As

filed with the Securities and Exchange Commission on November 30, 2016

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

Form

S-1

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NANOFLEX

POWER CORPORATION

(Exact

name of registrant as specified in its charter)

|

Florida

|

|

4955

|

|

46-1904002

|

(State

or other jurisdiction of

Incorporation or organization)

|

|

(Primary

Standard Industrial

Classification Code number)

|

|

(I.R.S.

Employer

Identification No.)

|

17207

N. Perimeter Dr., Suite 210

Scottsdale,

AZ 85255

(480)

585-4200

(Address

and telephone number of principal executive offices)

Dean

L. Ledger

Chief

Executive Officer

17207

N. Perimeter Dr., Suite 210

Scottsdale,

AZ 85255

(480)

585-4200

(Name,

address and telephone number of agent for service)

Copies

to:

|

M.

Ali Panjwani, Esq.

|

Mitchell

S. Nussbaum, Esq.

|

|

Pryor

Cashman LLP

|

Loeb

& Loeb LLP

|

|

7 Times

Square

|

345

Park Avenue

|

|

New

York, NY 10036

|

New

York, NY 10154

|

|

Tel:

(212) 326-0820

|

Tel:

(212) 407-4159

|

|

Fax:

(212) 798-6319

|

Fax:

(212) 504-3013

|

Approximate

date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration

statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under

the Securities Act of 1933 check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please

check the following box and list the Securities Act registration statement number of the earlier effective registration statement

for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller

reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large

accelerated filer

|

☐

|

Accelerated

filer

|

☐

|

|

Non-accelerated

filer

|

☐

|

Smaller

reporting company

|

☒

|

CALCULATION

OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered

|

|

Proposed Maximum

Aggregate

Offering Price (1)

|

|

|

Amount of

Registration Fee

|

|

|

Shares of common stock, par value $0.0001 per share (2)(3)

|

|

$

|

17,250,000.00

|

|

|

$

|

1,999.28

|

|

|

Warrants to purchase shares of common stock (4)

|

|

|

—

|

|

|

|

—

|

|

|

Shares of common stock issuable upon exercise of the warrants (2)(3)(5)

|

|

$

|

21,562,500.00

|

|

|

$

|

2,499.09

|

|

|

Representative’s Warrants to purchase common stock (4)

|

|

|

—

|

|

|

|

—

|

|

|

Shares of common stock issuable upon exercise of the Representative’s Warrants (2)(6)(7)

|

|

$

|

660,000.00

|

|

|

$

|

76.49

|

|

|

Total

|

|

$

|

39,472,500.00

|

|

|

$

|

4,574.86

|

(8)

|

|

(1)

|

Estimated

solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) of the Securities Act. Includes

shares that the underwriters have the option to purchase from the registrant to cover over-allotments, if any.

|

|

(2)

|

Pursuant to Rule

416 under the Securities Act, this registration statement also covers such indeterminate number of additional shares of common

stock as may be issuable with respect to the shares being registered hereunder as a result of stock splits, stock dividends,

recapitalizations or similar transactions.

|

|

(3)

|

Includes shares

of common stock which may be issued upon exercise of a 45-day option granted to the underwriters to cover over-allotments,

if any.

|

|

(4)

|

No registration

fee required pursuant to Rule 457(g) of the Securities Act

|

|

(5)

|

We have calculated

the proposed maximum aggregate offering price of the shares of common stock underlying the warrants by assuming that such

warrants are exercisable to purchase common stock at a price per share equal to 125% of the expected offering price of our

common stock.

|

|

(6)

|

We have agreed to

issue warrants exercisable within five years after the effective date of this registration statement representing 4% of the

securities issued in the offering, excluding any over-allotment securities (the “Representative’s Warrants”)

to Aegis Capital Corp. The Representative’s Warrants are exercisable at a per share price equal to 110% of the common

stock public offering price. Resales of the Representative’s Warrants on a delayed or continuous basis pursuant to Rule

415 under the Securities Act of 1933, as amended, are registered hereby. Resales of shares issuable upon exercise of the Representative’s

Warrants are also being similarly registered on a delayed or continuous basis hereby. See “Underwriting.”

|

|

(7)

|

Estimated solely

for the purpose of calculating the amount of the registration fee pursuant to Rule 457(g) of the Securities Act. We have calculated

the proposed maximum aggregate offering price of the shares of common stock underlying the Representative’s Warrants

by assuming that such warrants are exercisable to purchase shares of common stock at a per share price of 110% of the expected

offering price of our common stock, excluding any over-allotment securities.

|

|

(8)

|

Paid herewith.

|

The

registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until

the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become

effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until this Registration Statement shall

become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and is

not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

|

PRELIMINARY

PROSPECTUS

|

SUBJECT

TO COMPLETION

|

DATED

NOVEMBER 30, 2016

|

Shares

Common

Stock and Warrants

This

is a firm commitment public offering of shares of common stock and warrants of NanoFlex Power Corporation consisting of one share

of common stock and one warrant to purchase one share of common stock at an exercise price of 125% of the public offering price

of a share of common stock in this offering. The common stock and warrants are immediately separable and will be issued separately.

The warrants are exercisable immediately and will expire five years from the date of issuance.

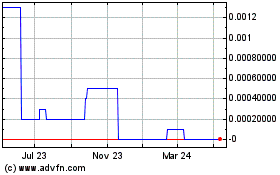

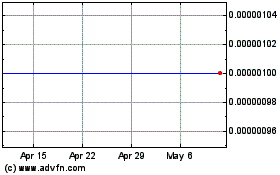

Our common

stock is currently traded on the OTCQB Marketplace operated by the OTC Markets Group, Inc., or OTCQB, under the symbol

“OPVS.” Prior to the effectiveness of the registration statement of which this prospectus is a part, we will

effect a reverse stock split in a range of between one-for- and

one-for- , such exact amount to be determined by the Company’s Board of

Directors. On November 25, 2016, the last reported sale price for our common stock was $0.75 per share.

We

intend to apply to list our common stock and warrants on the NYSE MKT under the symbols “NFP” and “NFPW”,

respectively. No assurance can be given that our application will be approved.

We

are an “emerging growth company” under the federal securities laws and will be subject to reduced public company reporting

requirements. An investment in our securities may be considered speculative and involves a high degree of risk, including the

risk of a substantial loss of your investment. See “Risk Factors” beginning on page 5 to read about the risks you

should consider before buying our securities. An investment in our securities is not suitable for all investors. We intend to

continue to issue common stock after this offering and, as a result, your ownership in us is subject to dilution. See “Risk

Factors—Risks Related to Ownership of Our Common Stock.”

