iHeartCommunications, Inc. Announces Consent Solicitations to Holders of Its Five Series of Priority Guarantee Notes & Senior...

November 28 2016 - 6:45AM

Business Wire

iHeartCommunications, Inc. (the “Company”) announced today the

commencement of six separate consent solicitations (the “Consent

Solicitations”) to seek the consent of holders of its five series

of priority guarantee notes and senior notes due 2021 listed in the

table below (collectively, the “Notes”) to a proposed amendment

(the “Proposed Amendment”) to each of the indentures governing the

Notes (the “Indentures”).

The Proposed Amendment, if adopted, would amend Section 9.07 of

each of the Indentures to allow the Company to exclude, in any

offer to consent, waive or amend any of the terms or provisions of

the Indentures or the Notes in connection with an exchange offer,

any holders of Notes who are not institutional “accredited

investors” or non-“U.S. persons”, or those in any jurisdiction

whose inclusion would require that the Company comply with the

registration requirements or other similar requirements under any

securities laws of such jurisdiction.

Each Consent Solicitation will expire at 5:00 p.m., New York

City time, on December 7, 2016, unless extended or earlier

terminated (the “Expiration Time”). Consents with respect to the

applicable series of Notes may not be revoked after the Expiration

Time. The consummation of each Consent Solicitation is not

conditioned on the consummation of the other Consent Solicitations.

Each Consent Solicitation is contingent upon the satisfaction of

certain conditions, including, without limitation, the receipt of

consents of holders of at least a majority of the aggregate

principal amount of the respective series of Notes outstanding

(excluding any Notes of such series held by the Company or its

affiliates) to the Proposed Amendment by the Expiration Time. If

any of the conditions to each Consent Solicitation is not

satisfied, the Company is not obligated to accept any consent in

the respective Consent Solicitation and may, in its sole

discretion, terminate, extend or amend each Consent Solicitation

without terminating, extending or amending the other Consent

Solicitations.

Subject to the terms and conditions of each Consent

Solicitation, upon receipt of consents of holders of at least a

majority of the aggregate principal amount of the respective series

of Notes outstanding (excluding any Notes of such series held by

the Company or its affiliates) to the Proposed Amendment, holders

of Notes who validly deliver (and do not validly revoke) their

consents prior to the Expiration Time will receive their portion of

the aggregate cash payment for its respective series of Notes

listed on the table below under “Aggregate Fixed Consideration

Amount” (the “Fixed Fee”). In addition, if the applicable Consent

Solicitation is consummated, upon effectiveness of a subsequent

amendment to an Indenture, as applicable, where the consideration

for such amendment includes debt or equity securities issued on an

unregistered basis in an exchange offer transaction, holders of

Notes who validly deliver (and do not validly revoke) their

consents prior to the Expiration Time will receive their portion of

the respective aggregate cash payment for its respective series of

Notes listed on the table below under “Aggregate Contingent

Consideration Amount” (the “Contingent Fee”).

The Fixed Fee and Contingent Fee (if and when payable) will be

paid to each consenting holder with respect to the applicable

series of Notes pro rata in accordance with the aggregate principal

amount of such series of Notes for which consents were validly

tendered (and not revoked) prior to the Expiration Time. The

applicable Contingent Fee if it becomes payable, will not be paid

at the same time as the applicable Fixed Fee. There is no assurance

that the Contingent Fee with respect to any series of Notes will be

paid. In no event will the Company ever be required to pay the

Contingent Fee more than once with respect to each series of

Notes.

The table below provides information with respect to each series

of Notes and the applicable Fixed Fee and Contingent Fee.

Notes

CUSIP Numbers

Aggregate FixedConsideration

Amount

Aggregate

ContingentConsideration Amount

9.0% Priority Guarantee Notes due 2019 184502BL5

184502BK7

184502BJ0

$1,999,815 $2,999,723 9.0% Priority Guarantee Notes due 2021

184502BG6 $1,750,000 $2,625,000 11.25% Priority Guarantee Notes due

2021 184502BN1 $575,000 $862,500 9.0% Priority Guarantee Notes due

2022 45174HAA5 $1,000,000 $1,500,000 10.625% Priority Guarantee

Notes due 2023 45174HAC1 $950,000 $1,425,000 Senior Notes due 2021

184502BQ4

184502BP6

U18285AK9

$1,729,168 $2,593,752

The complete terms and conditions of the each Consent

Solicitation are set forth in the applicable Consent Solicitation

Statement that is being sent to the applicable holders of the

Notes.

Moelis & Company LLC is acting as the solicitation agent for

the Consent Solicitations. Global Bondholder Services Corporation

is acting as the tabulation agent and information agent for the

Consent Solicitations. Questions regarding the Consent

Solicitations may be directed to Moelis & Company LLC at (877)

751-3389. Requests for Consent Solicitation Statements may be

directed to Global Bondholder Services Corporation at (212)

430-3774 (for bankers and brokers) or (866) 470-3900 (for all

others).

This press release does not constitute an offer to sell, or a

solicitation of an offer to buy, any security. No offer,

solicitation, or sale will be made in any jurisdiction in which

such an offer, solicitation, or sale would be unlawful.

About iHeartMedia, Inc./iHeartCommunications, Inc.

iHeartMedia, Inc. (PINK:IHRT), the parent company of

iHeartCommunications, Inc., is one of the leading global media and

entertainment companies. The company specializes in radio, digital,

outdoor, mobile, social, live events, on-demand entertainment and

information services for local communities, and uses its

unparalleled national reach to target both nationally and locally

on behalf of its advertising partners. The company is dedicated to

using the latest technology solutions to transform the company’s

products and services for the benefit of its consumers,

communities, partners and advertisers, and its outdoor business

reaches over 35 countries across five continents, connecting people

to brands using innovative new technology.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161128005267/en/

iHeartCommunications, Inc.Media:Wendy Goldberg,

212-377-1105Executive Vice President -

CommunicationsorInvestors:Eileen McLaughlin,

212-377-1116Vice President - Investor Relations

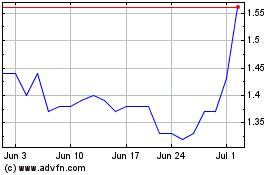

Clear Channel Outdoor (NYSE:CCO)

Historical Stock Chart

From Mar 2024 to Apr 2024

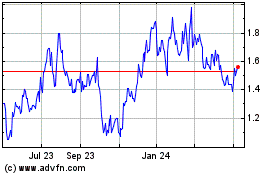

Clear Channel Outdoor (NYSE:CCO)

Historical Stock Chart

From Apr 2023 to Apr 2024