnings before interest and taxes to earnings before interest

and taxes on a non-GAAP basis.

(7)

Please see Table 8 for reconciliations of

GAAP income tax expense to income tax expense on a non-GAAP basis

and an explanation of the calculation of the tax effects associated

with the pre-tax items identified as non-GAAP exclusions.

(8)

Please see Table 1 for reconciliations of

GAAP net income to net income on a non-GAAP basis.

(9)

Please see Note A in the Notes to

Consolidated GAAP Income Statements for reconciliations of GAAP

diluted net income per common share to diluted net income per

common share on a non-GAAP basis.

(10)

Please see Table 9 for reconciliations of

GAAP depreciation and amortization expense to depreciation and

amortization expense on a non-GAAP basis.

PVH CORP.

Reconciliations of GAAP to Non-GAAP Amounts (In millions,

except per share data)

Table 1 -

Reconciliations of GAAP net income to net income on a non-GAAP

basis

Quarter Ended Nine

Months Ended

10/30/16

11/1/15

10/30/16

11/1/15

Net income attributable to PVH Corp. $ 126.2 $ 221.9 $ 448.3

$ 438.2 Diluted net income per common share attributable to

PVH Corp.(1) $ 1.56 $ 2.67 $ 5.52 $ 5.26 Pre-tax items

excluded:

Gross profit charges associated with the

TH China acquisition (short-livednoncash inventory valuation

adjustments)

1.8 7.3 Gross profit associated with the operation of and

exit from the Izod retail business (3.0 ) (28.3 )

Gross profit charges principally

associated with the discontinuation ofseveral licensed product

lines in the Heritage Brands dress furnishings business

8.8 8.8 SG&A expenses associated with the integration of

Warnaco and related restructuring 18.9 9.8 50.8 SG&A

expenses associated with the operation of and exit from the Izod

retail business 5.8 37.4

SG&A expenses associated with the

discontinuation of several licensedproduct lines in the Heritage

Brands dress furnishings business

4.3 2.6 7.6 SG&A expenses associated with the G-III

license 1.6 4.2

SG&A expenses associated with the new

global creative strategy for Calvin Klein and related

restructuring

5.5

SG&A expenses associated with the TH

China acquisition (primarilyconsisting of amortization of

short-lived assets)

15.5 54.5

Gain recorded in connection with a payment

made to the Company to exit aTommy Hilfiger retail flagship store

in Europe (recorded in SG&A)

(18.1 ) (18.1 )

Gain to write-up the Company’s equity

investment in TH China to fair value(recorded in other noncash

(loss) gain, net)

(153.1 )

Loss recorded in anticipation of the

Mexico deconsolidation (recorded inother noncash (loss) gain,

net)

76.9 76.9

One-time expenses recorded on the

Company’s equity investment in THChina (recorded in equity in net

income of unconsolidated affiliates)

5.9

Gain recorded on the equity investment in

Karl Lagerfeld (recorded in equityin net income of unconsolidated

affiliates)

(2.2 ) Debt modification and extinguishment costs 15.8

Tax effects of the above pre-tax items(2) (2.8 ) (17.1 )

(10.1 ) (30.3 ) Discrete tax benefits related to the

resolution of uncertain tax positions (7.8 ) (18.5 ) (13.6 ) (21.5

) Tax expense on the assets held for sale in anticipation of

the Mexico deconsolidation 16.5 16.5

Net income on a non-GAAP basis attributable to PVH Corp. $

209.8 $ 221.1 $ 452.4 $ 460.5 Diluted net income per common

share on a non-GAAP basis attributable to PVH Corp.(1) $ 2.60

$ 2.66 $ 5.57 $ 5.53

(1) Please see Note A in the

Notes to the Consolidated GAAP Income Statements for

reconciliations of GAAP diluted net income per common share to

diluted net income per common share on a non-GAAP basis. (2) Please

see Table 8 for an explanation of the calculation of the tax

effects of the above items.