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

|

|

|

Per Share

|

|

|

Per Warrant

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Underwriting discounts and commissions (1)

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

Proceeds, before expenses, to us

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

(1)

|

The underwriters will receive compensation in addition to the underwriting discount. See “Underwriting” beginning on page 59 of this prospectus for a description of compensation payable to the underwriters.

|

We

have granted a 45-day option to the representative of the underwriters to purchase up to additional shares of common stock and/or

additional warrants to purchase up to shares of common stock solely to cover over-allotments,

if any.

The

underwriters expect to deliver our shares to purchasers in the offering on or about , 2017.

Aegis

Capital Corp

NANOFLEX

POWER CORPORATION

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

You

should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with different

information. If anyone provides you with different or inconsistent information, you should not rely on it. The information contained

in this prospectus is accurate only as of the date of this prospectus. Our business, financial condition, results of operations

and prospects may have changed since such date. Other than as required under the federal securities laws, we undertake no obligation

to publicly update or revise such information, whether as a result of new information, future events or any other reason.

The

distribution of this prospectus and the offering of our securities in certain jurisdictions may be restricted by law. This prospectus

does not constitute, and may not be used in connection with, an offer or solicitation by anyone in any jurisdiction in which such

offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so to

any person to whom it is unlawful to make such offer or solicitation. See the “Underwriting” section of this prospectus.

In this prospectus, unless specifically set forth to the contrary, the terms “Company,” “we,” “us,”

or “our,” are references to the combined business of (i) NanoFlex Power Corporation, a Florida corporation, and (ii)

Global Photonic Energy Corporation, a Pennsylvania corporation (“GPEC”).

PROSPECTUS

SUMMARY

This

summary provides an overview of selected information contained elsewhere in this prospectus and does not contain all of the information

you should consider before investing in our securities. You should carefully read this prospectus and the registration statement

of which this prospectus is a part in their entirety before investing in our securities, including the information discussed under

“Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,”

and “Description of Business,” and our financial statements and notes thereto that appear elsewhere in this prospectus,

before making an investment decision.

Overview

NanoFlex

Power Corporation, formerly known as Universal Technology Systems, Corp., was incorporated in the State of Florida on January

28, 2013. On September 24, 2013, the Company completed the acquisition of Global Photonic Energy Corporation, a Pennsylvania corporation

(“GPEC”) pursuant to a Share Exchange Agreement (the “Share Exchange Transaction”). GPEC was founded and

incorporated on February 7, 1994 and is engaged in the research, development, and commercialization of advanced configuration

solar technologies. Immediately following the closing of the Share Exchange Transaction and as a result, the Company owned 100%

of the equity interests of GPEC and GPEC became a wholly-owned subsidiary of the Company. On November 25, 2013, the Company changed

its name from “Universal Technology Systems, Corp.” to “NanoFlex Power Corporation” and its trading symbol

was changed to “OPVS” on December 26, 2013.

Our

Business

The

Company is engaged in the research, development, and commercialization of advanced configuration solar technologies which enable

unique thin-film solar cell implementations with what we believe will be industry-leading efficiencies, light weight, flexibility,

and low total system cost. Our sponsored research programs at the University of Southern California, the University of Michigan,

and Princeton University have resulted in an extensive portfolio of issued and pending patents worldwide covering flexible, thin-film

photovoltaic technologies. Pursuant to our license agreement with our university research partners, we have obtained the exclusive

worldwide license and right to sublicense any and all intellectual property resulting from our sponsored research programs. While

each patent is issued in the name of the respective university that developed the subject technology, the Company has exclusive

commercial license rights to all of the patents and their attendant technologies and the patents are referred to herein as being

the Company’s patents.

As

of November 29, 2016, there were 81 issued patents, 54 pending non-provisional applications and 3 pending provisional applications

in the U.S. and 7 pending Patent Cooperation Treaty applications. In addition, in countries and regions outside the U.S., including,

but not limited to, China, European Patent Convention, India, Japan, Korea and Taiwan, there were a total of 74 issued patents

and 153 pending patent applications. The patent numbers presented exclude issued and pending patents that the Company has identified

for abandonment in order to optimize its patent portfolio and reduce unnecessary or redundant costs while still protecting critical

technologies. The duration of the issued U.S. and foreign patents is typically 20 years from their respective first effective

filing dates.

These

patented and patent-pending technologies fall into two general categories – (1) cost reducing and performance-enhancing

fabrication processes and device architectures for ultra-high efficiency Gallium Arsenide solar thin films and (2) organic photovoltaic

(“OPV”) materials, architectures, and fabrication processes for low cost, ultra-thin solar films offering high quality

aesthetics, such as semi-transparency and tinting, and highly flexible form factors. The technologies are targeted at certain

broad applications that require high power conversion efficiency, flexibility, and light weight. These applications include: (a)

mobile and off-grid solar power generation, (b) building applied photovoltaics (“BAPV”), (c) building integrated photovoltaics

(“BIPV”), (d) space vehicles and unmanned aerial vehicles (“UAVs”), (e) semi-transparent solar power generating

glazing or windows, and (f) ultra-thin solar films for automobiles or other consumer applications. The Company believes these

technologies have been demonstrated in a laboratory environment with our research partners. The Company is currently engaged in

product development and commercialization on some of these technologies in collaboration with industry partners and potential

customers.

Our

Growth Strategy

The

Company’s business model is oriented around licensing and sublicensing processes and technologies to large, well-positioned

commercial partners who can provide manufacturing and marketing capabilities to enable rapid commercial growth. The Company plans

to license or sublicense its intellectual property to industry partners and customers, rather than being a direct manufacturer

of its technologies. These manufacturing partners can supply customers directly, from which the Company expects to receive license

royalties. Additionally, these manufacturing partners can also serve as a source of solar cell supply for the Company to provide

products to customers on its own through a “fab-less” manufacturing model, particularly in the early stages of market

development.

We

have made contact with major solar cell and electronics manufacturers world-wide and are finding commercial interest in both our

high efficiency and OPV technologies. We are seeking to work closely with those companies interested in our technology solutions

to develop proof-of-concept prototypes and processes to mitigate commercialization risks and gain early market entry and acceptance.

The

Company has identified its high efficiency solar technologies as its nearest term market opportunity. A key to reducing the risk

to market entry of the Company’s high efficiency technologies by our partners is for us to demonstrate our technologies

on their product designs and fabrication processes. To support this joint development, the Company has established its own engineering

team and plans to expand this team contingent on its ability to secure sponsored development funding and/or raise the necessary

capital. This team is to be tasked with serving several key functions, including working closely with the Company’s sponsored

research organizations and its industry partners to integrate and customize our proprietary processes and technologies into the

partner’s existing product designs and fabrication processes. In conjunction with facilitating technology transfer, our

engineering team will also work closely with downstream partners and customers such as military users for mobile field applications,

system integrators, installers, and architects for BAPV and BIPV applications, and engineering, procurement, and construction

(“EPC”) companies and project developers for solar farm applications. This customer interaction allows the Company

to better understand application specific requirements and incorporate these requirements into its product development cycle.

