Mozido Founder Pleads Guilty to Making Illegal Campaign Contributions

November 29 2016 - 10:00AM

Dow Jones News

The founder of one of the most highly-valued U.S.

financial-technology startups pleaded guilty this week to making

illegal contributions to a presidential campaign five years

ago.

Michael A. Liberty, the founder of Austin, Texas-based

mobile-payments company Mozido Inc., faces up to two years in

prison and a fine of up to $250,000 for violating campaign

fundraising laws between May and June 2011, according to federal

prosecutors in Maine. Although Mr. Liberty is a large shareholder

in Mozido, he doesn't currently sit on the company's board and

isn't a member of its management team.

At that time, Mr. Liberty, now 56 years old, gave $22,500 to the

primary campaign of an unnamed presidential candidate through nine

family members, associates and employees "when, in fact, [Mr.]

Liberty paid for all of the contributions," the prosecutors said.

Although the presidential candidate isn't named in court filings,

Federal Election Commission records indicate that in May 2011 Mr.

Liberty gave $2,500 under his own name to the campaign of the

eventual Republican nominee Mitt Romney.

Sentencing will occur after the completion of a "presentence

investigation report" by the U.S. Prosecution Office, according to

the prosecutors. Attorneys for Mr. Liberty didn't immediately

respond to a request for comment.

Mozido and Mr. Liberty are also suing a former director for

defamation and wrongful "interference," and Mr. Liberty is involved

in a separate legal dispute with the U.S. Securities and Exchange

Commission.

Previously a real-estate, clothes-making and beverage-sales

executive, Mr. Liberty launched Mozido in 2008 to provide mobile

wallets and related technology to the roughly two billion people

around the world who lack bank accounts.

Mozido was valued at $2.4 billion in a 2014 fundraising that

attracted investors including Wellington Management, MasterCard

Inc. and hedge-fund veteran Julian Robertson.

Last year, Mr. Robertson passed on a chance to invest more money

in Mozido, a decision that has become the subject of a legal battle

between Mr. Liberty, the company and Philip Geier Jr., a former

chairman and chief executive for Interpublic Group of Cos. who had

previously served on Mozido's board. In a civil complaint filed in

New York state court earlier this month, attorneys for Mr. Liberty

and Mozido accused Mr. Geier of telling Mr. Robertson that Mozido

was a "fraud" that would go out of business.

Attorneys for Mr. Geier said in court documents that they intend

to file a motion to dismiss Mr. Liberty and Mozido's complaint.

Meanwhile, the SEC accused Mr. Liberty in a September court

filing of "intentionally mislead[ing]" the agency and making "

materially fraudulent" statements related to a settlement of a 2006

lawsuit the agency brought against him. In that suit, the SEC

accused Mr. Liberty and others of engaging in a "fraudulent scheme

to misappropriate more than $9 million from a private venture

capital fund and its investors, the majority of which were public

pension funds."

Mr. Liberty agreed to pay the SEC around $6 million to resolve

the matter without admitting any wrongdoing, but the agency waived

nearly all of that amount after Mr. Liberty documented that his net

worth was negative $29 million in 2009. Ultimately, he wound up

paying the agency $600,000.

In a filing in Pennsylvania federal court, the SEC pointed to

emails that were unearthed in a recent court case to demonstrate

its view that Mr. Liberty "had access to tens of millions of

dollars which he concealed." The filing described one email in

which Mr. Liberty "boasted to potential investors" that he owned

Mozido shares worth $127 million. The email was sent in November

2009 before the SEC entered into a final judgment with Mr.

Liberty.

Attorneys for Mr. Liberty asked the Pennsylvania court last

month to deny the SEC's attempt to reopen the case, arguing in part

that the government "does not point to a single line in Mr.

Liberty's financial disclosures that it claims is fraudulent,

inaccurate, or incomplete."

Write to Peter Rudegeair at Peter.Rudegeair@wsj.com

(END) Dow Jones Newswires

November 29, 2016 09:45 ET (14:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

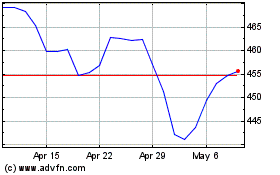

MasterCard (NYSE:MA)

Historical Stock Chart

From Mar 2024 to Apr 2024

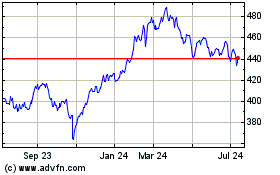

MasterCard (NYSE:MA)

Historical Stock Chart

From Apr 2023 to Apr 2024