Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

November 28 2016 - 5:29PM

Edgar (US Regulatory)

Filed pursuant to Rule 433

Registration No. 333-213263

November 28, 2016

Brookfield Infrastructure Partners L.P.

Offering of Limited Partnership Units

|

Term Sheet

|

November 28

, 2016

|

A final base shelf prospectus containing important information relating to the securities described in this document has been filed with the securities regulatory authorities in each of the provinces and territories of Canada. A copy of the final base shelf prospectus, any amendment to the final base shelf prospectus and any applicable shelf prospectus supplement that has been filed, is required to be delivered with this document.

This document does not provide full disclosure of all material facts relating to the securities offered. Investors should read the final base shelf prospectus, any amendment and any applicable shelf prospectus supplement for disclosure of those facts, especially risk factors relating to the securities offered, before making an investment decision.

|

Issuer:

|

|

Brookfield Infrastructure Partners L.P. (“

BIP

” or the “

Partnership

”).

|

|

|

|

|

|

Issue:

|

|

Treasury offering of 23,764,000 limited partnership units (“

Units

”) of the Partnership, consisting of 15,625,000 limited partnership units to the public (the “

Public Issue

”) and a concurrent private placement of 8,139,000 redeemable partnership units (“

RPUs

”) of Brookfield Infrastructure L.P. (the “

Holding LP

” and, together with BIP, “

Brookfield Infrastructure

”) discussed below (the “

Concurrent Private Placement

”).

|

|

|

|

|

|

Issue Size:

|

|

US$750,030,080 consisting of US$500,000,000 to the public and a Concurrent Private Placement of US$250,030,080.

|

|

|

|

|

|

Issue Price:

|

|

US$32.00 per Unit under the Public Issue.

|

|

|

|

|

|

Over-Allotment Option:

|

|

The Partnership has granted the Underwriters an over-allotment option to purchase up to an additional

2,343,750 Units (representing 15% of the Public Issue) at the Issue Price, exercisable for a 30-day period following the closing of the Public Issue.

|

|

|

|

|

|

Concurrent Private Placement:

|

|

Brookfield Asset Management Inc. (“

BAM

”) and its related entities (other than Brookfield Infrastructure, collectively, “

Brookfield

”) will participate in a private placement at the Issue Price (net of underwriting commissions) concurrent with the Public Issue pursuant to which Brookfield will acquire US$250,030,080 million of RPUs.

|

|

|

|

|

|

Use of Proceeds:

|

|

The Partnership intends to use a portion of the net proceeds of the Public Issue and Concurrent Private Placement to fund an increase in Brookfield Infrastructure’s investment (together with institutional partners) in the pending acquisition of a 90% controlling stake in Nova Transportadora do Sudeste S.A. (“

NTS

”) from Petroleo Brasileiro S.A. This increase would bring Brookfield Infrastructure’s expected investment from the previously disclosed minimum of 20% to an aggregate 28% of the total transaction, representing approximately $1.2 billion of the consideration payable on closing. Any proceeds that are not used for the pending NTS transaction will be used to fund a portion of Brookfield Infrastructure’s growing backlog of organic growth projects that

|

|

|

|

Brookfield Infrastructure expects to invest in 2017. These projects include recently awarded electricity transmission projects in Brazil, construction of which is expected to commence in the near future.

|

|

|

|

|

|

Distribution Policy:

|

|

Distributions are payable on a quarterly basis at the discretion of the Board of Directors of the general partner of the Partnership. The first distribution in which the purchasers of Units will be eligible to participate, if they continue to own the Units, will be for the first quarter of 2017, as and when declared by the Partnership’s general partner.

|

|

|

|

|

|

Form of Offering:

|

|

The Units will be offered: (i) in each of the provinces and territories of Canada by way of a prospectus supplement under the Partnership’s Canadian short form base shelf prospectus dated June 25, 2015; (ii) in the United States by way of a prospectus supplement together with the Partnership’s U.S. base shelf prospectus dated August 23, 2016; (iii) and internationally as expressly permitted by the Partnership.

|

|

|

|

|

|

Eligibility for Investment:

|

|

Eligible for RRSPs, RRIFs, DPSPs, RESPs, RDSPs and TFSAs.

|

|

|

|

|

|

Listing:

|

|

The existing limited partnership units are listed on the Toronto Stock Exchange (“