To

support this work, the Company’s engineering team leverages the facilities and equipment at the University of Michigan on

a recharge basis, which we believe is a cost effective approach to move the technologies toward commercialization. We believe

that this allows our engineering team to work directly with industry partners to acquire early licenses to use our intellectual

property without the need for large-scale capital investment in clean room facilities and solar cell fabrication equipment.

The

Company is pursuing sponsored development funding to generate revenue in the near-term. Having an established technical team enables

us to more effectively pursue and execute sponsored research projects from the Department of Defense (“DoD”), the

Department of Energy (“DOE”), and the National Aeronautics and Space Administration (“NASA”), each of

which has interests in businesses that can deliver ultra-lightweight, high-efficiency solar technologies for demanding applications.

Another

potential revenue source is from joint development agreements (“JDAs”) with existing solar cell manufacturers. Once

we are able to initially demonstrate the efficacy of our processes and technologies on partner’s products and fabrication

processes, we expect to be in a position where we can sign licenses covering further joint development, IP licensing, solar cell

supply, and joint marketing, as applicable. We anticipate that partnerships with one or more of the existing high efficiency solar

cell manufacturers can be supported by the Company’s engineering team, and result in near-term revenue opportunities, as

we have demonstrated with our current joint development partner.

Market

Opportunity

There

are several key trends that we believe are reshaping the future of the global energy mix, including continued rapid growth in

the use of solar technologies, a retreat from nuclear power in some countries, and the emergence of unconventional natural gas

production. These trends are driving a pronounced shift away from oil, coal, and nuclear towards renewables and natural gas. Expectations

are building for a concerted global effort to tackle climate change, according to the International Energy Agency’s World

Energy Outlook 2016.

Expansion

of solar generation worldwide is a necessary component of any serious strategy to mitigate climate change, according to the Massachusetts

Institute of Technology Energy Initiative. In recent years, solar costs have fallen substantially and installed capacity has grown

very rapidly. Nonetheless, solar energy currently accounts for only about 1% of global electricity generation.

Solar

photovoltaics (“PV”) installations have experienced rapid growth over the past several years. According to IHS Technology,

global solar installations reached 59 GW in 2015, a 35% increase over 2014, while growth in 2016 is expected to increase a further

17% to 69 GW.

The

dominant PV technology, used in approximately 90% of installations, is wafer-based crystalline silicon (“c-Si”), with

thin-film technologies, such as cadmium telluride (“CdTe”), copper indium gallium selenide (“CIGS”), and

amorphous silicon (“a-Si”), accounting for approximately 10% of the PV market, according to the MIT Energy Initiative.

However, current c-Si technologies have inherent technical limitations, including high processing complexity and low intrinsic

light absorption, which requires a thick silicon wafer, resulting in rigidity and heavy weight, according to the MIT Energy Initiative.

We believe these form factor constraints largely limit the addressable market for crystalline silicon-based solar to rooftop and

utility-scale installations, which dominate the current solar power installed base. We plan to initially focus our high efficiency

technologies and products on applications that are not well-served by crystalline silicon-based solar panels and rather demand

solar solutions with some combination of high power, light weight, and flexibility.

Corporate

Information

Our

corporate headquarters are located at 17207 N. Perimeter Dr., Suite 210, Scottsdale, AZ 85255 and our telephone number is (480)

585-4200. We maintain our web site at www.nanoflexpower.com. The information on our website or that can be accessed through our

website is not a part of, or incorporated in, this prospectus.

Recent Developments

Between November

18, 2016 and November 28, 2016, the Company entered into amendments with certain holders of the Company’s issued and outstanding

warrants and convertible promissory notes, pursuant to which such holders have agreed to remove price-based anti-dilution provisions

contained in the original securities effective immediately following the execution of the underwriting agreement relating to this

offering (the “Anti-Dilution Amendments”). The amendments have resulted in the reduction of the Company’s warrant

derivative liabilities and conversion option derivative liabilities from $12,581,604 as of September 30, 2016 to $5,648,773 as

of November 28, 2016. The Company expects to further reduce its warrant derivative liabilities and conversion option derivative

liabilities by entering into similar amendments with holders of the Company’s issued and outstanding warrants and convertible

promissory notes.

THE

OFFERING

|

Securities

offered

|

Up

to shares of common stock and warrants to purchase up to shares

of common stock. The warrants are issued separately from the shares of common stock.

|

|

|

|

|

Offering

price

|

$ per

share of common stock and warrant.

|

|

|

|

|

Common

stock outstanding before the offering

|

59,265,087

shares

|

|

|

|

|

Common

stock to be outstanding after the offering

|

shares

( shares if the warrants are exercised in full)

(1)

|

|

|

|

|

Description

of the warrants

|

The warrants will have a per share exercise price equal to

125%

of the closing bid price of our common stock on the date of this prospectus. The warrants are exercisable

immediately and expire five years from the date of issuance. The exercise price and the number of shares of common stock purchasable

upon the exercise of the warrants are subject to adjustment upon the occurrence of specific events, including stock dividends,

stock splits, combinations and reclassifications of our common stock.

|

|

|

|

|

Common

stock issuable upon exercise of warrants outstanding before the offering

|

58,957,805

shares

|

|

|

|

|

Common

stock issuable upon exercise of warrants to be outstanding after the offering

|

shares

|

|

|

|

|

Underwriter’s

option to purchase additional shares of common stock and/or warrants in this offer

|

We

have granted the underwriters a 45-day option to purchase, on the same terms and conditions set forth above, up to additional

shares of common stock and/or additional warrants to purchase up to shares

of common stock.

|

|

|

|

|

Use

of proceeds

|

We

estimate that the net proceeds from this offering will be approximately $ (approximately

$

if

the underwriters exercise their option to purchase additional shares of common stock and warrants in full) based upon an assumed

offering price of $ per share, after deducting the underwriting discounts and commissions. We

intend to use the net proceeds from this offering to fund development and commercialization of the Company’s high efficiency

thin film solar technology; to fund OPV research and development to support future joint development; to maintain and enhance

the Company’s IP portfolio; to pay the Company’s accounts payable and accrued liabilities; and for working capital

and general corporate purposes. See “Use of Proceeds.”

|

|

|

|

|

Market

symbol and listing

|

Our

common stock is listed on the OTCQB Marketplace operated by the OTC Markets Group, Inc. under the symbol “OPVS.”