PVH CORP.

Reconciliations of GAAP to Non-GAAP Amounts (continued)

(In millions)

Table 2 -

Reconciliations of GAAP earnings before interest and taxes to

earnings before interest and taxes on a non-GAAP basis

Quarter

Ended Nine Months Ended

10/30/16

11/1/15

10/30/16

11/1/15

Earnings before interest and taxes $ 197.9 $ 253.6 $ 635.5 $

584.5 Items excluded:

Gross profit charges associated with the

TH China acquisition(short-lived noncash inventory valuation

adjustments)

1.8 7.3 Gross profit associated with the operation of and

exit from the Izod retail business (3.0 ) (28.3 )

Gross profit charges principally

associated with the discontinuationof several licensed product

lines in the Heritage Brands dressfurnishings business

8.8 8.8 SG&A expenses associated with the integration of

Warnaco and related restructuring 18.9 9.8 50.8 SG&A

expenses associated with the operation of and exit from the Izod

retail business 5.8 37.4

SG&A expenses associated with the

discontinuation of severallicensed product lines in the Heritage

Brands dress furnishings business

4.3 2.6 7.6 SG&A expenses associated with the G-III

license 1.6 4.2

SG&A expenses associated with the new

global creative strategy forCalvin Klein and related

restructuring

5.5

SG&A expenses associated with the TH

China acquisition (primarilyconsisting of amortization of

short-lived assets)

15.5 54.5

Gain recorded in connection with a payment

made to the Companyto exit a Tommy Hilfiger retail flagship store

in Europe (recorded in SG&A)

(18.1 ) (18.1 )

Gain to write-up the Company’s equity

investment in TH China tofair value (recorded in other noncash

(loss) gain, net)

(153.1 )

Loss recorded in anticipation of the

Mexico deconsolidation(recorded in other noncash (loss) gain,

net)

76.9 76.9

One-time expenses recorded on the

Company’s equity investment inTH China (recorded in equity in net

income of unconsolidated affiliates)

5.9

Gain recorded on the equity investment in

Karl Lagerfeld (recordedin equity in net income of unconsolidated

affiliates)

(2.2 ) Debt modification and extinguishment costs

15.8 Earnings before interest and taxes

on a non-GAAP basis $ 275.6 $ 288.4 $ 646.8

$ 658.6

PVH CORP. Reconciliations of GAAP to Non-GAAP Amounts

(continued) (In millions)

Table 3 -

Reconciliations of GAAP gross profit to gross profit on a non-GAAP

basis

Quarter Ended Nine Months Ended

10/30/16

11/1/15

10/30/16

11/1/15

Gross profit $ 1,191.6 $ 1,101.0 $ 3,232.3 $ 3,088.7

Items excluded:

Gross profit charges associated with the

TH China acquisition(short-lived noncash inventory valuation

adjustments)

1.8 7.3 Gross profit associated with the operation of and

exit from the Izod retail business (3.0 ) (28.3 )

Gross profit charges principally

associated with thediscontinuation of several licensed product

lines in the HeritageBrands dress furnishings business

8.8 8.8 Gross profit on a

non-GAAP basis $ 1,193.4 $ 1,106.8 $ 3,239.6

$ 3,069.2

Table 4 -

Reconciliations of GAAP SG&A to SG&A on a non-GAAP

basis

Quarter

Ended Nine Months Ended

10/30/16

11/1/15

10/30/16

11/1/15

SG&A $ 918.0 $ 853.8 $ 2,657.9 $ 2,519.2 Items

excluded: SG&A expenses associated with the integration

of Warnaco and related restructuring (18.9 ) (9.8 ) (50.8 )

SG&A expenses associated with the

operation of and exit fromthe Izod retail business

(5.8 ) (37.4 )

