As filed with the Securities and Exchange Commission on November 28, 2016.

Registration No. 333-214686

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT

NO. 1

TO

FORM S-1

REGISTRATION

STATEMENT

Under

The Securities Act of 1933

IMPINJ, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

3577

|

|

91-2041398

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Primary Standard Industrial

Classification Code Number)

|

|

(I.R.S. Employer

Identification Number)

|

400 Fairview Avenue North, Suite 1200

Seattle, Washington 98109

(206) 517-5300

(Address,

including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Chris Diorio,

Ph.D.

Chief Executive Officer

400 Fairview Avenue North, Suite 1200

Seattle, Washington 98109

(206) 517-5300

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

|

|

|

|

|

|

|

Patrick J. Schultheis

Michael Nordtvedt

Jeana S.

Kim

Wilson Sonsini Goodrich & Rosati

Professional Corporation

701 Fifth Avenue, Suite 5100

Seattle, Washington 98104

(206) 883-2500

|

|

Yukio Morikubo

General Counsel

Impinj,

Inc.

400 Fairview Avenue North, Suite 1200

Seattle, Washington 98109

(206) 517-5300

|

|

Jeffrey R. Vetter

James D. Evans

Ran D.

Ben-Tzur

Fenwick & West LLP

1191 Second Avenue, 10th Floor

Seattle, Washington 98101

(206) 389-4510

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration

statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, check the following box.

¨

If this form is

filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for

the same offering.

¨

If this form is a post-effective amendment filed pursuant

to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering.

¨

If this form is a post-effective amendment filed pursuant to Rule

462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller

reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

¨

|

|

Accelerated filer

|

|

¨

|

|

Non-accelerated filer

|

|

x

(Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

¨

|

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

|

|

|

|

|

|

|

Title of Each Class of

Securities to be Registered

|

|

Amount

to be

Registered

(1)

|

|

Proposed

Maximum

Offering Price

Per Share

(2)

|

|

Proposed

Maximum

Aggregate

Offering Price

(1)(2)

|

|

Amount of

Registration Fee

(2)(3)

|

|

Common stock, $0.001 par value per share

|

|

4,043,249

|

|

$28.69

|

|

$116,000,814

|

|

$13,445

|

|

|

|

|

|

(1)

|

Includes shares the underwriters have the option to purchase.

|

|

(2)

|

Estimated solely for the purpose of computing the amount of registration fee based on the average of the high and low prices of the Registrant’s common stock on the NASDAQ Global Select Market on November 25, 2016

pursuant to Rule 457(c) under the Securities Act of 1933, as amended.

|

|

(3)

|

The Registrant previously paid $8,693 with the initial filing of this registration statement.

|

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become

effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

The information contained in this prospectus is not complete and may be changed. Neither

we nor the selling stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and neither we nor the selling

stockholders are soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS (Subject to Completion)

Issued November 28, 2016

3,515,869 Shares

COMMON STOCK

Impinj, Inc. is

offering 1,000,000 shares of its common stock and the selling stockholders identified in this prospectus are offering 2,515,869 shares of common stock. We will not receive any proceeds from the sale of common stock by the selling

stockholders.

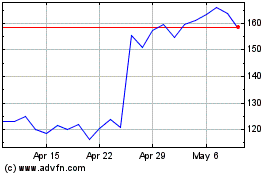

Our common stock is listed on The NASDAQ Global Select Market under the symbol “PI.” The last reported sale of our common stock on The NASDAQ

Global Select Market on November 25, 2016 was $28.60 per share.

We are an “emerging

growth company” as defined in the Jumpstart Our Business Startups Act of 2012. Investing in our common stock involves a high degree of risk. See “

Risk Factors

” beginning on page 12.

PRICE $ A SHARE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Price to

Public

|

|

|

Underwriting

Discounts

and

Commissions

|

|

|

Proceeds to

Impinj, Inc.

|

|

|

Proceeds to

Selling

Stockholders

|

|

|

Per share

|

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

Total

|

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

|

|

$

|

|

We have granted the underwriters an option for a period of 30 days to purchase an additional 527,380 shares

of common stock.

The Securities and Exchange Commission and state regulators have not approved or disapproved of these securities, or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the shares of common

stock is expected to be made on or about , 2016.

|

|

|

|

|

|

|

|

|

MORGAN STANLEY

|

|

RBC CAPITAL MARKETS

|

|

PACIFIC CREST SECURITIES

a division of KeyBanc Capital Markets

|

|

PIPER JAFFRAY

|

|

NEEDHAM & COMPANY

|

|

CANACCORD GENUITY

|

, 2016

TABLE OF CONTENTS

You should

rely only on the information contained in this prospectus and any free writing prospectus prepared by or on behalf of us or to which we have referred you. None of we, the selling stockholders or any of the underwriters have authorized anyone to

provide you with information that is different. We and the selling stockholders are offering to sell shares of our common stock, and seeking offers to buy shares of our common stock, only in jurisdictions where offers and sales are permitted. The

information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our common stock. Our business, financial condition, results of operations and prospects may have

changed since that date.

For investors outside of the United States: none of we, the selling stockholders or any of the underwriters

have done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to

observe any restrictions relating to this offering and the distribution of this prospectus.

Unless the context indicates otherwise, as

used in this prospectus, the terms “Impinj,” “we,” “us” and “our” refer to Impinj, Inc. and its wholly-owned subsidiaries. We use Impinj, the Impinj logo, the Powered by Impinj shield logo, Monza, Indy,

Speedway, xArray, ItemSense, the checkered flag logo and other marks as trademarks in the United States and other countries. This prospectus contains references to our trademarks and service marks and to those belonging to other entities. Solely for

convenience, trademarks and trade names referred to in this prospectus, including logos, artwork and other visual displays, may appear without the

®

or

™

symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensor to

these trademarks and trade names. We do not intend our use or display of other entities’ trade names, trademarks or service marks to imply a relationship with, or endorsement or sponsorship of us by, any other entity.

i

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. This summary does not contain all of the information you should

consider before investing in our common stock. Before you decide to invest in our common stock, you should read the entire prospectus carefully, including the section entitled “Risk Factors” and the consolidated financial statements and

related notes included elsewhere in this prospectus. In this prospectus, unless otherwise stated or the context otherwise indicates, references to “Impinj,” “we,” “us,” “our” and similar references refer to

Impinj, Inc. and its subsidiaries taken as a whole.

IMPINJ, INC.