We intend to apply to list our common stock and warrants on the NYSE MKT under the symbols “NFP” and “NFPW”,

respectively.

|

|

|

|

|

Risk

Factors

|

Investing

in our securities involves substantial risks. You should carefully review “Risk Factors” and the other information

in this prospectus for a discussion of the factors you should consider before you decide to invest in shares of our securities.

|

|

(1)

|

The number of shares of common stock outstanding is based on 59,265,087 shares outstanding as of November

29, 2016 and excludes, as of that date:

|

|

|

●

|

shares of common stock issuable upon exercise of warrants to be issued to investors in this offering at an exercise price of $ per share;

|

|

|

●

|

13,000 shares of common stock issuable upon exercise of outstanding stock options, with a weighted average exercise price of $0.54 per share;

|

|

|

●

|

58,957,805 shares of common stock issuable upon exercise of warrants outstanding prior to this offering, with a weighted average exercise price of $0.71 per share;

|

|

|

●

|

11,823,589 shares of common stock reserved for future issuance under our

2013 stock option plan;

|

|

|

●

|

shares of

common stock issuable upon the exercise of the underwriters’ over-allotment option to purchase additional shares of common stock and shares of common stock issuable upon the exercise of additional warrants that are issuable upon the exercise of the underwriters’ over-allotment option to purchase additional warrants; and

|

|

|

●

|

shares of common stock issuable upon exercise of the warrant to be issued to Aegis Capital Corp. (representing 4% of the shares of common stock and warrants sold by us in this offering).

|

Unless

otherwise specifically stated, information throughout this prospectus does not assume the exercise of outstanding options or warrants

to purchase shares of common stock.

RISK

FACTORS

You

should carefully consider the risks described below as well as other information provided to you in this document, including information

in the section of this document entitled “Cautionary Note Regarding Forward-Looking Statements”. If any of the following

risks actually occur, our business, financial condition or results of operations could be materially adversely affected, the value

of our common stock could decline, and you may lose all or part of your investment.

Risks

Relating to Our Business

There

is doubt about our ability to continue as a going concern, which may hinder our ability to obtain financing and force us to cease

operations.

The

Company has only generated limited revenues to date. In their audit reports for the fiscal years 2015 and 2014, our independent

registered public accounting firm expressed substantial doubt about our ability to continue as a going concern. The Company had

current liabilities of $25,506,910 and current assets of $116,467 as of December 31, 2015. As of September 30, 2016, the Company

had a working capital deficit of $18,983,497 and an accumulated deficit of $207,732,287. We generated revenues of $115,400 for

the nine months ended September 30, 2016, and we lack sufficient capital to fund ongoing operations, including our research and

development activities and for maintenance of our patent portfolio. The Company has funded its initial operations primarily by

way of sale of equity securities, convertible note financing, short term financing from private parties, and advances from related

parties. We anticipate that we will continue to experience net operating losses as we seek to commercialize our technologies and

that the continuation of our business and our ability to service existing liabilities will continue to be dependent primarily

on raising capital.

Our

net operating losses require that we finance our operations from outside sources through funding from the sale of our securities.

If we are unable to obtain such additional capital, we will not be able to sustain our operations and would be required to cease

our operations. Investors should consider this when determining if an investment in our company is suitable.

Even

if we do raise sufficient capital and generate sufficient revenues to support our operating expenses, there can be no assurance

that the revenue will be sufficient to enable us to develop our business to a level where it will generate sufficient profits

and cash flows from operations, or provide a return on investment. In addition, if we raise additional funds through the issuance

of equity or convertible debt securities, the percentage ownership of our stockholders could be significantly diluted, the newly-issued

securities may have rights, preferences or privileges senior to those of existing stockholders and the trading price of our common

stock could be adversely affected. Further, if we obtain additional debt financing, a substantial portion of our operating cash

flow may be dedicated to the payment of principal and interest on such indebtedness, and the terms of the debt securities issued

could impose significant restrictions on our operations. If we are unable to continue as a going concern, our shareholders may

lose their entire investment.

We

are presently solely dependent on raising capital to maintain the Company, our patent portfolio, research and development activities

and efforts to commercialize our technologies

.

We

are currently in the development stage and have not yet commercialized any of our technologies nor have we licensed any of our

technologies or sold any products, and have only generated limited revenues and are solely dependent on raising capital to fund

our operations. We currently need to raise capital in order to maintain the Company’s operations, our patent portfolio,

research and development activities and efforts to commercialize our technologies, as well as to pay our approximately $4.4 million

in outstanding accounts payable and accrued liabilities as of September 30, 2016, excluding derivative liabilities.

There

can be no assurance that we will be able to raise the capital that we need or that if we can, that it will be available on terms

that are acceptable to the Company and its shareholders or which would not substantially dilute existing shareholders’ interests.

If we fail to raise sufficient capital, we will be unable to maintain the Company, or our patents or commercialize our technologies

which may result in a total loss of shareholders’ investments.

We

will need additional capital to fund our growth and we may not be able to obtain sufficient capital on reasonable terms and may

be forced to limit the scope of our operations.

If

adequate additional financing is not available to us, or if available, it is not available on reasonable terms, we may not be

able to fund our future operations and we would have to modify our business plans accordingly. There is no assurance that additional

financing will be available to us.

If

we cannot obtain additional funding, we may be required to: (i) limit internal growth (ii) limit the recruitment and retention

of additional key personnel, and (iii) limited acquisitions of businesses and technology. Such limitations could materially adversely

affect our business and our ability to compete.

Even

if we do find a source of additional capital, we may not be able to negotiate terms and conditions for receiving the additional

capital that are acceptable to us. Any future capital investments could dilute or otherwise materially and adversely affect the

holdings or rights of our existing shareholders. In addition, new equity or convertible debt securities issued by us to obtain

financing could have rights, preferences and privileges senior to our common stock. We cannot give you any assurance that any

additional financing will be available to us, or if available, will be on terms favorable to us.

The

Company has incurred, and expects to continue to incur, significant losses as we seek to commercialize our technologies.

