Total Revenues Grew 40%; Increases Full-Year

Outlook

Splunk Inc. (NASDAQ: SPLK), provider of the leading software

platform for real-time Operational Intelligence, today announced

results for its fiscal third quarter ended October 31, 2016.

Third Quarter 2017 Financial

Highlights

- Total revenues were $245 million, up

40% year-over-year.

- License revenues were $140 million, up

34% year-over-year.

- GAAP operating loss was $91.0 million;

GAAP operating margin was negative 37.2%.

- Non-GAAP operating income was $16.7

million; non-GAAP operating margin was 6.8%.

- GAAP loss per share was $0.69; non-GAAP

earnings per share was $0.12.

- Operating cash flow was $45.3 million

with free cash flow of $32.3 million.

“Our market opportunity is tremendous,” said Doug Merritt,

President and CEO. “Splunk provides the market leading platform

that powers Operational Intelligence to enable customers to cost

effectively get value from machine data. We want to make it easier

to collect and analyze even larger volumes and varieties of data to

help our customers gain more insights and value from Splunk

solutions. Our passionate customers and their innovations with the

Splunk platform are at the core of our success.”

Third Quarter 2017 and Recent Business

Highlights:

Customers:

- Signed nearly 500 new enterprise

customers.

- New and Expansion Customers

Include: BMW (Germany), Cequint, Dow Jones, Educational

Testing Services, Emirates Airlines, Exostar, Florida State

University, Garanti Bank (Turkey), Monash University (Australia),

Progressive Insurance, Rackspace, State of Maine, University Health

System, University of Illinois, University of Miami, U.S.

Department of Homeland Security, U.S. Department of State, Yahoo

Japan and Zendesk.

Products:

- Announced the newest versions of Splunk

solutions leverage machine learning to empower IT, security and

business teams to make better data decisions and maximize the value

machine data can deliver to organizations.

- Announced the general availability (GA)

of the new versions of Splunk Cloud and Splunk Enterprise to expand

the Splunk platform with machine learning and simplified data

analysis.

- Announced the GA of Splunk IT Service

Intelligence 2.5 (ITSI) to simplify service operations with machine

learning and deliver business and service context to help

prioritize incident investigation.

- Announced the GA of Splunk Enterprise

Security 4.5 (ES), which includes Adaptive Response to extend the

security architecture beyond legacy preventative technologies and

expand its visual analytics capabilities with Glass Tables.

- Announced the GA of Splunk User

Behavior Analytics 3.0 (UBA) to provide customers with the ability

to update detection footprint with zero downtime and without

hassle.

- Introduced the Talk to Splunk with

Amazon Alexa App, enabling Splunk instances to interface with

Amazon Alexa by way of a custom Alexa skill and thereby

provisioning a Natural Language interface for Splunk.

- Released Splunk AppInspect, the first

static and dynamic analysis tool for Splunk apps, making it

possible for developers to get their work done faster, with fewer

errors and less debugging.

Corporate:

- Unveiled Splunk Pledge, a new

philanthropic program through the Splunk4Good initiative, which

commits to donate a minimum of $100 million in software licenses,

training, support, education and volunteerism over a 10-year period

to nonprofit organizations and educational institutions in order to

support academic research and generate social impact.

- Announced investments in two companies

– Acalvio and Insight Engines – to further drive innovation and

extend the power and reach of the Splunk platform.

Strategic and Channel Partners:

- Announced the expansion of the

Splunk-led Adaptive Response Initiative to strengthen enterprise

security, with 11 new members including Acalvio, Anomali, Cisco,

CrowdStrike, DomainTools, ForeScout, Okta, Proofpoint, Qualys,

Recorded Future and Symantec.

- Cisco and Splunk joined forces at

.conf2016 to highlight the companies’ eight-year partnership,

together delivering integrated solutions for thousands of

organizations around the globe.

- Highlighted the strong partnership

between Amazon Web Services (AWS) and Splunk at .conf2016, focused

on driving customer success in the cloud.