If you’ve purchased apparel from a major retailer like Macy’s or Zara, run a race like the New York City Marathon, enjoyed a

drink from a Coca-Cola Freestyle soda fountain, hit a ball at Topgolf or checked bags at airports worldwide like Las Vegas McCarran then you’ve probably interacted with the Impinj Platform. Our platform enables wireless connectivity to billions

of everyday items such as apparel, race bibs, golf balls and luggage tags and delivers each item’s unique identity, location and authenticity to enterprise and consumer applications.

Overview

Our vision is digital life for

everyday items. Our mission is to provide wireless connectivity for these everyday items and to deliver, to the digital world, each item’s unique identity, location and authenticity. Our platform connects billions of everyday items such as

apparel, medical supplies, automobile parts, drivers’ licenses, food and luggage to applications such as inventory management, patient safety, asset tracking and item authentication, delivering real-time information to businesses about items

they create, manage, transport and sell. We believe connecting everyday items and delivering real-time information about them is the essence of the Internet-of-Things, or IoT.

The Impinj Platform delivers Item Intelligence, an item’s unique identity, location and authenticity, to enterprise and consumer

applications through both hardware and software elements:

Endpoints

|

|

•

|

|

Endpoint integrated-circuit, or IC, radios that attach to and uniquely identify items. We refer to an item and its attached endpoint IC as an endpoint.

|

Connectivity

|

|

•

|

|

Reader ICs that enable wireless, bidirectional communications with endpoint ICs.

|

|

|

•

|

|

Stationary or mobile readers that read, write, authenticate or otherwise engage endpoint ICs.

|

|

|

•

|

|

Gateways that integrate stationary readers with scanning antennas to locate and track endpoints.

|

Software

|

|

•

|

|

An operating system that aggregates and transforms data from endpoint reads, delivers Item Intelligence to enterprise and consumer applications and configures, manages and controls readers and gateways.

|

1

We believe we are the only company selling a platform spanning endpoints, connectivity and

software. In 2015, we had leading market share with 65% and 61% of the endpoint IC and reader IC unit volume, respectively, based on our calculations derived from research conducted by IDTechEx, an information-technology research firm. We believe we

continue to have leading market share in the endpoint IC and reader IC markets. We estimate we enable approximately 70% unit volume of the stationary reader market inclusive of our readers and readers powered by our reader ICs. We also believe the

majority of handheld readers use our reader ICs.

End users in a variety of industries including retail, healthcare, automotive,

industrial and manufacturing, consumer experience, government, food, datacenter, travel and banking have deployed part or all of the Impinj Platform. We have sold more than 16 billion endpoint ICs to date, including approximately 3.1 billion and 5.1

billion in the 12 months ended September 30, 2015 and 2016, respectively. To date, our intellectual property portfolio includes 202 issued and allowed U.S. patents, 39 pending U.S. patent applications and two pending international patent

applications.

Our total revenue was $63.8 million and $78.5 million for 2014 and 2015, respectively, and $55.9 million and $78.6 million

for the nine months ended September 30, 2015 and 2016, respectively. We incurred losses since our inception in 2000 until we first became profitable in 2013. Our net income was $297,000 and $900,000 for 2014 and 2015, respectively, and our net

income was $82,000 and our net loss was $1.8 million for the nine months ended September 30, 2015 and 2016, respectively. Our adjusted EBITDA was $4.9 million and $4.8 million for 2014 and 2015, respectively, and $3.2 million and $2.7 million for

the nine months ended September 30, 2015 and 2016, respectively. See “Selected Consolidated Financial Data—Adjusted EBITDA” for additional information and a reconciliation of net income (loss) to adjusted EBITDA. We had an

accumulated deficit of $187.3 million as of September 30, 2016.

Industry Background

We live in a connected world. Smartphones, tablets and other electronic devices share ever-more information over ever-more interconnected radio

links, transforming our lives and unlocking unprecedented industry efficiencies. Advancements in wireless technology, cloud computing, data analytics, search, and storage have paved the way for this IoT era.

According to industry research, approximately 16 billion wireless devices were connected to networks and the Internet in 2014. However, these

devices form only a tiny subset of the items in the physical world, the vast majority of which are now connectable but remain unconnected. Apparel, shoes, jewelry, pharmaceuticals, medical supplies, documents, automotive parts, sporting items and

food are among the more than a trillion such everyday items connectable to the digital world. But despite the fact that today’s digital infrastructure can process, analyze and use data from such items, the physical infrastructure and processes

required to capture and deliver item-level data has historically been nonexistent or labor-intensive, expensive, time-consuming and ineffective, so these items remain unconnected. For example, retailers have not historically had an automated way to

track in-store inventory so they resort to infrequent and labor-intensive manual counts. Similarly, hospitals have not historically had an automated, timely way to track biospecimens so they resort to labor-intensive barcode scanning. In these and

numerous other examples a lack of real-time information about item identity and location increases inventory carrying costs, reduces operating efficiencies, and consumes labor and time.

Our Solution

We connect everyday items

using RAIN, a radio-frequency identification technology we pioneered. We spearheaded development of the RAIN radio standard, lobbied governments to allocate frequency spectrum and

2

cofounded the RAIN Industry Alliance along with Google, Intel and Smartrac. Today, our industry uses the RAIN radio standard nearly exclusively. RAIN spectrum is freely available in 78 countries

representing roughly 96.5% of the world’s GDP and the RAIN Alliance has more than 125 member companies worldwide.

We sell a platform

that includes endpoint ICs, reader ICs, readers and gateways that enable wireless connectivity to everyday items, and software that delivers Item Intelligence from endpoint reads. Our platform is secure, easy to deploy and manage, flexible to meet

end user needs across a range of industries including retail and healthcare, and scalable from a single location, store or hospital to large enterprises.

Our endpoint ICs are ideally suited for wirelessly connecting billions of everyday items. They power themselves from a reader’s radio

waves so do not need batteries, are readable to 30 feet without line-of-sight yet sell for pennies. Each endpoint IC uniquely identifies its host item and may include additional functionalities such as item authentication, data storage, security,

loss prevention and consumer privacy.

Our reader ICs, readers and gateways communicate bidirectionally with endpoint ICs, identifying and

locating more than 1,000 items-per-second while also supporting the additional functionalities that endpoint ICs provide. Our reader ICs sell for tens of dollars and our readers and gateways sell for hundreds to thousands of dollars.