The

Company’s operating subsidiary was incorporated under the laws of the Commonwealth of Pennsylvania in February 1994. We

have been a development-stage company since that time, and have only generated limited revenues to date. Since the Company’s

incorporation we have incurred significant losses. We expect that our expenditures will increase to the extent we seek to continue

to develop strategic partnerships to commercialize our products. We expect these losses to continue until such time, if ever,

as we are able to generate sufficient revenues from the commercial exploitation of our high efficiency and organic photovoltaics

(“OPV”) technologies to support our operations. Our high efficiency and OPV technologies may never be incorporated

in any commercial applications. We have encountered and will continue to encounter risks and difficulties frequently experienced

by early, commercial-stage companies in rapidly evolving industries. If we do not address these risks successfully, our business

will suffer. The Company may never be profitable. We may be unable to satisfy our obligations solely from cash generated from

operations. If, for any reason, we are unable to make required payments under our obligations, one or more of our creditors may

take action to collect their debts. If we continue to incur substantial losses and are unable to secure additional financing,

we could be forced to discontinue or further curtail our business operations; sell assets at unfavorable prices; refinance existing

debt obligations on terms unfavorable to us; or merge, consolidate or combine with a company with greater financial resources

in a transaction that may be unfavorable to us.

Our

inability to achieve and sustain profitability could cause us to go out of business and for our shareholders to lose their entire

investment.

We

are a development-stage company, and have only generated limited revenues to date. We cannot provide any assurance that any of

our business strategies will be successful or that future growth in revenues or profitability will ever be achieved or, if they

are achieved, that they can be consistently sustained or increased on a quarterly or annual basis. If we are unable to grow our

business sufficiently to achieve and maintain positive net cash flow, the Company may not be able to sustain operations and our

investors’ entire investment may be lost.

Our

substantial indebtedness could adversely affect our business, financial condition and results of operations and our ability to

meet our payment obligations.

As

of September 30, 2016, we had total indebtedness of approximately $1.7 million. Our substantial indebtedness could have important

consequences to our stockholders. For example, it could require us to dedicate a substantial portion of our cash flow from operations

to payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures,

research and development efforts and other general corporate purposes; increase our vulnerability to and limit our flexibility

in planning for, or reacting to, changes in our business; place us at a competitive disadvantage compared to our competitors that

have less debt; limit our ability to borrow additional funds, dispose of assets, and make certain investments; and make us more

vulnerable to a general economic downturn than a company that is less leveraged.

A

high level of indebtedness increases the risk that we may default on our debt obligations. Our ability to meet our debt obligations

and to reduce our level of indebtedness will depend on our future performance. General economic conditions and financial, business

and other factors affect our operations and our future performance. Many of these factors are beyond our control. We may not be

able to generate sufficient cash flows to pay the interest on our debt and future working capital, borrowings or equity financing

may not be available to pay or refinance such debt. Factors that will affect our ability to raise cash through an offering of

our capital stock or a refinancing of our debt include financial market conditions, the value of our assets and our performance

at the time we need capital.

Our

business could be adversely affected by general economic conditions which may negatively affect our ability to be profitable.

Our

business could be adversely affected in a number of ways by general economic conditions, including higher interest rates, consumer

credit conditions, unemployment and other economic factors. Changes in interest rates may increase our costs of capital and negatively

affect our ability to secure financing on favorable terms. During economic downturns, we may have greater difficulty in gaining

new customers for our products and services. Our strategies to acquire new customers may not be successful, which, in turn, could

have a material adverse effect on our business, financial condition and results of operations.

The

Company’s access to research facilities, engineers, resources, and equipment depends upon the continued effectiveness of

the Company’s sponsored research partnerships, the termination of which could materially impair the Company’s ability

to continue its business.

The

Company conducts research and development pursuant to sponsored research agreements with the University of Southern California

(“USC”) and the University of Michigan (“Michigan”).

The

Company’s sponsored research agreement with USC covers basic research related to high efficiency thin film solar technologies

and OPV technologies. Michigan is a subcontractor to USC on this research agreement. The agreement extends until January 31, 2021,

but is terminable upon 60 days’ prior written notice in the event that, for reasons outside of the terminating party’s

control, it becomes infeasible to continue the partnership. Pursuant to this agreement, all intellectual property made jointly

by USC, Michigan and Company personnel, or solely by the Company’s personnel using USC or Michigan facilities, resources,

equipment, or funds, will be jointly owned by USC, Michigan and the Company.

On

August 8, 2016, the Company amended this research agreement with USC, suspending the agreement effective as of August 15, 2016.

The amendment was requested by the Company for the purpose of temporarily suspending our OPV-related sponsored research activities

to reduce near-term expenditures while it seeks a development partner for OPV commercialization and allow the Company to bring

its account with USC current through a payment plan. The suspension is to continue until the date that is 30 days after expenses

incurred by USC have been reimbursed by the Company, which expenses will be repaid by the Company to USC in quarterly installments

through February 2018, unless earlier repaid by the Company at its option. The amended agreement provides USC with the option

to terminate the agreement upon any late installment payments.

The

Company’s failure to timely pay any of its installments to USC may result in the termination of its sponsored research agreement

with USC. If the agreement is terminated, the Company will no longer have use of USC’s facilities, equipment and resources

to research and develop its OPV technologies and our ability to generate revenues could be substantially impaired and our business

and financial condition could be materially and adversely impacted.

The

Company established direct agreements with Michigan on June 16, 2016, which were amended on July 21, 2016, to provide engineering

support and facility access associated with technology transfer and commercialization of its high efficiency thin film solar technologies.

The Company’s failure to timely pay any of its installments to Michigan may result in the termination of its sponsored research

agreement with Michigan. If the agreement is terminated, the Company will no longer have use of Michigan’s facilities, equipment

and resources to research and develop its high efficiency technologies and our ability to generate revenues could be substantially

impaired and our business and financial condition could be materially and adversely impacted.

The

Company’s patents depend upon the continued effectiveness of the Company’s license agreement, the termination of which

could materially impair the Company’s ability to continue its business.

Pursuant

to that certain License Agreement, as amended, with USC, Michigan and Princeton University, we have obtained the exclusive worldwide

license and right to sublicense any and all intellectual property resulting from our sponsored research programs. If the License

Agreement expires or is terminated for any reason, including by the Company’s default or breach thereof, our ability to

generate revenues could be substantially impaired and our business and financial condition could be materially and adversely impacted.

The

Company is in arrears on payments to certain critical vendors and may not have sufficient capital to pay such vendors in the future

which could negatively impact the Company’s business.

The

Company is currently in arrears with regard to payments to certain of its vendors and may not have sufficient capital to pay such

vendors in the short term or long term future. If the Company continues to fall behind on these payments and if the Company is

unable to ultimately pay its vendors, the vendors may stop providing critical services to the Company. Additionally, if the Company’s

vendors remain unpaid they may seek to recover payments owed to them by bringing legal claims for such payments against the Company.

The Company may not be able to successfully defend these claims which may lead to the Company being ordered to pay such amounts

by a court of lawful jurisdiction which could have a negative effect on the Company’s business operations.

T

he

success of the Company is dependent in part on market acceptance of thin-film solar technology.