SG&A expenses associated with the

discontinuation of severallicensed product lines in the Heritage

Brands dress furnishings business

(4.3 ) (2.6 ) (7.6 ) SG&A expenses associated with the

G-III license (1.6 ) (4.2 )

SG&A expenses associated with the new

global creativestrategy for Calvin Klein and related

restructuring

(5.5 )

SG&A expenses associated with the TH

China acquisition(primarily consisting of amortization of

short-lived assets)

(15.5 ) (54.5 )

Gain related to a payment made to the

Company to exit aTommy Hilfiger retail flagship store in Europe

18.1 18.1 SG&A on a non-GAAP

basis $ 919.0 $ 824.8 $ 2,599.4

$ 2,423.4

PVH CORP. Reconciliations of GAAP to Non-GAAP Amounts

(continued) (In millions)

Table 5 -

Reconciliation of GAAP debt modification and extinguishment costs

to debt modification and extinguishment costs on a non-GAAP

basis

Nine Months Ended

10/30/16

Debt modification and extinguishment costs $ 15.8

Items excluded: Costs incurred related to the amendment of

the Company’s credit facility (15.8 ) Debt modification and

extinguishment costs on a non-GAAP basis $ —

Table 6 -

Reconciliations of GAAP other noncash (loss) gain, net to noncash

(loss) gain, net on a non-GAAP basis

Quarter Ended Nine Months Ended

10/30/16

10/30/16

Other noncash (loss) gain, net $ (76.9 ) $ 76.2 Items

excluded: Gain to write-up the Company’s equity investment

in TH China to fair value (153.1 ) Loss recorded in

anticipation of the Mexico deconsolidation 76.9 76.9 Other

noncash (loss) gain, net on a non-GAAP basis $ —

$

—

PVH CORP. Reconciliations of GAAP to Non-GAAP Amounts

(continued) (In millions)

Table 7 -

Reconciliations of GAAP equity in net income of unconsolidated

affiliates to equity in net income of unconsolidated affiliates on

a non-GAAP basis

Nine Months Ended

10/30/16

11/1/15

Equity in net income of unconsolidated affiliates $ 0.7 $

15.0 Items excluded: One-time expenses recorded on

the Company’s equity investment in TH China 5.9 Gain

recorded on the equity investment in Karl Lagerfeld (2.2 )

Equity in net income of unconsolidated affiliates on a

non-GAAP basis $ 6.6 $ 12.8

Table 8 -

Reconciliations of GAAP income tax expense to income tax expense on

a non-GAAP basis

Quarter

Ended Nine Months Ended 10/30/16

11/1/15 10/30/16

11/1/15 Income tax expense $ 42.6 $ 4.3

$ 101.0 $ 61.1 Items excluded: Tax effects of pre-tax

items identified as non-GAAP exclusions (1) 2.8 17.1 10.1 30.3

Discrete tax benefits related to the resolution of uncertain

tax positions 7.8 18.5 13.6 21.5 Tax expense on the assets

held for sale in anticipation of the Mexico deconsolidation (16.5 )

(16.5 ) Income tax expense on a non-GAAP basis

$ 36.7 $ 39.9 $ 108.2 $ 112.9

(1) The estimated tax effects

associated with the Company’s non-GAAP exclusions are based on the

Company’s assessment of deductibility. In making this assessment,

the Company evaluated each pre-tax item that it had identified

above as a non-GAAP exclusion to determine if such item is taxable

or tax deductible, and if so, in what jurisdiction the tax expense

or tax deduction would occur. All of the pre-tax items identified

as non-GAAP exclusions were identified as either primarily taxable

or tax deductible, with the tax effect taken at the statutory

income tax rate of the local jurisdiction, or as non-taxable or

non-deductible, in which case the Company assumed no tax effect.