Our operating-system software, introduced in 2015, extracts Item Intelligence from the wireless item data, delivers it to the cloud, and

exposes it to existing and new enterprise and consumer applications through query- and event-based application program interfaces, or APIs. A single software instance can connect and manage hundreds of readers or gateways. We view our software as an

operating system that links the physical and digital worlds, enabling end users to access and leverage Item Intelligence.

Industry Use Cases

A variety of industries use RAIN and Item Intelligence. The following use cases are representative of what we believe to be a massive worldwide

opportunity, which we believe is still significantly underpenetrated today.

Retail

Retailers such as Macy’s and Zara have turned to RAIN and Item Intelligence, consuming billions of tags each year. These and other

retailers drive competitive advantages by tagging individual apparel items to:

|

|

•

|

|

Improve Inventory Visibility.

U.S. apparel retailers historically inferred store inventory using manual counts, store-receipt data and point-of-sale data, typically resulting in 65% visibility based on industry

sources. From measured data, RAIN offers apparel retailers better than 95% real-time inventory visibility.

|

|

|

•

|

|

Reduce Out-of-Stocks and Markdowns.

Item Intelligence helps retailers increase revenue by enabling them to stock shelves accurately, reducing inventory costs, out-of-stocks and overstock markdowns.

|

|

|

•

|

|

Enable Omnichannel Fulfillment.

Item Intelligence allows retailers to optimize logistics and increase selling opportunities using omnichannel fulfillment, offering online shoppers next-day, direct-from- store

delivery or in-store pickup.

|

|

|

•

|

|

Enhance Shopping Experiences.

Item Intelligence enables retailers to engage shoppers with interactive fitting rooms and product displays. It can also provide retailers real-time data on shopper preferences.

|

|

|

•

|

|

Identify and Prevent Loss.

Item Intelligence can help retailers deter theft and uniquely identify stolen items for replenishment.

|

3

We sell our products and platform to retailers, fulfilling through our partner channel

comprising distributors, system integrators, value-added resellers, or VARs, and software solution partners.

Healthcare

Under the Affordable Care Act, Medicare links hospital reimbursement to patient quality-of-care, increasing pressure on hospitals

to have real-time data about assets, inventory, staff and patients. The Veterans Affairs Hospitals, Northwestern Memorial Hospital, North York General and the University of Tennessee Medical Center use the Impinj Platform, fulfilled through our

partner ecosystem, to obtain these data. Applications include personnel compliance, biospecimen tracking, asset management, automated billing and replenishment of medical consumables, and authentication and visibility of pharmaceutical inventory.

Other Industries

Other industries such as automotive, industrial and manufacturing, consumer experience, food, datacenter, travel and banking are deriving

business value from Item Intelligence. A few examples of end users in these industries that have deployed part or all of the Impinj Platform include:

|

|

•

|

|

Automotive.

Audi tags parts and cars for assembly and delivery. Love’s Travel Stops uses vehicle windshield tags to enable automatic, cashless fueling.

|

|

|

•

|

|

Industrial and Manufacturing.

Boeing, Bell Helicopter and Eurocopter tag items for aircraft assembly. Carrier Corporation uses RAIN to improve their warehouse operations.

|

|

|

•

|

|

Consumer Experience.

Foot races such as the New York Marathon track runners though tags in race bibs. NASCAR tags tires for team compliance, and Topgolf tags golf balls to score participants’ shots.

|

|

|

•

|

|

Food.

Coca-Cola uses our endpoint ICs and reader ICs in its Freestyle soda fountains. The Hy-Vee supermarket chain tags items for cold-chain monitoring. Cheeky’s restaurant patrons self-dispense beverages

using tagged access cards. McDonald’s uses our gateways to enable direct-to-table food service.

|

|

|

•

|

|

Datacenter.

Cisco and Hewlett-Packard pre-tag servers and other equipment for asset tracking. Intel links our endpoint ICs with their microprocessors to enable processor-secured storage.

|

|

|

•

|

|

Travel.

Las Vegas, Hong Kong, Amsterdam and other airports, as well as a major U.S. airline, use RAIN-enabled luggage tags. Washington offers tagged drivers’ licenses to speed border crossings.

|

|

|

•

|

|

Banking.

Bank of America and Wells Fargo tag information technology equipment. The Agricultural Bank of China tags money bundles.

|

4

Our Opportunity

We believe our market opportunity is massive. Not only are the numbers of tagged items large and growing but so is the infrastructure, in both

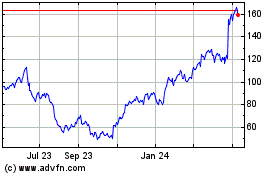

scale and investment, that produces, encodes, applies, reads and extracts business value from these tagged items. According to industry research, RAIN tag IC volumes grew at a 27% compound annual growth rate, or CAGR, from 2010 to 2015, reaching 5.3

billion in 2015 and are expected to grow to over 20 billion in 2020. The chart below shows yearly worldwide RAIN tag IC sales volumes and our yearly tag IC shipments in billions:

Our addressable market in the two largest RAIN opportunities, retail and healthcare, is large and growing.

Frost & Sullivan, a market research firm, forecasts the retail opportunity will grow at a 39% CAGR between 2014 and 2020, reaching $5.4 billion by 2020. Transparency Market Research, another market research firm, forecasts the healthcare

opportunity will grow at a 14% CAGR between 2014 and 2020, reaching $5.3 billion by 2020. We have additional opportunities in automotive, industrial and manufacturing, consumer experience, government, food, datacenter, travel and banking.

RAIN market adoption has historically been slower than anticipated or forecasted by us and industry sources. For additional information

related to RAIN market adoption, please see the section of this prospectus captioned “Risk Factors.”

Our Strengths

We lead the market in connecting and delivering Item Intelligence for everyday items. We believe we can maintain and extend our leadership

position as the market grows by leveraging our competitive strengths, including:

Comprehensive Platform

. End users who

deploy the Impinj Platform gain performance, reliability and ease-of-use we believe is unequaled by “mix-and-match” systems cobbled-together from competitors’ components.

Market Leadership

. Our leading market share in endpoint ICs, reader ICs and stationary readers gives us economies of scale

relative to our competitors.

Broad Partner Ecosystem

. Our strategy of selling to end users with fulfillment through our

worldwide partner ecosystem gives us market reach, penetration and scalability we believe few, if any, of our competitors enjoy.

5

Technology Leadership

. Our intense focus on RAIN and Item Intelligence has

enabled us to be first-to-market with innovative, high-quality products.

Trusted Brand

. We believe our industry leadership,

name recognition and reputation for innovative, high-performing and quality products have significantly contributed to our leading market position.