The

success of the Company’s business is dependent in part on market acceptance of thin-film solar technology. Thin-film technology

has a limited operating history making it difficult to predict a level at which the technology is competitive with other energy

sources without government subsidies. If thin-film technology performs below expectations or if it does not achieve cost competitiveness

with conventional or other solar or non-solar renewable energy sources without government subsidies, it could result in the failure

of the technology to be widely adopted in the market. This could significantly affect demand for thin-film solar technologies

and negatively impact our business.

The

Company may never develop or license a product that uses its high efficiency or OPV technologies.

We

have devoted substantially all of our financial resources and efforts to developing our OPV technologies and identifying potential

users of our technologies. Development and commercialization of the photovoltaic (“PV”) technologies is a highly speculative

undertaking and involves a substantial degree of uncertainty. Neither the Company nor anyone else has developed any product that

uses our OPV technologies, nor has the Company licensed its high efficiency or OPV technologies to anyone else who has developed

such a product. The Company may never develop a commercially viable use for those technologies, may never achieve commercially

viable performance for our OPV technologies and may never license our high efficiency or OPV technologies to anyone. Even if the

Company or a licensee of the Company does develop a commercially viable product or use, the product may never become profitable,

either because it is not developed quickly enough, it is not developed to meet industry standards, or because no market for the

product is identified, or otherwise.

Our

business is based on new and unproven technologies, and if our high efficiency or OPV technologies fail to achieve the performance

and cost metrics that we anticipate, then we may be unable to develop demand for our products and generate sufficient revenue

to support our operations.

Our

high efficiency and OPV technologies are new and unproven at commercial scale production, and such technologies may never gain

market acceptance, if they do not compare favorably against competing products on the basis of cost, quality, efficiency and performance.

Our business plan and strategies assume that we will be able to achieve certain milestones and metrics in terms of throughput,

uniformity of cell efficiencies, yield, cost and other production parameters. We cannot assure you that our technologies will

prove to be commercially viable in accordance with our plan and strategies. Further, we or our strategic partners and licensees

may experience operational problems with such technology after its commercial introduction that could delay or defeat the ability

of such technology to generate revenue or operating profits. If we are unable to achieve our targets on time and within our planned

budget, then we may not be able to develop adequate demand for our high efficiency and OPV technologies, and our business, results

of operations and financial condition could be materially and adversely affected.

We

may not reach profitability if our high efficiency and OPV technologies are not suitable for widespread adoption or sufficient

demand for our technologies does not develop or develops slower than we anticipate.

The

extent to which solar PV products based on our technologies will be widely adopted is uncertain. If our high efficiency and OPV

technologies prove unsuitable for widespread adoption or demand for our high efficiency and OPV technologies fails to develop

sufficiently, we may be unable to grow our business or generate sufficient revenue from operations to reach profitability or maintain

our business. In addition, demand for solar modules in our targeted markets may not develop or may develop to a lesser extent

than we anticipate. Many factors may affect the viability of widespread adoption of solar PV technology and demand for our high

efficiency and OPV products, including the following:

|

|

●

|

performance

and reliability of solar modules and thin film technology compared with conventional and other non-solar renewable energy sources

and products;

|

|

|

●

|

cost-effectiveness

of solar modules compared with conventional and other non-solar renewable energy sources and products;

|

|

|

●

|

availability

of government subsidies and incentives to support the development of the solar PV industry;

|

|

|

●

|

success

of other renewable energy generation technologies, such as hydroelectric, wind, geothermal, solar thermal, concentrated

PV

and biomass;

|

|

|

●

|

fluctuations

in economic and market conditions that affect the viability of conventional and non-solar renewable energy sources, such as increases

or decreases in the price of oil and other fossil fuels;

|

|

|

●

|

fluctuations

in economic and market conditions that affect the viability of conventional and non-solar renewable energy sources, such as increases

or decreases in the price of oil and other fossil fuels; and

|

|

|

●

|

deregulation

of the electric power industry and the broader energy industry.

|

If

we do not reach profitability because our PV technology is not suitable for widespread adoption or due to insufficient demand

for solar PV modules, our financial condition and business could be materially and adversely affected.

The

Company’s intellectual property rights with regard to its high efficiency and OPV technologies may be challenged.

Pursuant

to the license agreement, the Company has obtained exclusive rights to an extensive portfolio of issued and pending U.S. patents,

plus their foreign counterparts relating to advanced thin-film PV technologies. The Company may obtain rights to additional patents

and patent applications under its Sponsored Research Agreements. However, additional patent applications may never be filed and

the Company may never obtain any rights to such applications. Any patent applications now pending or filed in the future may not

result in patents being issued. Any patents now licensed to the Company, or licensed to us in the future, may not provide the

Company with any competitive advantages or prove enforceable. The Company’s rights to these patents may be challenged by

third parties. The cost of litigation to uphold the validity, or to prevent infringement of patents and to enforce licensing rights

can be substantial and beyond the Company’s financial means. Furthermore, others may independently develop similar technologies

or duplicate our high efficiency and OPV technologies licensed to the Company or design around the patented aspects of such technology.

In addition, there can be no assurance that the products and technologies the Company will seek to commercialize will not infringe

patents or other rights owned by others, or that licenses for other’s technology will be available.

Our

success is dependent on key personnel of the company, whom we may not be able to retain or hire.

Our

business relies heavily on the efforts and talents of our researchers and our management. The development and application of our

technologies originated and will greatly depend on the research by Dr. Mark E. Thompson and Dr. Stephen R. Forrest. None of our

researchers or executives is currently insured for the benefit of the Company by key man life insurance. The loss of the services

of any of these persons could result in material adverse effect to the development and commercialization of our technologies.

Competition for experienced researchers and management personnel in the PV sector is intense, the pool of qualified candidates

is very limited, and we may not be able to attract qualified candidates or retain the services of those already engaged, which

could significantly negatively impact our business.

We

may be unable to protect our intellectual property rights or keep up with that of our competitors

.

We

regard our intellectual property rights as highly valuable to our business strategy, and intend to rely on the maximum protection

provided by law to protect our rights. We have entered into and continue to use confidentiality agreements with our employees

and contractors and, to the extent practicable, nondisclosure agreements with our suppliers and strategic partners in order to

limit access to and disclosure of our information. We cannot be sure that these contractual arrangements or the other steps taken

by us to protect our intellectual property will prove sufficient to prevent misappropriation of our technology or deter independent

third-party development of similar technologies. Our failure to protect our intellectual property rights could put us at a competitive

disadvantage in the future. Any such failure could have a materially adverse effect on our future business, results of operations

and financial condition. We intend to defend vigorously our intellectual property against any known infringement, but such actions

could involve significant legal fees, and we have no guarantee that such actions will be resolved in our favor. We also cannot

be sure that any steps taken by us will be adequate to prevent misappropriation or infringement of our intellectual property.