- Ansible by Red Hat introduced the

Ansible Tower App for Splunk, a new app developed to

ingest all data associated with Ansible deployments,

inventories and jobs and deliver this visibility to teams involved

in app delivery.

Recognition:

- Splunk received three Cisco® Partner

Summit awards – one Global award and two country awards in the U.S.

Splunk was recognized as Global ISV Partner of the Year, as well as

a U.S. (West) Outstanding Solutions Partner and U.S. Public Sector

ISV and Consultant Partner of the Year.

- Splunk was named by Glassdoor as one of

the top-rated public cloud company employers.

- Splunk Cloud was named the 2016 Best

Big Data Analytics Solution in the fourth Cloud & DevOps World

Awards, which honor excellence and innovation in cloud

computing.

- Splunk was named to Database Trends and

Applications’ annual Big Data 50 awards.

- Splunk was ranked 18th on the San

Francisco Business Times’ list of the 75 Largest Software Companies

in the Greater Bay Area.

Events:

- Hosted .conf2016, the 7th annual Splunk

Worldwide Users’ Conference in Orlando, drawing more than 4,500

Splunk enthusiasts, partners and experts in machine learning, data

analytics, security, IT operations, cloud, DevOps, SaaS, business

analytics, Internet of Things and more.

- Hosted SplunkLive! events in cities

worldwide, including Auckland, Santa Clara, Denver, Nashville,

Shanghai and Stockholm. Presentations can be found on the

SplunkLive! website.

Appointments:

- Appointed Brian Goldfarb as Chief

Marketing Officer.

- Appointed Richard Campione as Chief

Product Officer.

Financial Outlook

The company is providing the following guidance for its fiscal

fourth quarter 2017 (ending January 31, 2017):

- Total revenues are expected to be

between $286 and $288 million.

- Non-GAAP operating margin is expected

to be between 8% and 9%.

The company is updating its previous guidance for its fiscal

year 2017 (ending January 31, 2017):

- Total revenues are expected to be

between $930 and $932 million (was between $910 and $914 million

per prior guidance provided on August 25, 2016).

- Non-GAAP operating margin is expected

to be between 5% and 6% (was approximately 5% per prior guidance

provided on August 25, 2016).

All forward-looking non-GAAP financial measures contained in

this section “Financial Outlook” exclude estimates for stock-based

compensation expenses, employer payroll tax expense related to

employee stock plans, amortization of acquired intangible assets,

acquisition-related costs and adjustments related to a financing

lease obligation.

A reconciliation of non-GAAP guidance measures to corresponding

GAAP measures is not available on a forward-looking basis without

unreasonable effort due to the uncertainty regarding, and the

potential variability of, many of these costs and expenses that may

be incurred in the future. For example, stock-based compensation

expense is impacted by a number of factors, such as Splunk’s future

hiring and retention, as well as the future fair market value of

Splunk’s common stock, all of which are difficult to predict and

subject to constant change. The company has provided a

reconciliation of GAAP to non-GAAP financial measures in the

financial statement tables for its fiscal third quarter 2017

non-GAAP results included in this press release. The exclusion of

these costs and expenses will have a significant impact on Splunk’s

non-GAAP operating margin.

Conference Call and

Webcast

Splunk’s executive management team will host a conference call

today beginning at 1:30 p.m. PT (4:30 p.m. ET) to discuss the

company’s financial results and business highlights. Interested

parties may access the call by dialing (866) 501-1535.

International parties may access the call by dialing (216)

672-5582. A live audio webcast of the conference call will be

available through Splunk’s Investor Relations website at

http://investors.splunk.com/events.cfm. A replay of the call will

be available through December 6, 2016 by dialing (855) 859-2056 and

referencing Conference ID: 4131068.

Safe Harbor Statement

This press release contains forward-looking statements that

involve risks and uncertainties, including statements regarding

Splunk’s revenue and non-GAAP operating margin targets for the

company’s fiscal fourth quarter and fiscal year 2017 in the

paragraphs under “Financial Outlook” above and other statements

regarding customer demand and return on investment, market

opportunity, the rate of customer adoption and growth strategies.