Our Growth Strategy

To further our

mission of connecting and delivering Item Intelligence for everyday items, we plan to focus on the following strategic areas:

Continue Investing in Our Platform

.

Since 2003, we have invested more than $170 million developing our platform. We plan

to continue investing in platform functionality, software/hardware linkages, broadening our software capabilities, supporting enhanced endpoint IC features and enhancing our gateway functionalities. Since 2003, investment in our platform comprised:

$160 million in research and development expense, $9 million in costs for development agreements and $1 million in capitalized internal-use software.

Drive End-User Adoption

. We plan to expand our engagements with end users in retail and healthcare, accelerating their adoption

of the Impinj Platform, and also intend to target other industries such as automotive, industrial and manufacturing, consumer experience, government, food, datacenter, travel and banking.

Cross-Sell and Up-Sell Our Platform within our Installed Footprint

. We believe the majority of RAIN deployments today use one or

more of our products, positioning us for future platform cross-sell and up-sell opportunities.

Expand within our Existing Customer

Base

. We will seek to generate additional revenue from existing end users of our platform by expanding their deployment scope and adding new use cases.

Enable Ubiquitous Reading

. We plan to invest in next-generation reader ICs to improve functionality, reduce costs, and make

Impinj-based readers ubiquitous in industrial and consumer devices and facilities infrastructure.

Risks Associated with Our Business

Our business and ability to execute our strategy are subject to many risks that you should be aware of before you buy our common stock. We

describe these risks more fully in the prospectus section captioned “Risk Factors” beginning on page 12. These risks include, among others:

|

|

•

|

|

if adoption of the RAIN market stalls or develops slower than we expect, our business will suffer;

|

|

|

•

|

|

our market is very competitive;

|

|

|

•

|

|

our growth prospects depend, in part, on others developing business analytics tools to derive business value from the Item Intelligence the Impinj platform delivers;

|

|

|

•

|

|

we rely on third-party distributors, system integrators, VARs, and software solution partners to sell our products;

|

|

|

•

|

|

we have limited marketing and sales resources, and because we fulfill through third parties, our visibility to end-user demand is limited and uncertain;

|

|

|

•

|

|

we rely on a small number of third parties to manufacture, assemble and test our products and some of our suppliers are sole-source; and

|

6

|

|

•

|

|

our executive officers, directors, principal stockholders, and their affiliates, who after this offering will beneficially own approximately 27.2% of our capital stock, will have the ability to significantly influence

the outcome of matters submitted to our stockholders for approval.

|

Corporate Information

We were incorporated in Delaware in April 2000. Our principal executive office is located at 400 Fairview Avenue North, Suite 1200, Seattle,

Washington 98109. Our telephone number is (206) 517-5300. Our website is www.impinj.com. Information contained in, or that can be accessed through, our website is not a part of, and is not incorporated into, this prospectus.

7

THE OFFERING

|

|

|

|

|

|

|

|

Common stock to be offered by us

|

|

1,000,000 shares (or 1,527,380 shares if the underwriters exercise their option to purchase

additional shares in full)

|

|

|

|

|

Common stock to be offered by the selling

stockholders

|

|

2,515,869

shares

|

|

|

|

|

Common stock to be outstanding immediately after this offering

|

|

19,780,142 shares

(or 20,307,522 shares if the underwriters exercise their option to purchase additional shares in full)

|

|

|

|

|

Option to purchase additional shares

|

|

527,380 shares

|

|

|

|

|

Use of proceeds

|

|

We expect to use the net proceeds from this offering for working capital and other general

corporate purposes. We may also use a portion of the net proceeds to acquire, license and invest in complementary products, technologies or businesses; however, we currently have no agreements or commitments to complete any such transaction. We will

not receive any of the proceeds from the sale of common stock of the selling stockholders. See “Use of Proceeds.”

|

|

|

|

|

NASDAQ Global Select Market symbol

|

|

“PI”

|

|

|

|

|

Risk factors

|

|

See “Risk Factors” beginning on page 12 and other information included in this

prospectus for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock.

|

The number of shares of our common stock outstanding immediately after this offering is based on

18,780,142 shares of our common stock outstanding as of September 30, 2016, and excludes:

|

|

•

|

|

2,237,191 shares of common stock issuable upon the exercise of outstanding options as of September 30, 2016 with a weighted-average exercise price of $7.84 per share;

|

|

|

•

|

|

1,664,394 shares of common stock reserved for future issuance under stock-based compensation plans as of September 30, 2016, including (1) 1,298,983 shares of common stock reserved for issuance under the 2016 Equity

Incentive Plan and any future automatic increase in shares reserved for issuance in accordance with the terms of such plan; and (2) 365,411 shares of common stock reserved for issuance under the 2016 Employee Stock Purchase Plan, and any future

automatic increase in shares reserved for issuance in accordance with the terms of such plan; and

|

|

|

•

|

|

124,450 shares of common stock issuable upon the exercise of options to purchase shares of our common stock which were issued following September 30, 2016, with a weighted-average exercise price of $25.17 per share.

|

Except as otherwise indicated, all information in this prospectus assumes:

|

|

•

|

|

no exercise of outstanding options to purchase common stock after September 30, 2016; and

|

|

|

•

|

|

no exercise of the underwriters’ option to purchase additional shares.

|

8

SUMMARY CONSOLIDATED FINANCIAL DATA

The following table sets forth a summary of our historical financial data as of and for the periods indicated. We derived the summary

consolidated statements of operations data for the years ended December 31, 2014 and 2015 from our audited consolidated financial statements included elsewhere in this prospectus. We derived the summary consolidated statements of operations data for

the year ended December 31, 2013 from our consolidated financial statements not included in this prospectus. We derived the consolidated statements of operations data for the nine months ended September 30, 2015 and 2016 and the consolidated balance

sheet data as of September 30, 2016 from unaudited interim consolidated financial statements included elsewhere in this prospectus. In the opinion of management, the unaudited consolidated financial statements reflect all adjustments, which include

normal recurring adjustments, necessary to state fairly our results of operations and financial position. Our historical results are not necessarily indicative of the results that may be expected in the future. The summary of our consolidated

financial data set forth below should be read together with the consolidated financial statements and the related notes to those statements included in this prospectus, as well as the sections captioned “Selected Consolidated Financial

Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR ENDED

DECEMBER 31,

|

|

|

NINE MONTHS ENDED

SEPTEMBER 30,

|

|

|

|

|

2013

|

|

|

2014

|

|

|

2015

|

|

|

2015

|

|

|

2016

|

|

|

|

|

(in thousands, except per share amounts)

|

|

|

Consolidated Statements of Operations Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