We

also intend to sell and/or license our products and technology in countries worldwide, including some with limited ability to

protect intellectual property of products and services sold in those countries by foreign firms. We cannot be sure that the steps

taken by us will be adequate to prevent misappropriation or infringement of our intellectual property in these countries.

We

may not have sufficient funds and may need additional capital to protect and maintain our intellectual property rights.

The

Company’s sponsored research has resulted in an extensive portfolio of issued and pending U.S. patents, plus their foreign

counterparts, which are in the names of our sponsored research partners, USC, Michigan, and Princeton. The Company has the exclusive

commercial rights to these intellectual property rights and the obligation to maintain, defend and fund the defense of these patents.

The Company has only generated limited revenues from its operating business and it expects to have limited cash flow in the near

future. In the event of filing infringement lawsuits or defending any infringement suits that are filed against the Company, relevant

expenses and fees will increase substantially and could harm our profitability. We may need to raise additional funds to protect

and maintain our intellectual property rights.

If

we are unable to successfully maintain or license existing patents, our ability to generate revenues could be substantially impaired.

Our

business model is to license or sublicense our proprietary high efficiency and OPV technologies to industry partners and customers,

and the Company is currently entitled to the exclusive right to sub-license an extensive portfolio of issued and pending U.S.

patents, plus their foreign counterparts. Our ability to be successful in the future therefore will depend on our continued efforts

and success in licensing existing patents, including maintaining and prosecuting our patents properly. If we are unable to successfully

maintain and license our existing patents, our ability to generate revenues could be substantially impaired and our business and

financial condition could be materially and adversely impacted.

Our

insurance coverage may be inadequate to cover all significant risk exposures.

We

will be exposed to liabilities that are unique to the products we provide. While we intend to maintain insurance for certain risks,

the amount of our insurance coverage may not be adequate to cover all claims or liabilities, and we may be forced to bear substantial

costs resulting from risks and uncertainties of our business. It is also not possible to obtain insurance to protect against all

operational risks and liabilities. The failure to obtain adequate insurance coverage on terms favorable to us, or at all, could

have a material adverse effect on our business, financial condition, results of operations and prospects.

If

we fail to establish and maintain an effective system of internal control, we may not be able to report our financial results

accurately or to prevent fraud. Any inability to report and file our financial results accurately and timely could harm our reputation

and adversely impact the trading price of our common stock.

Effective

internal control is necessary for us to provide reliable financial reports and prevent fraud. The Company currently does not have

an audit committee. As a result, our small size and any current internal control deficiencies may adversely affect our financial

condition, results of operation and access to capital. We have not performed an in-depth analysis to determine if historical un-discovered

failures of internal controls exist, and may in the future discover areas of our internal control that need improvement. If we

cannot provide reliable financial reports or prevent fraud, we may not be able to manage our business as effectively as we would

if an effective control environment existed, and our business and reputation with investors may be harmed.

Risks

Relating to Our Industry

Our

industry has historically been cyclical and experienced periodic downturns.

Our

future success partly depends on continued demand for solar PV systems in the solar energy markets, including in the United States

and internationally. The solar equipment industry has historically been cyclical and has experienced periodic downturns which

may affect the demand for our solar technologies. The solar industry has undergone challenging business conditions, including

downward pricing pressure for PV modules, mainly as a result of overproduction, and reductions in applicable governmental subsidies,

contributing to demand decreases. There is no assurance that the solar industry will not suffer significant downturns in the future,

which may adversely affect demand for our solar technologies and our operations.

Existing

regulations and policies and changes to these regulations and policies may present technical, regulatory and economic barriers

to the purchase and use of solar PV products, which may significantly reduce demand for our technologies.

The

market for electricity generation products is heavily influenced by foreign, federal, state and local government regulations and

policies concerning the electric utility industry, utility rates, and internal policies of electric utilities. These regulations

and policies often relate to electricity pricing and technical interconnection of customer-owned electricity generation. In the

United States and in a number of other countries, these regulations and policies have been, and continue to be, continuously modified.

The market for electric generation equipment is also influenced by trade and local content laws, regulations and policies. These

regulations and policies could deter end-user purchases of PV products and investment in the research and development of PV technology.

For example, without a mandated regulatory exception for PV systems, utility customers are often charged interconnection or standby

fees for putting distributed power generation on the electric utility grid. If these interconnection standby fees were applicable

to PV systems, it is likely that they would increase the cost to our end-users of using PV systems which could make them less

desirable, thereby harming our business, prospects, results of operations and financial condition. In addition, electricity generated

by PV systems mostly competes with expensive peak hour electricity, rather than the less expensive average price of electricity.

Modifications to the peak hour pricing policies of utilities, such as to a flat rate for all times of the day, would require PV

systems to achieve lower prices in order to compete with the price of electricity from other sources.

The

Company has not yet introduced commercial products and, as such, has not commenced any governmental approval process. The applicability

and extent of government approval requirements will depend on the particular end-market. Successful introduction of our products

into certain markets may require significant government testing and evaluation prior to high volume procurement. We anticipate

that the installation of products based on our high efficiency and OPV technologies will be subject to oversight and regulation

in accordance with national and local ordinances relating to building codes, safety, environmental protection, utility interconnection

and metering and related matters. It is difficult to track the requirements of individual states and design equipment to comply

with the varying standards. In addition, the U.S., European Union and Chinese governments, among others, have imposed tariffs

or are in the process of evaluating the imposition of tariffs on solar panels, solar cells, polysilicon, and potentially other

components. These tariffs may increase the price of our solar products, which could harm our results of operations and financial

condition. Any new government regulations or utility policies pertaining to our solar modules may result in significant additional

expenses to us, our resellers and their customers and, as a result, could cause a significant reduction in demand for our solar

modules.

The

solar energy industry depends, in part, on continued support in the form of rebates, tax credits and other incentives from federal,

state and local governments. An elimination or reduction of these rebates, tax credits and other incentives could negatively impact

the Company’s ability to successfully introduce products and secure capital.

Federal,

state and local governments currently provide tax credits, rebates, and other incentives to owners, users, and manufacturers of

solar energy. Any elimination or reduction of such incentives would increase the cost of solar energy, which would negatively

impact the Company’s ability to introduce products and secure necessary capital. The federal government currently provides

a 30% federal tax credit (the “ITC”) for solar systems installed on residential and commercial properties under Sections

25(d) and 48(a) of the Internal Revenue Code, respectively. In December 2015, legislation was signed into law extending the 30%

ITC for both residential and commercial projects through the end of 2019; after which the ITC drops to 26% in 2020 and 22% in

2021 before dropping permanently to 10% for commercial projects and 0% for residential projects. Unless modified by a further

change in law, the reduction of the ITC may negatively impact the demand for our solar products and our ability to obtain financing

support.