PVH CORP. Reconciliations of GAAP to

Non-GAAP Amounts (continued) (In millions)

Table 9 -

Reconciliations of GAAP depreciation and amortization expense to

depreciation and amortization expense on a non-GAAP

basis

Quarter

Ended Nine Months Ended

10/30/16

11/1/15

10/30/16

11/1/15

Depreciation and amortization expense $ 84.4 $ 63.0 $ 237.6

$ 187.0 Items excluded: Amortization of short-lived

assets associated with the TH China acquisition (14.3 ) (32.2 )

Depreciation and amortization associated with the G-III

license (1.2 ) (3.8 )

Depreciation and amortization associated

with the integration ofWarnaco and related restructuring

(1.6 ) (0.4 ) (4.8 ) Depreciation and amortization

expense on a non-GAAP basis $ 68.9 $ 61.4 $

201.2 $ 182.2

PVH CORP. Notes to

Consolidated GAAP Income Statements (In millions, except per

share data)

A. The Company computed

its diluted net income per common share as follows:

Quarter Ended Quarter Ended 10/30/16

11/1/15 GAAP Non-GAAP

GAAP Non-GAAP

Results Adjustments (1)

Results Results

Adjustments (2)

Results

Net income attributable to PVH Corp. $ 126.2 $ (83.6 ) $

209.8 $ 221.9 $ 0.8 $ 221.1 Weighted average common shares

80.0 80.0 82.4 82.4 Weighted average dilutive securities 0.7

0.7 0.7 0.7 Total shares 80.7 80.7 83.1

83.1 Diluted net income per common share attributable

to PVH Corp. $ 1.56 $ 2.60 $ 2.67 $ 2.66

Nine Months Ended Nine

Months Ended 10/30/16 11/1/15 GAAP

Non-GAAP GAAP Non-GAAP

Results Adjustments

(1)

Results Results

Adjustments (2)

Results

Net income attributable to PVH Corp. $ 448.3 $ (4.1 ) $

452.4 $ 438.2 $ (22.3 ) $ 460.5 Weighted average common

shares 80.6 80.6 82.6 82.6 Weighted average dilutive securities 0.6

0.6 0.7 0.7 Total shares 81.2 81.2

83.3 83.3 Diluted net income per common share

attributable to PVH Corp. $ 5.52 $ 5.57 $ 5.26

$ 5.53

(1)

Represents the impact on net income in the

periods ended October 30, 2016 from the elimination of (i) the

costs incurred in connection with the integration of Warnaco and

the related restructuring; (ii) the costs incurred in connection

with the discontinuation of several licensed product lines in the

Heritage Brands dress furnishings business; (iii) the costs

incurred in connection with the G-III license; (iv) the costs

incurred in connection with the restructuring associated with the

new global creative strategy for Calvin Klein; (v) the noncash gain

recorded to write-up the Company’s equity investment in TH China to

fair value in connection with the TH China acquisition; (vi) the

one-time costs recorded on the Company’s equity investment in TH

China prior to the TH China acquisition closing; (vii) the costs

incurred in connection with the TH China acquisition, primarily

consisting of noncash charges related to valuation adjustments and

amortization of short-lived assets; (viii) the noncash loss

recorded in anticipation of the Mexico deconsolidation; (ix) the

gain recorded in connection with a payment made to the Company to

exit a Tommy Hilfiger retail flagship store in Europe; (x) the

costs incurred in connection with the amendment of the Company’s

credit facility; (xi) the tax effects associated with the foregoing

pre-tax items; (xii) the tax benefits associated with discrete

items related to the resolution of uncertain tax positions; and

(xiii) the tax expense on the assets held for sale in anticipation

of the Mexico deconsolidation. Please see Table 1 for a

reconciliation of GAAP net income to net income on a non-GAAP

basis.