$

|

55,491

|

|

|

$

|

63,763

|

|

|

$

|

78,479

|

|

|

$

|

55,852

|

|

|

$

|

78,632

|

|

|

Cost of revenue

(1)(2)

|

|

|

27,069

|

|

|

|

30,121

|

|

|

|

37,633

|

|

|

|

27,045

|

|

|

|

37,567

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit

|

|

|

28,422

|

|

|

|

33,642

|

|

|

|

40,846

|

|

|

|

28,807

|

|

|

|

41,065

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

expense

(1)(2)

|

|

|

10,608

|

|

|

|

14,287

|

|

|

|

17,579

|

|

|

|

12,488

|

|

|

|

17,782

|

|

|

Sales and marketing expense

(1)(2)

|

|

|

9,645

|

|

|

|

10,825

|

|

|

|

14,579

|

|

|

|

10,151

|

|

|

|

15,902

|

|

|

General and administrative

expense

(1)(2)

|

|

|

5,653

|

|

|

|

6,115

|

|

|

|

7,087

|

|

|

|

5,089

|

|

|

|

8,214

|

|

|

Offering costs

(1)

|

|

|

—

|

|

|

|

1,959

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total operating expenses

(2)

|

|

|

25,906

|

|

|

|

33,186

|

|

|

|

39,245

|

|

|

|

27,728

|

|

|

|

41,898

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations

|

|

|

2,516

|

|

|

|

456

|

|

|

|

1,601

|

|

|

|

1,079

|

|

|

|

(833

|

)

|

|

Interest income (expense) and other income (expense), net

|

|

|

(2,183

|

)

|

|

|

(63

|

)

|

|

|

(535

|

)

|

|

|

(919

|

)

|

|

|

(845

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before tax expense

|

|

|

333

|

|

|

|

393

|

|

|

|

1,066

|

|

|

|

160

|

|

|

|

(1,678

|

)

|

|

Income tax expense

|

|

|

(98

|

)

|

|

|

(96

|

)

|

|

|

(166

|

)

|

|

|

(78

|

)

|

|

|

(98

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss)

|

|

|

235

|

|

|

|

297

|

|

|

|

900

|

|

|

|

82

|

|

|

|

(1,776

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Less: Accretion of preferred stock

|

|

|

(11,301

|

)

|

|

|

(11,301

|

)

|

|

|

(11,301

|

)

|

|

|

(8,476

|

)

|

|

|

(6,258

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to common stockholders—basic and diluted

|

|

$

|

(11,066

|

)

|

|

$

|

(11,004

|

)

|

|

$

|

(10,401

|

)

|

|

$

|

(8,394

|

)

|

|

$

|

(8,034

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) per share attributable to common stockholders—basic and diluted

(3)

|

|

$

|

(3.52

|

)

|

|

$

|

(3.30

|

)

|

|

$

|

(2.67

|

)

|

|

$

|

(2.20

|

)

|

|

$

|

(1.01

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted-average shares used to compute net income (loss) per share attributable to common

stockholders—basic and diluted

|

|

|

3,144

|

|

|

|

3,338

|

|

|

|

3,893

|

|

|

|

3,813

|

|

|

|

7,991

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Financial Information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA

(4)

|

|

$

|

4,316

|

|

|

$

|

4,918

|

|

|

$

|

4,751

|

|

|

$

|

3,246

|

|

|

$

|

2,727

|

|

9

|

(1)

|

Includes stock-based compensation as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YEAR ENDED

DECEMBER 31,

|

|

|

NINE MONTHS ENDED

SEPTEMBER 30,

|

|

|

|

|

2013

|

|

|

2014

|

|

|

2015

|

|

|

2015

|

|

|

2016

|

|

|

|

|

(in thousands)

|

|

|

Cost of revenue

|

|

$

|

45

|

|

|

$

|

49

|

|

|

$

|

31

|

|

|

$

|

26

|

|

|

$

|

39

|

|

|

Research and development expense

|

|

|

339

|

|

|

|

362

|

|

|

|

305

|

|

|

|

241

|

|

|

|

416

|

|

|

Sales and marketing expense

|

|

|

148

|

|

|

|

413

|

|

|

|

692

|

|

|

|

507

|

|

|

|

754

|

|

|

General and administrative expense

|

|

|

275

|

|

|

|

313

|

|

|

|

150

|

|

|

|

111

|

|

|

|

208

|

|

|

Offering costs

|

|

|

—

|

|

|

|

38

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total stock-based compensation expense

|

|

$

|

807

|

|

|

$

|

1,175

|

|

|

$

|

1,178

|

|

|

$

|

885

|

|

|

$

|

1,417

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2)

|

The Company corrected the classification of certain expenses relating to prior period amounts as described in note 2 of the notes to our consolidated financial

statements included elsewhere in this prospectus. Cost of product revenue increased $64,000, $89,000, $128,000 and $72,000, research and development expenses increased $289,000, $398,000, $574,000 and $324,000, sales and marketing expenses increased

$119,000, $163,000, $236,000 and $134,000 and general and administrative expenses decreased $472,000, $650,000, $938,000 and $530,000 for the years ended December 31, 2013, 2014 and 2015 and for the nine months ended September 30, 2015,

respectively. There was no change to net income (loss) as a result of the correction.

|

|

(3)

|

See note 2 of the notes to our consolidated financial statements included elsewhere in this prospectus for an explanation of the calculation of our net loss per share attributable to common stockholders—basic and

diluted.

|

|

(4)

|

See “Selected Consolidated Financial Data—Adjusted EBITDA” for additional information and a reconciliation of net income (loss) to adjusted EBITDA.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AS OF

SEPTEMBER 30, 2016

|

|

|

|

|

ACTUAL

|

|

|

AS

ADJUSTED

(1)

|

|

|

|

|

(in thousands)

|

|

|

Consolidated Balance Sheet Data:

|

|

|

|

|

|

|

|

|

|

Cash, cash equivalents and

investments

(2)

|

|

$

|

61,998

|

|

|

$

|

88,623

|

|

|

Working capital

(2)

|

|

|

85,230

|

|

|

|

111,855

|

|

|

Total assets

(2)

|

|

|

118,827

|

|

|

|

145,452

|

|

|

Total long-term debt

|

|

|

11,410

|

|

|

|

11,410

|

|

|

Accumulated deficit

|

|

|

(187,306

|

)

|

|

|

(187,306

|

)

|

|

Total stockholders’ equity

(2)

|

|

|

83,786

|

|

|

|

110,411

|

|

|

(1)

|

The as adjusted column reflects the sale of 1,000,000 shares of our common stock in this offering at an assumed public offering price of $28.60 per share, which is the last reported sale price of our common stock

on The NASDAQ Global Select Market on November 25, 2016, after deducting underwriting discounts and commissions and estimated offering expenses payable by us.