TSX

”) and the New York Stock Exchange (“

NYSE

”) under ticker symbols “BIP.UN” and “BIP”, respectively. The Partnership will apply to list the Units issued in connection with the Public Issue on the TSX and the NYSE.

|

|

|

|

|

|

Other Provisions:

|

|

The Partnership has agreed with the Underwriters not to issue or agree to issue, directly or indirectly (except pursuant to the Concurrent Private Placement or customary exceptions), any equity securities or other securities (other than debt securities or preferred units not convertible into Units) for a period commencing on the date of the underwriting agreement to be entered into in connection with the Public Issue and ending 60 days following the date hereof, without the prior written consent of the Joint Bookrunners on behalf of the Underwriters, such consent not to be unreasonably withheld. Brookfield has agreed not to offer, sell, contract to sell or otherwise dispose of any Units or RPUs (other than to an affiliate), agree to become bound to do so, or disclose to the public any intention to do so for a period commencing on the date of the underwriting agreement to be entered into in connection with the Public Issue and ending 60 days following the date hereof, without the prior written consent of the Joint Bookrunners on behalf of the Underwriters, which consent shall not be unreasonably withheld.

|

|

|

|

|

|

Trade Date:

|

|

November 29, 2016.

|

|

|

|

|

|

Closing Date:

|

|

On or about December 2, 2016.

|

|

|

|

|

|

Underwriting Fee:

|

|

4.00% on the Public Issue.

|

The Partnership has filed a Registration Statement on Form F-3 (including a prospectus) with the United States Securities and Exchange Commission (the “

SEC

”) in respect of the Public Issue. Before you invest, you should read the prospectus in that Registration Statement and other documents the Partnership has filed with the SEC for more complete information about the Partnership and the

2

Public Issue. The Partnership will also be filing a prospectus supplement relating to the Public Issue with securities regulatory authorities in Canada. You may get any of these documents for free by visiting EDGAR on the SEC website at www.sec.gov or via SEDAR at www.sedar.com. Also, the Partnership, any underwriter or any dealer participating in the Public Issue will arrange to send you the prospectus or you may request it in the United States from

Citigroup, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717, phone: 800-831-9146, or from RBC Capital Markets LLC, Attn: Equity Syndicate, 200 Vesey Street, 8th Floor, New York, NY 10281-8098, phone: 877-822-4089, email: equityprospectus@rbccm.com, or from CIBC World Markets, Corp., Attn: Hector Cruz, 212-667-6001, email: useprospectus@cibc.com, or from HSBC Securities (USA) Inc., Attn: Prospectus Department, 452 Fifth Avenue, New York, New York, 10018, phone: 877-429-7459, email: ny.equity.syndicate@us.hsbc.com, or from Merrill Lynch, Pierce, Fenner & Smith Incorporated, NC1-004-03-43, 200 North College Street, 3rd floor, Charlotte, NC 28255-0001, Attn: Prospectus Department, email: dg.prospectus_requests@baml.com, or in Canada from RBC Dominion Securities Inc., Attn: Simon Yeung, Distribution Centre, RBC Wellington Square, 8

th

Floor, 180 Wellington St. W., Toronto, Ontario, M5J 0C2. phone: 416-842-5349; email: Distribution.RBCDS@rbccm.com, or from Citigroup Global Markets Canada Inc., phone: 416-947-5500, or from CIBC World Markets Inc. Attention: Michelene Dougherty, michelene.dougherty@cibc.ca or 416-956-3636, or from HSBC Securities (Canada) Inc. ATTN: Lucy D’Anselmi, 250 University Avenue, 3th Floor, Toronto, Ontario, Canada M5H 3E5, or from Merrill Lynch Canada ATTN: Lisa Loughery, 181 Bay Street, 4th Floor, Toronto, Ontario, Canada M5J 2V8, phone: 416-369-7558

3

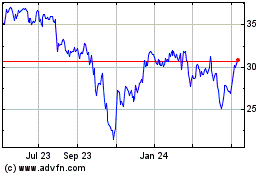

Brookfield Infrastructur... (NYSE:BIP)

Historical Stock Chart

From Mar 2024 to Apr 2024

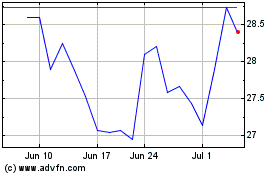

Brookfield Infrastructur... (NYSE:BIP)

Historical Stock Chart

From Apr 2023 to Apr 2024