(2) Represents the impact on net income in the periods ended

November 1, 2015 from the elimination of (i) the costs incurred in

connection with the integration of Warnaco and the related

restructuring; (ii) the costs incurred in connection with the

operation of and exit from the Izod retail business; (iii) the

costs incurred principally in connection with the discontinuation

of several licensed product lines in the Heritage Brands dress

furnishings business; (iv) the gain recorded on the equity

investment in Karl Lagerfeld; (v) the tax effects associated with

the foregoing pre-tax items; and (vi) the tax benefits associated

with discrete items related to the resolution of uncertain tax

positions. Please see Table 1 for a reconciliation of GAAP net

income to net income on a non-GAAP basis.

PVH CORP. Consolidated Balance Sheets

(In millions) 10/30/16 11/1/15 ASSETS

Current Assets: Cash and Cash Equivalents $ 662.4 $ 369.9

Receivables 788.4 866.2 Inventories 1,258.3 1,332.0 Other Current

Assets 189.9 196.8 Assets Held For Sale 49.1 — Total Current

Assets 2,948.1 2,764.9 Property, Plant and Equipment 730.2 731.8

Goodwill and Other Intangible Assets 7,154.8 6,921.9 Other Assets

235.5 285.9 $ 11,068.6 $ 10,704.5 LIABILITIES,

REDEEMABLE NON-CONTROLLING INTEREST AND STOCKHOLDERS’ EQUITY

Accounts Payable and Accrued Expenses $ 1,309.6 $ 1,214.7

Short-Term Borrowings 20.8 27.6 Current Portion of Long-Term Debt —

124.1 Current Liabilities Related to Assets Held For Sale 26.0 —

Other Liabilities 1,613.6 1,601.2 Long-Term Debt 3,303.1 3,191.3

Redeemable Non-Controlling Interest 1.2 — Stockholders’ Equity

4,794.3 4,545.6 $ 11,068.6 $ 10,704.5

Note: Year over year balances are impacted by changes in foreign

currency exchange rates.

PVH CORP.

Segment Data (In millions)

REVENUE BY

SEGMENT

Quarter Ended Quarter Ended 10/30/16

11/1/15

Calvin Klein North

America

Net sales $ 444.4 $ 420.1 Royalty revenue 43.1 43.9 Advertising and

other revenue 14.4 13.8 Total 501.9 477.8

Calvin Klein

International

Net sales 364.0 308.8 Royalty revenue 18.8 21.0 Advertising and

other revenue 6.5 6.5 Total 389.3 336.3

Total Calvin

Klein Net sales 808.4 728.9

Royalty revenue 61.9 64.9 Advertising and

other revenue 20.9 20.3 Total

891.2

814.1

Tommy Hilfiger North

America

Net sales 383.6 416.5 Royalty revenue 14.8 13.4 Advertising and

other revenue 3.8 4.0 Total 402.2 433.9

Tommy Hilfiger

International

Net sales 512.3 439.1 Royalty revenue 11.6 13.6 Advertising and

other revenue 1.1 1.0 Total 525.0 453.7

Total Tommy

Hilfiger Net sales 895.9 855.6

Royalty revenue 26.4 27.0 Advertising and

other revenue 4.9 5.0 Total

927.2 887.6

Heritage Brands

Wholesale

Net sales 354.2 384.0 Royalty revenue 5.1 4.9 Advertising and other

revenue 1.1 0.8 Total 360.4 389.7

Heritage Brands

Retail

Net sales 64.9 72.4 Royalty revenue 0.5 0.6 Advertising and other

revenue 0.1 0.1 Total 65.5 73.1

Total Heritage

Brands Net sales 419.1 456.4

Royalty revenue 5.6 5.5 Advertising and

other revenue 1.2 0.9 Total

425.9 462.8

Total

Revenue

Net sales 2,123.4 2,040.9 Royalty

revenue 93.9 97.4 Advertising and other

revenue 27.0 26.2 Total $

2,244.3 $ 2,164.5

PVH CORP.