|

|

(2)

|

Each $1.00 increase (decrease) in the assumed public offering price of $28.60 per share, which is the last

reported sale price of our common stock on The NASDAQ Global Select Market on November 25, 2016, would increase (decrease) each of cash, cash equivalents and investments, working capital, total assets and total stockholders’ equity on an

as adjusted basis by approximately $955,000, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus remains the same and after deducting underwriting discounts and commissions. Similarly, each increase

(decrease) by 100,000 shares in

|

10

|

|

the number of shares offered by us would increase (decrease) each of cash, cash equivalents and investments, working capital, total assets and total stockholders’ equity on an as adjusted

basis by approximately $2.7 million, assuming that the assumed public offering price remains the same, and after deducting underwriting discounts and commissions. The as adjusted information discussed above is illustrative only and will be adjusted

based on the actual public offering price and other terms of this offering determined at pricing.

|

11

RISK FACTORS

Investing in our common stock involves a high degree of risk. Before making an investment decision, you should carefully consider the risks

and uncertainties described below, which we believe are the material risks of our business and this offering. Our business, financial condition, operating results or growth prospects could be harmed by any of these risks. In such an event, the

trading price of our common stock could decline, and you may lose all or part of your investment. In assessing these risks, you should also refer to all of the other information contained in this prospectus, including our consolidated financial

statements and related notes.

Risks Related to Our Business and Industry

RAIN market adoption is uncertain. If RAIN market adoption does not continue to develop, or develops more slowly than we expect, our

business will suffer.

The RAIN market is relatively new and, to a large extent, unproven. RAIN technology and product adoption,

including that of the Impinj Platform and Item Intelligence, will depend on numerous factors, including:

|

|

•

|

|

whether end users embrace the benefits we believe RAIN offers, and if so whether RAIN will achieve and sustain high demand and market adoption;

|

|

|

•

|

|

whether end users perceive that the benefits of RAIN adoption outweigh the cost and time to install or replace their existing systems and processes; and

|

|

|

•

|

|

whether the technological capabilities of RAIN products and applications meet end users’ current or anticipated needs.

|

The adoption of RAIN technology and products has historically been slower than anticipated or forecasted by us and industry sources. Our

industry has also experienced periods of accelerated adoption that were not sustained. For example, RAIN adoption accelerated in late 2010 and early 2011, but then decelerated, in part, we believe, due to a patent infringement lawsuit filed by Round

Rock Research in 2011 against several large retailers and other end users. Round Rock settled with RAIN suppliers in late 2013, however the end users that were parties to the lawsuit did not finalize their settlements with Round Rock until early

2015. Near-term RAIN adoption depends on large organizations with market influence, particularly in the retail industry, continuing to deploy RAIN solutions. Long-term RAIN market growth will depend on adoption by other industries and government

agencies. End users and our prospective customers may not be familiar with our products or RAIN in general, or may use other products and technologies to identify, locate, authenticate, engage, track and prevent loss of their items. Additionally,

even if prospective customers are familiar with RAIN, our products or Item Intelligence, a negative perception of, or experience with, RAIN or a competitor’s RAIN products may deter them from adopting RAIN or our products. Before they adopt

RAIN, businesses, government agencies and other organizations may need education on the benefits of using RAIN in their operations. These educational efforts may not be successful, and organizations may decide that the costs of adopting RAIN

outweigh the benefits. Failure of organizations to adopt RAIN generally, and the Impinj Platform specifically, for any reason will hurt the development of our market and, consequently, impair our business and prospects.

Fluctuations in the adoption of RAIN may affect our ability to forecast our future operating results, including revenue, gross margins, cash

flows and profitability. Moreover, to ensure adequate inventory supply, we must forecast inventory needs and expenses and place orders sufficiently in advance with our suppliers and contract manufacturers based on our estimates of future demand for

particular products. Our failure to accurately forecast demand for RAIN solutions may cause us to experience excess inventory levels or a shortage of products available for sale.

12

If RAIN adoption by retailers does not continue at the rate we expect, our business will be

adversely affected.

The retail apparel industry leads RAIN adoption, and end users in the retail industry were the largest

consumers of our products in 2015. We believe the retail industry is a leading indicator of the market adoption of RAIN solutions and if large apparel retailers in particular continue to adopt the Impinj Platform adoption within the retail industry

and in other industries will accelerate. As such, the retail industry is our key strategic focus.

If retailers or other early adopters

fail to realize demonstrable benefits from RAIN or delay or abandon their deployments, overall RAIN market acceptance may be materially and adversely affected. For example, in July 2012, J.C. Penney Company, Inc. announced plans to connect every

item in their stores by February 2013; however, they subsequently stopped the RAIN deployment after experiencing challenging financial results and a change in senior management. Any widespread delay, slowdown or failure by retailers or other

organizations to implement RAIN-based systems generally, and our products and the Impinj Platform specifically, will materially and adversely affect our business, operating results, financial condition and long-term prospects.

We have a history of losses and only recently achieved profitability. We cannot be certain that we will increase or sustain

profitability in the future.

We have incurred losses since our inception in 2000 and only first became profitable in 2013.

Although we had net income of $297,000 and $900,000 for 2014 and 2015, respectively, we had an accumulated deficit of $187.3 million as of September 30, 2016. Our ability to increase or sustain profitability depends on numerous factors, many of

which are out of our control, including continued RAIN adoption, our market share and our margins. We expect significant expenditures to support operations, product development, and business and headcount expansion in sales, engineering, and

marketing as a public company. If we fail to increase our revenue or manage our expenses, we may not increase or sustain profitability in the future.

Fluctuations in our quarterly and annual operating results may adversely affect our business, prospects and stock price.

You must consider our business and prospects in light of the risks and difficulties we encounter in the uncertain and rapidly evolving RAIN

market. Because this market is new and evolving, predicting its future growth rate and size is difficult. The rapidly evolving nature of the markets in which we sell our products, as well as other factors that are beyond our control, reduce our

ability to accurately evaluate our future prospects and forecast quarterly or annual performance.

