President-elect Donald Trump will name longtime banker and

former Goldman Sachs executive Steven Mnuchin as Treasury

secretary, turning to a campaign loyalist and fundraiser for the

incoming administration's top economic cabinet post, a transition

official said Tuesday.

Mr. Mnuchin built his career sniffing out undervalued assets and

converting them into massive profits. But perhaps his greatest

trade just came in the political arena.

Mr. Mnuchin, 53, a former Goldman Sachs Group Inc. banker turned

Hollywood financier, parlayed a six-month stint as Donald Trump's

campaign finance chair into the president-elect's pick to be

Treasury secretary.

Mr. Mnuchin's Wall Street pedigree presents a contrast with the

populist themes Mr. Trump struck in his campaign, railing against

big banks and vowing to close tax loopholes that benefit hedge

funds. Mr. Trump also repeatedly attacked his rivals in the primary

and general elections for their Wall Street ties, especially those

connected to Goldman Sachs.

Mr. Mnuchin's links to the world of high finance, in particular

Goldman, go back to before he was born. His father, Robert Mnuchin,

started at Goldman in 1957 and spent his entire Wall Street career

at the firm. The elder Mr. Mnuchin was among those who pioneered

block trading, the buying or selling of large numbers of shares at

once. Steven's brother Alan also worked at Goldman.

"He's a person of great integrity," the elder Mr. Mnuchin said

of his son. "[We] expect he will do a good job in this very

exciting and demanding position."

If confirmed by the Senate as Treasury secretary, Mr. Mnuchin

will join a list of prominent bankers who made similar moves from

Wall Street to Washington, including two of his former bosses at

Goldman, Henry Paulson and Robert Rubin, who were both top Goldman

executives before running Treasury.

Despite his successful Wall Street career, Mr. Mnuchin has no

experience running a massive organization—the Treasury Department

has 86,000 employees—or in economic or financial policy-making. The

biggest entity Mr. Mnuchin has run was the technology division of

Goldman, which had over 5,000 employees.

Mr. Mnuchin's acquaintances describe him as smart, with several

people calling him "nerdy." He regularly attends New York

philanthropic galas. He has long held high-profile positions on

charity boards and is a former director of the Whitney Museum of

American Art. At an event for New York charity City Harvest in

2006, Mr. Mnuchin and his ex-wife were photographed with Mr. Trump.

Mr. Mnuchin is now engaged to Scottish actress Louise Linton.

Mr. Mnuchin joined Goldman in 1985. He worked in the

fixed-income department, eventually overseeing trading in

mortgages, U.S. government, money market and municipal bonds. He

made partner in 1994. Mr. Mnuchin later became the firm's chief

information officer.

When Goldman converted into a publicly traded company in 1999,

Mr. Mnuchin, like other partners, made millions. He later bought a

6,500-square-foot apartment in 740 Park Avenue, a storied Manhattan

co-op built by Jackie Kennedy's grandfather that is known as the

"billionaires' building."

At a recent conference, Goldman CEO Lloyd Blankfein called Mr.

Mnuchin a "highflier, a partner at a young age. He did very well.

He is a smart, smart guy."

In 2002, Mr. Mnuchin left Goldman and later was hired to run a

credit fund set up by billionaire George Soros.

In 2004, Mr. Mnuchin and two former Goldman colleagues founded

hedge fund Dune Capital Management LP with financial backing from

Mr. Soros. Dune soon expanded into the entertainment business,

striking up a film-financing deal with a unit of 21st Century Fox.

Among the films Dune financed was "Avatar," one of the all-time box

office hits.

21st Century Fox and News Corp, parent company of The Wall

Street Journal, share common ownership.

In 2008, IndyMac Bank in Pasadena, Calif., collapsed in one of

the largest bank failures in U.S. history. Mr. Mnuchin led a group

of investors, including funds run by Mr. Soros and other hedge-fund

and private-equity titans, who bought it from the government for

about $1.5 billion. The Federal Deposit Insurance Corporation

agreed to cover a portion of any future loan losses, a lucrative

arrangement for Mr. Mnuchin and his partners. Regulators who

negotiated with Mr. Mnuchin found him to be the kind of

detail-oriented person who would "know the cost of every pencil,"

according to a person familiar with their thinking.

Mr. Mnuchin, who became chairman of the renamed OneWest Bank and

CEO of its parent company, relocated to Los Angeles and bought a

mansion in the Bel Air neighborhood.

The deal soon became controversial. In 2011, community activists

descended on Mr. Mnuchin's Bel Air home to protest over the

possible eviction of a homeowner who was behind on her mortgage

payments to OneWest.

In 2014, OneWest was sold to CIT Group Inc., earning Mr. Mnuchin

and Dune hundreds of millions of dollars in profits, according to a

person familiar with the matter. He later pocketed $10.9 million in

severance payouts when he left the company.

Despite the huge profits, OneWest's legacy continues to trail

Mr. Mnuchin, who now sits on CIT's board and owns more than 1% of

its shares.

A portion of OneWest's mortgage business is under investigation

by the Department of Housing and Urban Development. Last July, CIT

said it was forced to take a $230 million charge as it cleaned up

accounting problems at OneWest. And two California housing groups

this month accused OneWest of discriminating against minorities by

not putting branches in their communities.

Meanwhile, 14 years after leaving Goldman, Mr. Mnuchin remains

in the firm's orbit, showing up at alumni events and involving

other ex-Goldman executives in his finance deals.

He has continued to work those angles as Mr. Trump's finance

chairman, a post he assumed in May. Mr. Mnuchin negotiated a joint

fundraising agreement with the Republican National Committee,

easing the way for major donors to give both to the party and to

Mr. Trump. The committee's chairman, Lewis Eisenberg, is a Goldman

veteran and contemporary of Mr. Mnuchin's father.

Write to Anupreeta Das at anupreeta.das@wsj.com and Rachel

Louise Ensign at rachel.ensign@wsj.com

(END) Dow Jones Newswires

November 29, 2016 18:55 ET (23:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

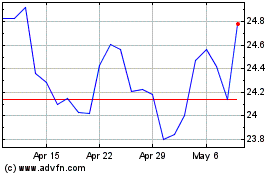

News (NASDAQ:NWSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

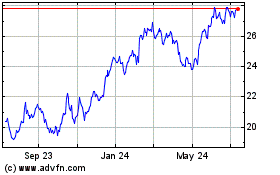

News (NASDAQ:NWSA)

Historical Stock Chart

From Apr 2023 to Apr 2024