There are a significant number of factors that could cause actual

results to differ materially from statements made in this press

release, including: Splunk’s limited operating history and

experience developing and introducing new products, including its

cloud offerings; risks associated with Splunk’s rapid growth,

Splunk’s limited experience with respect to predicting future

customer demand and customer acceptance of the company’s products

and services, in and outside of the United States; Splunk’s ability

to rapidly and successfully integrate new employees into its

workforce, particularly sales personnel; Splunk’s inability to

realize value from its significant investments in its business,

including product and service innovations; Splunk’s transition to a

multi-product software and services business; Splunk’s inability to

successfully integrate acquired businesses and technologies; and

general market, political, economic and business conditions.

Additional information on potential factors that could affect

Splunk’s financial results is included in the company’s Quarterly

Report on Form 10-Q for the quarter ended July 31, 2016, which is

on file with the U.S. Securities and Exchange Commission. Splunk

does not assume any obligation to update the forward-looking

statements provided to reflect events that occur or circumstances

that exist after the date on which they were made.

About Splunk Inc.

Splunk Inc. (NASDAQ: SPLK) is the market-leading

platform that powers Operational Intelligence. We

pioneer innovative, disruptive solutions that make machine

data accessible, usable and valuable to everyone. More than 12,000

customers in over 110 countries use Splunk software and cloud

services to make business, government and education more efficient,

secure and profitable. Join hundreds of thousands of passionate

users by trying Splunk solutions for free:

http://www.splunk.com/free-trials.

Social Media: Twitter | LinkedIn | YouTube

| Facebook

Splunk, Splunk>, Listen to Your Data, The Engine for Machine

Data, Hunk, Splunk Cloud, Splunk Light and SPL are trademarks and

registered trademarks of Splunk Inc. in the United States and other

countries. All other brand names, product names, or trademarks

belong to their respective owners. © 2016 Splunk Inc. All rights

reserved.

SPLUNK INC.CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(In thousands, except per share

data)(Unaudited) Three

Months Ended Nine Months Ended October

31,2016 October 31,2015 October

31,2016 October 31,2015 Revenues License $

139,725 $ 104,164 $ 356,412 $ 263,996 Maintenance and services

105,064 70,256 287,082

184,415 Total revenues 244,789

174,420 643,494 448,411

Cost of revenues License 2,883 3,136 8,713 6,110 Maintenance and

services 45,791 27,455 124,077

72,606 Total cost of revenues 48,674

30,591 132,790 78,716

Gross profit 196,115 143,829

510,704 369,695 Operating

expenses Research and development 85,659 56,186 220,254 149,192

Sales and marketing 167,330 130,131 462,709 343,906 General and

administrative 34,079 29,857

100,464 85,489 Total operating expenses

287,068 216,174 783,427

578,587 Operating loss (90,953 ) (72,345 )

(272,723 ) (208,892 ) Interest and other

income (expense), net Interest income (expense), net (823 ) 377

(2,023 ) 1,162 Other income (expense), net (348 )

(271 ) (2,536 ) (477 ) Total interest and other

income (expense), net (1,171 ) 106

(4,559 ) 685 Loss before income taxes (92,124 )

(72,239 ) (277,282 ) (208,207 ) Income tax provision (benefit)

1,367 735 3,702

(8,758 ) Net loss $ (93,491 ) $ (72,974 ) $ (280,984 ) $ (199,449 )

Basic and diluted net loss per share $ (0.69 ) $

(0.57 ) $ (2.11 ) $ (1.58 )