End users drive demand for our

products. Because we sell nearly all of our products through channel partners, our ability to determine end-user demand is limited. In addition, we rely on our channel partners to integrate our products with end-user information systems and this

integration has been uneven and unpredictable in scope, timing and implementation. In the past, both we and other industry participants have overestimated the RAIN market size and growth rates. To date, we have had limited success in accurately

predicting future sales of our products and platform. We expect that for the foreseeable future our visibility into future sales, including both volumes and prices, will continue to be limited. This poor visibility may cause fluctuations in our

operating results, particularly on a quarterly basis, that we are unable to predict as well as failure to achieve our expected operating results.

In addition, if endpoint IC sales (one indicator of market adoption) exceed expectations or if we discount prices to win a particularly large

opportunity, our revenue and profitability may be positively affected, but gross margins may be negatively affected depending on product mix for the applicable period. If research analysts or investors perceive such product mix shift negatively, the

trading price of our common stock could be adversely affected.

Numerous other factors, many of which are outside our control, may cause

or contribute to significant fluctuations in our quarterly and annual operating results. These fluctuations may make financial planning and

13

forecasting difficult. In addition, these fluctuations may result in unanticipated decreases in our available cash, which could negatively affect our business and prospects. Factors that may

contribute to fluctuations in our operating results and revenue include:

|

|

•

|

|

variations in RAIN adoption and deployment delays by end users;

|

|

|

•

|

|

fluctuations in demand for our products, the Impinj Platform or Item Intelligence, including by tag manufacturers and other significant customers on which we rely for a substantial portion of our revenue;

|

|

|

•

|

|

fluctuations in the available supply of our products;

|

|

|

•

|

|

variations in the quality of our products and return rates;

|

|

|

•

|

|

declines in selling prices for our products;

|

|

|

•

|

|

delays in our product-shipment timing, customer or end-user sales or deployment cycles, or work performed under development contracts;

|

|

|

•

|

|

intellectual property disputes involving us, our customers, end users or other participants in our industry;

|

|

|

•

|

|

adverse outcomes of litigation or governmental proceedings;

|

|

|

•

|

|

timing variability in product introductions, enhancements, services, and technologies by us and our competitors and market acceptance of these new or enhanced products, services and technologies;

|

|

|

•

|

|

unanticipated excess or obsolete inventory as a result of supply-chain mismanagement, introduction of new products, quality issues or otherwise;

|

|

|

•

|

|

changes in the amount and timing of our operating costs, including those related to the expansion of our business, operations and infrastructure;

|

|

|

•

|

|

changes in business cycles or seasonal fluctuations that may affect the markets in which we sell;

|

|

|

•

|

|

changes in industry standards or specifications, or changes in government regulations, relating to RAIN, the Impinj Platform, or Item Intelligence;

|

|

|

•

|

|

late, delayed or cancelled payments from our customers; and

|

|

|

•

|

|

unanticipated impairment of long-lived assets and goodwill.

|

A substantial portion of our

operating expenses are fixed for the short-term, and as a result fluctuations in revenue or unanticipated expenses can have a material and immediate impact on our profitability. The occurrence of any one of these risks could negatively affect our

operating results in any particular period, which could cause the price of our common stock to decline.

Our market is very

competitive. If we fail to compete successfully, our business and operating results will suffer.

We face significant competition

from both established and emerging competitors. We believe our principal current competitors are: in readers and gateways, Zebra Technologies Corporation, Alien Technology Corporation, or Alien; in reader ICs, STMicroelectronics and Phychips Inc.;

and in endpoint ICs, NXP B.V., or NXP, and Alien. Our channel partners, including distributors, system integrators, VARs, and software solution partners, may enter our market and compete with us rather than purchase our products, which would not

only reduce our customer base but also increase competition in the market, adversely affecting our operating results, business and prospects. In addition, companies in adjacent markets or newly formed companies may decide to enter our market,

particularly as RAIN adoption grows. For example, in October 2016, Qualcomm Incorporated, or Qualcomm, announced it entered into a definitive agreement to acquire NXP. Qualcomm could use its acquisition as an entry point into the RAIN market.

14

Competition for customers is intense. Because the RAIN market is evolving rapidly, winning

customer and end- user accounts at an early stage in the development of the market is critical to growing our business. End users that instead use competing products and technologies may face high switching costs, which may affect our and our

channel partners’ ability to successfully convert them to our products. Failure to obtain orders from customers and end users, for competitive reasons or otherwise, will materially adversely affect our operating results, business and prospects.

Some of our competitors have longer operating histories and much greater financial, research and development, marketing and other

resources than we have. Consequently, some of these competitors may be able to devote more resources to the development, promotion, sale and support of their products. These competitors may also be able to discount their product pricing, or bundle

their products with other products, to gain market share. For example, certain providers could bundle near-field communication, or NFC, products with RAIN products, or could bundle stationary readers with handheld readers. In addition, new

competitors could enter the gateway market or develop RAIN platforms or solutions. Larger or more established companies may deliver and directly compete with our Item Intelligence. Smaller companies could launch new products and applications we do

not offer and could gain market acceptance quickly. Moreover, consolidation in the RAIN industry could intensify the competitive pressures that we face. Many of our existing and potential competitors may be better positioned than we are to acquire

other companies, technologies or products.

Some of our customers have policies requiring diverse supplier bases to enhance competition

and maintain multiple RAIN product providers. They do not have an interest in purchasing exclusively from one supplier or promoting a particular brand. Our ability to increase order sizes from these customers and maintain or increase our market

share is constrained by these policies. In addition, any decline in quality or availability of our products or any increase in the number of suppliers that such a customer uses may decrease demand for our products and adversely affect our operating

results, business and prospects.

We cannot assure you that our products will continue to compete favorably or that we will be successful

in the face of increasing competition from new products, or enhancements introduced by our existing competitors, or new companies entering our market. In addition, we cannot assure you that our competitors do not have, or will not develop, processes

or product designs that currently or in the future will enable them to produce competitive products at lower costs than ours. Any failure to compete successfully will materially adversely affect our business, prospects, operating results and

financial condition.

Downturns in the industries we serve, particularly retail, may adversely affect our business.

Worldwide economic conditions have exhibited significant fluctuations in recent years, and market volatility and uncertainty remain widespread.