Segment Data (continued) (In millions)

EARNINGS BEFORE

INTEREST AND TAXES BY SEGMENT

Quarter Ended Quarter Ended 10/30/16

11/1/15 Results Results Under

Non-GAAP Under Non-GAAP

GAAP

Adjustments(1)

Results

GAAP

Adjustments(2)

Results

Calvin Klein North America $ (0.7 ) $ (76.9 ) $ 76.2 $ 80.2

$ (2.7 ) $ 82.9 Calvin Klein International 69.6

69.6 61.5 (3.9 ) 65.4

Total Calvin Klein

68.9 (76.9

) 145.8

141.7 (6.6 ) 148.3

Tommy Hilfiger North America 41.3 (1.6 ) 42.9 57.1

57.1 Tommy Hilfiger International 75.0 0.8

74.2 68.6 68.6

Total Tommy Hilfiger

116.3 (0.8 )

117.1 125.7

125.7 Heritage Brands

Wholesale 41.2 41.2 25.3 (14.5 ) 39.8 Heritage Brands Retail

2.4 2.4 0.5 (2.8 ) 3.3

Total Heritage

Brands 43.6

43.6 25.8

(17.3 ) 43.1

Corporate (30.9 ) (30.9 ) (39.6 ) (10.9 ) (28.7 )

Total

earnings before interest and taxes $ 197.9

$ (77.7 ) $ 275.6

$ 253.6 $ (34.8 )

$ 288.4

(1)

Adjustments for the quarter ended October

30, 2016 represent the elimination of (i) the costs incurred in

connection with the G-III license; (ii) the costs incurred in

connection with the TH China acquisition, principally consisting of

noncash charges related to amortization of short-lived assets;

(iii) the noncash loss recorded in anticipation of the Mexico

deconsolidation; and (iv) the gain recorded in connection with a

payment made to the Company to exit a Tommy Hilfiger retail

flagship store in Europe.

(2) Adjustments for the quarter ended November 1, 2015

represent the elimination of (i) the costs incurred in connection

with the integration of Warnaco and the related restructuring; (ii)

the costs incurred in connection with the operation of and exit

from the Izod retail business; and (iii) the costs incurred

principally in connection with the discontinuation of several

licensed product lines in the Heritage Brands dress furnishings

business.

PVH

CORP. Segment Data (continued) (In millions)

REVENUE BY

SEGMENT

Nine Months Ended

Nine Months Ended

10/30/16 11/1/15 Calvin Klein North

America Net sales $ 1,144.5 $ 1,037.0 Royalty revenue 101.4

103.1 Advertising and other revenue 34.6 34.7 Total 1,280.5

1,174.8

Calvin Klein

International

Net sales 986.5 865.2 Royalty revenue 54.2 57.0 Advertising and

other revenue 19.1 19.6 Total 1,059.8 941.8

Total

Calvin Klein Net sales 2,131.0

1,902.2 Royalty revenue 155.6 160.1

Advertising and other revenue 53.7 54.3

Total 2,340.3

2,116.6

Tommy Hilfiger North

America

Net sales 1,100.7 1,142.8 Royalty revenue 35.0 32.9 Advertising and

other revenue 8.5 9.4 Total 1,144.2 1,185.1

Tommy Hilfiger

International

Net sales 1,399.0 1,239.5 Royalty revenue 33.3 38.0 Advertising and

other revenue 2.7 2.8 Total 1,435.0 1,280.3

Total

Tommy Hilfiger Net sales 2,499.7

2,382.3 Royalty revenue 68.3 70.9

Advertising and other revenue 11.2 12.2

Total 2,579.2

2,465.4

Heritage Brands

Wholesale

Net sales 964.1 1,059.5 Royalty revenue 15.3 14.3 Advertising and

other revenue 2.9 2.2 Total 982.3 1,076.0

Heritage Brands

Retail

Net sales 191.7 247.9 Royalty revenue 1.7 1.7 Advertising and other

revenue 0.2 0.2 Total 193.6 249.8

Total Heritage

Brands Net sales 1,155.8 1,307.4

Royalty revenue 17.0 16.0 Advertising and

other revenue 3.1 2.4 Total

1,175.9

1,325.8

Total

Revenue

Net sales 5,786.5 5,591.9 Royalty

revenue 240.9 247.0 Advertising and other

revenue 68.0 68.9 Total $

6,095.4 $ 5,907.8

PVH CORP.