Weighted-average shares used in computing

basic and diluted net loss per share

134,677 128,368 133,273

126,534

SPLUNK INC.CONDENSED

CONSOLIDATED BALANCE SHEETS(In

thousands)(Unaudited) October

31,2016 January 31,2016 ASSETS

Current assets Cash and cash equivalents $ 365,593 $ 424,541

Investments, current portion 661,406 584,498 Accounts receivable,

net 172,489 181,665 Prepaid expenses and other current assets

29,743 26,565 Total current assets

1,229,231 1,217,269 Investments,

non-current 5,000 1,500 Property and equipment, net 159,823 134,995

Intangible assets, net 40,423 49,482 Goodwill 124,642 123,318 Other

assets 15,845 10,275 Total assets $

1,574,964 $ 1,536,839 LIABILITIES AND

STOCKHOLDERS' EQUITY Current liabilities Accounts payable $

6,395 $ 4,868 Accrued payroll and compensation 83,360 95,898

Accrued expenses and other liabilities 78,873 49,879 Deferred

revenue, current portion 385,519 347,121

Total current liabilities 554,147

497,766 Deferred revenue, non-current 113,636 102,382

Other liabilities, non-current 93,010 77,277

Total non-current liabilities 206,646

179,659 Total liabilities 760,793

677,425 Stockholders' equity Common stock 136 132

Accumulated other comprehensive loss (3,010 ) (3,770 ) Additional

paid-in capital 1,763,624 1,528,647 Accumulated deficit

(946,579 ) (665,595 ) Total stockholders' equity

814,171 859,414 Total liabilities and

stockholders' equity $ 1,574,964 $ 1,536,839

SPLUNK INC.CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS(In thousands)(Unaudited)

Three Months Ended Nine Months Ended

October 31,2016 October 31,2015

October 31,2016 October 31,2015

Cash Flows From Operating Activities Net loss $ (93,491 ) $

(72,974 ) $ (280,984 ) $ (199,449 ) Adjustments to reconcile net

loss to net cash provided by operating activities: Depreciation and

amortization 8,279 5,691 22,914 13,467 Amortization of investment

premiums 173 327 620 1,049 Stock-based compensation 105,014 74,164

285,247 203,882 Deferred income taxes 78 (111 ) (620 ) (11,416 )

Excess tax benefits from employee stock plans 476 (343 ) (551 )

(995 ) Changes in operating assets and liabilities, net of

acquisitions: Accounts receivable, net (41,227 ) (25,963 ) 9,176

2,756 Prepaid expenses, other current and non-current assets (4,951

) 3,162 (8,128 ) 15,630 Accounts payable 1,265 484 1,530 384

Accrued payroll and compensation 18,447 21,039 (12,538 ) 12,341

Accrued expenses and other liabilities 19,413 3,246 32,992 (3,839 )

Deferred revenue 31,796 27,638

49,652 44,803 Net cash provided by operating

activities 45,272 36,360 99,310

78,613

Cash Flow From Investing

Activities Purchases of investments (207,255 ) - (523,783 )

(219,195 ) Maturities of investments 156,000 152,145 446,275

399,145 Acquisitions, net of cash acquired - - - (142,693 )

Purchases of property and equipment (12,969 ) (15,272 ) (27,219 )

(24,496 ) Other investment activities - -

(3,500 ) (1,500 ) Net cash provided by (used

in) investing activities (64,224 ) 136,873

(108,227 ) 11,261

Cash Flow From

Financing Activities Proceeds from the exercise of stock

options 1,752 1,960 7,355 12,696 Excess tax benefits from employee

stock plans (476 ) 343 551 995 Proceeds from employee stock

purchase plan - - 15,183 10,906 Taxes paid related to net share

settlement of equity awards (26,533 ) -

(73,355 ) - Net cash provided by (used in) financing

activities (25,257 ) 2,303 (50,266 )

