FORM

6-K

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Report of Foreign Private

Issuer

Pursuant to Rule

13a-16 or 15d-16 of

the Securities Exchange

Act of 1934

For the month of November

2016

Commission File Number:

001-34848

SEANERGY

MARITIME HOLDINGS CORP.

(Translation of registrant's

name into English)

16 Grigoriou Lambraki Street

166 74 Glyfada

Athens, Greece

(Address of principal executive

office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F [X] Form 40-F

[ ]

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ___

Note: Regulation S-T Rule 101(b)(1) only permits

the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is

submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)7: ___

Note: Regulation S-T Rule 101(b)(7) only permits

the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer

must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized

(the registrant's "home country"), or under the rules of the home country exchange on which the registrant's securities

are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed

to the registrant's security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission

or other Commission filing on EDGAR.

INFORMATION CONTAINED

IN THIS FORM 6-K REPORT

This

Report on Form 6-K is being filed by Seanergy Maritime Holdings Corp. (the “Company”) to:

(1)

Report certain recent developments relating to the Company as follows:

On

September 26, 2016, the Company entered into agreements with an unaffiliated third party for the purchase of two secondhand Capesize

vessels, or the Additional Vessels, for a gross purchase price of $20.75 million per vessel. Under the agreements, the Company

was required to make a $4.2 million deposit. This deposit was funded with proceeds from a loan facility, originally entered into

October 4, 2016, with Jelco Delta Holding Corp., or Jelco, which is an entity affiliated with the Company’s principal shareholder.

This loan facility as it is amended from time to time is referred to as the Jelco Loan Facility. The Additional Vessels are expected

to be delivered between the end of November 2016 and mid December 2016, subject to the satisfaction of certain customary closing

conditions. The Company expects to fund the balance of the aggregate purchase price for the Additional Vessels with an additional

$5.3 million from the Jelco Loan Facility (for a total of $9.5 million borrowed under the Jelco Loan Facility in connection with

the purchase of the Additional Vessels), $29 million from a new secured loan facility with Northern Shipping Fund III LP, or NSF,

and $3 million of cash on hand.

On

October 4, 2016, the Company entered into the Jelco Loan Facility, initially a $4.2 million loan facility with Jelco to fund the

initial deposit for the Additional Vessels. On November 17, 2016 and November 28, 2016, the Company entered into amendments to

the Jelco Loan Facility, which, among other things, increased the aggregate amount that may be borrowed under the facility to up

to $12.8 million and extended the maturity date to the earlier of (i) February 28, 2018 and (ii) the date falling 14 months from

the final drawdown date, and the maturity date may, in certain circumstances, be extended to the earlier of (i) February 28, 2019

and (ii) the date falling 26 months from the final drawdown date. The Jelco Loan Facility bears interest at LIBOR plus a margin

of 9% and is repayable in one bullet payment together with accrued interest thereon on the maturity date. The margin may be decreased

to LIBOR plus 7% upon a $5 million prepayment by the Company. The Jelco Loan Facility further provides that the Company is required

to prepay Jelco (i) in the event of any public offering by the Company of its common shares, in an amount equal to 25 percent of

the net offering proceeds and (ii) $1.9 million upon the delivery of the second of the Additional Vessels. The Jelco Loan Facility

is secured by second priority mortgages and general assignments covering earnings, insurances and requisition compensation on the

Additional Vessels, and the vessel owning subsidiaries that will acquire the Additional Vessels have provided a guarantee to Jelco

for the Company’s obligations under this facility. On November 28, 2016, the Company drew down $8.7 million under the Jelco

Loan Facility. As of November 29, 2016, $12.8 million was outstanding under the Jelco Loan Facility.

On

November 18, 2016, the Company entered into a securities purchase agreement with unaffiliated third party institutional investors,

under which the Company sold 1,305,000 of its common shares in a registered direct offering at a public offering price of $2.75

per share. The net proceeds from the sale of the common shares, after deducting fees and expenses, were approximately $3.2 million.

The offering closed on November 23, 2016.

On

November 28, 2016, the Company entered into a $32 million secured term loan facility with NSF to partly finance the acquisition

of the Additional Vessels. The facility bears interest at 11% per annum, which is payable quarterly, and the principal is repayable

in four consecutive quarterly instalments of $900,000 each, commencing on March 31, 2019 and a final payment of $28.4 million due

on December 31, 2019, which is the initial maturity date assuming that the borrowers do not choose to extend the facility for one

or two maximum yearly periods. The facility may only be extended twice so that the final maturity date shall never extend beyond

the date falling on the fifth anniversary of the final drawdown date. The option to extend the facility for up to two years from

the initial maturity date is subject to an extension fee of 1.75% per extended year. The borrowers under the facility are the Company’s

applicable vessel-owning subsidiaries. The facility is secured by first priority mortgages and general assignment covering earnings,

insurances and requisition compensation over the Additional Vessels, account pledge agreements, share pledge agreements of the