Environmental

obligations and liabilities could have a substantial negative impact on our business and financial condition.

The

solar energy industry is subject to heavy laws, rules and regulations, some of which pertain to environmental concerns. The solar

energy industry can involve the use handling, generation, processing, storage, transportation, and disposal of hazardous materials

which are subject to extensive environmental laws and regulations at the national, state, local, and international levels. These

environmental laws and regulations include those governing the discharge of pollutants into the air and water, the use, management,

and disposal of hazardous materials and wastes, the cleanup of contaminated sites, and occupational health and safety. As the

Company proceeds to seek to develop and commercialize its solar technologies, we and our potential license partners will have

to comply with applicable environmental requirements, future developments such as more aggressive enforcement policies, the implementation

of new, more stringent laws and regulations, or the discovery of presently unknown environmental conditions may require expenditures

that could have a material adverse effect on our business, results of operations, and financial condition.

Competition

is intense in the energy industry.

The

global energy industry is presently dominated by hydrocarbon, hydroelectric and nuclear-based technologies, and therefore our

solar energy-based technologies will primarily compete against the providers of these established energy sources. However, we

also compete directly against large multinational corporations (including global energy suppliers and generators) and numerous

small entities worldwide that are pursuing the development and commercialization of renewable and non-renewable technologies that

might have performance and/or price characteristics similar or even superior to our high efficiency and OPV technologies. Most

of our current competitors are significantly larger and have substantially greater market presence as well as greater financial,

technical, operational, marketing and other resources and experience than we do. We also expect that new competitors are likely

to join existing competitors in this industry.

The

Company’s attempt to develop commercially viable technologies based on Company-funded research will also encounter competition

from other academic institutions and/or governmental laboratories, which are conducting or funding research in alternative technologies

similar to our high efficiency and OPV technologies. These academic institutions and/or governmental laboratories likely will

have financial resources substantially greater than the resources available to the Company. Given the foregoing competitive environment,

the Company cannot determine at this time whether it will be successful in its development and commercialization efforts or whether

such efforts, even if successful, will be commercially viable and profitable.

There

is competition between manufacturers of crystalline silicon solar modules, as well as thin-film solar modules and solar thermal

and concentrated PV systems. If global supply exceeds global demand, it could lead to a reduction in the demand and price for

PV modules, which could adversely affect our business.

The

solar energy and renewable energy industries are highly competitive and continually evolving as participants strive to distinguish

themselves within their markets and compete with the larger electric power industry. Within the global PV industry, there is competition

from crystalline silicon solar module manufacturers, other thin-film solar module manufacturers and companies developing solar

thermal and concentrated PV technologies. Existing or future solar manufacturers might be acquired by larger companies with significant

capital resources, thereby intensifying competition. This intensified competition can lead to a large amount of supply which can

exceed the demand. Even if demand for solar modules continues to grow, the rapid manufacturing capacity expansion undertaken by

many solar module manufacturers, particularly manufacturers of crystalline silicon solar modules, has created and may continue

to cause periods of structural imbalance during which supply exceeds demand. We anticipate that competitors will continue to develop

competing solar PV technologies and will attempt to commercialize these technologies. If these competing technologies present

a compelling value proposition or are available to market sooner than our technologies, then our market opportunity could diminish.

Our

business and financial results may be harmed as a result of increases in materials and component costs.

The

cost of raw materials and key components associated with our technologies could increase in the future due to a variety of factors,

including trade barriers, export regulations, regulatory or contractual limitations, industry market requirements and changes

in technology and industry standards. If we are unable to adjust our cost structure in the future to deal with potential increases

in costs, we may not be able to achieve profitability, which could have a material adverse effect on our business and prospects.

Developments

in alternative technologies or improvements in distributed solar energy generation may have a material adverse effect on our business.

Significant

developments in alternative technologies, such as advances in other forms of distributed solar PV power generation, storage solutions

such as batteries, the widespread use or adoption of fuel cells for residential or commercial properties or improvements in other

forms of centralized power production may have a material adverse effect on our business and prospects. Any failure by us to adopt

new or enhanced technologies or processes, or to react to changes in existing technologies, could result in product obsolescence,

the loss of competitiveness of our products and lack of revenues.

A

drop in the retail price of conventional energy or non-solar alternative energy sources may negatively impact our profitability.

We

believe that an end customer’s decision to purchase or install solar energy is primarily driven by the cost and return on

investment resulting from solar energy. Fluctuations in economic and market conditions that affect the prices of conventional

and non-solar alternative energy sources, such as decreases in the prices of oil, natural gas, and other fossil fuels, could cause

the demand for solar power systems to decline, which would have a negative impact on our business.

Risks

Relating to Our Securities

An

investment in the Company’s common stock is extremely speculative and there can be no assurance of any return on any such

investment.

An

investment in the Company’s common stock is extremely speculative and there is no assurance that investors will obtain any

return on their investment. Investors will be subject to substantial risks involved in an investment in the Company, including

the risk of losing their entire investment.

The

market price of our common stock is subject to significant fluctuations in response to variations in our quarterly operating results,

general trends in the market and other factors, many of which we have little or no control over. In addition, broad market fluctuations,

as well as general economic, business and political conditions, may adversely affect the market for our common stock, regardless

of our actual or projected performance.

Our

shares are subject to the Securities and Exchange Commission’s “penny stock” rules that limit trading activity

in the market, which may make it more difficult for our shareholders to sell their common stock.

Penny

stocks generally are equity securities with a price of less than $5.00. Since our common stock is trading at less than $5.00 per

share, we are subject to the penny stock rules adopted by the Securities and Exchange Commission that require broker-dealers to

deliver extensive disclosure to its customers prior to executing trades in penny stocks not otherwise exempt from the rules. The

broker-dealer must also provide its customers with current bid and offer quotations for the penny stock, the compensation of the

broker-dealer and its salesperson in the transaction, and monthly account statements showing the market value of each penny stock

held by the customer. Under the penny stock regulations, a broker-dealer selling a penny stock to anyone other than an established

customer or accredited investor must make a special suitability determination regarding the purchaser and must receive the purchaser’s

written consent to the transaction prior to the sale, unless the broker-dealer is otherwise exempt. Generally, an individual with

a net worth in excess of $1,000,000, or annual income exceeding $200,000 individually, or $300,000 together with his or her spouse,

is considered an accredited investor. The additional burdens from the penny stock requirements may deter broker-dealers from effecting