24,597 Effect of exchange rate changes on cash

and cash equivalents (147 ) (45 ) 235

(95 ) Net increase (decrease) in cash and cash equivalents

(44,356 ) 175,491 (58,948 ) 114,376 Cash and cash equivalents at

beginning of period 409,949 326,200

424,541 387,315 Cash and cash

equivalents at end of period $ 365,593 $ 501,691 $

365,593 $ 501,691

SPLUNK INC.Non-GAAP financial

measures and reconciliations

To supplement Splunk’s condensed consolidated financial

statements, which are prepared and presented in accordance with

generally accepted accounting principles in the United States

(“GAAP”), Splunk provides investors with certain non-GAAP financial

measures, including non-GAAP cost of revenues, non-GAAP gross

margin, non-GAAP research and development expense, non-GAAP sales

and marketing expense, non-GAAP general and administrative expense,

non-GAAP operating income (loss), non-GAAP operating margin,

non-GAAP net income (loss) and non-GAAP net income (loss) per share

(collectively the “non-GAAP financial measures”). These non-GAAP

financial measures exclude all or a combination of the following

(as reflected in the following reconciliation tables): stock-based

compensation expense, employer payroll tax expense related to

employee stock plans, amortization of acquired intangible assets,

acquisition-related costs, adjustments related to a financing lease

obligation and the partial release of the valuation allowance due

to acquisition. The adjustments for the financing lease obligation

are to reflect the expense we would have recorded if our

build-to-suit lease arrangement had been deemed an operating lease

instead of a financing lease and is calculated as the net of actual

ground lease expense, depreciation and interest expense over

estimated straight-line rent expense. In addition, non-GAAP

financial measures include free cash flow, which represents cash

from operations less purchases of property and equipment. The

presentation of the non-GAAP financial measures is not intended to

be considered in isolation or as a substitute for, or superior to,

the financial information prepared and presented in accordance with

GAAP. Splunk uses these non-GAAP financial measures for financial

and operational decision-making purposes and as a means to evaluate

period-to-period comparisons. Splunk believes that these non-GAAP

financial measures provide useful information about Splunk’s

operating results, enhance the overall understanding of past

financial performance and future prospects and allow for greater

transparency with respect to key metrics used by management in its

financial and operational decision making. In addition, these

non-GAAP financial measures facilitate comparisons to competitors’

operating results.

Splunk excludes stock-based compensation expense because it is

non-cash in nature and excluding this expense provides meaningful

supplemental information regarding Splunk’s operational

performance. In particular, because of varying available valuation

methodologies, subjective assumptions and the variety of award

types that companies can use under FASB ASC Topic 718, Splunk

believes that providing non-GAAP financial measures that exclude

this expense allows investors the ability to make more meaningful

comparisons between Splunk’s operating results and those of other

companies. Splunk excludes employer payroll tax expense related to

employee stock plans in order for investors to see the full effect

that excluding that stock-based compensation expense had on

Splunk’s operating results. These expenses are tied to the exercise

or vesting of underlying equity awards and the price of Splunk’s

common stock at the time of vesting or exercise, which may vary

from period to period independent of the operating performance of

Splunk’s business. Splunk also excludes amortization of acquired

intangible assets, acquisition-related costs, the partial release

of the valuation allowance due to acquisition and makes adjustments

related to a financing lease obligation from its non-GAAP financial

measures because these are considered by management to be outside

of Splunk’s core operating results. Accordingly, Splunk believes

that excluding these expenses provides investors and management

with greater visibility to the underlying performance of its

business operations, facilitates comparison of its results with

other periods and may also facilitate comparison with the results

of other companies in its industry. Splunk considers free cash flow

to be a liquidity measure that provides useful information to

management and investors about the amount of cash generated by the

business that can be used for strategic opportunities, including

investing in its business, making strategic acquisitions and

strengthening its balance sheet.

There are limitations in using non-GAAP financial measures

because the non-GAAP financial measures are not prepared in

accordance with GAAP, may be different from non-GAAP financial

measures used by Splunk’s competitors and exclude expenses that may

have a material impact upon Splunk’s reported financial results.

Further, stock-based compensation expense has been and will

continue to be for the foreseeable future a significant recurring

expense in Splunk’s business and an important part of the

compensation provided to Splunk’s employees. The non-GAAP financial

measures are meant to supplement and be viewed in conjunction with

GAAP financial measures.

The following tables reconcile Splunk’s non-GAAP results to

Splunk’s GAAP results included in this press release.

