Saudi Arabia Backs OPEC Push to Make Steep Oil Output Cuts

November 24 2016 - 9:00PM

Dow Jones News

VIENNA—Saudi Arabia is backing an effort to make the steepest

oil-production cuts possible at OPEC's meeting next week and to

convince producers outside the cartel to help remove almost 2% of

the world's oil supply, people familiar with the matter said.

The ambitious plan is encountering reservations from Iran and

Iraq, the second- and third-largest producers in the Organization

of the Petroleum Exporting Countries, the 14-nation cartel that

controls over a third of global oil production. It also ran into an

obstacle on Thursday when Russia's energy minister said his country

was planning only to hold output steady, not cut.

But the proposal backed by Saudi Arabia, the cartel's biggest

and most influential member, has been pushed to the center of talks

this week here at OPEC's headquarters as the group discusses ways

to shrink production and knock crude prices out of a two-and-a-half

year funk. OPEC's 14 national oil ministers are set to meet

Wednesday to decide on how to cut production to reduce a global

oversupply of oil.

The Saudi-backed proposal would set a production ceiling of 32.5

million barrels a day, the people said. That is more than 1.1

million barrels a day below OPEC's October output and at the top

end of a range of cuts the cartel promised in September.

OPEC agreed to reduce its record output to between 32.5 million

and 33 million barrels a day in September, but its members have

since increased production even more, complicating its calculations

for a cut.

According to the people familiar with the matter, OPEC is also

pushing for Russia and other oil producers outside OPEC to pitch in

by cutting another 500,000 to 600,000 barrels a day of output—the

equivalent of the output a country such as Ecuador. All told, the

OPEC and non-OPEC cuts would remove about 1.6% of global oil

supplies if enacted.

A growing group within the cartel believe only a strong

statement from OPEC and big producers outside the cartel will turn

market sentiment bullish and lift prices. One OPEC delegate said

the cartel's members were discussing cuts of up to 1.3 million

barrels a day from October levels.

The proposal has begun picking up steam in discussions in Vienna

as the cartel's officials study new data showing the imbalance

between oil supply and demand will take longer than they thought to

correct itself without intervention. The amount of oil going into

storage has been increasing in the U.S. and Japan, not falling as

some OPEC members hoped—a trend that keeps the glut going.

OPEC is set to discuss separate cuts with Russia and other

countries outside of OPEC on Monday in Vienna. OPEC specifically

wants Russia to reduce production by 300,000 barrels a day, from

current levels of over 11 million barrels a day, people familiar

with the matter said.

Russian energy minister Alexander Novak said Thursday that

Moscow was in talks with non-OPEC countries about freezing

production at current levels, including Kazakhstan, Uzbekistan and

Mexico. He said a production freeze would effectively be a cut of

200,000 to 300,000 barrels a day for Russia—the world's largest

producer of crude—because the country is planning to bring on new

output soon.

At a gathering in Vienna last month, Brazil told OPEC members

that the public listing of its state-oil giant Petrobras limited

its flexibility in turning off the spigots, while Mexico said its

privatization push could be derailed by such a move, according to

an attendee.

The discussions are beginning to pick up speed and intensity as

OPEC's oil ministers prepare to travel to Vienna.

OPEC still hasn't agreed to a formula for how to apportion the

production cuts. Nigeria and Libya, which have suffered disruptions

due to violence and civil unrest, are likely to be exempted. Iran

has also said it wants an exemption as it builds back the market

share it lost during years of Western sanctions over its nuclear

program.

An Iranian oil official said Tehran has yet to agree to join

OPEC's output-reduction plan.

Laura Mills in Moscow contributed to this article.

Write to Benoit Faucon at benoit.faucon@wsj.com

(END) Dow Jones Newswires

November 24, 2016 20:45 ET (01:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

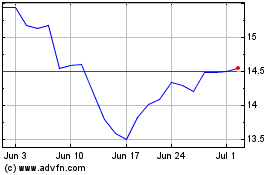

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Mar 2024 to Apr 2024

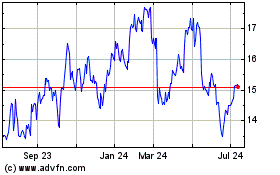

Petroleo Brasileiro ADR (NYSE:PBR)

Historical Stock Chart

From Apr 2023 to Apr 2024