Prospectus Filed Pursuant to Rule 424(b)(3) (424b3)

November 30 2016 - 12:06PM

Edgar (US Regulatory)

|

|

|

|

|

|

Supplement dated November 28, 2016

to term sheet dated October 27, 2016,

product supplement EQUITY INDICES SUN-1

dated

June 25, 2015, prospectus supplement dated April 30, 2015 and

prospectus dated April 30, 2015 (together, the “Note

Prospectus”)

|

|

|

Filed pursuant to Rule 424(b)(3)

Registration Statement No. 333-202584

|

|

Canadian Imperial Bank of Commerce

Market-Linked Step Up Notes

Linked to the Dow Jones Industrial Average

®

, due October 25, 2019

CUSIP: 13607R530

(the

“notes”)

This document (the “supplement”) supplements the Note Prospectus in connection with any secondary market transactions in

the notes by us, Merrill Lynch, Pierce, Fenner & Smith Incorporated and any of our respective affiliates. Capitalized terms used but not defined in this supplement have the meanings set forth in the Note Prospectus.

The Starting Value for the notes was defined in the final term sheet dated October 27, 2016 (the “Final Term Sheet”). The Starting Value was

defined as the lowest closing level of the Market Measure on any Market Measure Business Day (subject to adjustment as set forth in the Final Term Sheet) during the Starting Value Determination Period. The closing level of the Market Measure on

October 27, 2016, the first day of the Starting Value Determination Period, was 18,169.68.

The Starting Value Determination Period expired on

November 28, 2016. The lowest closing level of the Market Measure on any Market Measure Business Day during the Starting Value Determination Period was 17,888.28, which was the closing level of the Market Measure on November 4, 2016. This

closing level is less than 18,169.68.

Therefore, the Starting Value and the Threshold Value for the notes is 17,888.28, and the Step Up Value is

21,376.49 (119.50% of the Starting Value, rounded to two decimal places).

Documentation

You should read this supplement, together with the documents listed below, which together contain the terms of the notes and supersede all prior or

contemporaneous oral statements as well as any other written materials. You should carefully consider, among other things, the matters set forth in the “Risk Factors” sections beginning on page TS-6 of the Final Term Sheet, page PS-7 of

product supplement EQUITY INDICES SUN-1, page S-1 of the prospectus supplement, and page 1 of the prospectus, as the notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax,

accounting, and other advisors before you invest in the notes.

You may access these documents on the Securities and Exchange Commission (“SEC”) website at www.sec.gov

as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

|

•

|

|

Final Term Sheet dated October 27, 2016:

|

|

|

https://www.sec.gov/Archives/edgar/data/1045520/000119312516753131/d283038d424b2.htm

|

|

•

|

|

Product supplement EQUITY INDICES SUN-1 dated June 25, 2015:

|

|

|

http://www.sec.gov/Archives/edgar/data/1045520/000119312515234031/d945997d424b2.htm

|

|

•

|

|

Prospectus supplement dated April 30, 2015 and prospectus dated April 30, 2015:

|

|

|

http://www.sec.gov/Archives/edgar/data/1045520/000119312515161379/d916405d424b3.htm

|

Our Central Index

Key, or CIK, on the SEC website is 1045520. Unless otherwise indicated or unless the context requires otherwise, all references in this supplement to “we,” “us,” “our,” or similar references are to Canadian Imperial

Bank of Commerce.

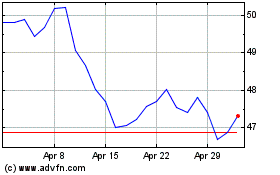

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Canadian Imperial Bank o... (NYSE:CM)

Historical Stock Chart

From Apr 2023 to Apr 2024