Company’s two vessel-owning subsidiaries, a commercial manager undertaking and a technical manager undertaking. The facility

also imposes certain operating and financing covenants. Certain of these covenants may significantly limit or prohibit, among other

things, the borrowers’ ability to incur additional indebtedness, create liens, engage in mergers, or sell vessels without

the consent of the relevant lenders. Certain other covenants require ongoing compliance, including requirements that (i) the Company

maintain restricted deposits of $3 million as prepaid interest to be applied equally against the first eight quarterly interest

payments of the facility, the first instalment to commence 3 months from the second drawdown date (ii) the Company maintain an

asset coverage ratio with respect to the Additional Vessels equal to at least 112.5% and (iii) the borrowers accumulate in each

of their earnings accounts within 3 months from each Advance relevant drawdown date, and maintain throughout the security period,

a minimum amount of at least $250,000 per Additional Vessel, or $500,000 in total. On November 28, 2016, the Company drew down

$7.5 million under the NSF loan facility. As of November 29, 2016, $7.5 million is outstanding under the facility.

(2) Report the capitalization of the Company as of June 30,

2016:

The following table sets forth the Company’s

capitalization as of June 30, 2016:

|

|

•

|

on an actual basis; and

|

|

|

|

|

|

|

•

|

on an as adjusted basis, to give effect to (a) $4.1 million of net proceeds from the Company’s registered direct offering on August 10, 2016 of 1,180,000 common shares, (b) an installment repayment of $0.1 million on September 19, 2016 under the Company’s March 2015 Alpha Bank A.E. Loan Facility, (c) a $4.2 million drawdown under the Jelco Loan Facility to fund the initial deposit related to the Additional Vessels, (d) $3.2 million of net proceeds from the Company’s registered direct offering on November 23, 2016 of 1,305,000 common shares, (e) a $8.7 million drawdown on November 28, 2016 under the Jelco Loan Facility, $5.3 million of which the Company expects to use to fund a portion of the aggregate purchase price of the Additional Vessels and (f) a $7.5 million drawdown under the Company’s November 28, 2016 secured loan facility with NSF to fund a portion of the aggregate purchase price of the Additional Vessels.

|

|

(All figures in thousands of U.S. dollars, except for share amounts)

|

Actual

|

As Adjusted

(unaudited)

|

|

|

Debt:

|

|

|

|

|

|

|

|

|

|

Secured long-term debt, net of deferred finance costs

|

|

177,090

|

|

|

197,290

|

|

|

|

|

Unsecured convertible promissory notes

|

|

510

|

|

|

510

|

|

|

|

|

Total Debt

|

|

177,600

|

|

|

197,800

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock, $0.0001 par value; 25,000,000 shares authorized; none issued

|

|

—

|

|

|

—

|

|

|

|

|

Common stock, $0.0001 par value; 500,000,000 authorized shares as at June 30, 2016; 19,514,410 shares issued and outstanding as at June 30, 2016; 21,999,410 shares issued and outstanding as adjusted

|

|

2

|

|

|

2

|

|

|

|

|

Additional paid-in capital (excluding shareholder’s convertible notes)

|

|

321,635

|

|

|

328,950

|

|

|

|

|

Shareholder’s convertible notes

|

|

24,965

|

|

|

24,965

|

|

|

|

|

Accumulated deficit

|

|

(325,698

|

)

|

|

(325,698

|

)

|

|

|

|

Total equity

|

|

20,904

|

|

|

28,219

|

|

|

|

|

Total capitalization

|

|

198,504

|

|

|

226,019

|

|

|

|

(3) Attach as exhibits to this Report on Form 6-K copies

of the following:

|

Exhibit 10.1

|

Amended and Restated Loan Agreement dated November

28, 2016 between Seanergy Maritime Holdings Corp. and Jelco Delta Holding Corp.

|

|

|

|

|

Exhibit 10.2

|

Loan Agreement dated November 28, 2016 between Lord

Ocean Navigation Co., Knight Ocean Navigation Co. and Northern Shipping Fund III LP

|

|

|

|

This Report on Form 6-K and the exhibits

attached hereto are hereby incorporated by reference into the Company’s registration statement on Form F-3 (File No. 333-205301)

filed with the U.S. Securities and Exchange Commission with an effective date of August 14, 2015.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

|

|

SEANERGY MARITIME HOLDINGS CORP.

(Registrant)

|

|

Dated: November 29, 2016

|

|

|

|

/s/ Stamatios Tsantanis

By: Stamatios Tsantanis

Chief Executive Officer

|

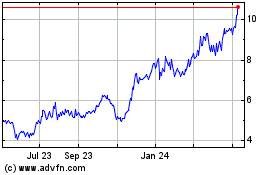

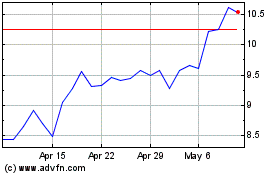

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Seanergy Maritime (NASDAQ:SHIP)

Historical Stock Chart

From Apr 2023 to Apr 2024