Microchip Technology Increases Guidance for Non-GAAP Net Sales and Non-GAAP EPS for Third Quarter of Fiscal 2017

November 29 2016 - 4:15PM

(NASDAQ:MCHP) - Microchip Technology Incorporated, a leading

provider of microcontroller, mixed signal, analog and Flash-IP

solutions, today improved the range of its prior guidance for

non-GAAP net sales and non-GAAP earnings per share for its fiscal

third quarter of 2017 ending December 31, 2016. Microchip

previously provided guidance on November 7, 2016 for consolidated

non-GAAP net sales to be flat to down 6% with a mid-point of down

3%. Microchip now expects consolidated non-GAAP net sales to

be down 1% to 4% with a mid-point of down 2.5% and non-GAAP

earnings per share to be between 87 cents and 94 cents per

share. The original guidance for non-GAAP earnings per share

was between 85 cents and 95 cents per share. Due to

Microchip’s recent acquisition of Atmel and the related purchase

accounting, Microchip is not able to provide GAAP guidance at this

time.

“Our business through the first eight weeks of the December 2016

quarter is tracking modestly above our November 7, 2016 guidance,”

said Steve Sanghi, Microchip’s CEO. “Furthermore, the

integration activities associated with our acquisitions of Atmel

and Micrel continue to make significant progress. Micrel’s

6-inch fab in San Jose is now closed which we expect to drive

significant gross margin benefits after the higher cost inventory

from that factory is sold through and our lower costs from our

higher volume factories are realized. The integration of

Atmel continues to progress as we approach a major milestone of

integrating business systems on January 1, 2017.”

“With the continued execution of our integration activities and

operational improvements for our business we are on track to

realize our long term business model of 33% non-GAAP operating

income by the fourth quarter of fiscal 2018,” concluded Mr.

Sanghi.

There will be no conference call associated with this press

release. Microchip’s CEO, Steve Sanghi, is presenting at the

Credit Suisse 20th Annual TMT Conference tomorrow, Wednesday,

November 30, 2016. A live webcast and replay of the

presentation will be available at www.microchip.com.

Cautionary Statement:

The statements in this release relating to expecting our

non-GAAP net sales to be down 1% to 4% with a mid-point of down

2.5%, expecting non-GAAP earnings per share to be between 87 cents

and 94 cents per share, our business tracking modestly above our

original guidance, integration activities associated with our

acquisitions of Atmel and Micrel continuing to make significant

progress, the Micrel 6-inch fab closure driving significant gross

margin benefits after the higher cost inventory from that factory

is sold through and our lower costs from our higher volume

factories are realized, that the integration of Atmel continues to

progress as we approach a major milestone of integrating business

systems on January 1, 2017 and being on track to realize our

long-term business model of 33% non-GAAP operating income by the

fourth quarter of fiscal 2018, are forward-looking statements made

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. These statements involve risks

and uncertainties that could cause our actual results to differ

materially, including, but not limited to: any economic uncertainty

due to monetary policy, political or other issues in the U.S. or

internationally, any unexpected fluctuations or weakness in the

U.S. and global economies, changes in demand or market acceptance

of our products and the products of our customers; foreign currency

effects on our business; the mix of inventory we hold and our

ability to satisfy short-term orders from our inventory; changes in

utilization of our manufacturing capacity and our ability to

effectively manage our production levels; competitive developments

including pricing pressures; the level of orders that are received

and can be shipped in a quarter; the level of sell-through of our

products through distribution; changes or fluctuations in customer

order patterns and seasonality; our ability to continue to

successfully integrate Atmel’s operations and employees, retain key

employees and otherwise realize the expected synergies and benefits

of the Atmel transaction; our ability to continue to realize the

expected benefits of our Micrel acquisition; the impact of any

other significant acquisitions that we may make; our ability to

obtain a sufficient supply of wafers from third party wafer

foundries and the cost of such wafers, the costs and outcome of any

current or future tax audit or any litigation or disputes involving

intellectual property, customers or other issues; our actual

average stock price in the December 2016 quarter and the impact

such price will have on our share count; disruptions in our

business or the businesses of our customers or suppliers due to

natural disasters (including any floods in Thailand), terrorist

activity, armed conflict, war, worldwide oil prices and supply,

public health concerns or disruptions in the transportation system;

and general economic, industry or political conditions in the

United States or internationally.

For a detailed discussion of these and other risk factors,

please refer to Microchip's filings on Forms 10-K and 10‑Q.

You can obtain copies of Forms 10-K and 10-Q and other relevant

documents for free at Microchip's website (www.microchip.com) or

the SEC's website (www.sec.gov) or from commercial document

retrieval services.

Stockholders of Microchip are cautioned not to place undue

reliance on our forward-looking statements, which speak only as of

the date such statements are made. Microchip does not

undertake any obligation to publicly update any forward-looking

statements to reflect events, circumstances or new information

after this November 29, 2016 press release, or to reflect the

occurrence of unanticipated events.

About Microchip:

Microchip Technology Incorporated is a leading provider of

microcontroller, mixed-signal, analog and Flash-IP solutions,

providing low-risk product development, lower total system cost and

faster time to market for thousands of diverse customer

applications worldwide. Headquartered in Chandler, Arizona,

Microchip offers outstanding technical support along with

dependable delivery and quality. For more information, visit

the Microchip website at www.microchip.com.

Note: The Microchip name and logo are registered

trademarks of Microchip Technology Inc. in the USA and other

countries.

INVESTOR RELATIONS CONTACT:

J. Eric Bjornholt – CFO

(480) 792-7804

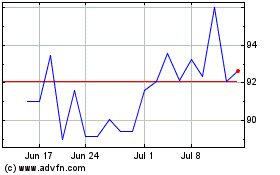

Microchip Technology (NASDAQ:MCHP)

Historical Stock Chart

From Mar 2024 to Apr 2024

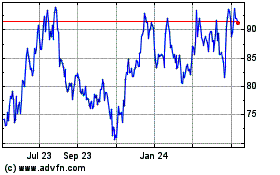

Microchip Technology (NASDAQ:MCHP)

Historical Stock Chart

From Apr 2023 to Apr 2024