SPLUNK INC.Reconciliation of GAAP to Non-GAAP

Financial Measures(In thousands, except per share

data)(Unaudited)

Reconciliation of

Cash Provided by Operating Activities to Free Cash

Flow

Three Months Ended Nine Months Ended

October 31,2016 October 31,2015

October 31,2016 October 31,2015 Net

cash provided by operating activities $ 45,272 $ 36,360 $ 99,310 $

78,613 Less purchases of property and equipment (12,969 )

(15,272 ) (27,219 ) (24,496 ) Free cash flow

(Non-GAAP) $ 32,303 $ 21,088 $ 72,091 $ 54,117

Net cash provided by (used in) investing activities $

(64,224 ) $ 136,873 $ (108,227 ) $ 11,261 Net cash

provided by (used in) financing activities $ (25,257 ) $ 2,303

$ (50,266 ) $ 24,597

Reconciliation of

GAAP to Non-GAAP Financial MeasuresThree Months Ended

October 31, 2016

GAAP

Stock-basedcompensation

Employer payrolltax on

employeestock plans

Amortization

ofacquiredintangible assets

Adjustmentsrelated

tofinancing leaseobligation

Non-GAAP

Cost of revenues $ 48,674 $ (7,610) $ (130) $ (2,814) $ 276

$ 38,396 Gross Margin 80.1% 3.1% 0.1% 1.1% (0.1)% 84.3%

Research and development 85,659 (45,355) (534) (63) 559 40,266

Sales and marketing 167,330 (38,750) (712) (110) 1,124 128,882

General and administrative 34,079 (13,299) (504) - 236 20,512

Operating income (loss) (90,953) 105,014 1,880 2,987 (2,195) 16,733

Operating margin (37.2)% 42.9% 0.8% 1.2% (0.9)% 6.8% Net

income (loss) $ (93,491) $ 105,014 $ 1,880 $ 2,987 $ (123)

(2)

$ 16,267 Net income (loss) per share(1) $ (0.69) $ 0.12 (1)

GAAP net loss per share calculated based on 134,677

weighted-average shares of common stock. Non-GAAP net income per

share calculated based on 138,401 diluted weighted-average shares

of common stock, which includes 3,724 potentially dilutive shares

related to employee stock awards. GAAP to Non-GAAP net income

(loss) per share is not reconciled due to the difference in the

number of shares used to calculate basic and diluted

weighted-average shares of common stock. (2) Includes $2.1 million

of interest expense related to the financing lease obligation.

Reconciliation of

GAAP to Non-GAAP Financial MeasuresThree Months Ended

October 31, 2015

GAAP

Stock-basedcompensation

Employer payrolltax on

employeestock plans

Amortization

ofacquiredintangible assets

Adjustmentsrelated

tofinancing leaseobligation

Non-GAAP Cost of revenues $ 30,591 $ (6,384) $

(145) $ (2,896) $ - $ 21,166 Gross Margin 82.5% 3.6% 0.1% 1.7% 0.0%

87.9% Research and development 56,186 (22,534) (510) (86) -

33,056 Sales and marketing 130,131 (33,247) (501) (164) - 96,219

General and administrative 29,857 (11,999) (283) - (222) 17,353

Operating income (loss) (72,345) 74,164 1,439 3,146 222 6,626

Operating margin (41.5)% 42.5% 0.8% 1.9% 0.1% 3.8% Net

income (loss) $ (72,974) $ 74,164 $ 1,439 $ 3,146 $ 222 $ 5,997 Net

income (loss) per share(1) $ (0.57) $ 0.05 (1) GAAP net loss

per share calculated based on 128,368 weighted-average shares of

common stock. Non-GAAP net income per share calculated based on

132,675 diluted weighted-average shares of common stock, which

includes 4,307 potentially dilutive shares related to employee

stock awards. GAAP to Non-GAAP net income (loss) per share is not

reconciled due to the difference in the number of shares used to

calculate basic and diluted weighted-average shares of common

stock.