As a consequence, we and our customers have had extreme difficulty forecasting and planning future business activities accurately. These economic conditions could cause our customers or end users to reduce their capital-expense budgets, which could

decrease spending for our products resulting in delayed and lengthened deployment, a decrease in sales or a loss of sales opportunities. The retail industry is subject to volatility, especially during uncertain economic conditions. A downturn in the

retail industry in particular may disproportionately affect us because retailers comprise a significant portion of the RAIN end users. We cannot predict the timing, strength or duration of any economic slowdown or recovery, whether global, regional

or within specific markets. If the conditions of the general economy or markets in which we operate worsen, our business could be harmed.

If we fail to obtain quality products in adequate quantity and in a timely and cost-effective manner, our operating results and growth

prospects will be adversely affected.

We do not own or operate manufacturing facilities. Currently, all our endpoint ICs are

manufactured by Taiwan Semiconductor Manufacturing Company Limited, or TSMC, and primarily post-processed by our subcontractor Stars Microelectronics (Thailand) Public Company Limited, or Stars; all our reader ICs are

15

manufactured by Tower Semiconductors Ltd., or TowerJazz; and all our readers and gateways are manufactured by Plexus Corp., or Plexus, or Western Corporation. We also use subcontractors for

post-processing, assembly and testing. We do not control our manufacturers’ or subcontractors’ ability or willingness to meet our supply requirements.

Currently, we do not have long-term supply contracts with TSMC, TowerJazz, Plexus or Western Corporation, and neither they nor our

subcontractors are required to supply us with products for any specific period or in any specific quantity. Suppliers can allocate production capacity to other companies’ and reduce deliveries to us on short notice. Our suppliers may allocate

capacity to other companies, which could impair our ability to secure sufficient product supply for sale.

We place orders with some of

our suppliers five or more months before our anticipated product delivery dates to our customers. We base these orders on our customer-demand forecasts. If we inaccurately forecast this customer demand then we may be unable to obtain adequate and

cost-effective foundry or assembly capacity to meet our customers’ delivery requirements, or we may accumulate excess inventory.

Manufacturing capacity may not be available when we need it or at reasonable prices. For example, in 2010 we experienced significant shortages

in endpoint IC delivery from TSMC relative to our submitted purchase orders because of high demand for foundry capacity in the semiconductor industry. Such shortages adversely affected our ability to meet our obligations to our customers and, in

some cases, caused customers to cancel orders, qualify alternative suppliers or purchase from our competitors. In response to any future shortages, our customers may act similarly or, alternatively, may overbuy our products, which could artificially

inflate sales in near-term periods while leading to sales declines in future periods as our customers consume their accumulated inventory.

At times, our suppliers ask us to purchase excess products to ensure we do not face a subsequent shortage. For example, in the second quarter

of 2014, we purchased more ICs from TSMC than required, which affected our available cash for the quarter. If we are unable to sell the additional inventory we purchased, or if we must sell it at lower prices due to obsolescence, our operating

results may be adversely affected.

If our suppliers fail to deliver products at reasonable prices or with satisfactory quality levels

then our ability to bring products to market and our reputation could suffer. For example, if supplier capacity diminishes, including from a catastrophic loss of facilities or otherwise, we could have difficulty fulfilling our orders, our revenue

could decline and our growth prospects could be impaired. We anticipate requiring three to 18 months to transition our assembly services or foundries to new providers. Such a transition would likely require a qualification process by our customers

or end users, which could also adversely affect our ability to sell our products and our operating results.

If we are unsuccessful

introducing new products and enhancements, our operating results will be harmed.

To keep pace with technology developments,

satisfy increasingly stringent end-user requirements and achieve market acceptance, we plan to introduce new products and solutions. We commit significant resources to developing these new products and solutions while improving performance,

reliability and reducing costs. For example, we are investing substantial resources to develop and enhance our platform software but do not expect to realize material revenue from this software in the near future. The market for our software is

nascent, and we need to create market awareness of its benefits to drive end-user adoption. Creating market awareness includes promoting our software as a useful platform on which end users, software developers, consultants, system integrators, or

SIs, and others can develop applications that can deliver tailored functionality and thereby accelerate adoption. We may find that our software does not meet the current or anticipated needs of our channel partners or end users. In addition, we have

limited experience developing and selling software products and cannot be certain that our proposed pricing model or sales strategy will be successful. We rely on and must train

16

our channel partners to sell, develop applications for and integrate our software with end users’ systems, but we cannot guarantee that we or they will be successful doing so. We believe

that we must continue to dedicate a significant amount of resources to our development efforts to maintain our competitive position. We also cannot be certain that our software will generate revenue from these investments for several years, if it

all, or that such revenue will exceed the investment we are committing to develop and deploy our software.

The success of a new or

enhanced product is impacted by accurate forecasts of long-term market demand. For example, our xArray and xSpan gateways are relatively new products that incorporate enhanced technological features, but we cannot be certain whether demand for such

gateways will develop as forecasted. We may also fail to anticipate or meet market requirements for new features and functionality. By focusing on certain new products and industries, we may miss opportunities for other products and applications

that may be more widely adopted.

In addition, we enter into non-recurring engineering, or NRE, development agreements which typically

include initial funding with a requirement for us to meet certain milestones in order to receive additional funding for the NRE engagement. If we are unable to meet such milestones, we may not realize the full benefits of the NRE engagement.

If we fail to introduce new or enhanced products in a timely fashion to meet our channel partners’ or end-users’ needs or do not

achieve the milestones in our NRE engagements then we will lose market share and our revenue and financial condition could be materially adversely affected.

If we are unable to develop new products using new or enhanced technologies, our competitive position will be adversely affected.

In the future, we may not succeed in developing the underlying technologies or processes necessary to create new or enhanced

products or license or otherwise acquire these technologies from third parties. We may be unable to develop commercially viable products using new or enhanced technologies, such as more advanced silicon process geometries for ICs or new materials or

designs for readers and gateways. The success of a new or enhanced product depends on future technological developments, as well as on various implementation factors, including:

|

|

•

|

|

our timely and efficient completion of the design process;

|

|

|

•

|

|

our timely and efficient implementation of manufacturing, assembly and testing procedures;

|

|

|

•

|

|

the quality, reliability and selling price of the product; and

|

|

|

•

|

|

effective marketing, sales and service.

|

If we are unable to develop new products or features

to compete effectively, our market share will be adversely affected, which would harm our business, financial condition and operating results.

An inability or limited ability of enterprise systems to exploit RAIN information may adversely affect the market for our products.

A successful end-user RAIN deployment requires not only tags and readers or gateways, but integration with information systems and

applications that derive business value from endpoint data. Unless technology providers continue developing and advancing business-analytics tools, and end users install or enhance their information systems and applications to use these tools,