Segment Data (continued) (In millions)

EARNINGS BEFORE

INTEREST AND TAXES BY SEGMENT

Nine Months Ended Nine Months Ended

10/30/16 11/1/15 Results

Results Under Non-GAAP Under

Non-GAAP

GAAP

Adjustments(1)

Results

GAAP

Adjustments(2)

Results

Calvin Klein North America $ 92.6 $ (79.8 ) $ 172.4 $ 166.7

$ (5.6 ) $ 172.3 Calvin Klein International 172.3

(5.4 ) 177.7 145.5 (7.6 ) 153.1

Total Calvin Klein

264.9 (85.2

) 350.1

312.2 (13.2 )

325.4 Tommy Hilfiger North America 110.4 (4.2

) 114.6 146.2 146.2 Tommy Hilfiger International 287.8

103.5 184.3 169.3 169.3

Total Tommy

Hilfiger 398.2

99.3 298.9

315.5 315.5

Heritage Brands Wholesale 77.4 (3.0 ) 80.4 72.9 (23.5 ) 96.4

Heritage Brands Retail 8.2 8.2 (2.3 ) (9.1 )

6.8

Total Heritage Brands 85.6

(3.0 ) 88.6

70.6 (32.6 )

103.2 Corporate (113.2 ) (22.4 ) (90.8

) (113.8 ) (28.3 ) (85.5 )

Total earnings before interest

and taxes $ 635.5 $ (11.3

) $ 646.8 $ 584.5

$ (74.1 ) $ 658.6

(1)

Adjustments for the nine months ended

October 30, 2016 represent the elimination of (i) the costs

incurred in connection with the integration of Warnaco and the

related restructuring; (ii) the costs incurred in connection with

the discontinuation of several licensed product lines in the

Heritage Brands dress furnishings business; (iii) the costs

incurred in connection with the G-III license; (iv) the costs

incurred in connection with the restructuring associated with the

new global creative strategy for Calvin Klein; (v) the noncash gain

recorded to write-up the Company’s equity investment in TH China to

fair value in connection with the TH China acquisition; (vi) the

one-time costs recorded on the Company’s equity investment in TH

China prior to the TH China acquisition closing; (vii) the costs

incurred in connection with the TH China acquisition, primarily

consisting of noncash charges related to valuation adjustments and

amortization of short-lived assets; (viii) the noncash loss

recorded in anticipation of the Mexico deconsolidation; (ix) the

gain recorded in connection with a payment made to the Company to

exit a Tommy Hilfiger retail flagship store in Europe; and (x) the

costs incurred in connection with the amendment of the Company’s

credit facility.

(2) Adjustments for nine months ended November 1, 2015

represent the elimination of (i) the costs incurred in connection

with the integration of Warnaco and the related restructuring; (ii)

the costs incurred in connection with the operation of and exit

from the Izod retail business, (iii) the costs incurred principally

in connection with the discontinuation of several licensed product

lines in the Heritage Brands dress furnishings business; and (iv)

the gain recorded on the equity investment in Karl Lagerfeld.

PVH CORP. Reconciliations of 2016 Constant Currency

Amounts (In millions)

As a supplement to the Company’s reported operating results, the

Company presents constant currency financial information, which is

a non-GAAP financial measure. The Company presents results in this

manner because it is a global company that reports financial

information in U.S. dollars in accordance with generally accepted

accounting principles in the U.S. Foreign currency exchange rate

fluctuations affect the amounts reported by the Company in U.S.