Reconciliation of

GAAP to Non-GAAP Financial MeasuresNine Months Ended October

31, 2016

GAAP

Stock-basedcompensation

Employerpayroll tax

onemployee stockplans

Amortizationof

acquiredintangibleassets

Adjustmentsrelated

tofinancing leaseobligation

Non-GAAP Cost of revenues $ 132,790 $ (22,475) $

(600) $ (8,612) $ 561 $ 101,664 Gross Margin 79.4% 3.5% 0.1% 1.3%

(0.1)% 84.2% Research and development 220,254 (102,303)

(1,966) (193) 1,172 116,964 Sales and marketing 462,709 (118,354)

(2,529) (412) 2,373 343,787 General and administrative 100,464

(42,115) (1,333) - 513 57,529 Operating income (loss) (272,723)

285,247 6,428 9,217 (4,619) 23,550 Operating margin (42.4)% 44.4%

1.0% 1.4% (0.7)% 3.7% Net income (loss) $ (280,984) $

285,247 $ 6,428 $ 9,217

$

994

(2)

$ 20,902 Net income (loss) per share(1) $ (2.11) $ 0.15 (1)

GAAP net loss per share calculated based on 133,273

weighted-average shares of common stock. Non-GAAP net income per

share calculated based on 136,690 diluted weighted-average shares

of common stock, which includes 3,417 potentially dilutive shares

related to employee stock awards. GAAP to Non-GAAP net income

(loss) per share is not reconciled due to the difference in the

number of shares used to calculate basic and diluted

weighted-average shares of common stock. (2) Includes $5.6 million

of interest expense related to the financing lease obligation.

Reconciliation of

GAAP to Non-GAAP Financial MeasuresNine Months Ended October

31, 2015

GAAP

Stock-basedcompensation

Employerpayroll tax

onemployee stockplans

Amortizationof

acquiredintangibleassets

Acquisition-related

costsand income taxeffects

Adjustmentsrelated

tofinancing leaseobligation

Non-GAAP Cost of revenues $ 78,716 $ (18,578)

$ (806) $ (5,379) $ - $ - $ 53,953 Gross Margin 82.4% 4.2% 0.2%

1.2% 0.0% 0.0% 88.0% Research and development 149,192

(61,910) (2,145) (234) - - 84,903 Sales and marketing 343,906

(91,067) (2,562) (469) - - 249,808 General and administrative

85,489 (32,327) (1,465) - (1,993) (666) 49,038 Operating income

(loss) (208,892) 203,882 6,978 6,082 1,993 666 10,709 Operating

margin (46.6)% 45.5% 1.6% 1.4% 0.4% 0.1% 2.4% Net income

(loss) $ (199,449) $ 203,882 $ 6,978 $ 6,082 $ (8,931)

(2)

$ 666 $ 9,228 Net income (loss) per share(1) $ (1.58) $ 0.07

(1) GAAP net loss per share calculated based on 126,534

weighted-average shares of common stock. Non-GAAP net income per

share calculated based on 131,693 diluted weighted-average shares

of common stock, which includes 5,159 potentially dilutive shares

related to employee stock awards. GAAP to Non-GAAP net income

(loss) per share is not reconciled due to the difference in the

number of shares used to calculate basic and diluted

weighted-average shares of common stock. (2) Includes $10.9 million

related to the partial release of the valuation allowance due to

acquisition.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161129006213/en/

Splunk Inc.Sherry Lowe,

415-852-5529slowe@splunk.comorInvestor ContactSplunk Inc.Ken

Tinsley, 415-848-8476ktinsley@splunk.com

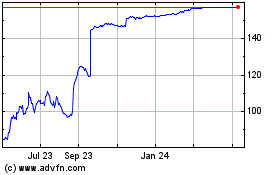

Splunk (NASDAQ:SPLK)

Historical Stock Chart

From Mar 2024 to Apr 2024

Splunk (NASDAQ:SPLK)

Historical Stock Chart

From Apr 2023 to Apr 2024